India Mobile Payments Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD7326

October 2024

98

About the Report

India Mobile Payments Market Overview

- The India Mobile Payments Market has seen significant growth, reaching a valuation of USD 640 billion based on a five-year historical analysis. This rapid expansion is primarily driven by the increasing adoption of digital payment methods, particularly due to the widespread availability of smartphones and the expansion of internet access. The introduction of Unified Payments Interface (UPI) by the National Payments Corporation of India (NPCI) has been a game-changer, offering seamless and secure payment solutions, which has significantly boosted transaction volumes. Additionally, government initiatives such as Digital India and demonetization have further encouraged the shift from cash to digital payments, creating a robust foundation for growth in the mobile payments market.

- Indias mobile payments market is highly concentrated in urban areas, with cities such as Mumbai, Delhi, and Bangalore leading the charge. These cities dominate due to their advanced banking infrastructure, tech-savvy population, and the presence of multiple e-commerce and fintech companies. Additionally, the high level of smartphone penetration and internet connectivity in these cities fosters a conducive environment for the adoption of mobile payment solutions. Rural areas are gradually catching up, but urban centers remain the key drivers of market growth due to their dense population and advanced digital infrastructure.

- The Reserve Bank of India has introduced several regulatory measures to ensure the stability and security of payment systems. In 2024, the Payment and Settlement Systems Act was amended to include new guidelines for mobile payments, covering cybersecurity protocols, KYC norms, and dispute resolution mechanisms. These regulations aim to safeguard user data and ensure secure transactions, crucial in maintaining consumer trust as mobile payment usage continues to rise. Non-compliance may result in severe penalties for financial institutions and payment service providers.

India Mobile Payments Market Segmentation

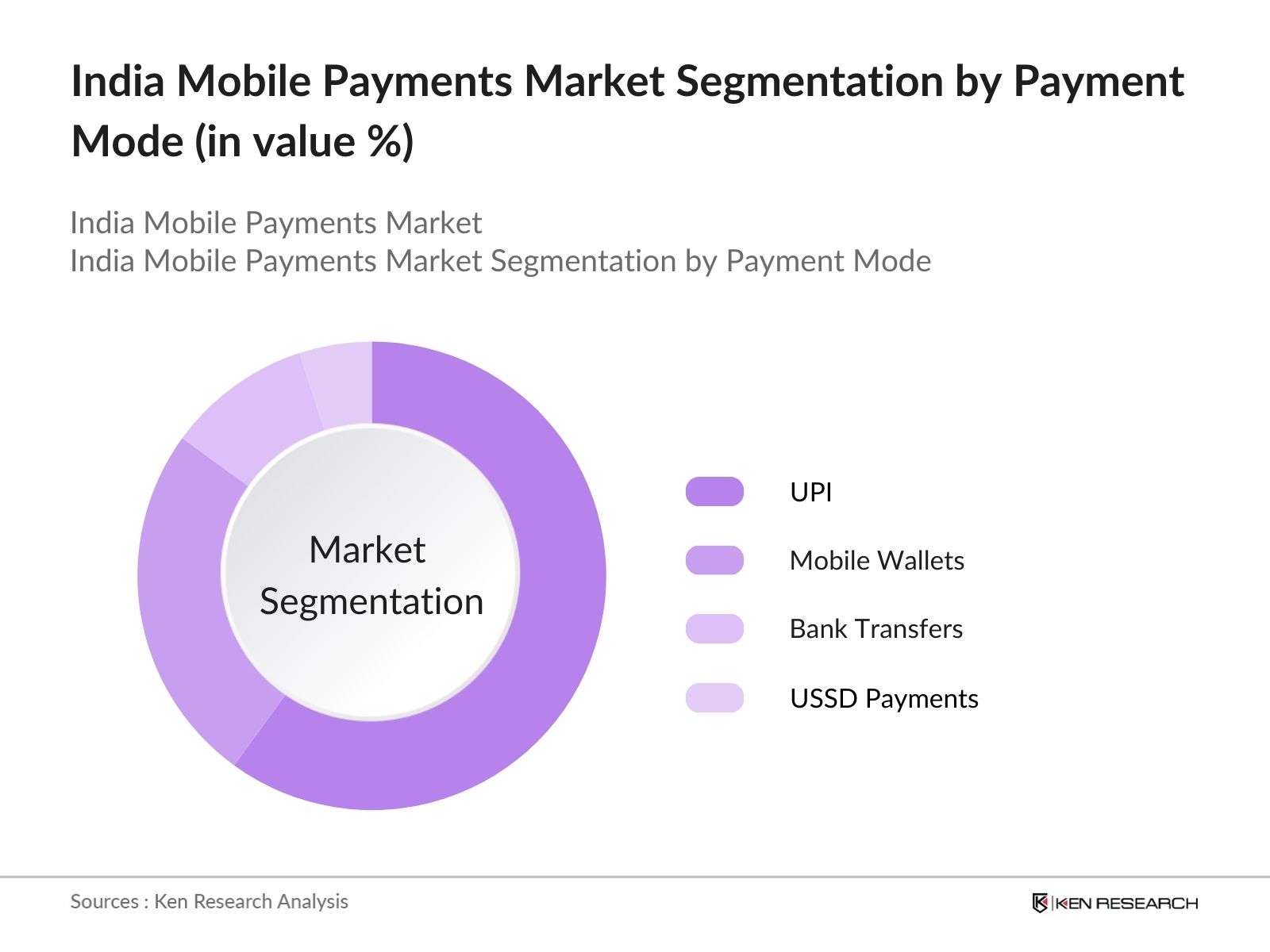

- By Payment Mode: India's mobile payments market is segmented by payment mode into UPI, mobile wallets, bank transfers, and USSD payments. UPI has a dominant market share under the payment mode segmentation, largely due to its ease of use, zero transaction fees, and widespread acceptance across both urban and rural India. UPI's instant transfer capabilities, along with its integration with over 200 banks, have further accelerated its adoption among users and businesses alike. Additionally, mobile wallets such as Paytm and PhonePe have also maintained a strong presence, especially for smaller, everyday transactions due to their convenience and cashback offers.

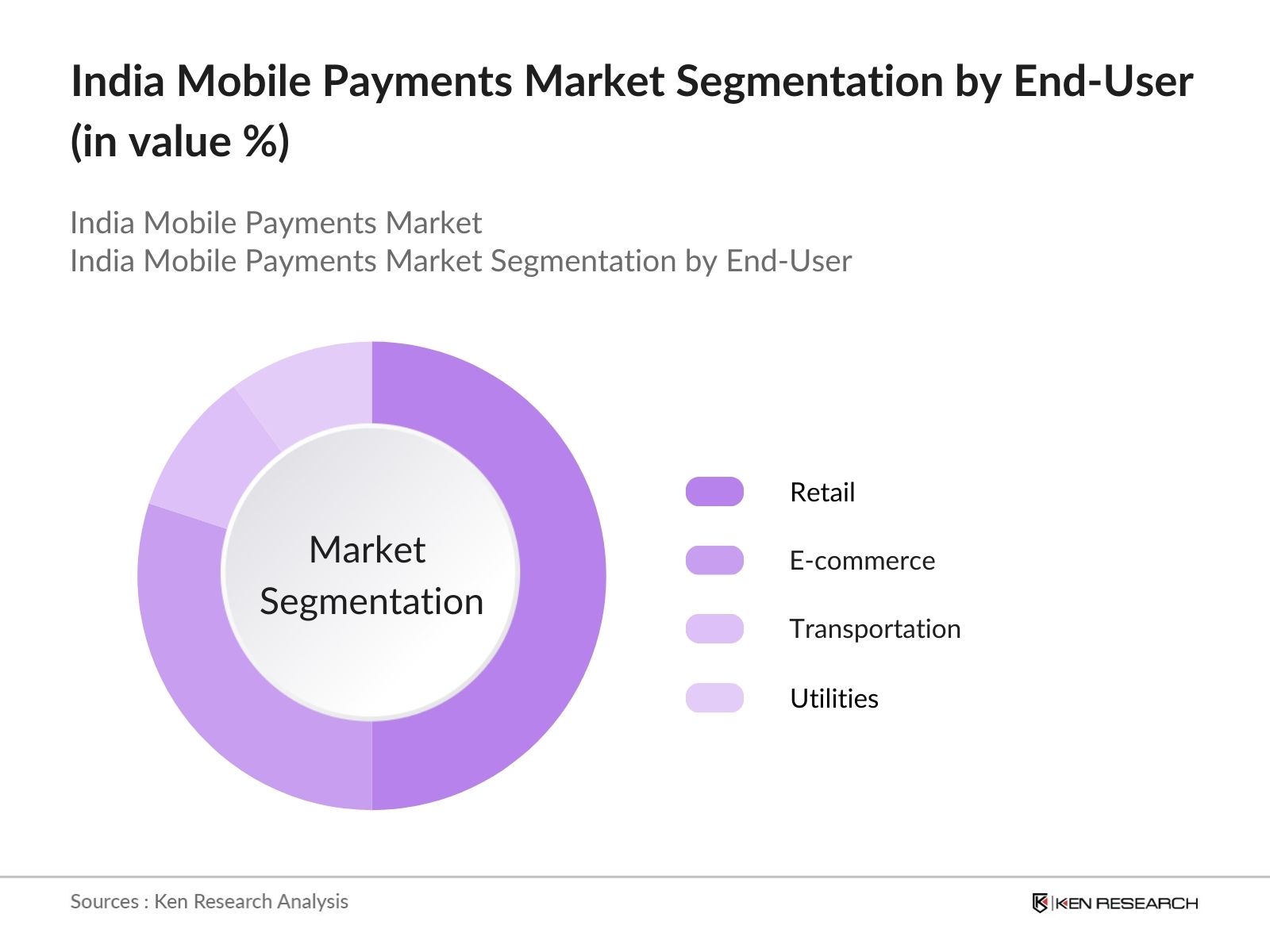

- By End-User: The mobile payments market in India is segmented by end-user into retail, e-commerce, transportation, utilities, and education. The retail sector holds the dominant market share under the end-user segmentation, driven by the increasing preference for cashless transactions in both physical stores and online platforms. Retailers, both large and small, have rapidly adopted mobile payment solutions, including QR code payments and contactless transactions, to offer seamless payment experiences to consumers. The convenience, speed, and security provided by mobile payments have made them the preferred choice for retail purchases, especially among younger, tech-savvy consumers.

India Mobile Payments Market Competitive Landscape

The India Mobile Payments Market is characterized by a few key players who dominate the market through their extensive networks, technological innovations, and customer-focused solutions. UPI-based platforms like Google Pay and PhonePe have gained a massive user base, while Paytm has capitalized on its early-mover advantage and diverse service offerings, including mobile wallets and digital banking.

|

Company |

Establishment Year |

Headquarters |

Total Transactions (Billion) |

No. of Active Users |

UPI Integration |

Wallet Service |

Transaction Success Rate |

Revenue Model |

Security Features |

|

Paytm |

2010 |

Noida |

|||||||

|

PhonePe |

2015 |

Bangalore |

|||||||

|

Google Pay |

2018 |

Hyderabad |

|||||||

|

Amazon Pay |

2016 |

Bangalore |

|||||||

|

BharatPe |

2018 |

New Delhi |

India Mobile Payments Industry Analysis

Growth Drivers

- UPI Adoption: The Unified Payments Interface (UPI) has emerged as a critical component of India's mobile payment ecosystem, with over 9 billion transactions processed monthly by mid-2024. As of June 2024, UPI handled 15 trillion worth of transactions monthly, supported by the National Payments Corporation of India (NPCI) infrastructure. The government's push for interoperability has been instrumental in facilitating the adoption of UPI by small businesses, further driving mobile payments adoption across various sectors. The increasing collaboration between banks and fintech companies also supports this upward trend.

- Government Push for Digital India: Indias Digital India initiative has been a strong driver for mobile payments. In 2023, the Indian government allocated 16,000 crore for building digital infrastructure, fostering greater connectivity across rural and urban areas. More than 1.2 billion Aadhaar numbers have been issued, creating a foundation for mobile-based digital payments linked to identity verification systems. The increased digital literacy campaigns further enhance adoption. Digital infrastructure expansion is expected to continue fueling the mobile payments sector, especially with the Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA

- Smartphone Penetration: India had approximately 825 million smartphone users in 2024, a significant growth from previous years, driving the usage of mobile-based payment platforms. The proliferation of affordable smartphones, especially from domestic manufacturers, has lowered the entry barrier for millions of new users. With mobile internet reaching over 700 million people, largely due to the availability of low-cost data plans, there is a growing demand for payment services that are seamlessly integrated with smartphones.

Market Restraints

- Cybersecurity Threats: Cybersecurity remains a significant challenge for Indias mobile payments market, with 13,000 cases of financial fraud reported in 2023 alone. As digital transactions grow, so do concerns about data breaches and identity theft. A 2022 report from the RBI highlighted that financial institutions were subjected to over 4,000 cyber-attacks, underlining the necessity of improving security measures for mobile payment platforms. Increased investment in secure encryption protocols and regulatory measures are essential for mitigating these risks.

- Rural Penetration Issues: Rural India, home to 65% of the population, faces challenges in mobile payment adoption due to limited digital literacy and infrastructure. Only 33% of rural residents had reliable internet access in 2024, significantly lagging urban counterparts. Although initiatives like PMGDISHA have made progress, the lack of high-speed internet, smartphone ownership, and digital payment awareness restricts growth. Government efforts to bridge this digital divide are ongoing, but full-scale rural adoption remains a critical hurdle.

India Mobile Payments Market Future Outlook

Over the next five years, the India Mobile Payments Market is expected to see substantial growth, fueled by increasing consumer preference for digital payments, the expansion of internet access, and rising smartphone penetration across both urban and rural areas. The government's continuous efforts toward building a cashless economy through initiatives like Digital India and BharatNet will further strengthen the market. Additionally, advancements in payment technologies, such as AI-driven fraud detection systems and the integration of blockchain, are anticipated to shape the future landscape of mobile payments in India, creating new opportunities for market players.

Market Opportunities

- Expansion into Rural Markets: The rural population, which constitutes nearly 900 million people, presents a massive untapped opportunity for mobile payments. With the continued expansion of government-backed digital infrastructure, mobile payment providers can leverage the ongoing BharatNet project, which aims to bring broadband access to over 250,000 village-level administrative units. By 2024, 80% of these units were connected, laying the foundation for mobile payment adoption across rural areas. Partnering with local government bodies to expand digital literacy will further enhance rural penetration.

- Partnerships with E-commerce: The Indian e-commerce sector, valued at over 10 trillion in 2024, offers extensive collaboration opportunities for mobile payment providers. By integrating mobile payments into leading e-commerce platforms, companies can drive higher transaction volumes. As more consumers shift to online shopping, driven by the rise of smartphone penetration, this creates a fertile ground for expanding mobile payment services. Collaborative strategies, such as co-branded wallets or BNPL (Buy Now, Pay Later) solutions, have been key drivers of success in this area.

Scope of the Report

|

By Payment Mode |

Unified Payments Interface (UPI), Mobile Wallets, Bank Transfers, USSD Payments, Credit/Debit Card Payments |

|

By End-User |

Retail, E-commerce, Transportation, Utilities, Education |

|

By Application |

Peer-to-Peer (P2P) Payments, Consumer-to-Business (C2B) Payments, Government Payments, Cross-border Transactions |

|

By Technology |

NFC-Based Payments, QR Code-Based Payments, Biometric Authentication, AI-Based Fraud Detection |

|

By Region |

North India, West India, South India, East India, Central India |

Products

Key Target Audience

Banks and Financial Institutions

Payment Gateway Providers

E-commerce Platforms

Telecom Companies

Retailers (including offline and online retailers)

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (RBI, NPCI)

Fintech Startups

Companies

Players Mentioned in the Report:

Paytm

PhonePe

Google Pay

Amazon Pay

BharatPe

MobiKwik

Airtel Payments Bank

JioMoney

Freecharge

CRED

Razorpay

Pine Labs

PayU

FSS (Financial Software and Systems)

NPCI (National Payments Corporation of India)

Table of Contents

1. India Mobile Payments Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Transaction volume, user adoption rate, mobile penetration, banking penetration)

1.4. Market Segmentation Overview

2. India Mobile Payments Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Launch of UPI, digital wallet integrations, demonetization impact, fintech ecosystem growth)

3. India Mobile Payments Market Analysis

3.1. Growth Drivers

3.1.1. UPI Adoption

3.1.2. Government Push for Digital India

3.1.3. Smartphone Penetration

3.1.4. Banking Infrastructure Expansion

3.2. Market Challenges

3.2.1. Cybersecurity Threats

3.2.2. Rural Penetration Issues

3.2.3. Regulatory Compliance

3.3. Opportunities

3.3.1. Expansion into Rural Markets

3.3.2. Partnerships with E-commerce

3.3.3. Cross-border Payment Integration

3.4. Trends

3.4.1. QR Code Payments

3.4.2. AI-Driven Payment Solutions

3.4.3. Integration of Blockchain

3.5. Government Regulation

3.5.1. RBI Regulations on Payment Systems

3.5.2. Data Localization Laws

3.5.3. NPCI Initiatives (e.g., UPI 2.0)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Banks, Fintech companies, Government, Payment Service Providers)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Mobile Payments Market Segmentation

4.1. By Payment Mode (In Value %)

4.1.1. Unified Payments Interface (UPI)

4.1.2. Mobile Wallets

4.1.3. Bank Transfers (NEFT, IMPS)

4.1.4. USSD Payments

4.1.5. Credit/Debit Card Payments

4.2. By End-User (In Value %)

4.2.1. Retail

4.2.2. E-commerce

4.2.3. Transportation

4.2.4. Utilities

4.2.5. Education

4.3. By Application (In Value %)

4.3.1. Peer-to-Peer (P2P) Payments

4.3.2. Consumer-to-Business (C2B) Payments

4.3.3. Government Payments

4.3.4. Cross-border Transactions

4.4. By Technology (In Value %)

4.4.1. NFC-Based Payments

4.4.2. QR Code-Based Payments

4.4.3. Biometric Authentication

4.4.4. AI-Based Fraud Detection

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. West India

4.5.3. South India

4.5.4. East India

4.5.5. Central India

5. India Mobile Payments Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Paytm

5.1.2. PhonePe

5.1.3. Google Pay

5.1.4. Amazon Pay

5.1.5. BharatPe

5.1.6. MobiKwik

5.1.7. Airtel Payments Bank

5.1.8. JioMoney

5.1.9. Razorpay

5.1.10. CRED

5.1.11. Pine Labs

5.1.12. Freecharge

5.1.13. NPCI

5.1.14. BankBazaar

5.1.15. Zeta

5.2. Cross Comparison Parameters

Number of Transactions

Total Payment Volume

Market Share

Geographical Presence

Transaction Success Rate

Revenue Model

Active Users

Security Features

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Mobile Payments Market Regulatory Framework

6.1. RBI Guidelines for Payment Systems

6.2. Compliance Requirements (KYC, AML)

6.3. Data Privacy Laws (IT Act, 2000)

6.4. Digital Payments Guidelines (RBI Payments Vision)

7. India Mobile Payments Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Mobile Payments Market Future Segmentation

8.1. By Payment Mode (In Value %)

8.2. By End-User (In Value %)

8.3. By Application (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. India Mobile Payments Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the mobile payments ecosystem in India, focusing on all major stakeholders such as banks, fintech companies, and regulatory bodies. Data was gathered through secondary research from credible sources like RBI reports and proprietary databases, aimed at identifying the key factors driving market growth.

Step 2: Market Analysis and Construction

This step includes analyzing historical data on mobile payment transactions, adoption rates, and consumer behavior. The analysis covered market drivers, such as UPI growth and smartphone penetration, along with a detailed examination of the competitive landscape and user experience metrics.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through in-depth interviews with industry experts, including representatives from top fintech firms and banks. These consultations helped refine our understanding of the market's future trajectory and provided insights into transaction success rates and user engagement.

Step 4: Research Synthesis and Final Output

In the final step, the data was synthesized into a comprehensive report, incorporating insights from both qualitative and quantitative research. The final report includes detailed market segmentation, competitive analysis, and future outlooks, verified through expert consultations and secondary data.

Frequently Asked Questions

01. How big is the India Mobile Payments Market?

The India Mobile Payments Market is valued at USD 640 billion based on a five-year historical analysis., primarily driven by the growing adoption of UPI and mobile wallets across the country.

02. What are the challenges in the India Mobile Payments Market?

Challenges in this market include cybersecurity risks, rural penetration barriers, and regulatory compliance, which continue to affect the adoption of mobile payment solutions across diverse user segments.

03. Who are the major players in the India Mobile Payments Market?

Key players in the market include Paytm, PhonePe, Google Pay, Amazon Pay, and BharatPe. These companies dominate due to their extensive user base, technological innovations, and integration with banking systems.

04. What are the growth drivers of the India Mobile Payments Market?

The market is primarily driven by government initiatives like Digital India, the introduction of UPI, increasing smartphone penetration, and the growing preference for contactless payment solutions among consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.