India Medical Tourism Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD4707

November 2024

81

About the Report

India Medical Tourism Market Overview

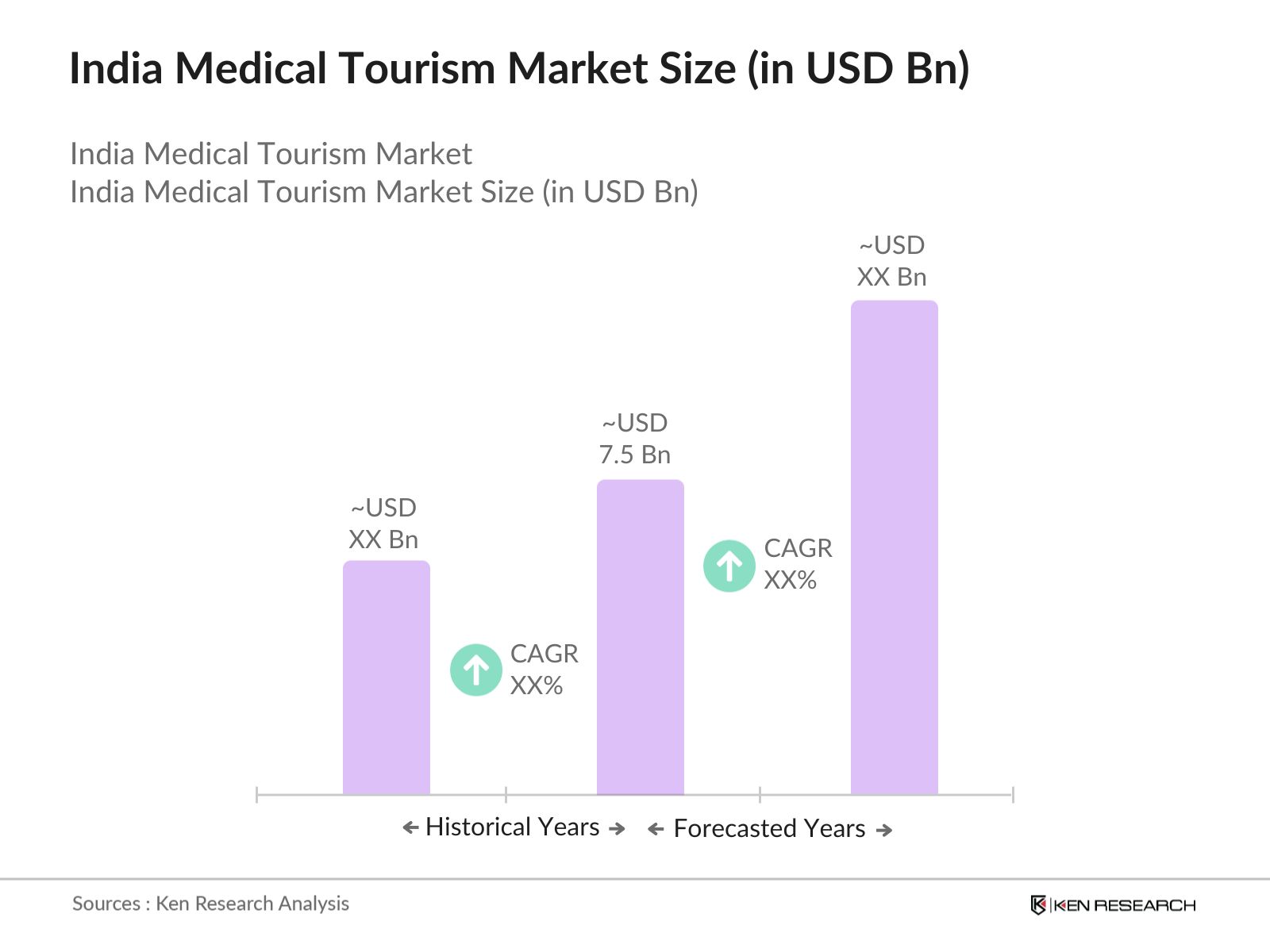

- The India Medical Tourism market is valued at USD 7.5 Bn, is experiencing significant growth driven by cost-effective healthcare services, the rising influx of international patients, and India's established reputation for high-quality specialized treatments such as cardiology, oncology, and organ transplants. The affordability of procedures in India compared to developed countries makes it an attractive destination for medical tourists, who can save up to 70-80% on healthcare costs without compromising on quality. This trend is bolstered by government support, including the streamlined e-Medical visa process, which facilitates patient travel and treatment.

- Dominant regions in India's medical tourism include Delhi NCR, Maharashtra, Tamil Nadu, and Kerala, with these areas hosting some of the country's most prestigious hospitals and wellness centers. Cities like Chennai and Mumbai are preferred due to their advanced infrastructure, highly qualified medical professionals, and hospitals with international accreditations such as NABH and JCI. These cities attract a substantial number of patients from GCC countries, Africa, and Bangladesh due to cultural similarities, geographical proximity, and the availability of specialized treatments.

- Indias rich heritage in Ayurvedic medicine and wellness tourism is being actively promoted by the government, especially in states like Kerala, Uttarakhand, and Goa. By 2023, the Indian wellness industry was valued at INR 49,000 crore (USD 6 billion), with a growing share of international tourists seeking treatments like Panchakarma, yoga, and naturopathy. The Ministry of AYUSH (Ayurveda, Yoga, Unani, Siddha, and Homeopathy) has facilitated the establishment of wellness centers in collaboration with private entities, helping promote India as a holistic medical tourism destination, further diversifying its offerings for international patients.

India Medical Tourism Market Segmentation

By Treatment Type: The market is segmented by treatment type into cardiovascular surgery, oncology treatments, cosmetic surgery, orthopedic surgery, and reproductive medicine. Among these, cardiovascular surgery holds a dominant share due to Indias advanced healthcare infrastructure and expertise in complex heart procedures. Medical tourists seek cardiovascular treatments in India primarily because of the high success rates and the significantly lower cost compared to countries like the U.S. and U.K. Additionally, the growing number of specialized cardiac hospitals across key cities has helped India secure its position as a global leader in heart surgeries.

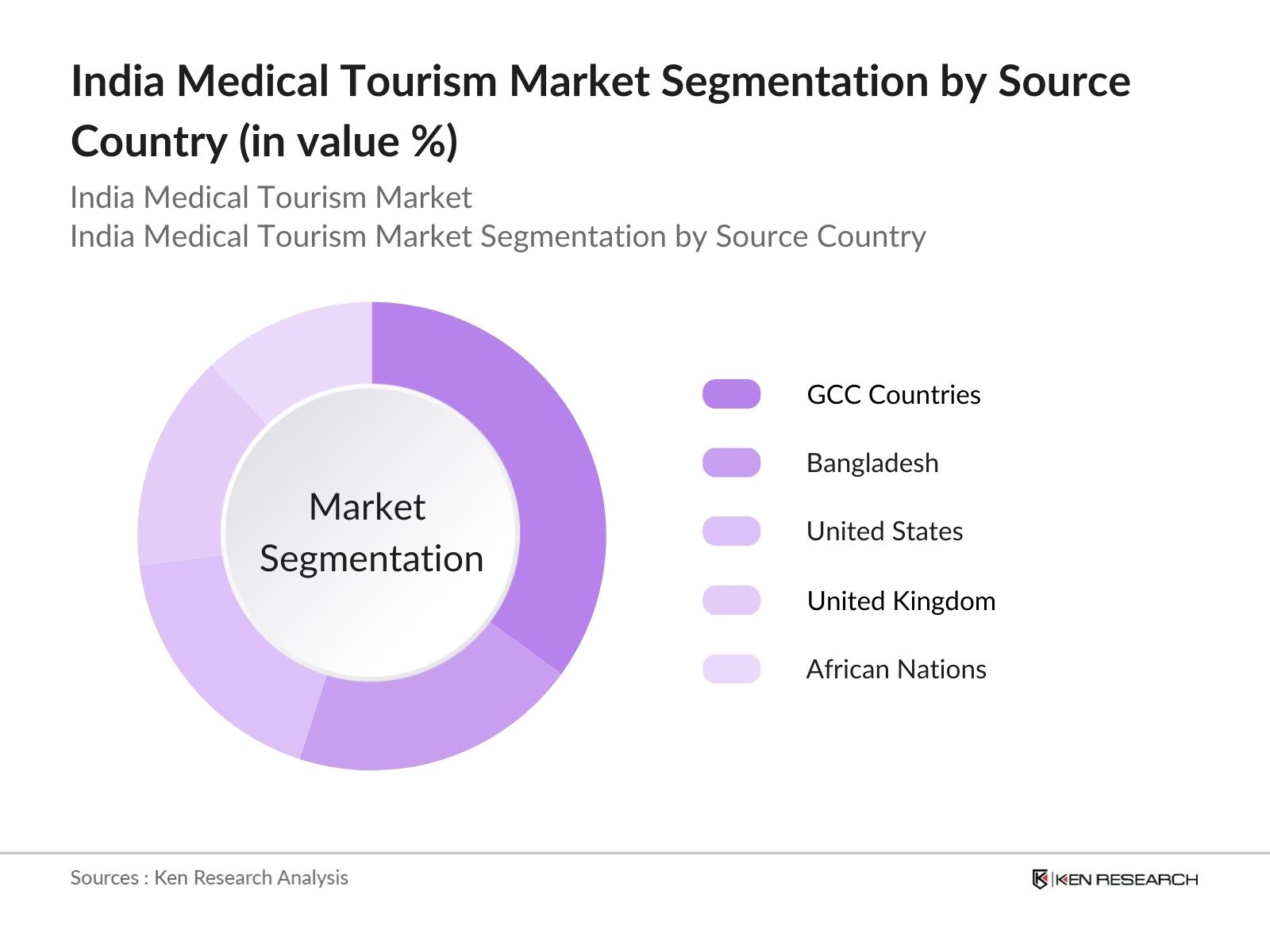

By Source Country: The market is also segmented by source country, including the United States, the United Kingdom, Gulf Cooperation Council (GCC) countries, African nations, and Bangladesh. GCC countries dominate the market share due to cultural and religious similarities, as well as close diplomatic ties with India. Patients from the GCC primarily seek treatments for chronic conditions like cardiovascular disease, diabetes, and organ transplants, areas where Indian healthcare excels. India also provides highly affordable fertility and cosmetic treatments that are otherwise expensive in their home countries.

India Medical Tourism Market Competitive Landscape

The India Medical Tourism market is dominated by several key players, including both large hospital chains and specialized clinics. These organizations have established themselves as leaders by offering world-class medical services at affordable costs, attracting patients globally. The competitive landscape is characterized by continuous investments in infrastructure, accreditations, and collaborations with international insurance companies.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

No. of Beds |

Specializations |

International Patients (per year) |

Partnerships |

|

Apollo Hospitals |

1983 |

Chennai |

||||||

|

Fortis Healthcare |

1996 |

Gurgaon |

||||||

|

Narayana Health |

2000 |

Bengaluru |

||||||

|

Max Healthcare |

2000 |

Delhi NCR |

||||||

|

Manipal Hospitals |

1953 |

Bengaluru |

India Medical Tourism Industry Analysis

Growth Drivers

- Affordability and Cost-Effectiveness of Treatments: India's medical tourism sector thrives due to its cost-effective healthcare services. For instance, a heart bypass surgery in India typically costs between USD 5,000 to USD 7,000, compared to over USD 100,000 in the United States. Additionally, orthopedic procedures like hip replacement cost around USD 7,000 in India, while the same treatment in Europe exceeds USD 35,000. These significant cost differences make India an attractive destination for international patients seeking high-quality yet affordable treatments. According to government data, over 495,000 medical tourists visited India in 2023, seeking treatments ranging from cardiology to orthopedics.

- Increasing Accreditation of Indian Hospitals: India has seen a rise in the accreditation of hospitals by reputable organizations such as the National Accreditation Board for Hospitals & Healthcare Providers (NABH) and Joint Commission International (JCI). By 2023, over 780 hospitals in India were NABH accredited, and 41 hospitals had JCI accreditation, ensuring world-class medical services. These accreditations enhance trust among international patients, ensuring that healthcare standards meet global expectations. The government aims to increase NABH-accredited facilities by 20% over the next two years, driving more confidence in the quality of care available in India.

- Government Initiatives Promoting Medical Tourism: The Indian government has introduced various measures to promote medical tourism, such as the e-Medical visa scheme, which allows tourists from over 165 countries to apply online. In 2023, the government approved over 200,000 e-Medical visas, demonstrating strong demand for Indias medical services. Additionally, the government has invested over INR 500 crore (USD 60 million) to upgrade healthcare infrastructure in major cities like Delhi, Mumbai, and Chennai, enhancing the capacity of hospitals to cater to international patients. The healthcare sector is further supported by government-backed public-private partnerships to attract medical tourists.

Market Challenges

- Language and Cultural Barriers: Despite Indias growing medical tourism sector, language and cultural differences remain barriers for many international patients. While English is widely spoken in metropolitan hospitals, only about 10% of the population speaks English fluently, which can cause communication challenges for patients from non-English-speaking countries. This is especially true in rural hospitals or specialized clinics where English proficiency is lower. Furthermore, cultural differences in medical practices and patient expectations can sometimes lead to misunderstandings or discomfort for foreign patients, particularly those from Western or Middle Eastern nations.

- Regulatory and Legal Complications: Indias regulatory framework for medical liability and malpractice remains underdeveloped compared to Western countries. Foreign patients often face legal challenges in seeking compensation in case of medical errors. The legal system can be slow and difficult to navigate, with average court cases related to medical liability taking over five years to resolve. Indias government has acknowledged these issues and is in the process of strengthening legal protections for both patients and healthcare providers, but regulatory challenges still act as a deterrent for many potential medical tourists.

India Medical Tourism Market Future Outlook

Over the next five years, the India Medical Tourism market is expected to witness robust growth driven by advancements in healthcare technology, the rise of telemedicine services, and the increasing preference for minimally invasive surgeries. The Indian governments continued focus on improving healthcare infrastructure and promoting wellness tourism, especially Ayurvedic and alternative therapies, is set to further expand the market. With Indias reputation for delivering high-quality medical services at affordable costs, the market is poised to attract a higher influx of patients from new regions such as Southeast Asia and Eastern Europe.

Future Market Opportunities

- Collaborations with International Healthcare Providers: Indian hospitals are increasingly collaborating with international healthcare providers, creating opportunities for growth. For example, Apollo Hospitals and Cleveland Clinic, a renowned U.S.-based medical institution, entered a joint venture in 2023 to improve cardiac care services in India. Such collaborations help Indian hospitals adopt global best practices, increasing the quality of care for international patients. Moreover, research partnerships in fields like oncology and stem cell therapy have grown, boosting India's appeal for medical tourists seeking specialized treatments. These collaborations further cement Indias reputation as a top medical tourism destination.

- Expansion in Niche Specialties: India is rapidly becoming a leader in niche specialties such as reproductive medicine and alternative therapies like Ayurveda. By 2023, Indian fertility clinics reported treating over 20,000 foreign couples annually for procedures like in vitro fertilization (IVF). The government has also promoted Ayurvedic treatments, establishing more than 250 Ayurveda centers across India by 2023. These centers cater specifically to international patients seeking natural and holistic approaches to healthcare. The expansion of these niche sectors offers significant growth opportunities for India's medical tourism industry, attracting a new segment of wellness-focused international patients.

Scope of the Report

|

By Treatment Type |

Cardiovascular Surgery Orthopedic Surgery Oncology Treatments Cosmetic Surgery Reproductive Medicine |

|

By Source Country |

United States United Kingdom GCC Countries African Nations Bangladesh |

|

By Healthcare Facility |

Multi-Specialty Hospitals Specialized Clinics Wellness and Ayurvedic Centers |

|

By Type of Traveler |

Medical Tourists Wellness Tourists Cosmetic Tourists |

|

By Region |

Delhi NCR Maharashtra Tamil Nadu Kerala Karnataka |

Products

Key Target Audience

Hospitals and Specialty Clinics

Healthcare Investment and Venture Capitalist Firms

Medical Insurance Companies

International Healthcare Providers and Collaborators

Travel Agencies and Medical Tourism Facilitators

Private Healthcare Investors

Banks and Financial Institutes

Wellness Centers and Ayurvedic Institutions

Government and Regulatory Bodies (Ministry of Health and Family Welfare, NABH)

Companies

Major Players

Apollo Hospitals

Fortis Healthcare

Narayana Health

Max Healthcare

Medanta-The Medicity

Manipal Hospitals

AIIMS Delhi

BLK Super Specialty Hospital

Global Hospitals

Columbia Asia

Wockhardt Hospitals

Jaslok Hospital

Artemis Hospitals

Aster DM Healthcare

Care Hospitals

Table of Contents

1. India Medical Tourism Market Overview

1.1. Definition and Scope (Medical Tourism Services, Patient Categories, Geographical Focus)

1.2. Market Taxonomy (Inpatient vs. Outpatient Procedures, Treatment Specializations)

1.3. Market Dynamics (Growth Rate, Drivers, Challenges)

1.4. Market Segmentation Overview (By Treatment Type, Source Country, Healthcare Facility Type)

2. India Medical Tourism Market Size (In USD Bn)

2.1. Historical Market Size (In USD Bn)

2.2. Year-On-Year Growth Analysis (Inpatient vs. Outpatient Growth)

2.3. Key Market Developments and Milestones (Health Infrastructure Investments, Public-Private Collaborations)

3. India Medical Tourism Market Analysis

3.1. Growth Drivers

3.1.1. Affordability and Cost-Effectiveness of Treatments (Surgical Costs, Comparative Analysis)

3.1.2. Increasing Accreditation of Indian Hospitals (NABH, JCI)

3.1.3. Government Initiatives Promoting Medical Tourism (e-Medical Visa, Healthcare Infrastructure)

3.1.4. Quality of Specialized Treatments (Cardiology, Oncology, Neurology)

3.2. Market Restraints

3.2.1. Language and Cultural Barriers (Communication Challenges)

3.2.2. Regulatory and Legal Complications (Medical Liability, Malpractice)

3.2.3. Infrastructure Bottlenecks (Transport, Accommodation)

3.2.4. COVID-19 Aftermath on Travel and Healthcare Systems

3.3. Market Opportunities

3.3.1. Collaborations with International Healthcare Providers (Joint Ventures, Research Partnerships)

3.3.2. Expansion in Niche Specialties (Reproductive Medicine, Alternative Therapies)

3.3.3. Rise of Telemedicine and Post-treatment Follow-up Services

3.3.4. Promotion of Ayurvedic and Wellness Tourism

3.4. Market Trends

3.4.1. Integration of Technology (AI, Robotics in Surgery)

3.4.2. Growing Demand for Wellness and Preventive Healthcare (Ayurveda, Yoga)

3.4.3. Preference for Minimally Invasive Procedures

3.4.4. Strategic Partnerships with International Insurance Companies

3.5. Regulatory Framework

3.5.1. Medical Visa Policies (e-Visa Facilitation, Visa on Arrival)

3.5.2. International Healthcare Standards Compliance (JCI, NABH)

3.5.3. Guidelines for Medical Practitioners and Hospitals (Accreditation, Ethical Standards)

3.5.4. Tax Incentives and Subsidies for Medical Infrastructure Development

3.6. Competitive Analysis

3.6.1. Porters Five Forces Analysis (Barriers to Entry, Buyer Power)

3.6.2. SWOT Analysis of Indias Medical Tourism Market

3.6.3. Stakeholder Ecosystem (Hospitals, Insurance Companies, Travel Agencies)

4. India Medical Tourism Market Segmentation

4.1. By Treatment Type (In Value USD Bn)

4.1.1. Cardiovascular Surgery

4.1.2. Orthopedic Surgery

4.1.3. Oncology Treatments

4.1.4. Cosmetic Surgery

4.1.5. Reproductive Medicine

4.2. By Source Country (In Value USD Bn)

4.2.1. United States

4.2.2. United Kingdom

4.2.3. Gulf Cooperation Council (GCC) Countries

4.2.4. African Nations

4.2.5. Bangladesh

4.3. By Healthcare Facility Type (In Value USD Bn)

4.3.1. Multi-Specialty Hospitals

4.3.2. Specialized Clinics

4.3.3. Wellness and Ayurvedic Centers

4.4. By Type of Traveler (In Value USD Bn)

4.4.1. Medical Tourists (For Critical Treatments)

4.4.2. Wellness Tourists (For Preventive and Alternative Therapies)

4.4.3. Cosmetic Tourists

4.5. By Region (In Value USD Bn)

4.5.1. Delhi NCR

4.5.2. Maharashtra (Mumbai, Pune)

4.5.3. Tamil Nadu (Chennai)

4.5.4. Kerala (Ayurveda, Wellness Tourism)

4.5.5. Karnataka (Bangalore)

5. India Medical Tourism Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Apollo Hospitals

5.1.2. Fortis Healthcare

5.1.3. Max Healthcare

5.1.4. Narayana Health

5.1.5. Medanta-The Medicity

5.1.6. BLK Super Specialty Hospital

5.1.7. AIIMS Delhi

5.1.8. Manipal Hospitals

5.1.9. Artemis Hospitals

5.1.10. Global Hospitals

5.1.11. Columbia Asia

5.1.12. Wockhardt Hospitals

5.1.13. Jaslok Hospital and Research Centre

5.1.14. Aster DM Healthcare

5.1.15. Care Hospitals

5.2. Cross Comparison Parameters (Number of International Patients, Specialization, Accreditation, Success Rates, Geographic Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Joint Ventures, Facility Expansions)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding

5.8. Government Grants and Support Programs

6. India Medical Tourism Market Regulatory Framework

6.1. Healthcare and Hospital Regulations (Licensing, Certifications)

6.2. Medical Liability and Insurance Regulations (International Patient Coverage)

6.3. Environmental and Hygiene Standards Compliance

7. India Medical Tourism Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth (Expansion of Specialized Facilities, Government Policies)

8. India Medical Tourism Market Future Segmentation

8.1. By Treatment Type

8.2. By Source Country

8.3. By Healthcare Facility Type

8.4. By Type of Traveler

8.5. By Region

9. Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunities in Niche Specialties

9.3. Patient Journey Mapping

9.4. Marketing Strategies for Attracting International Patients

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first stage involves identifying the key drivers and barriers influencing the India Medical Tourism market. Extensive desk research was conducted to understand the dynamics of international patient inflow, the types of treatments most in demand, and the regions/countries that contribute to medical tourism growth. This phase included analysis of government reports, industry publications, and hospital data.

Step 2: Market Analysis and Construction

In this stage, we compiled and analyzed data on patient numbers, revenue generation from medical tourism, and the ratio of international to domestic patients. This data allowed us to gauge market size accurately and predict future growth. We also analyzed market segments based on treatment types and the origin of patients to provide a granular view of the market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

During this phase, market assumptions and data points were validated by consulting medical professionals, hospital administrators, and experts in medical tourism. These consultations were conducted through telephonic interviews and surveys to corroborate the data and refine our analysis.

Step 4: Research Synthesis and Final Output

In the final stage, the insights gathered from primary and secondary research were synthesized to provide a comprehensive understanding of the India Medical Tourism market. The final report includes a detailed analysis of market trends, competitive dynamics, and future outlook based on validated data.

Frequently Asked Questions

01 How big is the India Medical Tourism Market?

The India Medical Tourism market is valued at USD 7.5 billion, driven by the countrys affordability in healthcare services and increasing international patient inflows.

02 What are the challenges in the India Medical Tourism Market?

Challenges in the India Medical Tourism market include language barriers, cultural differences, and regulatory complexities related to medical liability and patient care.

03 Who are the major players in the India Medical Tourism Market?

Key players in India Medical Tourism market include Apollo Hospitals, Fortis Healthcare, Narayana Health, Max Healthcare, and Manipal Hospitals, which dominate due to their international accreditations and high success rates in specialized treatments.

04 What are the growth drivers of the India Medical Tourism Market?

Growth drivers in India Medical Tourism market include the availability of cost-effective treatments, government support through streamlined medical visa processes, and increasing accreditation of hospitals to international standards.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.