India Music Streaming Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD4481

December 2024

83

About the Report

India Music Streaming Market Overview

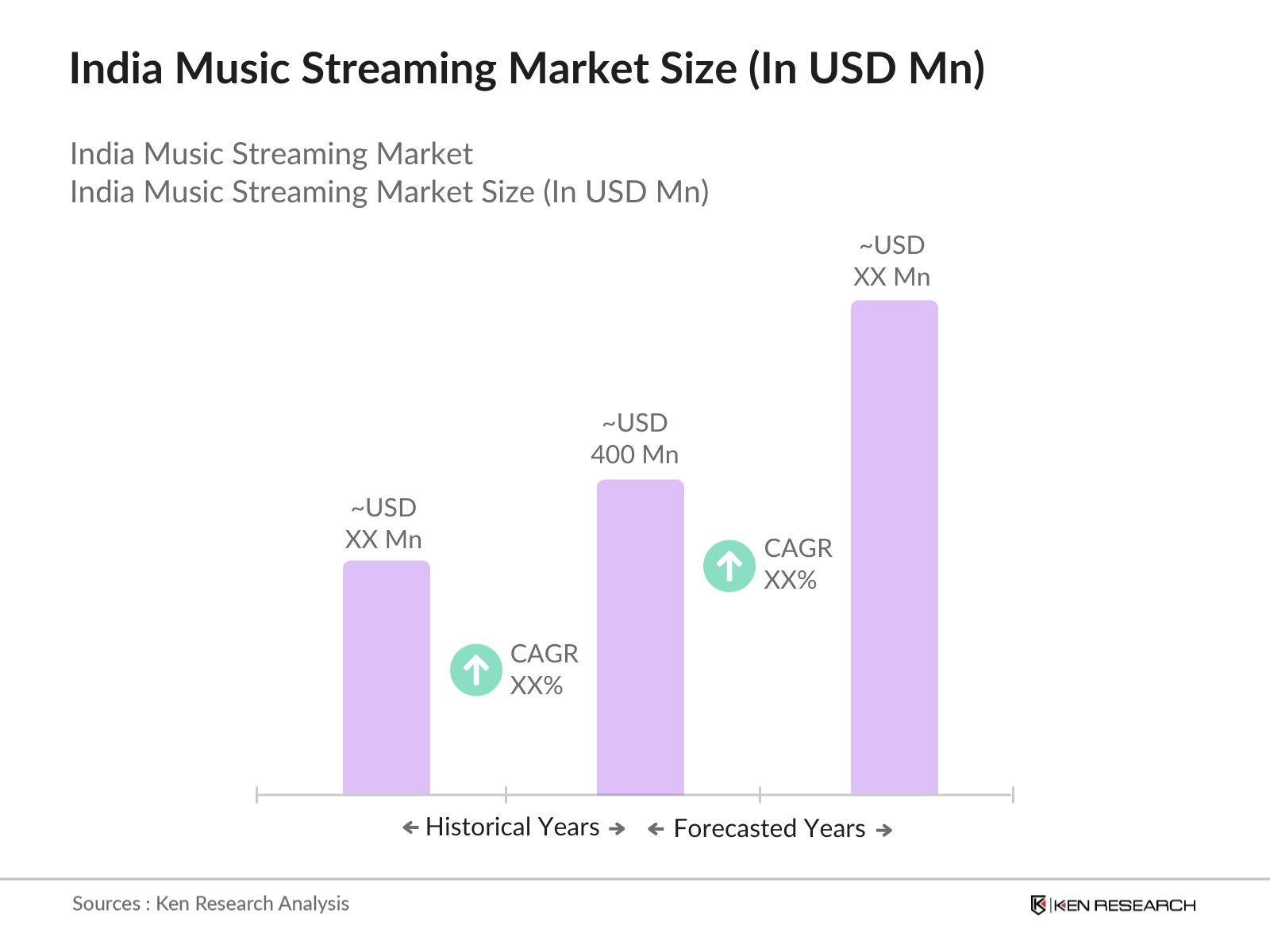

- The India music streaming market is experiencing rapid growth, reaching a market size of USD 400 Mn, driven by increasing internet penetration, rising smartphone usage, and growing demand for digital entertainment. As of 2023, more than 692 million Indians have access to the internet, and the number of smartphone users has crossed 750 million, which has significantly contributed to the rise in music streaming. The digital shift is further accelerated by low-cost data plans and increasing availability of regional content on streaming platforms, making music accessible to a larger audience.

- Major cities such as Mumbai, Delhi, and Bangalore are the leading contributors to the growth of music streaming due to their high internet penetration rates, tech-savvy populations, and preference for digital media consumption. Additionally, the growth of music streaming in Tier-2 and Tier-3 cities is noteworthy, with regional language content driving adoption in these areas. This shift is enabling platforms to tap into previously underserved regions, expanding their user base.

- Indias Copyright Act of 1957 governs the copyright and royalty distribution for music content. The Indian Performing Rights Society (IPRS) oversees the collection and distribution of royalties to artists, composers, and music publishers. In 2023, IPRS collected over $40 million in royalties, ensuring fair compensation for creators in the music streaming industry. The government has also implemented stricter enforcement measures to combat piracy and copyright infringement, ensuring that streaming platforms adhere to copyright laws and protect intellectual property rights

India Music Streaming Market Segmentation

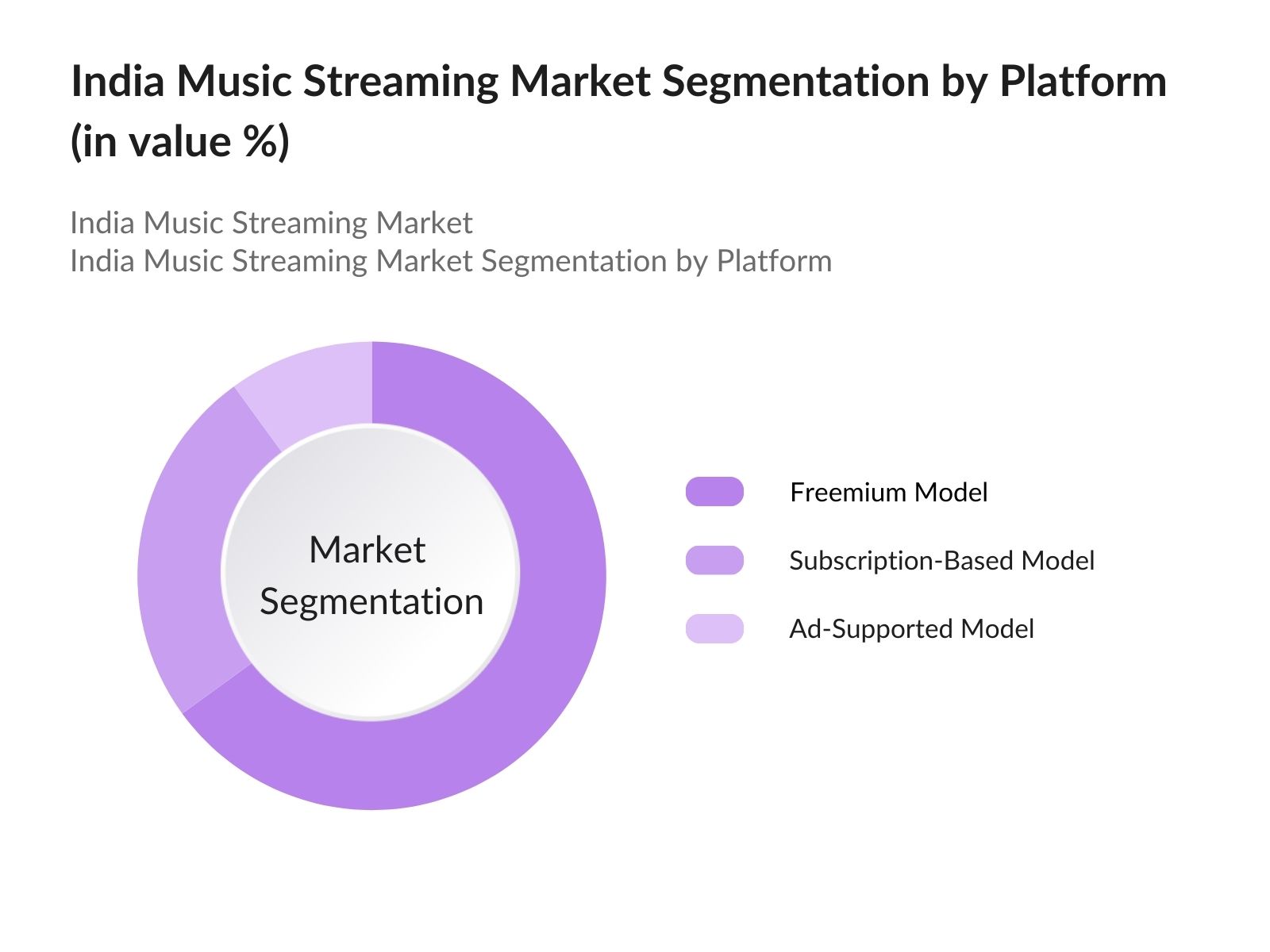

- By Platform: The market is segmented by platform type into freemium models, subscription-based models, and ad-supported models. The freemium model dominates the market due to its accessibility to a larger audience who can access content without upfront payments. However, subscription-based models are gaining traction, particularly in urban areas, as users seek ad-free experiences, high-quality audio, and exclusive content. Platforms like Spotify, Apple Music, and YouTube Music are leading in this segment by offering personalized recommendations and curated playlists to enhance user engagement.

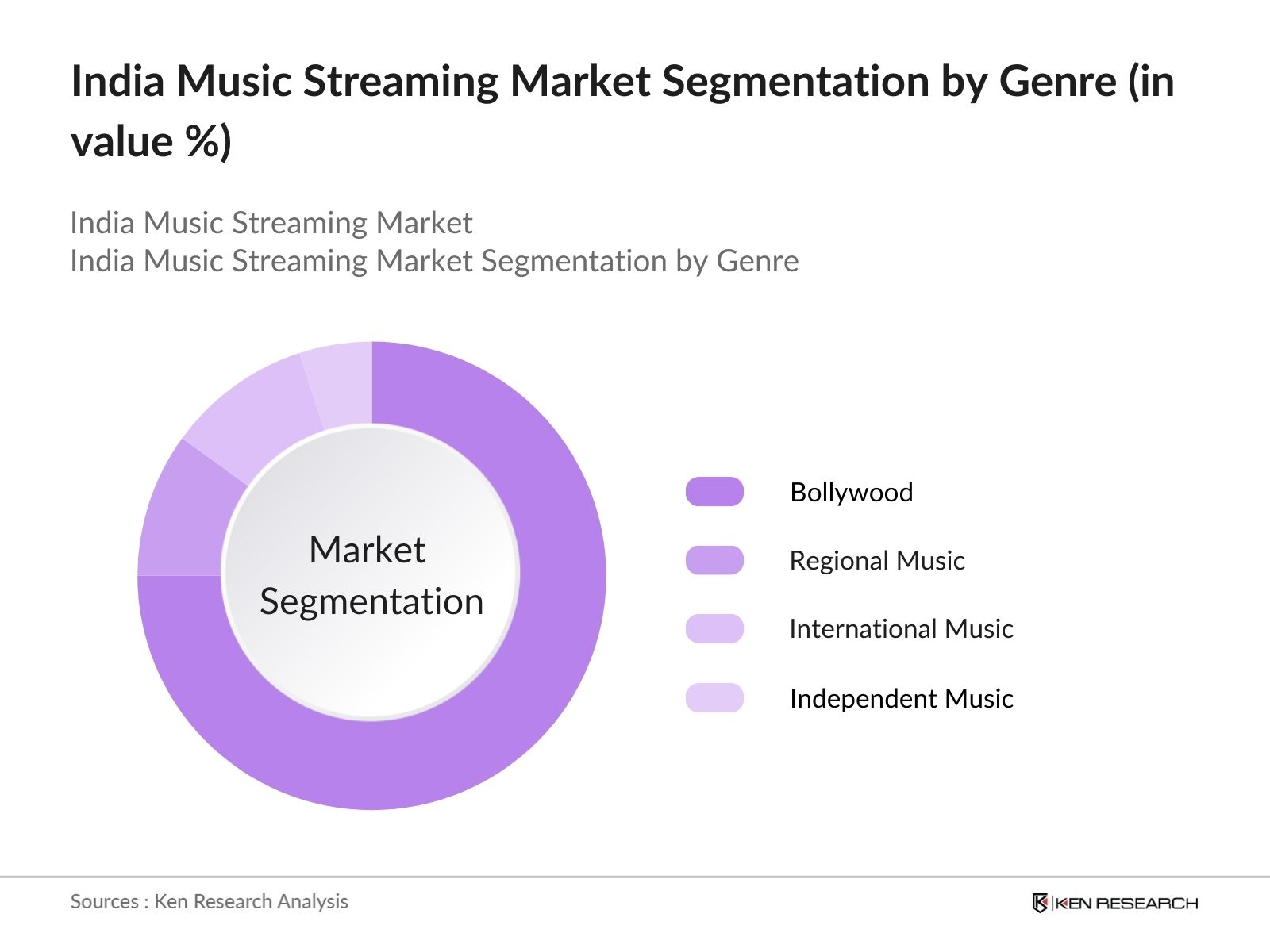

- By Genre: The market is segmented by genre into Bollywood, regional music, international music, and independent music. Bollywood remains the most popular genre, dominating the streaming landscape due to its vast fan base and constant new releases. However, regional music is witnessing significant growth, especially in languages such as Tamil, Telugu, Punjabi, and Bengali, as platforms expand their libraries to cater to local tastes. Independent music is also rising, with artists using streaming platforms as a launchpad to reach a global audience, bypassing traditional distribution channels.

India Music Streaming Market Competitive Landscape

The India music streaming market is highly competitive, with major players investing in exclusive content, regional expansion, and strategic partnerships to maintain a competitive edge. Leading players in the market include Gaana, JioSaavn, Spotify, YouTube Music, and Apple Music. These platforms are investing heavily in curating regional music content, enhancing user experience with AI-driven recommendations, and offering exclusive deals to subscribers.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

Partnerships |

|

Gaana |

2010 |

Gurugram, India |

|||||

|

JioSaavn |

2007 |

Mumbai, India |

|||||

|

Spotify |

2006 |

Stockholm, Sweden |

|||||

|

YouTube Music |

2015 |

California, USA |

|||||

|

Apple Music |

2015 |

Cupertino, USA |

India Music Streaming Industry Analysis

Growth Drivers:

- Increase in Internet and Smartphone Penetration: India's digital transformation has been driven by a sharp rise in internet and smartphone penetration, directly impacting the music streaming market. As of 2024, the number of internet users in India reached 692 million, according to the Telecom Regulatory Authority of India (TRAI). Affordable smartphones, along with an increasing number of mobile users, which hit 1.17 billion in 2023, have fueled this trend, enabling widespread access to digital services, including music streaming. This growth is also supported by the Indian governments Digital India initiative, which promotes internet access across rural and urban areas

- Demand for Regional and Vernacular Content: The growing appetite for regional and vernacular content has become a significant driver for the Indian music streaming market. With over 121 languages spoken across India, platforms like Gaana and JioSaavn are increasingly offering content in Tamil, Telugu, Bengali, and other regional languages to cater to this diverse linguistic audience. In 2023, regional music accounted for 34% of total music consumption in India, reflecting the growing importance of vernacular content in expanding user bases and increasing engagement

- Growing Popularity of Independent Music: India has seen a rise in independent artists using streaming platforms to distribute their music, bypassing traditional labels. With platforms like Spotify and YouTube Music supporting independent music, artists have greater visibility and access to a global audience. By 2023, over 30,000 independent musicians in India had uploaded their content on digital streaming platforms, capitalizing on low distribution costs and high reach. This trend has helped diversify the music landscape and increased the variety of content available to users, fostering a more dynamic and competitive market

Market Challenges:

- High Licensing and Content Acquisition Costs: Licensing and content acquisition costs pose a significant challenge for the Indian music streaming market. The fees paid to music labels and publishers for distributing music contribute substantially to operational expenses. These costs often make it difficult for platforms to balance profitability while offering diverse and high-quality content. Music streaming platforms must navigate the financial strain of acquiring popular music, especially when competing with global platforms that have larger budgets. Ensuring a robust content library without compromising financial sustainability remains a critical challenge for local players in this space.

- Monetization Challenges in the Freemium Model: Freemium models, where users can access basic services for free and premium features are available through subscriptions, have proven challenging to monetize effectively in India. While music streaming enjoys a large user base, only a small percentage of users convert to paid subscriptions. This low rate of paid subscriptions affects platform profitability and the ability to sustain high-quality services. Moreover, the pricing sensitivity in the Indian market and the availability of free alternatives make it challenging for platforms to strike a balance between offering premium features and generating adequate revenue.

India Music Streaming Market Future Outlook

The India music streaming market is expected to grow rapidly through 2028, driven by increasing internet penetration, the rise of regional content, and a growing preference for digital entertainment. The market is likely to witness further advancements in personalization, AI-driven content recommendations, and integration with other digital services, as platforms compete to enhance user engagement. The growing adoption of voice assistants and smart speakers will also drive new opportunities for music streaming platforms to expand their reach.

Future Market Opportunities:

- Increasing Regional and Independent Music Popularity: The rising popularity of regional and independent music presents a significant opportunity for Indian music streaming platforms. With more than 60% of the population residing in rural areas, there is an untapped market for regional content. As of 2024, regional language content had grown by 20% in user engagement, driven by increasing demand from rural audiences and tier-2 cities. Music streaming platforms can capitalize on this demand by expanding their regional catalog and providing independent artists with platforms to reach larger audiences.

- Expansion in Rural Areas and Tier-2 Cities: Indias music streaming market has ample opportunity for expansion in rural areas and tier-2 cities. According to data from the Ministry of Electronics and Information Technology, over 700 million people reside in rural India, with increasing access to the internet due to government initiatives like BharatNet. In 2023, rural internet usage grew by 78%, representing a significant market for digital services, including music streaming. Expanding services to these regions through targeted marketing and regional content offerings is a lucrative growth avenue.

Scope of the Report

|

By Platform Type |

Freemium Model Subscription-Based Model Ad-Supported Model |

|

By Genre |

Bollywood Regional Music International Music Independent Music |

|

By Device |

Smartphones Tablets Smart Speakers Desktop/Laptops |

|

By User Demographics |

Urban Users Rural Users Millennials Gen Z |

|

By Region |

North South West East |

Products

Key Target Audience

Music Streaming Platforms

Telecom Operators and ISPs

Content Creators and Record Labels

Technology and Software Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Information and Broadcasting, TRAI)

Digital Media Agencies

Music Publishers and Distributors

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Gaana

JioSaavn

Spotify

YouTube Music

Apple Music

Amazon Prime Music

Hungama

Wynk Music

SoundCloud

Resso

Tidal

Airtel Xstream Music

Google Play Music

Cube

Audiomack

Table of Contents

1. India Music Streaming Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy (Audio Streaming, Video Streaming, Freemium, Subscription-based, Ad-supported)

1.3 Market Growth Rate (Music Streaming Adoption Rate, Smartphone Penetration, Internet Data Consumption)

1.4 Market Segmentation Overview (Platform Type, Genre, Device, User Demographics, Region)

2. India Music Streaming Market Size (In USD Bn)

2.1 Historical Market Size (Revenue from Audio Streaming Platforms, Revenue from Video Streaming Platforms)

2.2 Year-On-Year Growth Analysis (Growth in Paid Subscribers, Increase in Ad Revenues)

2.3 Key Market Developments and Milestones (Partnerships with Telecom Operators, Platform Expansion, Exclusive Content Acquisition)

3. India Music Streaming Market Analysis

3.1 Growth Drivers

3.1.1 Increase in Internet and Smartphone Penetration

3.1.2 Demand for Regional and Vernacular Content

3.1.3 Affordable Data Plans and Digital Infrastructure Development

3.1.4 Rise of Independent Artists

3.2 Market Challenges

3.2.1 High Licensing and Content Acquisition Costs

3.2.2 Monetization Difficulties in Freemium Models

3.2.3 Copyright and Intellectual Property Issues

3.2.4 Competition from Global Platforms

3.3 Opportunities

3.3.1 Increasing Regional and Independent Music Popularity

3.3.2 Expansion in Rural Areas and Tier-2 Cities

3.3.3 Collaborations with Telecom and Internet Service Providers

3.3.4 Enhanced Subscription Offerings and Exclusive Content

3.4 Trends

3.4.1 AI-Driven Personalized Recommendations

3.4.2 Rise in Podcast Streaming and Long-Form Audio Content

3.4.3 Integration with Smart Devices (Smart Speakers, Wearables)

3.4.4 Regional Language Expansion

3.5 Government Regulation

3.5.1 Copyright and Royalty Regulations

3.5.2 Data Privacy and Security Regulations

3.5.3 Governments Digital India Initiative

3.5.4 Taxation on Digital Services

3.6 SWOT Analysis

Strengths (Growing Subscriber Base, Regional Content Expansion)

Weaknesses (Monetization Challenges, Licensing Costs)

Opportunities (Rural Expansion, Tech Integration)

Threats (Piracy, Global Competition)

3.7 Stake Ecosystem (Music Labels, Telecom Partners, Artists, Streaming Platforms)

3.8 Porters Five Forces (Supplier Power, Buyer Power, Competitive Rivalry, Threat of Substitutes, Entry Barriers)

3.9 Competition Ecosystem (Collaborations, Acquisition Strategies, Subscription Model Enhancements)

4. India Music Streaming Market Segmentation

4.1 By Platform Type (In Value %)

4.1.1 Freemium Model

4.1.2 Subscription-Based Model

4.1.3 Ad-Supported Model

4.2 By Genre (In Value %)

4.2.1 Bollywood

4.2.2 Regional Music

4.2.3 International Music

4.2.4 Independent Music

4.3 By Device (In Value %)

4.3.1 Smartphones

4.3.2 Tablets

4.3.3 Smart Speakers

4.3.4 Desktop/Laptops

4.4 By User Demographics (In Value %)

4.4.1 Urban Users

4.4.2 Rural Users

4.4.3 Millennials

4.4.4 Gen Z

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 West India

4.5.4 East India

4.5.5 Central India

5. India Music Streaming Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Gaana

5.1.2 JioSaavn

5.1.3 Spotify

5.1.4 Apple Music

5.1.5 YouTube Music

5.1.6 Amazon Prime Music

5.1.7 Hungama

5.1.8 Wynk Music

5.1.9 SoundCloud

5.1.10 Resso

5.1.11 Tidal

5.1.12 Airtel Xstream Music

5.1.13 Google Play Music

5.1.14 Cube

5.1.15 Audiomack

5.2 Cross Comparison Parameters (Subscribers, Monthly Active Users, Exclusive Content, Revenue Streams, Genre Strength, Regional Expansion, Market Share, Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Music Streaming Market Regulatory Framework

6.1 Copyright and Royalties Regulations

6.2 Compliance Requirements

6.3 Data Protection and Privacy

6.4 Government Initiatives

7. India Music Streaming Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Music Streaming Future Market Segmentation

8.1 By Platform Type (In Value %)

8.2 By Genre (In Value %)

8.3 By Device (In Value %)

8.4 By User Demographics (In Value %)

8.5 By Region (In Value %)

9. India Music Streaming Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process began by mapping the entire India music streaming market ecosystem, focusing on major stakeholders such as streaming platforms, telecom operators, and content creators. Extensive secondary research was conducted using industry reports and proprietary databases to identify market drivers and trends.

Step 2: Market Analysis and Construction

Historical market data was analyzed, focusing on user growth rates, subscription patterns, and regional content consumption. Key performance indicators such as subscriber growth and revenue generation were assessed to ensure accuracy in market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts from major streaming platforms and content providers. This helped verify critical assumptions regarding market penetration, revenue models, and the role of regional music in driving growth.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing all collected data and insights, with additional validation from telecom operators to understand the role of bundled services in music streaming adoption. This process ensured the accuracy of the report's conclusions and market forecasts.

Frequently Asked Questions

01. How big is the India Music Streaming Market?

The India music streaming market is valued at USD 400 million, driven by the growing availability of affordable data plans, smartphone penetration, and a significant demand for both Bollywood and regional music content.

02. What are the challenges in the India Music Streaming Market?

Challenges in the India music streaming market include high licensing costs for music rights, difficulty monetizing users under freemium models, and intense competition from both local and global platforms offering similar services.

03. Who are the major players in the India Music Streaming Market?

Key players in the India music streaming market include Gaana, JioSaavn, Spotify, YouTube Music, and Apple Music, with local platforms focusing on regional content and global platforms appealing to premium urban users.

04. What are the growth drivers of the India Music Streaming Market?

The India music streaming market is propelled by factors such as increasing internet and smartphone penetration, growing demand for regional and vernacular content, and the expanding reach of affordable data plans provided by telecom operators.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.