India Mutual Funds Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD891

July 2024

100

About the Report

India Mutual Funds Market Overview

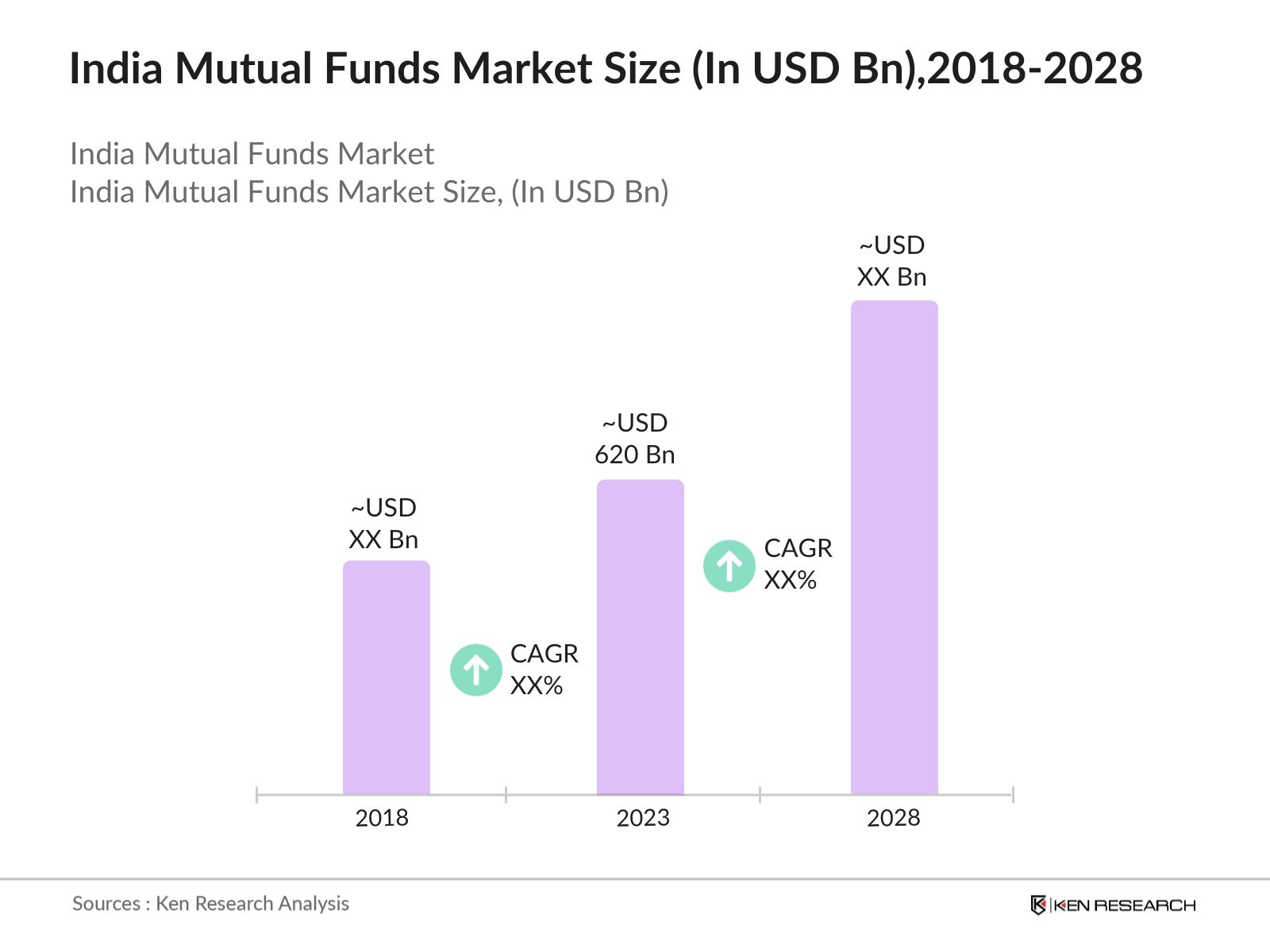

- India Mutual Funds Market has experienced significant growth over the past few years. In 2023, the assets under management were valued at USD 620 Bn. This growth is driven by increasing awareness among retail investors, favorable regulatory policies, and the rise of digital platforms facilitating easier access to mutual funds. Additionally, the growing middle class with rising disposable incomes has contributed to the market's expansion.

- Indian mutual fund industry is dominated by several key players, including HDFC Mutual Fund, SBI Mutual Fund, ICICI Prudential Mutual Fund, Aditya Birla Sun Life Mutual Fund, Nippon India Mutual Fund. These players have established a strong presence through extensive distribution networks, diverse product portfolios, and robust performance records.

- In May 2023, SBI Mutual Fund launched a new thematic fund focused on the technology sector, aimed at capitalizing on the digital transformation wave in India. The fund has already attracted over INR 5 billion in initial investments, indicating strong investor interest in sector-specific mutual funds.

India Mutual Funds Current Market Analysis

- Systematic Investment Plans (SIPs) have surged in popularity, with monthly contributions rising from INR 7,500 crore in 2018 to INR 12,000 crore in 2023. This growth reflects increasing investor confidence and participation in the Indian financial markets.

- The mutual funds market has a significant impact on the Indian economy by channeling household savings into productive investments. It supports capital market development, provides liquidity, and contributes to economic growth. Additionally, mutual funds offer diversification benefits to individual investors, thereby enhancing financial inclusion.

- The Western region, particularly Maharashtra, dominates the Indian mutual funds market. Maharashtra alone accounts for a significant share of the total assets under management (AUM), thanks to its financial hubs like Mumbai and Pune. This dominance is due to the high concentration of financial institutions, wealth management firms, and a financially literate population.

India Mutual Funds Market Segmentation

The India Mutual Funds Market can be segmented based on several factors:

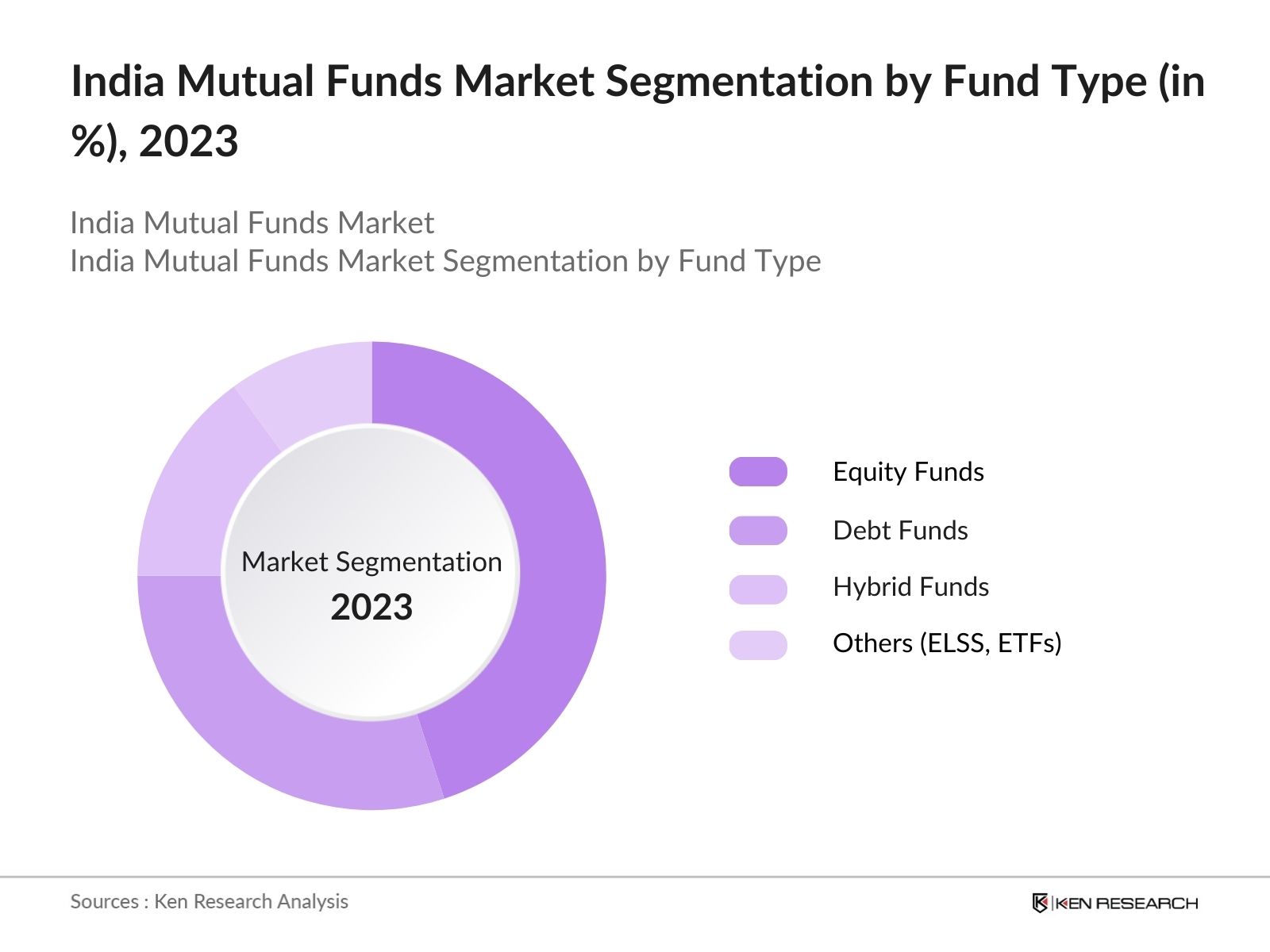

By Fund Type: By fund type the market is segmented into equity funds, debt funds, hybrid funds and others (ELSS, ETFs). In 2023, Equity Funds reign as the most dominant sub-segment, due to higher return potential and favorable market performance. They are preferred by investors looking for long-term capital appreciation and are supported by a growing stock market.

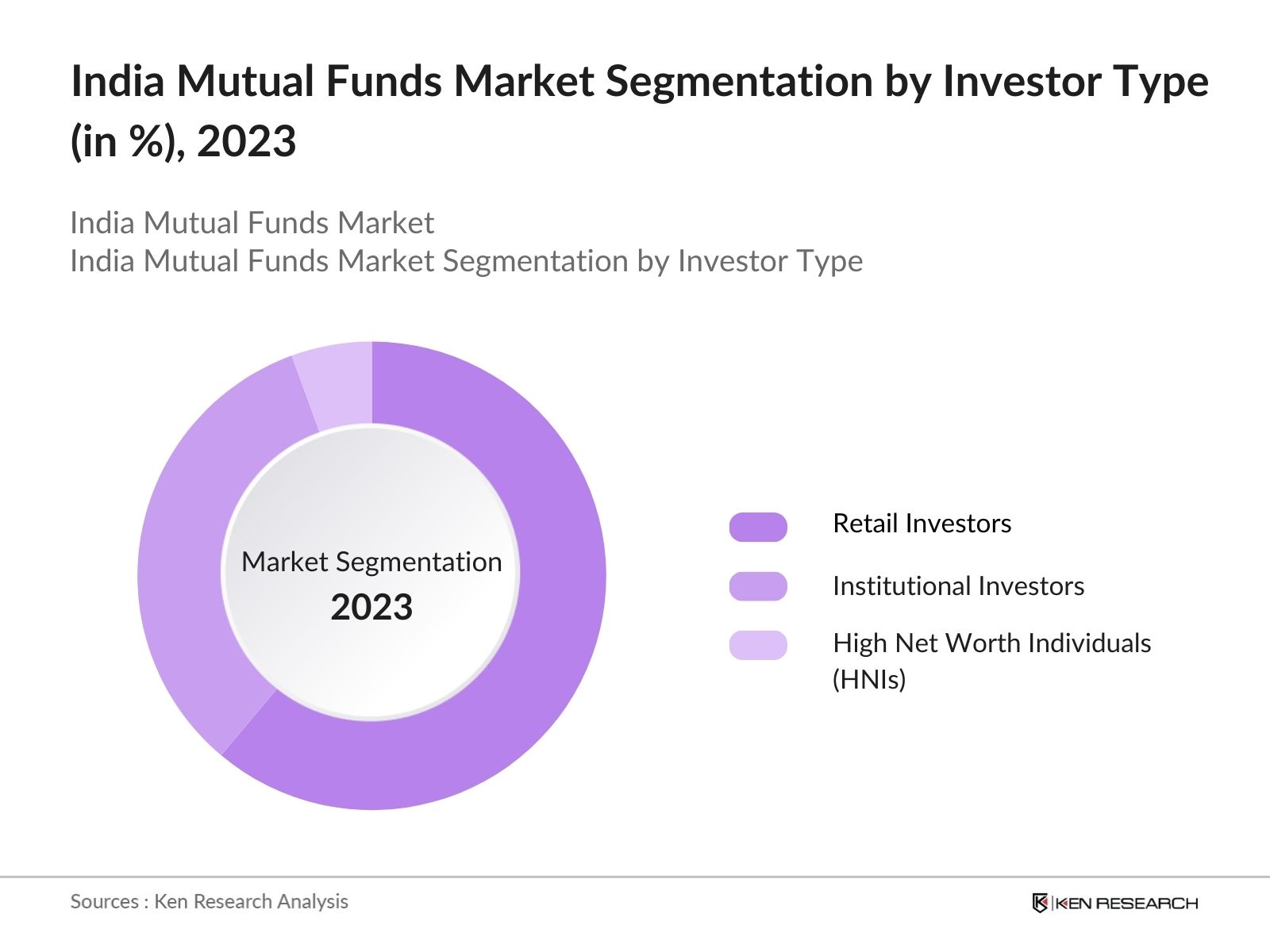

By Investor Type: By investor type in 2023, the market is segmented into retail investors, institutional investors & high net worth individuals. Retail investors emerge as the most dominant sub-segment, commanding a significant percentage of the market share. This dominance is attributed to their increasing financial literacy and accessibility through digital platforms. Government initiatives and campaigns have also boosted participation.

By Distribution Channel: By distribution channel, the market is segmented into direct channels, banks, financial advisors and online platforms. In 2023, the bank segment prevails due to their widespread presence and trust among investors. They leverage their extensive branch networks to reach a broad audience.

India Mutual Funds Market Competitive Landscape

|

Player |

Establishment Year |

Headquarters |

|

HDFC Mutual Fund |

2000 |

Mumbai |

|

SBI Mutual Fund |

1987 |

Mumbai |

|

ICICI Prudential Mutual Fund |

1993 |

Mumbai |

|

Aditya Birla Sun Life Mutual Fund |

1994 |

Mumbai |

|

Nippon India Mutual Fund |

1995 |

Mumbai |

- HDFC Mutual Fund: HDFC Mutual Fund launched a new equity fund targeting small-cap stocks in 2023, aiming to capitalize on high-growth potential sectors. The fund raised over ₹500 crore in its initial offering phase, reflecting strong investor interest in niche market segments.

- ICICI Prudential Mutual Fund: ICICI Prudential Mutual Fund introduced a thematic fund focused on digital economy and technology sectors in 2023. The fund attracted ₹700 crore in subscriptions within the first month, highlighting investor confidence in tech-driven growth opportunities.

- SBI Mutual Fund: SBI Mutual Fund expanded its presence in the retirement solutions market by launching a new pension fund aimed at providing long-term wealth accumulation for retirees. The fund garnered over ₹1,000 crore in assets under management within six months of its launch.

India Mutual Funds Industry Analysis

India Mutual Funds Market Growth Drivers:

- Increasing Retail Participation: The number of individual investors in mutual funds has surged, driven by increased awareness and accessibility. Mutual fund investor accounts have surged, with individual investor AUM now reaching ₹5 lakh crore. In this, individual investors account for 88% of investments in equity-oriented schemes, yet only 59% of their equity holdings are held for over two years.

- Technological Advancements in FinTech: The rise of fintech platforms has revolutionized the mutual funds industry in India. Digital platforms like Groww, Zerodha, and Paytm Money have made it easier for investors to access and manage their mutual fund portfolios. This digital transformation has not only enhanced convenience but also expanded the reach of mutual funds to younger and tech-savvy investors.

- Economic Growth and Rising Disposable Incomes: India's robust economic growth has had a positive impact on the mutual funds market. India’s GDP was at 3416.65 billion US dollars in 2022. With a GDP growth rate averaging around 6-7% annually, the increase in disposable incomes has allowed more individuals to invest in mutual funds. This macroeconomic trend supports the continuous inflow of investments into the mutual fund industry.

India Mutual Funds Market Challenges:

- Market Volatility: Market volatility remains a significant challenge for the mutual funds industry. For instance, the COVID-19 pandemic caused extreme market fluctuations, leading to a temporary dip in mutual fund inflows. According to AMFI, the net inflows into equity mutual funds dropped by 47% in March 2020 compared to the previous year. This volatility can deter new investors and impact the overall growth of the mutual funds market.

- Regulatory Changes: Frequent changes in regulations can create uncertainty and require constant adaptation by mutual fund houses. SEBI's introduction of new compliance norms in 2020, including changes to the categorization and rationalization of mutual funds, required fund houses to realign their product offerings. These regulatory changes, while beneficial in the long run, can pose short-term challenges and operational disruptions for mutual fund companies.

India Mutual Funds Market Government Initiatives:

- SEBI’s Investor Protection and Education Fund (IPEF): Launched in 2019, SEBI's IPEF aims to educate investors about the benefits and risks of mutual funds. The initiative has conducted over 1,000 investor awareness programs across the country, significantly improving investor knowledge and participation.

- Digital India Campaign: The government's Digital India campaign has played a crucial role in the digital transformation of the mutual funds industry. The campaign has facilitated the development of digital platforms and mobile applications, making it easier for investors to access and manage their mutual fund investments.

- Pradhan Mantri Jan Dhan Yojana (PMJDY): Introduced in 2014, PMJDY has significantly increased financial inclusion by opening over 43 crore bank accounts. This initiative has created a larger pool of potential mutual fund investors, particularly in rural and semi-urban areas.

India Mutual Funds Future Market Outlook

The mutual funds market in India is projected to continue its robust growth, driven by increasing retail participation, enhanced digital access, and a growing economy.

Future Market Trends:

- Rise of Passive Investing: The popularity of passive investing, including index funds and ETFs, is expected to continue rising. Predictions suggest that assets under management (AUM) for index funds and ETFs will grow significantly in 2024, building on a 45% increase observed in 2023. This trend will be driven by the lower cost and simplicity of passive funds, appealing increasingly to both retail and institutional investors seeking cost-effective investment options.

- Growing Interest in ESG Funds: Environmental, Social, and Governance (ESG) investing is set to gain further traction in India. This trend will be supported by global movements towards sustainability and heightened regulatory scrutiny on corporate governance and environmental impact.

- Customization and Personalization: The demand for customized and personalized investment solutions is expected to rise. Mutual fund companies will increasingly leverage technology to offer tailored portfolios based on individual risk profiles and investment goals, anticipating a surge in investor preference for personalized financial products.

Scope of the Report

|

By Product Type |

Equity Funds Debt Funds Hybrid Funds Others (ELSS, ETFs) |

|

By Investor Type |

Retail Investors Institutional Investors High Net Worth Individuals (HNIs) |

|

By Distribution Channel |

Direct Channels Banks Financial Advsiors Online Platforms |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing This Report:

Asset Management Companies (AMCs)

Financial Advisors & Distributors

FinTech Providers

Wealth Management Firms

Financial Professionals

Bank Institutions

Government and Regulatory Bodies (RBI, SEBI etc.)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

HDFC Mutual Fund

SBI Mutual Fund

ICICI Prudential Mutual Fund

Aditya Birla Sun Life Mutual Fund

Reliance Nippon Life Asset Management

Kotak Mahindra Asset Management

Axis Mutual Fund

Franklin Templeton Mutual Fund

DSP Mutual Fund

L&T Mutual Fund

UTI Mutual Fund

Mirae Asset Mutual Fund

Invesco Mutual Fund

Table of Contents

1. India Mutual Funds Market Overview

1.1 India Mutual Funds Market Taxonomy

2. India Mutual Funds Market Size (in USD Bn), 2018-2023

3. India Mutual Funds Market Analysis

3.1 India Mutual Funds Market Growth Drivers

3.2 India Mutual Funds Market Challenges and Issues

3.3 India Mutual Funds Market Trends and Development

3.4 India Mutual Funds Market Government Regulation

3.5 India Mutual Funds Market SWOT Analysis

3.6 India Mutual Funds Market Stake Ecosystem

3.7 India Mutual Funds Market Competition Ecosystem

4. India Mutual Funds Market Segmentation, 2023

4.1 India Mutual Funds Market Segmentation by Product Type (in value %), 2023

4.2 India Mutual Funds Market Segmentation by Investor Type (in value %), 2023

4.3 India Mutual Funds Market Segmentation by Distribution Channel (in value %), 2023

5. India Mutual Funds Market Competition Benchmarking

5.1 India Mutual Funds Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Mutual Funds Future Market Size (in USD Bn), 2023-2028

7. India Mutual Funds Future Market Segmentation, 2028

7.1 India Mutual Funds Market Segmentation by Product Type (in value %), 2028

7.2 India Mutual Funds Market Segmentation by Investor Type (in value %), 2028

7.3 India Mutual Funds Market Segmentation by Distribution Channel (in value %), 2028

8. India Mutual Funds Market Analysts’ Recommendations

8.1 India Mutual Funds Market TAM/SAM/SOM Analysis

8.2 India Mutual Funds Market Customer Cohort Analysis

8.3 India Mutual Funds Market Marketing Initiatives

8.4 India Mutual Funds Market White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on India mutual funds market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India mutual funds market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple mutual funds companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from mutual funds companies.

Frequently Asked Questions

01 How big is India Mutual Funds Market?

In India mutual funds market, the assets under management were valued at USD 620 Bn, driven by increasing awareness among retail investors & favorable regulatory policies.

02 What are the challenges in India Mutual Funds Market?

The key challenges faced by the India Mutual Funds Market are market volatility and regulatory changes.

03 Who are the major players in India Mutual Funds Market?

Some of the major players in the India Mutual Funds Market include Everest Spices, MDH Spices and Badshah Masala.

04 Which segment is dominant in India Mutual Funds Market?

Equity funds are the dominant segment due to their higher return potential and favorable market performance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.