India Molding Machine Market Outlook to 2030

Region:Asia

Author(s):Mukul Soni

Product Code:KROD407

July 2024

87

About the Report

India Molding Machine Market Overview

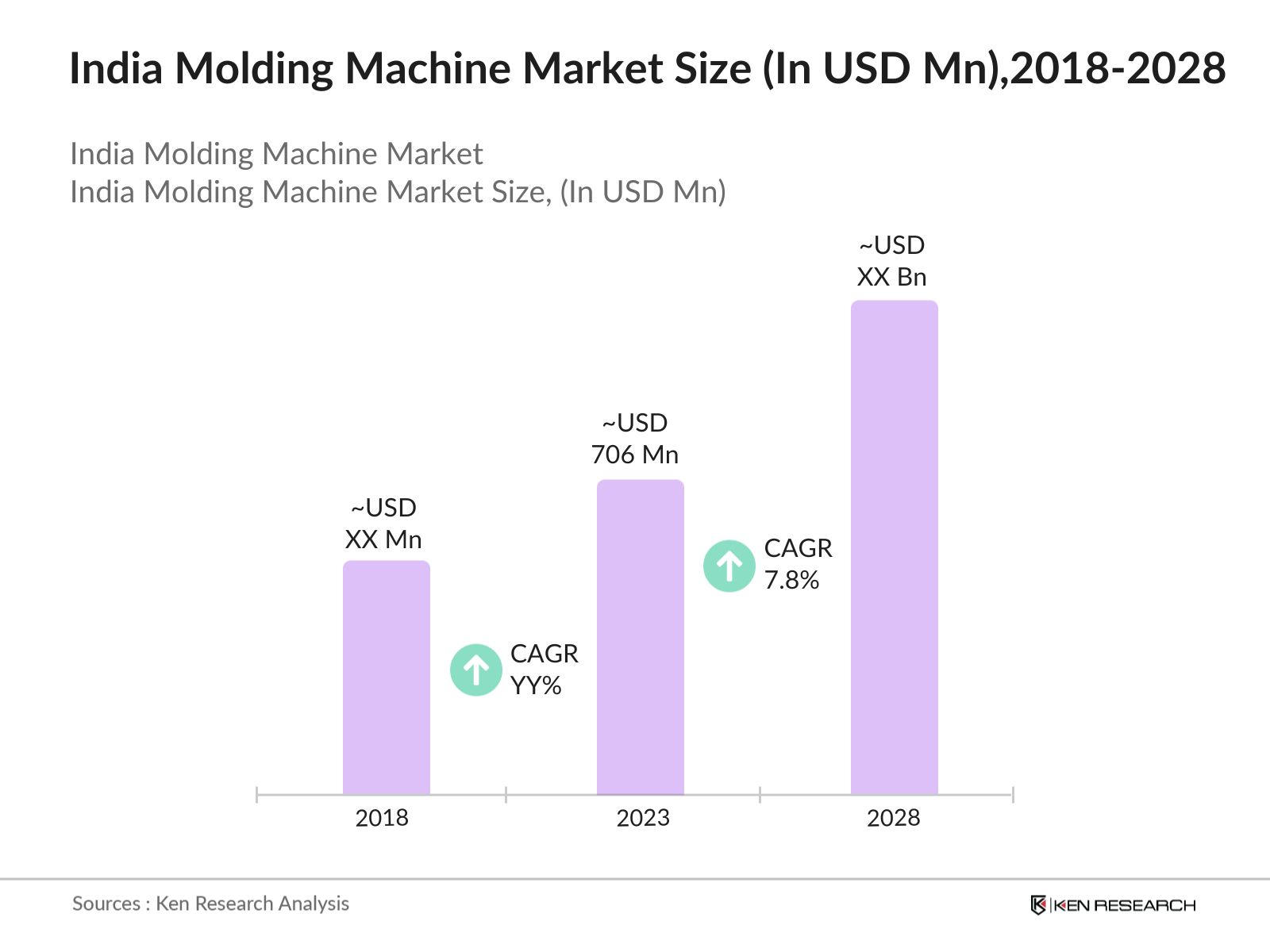

- In recent years, the India molding machine market has experienced substantial growth, this is reflected by the India injection molding machine market reached a valuation of USD 706 million in 2023. driven by increasing demand in various industries such as automotive, electronics, and packaging.

- Leading players in the India Molding Machine Market include Toshiba Machine Co., Ltd., Arburg GmbH + Co KG, Engel Austria GmbH, and Haitian International Holdings Limited. These companies dominate due to their innovative technologies, expansive distribution networks, and comprehensive service offerings.

- Maharashtra stands out as a significant hub in the India Molding Machine Market, primarily because of its large industrial base, strategic location for logistics, and concentration of manufacturing facilities.

- Toshiba Machine Co., Ltd. highlighted impressive growth in the first three quarters of 2023, with revenue reaching $200 million and a substantial 20% increase in net profits, driven by their pioneering injection molding technologies and strong global partnerships.

India Molding Machine Market Segmentation

The India Molding Machine Market can be segmented based on various factors like product, end use industry and region.

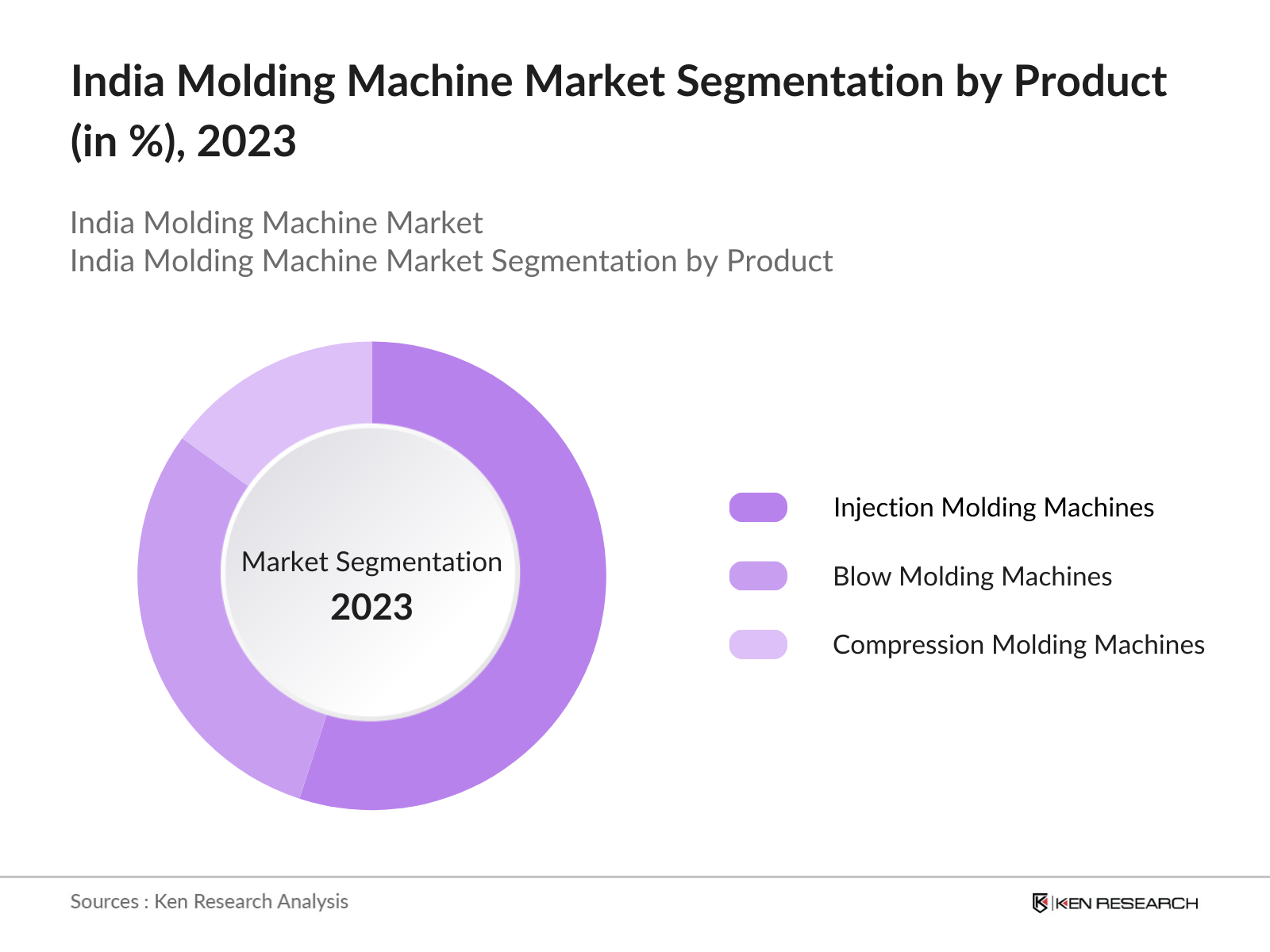

By Product Type: The India molding machine market is segmented by product type into injection molding machines, blow molding machines, and compression molding machines. In 2023, injection molding machines dominated the market. This dominance is attributed to their widespread application in producing complex and high-precision components for the automotive and electronics industries.

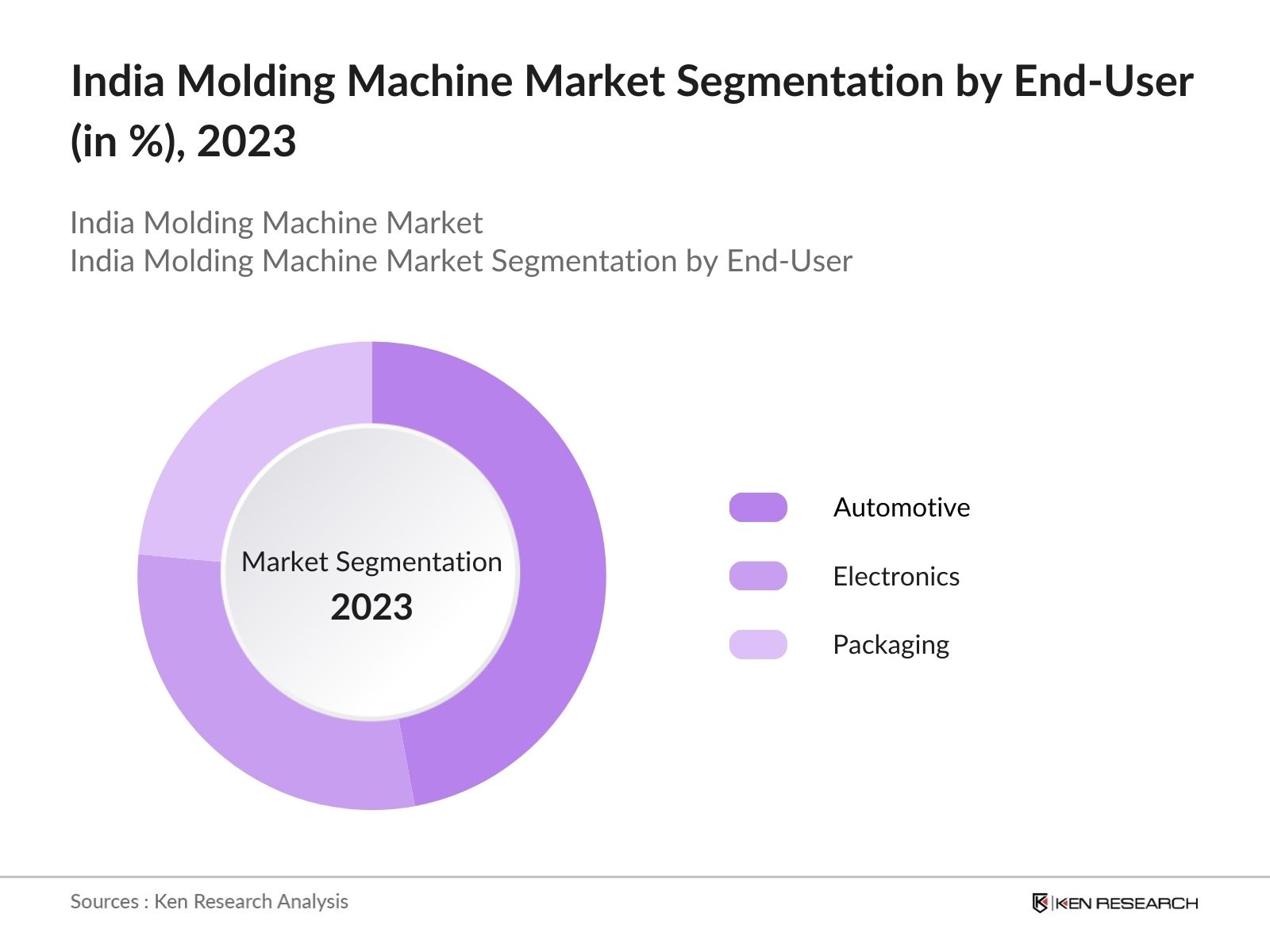

By End-User: The India molding machine market is segmented by end-user into automotive, electronics, packaging, and others. The automotive sector dominated the market. The demand for lightweight and high-precision components in vehicle manufacturing drives the adoption of advanced molding machines. Innovations in electric and hybrid vehicles also contribute to the increased demand for molding machines in this sector.

By Region: The India molding machine market is segmented by region into North, South, East, and West. The northern region dominated the market. The presence of numerous automotive and electronics manufacturers in this region drives the demand for advanced molding machines.

India Molding Machine Market Competitive Landscape

- In 2023, Haitian International announced the opening of a new manufacturing plant in Gujarat, India. This facility aims to increase production capacity and reduce lead times for molding machines, addressing the growing demand in the Indian market. The plant is expected to produce over 1,000 units annually, contributing to the company's market expansion.

- In 2023, ENGEL Machinery entered into a partnership with an Indian automotive manufacturer to supply advanced injection molding machines. This collaboration aims to enhance the automaker's production capabilities and meet the rising demand for high-precision automotive components. The partnership is expected to generate annual revenue of USD 50 million.

India Molding Machine Industry Analysis

India Molding Machine Market Growth Drivers:

- Electronics Manufacturing Surge: The electronics manufacturing sector in India is expanding due to increased consumer demand for electronic devices such as smartphones, laptops, and home appliances. In 2024, India's electronics manufacturing output is expected to surpass 300 million units, necessitating high-precision molding machines for producing intricate electronic components. The government's "Digital India" initiative and investments in semiconductor manufacturing are propelling this growth, creating substantial opportunities for the molding machine market.

- Packaging Industry Growth: The packaging industry in India is growing due to the rising demand for packaged goods in food and beverage, pharmaceuticals, and personal care sectors. In 2024, the packaging industry is projected to produce over 50 billion units, increasing the need for blow molding machines for creating plastic bottles and containers.

- Infrastructure Development Projects: The Indian government's focus on infrastructure development, including the construction of smart cities, industrial corridors, and residential complexes, is driving the demand for construction materials and components. In 2024, the construction sector is expected to generate over 200 million tons of building materials, necessitating the use of compression molding machines for producing durable and high-strength components

India Molding Machine Market Challenges:

- High Cost of Advanced Molding Machines: The high cost of advanced molding machines remains a significant challenge for small and medium-sized enterprises (SMEs) in India. In 2024, the average cost of a state-of-the-art molding machine is estimated to be around USD 200,000, making it difficult for SMEs to invest in such equipment. This financial barrier limits the adoption of advanced molding technologies, affecting production efficiency and competitiveness in the market.

- Skilled Labor Shortage: The shortage of skilled labor to operate and maintain advanced molding machines is a critical challenge for the industry. In 2024, it is estimated that the Indian manufacturing sector will face a shortage of 1 million skilled workers. This gap impacts the efficient utilization of molding machines, leading to increased downtime and reduced productivity. Efforts to bridge this skill gap through vocational training and education programs are essential to address this challenge.

India Molding Machine Market Government Initiatives:

- Make in India Program: The "Make in India" initiative continues to play a pivotal role in boosting the manufacturing sector, including the molding machine market. In 2024, the government allocated USD 1 billion towards the program to enhance local manufacturing capabilities and attract foreign investments. This funding aims to support the development of advanced manufacturing technologies and infrastructure, promoting the growth of the molding machine industry.

- Production-Linked Incentive (PLI) Scheme: The PLI scheme for the electronics and automotive sectors is driving demand for molding machines in India. In 2024, the government announced an incentive package of USD 500 million to encourage domestic manufacturing of electronic components and automotive parts. This initiative aims to reduce dependence on imports and foster the growth of local industries, creating significant opportunities for the molding machine market.

India Molding Machine Future Market Outlook

The India Molding Machine Market is projected to grow significantly by 2028, with a strong CAGR driven by continuous technological advancements, an expanding consumer goods market, and the growing influence of online retail channels.

Future Market Trends

- Adoption of Industry 4.0 Technologies: Over the next five years, the adoption of Industry 4.0 technologies, including IoT, AI, and robotics, will transform the molding machine industry in India. By 2028, it is estimated that over 70% of molding machine manufacturers will implement these advanced technologies to enhance production efficiency, reduce operational costs, and improve product quality. The integration of smart manufacturing solutions will drive significant improvements in the industry's competitiveness.

- Growth in Electric Vehicle Production: The growth in electric vehicle (EV) production will drive the demand for advanced molding machines used in manufacturing lightweight and high-precision components. By 2028, India's EV production is projected to reach 2 million units annually, necessitating the use of innovative molding technologies to produce components such as battery casings, charging ports, and lightweight panels. This trend will create substantial opportunities for the molding machine market.

Scope of the Report

|

By Product Type |

Injection Molding Machines Blow Molding Machines Compression Molding Machines |

|

By End-User |

Automotive Electronics Packaging Others |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Electronics Manufacturers

Packaging Companies

Medical Device Manufacturers

Construction Companies

Government Agencies

Industrial Machinery Distributors

Plastic Component Manufacturers

Raw Material Suppliers

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Haitian International Holdings Limited

ENGEL Machinery India Pvt. Ltd.

Milacron India Pvt. Ltd.

Toshiba Machine (India) Pvt. Ltd.

Windsor Machines Limited

KraussMaffei Group

Arburg GmbH + Co KG

Sumitomo (SHI) Demag Plastics Machinery GmbH

Nissei Plastic Industrial Co., Ltd.

Husky Injection Molding Systems Ltd.

UBE Machinery Corporation, Ltd.

JSW Plastics Machinery Inc.

Chen Hsong Holdings Limited

FANUC Corporation

Table of Contents

1. India Molding Machine Market Overview

1.1 India Molding Machine Market Taxonomy

2. India Molding Machine Market Size (in USD Mn), 2018-2023

3. India Molding Machine Market Analysis

3.1 India Molding Machine Market Growth Drivers

3.2 India Molding Machine Market Challenges and Issues

3.3 India Molding Machine Market Trends and Development

3.4 India Molding Machine Market Government Regulation

3.5 India Molding Machine Market SWOT Analysis

3.6 India Molding Machine Market Stake Ecosystem

3.7 India Molding Machine Market Competition Ecosystem

4. India Molding Machine Market Segmentation, 2023

4.1 India Molding Machine Market Segmentation by Product Type (in %), 2023

4.2 India Molding Machine Market Segmentation by End-User (in %), 2023

4.3 India Molding Machine Market Segmentation by Region (in %), 2023

5. India Molding Machine Market Competition Benchmarking

5.1 India Molding Machine Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Molding Machine Market Future Market Size (in USD Mn), 2023-2028

7. India Molding Machine Market Future Market Segmentation, 2028

7.1 India Molding Machine Market Segmentation by Product Type (in %), 2028

7.2 India Molding Machine Market Segmentation by End-User (in %), 2028

7.3 India Molding Machine Market Segmentation by Region (in %), 2028

8. India Molding Machine Market Analysts’ Recommendations

8.1 India Molding Machine Market TAM/SAM/SOM Analysis

8.2 India Molding Machine Market Customer Cohort Analysis

8.3 India Molding Machine Market Marketing Initiatives

8.4 India Molding Machine Market White Space Opportunity Analysis

Disclaimer

Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry level information.

Step 2: Market Building:

Collating statistics on India molding machine market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India molding machine market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach manufacturers companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from machine companies.

Frequently Asked Questions

01 How big is India Molding Machine Market?

In recent years, the India molding machine market has experienced substantial growth, this is reflected by the India injection molding machine market reached a valuation of USD 706 million in 2023. driven by increasing demand in various industries such as automotive, electronics, and packaging.

02 Who are the major players in the India Molding Machine Market?

Key players in the India molding machine market include Haitian International Holdings Limited, ENGEL Machinery India Pvt. Ltd., Milacron India Pvt. Ltd., Toshiba Machine (India) Pvt. Ltd., and Windsor Machines Limited. These companies lead the market due to their innovative products, extensive distribution networks, and strong market presence.

03 What are the growth drivers of the India Molding Machine Market?

The India molding machine market is driven by the robust growth in the automotive and electronics industries, the expanding packaging sector, and significant infrastructure development projects. Government initiatives supporting local manufacturing also contribute to market growth.

04 What are the challenges in the India Molding Machine Market?

Challenges in the India molding machine market include the high cost of advanced molding machines, a shortage of skilled labor, supply chain disruptions, and stringent environmental regulations. These factors impact the adoption of advanced technologies and overall market efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.