India Military Drone Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD4529

October 2024

84

About the Report

India Military Drone Market Overview

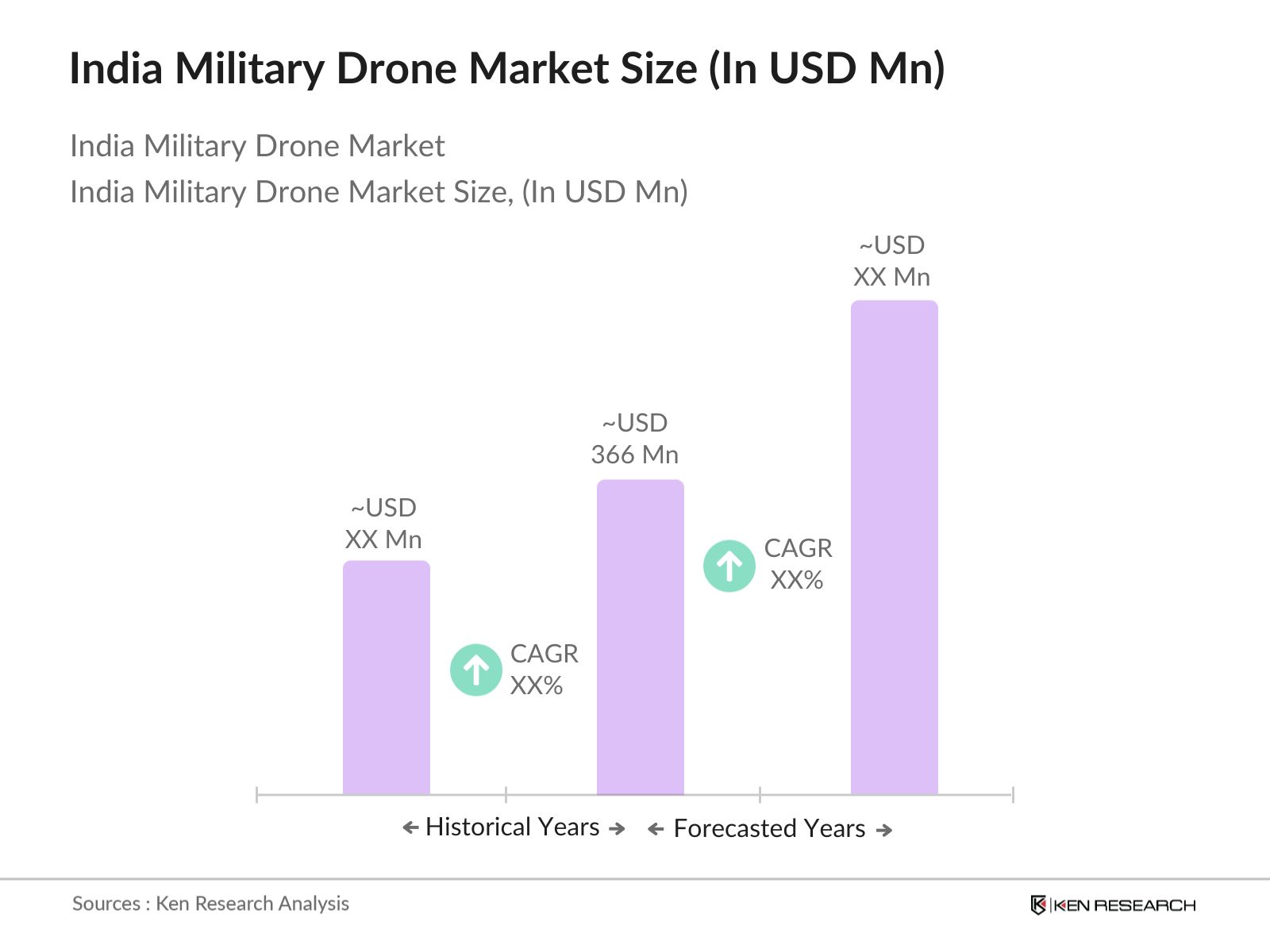

- The India Military Drone market is valued at USD 366 million, driven by increasing demand for surveillance and combat drones. The market has seen steady growth over the past five years, largely fueled by the Indian government’s focus on modernizing the defence sector and improving border security. Military drones, especially UAVs for reconnaissance, surveillance, and combat missions, are becoming integral components of the country’s defence strategy. The rise in defence budget allocation, combined with the government's focus on indigenization through initiatives like "Make in India," continues to boost market growth.

- The dominance in the Indian military drone market is primarily led by regions with ongoing border tensions, such as Jammu & Kashmir and the Northeast. These regions, which have witnessed continuous security challenges, demand advanced UAV technologies for constant monitoring and real-time surveillance. Additionally, major cities like New Delhi are central to procurement activities, where the Ministry of Defence coordinates acquisitions and defence projects.

- India’s Ministry of Defence has launched several procurement programs to fast-track drone acquisitions for the military. In 2024, the MoD allocated $10 billion to its capital acquisition budget, with a substantial portion directed towards drone technology. The Defence Acquisition Council (DAC) has cleared projects for purchasing over 200 tactical drones, emphasizing locally manufactured systems. These programs are aligned with India’s broader defence modernization strategy, which aims to enhance self-reliance while meeting the growing security demands.

India Military Drone Market Segmentation

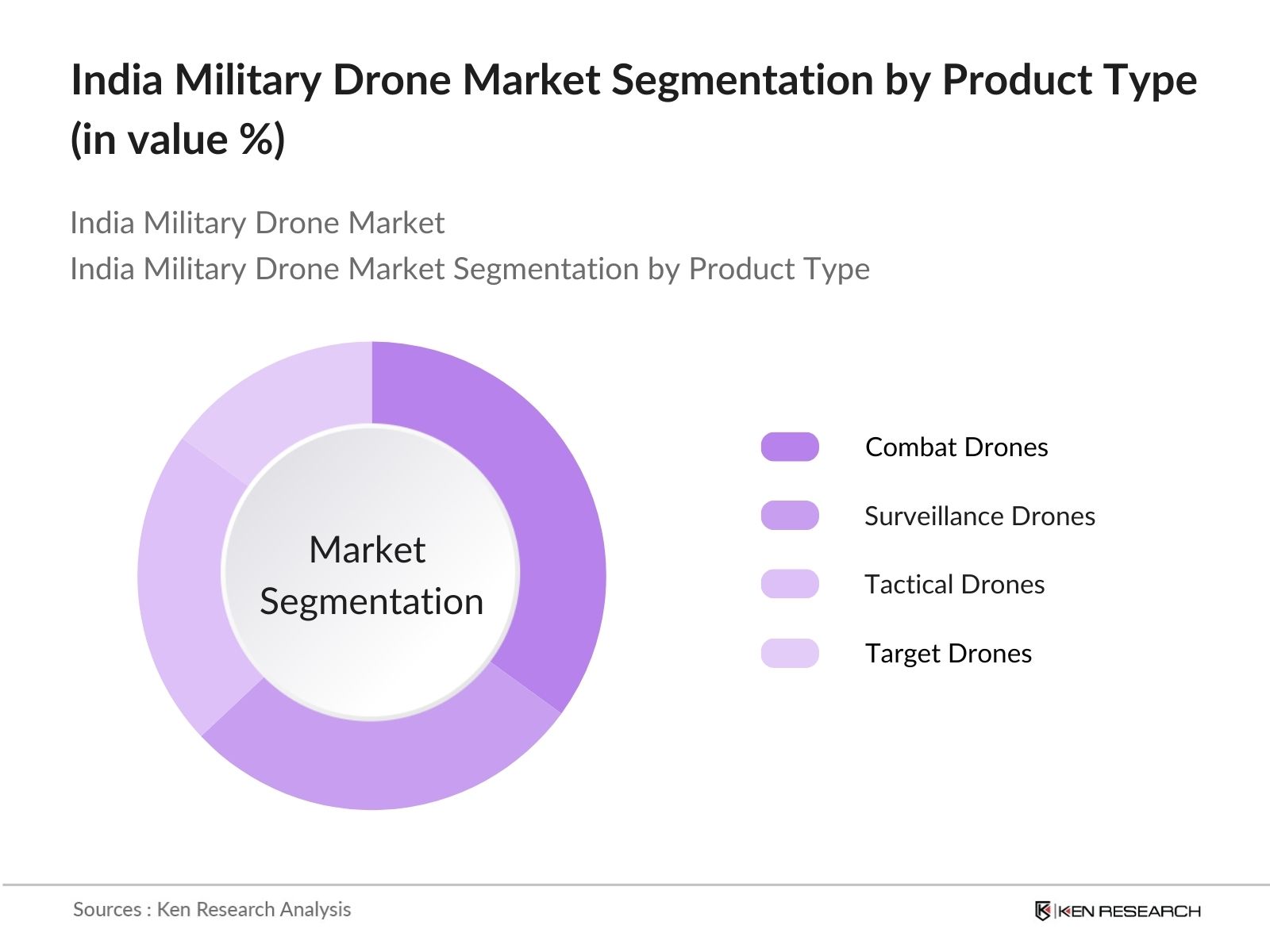

- By Product Type: India Military Drone market is segmented by product type into combat drones, surveillance drones, tactical drones, and target drones. Recently, combat drones have dominated the market under this segmentation due to their increasing utility in offensive military operations and defence readiness. The Indian Army and Air Force have invested in acquiring combat drones for precision strike capabilities and enhanced battlefield intelligence. These drones offer real-time monitoring and can be used in both defensive and offensive operations, contributing to their rising demand.

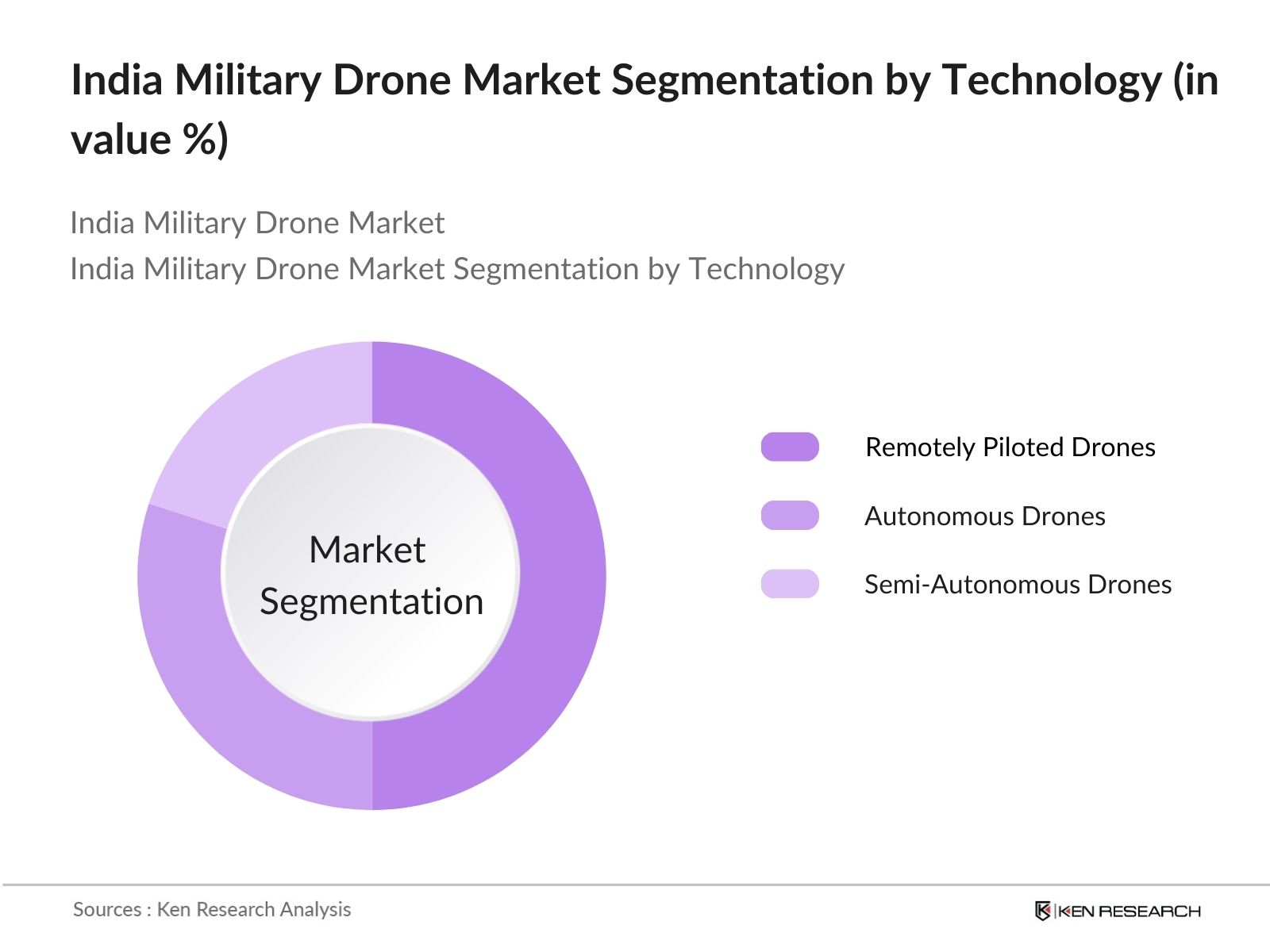

- By Technology: The India Military Drone market is also segmented by technology into remotely piloted drones, autonomous drones, and semi-autonomous drones. Among these, remotely piloted drones dominate the market due to their ease of control, reliability, and the ability to perform a wide range of tasks from surveillance to combat. These drones provide enhanced control to operators, allowing them to make real-time decisions, which is critical in volatile military environments.

India Military Drone Market Competitive Landscape

The India Military Drone market is dominated by key players that have been at the forefront of drone technology development and defence equipment supply. Indigenous manufacturers, as well as global players, have a notable presence in the market. Companies such as Bharat Electronics Limited (BEL) and Hindustan Aeronautics Limited (HAL) lead the domestic front, while international firms like General Atomics Aeronautical Systems have partnered with Indian companies to enhance drone capabilities.

| Company Name | Establishment Year | Headquarters | Key Drones Produced | Number of Contracts | Partnerships | Revenue (USD Bn) | Employees | Technology Focus | Key Region |

|---|---|---|---|---|---|---|---|---|---|

| Bharat Electronics Limited (BEL) | 1954 | Bengaluru, India | |||||||

| Hindustan Aeronautics Limited (HAL) | 1940 | Bengaluru, India | |||||||

| General Atomics Aeronautical Systems | 1993 | California, USA | |||||||

| DRDO (Defence Research & Dev Org) | 1958 | New Delhi, India | |||||||

| Adani Defense & Aerospace | 2015 | Ahmedabad, India |

India Military Drone Market Analysis

India Military Drone Market Growth Drivers

- Geopolitical Tensions and Border Security: India’s military drone market is largely driven by persistent geopolitical tensions, particularly along its northern and western borders. The Line of Actual Control (LAC) with China and the Line of Control (LoC) with Pakistan have been frequent flashpoints, requiring advanced surveillance and reconnaissance capabilities. According to the Indian Ministry of Defence, nearly 77,000 troops are stationed at high-altitude locations along the LAC, further emphasizing the need for drones to monitor border regions in real time. The Indian government has allocated $70 billion towards defence modernization in 2024, with a substantial portion earmarked for drone acquisitions to enhance security.

- Increased Government Investments: India has steadily increased its defence research and development expenditure to bolster indigenous military drone technology. The Defence Research and Development Organisation (DRDO) has been allocated $4 billion in 2024 to advance drone systems capable of long-range surveillance, precision strikes, and tactical intelligence. This surge in funding aims to reduce dependence on imports and drive innovation in military drone manufacturing. The Ministry of Defence's push for self-reliance has already seen the Indian armed forces deploy over 300 drones for reconnaissance and combat purposes.

- Drone Technology Advancements: Technological advancements in India's drone sector are enabling enhanced surveillance and reconnaissance capabilities. The DRDO's latest drone, "Rustom-II," can fly continuously for 24 hours, covering vast areas of over 2,000 kilometres. These drones are now equipped with electro-optic sensors and synthetic aperture radars for superior image capturing and intelligence gathering, essential for real-time monitoring of hostile territories. The Indian Army has initiated a project to induct 75 surveillance drones into high-altitude areas to further enhance border security in 2024.

India Military Drone Market Challenges

Regulatory Hurdles: The regulatory landscape for drones in India poses major challenges. Despite relaxed rules under the Drone Rules 2021, military drone operations still require strict compliance with aviation laws. For instance, the Directorate General of Civil Aviation (DGCA) mandates unmanned aircraft systems to operate under pre-approved flight paths, which limits operational flexibility in high-risk combat zones. According to a recent government report, 27% of drone projects in the defence sector faced delays due to these regulatory constraints.

High Initial Costs: The cost of manufacturing and maintaining military drones is a major barrier to market expansion. Building a medium-altitude long-endurance (MALE) drone such as the Rustom-II costs approximately $25 million, with an annual maintenance cost of over $1 million. These high costs strain the defence budget, particularly given India's focus on indigenization. Moreover, the government has initiated a public-private partnership to reduce costs, but the high investment threshold continues to be a challenge for smaller defence contractors.

India Military Drone Market Future Outlook

Over the next five years, the India Military Drone market is expected to experience growth, driven by continuous government support, increased defence budgets, and rapid advancements in drone technology. The integration of artificial intelligence and autonomous systems into drones will enable more sophisticated and diverse military applications. Additionally, the ongoing focus on indigenization through the "Make in India" initiative is expected to encourage domestic manufacturing and reduce dependency on imports. These factors, combined with the growing demand for surveillance and combat drones, will continue to drive the market forward.

India Military Drone Market Opportunities

- Indigenous Production Incentives: The Indian government's "Make in India" initiative provides a massive boost to the domestic military drone industry. The program incentivizes local manufacturing by offering tax breaks, funding grants, and easing regulations for defence companies. In 2024, the Ministry of Defence announced $6.5 billion in contracts awarded to local firms for drone development, intending to achieve 80% self-reliance in defence production. This has resulted in over 120 new drone start-ups entering the market, expanding production capabilities.

- Cross-border Drone Collaborations: India has established several defence partnerships with countries like the United States, Israel, and Russia, focusing on drone technology transfer and joint production. For example, the Indo-Israel defence cooperation on drones has resulted in the production of advanced Heron drones, widely used for border surveillance. The Indian government is also in talks with the U.S. to purchase MQ-9B Predator drones, enhancing its long-range reconnaissance capabilities. These international collaborations are expected to increase India’s drone fleet size by over 30% in 2024.

Scope of the Report

| By Product Type |

Combat Drones Surveillance Drones Tactical Drones Target Drones |

| By Technology |

Remotely Piloted Autonomous Semi-Autonomous |

| By Application |

Border Surveillance Combat Operations Logistics |

| By Range |

Short-Range Medium-Range Long-Range |

| By Region |

North India South India East India West India |

Products

Key Target Audience

Ministry of Defence (India)

Indian Army, Air Force, and Navy Procurement Divisions

Drone Manufacturers and Suppliers

Private Defense Contractors

Banks and Financial Institutions

Investment and Venture Capitalist Firms

Aerospace and Defense Engineering Companies

Government and Regulatory Bodies (DRDO, DGCA)

Unmanned Aerial Systems (UAS) Technology Providers

Companies

Bharat Electronics Limited (BEL)

Hindustan Aeronautics Limited (HAL)

DRDO (Defence Research and Development Organisation)

General Atomics Aeronautical Systems

Adani Defense & Aerospace

TATA Advanced Systems Limited (TASL)

Israel Aerospace Industries (IAI)

Boeing India

Lockheed Martin India Pvt Ltd.

Paras Aerospace Pvt Ltd.

IdeaForge Technology Pvt Ltd.

Alpha Design Technologies Pvt Ltd.

Garuda Aerospace Pvt Ltd.

TAS India Pvt Ltd.

Honeywell International Inc.

Table of Contents

1. India Military Drone Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Military Demand for UAVs)

1.4 Market Segmentation Overview

2. India Military Drone Market Size (In USD Bn)

2.1 Historical Market Size (Defense UAV Deployments and Acquisitions)

2.2 Year-On-Year Growth Analysis (Defense Budget Allocation)

2.3 Key Market Developments and Milestones (Indigenous Drone Programs)

3. India Military Drone Market Analysis

3.1 Growth Drivers (Defense Modernization & Security Needs)

3.1.1 Geopolitical Tensions and Border Security

3.1.2 Increased Government Investments (Defence R&D Expenditure)

3.1.3 Drone Technology Advancements (Surveillance & Reconnaissance Capabilities)

3.2 Market Challenges (Technical and Operational Limitations)

3.2.1 Regulatory Hurdles (Compliance with Aviation Rules)

3.2.2 High Initial Costs (Drone Manufacturing and Maintenance Costs)

3.2.3 Limited Drone Pilots and Operational Expertise

3.3 Opportunities (Emerging Defense Partnerships)

3.3.1 Indigenous Production Incentives (Make in India Program)

3.3.2 Cross-border Drone Collaborations (Strategic Military Alliances)

3.3.3 Expansion into Tactical and Combat Drones

3.4 Trends (Integration with AI and Data Analytics)

3.4.1 Rise of Autonomous Drone Systems (AI in Military Drones)

3.4.2 Adoption of Drones for Surveillance and Combat Missions

3.4.3 Increasing Use of Small and Micro Drones (Tactical Field Operations)

3.5 Government Regulation (Defense Acquisition Policies)

3.5.1 Ministry of Defence (MoD) Procurement Programs

3.5.2 Unmanned Aircraft Systems (UAS) Regulations

3.5.3 Defence Offsets Policy and Import Substitution

3.6 SWOT Analysis

3.7 Stake Ecosystem (Defense Contractors, Drone Manufacturers, and Suppliers)

3.8 Porter’s Five Forces (Power Dynamics Among Drone Manufacturers)

3.9 Competition Ecosystem

4. India Military Drone Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Combat Drones

4.1.2 Surveillance and Reconnaissance Drones

4.1.3 Tactical Drones

4.1.4 Target Drones

4.2 By Technology (In Value %)

4.2.1 Remotely Piloted Drones

4.2.2 Autonomous Drones

4.2.3 Semi-Autonomous Drones

4.3 By Application (In Value %)

4.3.1 Border Surveillance

4.3.2 Combat and Strike Operations

4.3.3 Logistics and Supply Missions

4.4 By Range (In Value %)

4.4.1 Short-Range Drones

4.4.2 Medium-Range Drones

4.4.3 Long-Range Drones

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India Military Drone Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Bharat Electronics Limited (BEL)

5.1.2 Hindustan Aeronautics Limited (HAL)

5.1.3 DRDO (Defence Research and Development Organisation)

5.1.4 Adani Defense & Aerospace

5.1.5 TATA Advanced Systems Limited (TASL)

5.1.6 Israel Aerospace Industries (IAI)

5.1.7 General Atomics Aeronautical Systems

5.1.8 Boeing India

5.1.9 Lockheed Martin India Pvt Ltd.

5.1.10 Thales Group India

5.1.11 IdeaForge Technology Pvt Ltd.

5.1.12 Paras Aerospace Pvt Ltd.

5.1.13 Alpha Design Technologies Pvt Ltd.

5.1.14 Garuda Aerospace Pvt Ltd.

5.1.15 TAS India Pvt Ltd.

5.2 Cross Comparison Parameters (Inception Year, No. of Defense Contracts, Operational Drones, Revenue from UAVs, Key Regions, Technology Focus, Partnerships, Product Offerings)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Contracts and Grants

5.9 Research Collaborations and Partnerships

6. India Military Drone Market Regulatory Framework

6.1 Defense Procurement Procedures (DPP)

6.2 UAS Certification and Airworthiness Standards

6.3 Defense Offset Policy for Drones

6.4 Import Substitution and Indigenization Programs

7. India Military Drone Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Military Drone Market Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Technology (In Value %)

8.3 By Application (In Value %)

8.4 By Range (In Value %)

8.5 By Region (In Value %)

9. India Military Drone Market Analysts’ Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis (Military Units, Special Forces, etc.)

9.3 Strategic Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Military Drone Market. Extensive desk research was conducted, utilizing secondary and proprietary databases to gather detailed industry information. This step helps identify critical variables, including technology trends and government regulations.

Step 2: Market Analysis and Construction

In this phase, historical data on the India Military Drone Market was analyzed. The ratio of drone suppliers to defence contracts was evaluated, alongside the resulting revenue generation from military drone applications. This step ensures an accurate understanding of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through consultations with industry experts, representing drone manufacturers and defense contractors. These consultations provided critical insights into operational strategies and government procurement processes.

Step 4: Research Synthesis and Final Output

The final phase involved engaging with multiple drone manufacturers to obtain detailed insights into product segments, sales performance, and consumer preferences. This bottom-up approach ensured that the analysis was comprehensive and validated, providing a robust market report.

Frequently Asked Questions

01. How big is the India Military Drone Market?

The India Military Drone market is valued at USD 366 million, driven by defence modernization initiatives and increasing demand for surveillance and combat drones.

02. What are the challenges in the India Military Drone Market?

Key challenges in the India Military Drone market include the high initial costs of drone technology, regulatory hurdles related to drone usage, and a shortage of skilled operators.

03. Who are the major players in the India Military Drone Market?

Major players in the India Military Drone market include Bharat Electronics Limited (BEL), Hindustan Aeronautics Limited (HAL), General Atomics Aeronautical Systems, and Adani Defense & Aerospace.

04. What are the growth drivers of the India Military Drone Market?

The India Military Drone market is driven by factors such as geopolitical tensions, defence modernization, government investments in UAV technology, and the "Make in India" initiative.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.