India Micro LED Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD652

July 2024

97

About the Report

India Micro LED Market Overview

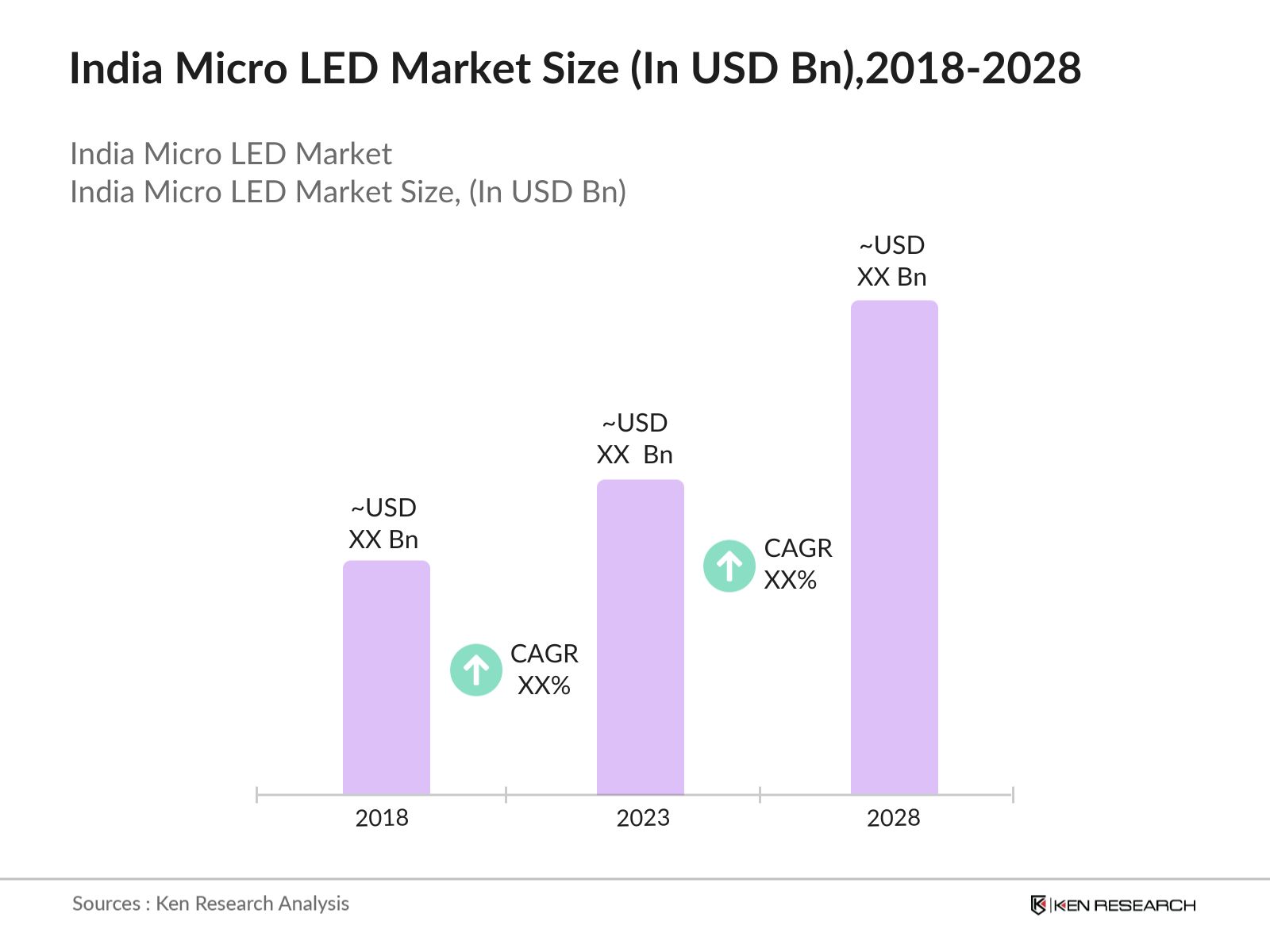

- The India Micro LED market has experienced notable growth, this is reflected by Global Micro LED market reaching a valuation of USD 620 million in 2023. This growth is fueled by rising demand for rapid diagnostic solutions and increasing healthcare awareness. This growth is driven by the increasing demand for energy-efficient and high-brightness display solutions across various applications such as smartphones, televisions, and wearable devices.

- Key players in the India Micro LED market include major Samsung Electronics Co. Ltd., Sony Corporation, LG Display Co. Ltd., Apple Inc. and Epistar Corporation. These companies have been pivotal in advancing Micro LED technology through substantial investments in research and development, strategic partnerships, and collaborations.

- Samsung has announced about its new Micro LED display technology designed for smartphones and televisions in early 2023. This new technology is expected to enhance display performance with better energy efficiency and durability. According to Samsung, this innovation could lead to a 20% reduction in power consumption compared to current display technologies, making it a crucial advancement in the context of energy-saving and sustainable electronic devices.

- Bengaluru, is dominating the Micro LED market. Bengaluru is home to numerous tech companies and research institutions, making it a hub for technological innovation. In 2023, it accounted for the largest market share, driven by significant investments in research and development and the presence of major electronics manufacturers.

India Micro LED Market Segmentation

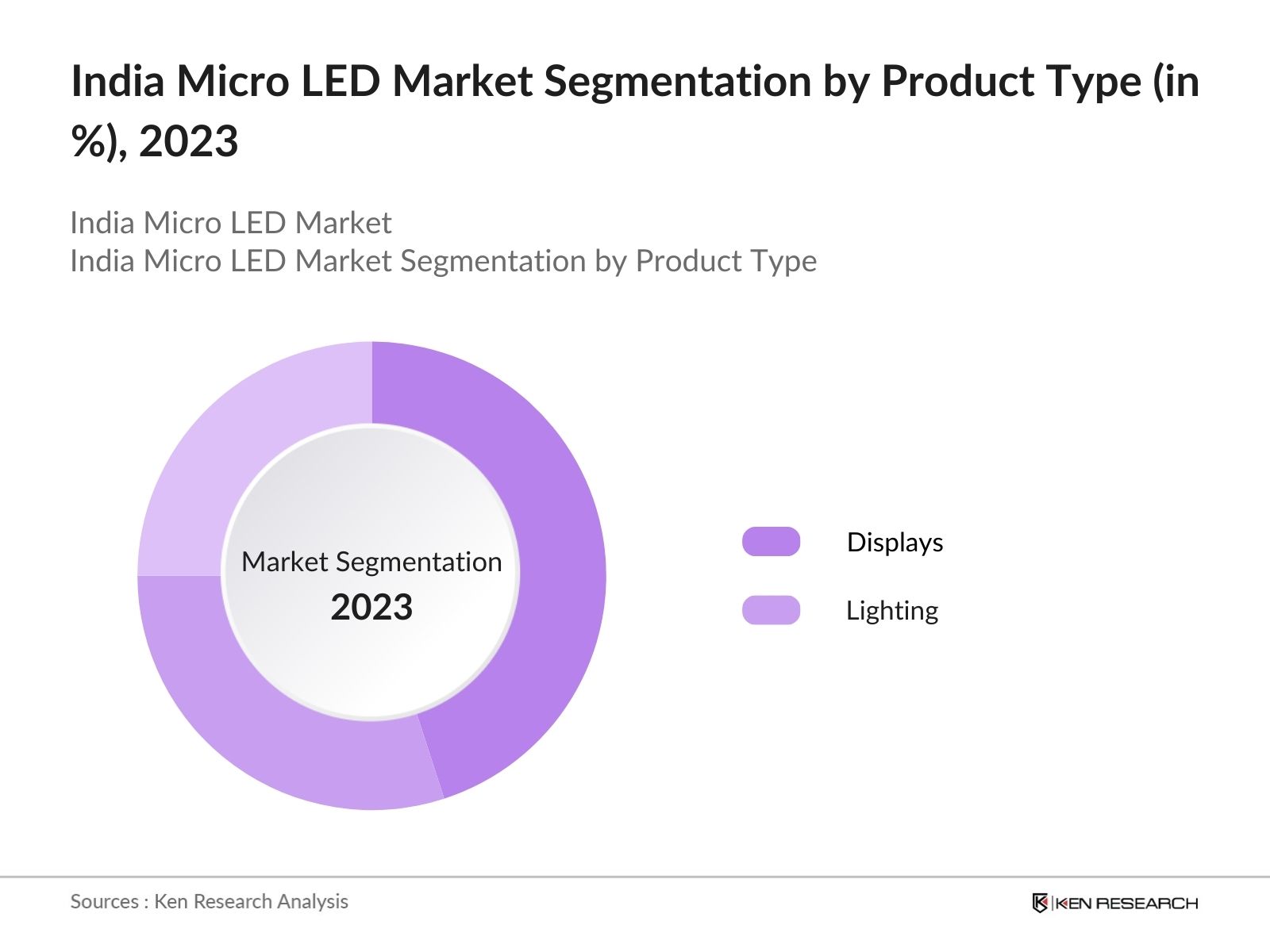

By Product Type: India's Micro LED market is segmented by product type into Displays and Lighting. In 2023, the displays segment held a dominant market share. This dominance is attributed to the increasing demand for high-resolution and energy-efficient displays in consumer electronics, such as smartphones and televisions. The adoption of Micro LED technology in displays offers superior performance, including higher brightness, better color accuracy, and longer lifespan compared to traditional display technologies.

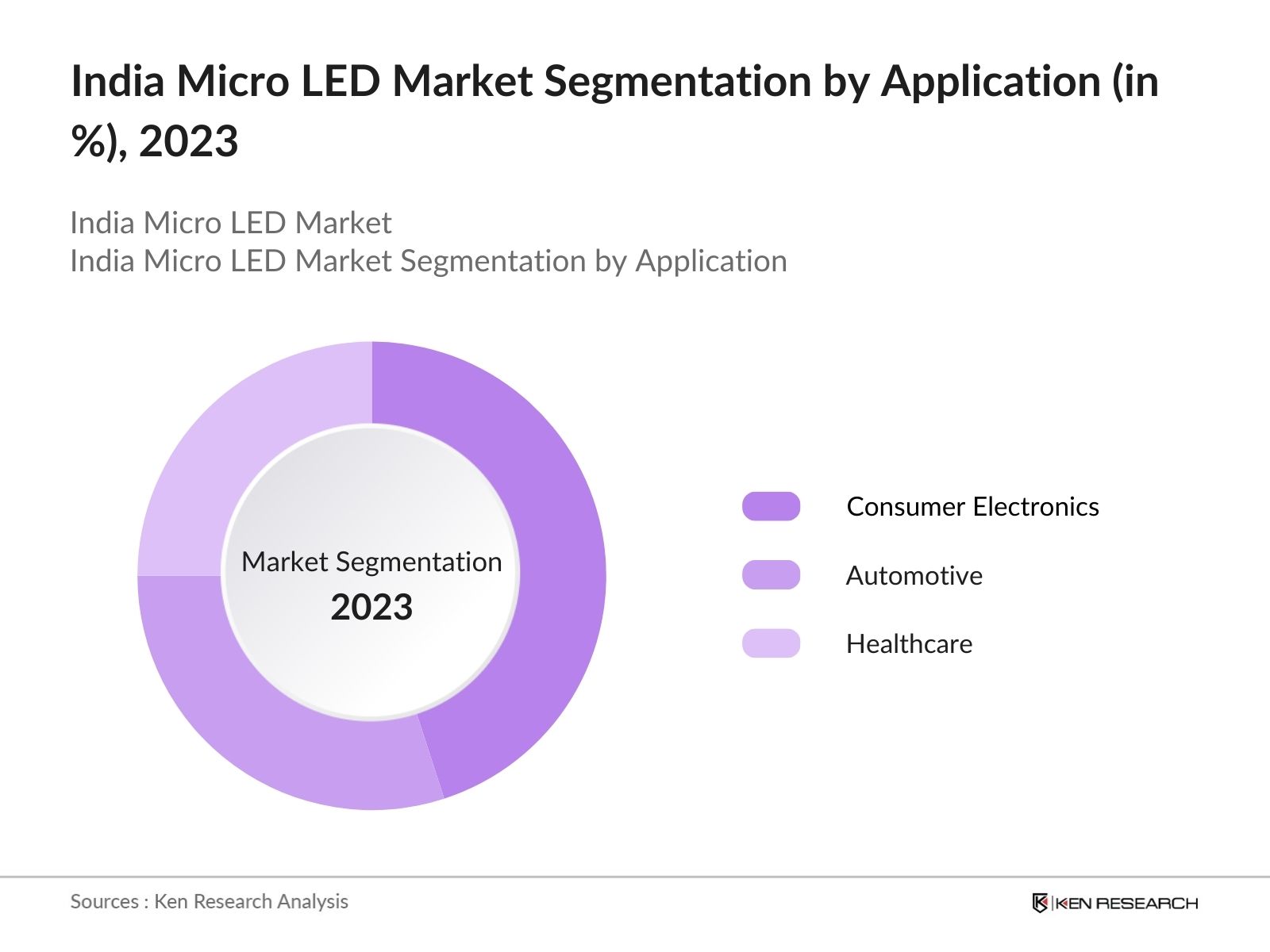

By Application: India's Micro LED market is segmented by application into Consumer Electronics, Automotive and Healthcare. In 2023, the consumer electronics segment dominated the market. This is due to the widespread use of Micro LEDs in smartphones, televisions, and wearable devices. The consumer electronics industry's constant drive for better display technologies to enhance user experience and reduce power consumption significantly contributes to this segment's dominance.

By Region: India's Micro LED market is segmented by region into North, South, East and West. In 2023, the South region, dominated the market share. This is attributed to the concentration of technology companies and research institutions in the region, leading to significant advancements in Micro LED technology. The strong presence of major electronics manufacturers and substantial investments in research and development also contribute to the region's market leadership.

India Micro LED Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Samsung Electronics Co., Ltd. |

1969 |

Suwon, South Korea |

|

Sony Corporation |

1946 |

Tokyo, Japan |

|

LG Display Co., Ltd. |

1985 |

Seoul, South Korea |

|

Apple Inc. |

1976 |

Cupertino, USA |

|

Epistar Corporation |

1996 |

Hsinchu, Taiwan |

- Plessey’s and Vuzix’s Partnership: In 2022, UK-based Plessey Semiconductors partnered with Vuzix, a US-based augmented reality company, to develop micro-LED-based AR smart glasses. This collaboration aims to leverage Vuzix's expertise in smart glasses and waveguide optic technologies alongside Plessey's micro-LED light source technology to create advanced augmented reality solutions, which is expected to enhance the performance and capabilities of these devices, particularly for the Indian market.

- Reliance Jioglass: India's Reliance announced the JioGlass, a VR HMD based on dual full-color FHD micro-LED microdisplays, in 2023. The JioGlass creates a 100-inch virtual screen in front of the viewer, and the two microdisplays enable a 40-degree FOV. The HMD connects via USB to any iOS or Android smartphone or laptop. The HMD is designed by Tesseract, an India-based startup that was acquired by Reliance in 2019.

India Micro LED Industry Analysis

India Micro LED Market Growth Drivers

- Increasing Demand for High-Resolution Displays: Consumers are increasingly seeking better visual experiences and enhanced color accuracy, which Micro LED technology can provide. This aligns with the broader trend in consumer electronics where high-quality display features are highly valued. Additionally, fitness trackers and augmented reality glasses incorporating Micro LED technology are expected to see significant growth.

- Government Initiatives Supporting Local Manufacturing: The "Make in India" initiative was launched in 2014 with the objective of facilitating investment, fostering innovation, and building best-in-class manufacturing infrastructure. It focuses on 27 sectors, including manufacturing and service sectors. The initiative aims to transform India into a global manufacturing and design hub including support to the establishment of Micro LED manufacturing plants in the country. This initiative is expected to create new jobs and enhance the domestic production capacity, reducing dependency on imports and driving market growth.

- Collaboration Between Industry Leaders and Startups: Collaborations between established industry leaders and innovative startups are driving advancements in Micro LED technology. In 2024, partnerships between major players like Samsung and local startups are projected to result in the development of next-generation Micro LED displays. These collaborations are expected to accelerate technological advancements and bring cost-effective solutions to the market, fostering overall growth.

India Micro LED Market Challenges

- High Production Costs: One of the significant challenges in the India Micro LED market is the high production cost. In 2024, the production cost for Micro LED displays remains considerably high, USD 300 per unit for high-end applications. This cost barrier limits widespread adoption, particularly in budget-sensitive segments. Addressing this challenge requires continuous research and development to streamline production processes and reduce costs.

- Competition from Alternative Technologies: The technological complexity involved in Micro LED production poses a challenge. In 2024, achieving uniformity and precision in Micro LED displays remains difficult because of this Micro LED technology faces stiff competition from established technologies such as OLED and Mini LED. In 2024, OLED displays continue to dominate the market with substantial shipments, making it difficult for Micro LED to gain market share. The competition necessitates continuous innovation and differentiation to establish Micro LEDs as a preferred choice.

India Micro LED Market Government Initiatives

- Subsidies for R&D: Niti Aayog has set an ambitious target of USD 500 billion for electronics manufacturing in India by 2030, which includes various strategic interventions to boost the sector. The focus appears to be on broader initiatives to enhance the electronics manufacturing ecosystem, which will thereby enhance the country's technological capabilities, encouraging more companies to invest in Micro LED R&D.

- Skill Development Initiatives: According to Union budget projections Government of India anticipate more measures aimed at enhancing STEM education, expanding digital infrastructure in rural areas, and raising educational standards to meet global benchmarks. These investments in 2024 will be focused on building state-of-the-art manufacturing facilities, which will help reduce production costs and increase domestic production capacity of latest technologies like Micro LED Display and other entertainment mediums.

India Micro LED Market Future Outlook

The India Micro LED market is poised for continued expansion. The growth will be driven by increased adoption of Micro LED displays in various sectors, including automotive, retail, and healthcare, along with ongoing advancements in display technology. Additionally, the integration of Micro LED displays in augmented and virtual reality devices will open new avenues for market growth.

Future Market Trends

- Increased Adoption in Automotive Industry: Over the next five years, the adoption of Micro LED displays in the automotive industry along with augmented reality (AR) devices is anticipated to expand Future vehicles will be equipped with Micro LED dashboards and infotainment systems. This trend is driven by the superior brightness and energy efficiency of Micro LEDs, which will enhance the driving experience.

- Development of Flexible Micro LED Displays: The development of flexible Micro LED displays is expected to be a key trend. By 2028, flexible Micro LED displays will be in demand because of trending foldable smartphones and wearable devices. The flexibility and durability of these displays will drive their adoption in innovative and compact device designs. This growth will also drive by the demand for high-quality, energy-efficient displays in the smart home gadget market.

Scope of the Report

|

By Product Type |

Display Lighting |

|

By Application |

Consumer Electronics Automotive Healthcare |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing this Report:

Energy and Utility Companies

Electronics Manufacturers

Display Technology Providers

Automotive Companies

Technology Startups

Ministry of Science and Technology

Ministry of Electronics and Information Technology (MeitY)

Investors and VC Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Samsung Electronics Co., Ltd.

Sony Corporation

LG Display Co., Ltd.

Apple Inc.

Epistar Corporation

Rohinni LLC

VueReal Inc.

Jade Bird Display

Lumens Co., Ltd.

Mikro Mesa Technology Co., Ltd.

GLO AB

PlayNitride Inc.

Tianma Microelectronics Co., Ltd.

Aledia SA

Optovate Limited

X-Celeprint Limited

Table of Contents

1. India Micro LED Market Overview

1.1 India Micro LED Market Taxonomy

2. India Micro LED Market Size (in USD Bn), 2018-2023

3. India Micro LED Market Analysis

3.1 India Micro LED Market Growth Drivers

3.2 India Micro LED Market Challenges and Issues

3.3 India Micro LED Market Trends and Development

3.4 India Micro LED Market Government Regulation

3.5 India Micro LED Market SWOT Analysis

3.6 India Micro LED Market Stake Ecosystem

3.7 India Micro LED Market Competition Ecosystem

4. India Micro LED Market Segmentation, 2023

4.1 India Micro LED Market Segmentation by Product Type (in value %), 2023

4.2 India Micro LED Market Segmentation by Application (in value %), 2023

4.3 India Micro LED Market Segmentation by Region (in value %), 2023

5. India Micro LED Market Competition Benchmarking

5.1 India Micro LED Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Micro LED Future Market Size (in USD Bn), 2023-2028

7. India Micro LED Future Market Segmentation, 2028

7.1 India Micro LED Market Segmentation by Product Type (in value %), 2028

7.2 India Micro LED Market Segmentation by Application (in value %), 2028

7.3 India Micro LED Market Segmentation by Region (in value %), 2028

8. India Micro LED Market Analysts’ Recommendations

8.1 India Micro LED Market TAM/SAM/SOM Analysis

8.2 India Micro LED Market Customer Cohort Analysis

8.3 India Micro LED Market Marketing Initiatives

8.4 India Micro LED Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2 Market Building:

Collating statistics on India Micro LED market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Micro LED industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4 Research output:

Our team will approach multiple Micro LED manufacturing companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Micro LED manufacturing companies.

Frequently Asked Questions

01 How big is the India Micro LED Market?

The India Micro LED market was valued at USD 620 million in 2023. This growth is driven by the increasing demand for energy-efficient and high-brightness display solutions across various applications such as smartphones, televisions, and wearable devices.

02 What are the growth drivers of the India Micro LED Market?

Key growth drivers in India Micro LED market include rising demand for high-resolution displays, expansion in the wearable devices market, government initiatives like the "Make in India 2.0" supporting local manufacturing, and collaborations between industry leaders and startups, enhancing technological advancements and reducing production costs.

03 What are challenges faced by the India Micro LED Market?

The major challenges in India Micro LED market include high production costs, limited manufacturing infrastructure, technological complexity, and competition from established technologies like OLED and Mini LED. These factors hinder the widespread adoption and scalability of Micro LED technology in the market.

04 Who are the major players in the India Micro LED Market?

Major players in the India Micro LED market include Samsung Electronics, Sony Corporation, LG Display, Apple Inc., and Epistar Corporation. These companies drive the market through substantial investments in research and development, innovative product launches, and strategic collaborations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.