India Medium Cars Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD9443

November 2024

90

About the Report

India Medium Cars Market Overview

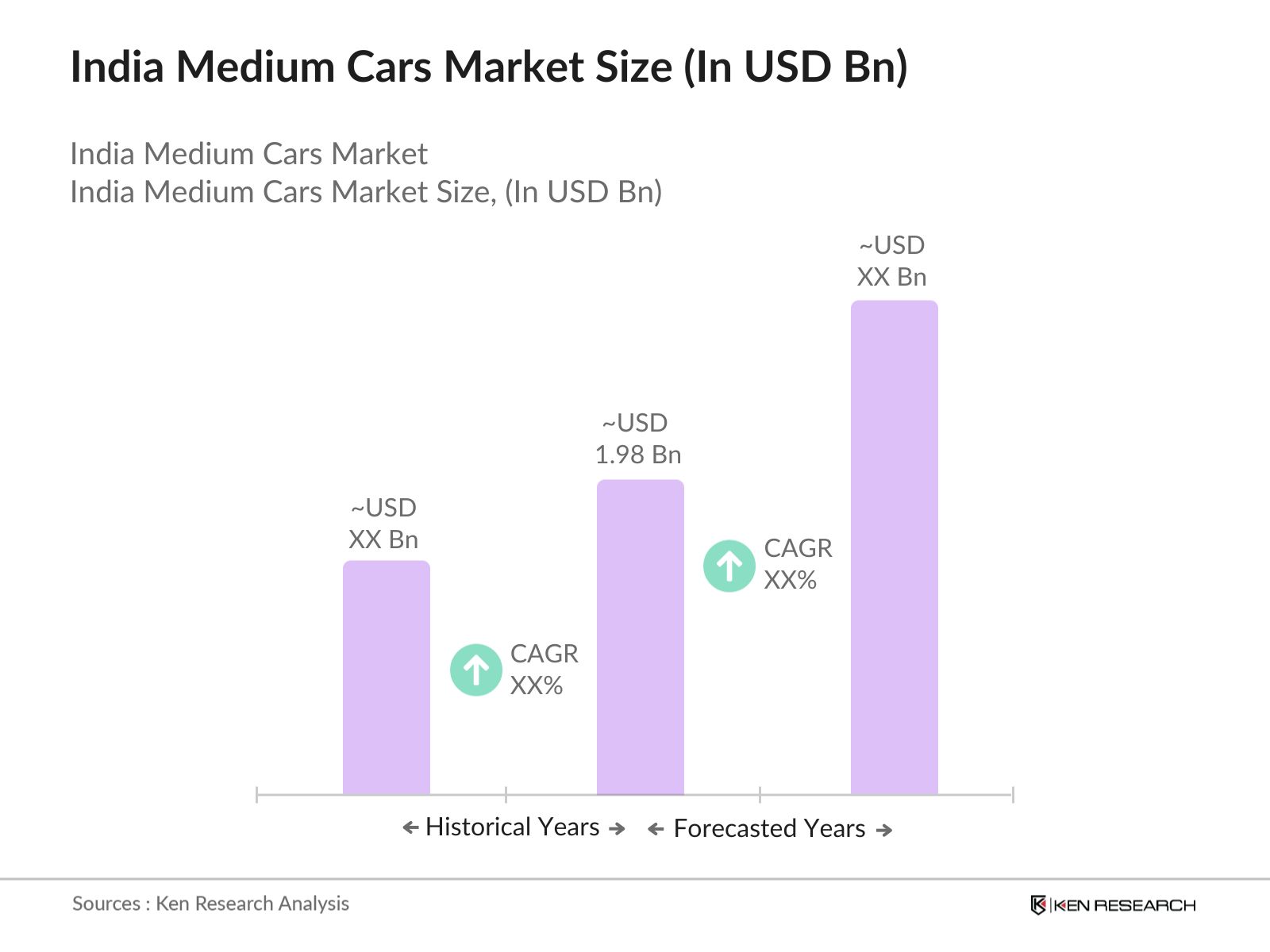

- The India medium cars market is valued at USD 1.98 billion, based on historical analysis over the last five years. This market is primarily driven by a growing middle-class population, rising disposable incomes, and an increasing preference for vehicles with advanced safety features and fuel efficiency. Additionally, government incentives for electric vehicles and a shift in consumer preference toward environmentally friendly options have further propelled the growth of the medium cars segment in India.

- Indias medium car market is dominated by cities like Delhi, Mumbai, and Bengaluru due to their large populations, higher disposable incomes, and significant demand for personal vehicles. These cities also benefit from a well-established dealership network and service infrastructure, making car ownership more convenient. Additionally, the higher urbanization rates and the presence of corporate professionals in these regions drive the demand for medium-sized sedans and compact SUVs.

- The Bharat Stage (BS-VI) emission standards, which came into effect in 2020, continue to impact the medium car market in 2023. The BS-VI norms, which require cars to emit 60-70% fewer nitrogen oxides, have led manufacturers to adopt cleaner technologies. As a result, medium cars in India now come with advanced exhaust treatment systems, which reduce emissions and comply with the stringent regulatory standards. The government's focus on reducing air pollution has pushed automakers to innovate and offer BS-VI compliant cars in the medium segment.

India Medium Cars Market Segmentation

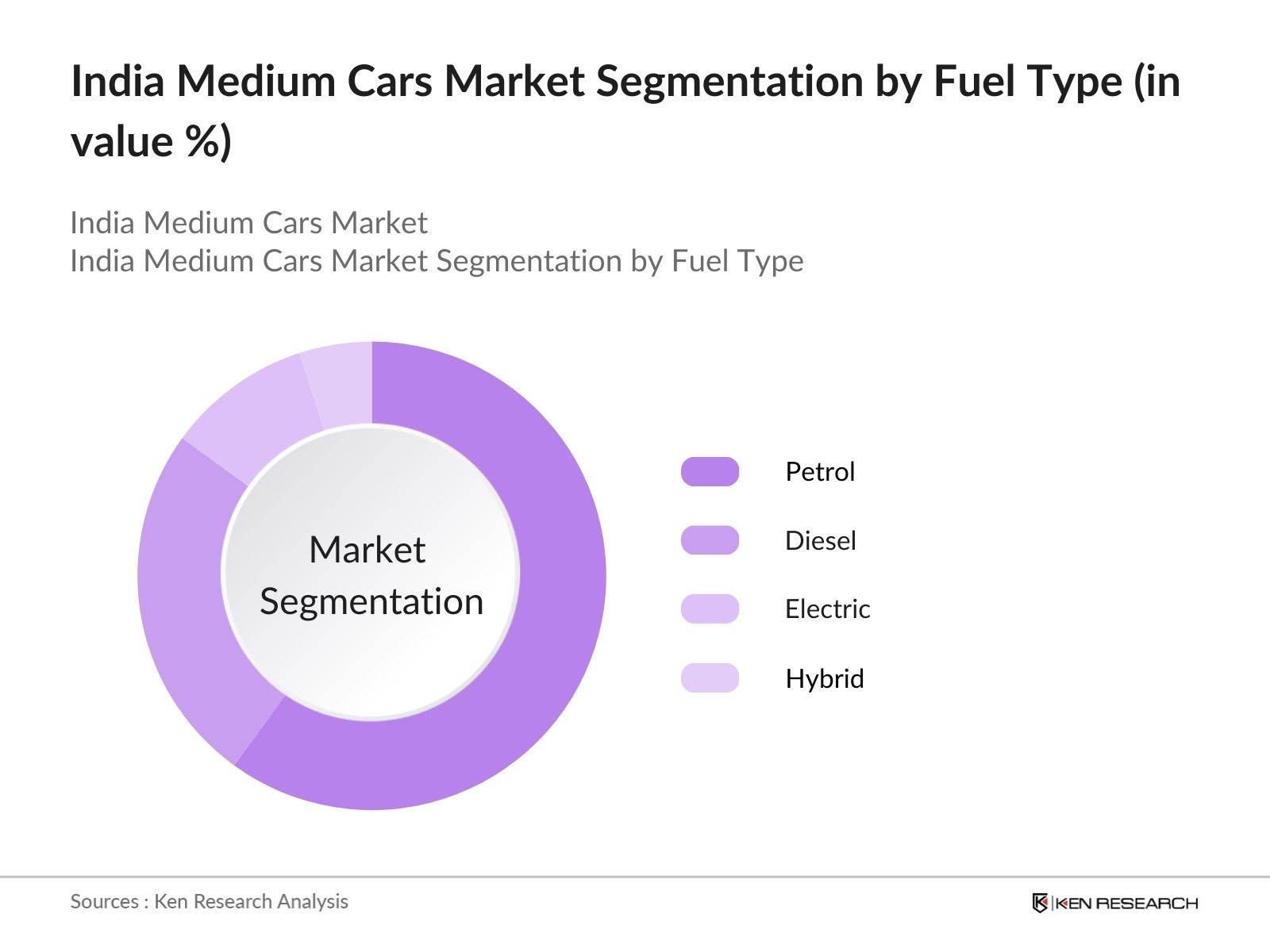

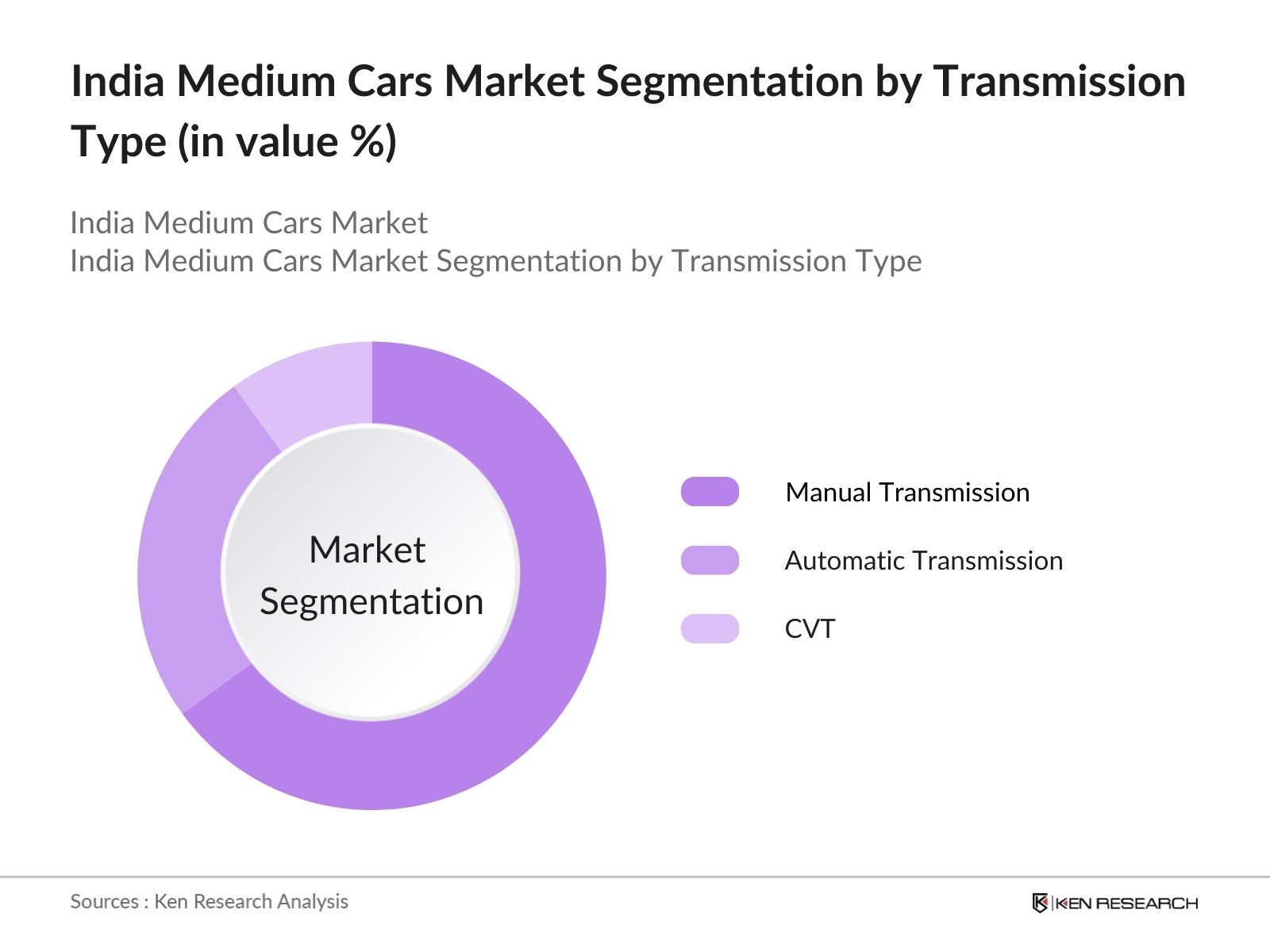

The India medium cars market is segmented by fuel type and by transmission type.

- By Fuel Type: The India medium cars market is segmented by fuel type into petrol, diesel, electric, and hybrid vehicles. Petrol vehicles currently dominate the market, primarily due to the well-established fuel distribution network and the affordability of petrol cars for the majority of the population. However, with the rising prices of petrol and growing environmental concerns, consumers are gradually showing a preference for hybrid and electric options. Despite this, the affordability and availability of petrol cars continue to make this segment a key driver of market growth.

- By Transmission Type: The India medium cars market is also segmented by transmission type into manual transmission, automatic transmission, and CVT (continuously variable transmission). Manual transmission cars currently hold a dominant market share, largely due to their lower cost and ease of maintenance, which appeals to the budget-conscious Indian consumer. However, the demand for automatic cars is rapidly growing, especially in urban areas where traffic congestion makes automatic cars more convenient to drive.

India Medium Cars Market Competitive Landscape

The India medium cars market is dominated by a few major automotive companies. Local manufacturers like Maruti Suzuki and Tata Motors have strong market penetration due to their extensive distribution networks and affordable pricing. International brands like Hyundai, Honda, and Toyota have also established a significant presence, offering a range of medium-sized vehicles that cater to the growing demand for advanced safety and tech features. This consolidation reflects the significant influence of these key players, which collectively control a large portion of the market.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

R&D Investment |

Electric Vehicle Offerings |

Sustainability Initiatives |

Service Network |

Revenue |

Key Models |

|

Maruti Suzuki India Ltd. |

1981 |

New Delhi |

|||||||

|

Hyundai Motor India Ltd. |

1996 |

Chennai |

|||||||

|

Tata Motors Ltd. |

1945 |

Mumbai |

|||||||

|

Honda Cars India Ltd. |

1995 |

Greater Noida |

|||||||

|

Toyota Kirloskar Motor |

1997 |

Bengaluru |

India Medium Cars Industry Analysis

Market Growth Drivers

- Rising Urbanization: Indias urban population continues to rise, driving demand for medium cars. According to the World Bank, Indias urban population reached 35.39% of the total population in 2023, representing over 490 million people. This growth increases the need for private vehicles, especially in the medium car segment, which appeals to urban households. The increase in urban households, along with the congestion in cities, also fuels interest in compact and fuel-efficient cars. As urbanization advances, India's road infrastructure investment has grown, with government expenditure on roads reaching INR 1.89 lakh crore ($23 billion) in 2023, improving road networks for car use.

- Increasing Disposable Income: India's rising disposable income is a key driver for the medium car market. Data from the Ministry of Statistics and Programme Implementation (MoSPI) highlights that per capita income increased to INR 172,000 ($2,100) in 2023. This increase in disposable income has led to higher affordability for middle-class households, particularly in urban areas. The governments economic reforms have also enhanced consumer purchasing power. Consequently, the demand for medium cars, perceived as status symbols and essential urban vehicles, has grown significantly. This trend is further strengthened by the increase in car financing options.

Market Challenges

- Rising Fuel Prices: Fuel costs remain a challenge for the Indian car market. In 2023, the price of petrol in major cities like Mumbai averaged INR 106 per liter, while diesel stood at INR 94 per liter. Rising fuel prices increase the cost of ownership for medium car buyers, potentially reducing demand for fuel-dependent vehicles. With crude oil prices hovering around $90 per barrel, and limited government intervention on fuel subsidies, many consumers are cautious about purchasing conventional petrol or diesel cars, looking instead towards electric alternatives.

- High Vehicle Ownership Costs: The overall cost of owning a medium car in India has been increasing. In addition to fuel prices, the Goods and Services Tax (GST) on vehicles stands at 28%, with an additional cess ranging from 1% to 15%, depending on the vehicle type. For medium cars, the effective tax rate can be as high as 45%, significantly inflating the on-road price. Moreover, insurance premiums have risen by 8% in 2023, adding to the financial burden of car ownership. These factors contribute to a slowdown in the growth of the medium car segment.

India Medium Cars Market Future Outlook

Over the next five years, the India medium cars market is expected to witness significant growth, driven by a surge in demand for electric and hybrid vehicles, improvements in battery technology, and the increasing affordability of EVs. Additionally, the government's push for electric mobility and stricter emission norms will further fuel this transition, with consumers increasingly opting for environmentally sustainable vehicles. As a result, the market is poised to expand as both domestic and international manufacturers invest heavily in EV infrastructure and R&D.

Market Opportunities

- Growing Electric Vehicle Demand: The shift towards electric vehicles (EVs) presents significant opportunities for the medium car market. As of 2023, over 1.7 million EVs were registered in India, reflecting growing consumer preference for eco-friendly vehicles. The central governments goal to have 30% of all vehicles electric by 2030 has accelerated investments in EV infrastructure. The expansion of charging stationsexpected to surpass 70,000 by 2024will further support the growth of electric medium cars. Automakers are also launching affordable EV models in the medium car segment, attracting environmentally conscious consumers

- Emerging Hybrid Technology: Hybrid technology offers a bridge between traditional fuel and electric vehicles, creating an opportunity in the medium car market. The Ministry of Heavy Industries reported that hybrid vehicles, which use both electric power and internal combustion engines, saw a 25% increase in production in 2023. With government policies encouraging fuel-efficient technologies and a growing focus on reducing carbon emissions, medium hybrid cars are becoming more appealing. Automakers are responding by introducing hybrid versions of their popular medium-sized models, making hybrid technology accessible to a larger consumer base.

Scope of the Report

Products

Key Target Audience

Automobile Manufacturers

Original Equipment Manufacturers (OEMs)

Automobile Dealerships

Government and Regulatory Bodies (Ministry of Heavy Industries & Public Enterprises, NITI Aayog)

Electric Vehicle Charging Infrastructure Companies

Component Suppliers

Investments and Venture Capitalist Firms

Car Rental and Leasing Companies

Companies

India Medium Cars Market Major Players

Maruti Suzuki India Ltd.

Hyundai Motor India Ltd.

Tata Motors Ltd.

Honda Cars India Ltd.

Toyota Kirloskar Motor

Mahindra & Mahindra Ltd.

Renault India Pvt. Ltd.

Kia Motors India Pvt. Ltd.

Ford India Pvt. Ltd.

Volkswagen India Pvt. Ltd.

Nissan Motor India Pvt. Ltd.

Skoda Auto India Pvt. Ltd.

MG Motor India Pvt. Ltd.

Peugeot India Pvt. Ltd.

Fiat India Automobiles Pvt. Ltd.

Table of Contents

1. India Medium Cars Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Market Demand, Production Volume)

1.4. Market Segmentation Overview (Fuel Type, Transmission Type, Vehicle Type)

2. India Medium Cars Market Size (In INR Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Market Demand, Sales Units)

2.3. Key Market Developments and Milestones

3. India Medium Cars Market Analysis

3.1. Growth Drivers

3.1.1. Rising Urbanization

3.1.2. Increasing Disposable Income

3.1.3. Government Incentives for Electric Vehicles

3.1.4. Expanding Middle-Class Population 3.2. Market Challenges

3.2.1. Rising Fuel Prices

3.2.2. High Vehicle Ownership Costs

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Growing Electric Vehicle Demand

3.3.2. Emerging Hybrid Technology

3.3.3. Expansion in Tier-2 and Tier-3 Cities

3.4. Trends

3.4.1. Adoption of Advanced Driver Assistance Systems (ADAS)

3.4.2. Shift towards SUV Variants in the Medium Car Segment

3.4.3. Increased Focus on Fuel Efficiency

3.5. Government Regulations

3.5.1. Bharat Stage Emission Standards (BS-VI)

3.5.2. FAME India Scheme

3.5.3. Electric Vehicle Manufacturing Policies

3.6. SWOT Analysis

3.7. Stake Ecosystem (OEMs, Suppliers, Dealerships, Aftermarket)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Medium Cars Market Segmentation

4.1. By Fuel Type (In Value %) 4.1.1. Petrol

4.1.2. Diesel

4.1.3. Electric

4.1.4. Hybrid

4.2. By Transmission Type (In Value %) 4.2.1. Manual Transmission

4.2.2. Automatic Transmission

4.2.3. CVT (Continuously Variable Transmission)

4.3. By Vehicle Type (In Value %) 4.3.1. Sedan

4.3.2. Hatchback

4.3.3. Crossover

4.3.4. SUV (Medium Segment SUVs)

4.4. By End-User (In Value %) 4.4.1. Personal Use

4.4.2. Corporate Fleet

4.4.3. Car Rental & Leasing Companies

4.5. By Region (In Value %) 4.5.1. North India

4.5.2. West India

4.5.3. South India

4.5.4. East India

5. India Medium Cars Market Competitive Analysis

5.1. Detailed Profiles of Major Companies 5.1.1. Maruti Suzuki India Limited

5.1.2. Hyundai Motor India Limited

5.1.3. Tata Motors Limited

5.1.4. Mahindra & Mahindra Limited

5.1.5. Honda Cars India Limited

5.1.6. Toyota Kirloskar Motor Private Limited

5.1.7. Volkswagen India Private Limited

5.1.8. Ford India Private Limited

5.1.9. Nissan Motor India Private Limited

5.1.10. Renault India Private Limited

5.1.11. Kia India Private Limited

5.1.12. Skoda Auto India Private Limited

5.1.13. MG Motor India

5.1.14. Fiat India Automobiles

5.1.15. Peugeot India

5.2. Cross Comparison Parameters (Production Capacity, Market Presence, Vehicle Portfolio, Innovation Index, Market Share, Sustainability Initiatives, Warranty Programs, After-Sales Service Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Medium Cars Market Regulatory Framework

6.1. Automotive Emission Norms

6.2. Import Duties on Automotive Parts

6.3. Safety Compliance Regulations (Crash Tests, Safety Features)

6.4. Electric Vehicle Subsidies

7. India Medium Cars Future Market Size (In INR Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Medium Cars Future Market Segmentation

8.1. By Fuel Type (In Value %)

8.2. By Transmission Type (In Value %)

8.3. By Vehicle Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India Medium Cars Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step in our research process involves identifying all major stakeholders within the India Medium Cars Market. This includes a comprehensive review of government regulations, production trends, and sales data across the medium car segment. We utilized secondary data sources, including government reports and automotive industry associations, to create a foundational ecosystem of variables impacting the market.

Step 2: Market Analysis and Construction

We collected historical data on vehicle production, sales units, and price trends over the last five years. This phase included a detailed analysis of key factors influencing demand, such as fuel type preferences, transmission types, and regional consumer behaviors. The results of this analysis allowed us to create an accurate picture of the current market structure.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses on market growth drivers and barriers were validated through interviews with key industry experts from car manufacturing companies, dealerships, and government bodies. These consultations helped refine our data and ensure accuracy, incorporating insights on market trends, consumer preferences, and upcoming regulatory changes.

Step 4: Research Synthesis and Final Output

In the final stage, we synthesized all data points gathered from both primary and secondary sources. This involved aggregating feedback from industry professionals and validating market projections through bottom-up analysis, ensuring a comprehensive and reliable final report on the India Medium Cars Market.

Frequently Asked Questions

01. How big is the India Medium Cars Market?

The India medium cars market is valued at INR 1.98 billion, driven by rising middle-class income levels, increasing vehicle affordability, and strong government incentives for electric mobility.

02. What are the challenges in the India Medium Cars Market?

The India medium cars market faces challenges such as rising fuel prices, the high cost of electric vehicles, and supply chain disruptions, which have impacted vehicle availability and delivery timelines.

03. Who are the major players in the India Medium Cars Market?

India medium cars market Key players include Maruti Suzuki, Hyundai, Tata Motors, Honda, and Toyota, who dominate the market due to their extensive vehicle portfolios, strong dealership networks, and established brand loyalty.

04. What are the growth drivers of the India Medium Cars Market?

The India medium cars market is propelled by increasing disposable incomes, growing urbanization, and the government's push towards electric mobility. Additionally, the rising preference for environmentally sustainable vehicles is fueling growth.

05. What is the outlook for electric vehicles in the India Medium Cars Market?

Electric vehicles in India medium cars market are expected to witness significant growth in the coming years due to government subsidies, advancements in battery technology, and increasing consumer awareness of environmental issues.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.