India Medical Plastics Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD2044

October 2024

90

About the Report

India Medical Plastics Market Overview

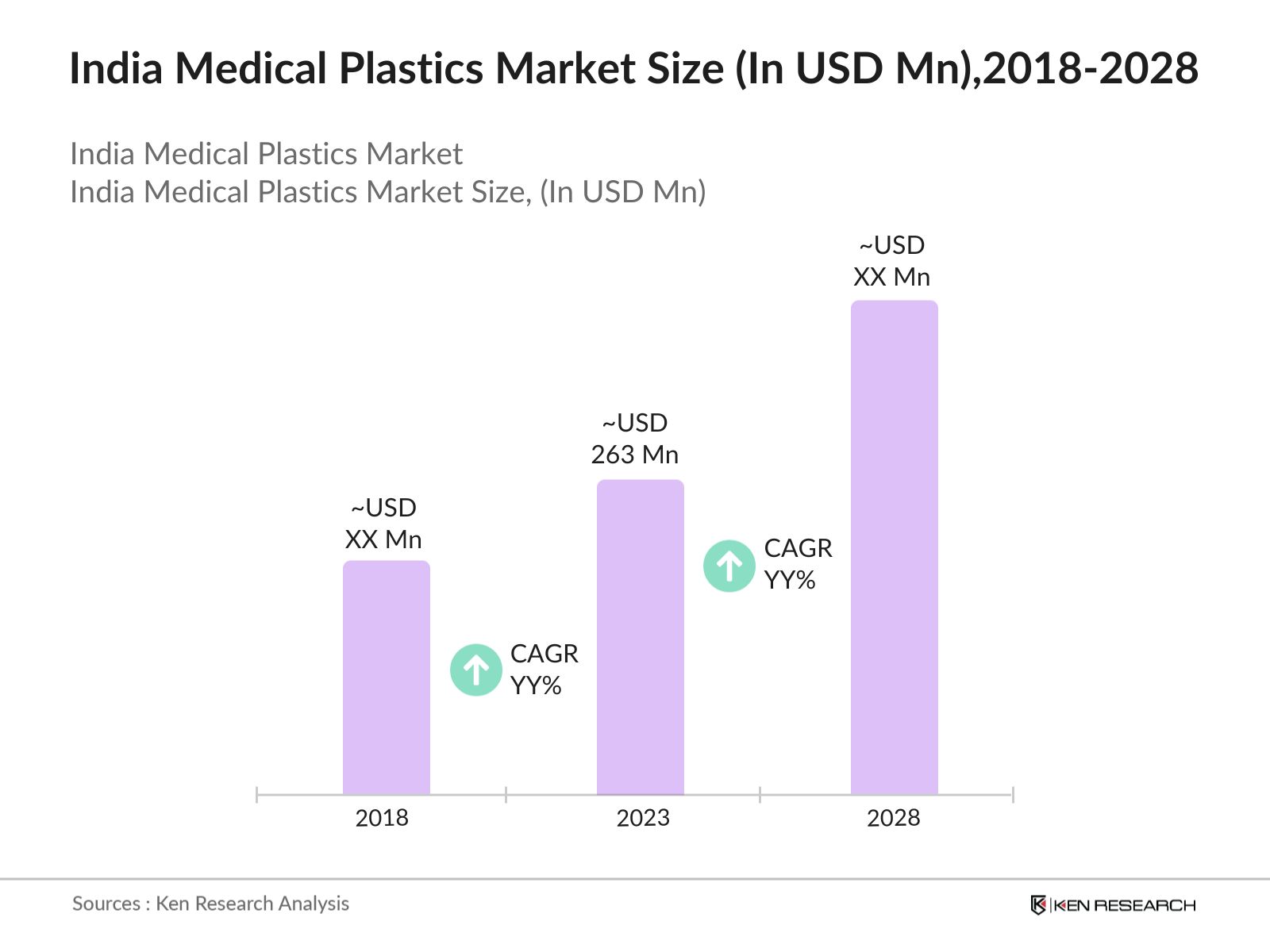

- The India medical plastics market was valued at USD 263 million in 2023, driven by increasing demand for high-quality medical equipment and devices. Growth in healthcare infrastructure, propelled by both private and government investments, is a key factor supporting this market's expansion.

- The India Medical Plastics Market is led by key players such as BASF, SABIC, DuPont, Reliance Industries, and Essel Propack. These companies are known for their innovation in medical-grade plastics and sustainable solutions tailored to the medical industry.

- Mumbai, Bangalore, and Pune are the dominant cities in the India Medical Plastics Market, driven by their advanced healthcare infrastructure and established medical device manufacturing sectors. These cities benefit from strong logistics networks and a growing number of medical startups.

- In 2023, Reliance Industries announced a major expansion of its medical-grade plastics production, investing INR 2,000 crore to meet rising domestic and international demand. This development strengthens the companys position in the India medical plastics market, focusing on sustainability and innovation.

India Medical Plastics Market Segmentation

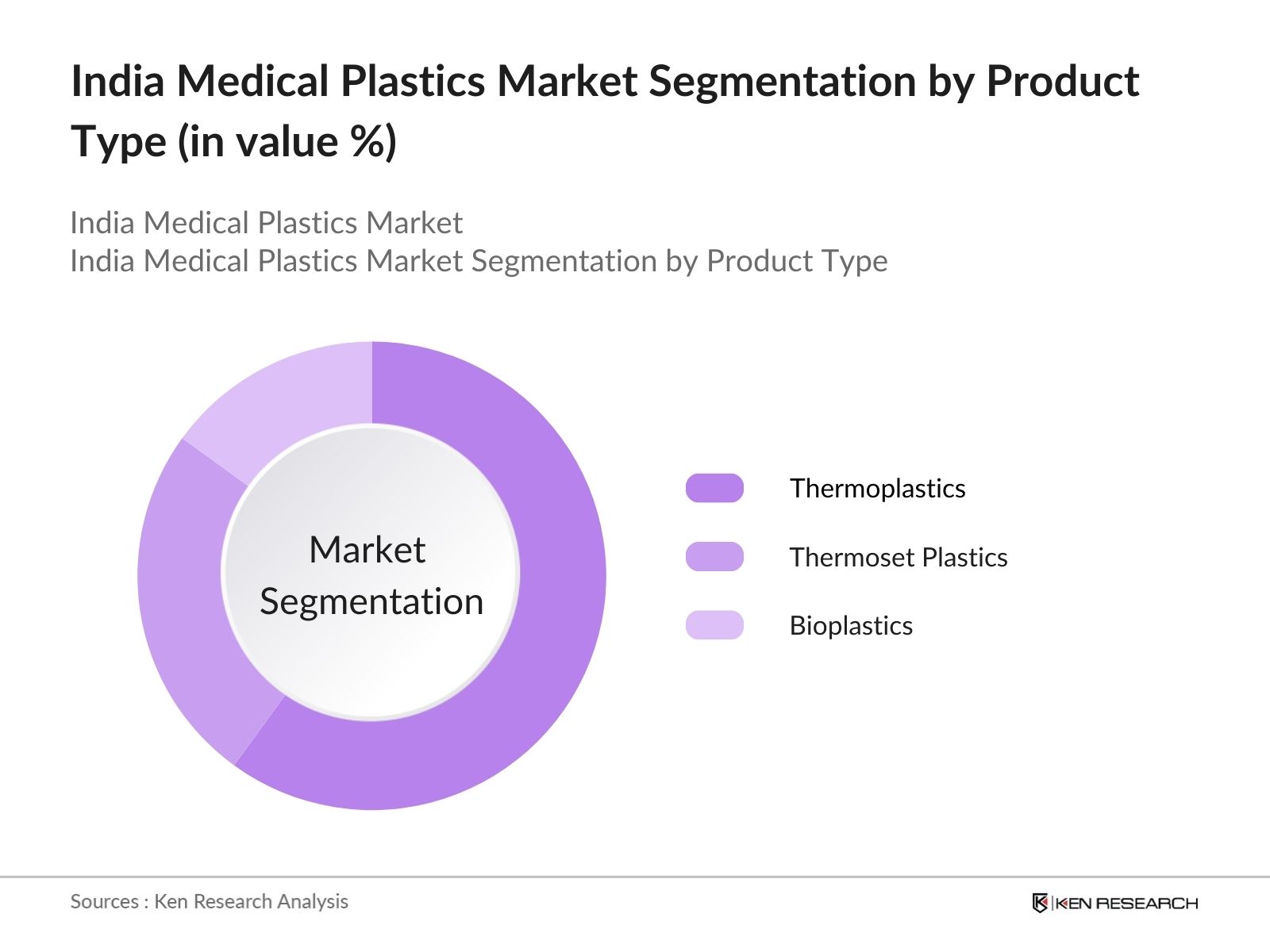

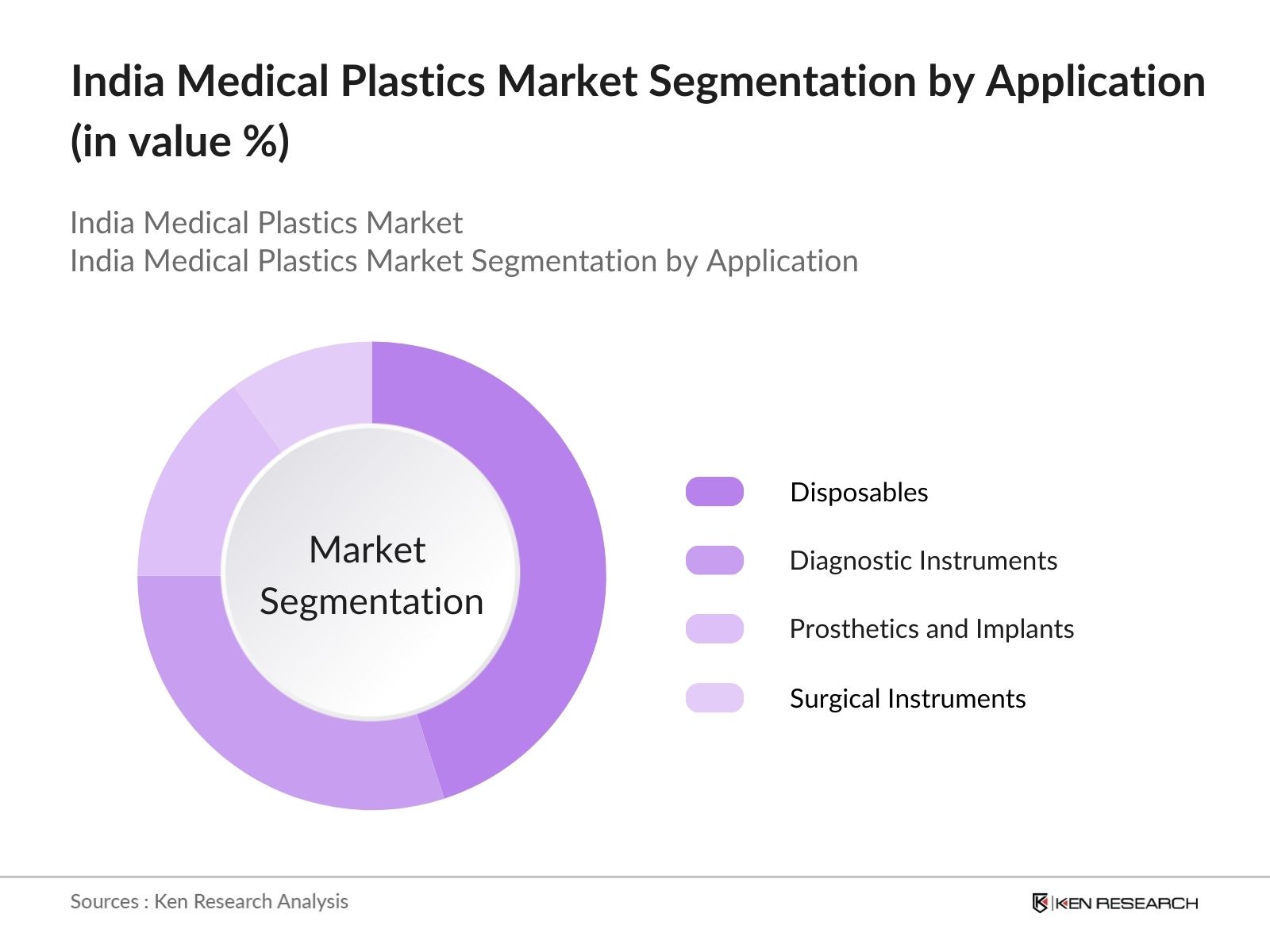

The India Medical Plastics Market can be segmented by product type, application, and region.

By Product Type: The India medical plastics market is segmented by product type into thermoplastics, thermoset plastics, and bioplastics. In 2023, thermoplastics dominated the market due to their extensive use in disposable medical devices such as syringes, catheters, and IV bags. Their ability to be easily molded and sterilized makes thermoplastics a preferred material in the healthcare sector.

By Application: The India medical plastics market is further segmented by application into disposables, diagnostic instruments, prosthetics and implants, and surgical instruments. In 2023, disposables dominated the market due to the increasing demand for single-use plastic devices in hospitals and clinics to prevent cross-contamination and infections. The rising need for disposable gloves, masks, and syringes has boosted the demand for medical plastics.

By Region: The India medical plastics market is segmented by region into North, South, East, and West India. In 2023, South India emerged as the dominant region due to the presence of multiple medical device manufacturing hubs, particularly in Tamil Nadu and Karnataka. The region benefits from government-backed infrastructure projects and an increasing number of medical startups, contributing to its leadership in the market.

India Medical Plastics Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

BASF |

1865 |

Germany |

|

SABIC |

1976 |

Saudi Arabia |

|

DuPont |

1802 |

USA |

|

Reliance Industries |

1966 |

India |

|

Essel Propack |

1982 |

India |

- BASF: BASF will increase the capacity of its Ultramid polyamide (PA) and Ultradur polybutylene terephthalate (PBT) compounding plants in Panoli, Gujarat and Thane, Maharashtra by over 40%. This expansion will help meet the strong market demand for high-performance materials in India and will be available in the second half of 2025

- Essel Propack: Essel Propack has been actively enhancing its capabilities in medical packaging solutions in2023. The company specializes in laminated plastic tubes and has been expanding its offerings to cater to the healthcare sector, which is experiencing significant growth due to increasing healthcare demands in India. This strategic focus aligns with the broader trends in the medical plastics market, driven by rising healthcare expenditures and the need for advanced medical packaging solutions

India Medical Plastics Industry Analysis

India Medical Plastics Market Growth Drivers

- Healthcare Infrastructure Investments: Significant investments in healthcare infrastructure, including the establishment of new hospitals and healthcare facilities, are increasing the need for medical equipment and devices. This growth in infrastructure directly correlates with a rise in demand for medical plastics.

- Government Incentives for Local Manufacturing: The Production Linked Incentive (PLI) Scheme, launched in 2021 with an allocation of INR 3,420 crore, has driven the local production of medical devices, enhancing demand for medical plastics. By 2024, several domestic companies expanded their manufacturing capabilities under this scheme.

- Healthcare Infrastructure Investments: The Pradhan Mantri Ayushman Bharat Health Infrastructure Mission, with a budget of INR 64,180 crore, has led to the establishment of new healthcare facilities across India. This initiative has significantly increased the demand for plastic-based medical equipment and devices.

India Medical Plastics Market Challenges

- Regulatory Compliance Costs: Stringent regulations enforced by the Central Drugs Standard Control Organization (CDSCO) increase compliance costs for medical plastic manufacturers. Meeting biocompatibility and safety standards requires substantial investments, which presents a challenge for smaller players.

- Plastic Waste Management: The rise in single-use plastic medical devices has led to significant waste management challenges. India generates nearly 550 tonnes of biomedical waste per day as of 2024, creating a pressing need for sustainable waste disposal practices.

- Material Cost Management: Manufacturers face challenges in managing the costs of raw materials for medical plastics. Fluctuations in supply and production inefficiencies add to the complexity of maintaining competitive pricing without compromising on quality.

India Medical Plastics Market Government Initiatives

- Pradhan Mantri Ayushman Bharat Health Infrastructure Mission (2021): Launched with an allocation of INR 64,180 crore, this initiative focuses on strengthening Indias healthcare infrastructure, driving the demand for medical-grade plastics in new healthcare facilities.

- Medical Device Parks: The government is establishing medical device parks in various states, such as Tamil Nadu and Andhra Pradesh, to promote domestic manufacturing. These parks support the growth of the medical device industry, which in turn increases the demand for medical plastics.

India Medical Plastics Market Future Outlook

The India Medical Plastics Market is expected to witness robust growth by 2028, driven by technological advancements in medical devices, increasing healthcare infrastructure investments, and government policies promoting local manufacturing.

Future Market Trends

- Sustainability in Medical Plastics: In the coming years, the India medical plastics market will witness a shift towards more sustainable materials. Manufacturers are expected to invest in biodegradable and recyclable plastics to meet environmental regulations and address the issue of plastic waste. This trend will drive the development of innovative materials that offer both functionality and sustainability, reducing the environmental impact of disposable medical devices.

- Technological Advancements in Medical Device Manufacturing: By 2028, technological advancements such as 3D printing and nanotechnology will transform medical device manufacturing, increasing the use of custom-designed medical plastics. These advancements will enable the production of complex, patient-specific medical devices made from high-performance plastics, enhancing the efficiency of healthcare delivery and improving patient outcomes.

Scope of the Report

|

By Product Type |

Thermoplastics Thermoset Plastics Bioplastics |

|

By Application |

Disposables Diagnostic Instruments Prosthetics and Implants Surgical Instruments |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Medical Device Manufacturers

Government Agencies (Ministry of Health and Family Welfare, Central Drugs Standard Control Organization)

Healthcare Facilities

Pharmaceutical Companies

Medical Packaging Companies

Investment and Venture Capitalist Firms

Plastic and Polymer Suppliers

Time Period Captured in the Report:

Historical Period:2018-2023

Base Year:2023

Forecast Period:2023-2028

Companies

Players Mentioned in the Report:

- BASF

- SABIC

- DuPont

- Reliance Industries

- Essel Propack

- Covestro AG

- Celanese Corporation

- Tekni-Plex, Inc.

- Trelleborg AB

- Lubrizol Corporation

Table of Contents

India Medical Plastics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

India Medical Plastics Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Medical Plastics Market Analysis

3.1. Growth Drivers

3.1.1. Healthcare Infrastructure Investments

3.1.2. Government Incentives for Local Manufacturing

3.1.3. Technological Advancements in Medical Devices

3.2. Restraints

3.2.1. Regulatory Compliance Costs

3.2.2. Plastic Waste Management

3.2.3. Material Cost Management

3.3. Opportunities

3.3.1. Emerging Markets for Medical Plastics

3.3.2. Expansion of Biodegradable and Recyclable Plastics

3.3.3. Innovation in 3D-Printed Medical Devices

3.4. Trends

3.4.1. Sustainability in Medical Plastics

3.4.2. Increased Focus on Customized Medical Devices

3.4.3. Rising Adoption of Single-Use Plastics

3.5. Government Regulation

3.5.1. Central Drugs Standard Control Organization (CDSCO) Guidelines

3.5.2. Plastic Waste Management Rules (Amendments)

3.5.3. Medical Device Parks Scheme

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

India Medical Plastics Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Thermoplastics

4.1.2. Thermoset Plastics

4.1.3. Bioplastics

4.2. By Application (in Value %)

4.2.1. Disposables

4.2.2. Diagnostic Instruments

4.2.3. Prosthetics and Implants

4.2.4. Surgical Instruments

4.3. By Region (in Value %)

4.3.1. North India

4.3.2. South India

4.3.3. East India

4.3.4. West India

India Medical Plastics Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. BASF

5.1.2. SABIC

5.1.3. DuPont

5.1.4. Reliance Industries

5.1.5. Essel Propack

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

India Medical Plastics Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

India Medical Plastics Market Regulatory Framework

7.1. Central Drugs Standard Control Organization (CDSCO) Guidelines

7.2. Compliance Requirements

7.3. Certification Processes

India Medical Plastics Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

India Medical Plastics Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

India Medical Plastics Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Creation of an ecosystem for all major entities within the India Medical Plastics Market by referring to multiple secondary and proprietary databases. This step involves extensive desk research to gather information on market dynamics, growth drivers, challenges, key players, product types, applications, and regional distribution.

Step 2: Market Building

Collating statistics on the India Medical Plastics Market from 2018 to 2023, including data on market penetration by product types, application, and regional segments. This step also involves assessing the market share, revenue generation, and the impact of healthcare infrastructure investments to ensure accuracy behind the data points.

Step 3: Validating and Finalizing

Building market hypotheses and conducting CATIs (Computer-Assisted Telephonic Interviews) with industry experts from medical plastic manufacturers, healthcare providers, and regulatory bodies. This validation ensures the accuracy of the statistics and gathers operational and financial insights from key market players.

Step 4: Research Output

Our team approaches multiple medical plastic suppliers, manufacturers, and distributors to gather insights on product segmentation, sales channels, consumer preferences, and other parameters. This bottom-up approach validates the statistics and market trends derived from the data, ensuring comprehensive and reliable research output for the India Medical Plastics Market.

Frequently Asked Questions

1.How big is the India Medical Plastics Market?

The India medical plastics market was valued at USD 263 million in 2023, fueled by the rising demand for high-quality medical equipment and devices. The expansion of healthcare infrastructure, driven by investments from both the private sector and the government, is a significant factor contributing to the growth of this market.

2.What are the challenges in the India Medical Plastics Market?

Challenges in the India medical plastics market include stringent regulatory compliance, increasing plastic waste management concerns, and fluctuating raw material costs. These factors hinder the smooth operation and profitability of manufacturers.

3.Who are the major players in the India Medical Plastics Market?

Major players in the India medical plastics market include BASF, SABIC, DuPont, Reliance Industries, and Essel Propack. These companies lead the market due to their wide range of medical-grade plastics and strong manufacturing capabilities.

4.What are the growth drivers of the India Medical Plastics Market?

Growth drivers include the increasing demand for advanced medical devices, government incentives for local manufacturing, and rising investments in healthcare infrastructure. These factors have accelerated the need for high-quality medical plastics in India.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.