India Motorbike Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD3467

December 2024

92

About the Report

India Motorbike Market Overview

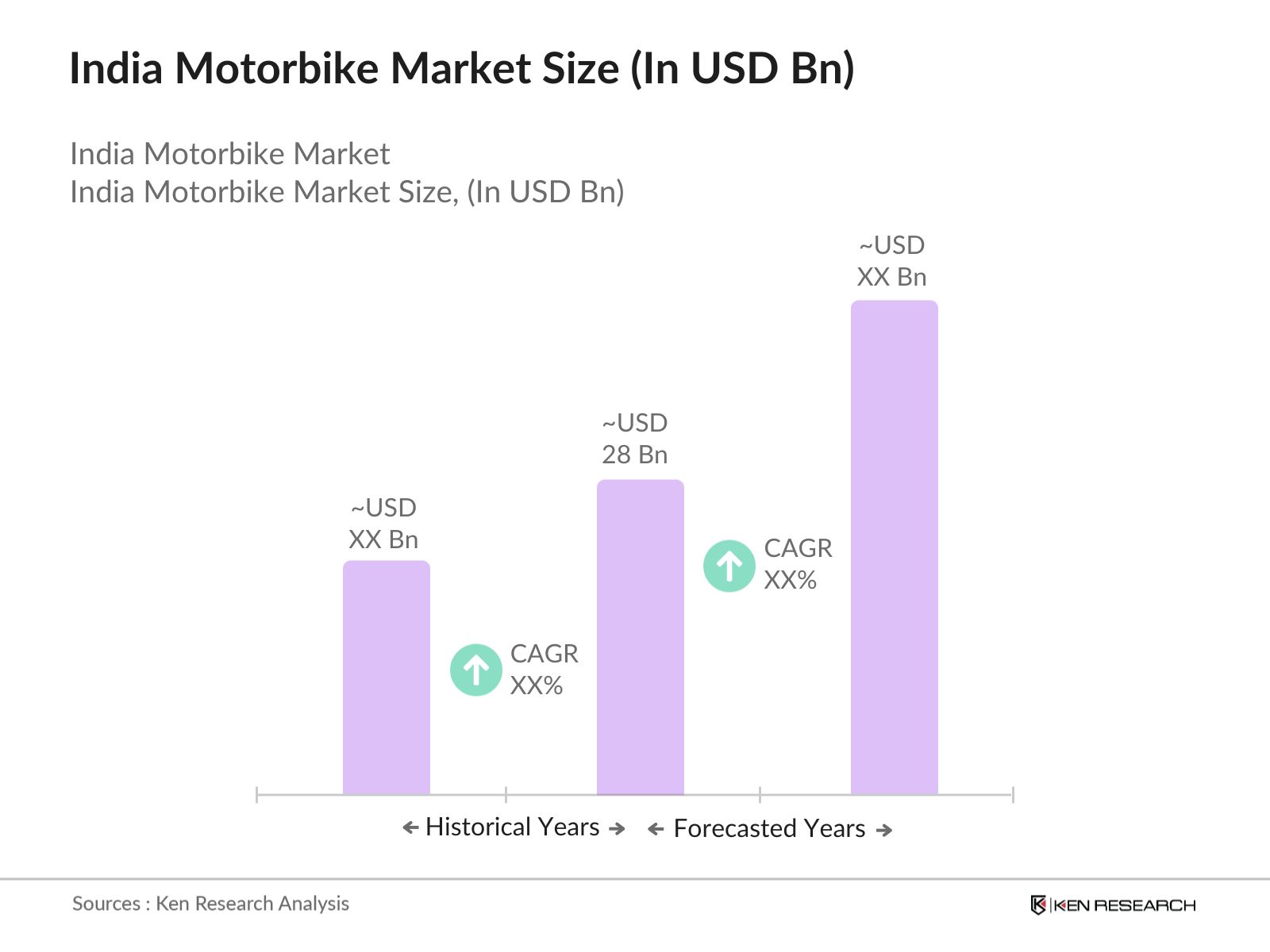

- The India motorbike market is valued at USD 28 billion, driven by rising demand for affordable mobility, especially in urban and semi-urban regions. Increasing disposable incomes, coupled with the expansion of motorbike financing options, are contributing significantly to market growth. The introduction of advanced motorbike models and a surge in sales of premium bikes have also fueled the market. This growth is supported by the government's focus on rural connectivity and transport infrastructure development, which has further spurred motorbike adoption across the country.

- Cities like Delhi, Mumbai, and Bangalore dominate the motorbike market due to their dense urban populations and high demand for efficient commuting options. These cities have a well-established road infrastructure, and their residents typically have higher purchasing power, contributing to a surge in both commuter and premium bike sales. Additionally, the growing popularity of motorbike enthusiasts in these regions has led to an increase in sales of high-end models, further boosting the market share of these cities.

- India's import and export regulations for motorbikes have been streamlined to encourage domestic manufacturing under the "Make in India" initiative. In 2023, the government reduced import duties on key components required for electric motorbike manufacturing while promoting the export of Indian-made motorbikes to markets in Africa and Southeast Asia. This regulatory framework supports the growth of Indias motorbike manufacturing sector.

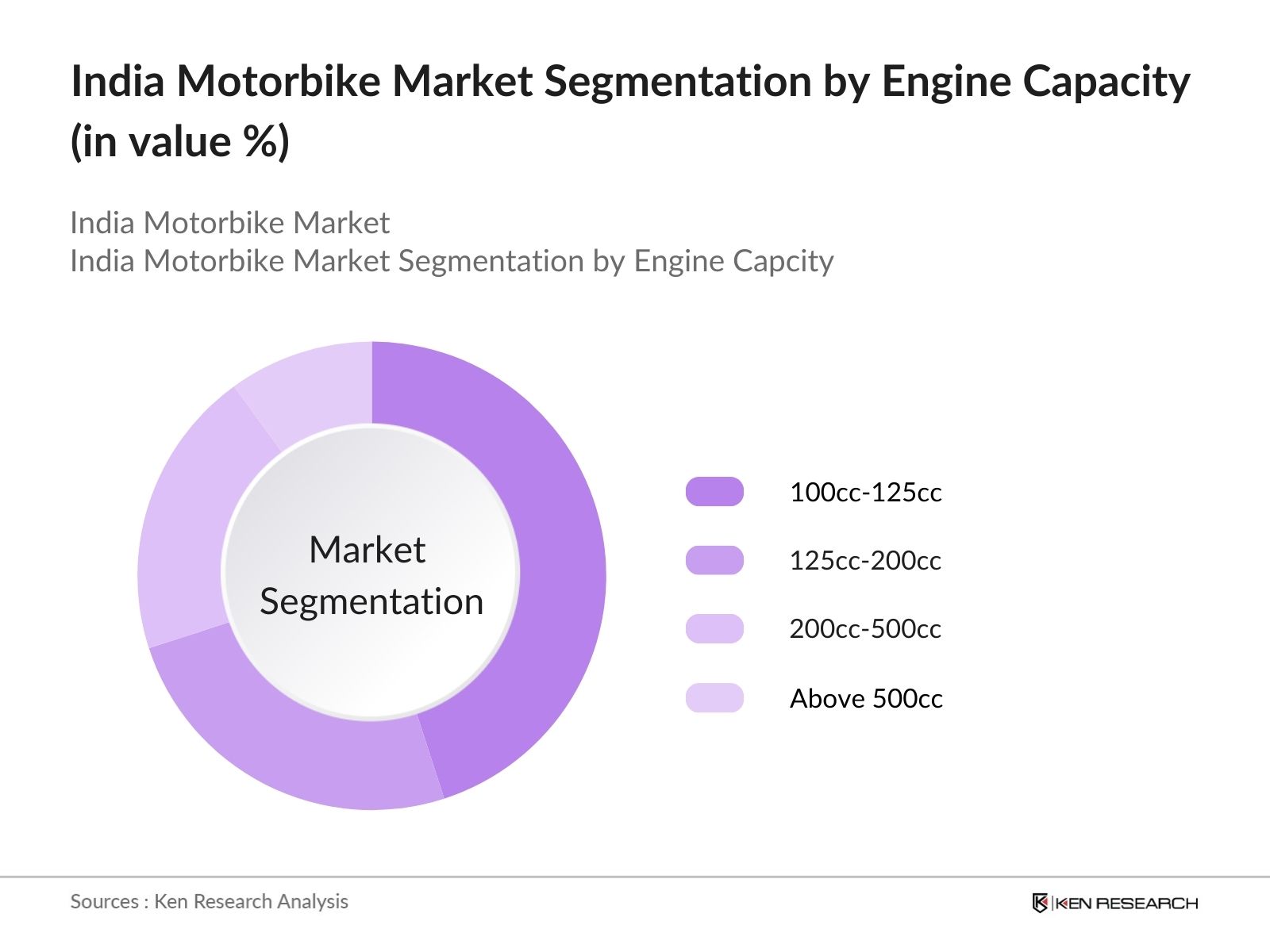

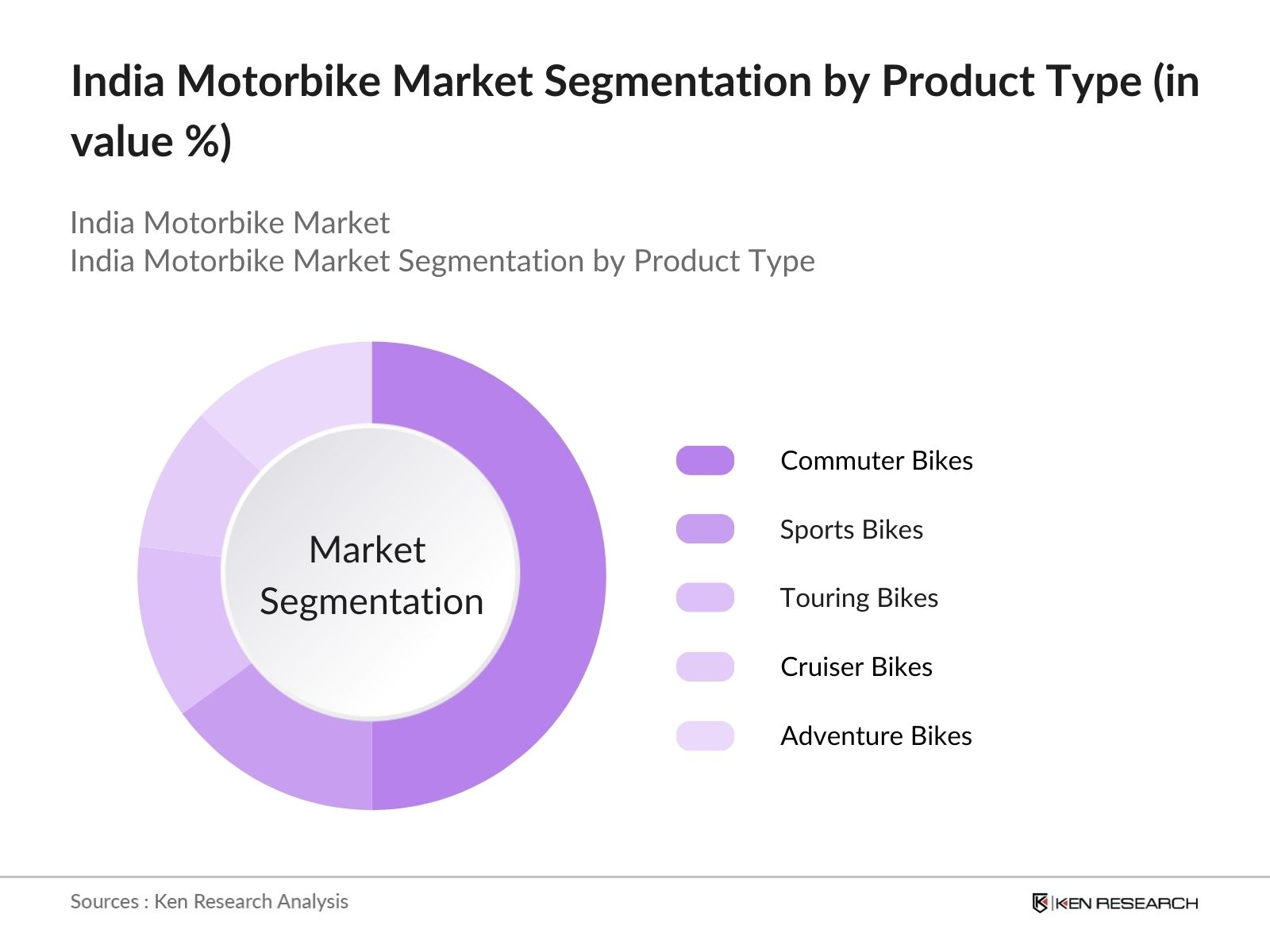

India Motorbike Market Segmentation

By Engine Capacity: The India motorbike market is segmented by engine capacity into 100cc-125cc, 125cc-200cc, 200cc-500cc, and above 500cc. The 100cc-125cc segment holds a dominant position in the market, driven by its widespread use among daily commuters. These motorbikes offer an ideal balance between fuel efficiency and cost-effectiveness, making them highly popular among middle-income consumers. Brands like Hero MotoCorp and Honda dominate this segment, owing to their affordable and reliable products. The growing need for economical transportation in rural and semi-urban areas further strengthens the dominance of this segment.

By Product Type: The India motorbike market is also segmented by product type into commuter bikes, sports bikes, touring bikes, cruiser bikes, and adventure bikes. Commuter bikes dominate this segmentation, accounting for the highest market share. Their dominance is attributed to their affordability, durability, and fuel efficiency, which cater to the mass market's demand for cost-effective daily transportation.

India Motorbike Market Competitive Landscape

The India motorbike market is dominated by a combination of local manufacturers and international players. Leading companies such as Hero MotoCorp, Bajaj Auto, and TVS Motor Company have solidified their market position through strong brand loyalty and extensive distribution networks. Additionally, international players like Honda and Yamaha have a significant presence due to their high-quality products and innovation.

|

Company Name |

Establishment Year |

Headquarters |

Market Share |

R&D Investments |

Distribution Network |

Product Portfolio |

Electric Bike Offerings |

Customer Base |

|---|---|---|---|---|---|---|---|---|

|

Hero MotoCorp |

1984 |

New Delhi, India |

- | - | - | - | - | - |

|

Bajaj Auto |

1945 |

Pune, India |

- | - | - | - | - | - |

|

TVS Motor Company |

1978 |

Chennai, India |

- | - | - | - | - | - |

|

Honda Motorcycle & Scooter India |

1999 |

Gurgaon, India |

- | - | - | - | - | - |

|

Yamaha Motor India |

1955 |

Surajpur, India |

- | - | - | - | - | - |

India Motorbike Market Analysis

Growth Drivers

- Rising Urbanization and Income Levels: India's rapid urbanization is directly influencing the growth of the motorbike market. By 2022, approximately 35% of the Indian population lived in urban areas, and this number is expected to rise due to increasing migration from rural regions. Additionally, per capita income in India has risen steadily, reaching INR 1.72 lakh ($2,084) in 2023, significantly enhancing consumers' purchasing power, especially for two-wheelers. As urban mobility becomes more constrained due to traffic congestion, motorbikes offer a flexible solution for commuting in cities.

- Increased Demand for Affordable Mobility Solutions: India has witnessed a rise in demand for affordable transportation, especially in tier 2 and tier 3 cities, where public transportation is limited. In 2023, two-wheelers, particularly motorbikes priced below INR 1 lakh, accounted for the majority of vehicle registrations, with more than 17 million two-wheelers sold across the country. The availability of affordable financing and payment options has further boosted the adoption of motorbikes as a primary means of transportation.

- Expanding Middle-Class Segment: Indian middle class was estimated to be around 432 million in 2020-21, representing approximately 31% of the population. This burgeoning middle-class segment is driving the demand for motorbikes as a preferred mobility solution. With aspirations for better mobility and increasing disposable incomes, middle-class consumers are contributing to the growth of the motorbike industry. Additionally, this segments preference for branded, fuel-efficient, and stylish motorbikes further stimulates market growth.

Market Challenges

- Regulatory Emission Norms: The enforcement of Bharat Stage (BS) emission standards has been a significant challenge for the motorbike industry. With BS-VI norms in place since 2020, motorbike manufacturers have had to invest heavily in research and development to comply with stricter emission regulations. The implementation of these norms has led to increased production costs, which in turn raises the final price of motorbikes. The shift from BS-IV to BS-VI affected nearly 80% of the two-wheeler models on the market.

- Volatility in Raw Material Prices: Fluctuations in the prices of raw materials, especially steel, aluminum, and rubber, have caused disruptions in the motorbike manufacturing sector. The price of hot rolled coils (HRC) has fallen from a peak of USD 915.6 per ton in April 2022 to around USD 614 per ton, directly impacting production costs. This volatility creates challenges for manufacturers who rely on stable input costs to maintain competitive pricing in a market driven by affordability.

India Motorbike Future Market Outlook

The India motorbike market is expected to experience substantial growth over the next five years, driven by continuous government incentives for electric mobility, increased urbanization, and the growing demand for affordable transportation solutions. The expansion of motorbike financing options and the emergence of connected technologies in motorbikes are expected to further drive market demand. Additionally, the shift towards environmentally sustainable transport solutions will accelerate the adoption of electric motorbikes, particularly in urban centers, positioning India as a growing market for electric vehicles.

Market Opportunities

- Surge in Electric Motorbike Demand: In 2023, there was a reported34% year-on-year growth, leading to a total of849,000 electric two-wheelers registered. Government incentives, such as the FAME II subsidy have made electric motorbikes more affordable for consumers. Additionally, the expansion of EV charging infrastructure and rising fuel prices have made electric motorbikes a cost-effective alternative to traditional models.

- Expansion into Rural Markets: Rural India represents a significant untapped market for motorbike manufacturers, with over 900 million people living in rural areas. In 2023, rural regions accounted for 55% of total motorbike sales, driven by increasing connectivity, rising incomes, and government schemes aimed at improving rural infrastructure. The demand for reliable and affordable mobility solutions in rural areas offers significant growth opportunities for motorbike manufacturers.

Scope of the Report

|

By Engine Capacity |

100cc-125cc 125cc-200cc 200cc-500cc Above 500cc |

|

By Product Type |

Commuter Bikes Sports Bikes Touring Bikes Cruiser Bikes Adventure Bikes |

|

By Fuel Type |

Petrol Electric Hybrid |

|

By Application |

Personal Commuting Commercial Use Recreational |

|

By Region |

North India South India East India West India |

Products

Key Target Audience

Motorbike Manufacturers

Electric Vehicle Startups

Spare Parts Manufacturers

Oil and Lubricant Companies

Fleet Management Companies

Auto Finance Companies

Investments and Venture Capital Firms

Government and Regulatory Bodies (Ministry of Road Transport & Highways, NITI Aayog)

Companies

Major Players in the India Motorbike Market

Hero MotoCorp

Bajaj Auto

TVS Motor Company

Honda Motorcycle & Scooter India

Yamaha Motor India

Suzuki Motorcycle India

Royal Enfield

KTM India

Jawa Motorcycles

Harley-Davidson India

Triumph Motorcycles India

BMW Motorrad India

Kawasaki Motors India

Ducati India

Mahindra Two Wheelers

Table of Contents

1. India Motorbike Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Motorbike Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Motorbike Market Analysis

3.1 Growth Drivers

3.1.1 Rising Urbanization and Income Levels

3.1.2 Increased Demand for Affordable Mobility Solutions

3.1.3 Expanding Middle-Class Segment

3.1.4 Growth in Motorcycle Financing

3.2 Market Challenges

3.2.1 Regulatory Emission Norms

3.2.2 Volatility in Raw Material Prices

3.2.3 High Competition from Electric Vehicles

3.2.4 High Cost of Advanced Motorbike Models

3.3 Opportunities

3.3.1 Surge in Electric Motorbike Demand

3.3.2 Expansion into Rural Markets

3.3.3 Product Customization and Lifestyle Biking

3.3.4 Rising Popularity of Premium Motorbikes

3.4 Trends

3.4.1 Shift Towards Electric Mobility

3.4.2 Introduction of Connected Motorbike Technology

3.4.3 Increasing Focus on Safety Features

3.4.4 Rise of Online and Digital Sales Channels

3.5 Government Regulation

3.5.1 Bharat Stage (BS) Emission Standards

3.5.2 EV Incentives Under FAME II Scheme

3.5.3 Road Safety and Helmet Mandates

3.5.4 Import and Export Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. India Motorbike Market Segmentation

4.1 By Engine Capacity (In Value %)

4.1.1 100cc-125cc

4.1.2 125cc-200cc

4.1.3 200cc-500cc

4.1.4 Above 500cc

4.2 By Product Type (In Value %)

4.2.1 Commuter Bikes

4.2.2 Sports Bikes

4.2.3 Touring Bikes

4.2.4 Cruiser Bikes

4.2.5 Adventure Bikes

4.3 By Fuel Type (In Value %)

4.3.1 Petrol

4.3.2 Electric

4.3.3 Hybrid

4.4 By Application (In Value %)

4.4.1 Personal Commuting

4.4.2 Commercial Use (Delivery, Ride-hailing, etc.)

4.4.3 Recreational

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

5. India Motorbike Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Hero MotoCorp

5.1.2 Bajaj Auto

5.1.3 TVS Motor Company

5.1.4 Royal Enfield

5.1.5 Honda Motorcycle & Scooter India

5.1.6 Suzuki Motorcycle India

5.1.7 Yamaha Motor India

5.1.8 KTM India

5.1.9 Jawa Motorcycles

5.1.10 Harley-Davidson India

5.1.11 Triumph Motorcycles India

5.1.12 BMW Motorrad India

5.1.13 Kawasaki Motors India

5.1.14 Ducati India

5.1.15 Mahindra Two Wheelers

5.2 Cross Comparison Parameters (Market Share, Revenue, Product Range, Distribution Network, Strategic Initiatives, R&D Investments, Sustainability Initiatives, Customer Base)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. India Motorbike Market Regulatory Framework

6.1 Emission Standards Compliance

6.2 Safety Regulations

6.3 Certification Processes

6.4 Import and Export Regulations

7. India Motorbike Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Motorbike Market Future Segmentation

8.1 By Engine Capacity

8.2 By Product Type

8.3 By Fuel Type

8.4 By Application

8.5 By Region

9. India Motorbike Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the entire motorbike ecosystem in India. Comprehensive desk research and proprietary databases were utilized to identify critical variables affecting the market, including motorbike manufacturing, distribution networks, and regulatory factors.

Step 2: Market Analysis and Construction

In this phase, historical data on market growth, revenue generation, and production volumes was analyzed. Market penetration and service statistics were compiled to estimate the market's current size and trends.

Step 3: Hypothesis Validation and Expert Consultation

To validate market data, consultations were conducted with industry experts, including senior executives from leading motorbike companies. These discussions provided valuable insights into market performance, competition, and future growth areas.

Step 4: Research Synthesis and Final Output

The final synthesis involved collecting data from major market players and compiling a comprehensive report. Bottom-up analysis was employed to ensure accuracy, and findings were validated through further interactions with motorbike manufacturers and industry analysts.

Frequently Asked Questions

01. How big is the India Motorbike Market?

The India motorbike market is valued at USD 28 billion, driven by rising demand for affordable transportation options, especially in urban and semi-urban regions.

02. What are the challenges in the India Motorbike Market?

Challenges include strict emission regulations, rising raw material costs, and competition from electric vehicles. Additionally, volatility in fuel prices affects the market's overall profitability.

03. Who are the major players in the India Motorbike Market?

Key players in the market include Hero MotoCorp, Bajaj Auto, TVS Motor Company, Honda Motorcycle & Scooter India, and Yamaha Motor India, which dominate due to their strong brand presence and extensive product portfolios.

04. What are the growth drivers of the India Motorbike Market?

Growth drivers include increasing urbanization, rising disposable incomes, expanding middle-class demand for affordable transport, and the introduction of premium motorbike models.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.