India Mobile Games Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD4838

November 2024

83

About the Report

India Mobile Games Market Overview

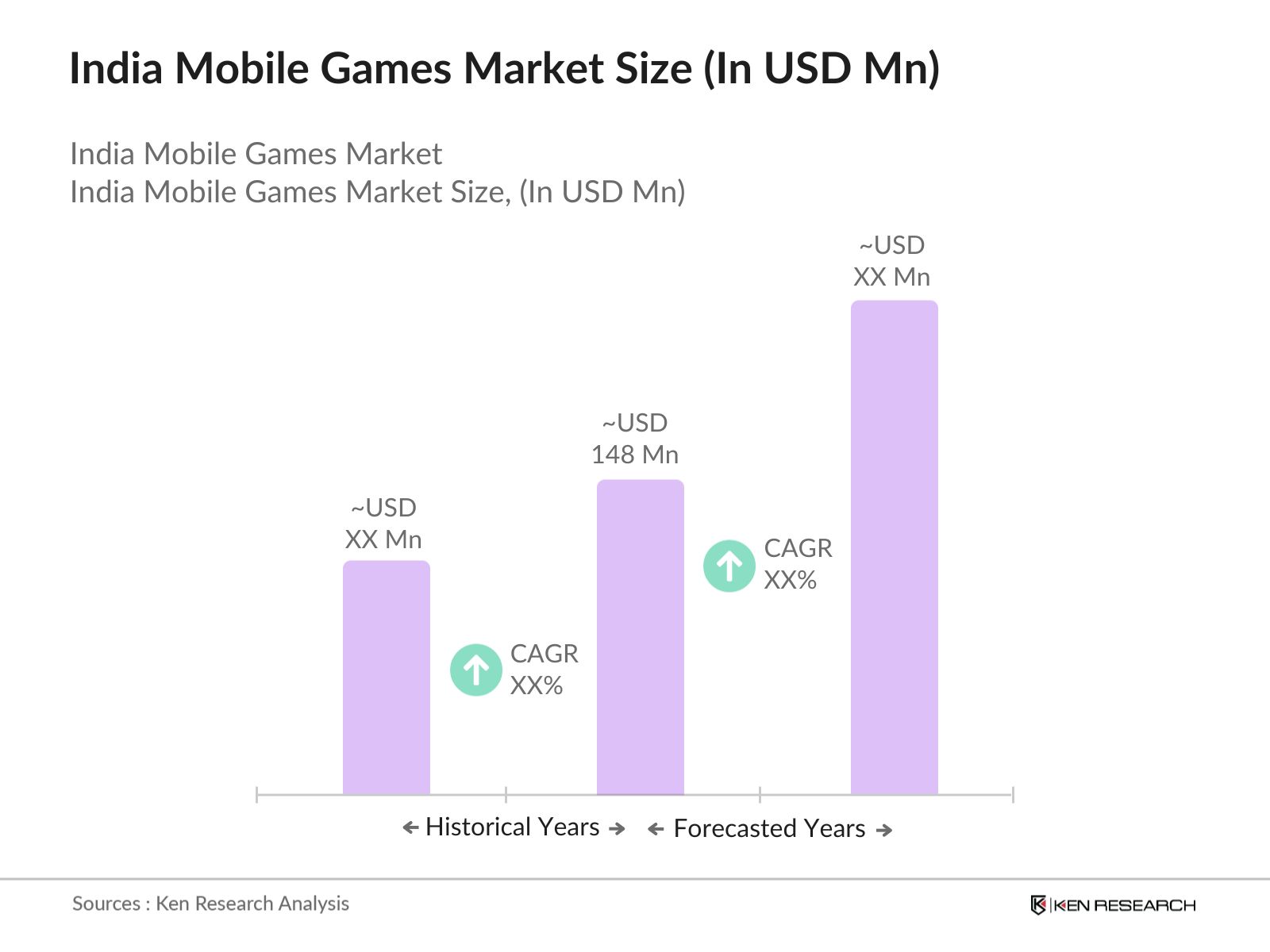

- The India Mobile Games Market is valued at USD 148 million, driven by the proliferation of smartphones and increasing internet accessibility across urban and rural areas. This growth is further fueled by the rising popularity of gaming among various demographics, particularly the youth, which has led to a surge in mobile game downloads and user engagement, the number of mobile gamers in India is expected to reach 500 million, underlining the potential for further market expansion.

- Key cities such as Bangalore, Mumbai, and Delhi are dominant in the mobile games market due to their high concentration of tech-savvy populations and robust internet infrastructure. Additionally, Bangalore serves as a major hub for game development companies, contributing to innovative gaming experiences. The urban lifestyle and entertainment demands of these cities are driving the market, as residents increasingly seek engaging and interactive forms of leisure.

- Gaming taxation policies are evolving in India, posing challenges for developers and players alike. In 2023, the GST (Goods and Services Tax) on online gaming was set at 28%, creating substantial financial implications for both consumers and the gaming industry. This high tax rate has led to debates on the sustainability of online gaming businesses, as it impacts affordability for players. As discussions continue regarding potential revisions, developers are urged to adapt their pricing strategies accordingly to remain competitive. The implementation of fair taxation could encourage growth and investment in the sector.

India Mobile Games Market Segmentation

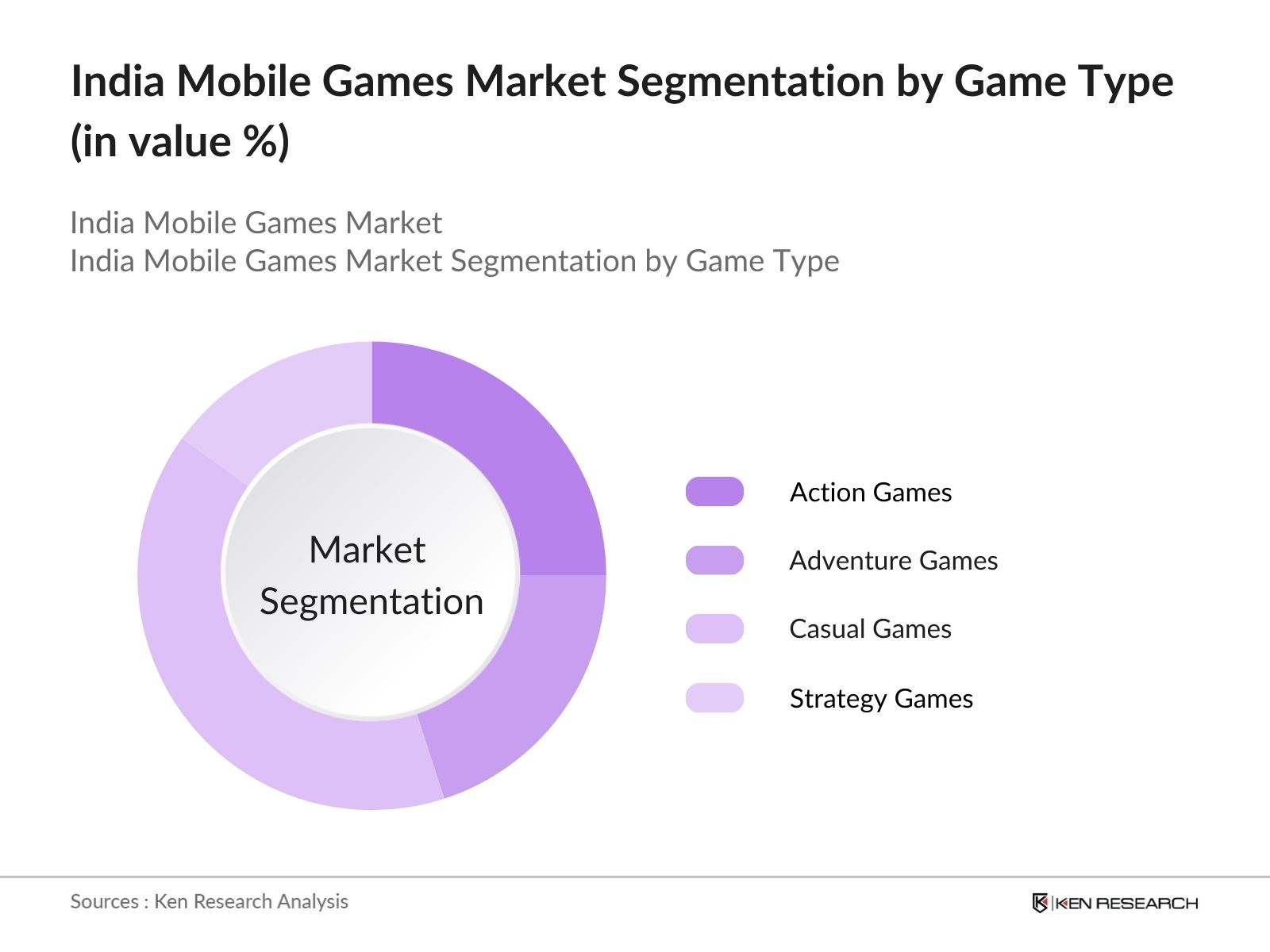

The India Mobile Games Market is segmented by game type and by Platform type.

- By Game Type: The market is segmented by game type into action games, adventure games, casual games, and strategy games. Among these, casual games have a dominant market share, primarily due to their accessibility and broad appeal to diverse age groups. The popularity of games like Candy Crush and PUBG Mobile exemplifies how casual gaming attracts players who may not typically engage in traditional gaming formats. Furthermore, the integration of social features in casual games enhances user retention, making this sub-segment particularly lucrative.

- By Platform: The market is also segmented by platform, comprising Android, iOS, and Windows. The Android platform holds a significant market share, attributed to its widespread availability and affordability of devices in India. The vast array of applications available on the Google Play Store, including both free and paid games, further drives user engagement on this platform. With continuous improvements in mobile technology and game development, Android remains the preferred choice for most mobile gamers in India.

India Mobile Games Market Competitive Landscape

The India Mobile Games Market is characterized by a few major players, including local developers and international companies. This competitive landscape is marked by the presence of companies like Tencent, Activision Blizzard, and Zynga, which significantly influence market trends through their innovative offerings and robust marketing strategies.

|

Major Player |

Establishment Year |

Headquarters |

Game Portfolio |

User Base (Million) |

Revenue (USD Million) |

R&D Investment (USD Million) |

|

Tencent |

1998 |

Shenzhen, China |

||||

|

Activision Blizzard |

2003 |

Santa Monica, USA |

||||

|

Zynga |

2007 |

San Francisco, USA |

||||

|

Supercell |

2010 |

Helsinki, Finland |

||||

|

Nazara Technologies |

2000 |

Mumbai, India |

India Mobile Games Industry Analysis

Market Growth Drivers

- Increasing Smartphone Penetration: India has witnessed growth in smartphone penetration, with over 1.2 billion mobile connections as of early 2023, accounting for 85% of the population. The smartphone user base is expected to reach around 800 million by 2025, driven by affordable devices priced below 10,000. This increase in smartphone adoption enables access to a wider array of mobile games, catering to diverse demographics. Furthermore, the Indian smartphone market is projected to grow by 13% annually, boosting the mobile gaming sector's expansion.

- Rising Internet Accessibility: Internet accessibility in India has improved remarkably, with over 600 million internet users recorded in 2023, representing 44% of the population. The governments Digital India initiative aims to enhance connectivity, targeting 1.3 billion people by increasing broadband coverage to rural areas. As of 2022, internet penetration is expected to reach 70% by 2025, driven by affordable data plans and the rollout of 5G technology, which will facilitate seamless online gaming experiences. The average monthly data consumption per user is projected to exceed 20 GB by 2024.

- Surge in Mobile Payment Solutions: The mobile payments landscape in India has grown rapidly, with transactions reaching 7.4 trillion in 2022, a significant leap from previous years. As digital wallets and payment applications proliferate, the number of UPI (Unified Payments Interface) transactions crossed 8 billion in 2023, facilitating in-game purchases seamlessly. This surge in mobile payment solutions enhances the gaming experience by allowing easy monetization through microtransactions and subscriptions, driving growth in the mobile gaming sector. As of 2024, mobile payment users are estimated to be around 500 million.

Market Challenges

- Regulatory Hurdles: Regulatory challenges present obstacles to the mobile gaming industry in India. The government has initiated discussions regarding a comprehensive regulatory framework for online gaming, addressing concerns related to gambling and addiction. Currently, there are no unified regulations, leading to a fragmented market. Various state governments have implemented different rules, creating confusion among developers and users. This lack of clarity hampers investment in the sector, which is crucial for innovation and growth. Compliance costs pose additional burdens for gaming companies, impacting their operational strategies and financial planning.

- Monetization Issues: Monetization remains a challenge for mobile game developers in India, with many struggling to convert free users into paying customers. A significant portion of mobile gamers is reluctant to spend money on in-app purchases, primarily due to economic constraints and a strong preference for free-to-play models. This trend creates difficulties for developers aiming to sustain their businesses and improve profit margins. The pressure to innovate monetization strategies is increasing as the market evolves, and developers must find effective ways to encourage spending among users.

India Mobile Games Market Future Outlook

Over the next five years, the India Mobile Games Market is expected to show growth, driven by continuous technological advancements and the increasing penetration of smartphones. The market will benefit from enhanced gaming experiences through augmented reality (AR) and virtual reality (VR), alongside a growing interest in e-sports and competitive gaming. Government initiatives promoting digital literacy and internet accessibility will further catalyze user engagement, leading to a more vibrant gaming ecosystem.

Future Market Opportunities

- E-sports Growth: The e-sports segment in India is experiencing rapid growth, with the audience expected to surpass 100 million by the end of 2024. The country hosted over 100 e-sports tournaments in 2023, attracting significant investments and sponsorships, estimated to reach 500 crore. This surge in interest is fostering a robust ecosystem for mobile gaming, as gamers seek competitive platforms. Additionally, leading game developers are investing in e-sports titles tailored for Indian audiences, creating opportunities for innovation and engagement within the mobile gaming space. The trend highlights a promising avenue for future growth.

- AR/VR Integration: The integration of Augmented Reality (AR) and Virtual Reality (VR) into mobile gaming presents a lucrative opportunity for growth. By the end of 2024, the AR gaming market in India is projected to reach 8,000 crore, driven by advances in technology and user interest. Currently, over 25 million users are engaging with AR-based applications, indicating a strong market readiness. Game developers are increasingly incorporating AR features to enhance user experience, leading to immersive gameplay. As the technology becomes more accessible, it is expected to attract a broader audience to mobile gaming. Source:

Scope of the Report

|

By Game Type |

Action Games Adventure Games Casual Games Strategy Games |

|

By Platform |

Android iOS Windows |

|

By User Demographics |

Age Groups Gender Distribution |

|

By Revenue Model |

Free-to-Play Pay-to-Play In-App Purchases |

|

By Region |

North East West South |

Products

Key Target Audience

Game Developers

Investors and Venture Capitalist Firms

Mobile Device Manufacturers

Advertising Agencies

Government and Regulatory Bodies (Ministry of Electronics and Information Technology)

Banks and Financial Institutes

Telecommunications Companies

Distribution Platforms (e.g., Google Play, App Store)

Game Publishing Companies

Companies

Major Players in the India Mobile Games Market

Tencent

Activision Blizzard

Zynga

Supercell

Nazara Technologies

Gameloft

Electronic Arts

NetEase

Rovio Entertainment

Ubisoft

Playtika

Gamers Factory

Octro

Moonfrog Labs

Big Blue Bubble

Table of Contents

1. India Mobile Games Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate (CAGR)

Market Segmentation Overview

2. India Mobile Games Market Size (In USD Bn)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

3. India Mobile Games Market Analysis

Growth Drivers

Increasing Smartphone Penetration

Rising Internet Accessibility

Surge in Mobile Payment Solutions

Gamification in Various Sectors

Market Challenges

Regulatory Hurdles

Monetization Issues

High Competition

Opportunities

E-sports Growth

AR/VR Integration

Expansion of Mobile Gaming Communities

Trends

Subscription-based Models

Cross-Platform Play

In-game Advertising Innovations

Regulatory Framework

Data Privacy Regulations

Gaming Taxation Policies

SWOT Analysis

Stake Ecosystem

Porters Five Forces

Competition Ecosystem

4. India Mobile Games Market Segmentation

By Game Type (In Value %)

Action Games

Adventure Games

Casual Games

Strategy Games

By Platform (In Value %)

Android

iOS

Windows

By User Demographics (In Value %)

Age Groups

Gender Distribution

By Revenue Model (In Value %)

Free-to-Play

Pay-to-Play

In-App Purchases

By Region (In Value %)

North

South

East

West

5. India Mobile Games Market Competitive Analysis

Detailed Profiles of Major Companies

Tencent

Activision Blizzard

Electronic Arts

Zynga

Gameloft

Supercell

NetEase

Ubisoft

Microsoft

Playtika

Gamers Factory

Nazara Technologies

Rolocule Games

Moonfrog Labs

Octro

Cross Comparison Parameters (Market Share, Revenue, Geographic Presence, Game Portfolio, User Base, Investment in R&D, Partnerships, Strategic Alliances)

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Venture Capital Funding

Government Grants

Private Equity Investments

6. India Mobile Games Market Regulatory Framework

Data Privacy Regulations

Compliance Requirements

Certification Processes

7. India Mobile Games Market Future Market Size (In USD Bn)

Future Market Size Projections

Key Factors Driving Future Market Growth

8. India Mobile Games Market Future Segmentation

By Game Type (In Value %)

By Platform (In Value %)

By User Demographics (In Value %)

By Revenue Model (In Value %)

By Region (In Value %)

9. India Mobile Games Market Analysts Recommendations

TAM/SAM/SOM Analysis

Customer Cohort Analysis

Marketing Initiatives

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Mobile Games Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Mobile Games Market. This includes assessing market penetration, user engagement metrics, and resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple game developers and publishers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Mobile Games Market.

Frequently Asked Questions

01. How big is the India Mobile Games Market?

The India Mobile Games Market is valued at USD 148 million, driven by smartphone penetration and rising internet accessibility, with expectations for significant growth in the coming years.

02. What are the challenges in the India Mobile Games Market?

Challenges in India mobile games market include regulatory hurdles, intense competition among game developers, and monetization issues that affect profitability and market sustainability.

03. Who are the major players in the India Mobile Games Market?

Key players in India mobile games market include Tencent, Activision Blizzard, Zynga, and Nazara Technologies, known for their extensive game portfolios and innovative approaches to mobile gaming.

04. What are the growth drivers of the India Mobile Games Market?

Growth drivers in India mobile games market include increasing smartphone adoption, expanding internet access, and the rising popularity of casual and competitive gaming among diverse demographics.

05. How is the India Mobile Games Market segmented?

The India mobile games market is segmented by game type (casual, action, etc.) and platform (Android, iOS, Windows), with each segment exhibiting unique trends and consumer preferences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.