India Natural Rubber Market Outlook to 2030

Region:Asia

Author(s):Geetanshi Chugh

Product Code:KROD288

June 2024

100

About the Report

India Natural Rubber Market Overview

- The India Natural Rubber market has shown substantial growth over the past few years. In 2018, the market size was approximately 720,000 tonnes. By 2023, it is estimated to have grown to 850,000 tonnes, with a compound annual growth rate (CAGR) of around 3.4%.

- This growth is driven by increasing demand from the automotive industry, which uses natural rubber for tire production, and rising export opportunities due to India's competitive pricing and quality of natural rubber.

- Key players in the Indian natural rubber market include Harrisons Malayalam Limited, RPG Life Sciences, JK Tyre & Industries Ltd, Apollo Tyres Ltd, MRF LtdLtd. These companies dominate the market by leveraging advanced agricultural practices, extensive distribution networks, and significant investments in research and development.

- Apollo Tyres Ltd announced a major investment in sustainable rubber plantations in 2023, amounting to INR 300 crore, aiming to achieve 100% sustainable sourcing by 2025.

India Natural Rubber Current Market Analysis

- In 2023, the Indian government announced a substantial investment of INR 1,100 crore in the North East region for rubber plantation development under the North East Rubber Mission.

- The Rubber Board of India holds sway due to its regulatory oversight and quality assurance. It oversees rubber cultivation on 630,000 hectares of land and ensures adherence to international standards, fostering consumer trust.

- The automotive sector reigns supreme, consuming over 60% of India's natural rubber output. With over 22 million vehicles produced in 2023, tire manufacturing accounted for 75% of the rubber consumed in India.

India Natural Rubber Market Segmentation

The India Natural Rubber market can be segmented based on various factors. Here are three key segmentation types with their sub-segments and estimated market share ranges:

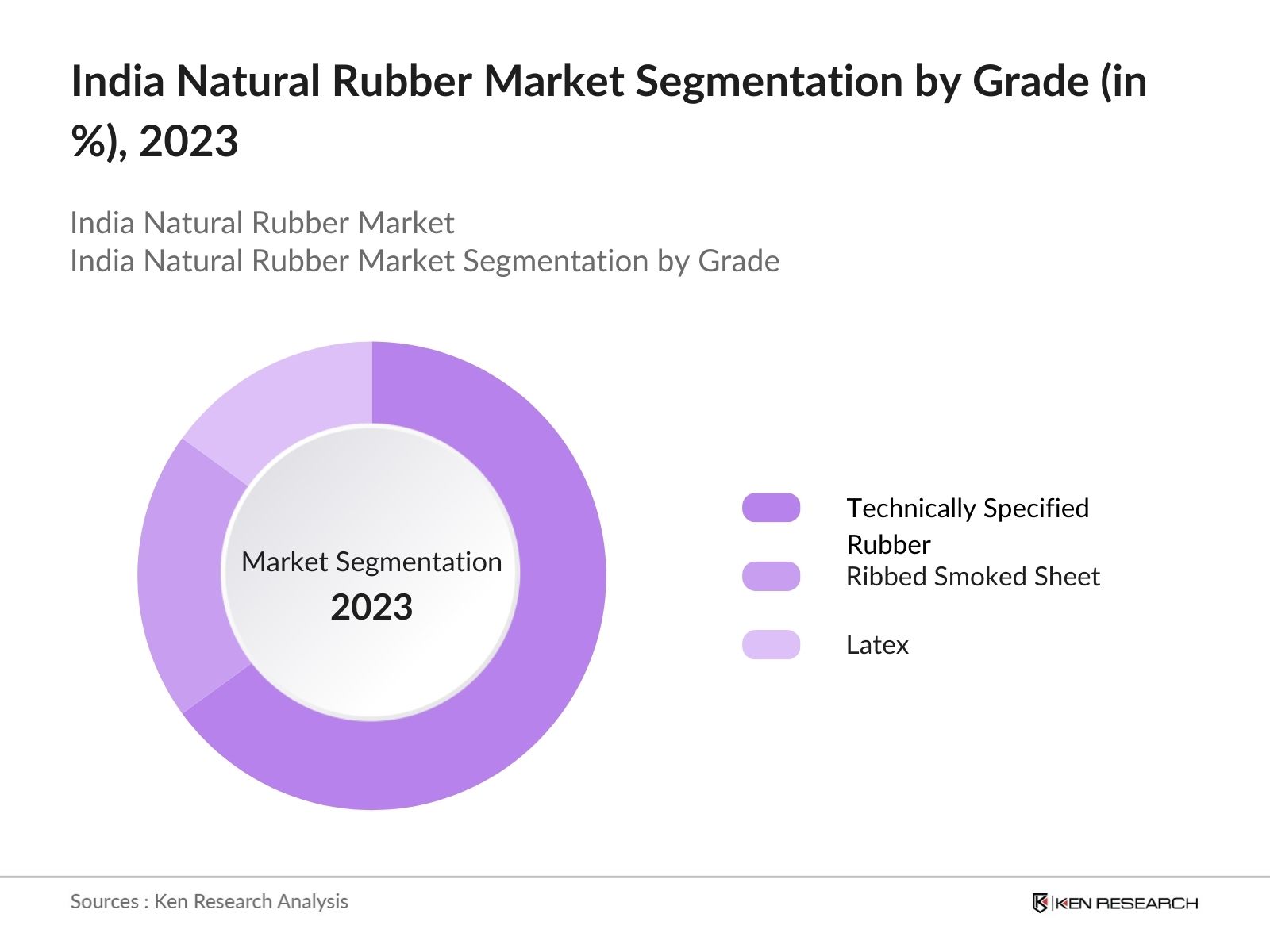

By Grade: In 2023, technically specified rubber (TSR) grade dominated the India natural rubber market, holding more than half of the market share. This dominance is attributed to TSR's consistent quality, ease of processing, and suitability for high-demand applications, particularly in the automotive industry for tire manufacturing. Its standardized grading system ensures reliability, making it the preferred choice for manufacturers seeking uniformity and efficiency in production processes.

By End-User Industry: In 2023, the tire industry was the dominant end-user in India's natural rubber market, commanding a significant market share. This dominance is due to the tire industry's high consumption of natural rubber for manufacturing, driven by robust growth in automotive production and sales, increased vehicle ownership, and the demand for replacement tires in both domestic and export markets.

By Source: The India natural rubber market is segmented by source into plant-based and synthetic. In 2023, the plant-based source dominated the India natural rubber market due to its eco-friendly nature, superior elasticity, and strength, which are highly valued in key industries like automotive and healthcare. Additionally, growing environmental awareness and regulatory support for sustainable products bolstered the preference for natural, plant-based rubber over synthetic alternatives.

India Natural Rubber Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Harrisons Malayalam Limited |

1978 |

Kochi, Kerala |

|

RPG Life Sciences |

1993 |

Mumbai, Maharashtra |

|

JK Tyre & Industries Ltd |

1974 |

Delhi |

|

Apollo Tyres Ltd |

1972 |

Gurugram, Haryana |

|

MRF Ltd |

1946 |

Chennai, Tamil Nadu |

- Competitive pricing strategies drive market share. Companies offering cost-effective solutions, such as South China Tire & Rubber Co. Ltd., maintain competitiveness and attract price-sensitive consumers.

- Apollo Tyres Ltd announced a major investment in sustainable rubber plantations in 2023, amounting to INR 300 crore, aiming to achieve 100% sustainable sourcing by 2025.

- MRF Ltd introduced a new line of eco-friendly tires made with high-performance natural rubber blends, showcasing innovation in the market.

India Natural Rubber Market Industry Analysis

India Natural Rubber Market Growth Drivers:

- Automotive Industry Demand: The automotive industry in India is a major consumer of natural rubber, particularly for tire manufacturing. The production of passenger vehicles in India reached approximately 3.4 million units in 2023, up from 3.1 million units in 2018. This rise in automotive production has led to increased demand for natural rubber.

- Government Support and Initiatives: The Indian government has been proactive in supporting the natural rubber industry through various schemes and policies. The North East Rubber Mission, launched in 2023, aims to enhance rubber production in the North East region with an investment of INR 1,100 crore. This initiative is expected to increase the production capacity by 30% over the next five years.

- Export Opportunities: India's natural rubber exports have witnessed a steady increase, driven by high demand from countries like China, Germany, and the United States. In 2023, India's natural rubber exports grew by 15%, reaching approximately 85,000 tonnes. The competitive pricing and superior quality of Indian natural rubber have made it a preferred choice in the global market.

India Natural Rubber Market Challenges:

- Climate Change and Weather Variability: Climate change poses a significant threat to natural rubber production in India. Unpredictable weather patterns, including irregular rainfall and temperature fluctuations, have adversely affected rubber yield. The Indian Meteorological Department reported a 10% decrease in annual rainfall in major rubber-producing regions like Kerala in 2023 compared to historical averages. This variability leads to supply inconsistencies and increases the risk of crop failure, impacting the overall market stability.

- Pest Infestations and Diseases: Pest infestations, such as the South American leaf blight, pose a severe risk to rubber plantations. In 2022, the Rubber Board of India recorded a 12% loss in rubber production due to pest-related issues. The spread of diseases can devastate entire plantations, leading to significant economic losses for farmers and the industry. Effective pest management and disease control measures are critical to mitigate these risks and ensure sustainable production.

- Labor Shortages: The natural rubber industry heavily relies on manual labor for tapping and processing activities. However, there has been a decline in the availability of skilled labor in recent years. According to a survey by the Rubber Research Institute of India, there was a 20% reduction in the number of skilled tappers in 2023 compared to 2018. This labor shortage has led to increased labor costs and operational challenges, impacting the profitability of rubber plantations.

India Natural Rubber Market Recent Developments:

- Board of India initiated organic farming methods on 50,000 hectares of rubber plantations in 2023, reducing chemical usage by 30% and promoting biodiversity. This Rubber investment aims to address environmental concerns and meet consumer demand for eco-friendly products.

- Hainan Natural Rubber Industry Group introduced specialty rubber grades for medical applications, such as surgical gloves and medical tubing, in 2023. This expansion diversifies its product range, tapping into high-growth segments and strengthening market competitiveness.

- JK Tyre & Industries Ltd expanded its rubber plantation area by 10,000 hectares to meet growing demand. This expansion aims to secure a steady supply of natural rubber for its manufacturing needs and reduce dependency on external suppliers.

India Natural Rubber Future Outlook:

The India natural rubber market is expected to grow exponentially, driven by the expanding automotive sector, increasing industrial applications, and growing demand for sustainable rubber products.

- Technological Integration: The integration of AI and IoT in plantation management is expected to revolutionize the natural rubber industry. These technologies provide real-time monitoring, predictive analytics, and automated processes, leading to higher efficiency, reduced labor costs, and improved yield. The widespread adoption of these technologies will transform the traditional rubber industry into a modern, data-driven sector.

- Diversification into Non-tire Applications: The demand for natural rubber in non-tire applications, such as medical gloves, industrial products, and consumer goods, is on the rise. The medical sector, in particular, is seeing increased demand for natural rubber latex, driven by heightened health and hygiene awareness. This diversification will reduce the market's dependency on the automotive sector and open up new growth avenues.

- Regional Production Shifts: There is a noticeable shift in rubber production from traditional regions like Kerala to the North East states, driven by favorable government policies and untapped potential. The North East Rubber Mission aims to increase the region's share in national production, contributing to regional development and balancing production disparities. This shift leverages the agro-climatic advantages of the North East and supports the overall growth of the market.

Scope of the Report

|

India Natural Rubber Market Segmentation |

|

|

By Grade |

Technically Specified Rubber Ribbed Smoked Sheet Latex |

|

By End-User Industry |

Tire Industry Footwear Industry Other Industries |

|

By Source |

Plant-Based Synthetic |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Construction Companies

Chemical and Industrial Product Manufacturers

Rubber Products Retailers and Distributors

Rubber Processing and Manufacturing Firms

Government Bodies and Regulatory Agencies

Banks and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Hainan Natural Rubber Industry Group

Apollo Tyres Ltd.

JK Tyre & Industries Ltd.

MRF Limited

Ceat Ltd.

Goodyear India Ltd.

Bridgestone India Pvt. Ltd.

Continental India Ltd.

TVS Srichakra Ltd.

Birla Tyres

Michelin India Pvt. Ltd.

Balkrishna Industries Ltd. (BKT Tires)

Maxxis Rubber India Pvt. Ltd.

Metro Tyres Limited

Modi Rubber Limited

Pirelli Tyres India Pvt. Ltd.

Ralson India Ltd.

Kesoram Industries Ltd.

Falcon Tyres Ltd.

Table of Contents

1. India Natural Rubber Market Overview

1.1 India Natural Rubber Market Taxonomy

2. India Natural Rubber Market Size (in USD Bn), 2018-2023

3. India Natural Rubber Market Analysis

3.1 India Natural Rubber Market Growth Drivers

3.2 India Natural Rubber Market Challenges and Issues

3.3 India Natural Rubber Market Trends and Development

3.4 India Natural Rubber Market Government Regulation

3.5 India Natural Rubber Market SWOT Analysis

3.6 India Natural Rubber Market Stake Ecosystem

3.7 India Natural Rubber Market Competition Ecosystem

4. India Natural Rubber Market Segmentation, 2023

4.1 India Natural Rubber Market Segmentation by Grade (in %), 2023

4.2 India Natural Rubber Market Segmentation by End-User Industry (in %), 2023

4.3 India Natural Rubber Market Segmentation by Source (in %), 2023

5. India Natural Rubber Market Competition Benchmarking

5.1 India Natural Rubber Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Natural Rubber Market Future Market Size (in USD Bn), 2023-2028

7. India Natural Rubber Market Future Market Segmentation, 2028

7.1 India Natural Rubber Market Segmentation by Grade (in %), 2028

7.2 India Natural Rubber Market Segmentation by End-User Industry (in %), 2028

7.3 India Natural Rubber Market Segmentation by Source (in %), 2028

8. India Natural Rubber Market Analysts’ Recommendations

8.1 India Natural Rubber Market TAM/SAM/SOM Analysis

8.2 India Natural Rubber Market Customer Cohort Analysis

8.3 India Natural Rubber Market Marketing Initiatives

8.4 India Natural Rubber Market White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on India Natural Rubber market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Natural Rubber market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple natural rubber companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Natural rubber companies.

Frequently Asked Questions

01 What is the current market size of the Global Natural Rubber market in India?

The current market size of the natural rubber industry in India is 720,000 Tonnes as of 2023.

02 Who are the major players in the Indian natural rubber market?

Major players include, Hainan Natural Rubber Industry Group, and South China Tire & Rubber Co. Ltd.

03 What are the key growth drivers of the natural rubber market in India?

Key growth drivers include demand from automotive, construction, and healthcare sectors, technological advancements, and government support initiatives.

04 What are the major challenges faced by the natural rubber industry?

Major challenges include price volatility, environmental concerns, competition from synthetic rubber, supply chain disruptions, and regulatory compliance complexities.

05 Which end-user industry dominated India Natural Rubber market?

The tire industry dominates India Natural rubber Market in 2023.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.