India Mattress Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD775

July 2024

82

About the Report

India Mattress Market Overview

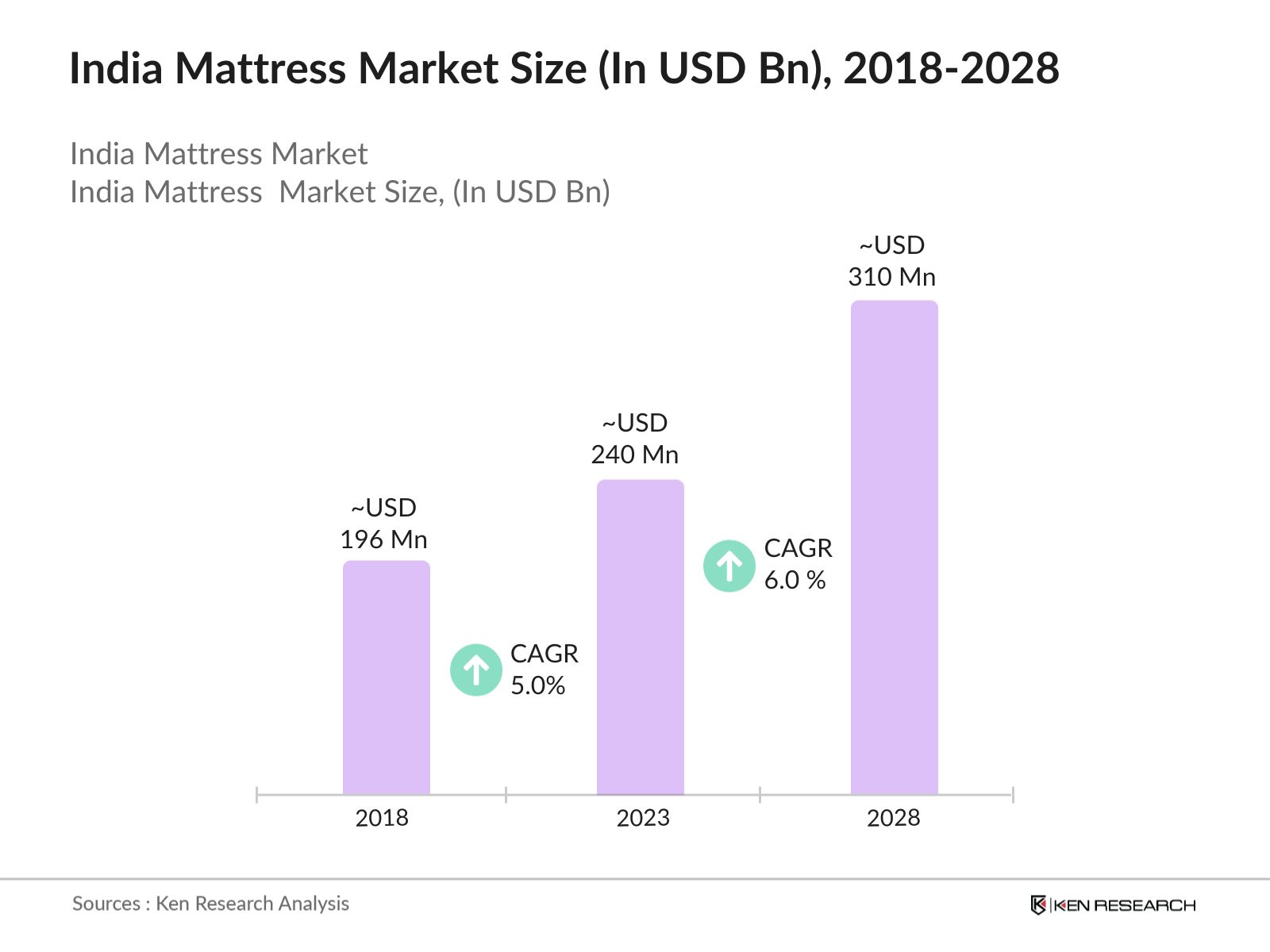

- The India mattress market was valued at USD 240 Mn in 2023, demonstrating significant growth driven by rising urbanization, increased income levels, and growing health awareness among consumers.

- The major players in the market include Sleepwell, Kurlon, Duroflex, Springfit, and Wakefit. These companies have established strong brand recognition and extensive distribution networks.

- Springfit Mattress Pvt. Ltd. launched smart mattresses with sleep tracking technology. These mattresses use advanced sensors to monitor sleep patterns and provide personalized recommendations. The initial market response has been encouraging, with a 15% sales increase in the first quarter, indicating strong consumer interest in smart home products.

India Mattress Current Market Analysis

- The Indian mattress market is experiencing vigorous growth, with significant demand for orthopedic and memory foam mattresses due to increasing health consciousness and lifestyle changes. Sleepwell is the dominant player owing to its extensive product range, strong brand equity, and wide distribution network across urban and rural areas.

- E-commerce platforms have revolutionized the mattress market by simplifying the purchasing process for consumers. The Internet and Mobile Association of India predicts a 25% annual growth in the online retail market in next five years, with significant sales from home furnishings, including mattresses. The convenience, variety, and competitive pricing of online shopping have greatly contributed to market growth.

- The West and Central regions of India are currently dominating the mattress market. This dominance is attributed to several factors including higher disposable incomes, urbanization, and a growing awareness of health and wellness which drives the demand for quality mattresses.

India Mattress Market Segmentation

The India Mattress market is segmented based on various factors. Here are three key segmentation types with their sub-segments and estimated market share ranges:

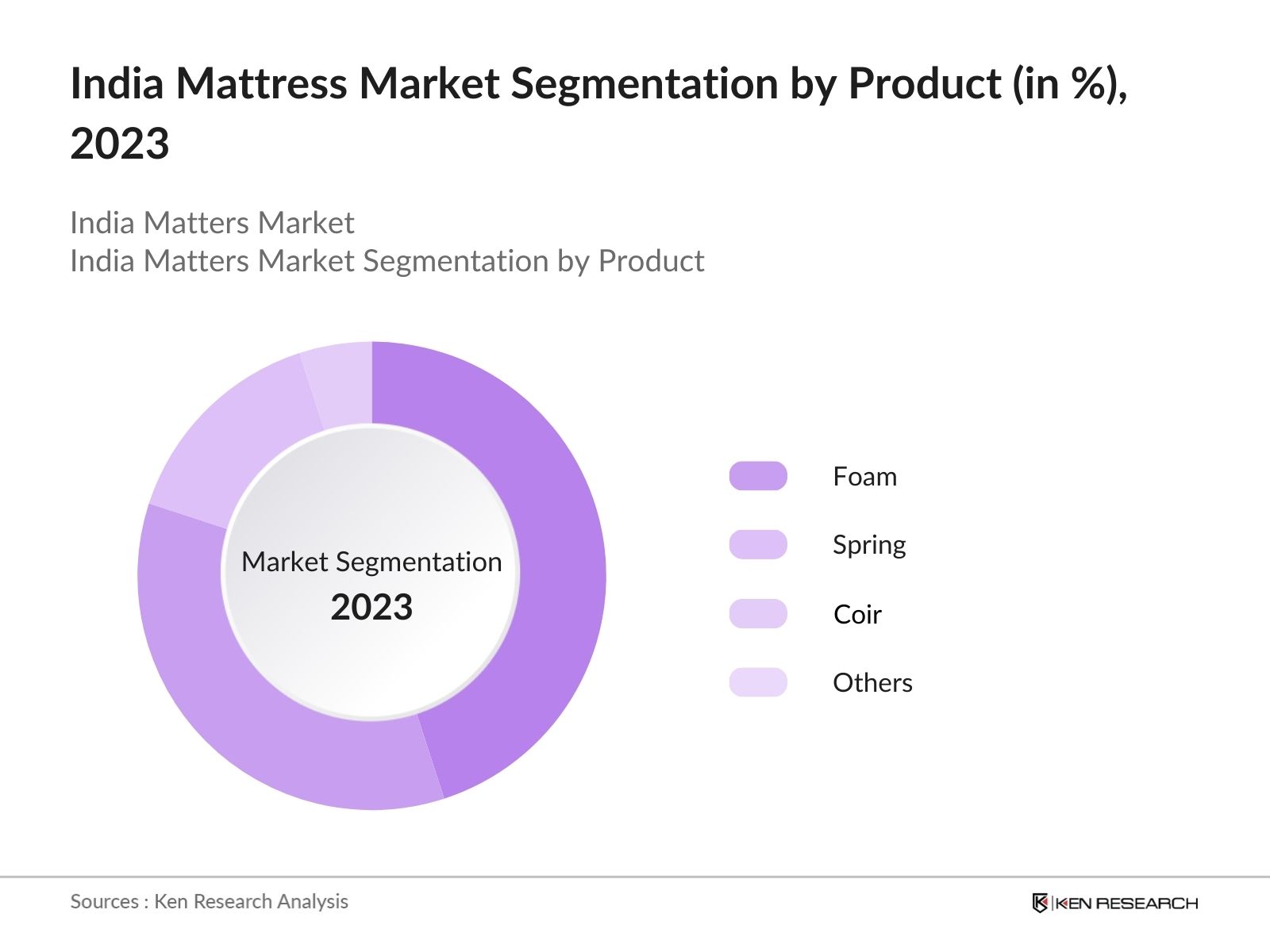

By Product Type: India mattress market segmentation by product type is divided into foam, spring, coir and others. In 2023, Foam mattresses, especially memory foam, are highly preferred for their ability to contour to the body's shape, providing excellent support and pressure relief. This makes them particularly popular among consumers with back pain or other health issues requiring better spinal alignment.

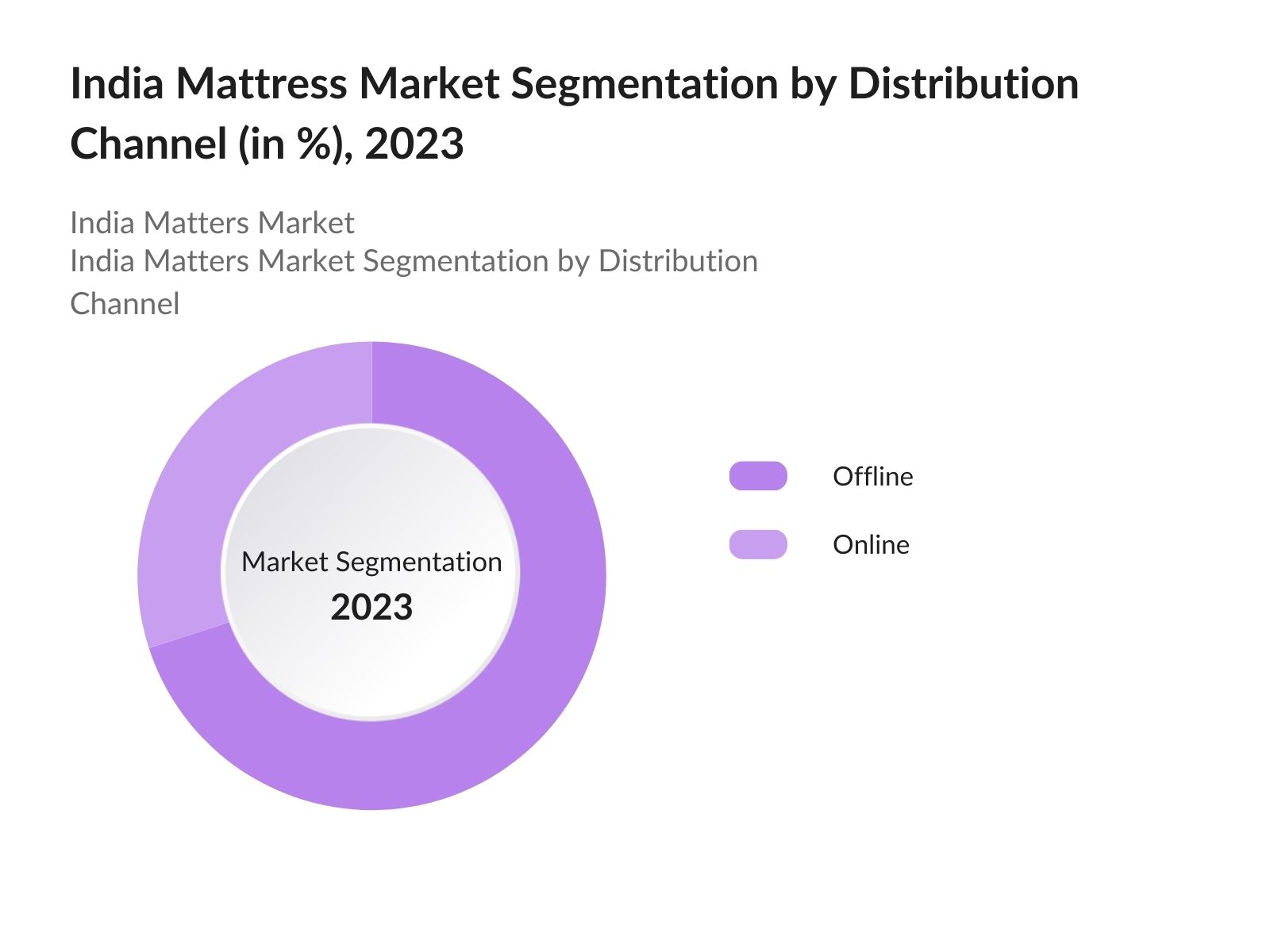

By Distribution Channel: India mattress market segmentation by distribution channel is divided into offline ad online channel. In 2023, the offline distribution channel, remains the dominant sales channel for mattresses in India. This dominance is attributed to the nature of the product, as consumers prefer to physically test mattresses before making a purchase. The tactile experience of feeling the mattress's firmness and comfort level is crucial for buyers.

By End-User: The India matters market is segmented by end-user into residential and commercial. In 2023, The residential segment, leads the Indian mattress market. This segment's dominance is driven by the essential nature of mattresses as household items and the growing number of nuclear families, which increases the demand for individual household furniture and furnishings.

India Mattress Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Sleepwell |

1971 |

Noida, India |

|

Kurlon |

1962 |

Bangalore, India |

|

Duroflex |

1963 |

Alleppey, India |

|

Springfit |

2008 |

Noida, India |

|

Wakefit |

2016 |

Bangalore, India |

- Sheela Foam Ltd. acquired Kurlon Enterprises Ltd., strengthening its market position. This acquisition leverages Kurlon's extensive distribution network and customer base, creating significant synergies. Valued at INR 2,000 crores, the deal is expected to enhance Sheela Foam's market share and drive growth in the coming years.

- Duroflex introduced eco-friendly mattresses made from natural and recycled materials, catering to the growing demand for sustainable products. The new range has received positive feedback, with initial sales exceeding company expectations by 20%, highlighting the market's shift towards eco-friendly products.

- In 2024, Peps Industries Pvt. Ltd. expanded its manufacturing capacity to meet the growing demand for spring mattresses, investing INR 500 crores in a new Tamil Nadu facility. This expansion is expected to increase production capacity, enabling the company to cater to rising demand and enhance its market presence.

India Mattress Market Industry Analysis

India Mattress Market Growth Drivers

- Rising Disposable Incomes and Urbanization: Increased disposable incomes and urbanization in India have significantly boosted mattress demand. The Ministry of Statistics and Programme Implementation reports a 5% annual rise in urban household income over the past five years. In 2022, country’s disposable income per capita was valued at USD 5,497 which is expected to reach USD 10,438 by 2035. Urbanization has led to a higher living standard, with more people investing in home comforts like quality mattresses. Urban households spend around 10% of their income on home furnishings, showing strong market potential for mattress manufacturers.

- Expanding Real Estate and Hospitality Sector: The growth of the real estate and hospitality sectors is pivotal for the mattress market. According to the Ministry of Housing and Urban Affairs, the real estate sector is projected to contribute about 13% to India's GDP by 2025. The hospitality industry is also booming, with a steady increase in hotels and resorts, necessitating a continuous supply of mattresses, thereby significantly boosting the mattress market.

- Increased Health and Wellness Awareness: Growing health and wellness awareness has increased the demand for high-quality mattresses. A survey by the Indian Council of Medical Research found that more than half of urban Indians see a good mattress as essential for their health. This shift towards better sleep health has driven manufacturers to innovate, offering products tailored to health-conscious consumers.

India Mattress Market Challenges

- Limited Awareness in Rural Areas: Despite growing sleep health awareness in urban areas, rural regions still lack awareness. The National Sample Survey Office notes that rural households spend significantly less on home furnishings compared to urban ones. This limited awareness and lower spending capacity in rural areas challenge manufacturers aiming to expand their market reach.

- Price Sensitivity and Competition from Unorganized Sector: The Indian mattress market is highly price-sensitive, with consumers often prioritizing cost over quality, challenging premium manufacturers. The unorganized sector, offering lower-priced mattresses, captures majority of the market, affecting organized players' market share and profitability, according to the Confederation of Indian Industry.

- Fluctuating Raw Material Costs: The mattress industry faces significant challenges due to fluctuating raw material costs, such as foam and latex. The Indian Rubber Manufacturers Research Association reports increase in natural rubber prices over the last year, affecting production costs and pricing strategies for manufacturers, posing a significant challenge.

India Mattress Market Government Initiatives

- Startup India (2016): Startup India promotes entrepreneurship and innovation across sectors, including home furnishings. The initiative has led to the emergence of several mattress startups offering innovative products. The Department for Promotion of Industry and Internal Trade reports over 30,000 recognized startups, many in the home furnishing and lifestyle segment.

- Make in India (2014): The Make in India initiative promotes domestic manufacturing, aiming to make India a global manufacturing hub. This policy has benefited the mattress industry by encouraging local production and reducing import dependence. The Ministry of Commerce and Industry indicates a 10% annual growth in domestic manufacturing in the home furnishing sector since the initiative's launch.

- Pradhan Mantri Awas Yojana (PMAY) (2015): The PMAY scheme aims to provide affordable housing by 2022. The Ministry of Housing and Urban Affairs reports over 11 million sanctioned houses under the scheme. This initiative has significantly increased the demand for home furnishings, including mattresses, as new homeowners furnish their residences.

India Mattress Future Market Outlook

The India mattress market is expected to show substantial growth, driven by smart mattresses with integrated technology, customised and personalized mattresses, and E-commerce Expansion.

Future Market Trends

- Smart Mattresses with Integrated Technology: Smart mattresses with sleep tracking technology will become an increasingly prevalent trend. These mattresses will monitor sleep patterns and offer personalized recommendations, appealing to tech-savvy urban consumers. A study by the Indian Institute of Technology predicts a growing adoption of smart home products, including smart mattresses, signaling a promising future trend.

- Customized and Personalized Mattresses: Customized and personalized mattresses tailored to individual preferences will gain more traction. Consumers will increasingly seek products catering to specific needs, such as orthopedic support or hypoallergenic materials. A survey by the National Sleep Foundation indicates that 70% of respondents will prefer customized mattresses, highlighting the significant potential of this trend in the Indian market.

Scope of the Report

|

By Product |

Foam Spring Coir Others |

|

By Distribution Channel |

Offline Online |

|

By End-User |

Residential Commercial |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Mattress Manufacturers and Suppliers

Hospitality Industry Professionals

Healthcare Institutions

E-commerce Platforms

Interior Designing Firms

Bank and Financial Institution

Government and Regulatory Bodies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Sleepwell

Kurlon

Duroflex

Springfit

Wakefit

Peps Industries

Coirfit Mattress

Restonic, Tempur-Pedic

Magniflex

King Koil

Nilkamal

Godrej Interio

Springwel

Centuary Mattresses

MM Foam

Urban Ladder

The Sleep Company

Amore International

Repose Mattress

Table of Contents

1. India Mattress Market Overview

1.1 India Mattress Market Taxonomy

2. India Mattress Market Size (in USD Bn), 2018-2023

3. India Mattress Market Analysis

3.1 India Mattress Market Growth Drivers

3.2 India Mattress Market Challenges and Issues

3.3 India Mattress Market Trends and Development

3.4 India Mattress Market Government Regulation

3.5 India Mattress Market SWOT Analysis

3.6 India Mattress Market Stake Ecosystem

3.7 India Mattress Market Competition Ecosystem

4. India Mattress Market Segmentation, 2023

4.1 India Mattress Market Segmentation by Product (in %), 2023

4.2 India Mattress Market Segmentation by Distribution Channel (in %), 2023

4.3 India Mattress Market Segmentation by End-User (in %), 2023

5. India Mattress Market Competition Benchmarking

5.1 India Mattress Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Mattress Future Market Size (in USD Bn), 2023-2028

7. India Mattress Future Market Segmentation, 2028

7.1 India Mattress Market Segmentation by Product (in %), 2028

7.2 India Mattress Market Segmentation by Distribution Channel (in %), 2028

7.3 India Mattress Market Segmentation by End-User (in %), 2028

8. India Mattress Market Analysts’ Recommendations

8.1 India Mattress Market TAM/SAM/SOM Analysis

8.2 India Mattress Market Customer Cohort Analysis

8.3 India Mattress Market Marketing Initiatives

8.4 India Mattress Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on India mattress market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India mattress market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple mattress companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from mattress companies.

Frequently Asked Questions

01 How big is India mattress market?

The India mattress market was valued at USD 240 Mn in 2023, demonstrating significant growth driven by rising urbanization, increased income levels, and growing health awareness among consumers.

02 Who are the major players in the India mattress market?

Some of the major players in the market include Sleepwell, Kurlon, Duroflex, Springfit, and Wakefit which dominates the market owing to their extensive distribution networks, strong brand presence, and diverse product portfolios.

03 What are the growth drivers for India mattress market?

Some of the major growth drivers in the market include increasing urbanization, rising disposable income, health awareness, and the expansion of the hospitality sector.

04 What are the challenges in India mattress market?

Key challenges include competition from unorganized players, raw material price fluctuations, and limited consumer awareness. Additionally, counterfeit products are also impacting the growth of market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.