India Luxury Hotel Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD10476

November 2024

92

About the Report

India Luxury Hotel Market Overview

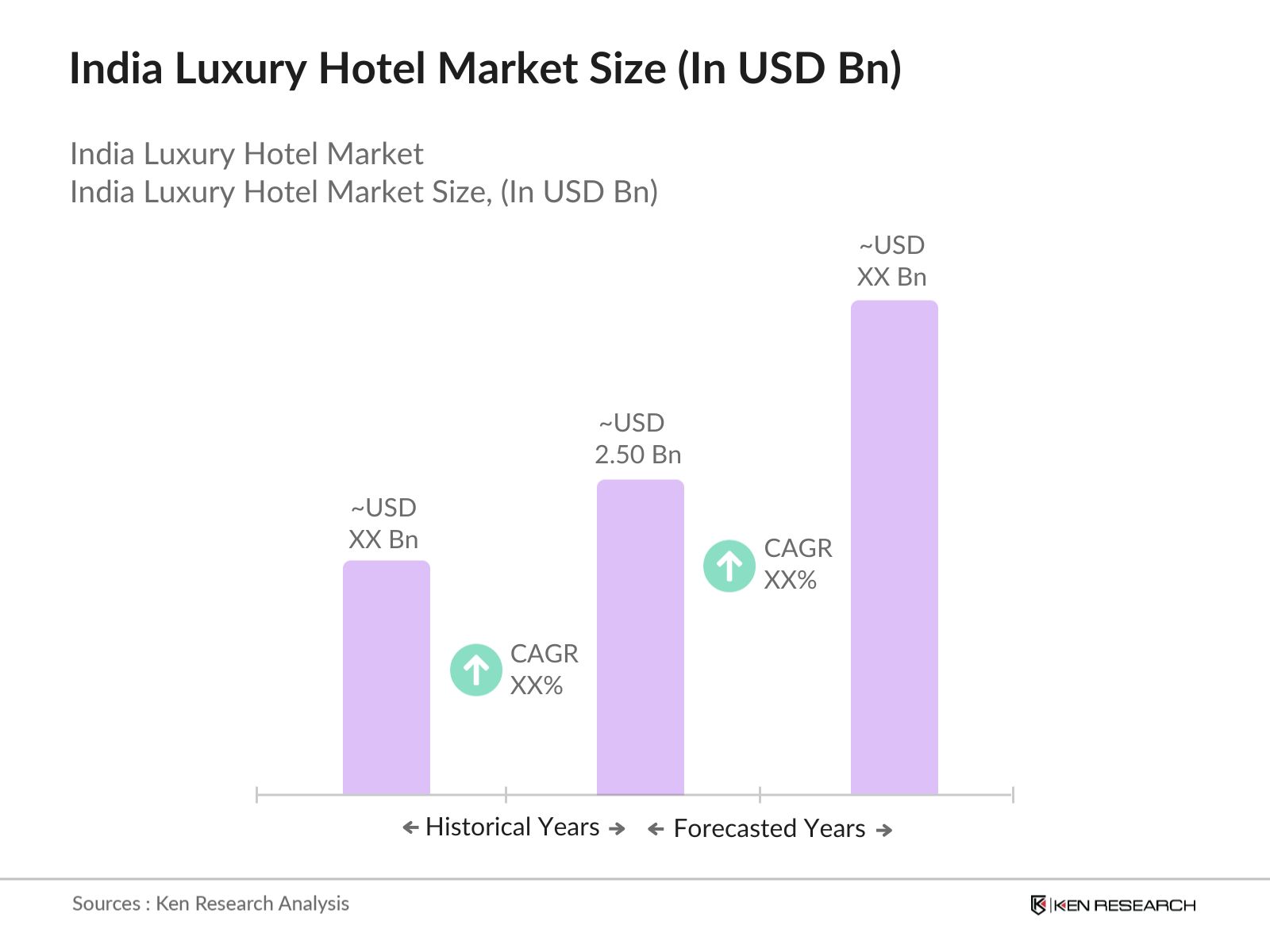

- The India luxury hotel market, valued at USD 2.50 billion, is experiencing robust growth driven by the rising affluence of the middle class and a significant increase in high-net-worth individuals (HNWIs). Major urban centers and tourist destinations, such as Mumbai, Delhi, Bengaluru, and Goa, have witnessed a surge in demand for premium hospitality services. The development of international airports and improved infrastructure has further bolstered the sector, with luxury travelers seeking exclusive, high-end experiences. This market's growth trajectory is further supported by the expansion of domestic tourism, alongside inbound international tourist arrivals.

- Dominant cities such as Mumbai, Delhi, and Bengaluru lead the market due to their status as commercial hubs and global business centers. Mumbais strong business environment, along with Delhis governmental and corporate presence, makes them prime locations for luxury hotels. Goa is a major leisure destination, popular among international tourists, and its natural beauty and resort culture contribute to its dominance in the luxury segment. These cities benefit from high connectivity, a growing expatriate population, and strong branding by international and local luxury hotel chains.

- Government schemes like FAME India and UDAN have been instrumental in enhancing tourism infrastructure, benefiting the luxury hotel sector. Under the FAME India initiative, approximately INR 800 crore was allocated in 2023 to improve electric vehicle (EV) charging infrastructure, making travel more eco-friendly for tourists. Additionally, the UDAN scheme has improved air connectivity to remote tourist destinations, driving demand for luxury stays in these areas. Such policies directly contribute to the growth of luxury hospitality by improving access to and within tourist regions.

India Luxury Hotel Market Segmentation

The India luxury hotel market is segmented by property type and by service type.

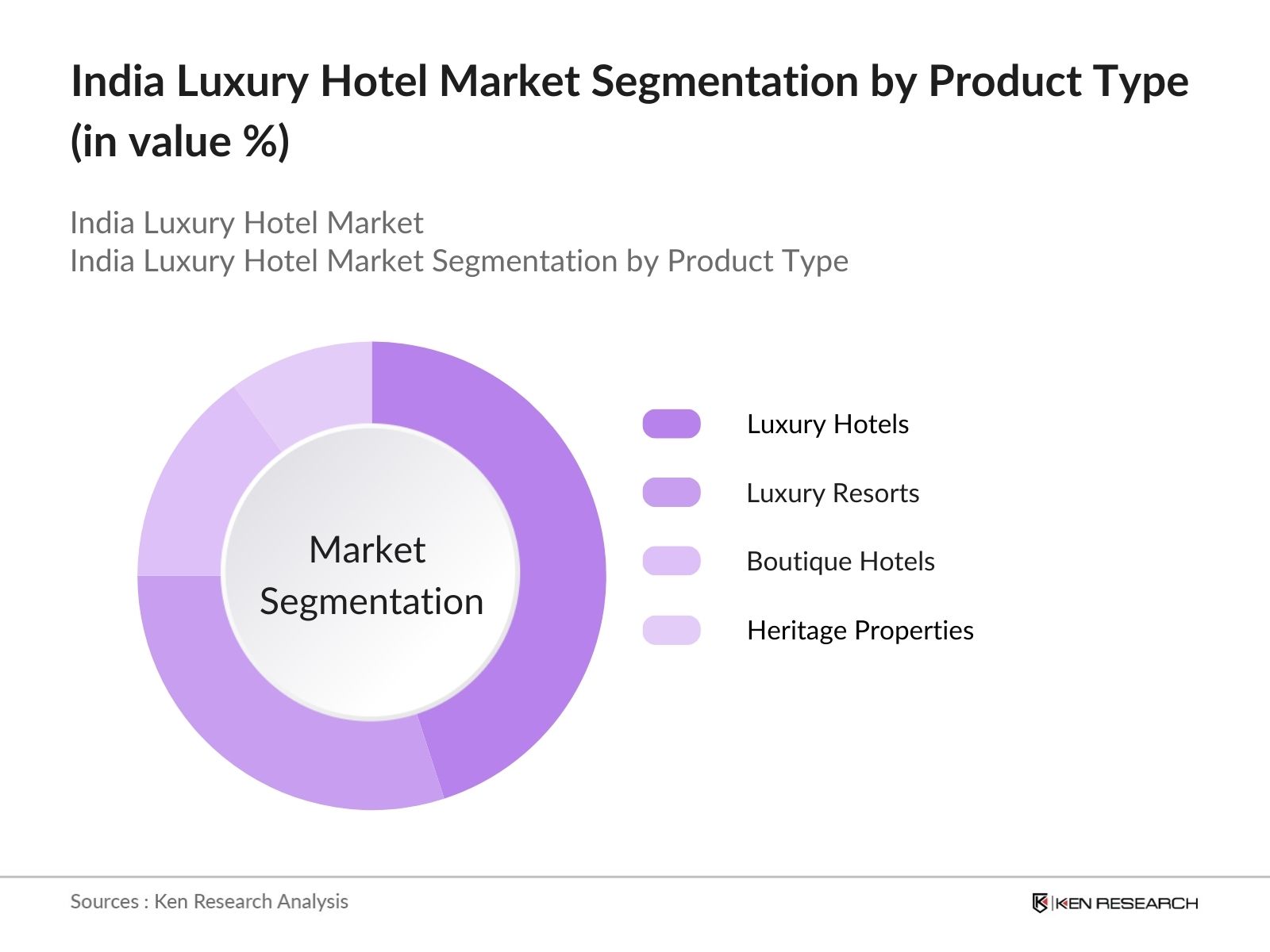

- By Property Type: The India luxury hotel market is segmented by property type into luxury hotels, luxury resorts, boutique hotels, and heritage properties. Recently, luxury hotels have gained a dominant market share due to their widespread presence in metropolitan cities and the frequent hosting of high-profile business and leisure travelers. Brands such as Taj, Oberoi, and Leela have set the standard for luxury services, and their consistent quality across different regions makes them the preferred choice among both domestic and international travelers.

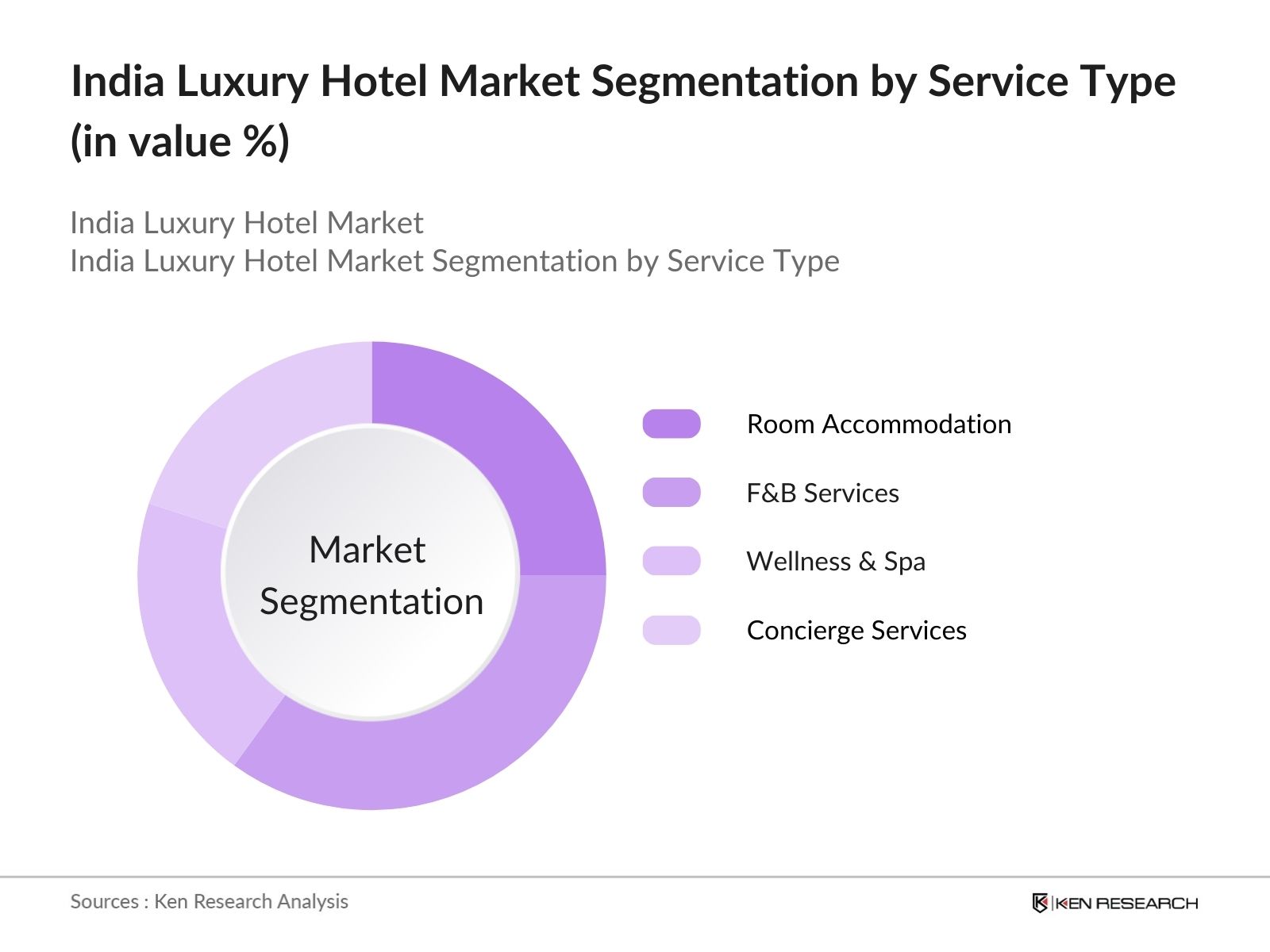

- By Service Type: In terms of service type, the market is segmented into room accommodation, food & beverage (F&B) services, wellness and spa services, and concierge and butler services. F&B services dominate the segment, comprising 35% of the market, as luxury hotels in India are renowned for offering world-class dining experiences that often attract customers beyond hotel guests. The integration of globally recognized chefs and culinary experiences at luxury properties further elevates the prominence of this sub-segment in driving footfall and revenues.

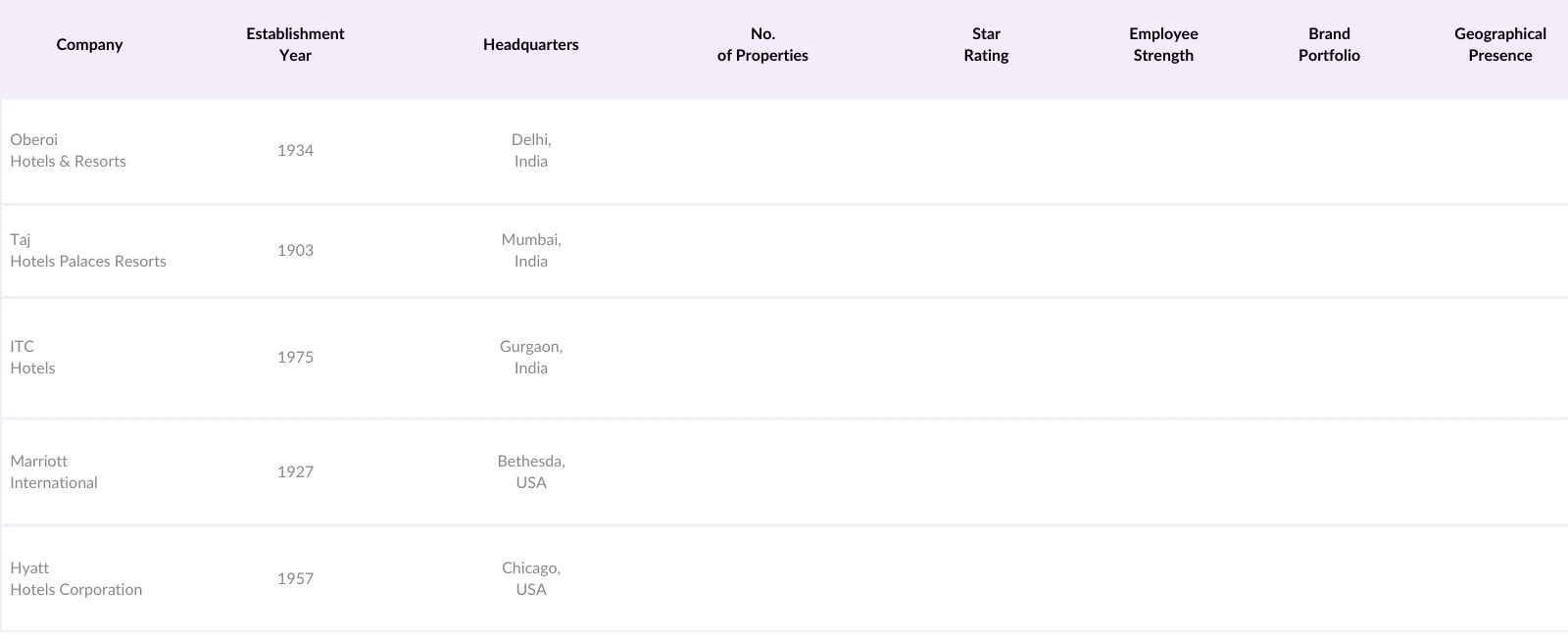

India Luxury Hotel Market Competitive Landscape

The India luxury hotel market is dominated by several key players, including both domestic chains and international brands. The competitive landscape is shaped by consistent innovations in hospitality, acquisitions, and collaborations with international players to cater to growing consumer demand.

India Luxury Hotel Market Analysis

Growth Drivers

- Increasing Domestic Tourism: India witnessed a significant surge in domestic tourism, driven by an expanding middle class and improved infrastructure. According to the Ministry of Tourism, over 1.85 billion domestic tourists were recorded in 2022, a sharp increase from previous years. Government initiatives like Dekho Apna Desh and improved connectivity under the UDAN scheme have made travel more accessible across the country. Additionally, the rising disposable income of Indian households has further fueled demand for luxury accommodations. The influx of domestic travelers to key destinations such as Rajasthan, Kerala, and Goa is expected to strengthen luxury hotel revenues.

- Rise in High-Net-Worth Individuals (HNWIs): Indias population of HNWIs continues to grow, with more than 350,000 HNWIs in 2023, according to reports from the World Bank. The wealth generated from sectors like technology, real estate, and finance has contributed to the rising demand for high-end luxury accommodations. The presence of these affluent individuals is particularly strong in metropolitan cities such as Mumbai, Delhi, and Bangalore, which are hubs for luxury hotels offering personalized services. This demographics preference for high-end, customized experiences in hospitality has created immense growth opportunities for the luxury hotel market.

- Government Policies Promoting Tourism: The Indian governments emphasis on boosting tourism is apparent in its policies, such as the Incredible India 2.0 campaign, which focuses on luxury and heritage tourism. The Ministry of Tourism allocated approximately INR 1,250 crore in 2023 for various initiatives aimed at improving tourist facilities across India. Policies like the FAME India Scheme and UDAN are designed to enhance tourism infrastructure, providing support for the hospitality sector through lower travel costs and improved accessibility to remote areas. These initiatives are likely to support luxury hotel investments and upgrades.

Market Challenges

- High Operational Costs (Labor, Energy): Luxury hotels in India face significant operational challenges due to rising costs, particularly in terms of labor and energy consumption. Data from the Ministry of Labor indicates that minimum wage levels have increased by 7% annually from 2020 to 2023, adding to staffing expenses. Similarly, energy prices have surged, with electricity tariffs for commercial establishments in states like Maharashtra and Karnataka exceeding INR 10 per kWh in 2023. These escalating costs have reduced profitability margins, making it essential for hoteliers to adopt energy-efficient practices and explore automation to mitigate operational expenses.

- Seasonal Variations in Demand: India's luxury hotel industry experiences sharp seasonal variations in demand, especially in tourist hotspots such as Goa and Rajasthan. According to the Indian Meteorological Department (IMD), the peak tourist season runs from October to March, driven by favorable weather conditions. During the summer months and monsoon seasons, occupancy rates drop significantly, with some hotels reporting a decline in occupancy by as much as 40% in the off-season. This demand volatility presents challenges for revenue management and resource allocation for luxury hotels.

India Luxury Hotel Market Future Outlook

The India luxury hotel market is expected to witness significant growth in the coming years due to the increasing purchasing power of domestic travelers and the influx of international tourists. The market's growth will be supported by several factors, including the rise in wellness tourism, the expansion of MICE (Meetings, Incentives, Conferences, and Exhibitions) travel, and the adoption of sustainability practices in the luxury sector. As environmental consciousness grows, hotels are increasingly focusing on eco-friendly infrastructure and services. Additionally, technological advancements in guest experiences, such as AI-powered concierge services and mobile integration, will contribute to enhancing customer satisfaction and loyalty in the luxury segment.

Market Opportunities

- Growth in Wellness Tourism: Indias luxury hotel market is witnessing an increasing demand for wellness tourism, driven by the global rise in health consciousness. The Ministry of AYUSH reported that the wellness industry in India was valued at INR 490 billion in 2023, with significant contributions from wellness tourism. Luxury hotels, especially those in Kerala, Himachal Pradesh, and Uttarakhand, have capitalized on this trend by offering specialized wellness retreats that combine Ayurveda, yoga, and spa therapies. This segment presents a lucrative opportunity for luxury hotels to expand their offerings.

- Increasing MICE (Meetings, Incentives, Conferences, and Exhibitions) Demand: MICE tourism is emerging as a major opportunity for Indias luxury hotel sector, with an estimated 25,000 MICE events being hosted in 2023, according to the India Convention Promotion Bureau (ICPB). Metropolitan cities like Delhi, Mumbai, and Hyderabad have established themselves as key MICE destinations due to their world-class infrastructure and connectivity. Luxury hotels in these regions are well-positioned to cater to corporate travelers and large-scale events, with many investing in expanding their conference facilities and business services to capture a larger share of this growing market.

Scope of the Report

|

||

|

By Service Type |

Room Accommodation, F&B Services, Wellness and Spa, Concierge and Butler Services |

|

|

By Business Model |

Owned, Leased, Managed, Franchise |

|

|

By Customer Type |

Business Travelers, Leisure Travelers, MICE Travelers, Wellness Tourists |

|

|

By Region |

North East West South |

Products

Key Target Audience

Luxury Hotel Operators

Property Developers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Tourism, India Tourism Development Corporation)

Hospitality Industry Associations (Federation of Hotel & Restaurant Associations of India)

Travel and Tourism Agencies

Wellness Tourism Promoters

Corporate Event Planners (MICE Organizers)

Companies

Major Players in the Market

Oberoi Hotels & Resorts

Taj Hotels Palaces Resorts Safaris

ITC Hotels

Marriott International

Hyatt Hotels Corporation

AccorHotels

Radisson Hotel Group

Hilton Hotels & Resorts

Leela Palaces, Hotels and Resorts

Four Seasons Hotels and Resorts

Aman Hotels

Roseate Hotels & Resorts

Lalit Hotels

JW Marriott

Shangri-La Hotels and Resorts

Table of Contents

1. India Luxury Hotel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Luxury Hotel Market Size (In INR Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Luxury Hotel Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Domestic Tourism

3.1.2. Rise in High-Net-Worth Individuals (HNWIs)

3.1.3. Government Policies Promoting Tourism

3.1.4. Expansion of International Tourism

3.2. Market Challenges

3.2.1. High Operational Costs (Labor, Energy)

3.2.2. Seasonal Variations in Demand

3.2.3. Competition from Alternative Accommodation (e.g., Luxury Rentals)

3.3. Opportunities

3.3.1. Growth in Wellness Tourism

3.3.2. Increasing MICE (Meetings, Incentives, Conferences, and Exhibitions) Demand

3.3.3. Strategic Collaborations with International Hotel Chains

3.4. Trends

3.4.1. Eco-friendly and Sustainable Luxury Properties

3.4.2. Integration of Advanced Technology in Guest Experience

3.4.3. Rise of Boutique Luxury Hotels

3.5. Government Regulations

3.5.1. Tourism Policies and Incentives (FAME India Scheme, UDAN)

3.5.2. Hospitality Sector Compliance Standards (Health, Safety, Environment)

3.5.3. Tax Incentives for Infrastructure Development

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Competitive Landscape

3.8. Porters Five Forces Analysis (Bargaining Power of Suppliers, Buyers, Industry Rivalry, Threat of Substitutes, New Entrants)

3.9. Competition Ecosystem

4. India Luxury Hotel Market Segmentation

4.1. By Property Type (In Value %)

4.1.1. Luxury Hotels

4.1.2. Luxury Resorts

4.1.3. Boutique Hotels

4.1.4. Heritage Properties

4.2. By Service Type (In Value %)

4.2.1. Room Accommodation

4.2.2. F&B (Food & Beverage) Services

4.2.3. Wellness and Spa Services

4.2.4. Concierge and Butler Services

4.3. By Business Model (In Value %)

4.3.1. Owned

4.3.2. Leased

4.3.3. Managed

4.3.4. Franchise

4.4. By Customer Type (In Value %)

4.4.1. Business Travelers

4.4.2. Leisure Travelers

4.4.3. MICE Travelers

4.4.4. Wellness Tourists

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. India Luxury Hotel Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Oberoi Hotels & Resorts

5.1.2. Taj Hotels Palaces Resorts Safaris

5.1.3. ITC Hotels

5.1.4. Marriott International

5.1.5. Hyatt Hotels Corporation

5.1.6. AccorHotels

5.1.7. Radisson Hotel Group

5.1.8. Hilton Hotels & Resorts

5.1.9. Leela Palaces, Hotels and Resorts

5.1.10. Four Seasons Hotels and Resorts

5.1.11. Aman Hotels

5.1.12. Roseate Hotels & Resorts

5.1.13. Lalit Hotels

5.1.14. JW Marriott

5.1.15. Shangri-La Hotels and Resorts

5.2. Cross Comparison Parameters (No. of Properties, No. of Employees, Headquarters, Revenue, Expansion Plans, Star Rating, Online Reviews, Market Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures and Collaborations

6. India Luxury Hotel Market Regulatory Framework

6.1. Taxation Policies (GST on Hotel Room Tariffs)

6.2. Licensing and Regulatory Compliance (Tourism Regulatory Authority)

6.3. Environmental Certification (LEED, Green Globe, Eco Certifications)

7. India Luxury Hotel Future Market Size (In INR Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Luxury Hotel Future Market Segmentation

8.1. By Property Type (In Value %)

8.2. By Service Type (In Value %)

8.3. By Business Model (In Value %)

8.4. By Customer Type (In Value %)

8.5. By Region (In Value %)

9. India Luxury Hotel Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Experience Enhancement Strategies

9.3. Marketing and Branding Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, we conducted comprehensive desk research and consulted proprietary databases to map out the key stakeholders in the India luxury hotel market. The primary aim was to identify variables such as customer preferences, regulatory frameworks, and competition intensity that influence market dynamics.

Step 2: Market Analysis and Construction

Historical data from the last five years were collected to understand trends in property developments, customer service preferences, and revenue generation. Data on service quality was carefully evaluated to ensure the reliability of projected growth trends and market performance.

Step 3: Hypothesis Validation and Expert Consultation

Our research team validated key market assumptions through in-depth interviews with hospitality industry experts, including general managers and marketing heads of luxury hotels. Their insights were instrumental in refining the overall market understanding.

Step 4: Research Synthesis and Final Output

The final stage involved compiling and validating the data through engagement with luxury hotel operators and industry bodies, ensuring the accuracy of segmentations, consumer behavior patterns, and competitive landscape.

Frequently Asked Questions

01. How big is the India Luxury Hotel Market?

The India luxury hotel market is valued at USD 2.50 billion. Growth is fueled by the rising demand for premium hospitality services, driven by an expanding middle class and an increase in international tourism.

02. What are the challenges in the India Luxury Hotel Market?

Challenges in India luxury hotel market include high operational costs, intense competition from alternative accommodations such as luxury rentals, and fluctuations in demand due to seasonality.

03. Who are the major players in the India Luxury Hotel Market?

Key players in India luxury hotel market include Oberoi Hotels & Resorts, Taj Hotels Palaces Resorts Safaris, ITC Hotels, Marriott International, and Hyatt Hotels Corporation. Their dominance is attributed to their extensive geographical presence, strong brand loyalty, and consistent service standards.

04. What are the growth drivers of the India Luxury Hotel Market?

The India luxury hotel market is driven by increasing domestic tourism, a rise in high-net-worth individuals, and government initiatives to promote tourism and infrastructure development.

05. What are the key trends in the India Luxury Hotel Market?

The key trends in India luxury hotel market include the adoption of sustainable and eco-friendly practices in hospitality, the integration of technology in guest services, and the rising popularity of wellness tourism among luxury travelers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.