India Male Grooming Products Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD5766

December 2024

84

About the Report

India Male Grooming Products Market Overview

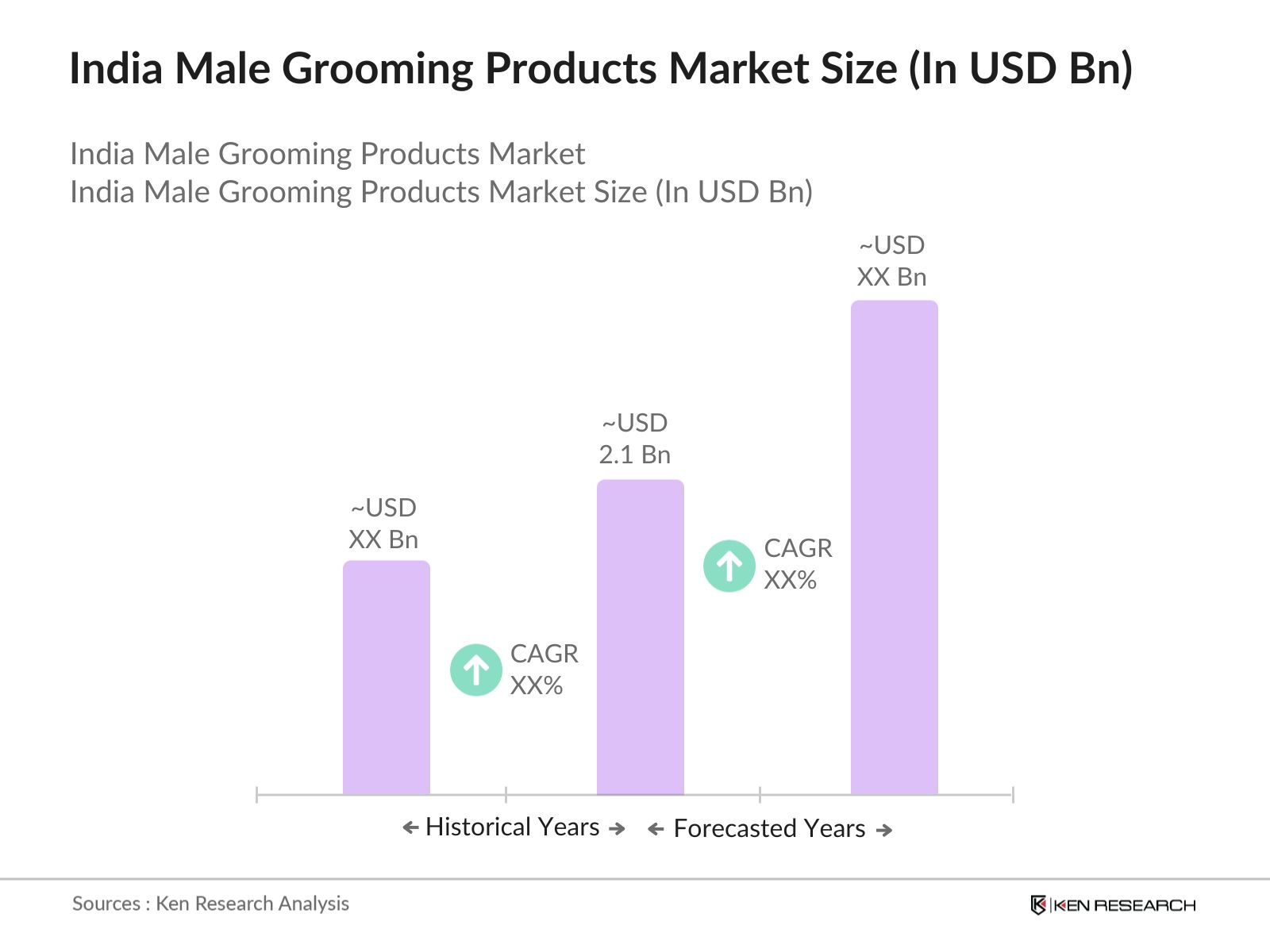

- The India Male Grooming Products Market is valued at USD 2.1 billion, driven primarily by increasing consumer awareness regarding personal grooming and hygiene, combined with rising disposable income among urban men. Growing cultural influence through media, fashion trends, and digital platforms has further spurred demand for grooming products like razors, skincare, and hair styling items. As more men prioritize grooming, the market is witnessing robust sales growth, particularly in premium and natural grooming products.

- In terms of dominance, metro cities such as Delhi, Mumbai, and Bengaluru lead the market due to higher disposable incomes, exposure to global grooming trends, and the availability of diverse product offerings. These urban hubs benefit from a strong presence of premium retail outlets and a growing inclination among consumers to invest in personal grooming solutions. Tier-II cities are also showing rapid growth, primarily driven by increasing digital penetration and the convenience of online shopping platforms.

- The Bureau of Indian Standards (BIS) sets quality standards for grooming products, ensuring consumer safety. In 2023, the BIS approved over 2,500 grooming products under various safety certifications, covering ingredients, labelling, and manufacturing processes. These regulations are vital to maintaining product integrity, especially with the growing demand for organic and natural grooming solutions.

India Male Grooming Products Market Segmentation

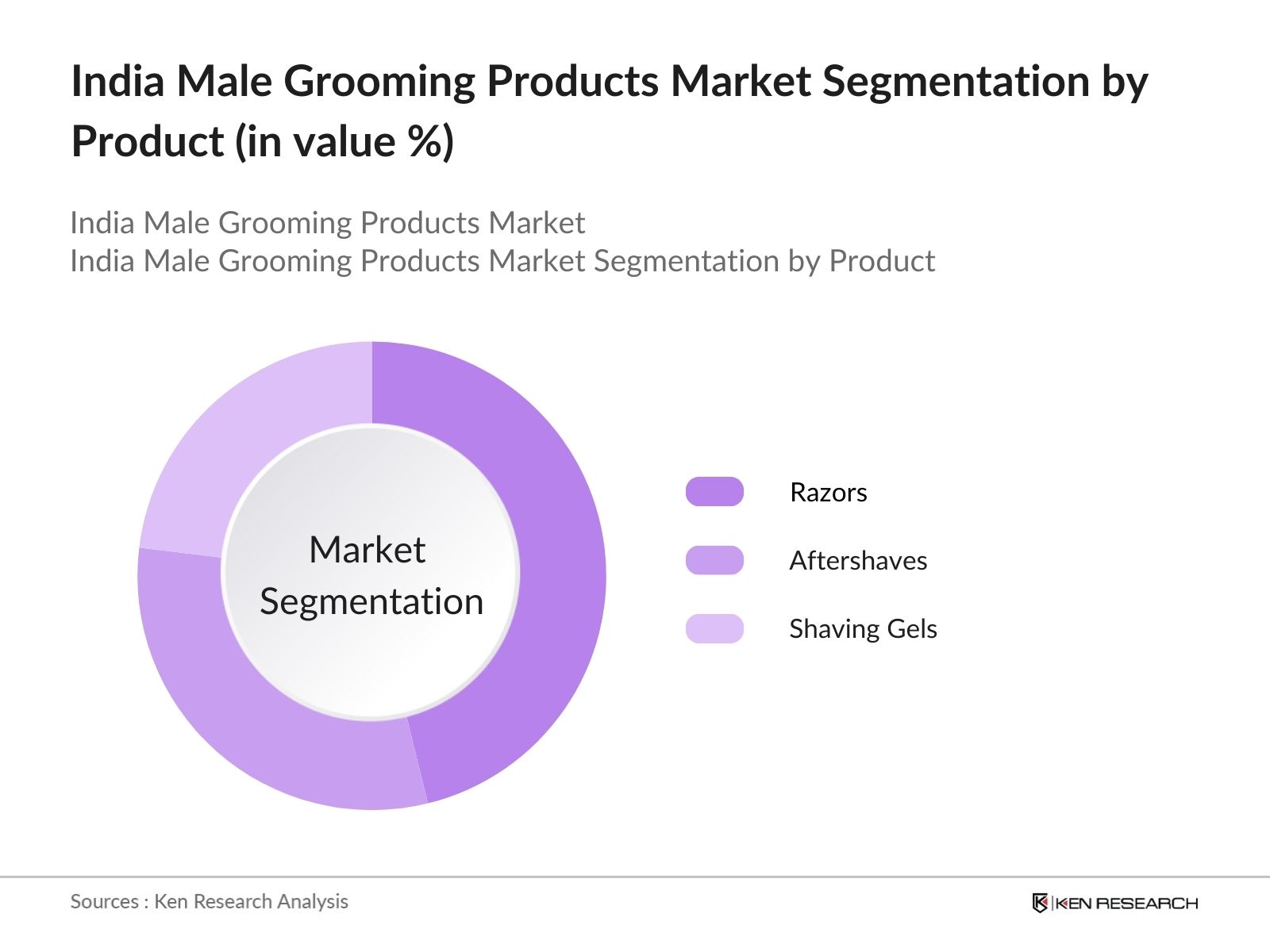

- By Product Type: The market is segmented by product type into shaving products, skincare products, haircare products, fragrances, and bath & body products. Recently, shaving products have maintained a dominant market share due to their necessity in the daily grooming routines of Indian men. The segment includes razors, aftershaves, and shaving gels, with brands such as Gillette holding a notable share due to their established reputation for quality and performance. Furthermore, the availability of varied price points caters to both premium and economy consumers, ensuring broad market coverage.

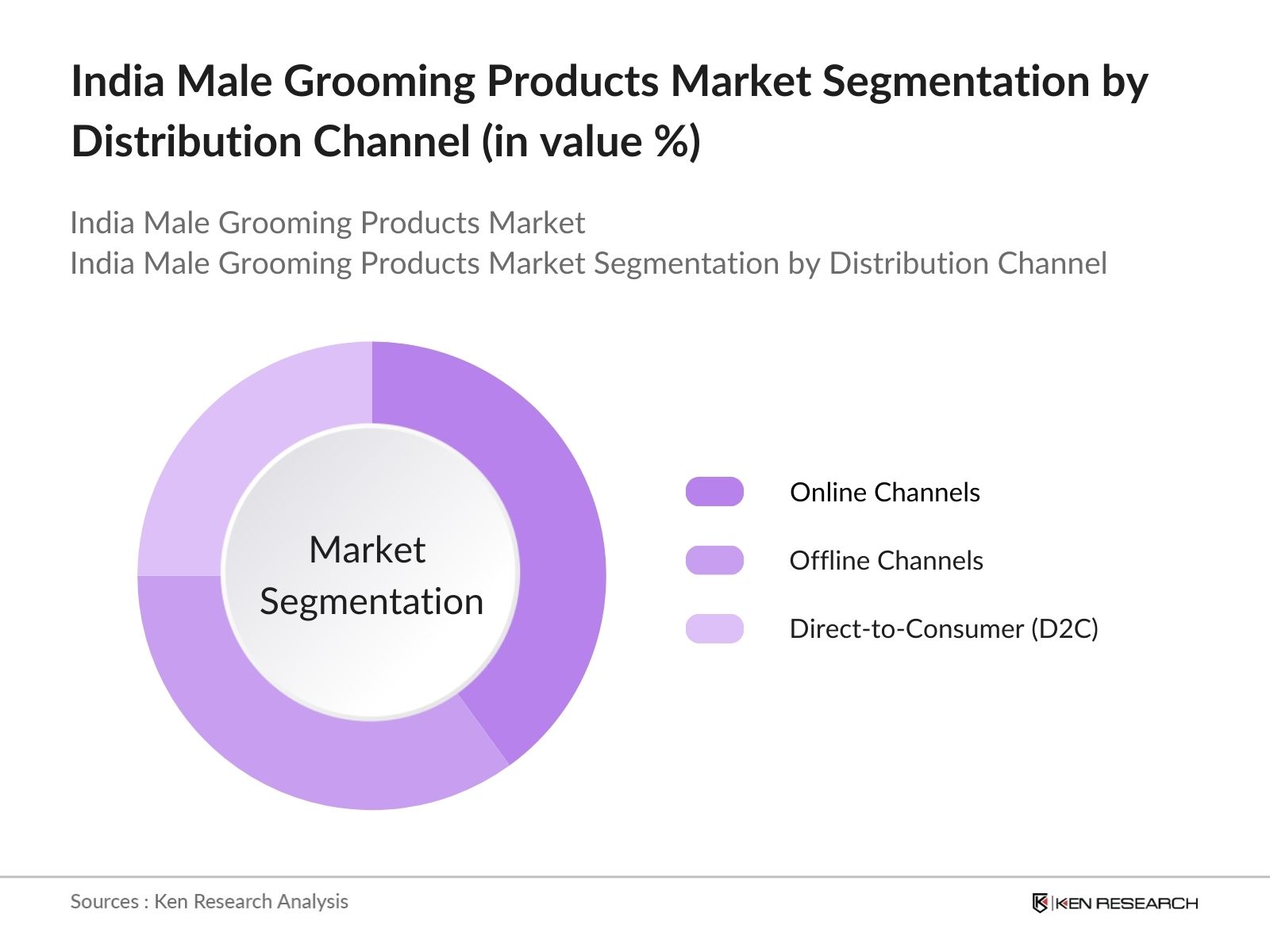

- By Distribution Channel: The market is segmented by distribution channel into online channels, offline channels (supermarkets, specialty stores, salons), and direct-to-consumer platforms. Online channels have surged ahead in recent years, driven by the convenience of home delivery, wide product ranges, and the availability of exclusive online discounts. Major e-commerce platforms such as Amazon and Flipkart, along with the rise of direct-to-consumer brands like The Man Company and Beardo, have contributed to this shift, with the younger generation favoring the ease of digital purchasing.

India Male Grooming Products Market Competitive Landscape

The India Male Grooming Products Market is characterized by the presence of both domestic and international players who dominate through brand loyalty, innovation, and distribution reach. The top competitors offer a diverse product range across multiple segments, including premium grooming products, which appeal to urban men with higher disposable incomes. The market is dominated by key players like Emami Ltd., Gillette India Ltd., and Beardo. This consolidation highlights the influence of both legacy and digitally-native brands. These companies use extensive marketing campaigns, celebrity endorsements, and continuous innovation to maintain their competitive edge.

|

Company |

Established |

Headquarters |

Product Portfolio |

Distribution Channels |

Brand Recognition |

R&D Investment |

Celebrity Endorsements |

Market Penetration |

Consumer Loyalty Programs |

|

Emami Ltd. |

1974 |

Kolkata, India |

- |

- |

- |

- |

- |

- |

- |

|

Gillette India Ltd. |

1901 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

- |

|

The Man Company |

2015 |

Gurugram, India |

- |

- |

- |

- |

- |

- |

- |

|

Beardo |

2016 |

Ahmedabad, India |

- |

- |

- |

- |

- |

- |

- |

|

Bombay Shaving Company |

2016 |

New Delhi, India |

- |

- |

- |

- |

- |

- |

- |

India Male Grooming Products Market Analysis

India Male Grooming Products Market Growth Drivers

- Influence of Western Culture and Media: The influence of Western culture and media has played a major role in shaping male grooming habits in India. Indian men are increasingly adopting grooming routines similar to those of their Western counterparts, including beard care, skincare, and hair grooming. The growth of international platforms like Netflix and social media has exposed the Indian audience to global grooming trends. According to the Ministry of Information and Broadcasting, the OTT market in India grew to 400 million viewers in 2023, expanding the reach of Western media.

- Increase in Disposable Income and Spending Power: The average per capita income in India rose to INR 170,000 in 2024, according to the Ministry of Statistics and Programme Implementation. With rising disposable income, male consumers are more willing to spend on premium grooming products and solutions. India's middle-class expansion, coupled with growing urbanization, has increased consumer spending on personal care and grooming products, particularly in Tier-I and Tier-II cities.

- E-Commerce Expansion and Online Retail: The rapid expansion of e-commerce platforms like Amazon, Flipkart, and Nykaa has made male grooming products more accessible across India. In 2024, India's e-commerce market reached approximately USD 55 billion in sales, driven by the growing penetration of smartphones and improved internet connectivity. According to the Telecom Regulatory Authority of India (TRAI), India had over 750 million internet users by 2023, enabling greater reach of grooming brands in urban and rural areas alike.

India Male Grooming Products Market Challenges

- High Competition from Unorganized Sector: Indias male grooming market faces stiff competition from the unorganized sector, which accounts for a portion of sales, especially in rural areas. Unbranded, low-cost products are readily available and appeal to price-sensitive consumers. According to the Ministry of Micro, Small and Medium Enterprises, unorganized players accounted for over 40% of grooming product sales in India in 2023, presenting a challenge for branded and premium grooming solutions.

- Consumer Sensitivity to Price: Despite the growing demand for premium grooming products, a large section of Indian consumers remains price-sensitive. The average spending per capita on personal care products was INR 1,500 annually in 2023, according to the National Sample Survey Office (NSSO). This makes it challenging for brands to introduce high-end products, as consumers are more inclined towards affordable options. Price remains a critical factor in product adoption, especially in Tier-II and Tier-III cities.

India Male Grooming Products Market Future Outlook

Over the next five years, the India Male Grooming Products Market is expected to witness growth driven by an increase in disposable incomes, changing consumer preferences, and the rise of premium grooming products. The market will also benefit from the expansion of e-commerce, with more men in Tier-II and Tier-III cities gaining access to a wider range of grooming products. Additionally, sustainability trends and the demand for eco-friendly packaging are expected to shape future market offerings.

India Male Grooming Products Market Opportunities

- Demand for Specialized Grooming Solutions: As grooming habits evolve, demand for specialized products like beard oils, serums, and hair styling gels has surged. According to the Indian Society of Cosmetic Chemists, sales of beard care products grew by 20% between 2022-2024, as men increasingly seek grooming solutions tailored to their specific needs. Brands that cater to niche demands, such as beard grooming, are well-positioned to tap into this growing segment.

- Untapped Rural and Tier-II Markets: Indias rural and Tier-II markets represent a massive opportunity for the male grooming sector. According to the National Statistical Office (NSO), 65% of Indias population resides in rural areas, where grooming habits are changing with increasing access to media and e-commerce. As brands expand their distribution networks and offer affordable grooming solutions, they stand to gain from these markets, where consumer aspirations are growing rapidly.

Scope of the Report

|

By Product Type |

Shaving Products (Razors, Aftershave, Shaving Gels) Skincare Products (Moisturizers, Anti-aging Creams) Haircare Products (Shampoos, Beard Oils) Fragrances (Deodorants, Perfumes) Bath and Body Products (Soaps, Body Washes) |

|

By Distribution Channel |

Online Channels Offline Channels Salons D2C |

|

By End-User |

Teenagers Young Professionals Mature Consumers |

|

By Pricing Category |

Premium Segment Mid-Range Segment Economy Segment |

|

By Region |

North India South India East India West India |

Products

Key Target Audience

Male Grooming Product Manufacturers

Male Grooming Product Retailers

Distributors and Wholesalers

Banks and Financial Institutions

E-Commerce Platforms

Government and Regulatory Bodies (Ministry of Consumer Affairs)

Private Equity and Venture Capital Firms

Advertising and Marketing Agencies

FMCG Industry Players

Companies

Players Mentioned in the Report

Emami Ltd.

Gillette India Ltd.

The Man Company

Beardo

Bombay Shaving Company

Philips India Ltd.

Hindustan Unilever

ITC Limited

Marico Ltd.

Nivea India Pvt. Ltd.

Table of Contents

1. India Male Grooming Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Male Grooming Products Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Male Grooming Products Market Analysis

3.1. Growth Drivers (Consumer preferences, Rising disposable income, Urbanization, Increased Awareness of Personal Grooming)

3.1.1. Rising Demand for Organic and Natural Products

3.1.2. Influence of Western Culture and Media

3.1.3. Increase in Disposable Income and Spending Power

3.1.4. E-Commerce Expansion and Online Retail

3.2. Market Challenges (High Cost of Premium Products, Consumer Brand Loyalty, Regulatory Barriers)

3.2.1. High Competition from Unorganized Sector

3.2.2. Consumer Sensitivity to Price

3.2.3. Regulatory and Certification Hurdles

3.3. Opportunities (New Product Development, Expansion into Rural Markets, Growth in Salon and Beauty Service Industry)

3.3.1. Demand for Specialized Grooming Solutions (beard care, hair styling products)

3.3.2. Untapped Rural and Tier-II Markets

3.3.3. Digital Marketing and Direct-to-Consumer (D2C) Brands

3.4. Trends (Customization of Products, Male Grooming Subscription Models, Growing Popularity of Grooming Kits)

3.4.1. Subscription-based Grooming Services

3.4.2. Focus on Sustainable and Eco-friendly Packaging

3.4.3. Premiumization of Male Grooming Products

3.5. Government Regulation (Cosmetic Safety Regulations, Certification Standards, Import Duties on Grooming Products)

3.5.1. BIS (Bureau of Indian Standards) Regulations for Grooming Products

3.5.2. Compliance with Ayurvedic and Herbal Product Certifications

3.5.3. Taxation and Import Tariffs on Grooming Products

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Male Grooming Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Shaving Products (Razors, Aftershave, Shaving Gels)

4.1.2. Skincare Products (Moisturizers, Anti-aging Creams, Sunscreen)

4.1.3. Haircare Products (Shampoos, Hair Styling Gels, Beard Oils)

4.1.4. Fragrances (Deodorants, Perfumes, Body Mists)

4.1.5. Bath and Body Products (Soaps, Body Washes, Scrubs)

4.2. By Distribution Channel (In Value %)

4.2.1. Online Channels

4.2.2. Offline Channels (Supermarkets, Specialty Stores, Salons)

4.2.3. Direct-to-Consumer (D2C)

4.2.4. E-commerce Platforms

4.3. By End-User (In Value %)

4.3.1. Teenagers

4.3.2. Young Professionals

4.3.3. Mature Consumers

4.4. By Pricing Category (In Value %)

4.4.1. Premium Segment

4.4.2. Mid-Range Segment

4.4.3. Economy Segment

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Male Grooming Products Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Emami Ltd.

5.1.2. Procter & Gamble

5.1.3. Hindustan Unilever

5.1.4. Gillette India Ltd.

5.1.5. The Man Company

5.1.6. Beardo

5.1.7. Bombay Shaving Company

5.1.8. Nivea India Pvt. Ltd.

5.1.9. Loreal India Pvt. Ltd.

5.1.10. Marico Ltd.

5.1.11. McNROE Consumer Products Pvt. Ltd.

5.1.12. ITC Limited

5.1.13. Philips India Ltd.

5.1.14. Park Avenue

5.1.15. Ustraa (Happily Unmarried)

5.2 Cross Comparison Parameters (Product Portfolio, Distribution Channels, R&D Investment, Consumer Engagement Strategies, Pricing Models, Market Penetration, Brand Loyalty, Marketing Campaigns)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Male Grooming Products Market Regulatory Framework

6.1. Cosmetic Industry Regulations (FDA, BIS)

6.2. Product Labelling Requirements

6.3. Licensing and Certification Processes

7. India Male Grooming Products Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Male Grooming Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-User (In Value %)

8.4. By Pricing Category (In Value %)

8.5. By Region (In Value %)

9. India Male Grooming Products Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research involved mapping the ecosystem of the India Male Grooming Products Market. This included identifying stakeholders such as manufacturers, distributors, and consumers. Extensive desk research was conducted using proprietary and secondary databases to define the variables influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data on product penetration, sales channels, and revenue generation were compiled to assess market trends. We analyzed the distribution network across Tier-I, Tier-II, and Tier-III cities and evaluated the performance of major product categories to ensure reliable revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

In this step, hypotheses were developed and validated through in-depth interviews with industry experts and company executives. These consultations provided valuable insights into consumer behaviour, distribution challenges, and market forecasts, which refined our data analysis.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagement with manufacturers and distributors provided detailed insights into product sales and emerging trends. This bottom-up approach allowed us to cross-verify data and ensure a comprehensive and accurate analysis of the India Male Grooming Products Market.

Frequently Asked Questions

01. How big is the India Male Grooming Products Market?

The India Male Grooming Products Market is valued at USD 2.1 billion, driven by increasing consumer demand for grooming and skincare products, particularly in urban areas.

02. What are the challenges in the India Male Grooming Products Market?

Challenges in the India Male Grooming Products Market include intense competition, high price sensitivity among consumers, and regulatory hurdles related to the certification of grooming products.

03. Who are the major players in the India Male Grooming Products Market?

The India Male Grooming Products Market Major players include Emami Ltd., Gillette India Ltd., Beardo, The Man Company, and Bombay Shaving Company, which dominate through brand recognition and distribution strength.

04. What are the growth drivers of the India Male Grooming Products Market?

The India Male Grooming Products Market Growth drivers include rising disposable incomes, increasing digital penetration, and the growing popularity of personal grooming among men.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.