India Marine Coatings Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD5063

December 2024

90

About the Report

India Marine Coatings Market Overview

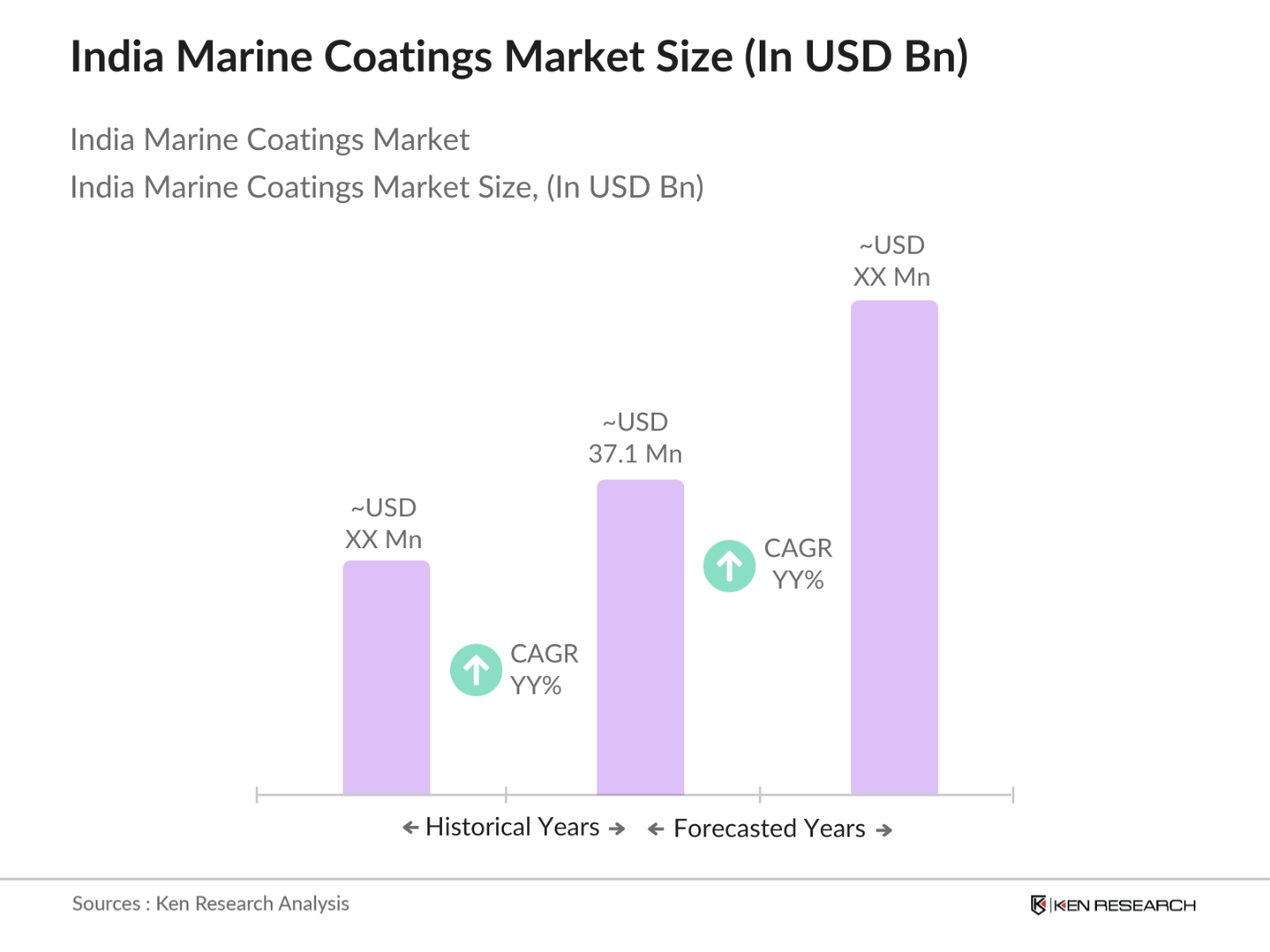

- The India marine coatings market is valued at USD 37.1 million, based on a five-year historical analysis. This market is driven by a growing shipbuilding industry, a rise in maritime trade, and government initiatives promoting local manufacturing and exports. Increased environmental awareness has also spurred the demand for eco-friendly and advanced coatings, leading to significant investments in R&D to develop sustainable solutions. Additionally, as marine tourism expands, the demand for leisure boat coatings is projected to rise, further fueling the market.

- The market is primarily dominated by regions like Southern India and Western India, particularly cities such as Chennai, Cochin, and Mumbai. Southern India, with its established shipyards and proximity to major shipping lanes, is a key contributor to the market's dominance. Western India, driven by the bustling ports of Mumbai and Kandla, also plays a crucial role due to the heavy inflow of trade vessels requiring marine maintenance and coatings.

- The Make in India initiative has been instrumental in revitalizing India's shipbuilding sector. The initiative encourages domestic and international companies to set up shipyards in India, increasing local production of vessels. In 2023, the Indian government allocated INR 400 crore towards boosting the shipbuilding industry, focusing on naval and commercial vessels. This push for local manufacturing directly correlates with an increased demand for marine coatings, as new vessels being built in Indian shipyards require advanced coatings to ensure durability and compliance with international standards.

India Marine Coatings Market Segmentation

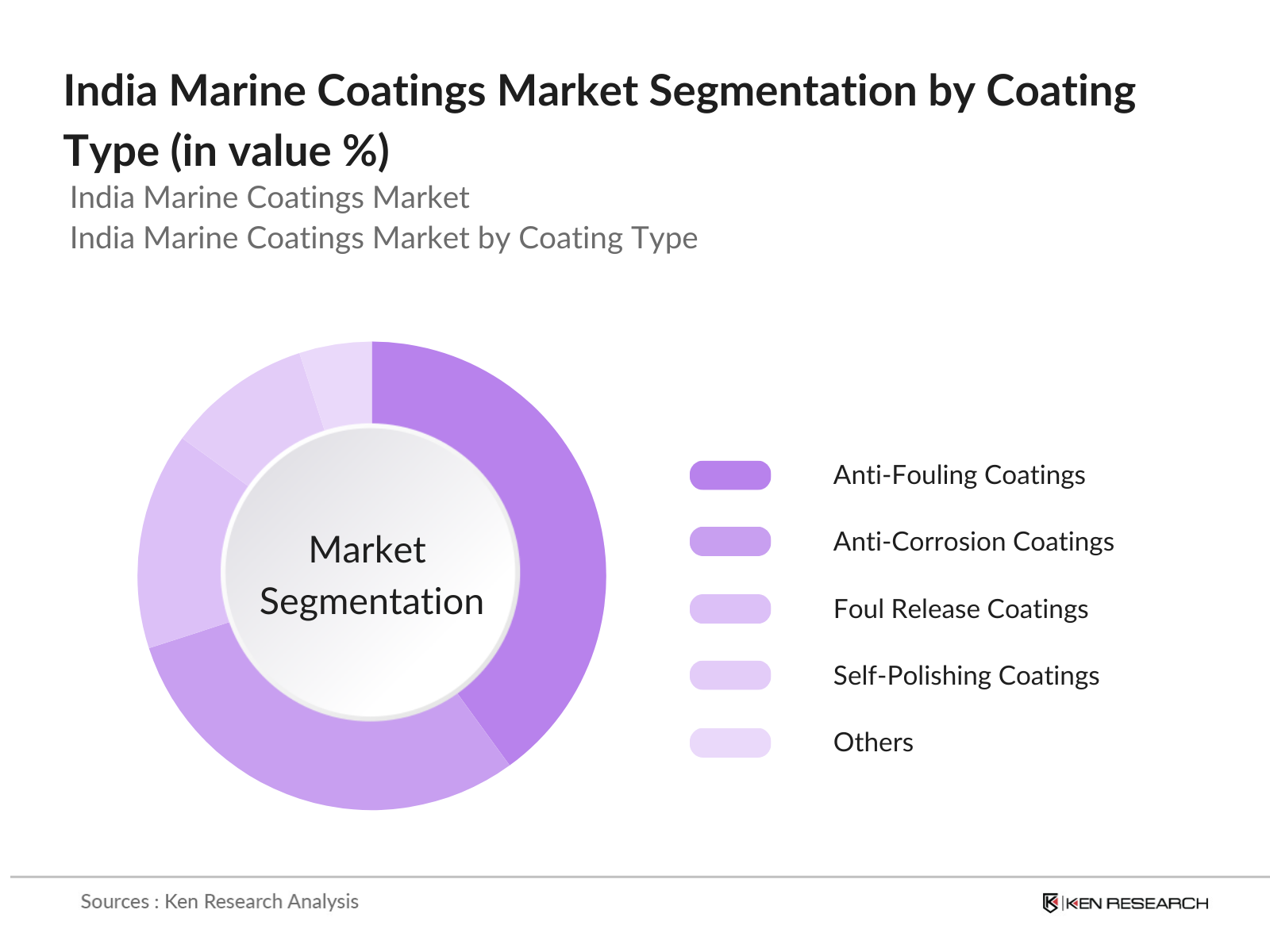

By Coating Type: India's marine coatings market is segmented by coating type into anti-fouling coatings, anti-corrosion coatings, foul release coatings, and self-polishing coatings. Currently, anti-fouling coatings hold a dominant share in this segment. This is due to their critical role in preventing biofouling on ships and marine structures, which helps maintain fuel efficiency and reduces maintenance costs. Leading companies such as AkzoNobel and Jotun have developed advanced anti-fouling coatings that offer long-term protection, leading to widespread adoption in commercial shipping and offshore industries.

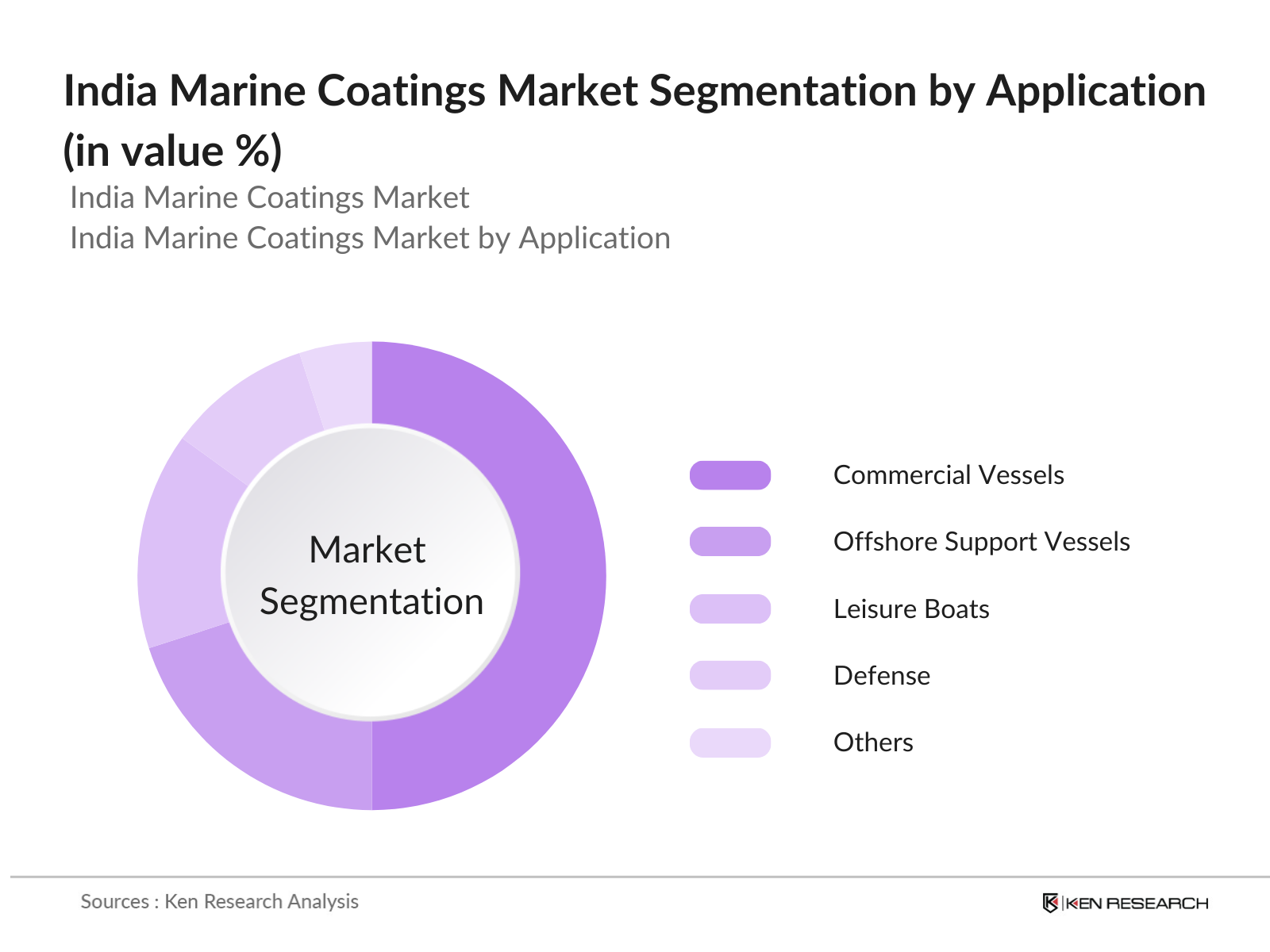

By Application: The India's marine coatings market in India is also segmented by application into commercial vessels, offshore support vessels (OSVs), leisure boats, defense, and others. The commercial vessels sub-segment dominates the market due to India's significant involvement in global maritime trade. The necessity for regular maintenance and coatings to protect ships from corrosion and biofouling ensures a constant demand for marine coatings in this sub-segment. Additionally, the expansion of commercial ports and the governments focus on developing India's shipping industry has further solidified the dominance of this segment.

India Marine Coatings Market Competitive Landscape

The India marine coatings market is highly competitive, with several major players dominating the landscape. These companies are distinguished by their vast product portfolios, extensive R&D activities, and strong distribution networks. Market competition is primarily based on product quality, innovation, and environmental compliance.

|

Company |

Establishment Year |

Headquarters |

R&D Investment (USD Mn) |

No. of Employees |

Product Range |

Market Share (%) |

Revenue (USD Mn) |

Recent Innovations |

|

AkzoNobel N.V. |

1792 |

Amsterdam, NL |

- |

- |

- |

- |

- |

- |

|

Jotun Group |

1926 |

Sandefjord, NO |

- |

- |

- |

- |

- |

- |

|

Hempel A/S |

1915 |

Lyngby, DK |

- |

- |

- |

- |

- |

- |

|

Chugoku Marine Paints, Ltd. |

1917 |

Hiroshima, JP |

- |

- |

- |

- |

- |

- |

|

PPG Industries, Inc. |

1883 |

Pittsburgh, US |

- |

- |

- |

- |

- |

- |

India Marine Coatings Market Analysis

Market Growth Drivers

- Expansion in Shipbuilding Industry (Shipbuilding Output): Indias shipbuilding industry has witnessed significant growth, supported by government initiatives like Make in India and an increase in defense shipbuilding. In 2023, India delivered around 2.8 million deadweight tonnage (DWT) in shipbuilding output, up from 2.1 million DWT. This increase in ship production is expected to drive demand for marine coatings, as the newly built vessels require protective coatings. Shipyards in Visakhapatnam and Cochin have seen notable increases in output, further contributing to the demand. This trend has been supported by increased investment in defense and commercial shipbuilding by state-owned enterprises.

- Government Initiatives and Policies (Make in India, Coastal Development): The Indian governments Make in India initiative has significantly boosted the domestic shipbuilding sector by promoting local manufacturing and investments. In 2023, the government allocated INR 1,500 crore to the coastal development project Sagarmala, which aims to modernize ports and develop coastal infrastructure. This initiative is expected to drive marine coatings demand as ports require maintenance and protective coatings to enhance operational efficiency. Additionally, Sagarmala's promotion of inland waterways and port-led development directly stimulates the requirement for durable coatings to ensure long-term maritime sustainability.

- Rise in Maritime Trade (Import-Export Volume): Indias maritime trade has surged, with the total cargo handled by Indian ports reaching 1.2 billion metric tons in 2023, up from 1.06 billion metric tons. The rise in import-export volume is primarily attributed to the increasing demand for goods and materials, which has led to heightened vessel activity. This surge in maritime operations boosts the need for marine coatings, as vessels operating in India's waters require constant maintenance to withstand harsh marine environments, ensuring longevity and efficiency in trade-related shipping.

Market Challenges

- High Costs of Raw Materials (Raw Material Price Trends): The marine coatings industry has faced challenges due to the rising cost of raw materials, including titanium dioxide and resins. In 2023, the price of titanium dioxide increased by 10% from the previous year, mainly due to supply chain disruptions and raw material shortages globally. This has affected the profit margins for manufacturers, forcing many to either absorb the costs or pass them on to consumers. The volatile price trend in key inputs remains a challenge, especially for small and medium-sized marine coating manufacturers in India.

- Stringent Environmental Regulations (Emission Norms Compliance): Compliance with Indias stringent environmental regulations, such as those set by the Central Pollution Control Board (CPCB), remains a challenge for the marine coatings market. In 2023, the CPCB introduced more stringent volatile organic compounds (VOC) limits for coatings, particularly affecting solvent-based products. The industry faces the cost burden of reformulating coatings to meet these new requirements while maintaining performance. Adhering to emission standards is crucial for manufacturers to avoid penalties and maintain market access, but this regulatory compliance increases operational costs.

India Marine Coatings Market Future Outlook

Over the next five years, the India marine coatings market is expected to experience significant growth, driven by government incentives for local manufacturing, advancements in coating technologies, and a rising focus on environmental sustainability. As the marine industry adopts digital and automated processes for maintenance, the demand for advanced coatings with longer life cycles will increase. Moreover, the expansion of maritime trade and the construction of new ports are projected to create further opportunities in this market.

Market Opportunities:

- Digital Innovations in Application Processes (Automation in Coating Applications): The introduction of automated systems in marine coatings application is transforming the industry. In 2023, Indias leading shipyards began adopting robotic spray technologies, which have improved the precision and efficiency of coating application. This automation reduces human error and increases the speed of application, resulting in lower operational costs and enhanced coating quality. This trend is expected to accelerate as more shipyards integrate digital innovations into their maintenance and manufacturing processes.

- Shift Towards Biocide-Free Coatings (Biocide Market Share): Biocide-free coatings are gaining traction due to environmental regulations and the need to reduce harmful substances in marine environments. These coatings, which prevent biofouling without releasing harmful biocides, are being adopted by an increasing number of vessel operators seeking compliance with IMO regulations on hazardous substances. As environmental concerns grow, this shift highlights the increasing focus on eco-friendly alternatives within the marine industry. The trend is driven by the need for sustainable maritime practices and compliance with both local and international regulations.

Scope of the Report

|

By Type |

Anti-Fouling Coatings Anti-Corrosion Coatings Foul Release Coatings Self-Polishing Coatings |

|

By Application |

Commercial Vessels Leisure Boats Offshore Support Vessels Defense Others |

|

By Resin Type |

Epoxy Polyurethane Acrylic Others |

|

By End-User |

Shipping Oil & Gas Ports & Harbors Defense (Navy, Coast Guard) Leisure & Tourism |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Shipbuilding companies

Port operators

Marine maintenance service providers

Oil and gas offshore operators

Defense agencies (Indian Navy, Indian Coast Guard)

Maritime transport companies

Investments and venture capitalist firms

Government and regulatory bodies (Ministry of Shipping, Directorate General of Shipping)

Companies

Players Mention in the Report

AkzoNobel N.V.

Jotun Group

Hempel A/S

Chugoku Marine Paints, Ltd.

PPG Industries, Inc.

Sherwin-Williams Company

Nippon Paint Marine Coatings Co. Ltd.

Kansai Paint Co. Ltd.

RPM International Inc.

BASF SE

Berger Paints India Ltd.

Asian Paints Limited

Shalimar Paints

Tikkurila Oyj

Axalta Coating Systems

Table of Contents

1. India Marine Coatings Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Marine Coatings Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Marine Coatings Market Analysis

3.1 Growth Drivers

3.1.1 Expansion in Shipbuilding Industry (Shipbuilding Output)

3.1.2 Government Initiatives and Policies (Make in India, Coastal Development)

3.1.3 Rise in Maritime Trade (Import-Export Volume)

3.1.4 Increasing Marine Tourism (Tourism Growth)

3.2 Market Challenges

3.2.1 High Costs of Raw Materials (Raw Material Price Trends)

3.2.2 Stringent Environmental Regulations (Emission Norms Compliance)

3.2.3 Lack of Skilled Labor (Skilled Workforce Availability)

3.3 Opportunities

3.3.1 Technological Advancements (Advanced Coating Technologies)

3.3.2 Green and Sustainable Coatings (Eco-Friendly Marine Coatings)

3.3.3 Increasing Demand for Maintenance and Repair Services (Maintenance Market Growth)

3.4 Trends

3.4.1 Shift Towards Biocide-Free Coatings (Biocide Market Share)

3.4.2 Adoption of Anti-Fouling and Self-Cleaning Technologies (Technology Adoption Rate)

3.4.3 Digital Innovations in Application Processes (Automation in Coating Applications)

3.5 Government Regulations

3.5.1 Environmental Protection Laws (Regulatory Standards)

3.5.2 Import Duty and Tariff Regulations (Custom Duty Trends)

3.5.3 Compliance with International Maritime Organization (IMO) Standards

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. India Marine Coatings Market Segmentation

4.1 By Type (In Value %)

4.1.1 Anti-Fouling Coatings

4.1.2 Anti-Corrosion Coatings

4.1.3 Foul Release Coatings

4.1.4 Self-Polishing Coatings

4.1.5 Others

4.2 By Application (In Value %)

4.2.1 Commercial Vessels

4.2.2 Leisure Boats

4.2.3 Offshore Support Vessels (OSVs)

4.2.4 Defense

4.2.5 Others

4.3 By Resin Type (In Value %)

4.3.1 Epoxy

4.3.2 Polyurethane

4.3.3 Acrylic

4.3.4 Others

4.4 By Region (In Value %)

4.4.1 Northern India

4.4.2 Southern India

4.4.3 Eastern India

4.4.4 Western India

5. India Marine Coatings Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 AkzoNobel N.V.

5.1.2 Jotun Group

5.1.3 Hempel A/S

5.1.4 Chugoku Marine Paints, Ltd.

5.1.5 PPG Industries, Inc.

5.1.6 Sherwin-Williams Company

5.1.7 Nippon Paint Marine Coatings Co. Ltd.

5.1.8 Kansai Paint Co. Ltd.

5.1.9 RPM International Inc.

5.1.10 BASF SE

5.1.11 Berger Paints India Ltd.

5.1.12 Asian Paints Limited

5.1.13 Shalimar Paints

5.1.14 Tikkurila Oyj

5.1.15 Axalta Coating Systems

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, R&D Investment, Product Portfolio, Market Share, Key End-User Industries)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Marine Coatings Market Regulatory Framework

6.1 Environmental Standards (Regulatory Compliance)

6.2 Certification Processes (Indian Standards, IMO Certification)

6.3 Compliance Requirements (Marine Coating Regulations)

7. India Marine Coatings Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Technological Advancements, New Market Entrants)

8. India Marine Coatings Future Market Segmentation

8.1 By Type (In Value %)

8.2 By Application (In Value %)

8.3 By Resin Type (In Value %)

8.4 By Region (In Value %)

9. India Marine Coatings Market Analyst Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves identifying the main variables affecting the India marine coatings market. A comprehensive ecosystem map is created, highlighting the stakeholders, including shipbuilders, port operators, and oil & gas offshore operators. Desk research, backed by secondary and proprietary databases, is utilized to gather market intelligence.

Step 2: Market Analysis and Construction

This step compiles and analyzes historical data related to the India marine coatings market. Data from shipbuilding activity, port infrastructure growth, and offshore operations are evaluated. The penetration of advanced coating technologies in commercial vessels and the defense sector is thoroughly examined to construct reliable market revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through in-depth consultations with industry experts, including representatives from leading marine coatings companies. These consultations provide valuable insights into key operational trends, product innovation, and market dynamics, ensuring the accuracy of the analysis.

Step 4: Research Synthesis and Final Output

In the final stage, the research synthesis involves consolidating inputs from multiple marine coating manufacturers and industry stakeholders. These insights are combined with bottom-up market data to deliver a comprehensive, validated analysis of the India marine coatings market, supported by both quantitative and qualitative data.

Frequently Asked Questions

01. How big is the India Marine Coatings Market?

The India marine coatings market, valued at USD 37.1 million, is driven by a growing shipbuilding industry, an increase in maritime trade, and government initiatives to boost local manufacturing.

02. What are the challenges in the India Marine Coatings Market?

Challenges include fluctuating raw material costs, stringent environmental regulations, and the lack of skilled labor in the marine industry, which pose significant hurdles for market players.

03. Who are the major players in the India Marine Coatings Market?

Major players in the market include AkzoNobel N.V., Jotun Group, Hempel A/S, Chugoku Marine Paints, Ltd., and PPG Industries, Inc. These companies lead due to their product innovation, vast distribution networks, and strong focus on sustainability.

04. What are the growth drivers of the India Marine Coatings Market?

The market is propelled by the expansion of the shipbuilding industry, advancements in coating technologies, and a rise in maritime trade, which has increased demand for high-performance coatings.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.