India MRI Equipment Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD5219

December 2024

91

About the Report

India MRI Equipment Market Overview

- The India MRI equipment market is valued at USD 300 million, primarily driven by the growing healthcare sector, technological advancements, and increasing demand for accurate diagnostic solutions. The market shows consistent growth due to the rising prevalence of chronic illnesses and the government's emphasis on enhancing healthcare infrastructure. Key factors such as an increasing elderly population and advancements in MRI technology, including AI integration and higher field strengths, contribute to the market's steady expansion, positioning India as a significant player in diagnostic imaging within Asia.

- Major demand centers for MRI equipment in India include metropolitan areas like Mumbai, Delhi, and Bangalore. These cities dominate due to their advanced healthcare infrastructure, high concentration of diagnostic centers, and increased healthcare awareness among the urban population. Additionally, states with growing urbanization and healthcare investment, like Tamil Nadu and Maharashtra, are also gaining prominence, backed by strong support for healthcare infrastructure and accessibility to advanced medical technologies.

- The Central Drugs Standard Control Organization (CDSCO) mandates that MRI equipment in India meet stringent regulatory standards for safety and quality. As of 2023, over 85% of MRI machines installed in hospitals had been certified compliant by CDSCO, ensuring adherence to health and safety regulations. These standards encourage high-quality imaging services, boosting market reliability and adoption.

India MRI Equipment Market Segmentation

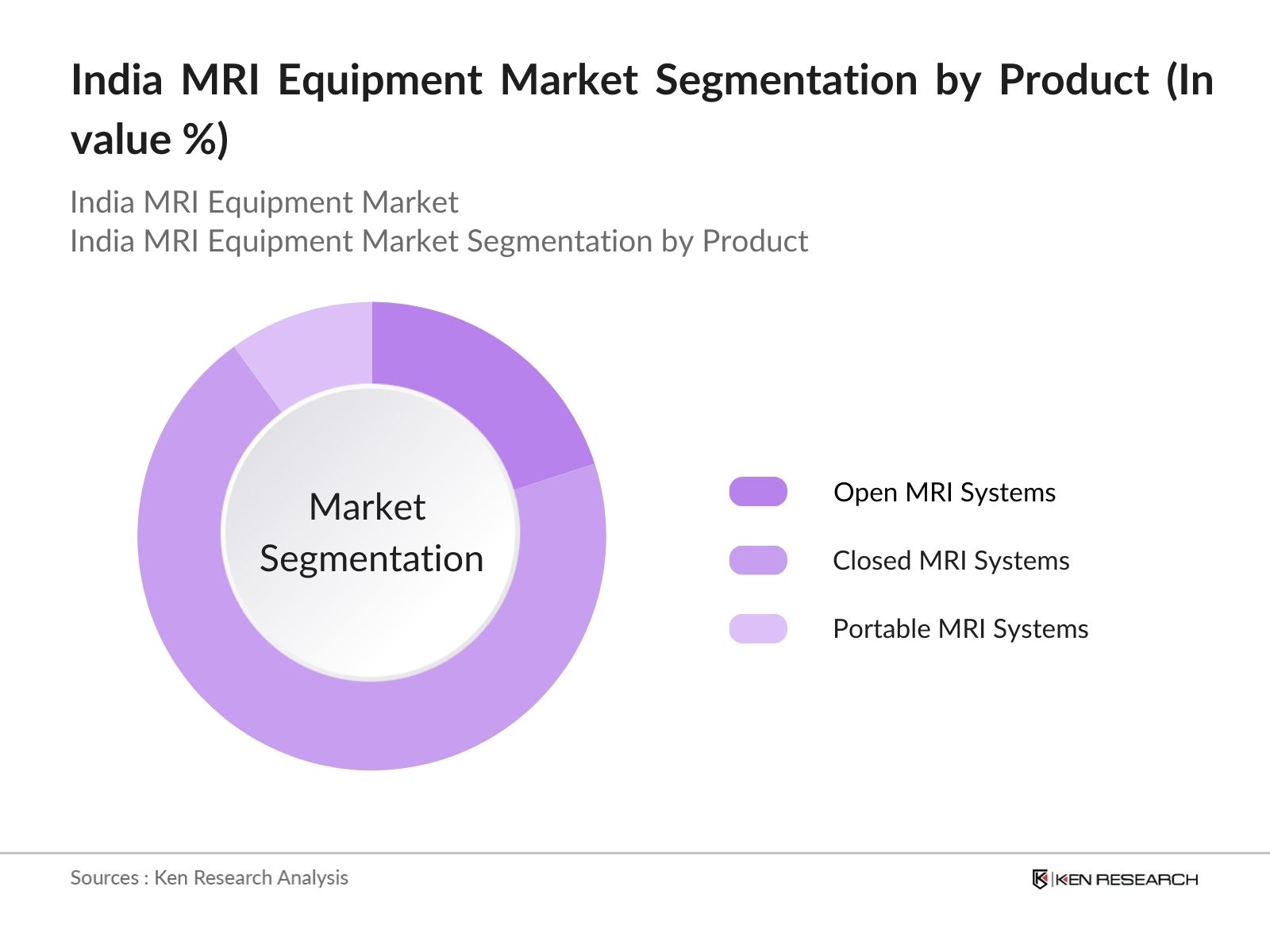

- By Product Type: The market is segmented by product type into open MRI systems, closed MRI systems, and portable MRI systems. Recently, closed MRI systems hold a dominant market share within this segmentation. This trend is attributed to their superior image quality and higher diagnostic accuracy, especially for complex medical conditions. Closed MRI systems, typically operating at higher field strengths, are preferred for their detailed imaging capabilities, making them the primary choice for hospitals and diagnostic centers.

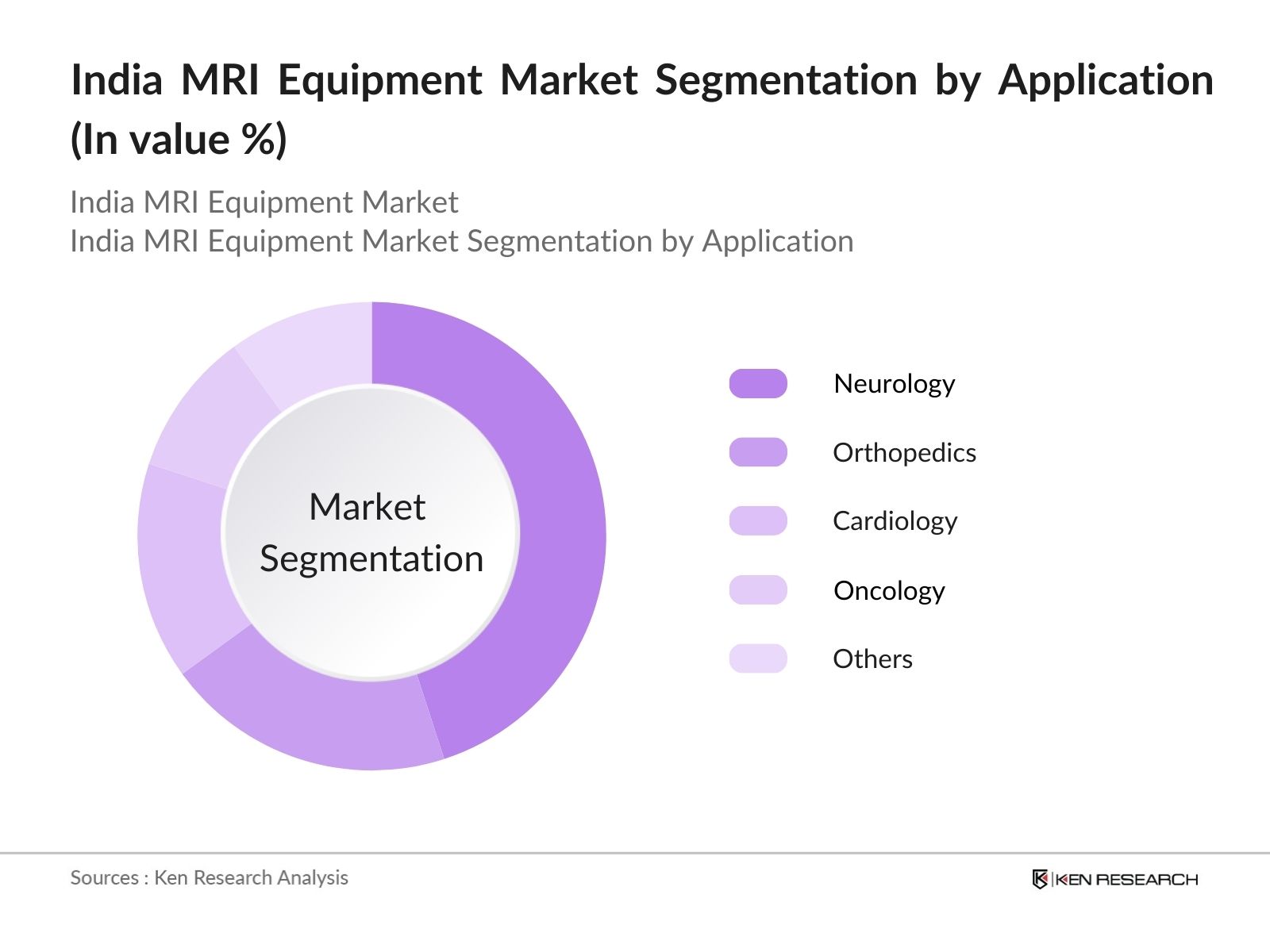

- By Application: The market is segmented by application into neurology, orthopedics, cardiology, oncology, and others (such as pediatric and abdominal imaging). Neurology leads in terms of market share under this segmentation, as MRI is crucial for diagnosing neurological disorders like brain tumors, strokes, and multiple sclerosis. With the rise in neurological cases, the demand for high-resolution MRI scans in neurology has surged, making this application segment highly dominant in the market.

India MRI Equipment Market Competitive Landscape

The India MRI equipment market is dominated by several key players, including prominent domestic and international manufacturers. These companies leverage technological advancements, extensive distribution networks, and strong after-sales support to maintain their competitive positions.

India MRI Equipment Market Analysis

Growth Drivers

- Increasing Healthcare Expenditure: Indias healthcare expenditure has been rising, with government spending reaching INR 86,175 crore in 2023, a significant increase from INR 76,000 crore in 2022, as reported by the Ministry of Health and Family Welfare. This increased expenditure is directed toward enhancing medical infrastructure, including MRI equipment. The Indian governments focus on strengthening healthcare accessibility is notable, with recent allocations aimed at setting up diagnostic facilities across Tier II and Tier III cities. These improvements are fostering a favorable environment for the MRI equipment market to grow within the healthcare ecosystem.

- Advancements in MRI Technology: Technological advancements in MRI have led to improved imaging capabilities, with new models offering higher resolution and faster scanning times. In 2024, Indian hospitals and diagnostic centers began incorporating 3T MRI machines, which are capable of providing detailed imaging for more accurate diagnosis. These machines are being widely adopted in major hospitals, supported by the governments push for healthcare modernization, contributing to the increase in MRI equipment installations.

- Rising Prevalence of Chronic Diseases: India has witnessed a surge in chronic diseases, with over 75 million individuals diagnosed with diabetes and over 50 million affected by cardiovascular diseases in 2023, according to the Indian Council of Medical Research (ICMR). This growing prevalence has escalated the demand for diagnostic imaging, particularly MRI, as it plays a vital role in detecting complex health issues. Increased chronic disease incidence is driving MRI equipment demand, as more healthcare providers are investing in advanced diagnostic solutions to address patient needs.

Challenges

- High Installation and Operational Costs: The installation of MRI machines in India is a significant investment, varying widely based on the technology and features offered. This high upfront cost presents a substantial challenge for smaller diagnostic centers and hospitals, particularly in rural and underserved regions. Limited subsidy options for expensive medical equipment further restrict the affordability and accessibility of MRI technology, posing a significant barrier to market expansion.

- Limited Skilled Workforce: The availability of qualified radiologists and technicians in India is insufficient to meet the growing demand for advanced medical imaging services. This shortage impacts the effective utilization of MRI technology, particularly in rural and remote areas where skilled operators are scarce. The gap in trained professionals limits operational efficiency, restricting the broader adoption and accessibility of MRI services.

India MRI Equipment Market Future Outlook

The India MRI equipment market is poised for robust growth, supported by rising healthcare awareness, technological advancements, and favorable government policies aimed at improving healthcare access. The market is expected to benefit from the adoption of portable MRI systems, especially in remote areas, and AI-enhanced imaging capabilities, which enable more accurate diagnoses and efficient workflows. Furthermore, ongoing investments in healthcare infrastructure will likely drive increased adoption of MRI equipment across hospitals and diagnostic centers in the coming years.

Future Market Opportunities

- Government Initiatives for Healthcare Infrastructure: The Indian government has launched initiatives, including the Ayushman Bharat Digital Mission, which received INR 3757 crore in funding in 2024 to support healthcare infrastructure expansion. This initiative aims to create a unified digital health infrastructure, indirectly promoting the adoption of MRI technology by providing financial and logistical support to diagnostic centers. Such government efforts increase the demand for MRI equipment as part of overall healthcare modernization.

- Expanding Private Hospital Chains: India has witnessed an expansion in private hospital chains, with over 100 new branches established in 2023. This growth enhances the demand for MRI equipment as private hospitals seek to offer comprehensive diagnostic services to attract patients. Prominent healthcare groups like Apollo and Max Healthcare are investing in advanced MRI technology to differentiate their services, thus driving equipment demand within the private sector.

Scope of the Report

|

By Product Type |

Open MRI Systems |

|

By Field Strength |

Low Field Strength (Below 1.5T) |

|

By Application |

Neurology |

|

By End-User |

Hospitals |

|

By Region |

North |

Products

Key Target Audience

Hospitals and Diagnostic Centers

Government and Regulatory Bodies (Ministry of Health and Family Welfare)

Medical Device Distributors

Private Healthcare Facilities

Research and Academic Institutes

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Healthcare Service Providers

Companies

Players Mentioned in the Report

GE Healthcare

Siemens Healthineers

Philips Healthcare

Canon Medical Systems

Fujifilm Holdings

Hitachi Medical Corporation

Esaote SpA

Toshiba Medical Systems

Mindray Medical International

Allengers Medical Systems

Carestream Health

United Imaging Healthcare

Agfa-Gevaert Group

Hologic Inc.

Shimadzu Corporation

Table of Contents

1. India MRI Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India MRI Equipment Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India MRI Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Healthcare Expenditure

3.1.2. Rising Prevalence of Chronic Diseases

3.1.3. Technological Advancements in MRI Technology

3.1.4. Expanding Diagnostic Imaging Services

3.2. Market Challenges

3.2.1. High Installation Costs

3.2.2. Limited Skilled Workforce

3.2.3. Maintenance and Operational Costs

3.3. Opportunities

3.3.1. Government Initiatives for Healthcare Infrastructure

3.3.2. Expanding Private Hospital Chains

3.3.3. Integration of AI and Machine Learning in MRI

3.4. Trends

3.4.1. Adoption of Portable and Compact MRI Systems

3.4.2. Use of MRI for Oncology Applications

3.4.3. Growth of 3T MRI Equipment in India

3.5. Government Regulations

3.5.1. Medical Device Regulatory Compliance (CDSCO)

3.5.2. Imaging Protocol Standards

3.5.3. Healthcare Safety and Licensing Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India MRI Equipment Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Open MRI Systems

4.1.2. Closed MRI Systems

4.1.3. Portable MRI Systems

4.2. By Field Strength (In Value %)

4.2.1. Low Field Strength (Below 1.5T)

4.2.2. Mid Field Strength (1.5T)

4.2.3. High Field Strength (3T and Above)

4.3. By Application (In Value %)

4.3.1. Neurology

4.3.2. Orthopedics

4.3.3. Cardiology

4.3.4. Oncology

4.3.5. Others (Abdominal, Pediatric)

4.4. By End-User (In Value %)

4.4.1. Hospitals

4.4.2. Diagnostic Imaging Centers

4.4.3. Research Institutions

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India MRI Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. GE Healthcare

5.1.2. Siemens Healthineers

5.1.3. Philips Healthcare

5.1.4. Canon Medical Systems

5.1.5. Fujifilm Holdings

5.1.6. Hitachi Medical Corporation

5.1.7. Esaote SpA

5.1.8. Toshiba Medical Systems

5.1.9. Mindray Medical International

5.1.10. Allengers Medical Systems

5.1.11. Carestream Health

5.1.12. United Imaging Healthcare

5.1.13. Agfa-Gevaert Group

5.1.14. Hologic Inc.

5.1.15. Shimadzu Corporation

5.2. Cross Comparison Parameters (Market Share %, Revenue, Market Penetration, Product Portfolio, Geographical Presence, R&D Investment, Technology Upgradation, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India MRI Equipment Market Regulatory Framework

6.1. Compliance with CDSCO and Medical Device Rules

6.2. Import Licensing and Standards

6.3. Safety Standards for MRI Equipment

6.4. Approval and Certification Process

7. India MRI Equipment Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India MRI Equipment Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Field Strength (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India MRI Equipment Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Entry Strategies

9.3. Customer Cohort Analysis

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves a comprehensive analysis of the India MRI Equipment Market ecosystem. This includes identifying major stakeholders such as healthcare providers, device manufacturers, and regulatory bodies. Secondary research and proprietary databases are utilized to establish the critical variables impacting market dynamics.

Step 2: Market Analysis and Construction

In this step, we gather and assess historical data related to the India MRI Equipment Market. Key parameters like market penetration, diagnostic service expansion, and revenue generation are analyzed to ensure a robust understanding of the market.

Step 3: Hypothesis Validation and Expert Consultation

Developed hypotheses are validated through telephonic interviews with industry experts from diverse MRI equipment companies. This process yields essential insights into market trends, competitive dynamics, and operational practices, enhancing the accuracy of the data.

Step 4: Research Synthesis and Final Output

The final step involves direct engagement with MRI equipment manufacturers and distributors to gain insights into product segmentation, consumer preferences, and sales trends. This information complements bottom-up estimates, ensuring a thorough, validated analysis of the India MRI Equipment Market.

Frequently Asked Questions

01 How big is the India MRI Equipment Market?

The India MRI Equipment Market is valued at USD 300 million, supported by factors such as technological advancements, increased healthcare spending, and infrastructure improvements.

02 What are the challenges in the India MRI Equipment Market?

Key challenges in the India MRI Equipment Market include high initial investment costs, maintenance and operational expenses, and a limited skilled workforce trained in MRI technology.

03 Who are the major players in the India MRI Equipment Market?

Major players in the India MRI Equipment Market include GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, and Allengers Medical Systems.

04 What are the growth drivers of the India MRI Equipment Market?

The India MRI Equipment Market is driven by rising healthcare expenditure, government support for healthcare infrastructure, and the adoption of advanced MRI technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.