India Neobank Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD6371

December 2024

83

About the Report

India Neobank Market Overview

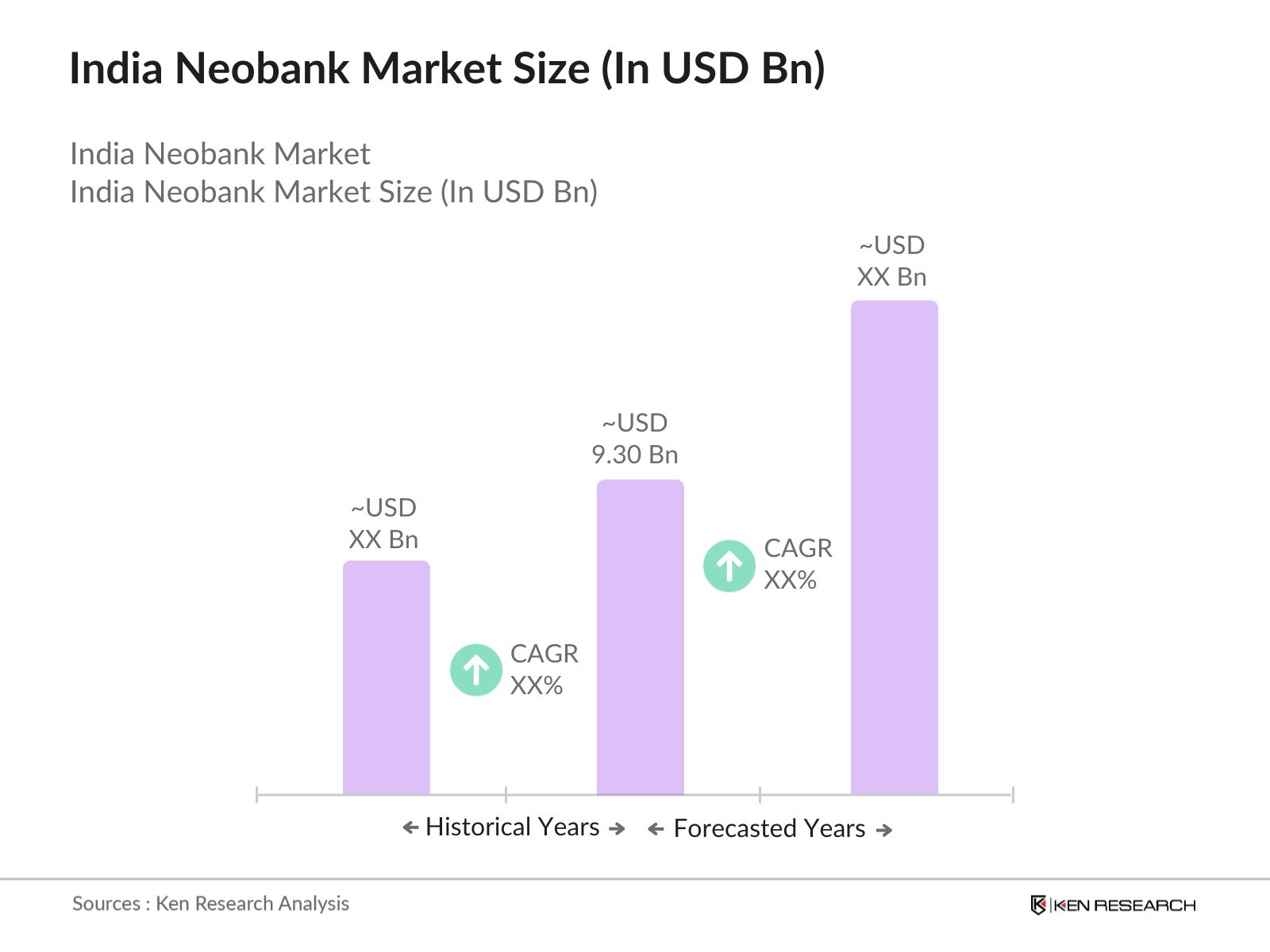

- The India Neobank market, valued at USD 9.30 billion, is driven by the rapid digitization of financial services, increasing smartphone penetration, and a strong focus on financial inclusion by the government. As more consumers embrace digital banking, the demand for neobanks is on the rise. According to the Reserve Bank of India, digital payment transactions have increased significantly, indicating a shift towards online financial services. The ongoing initiatives like the Digital India campaign further support this trend, fostering a robust ecosystem for neobanks.

- Major cities such as Mumbai, Bengaluru, and Delhi are at the forefront of the neobank market, driven by their established tech infrastructure, high financial literacy rates, and a large base of tech-savvy consumers. These cities serve as innovation hubs for fintech solutions, with a considerable number of startups emerging in the neobanking space. Additionally, the concentration of businesses and young professionals in these urban areas creates a conducive environment for neobanks to thrive, meeting the evolving needs of both individual and business clients.

- The Reserve Bank of India has implemented guidelines specific to digital banking, offering a structured approach to neobank operations. The guidelines provide clarity on service limitations, especially regarding KYC protocols and transaction monitoring. These measures, updated in early 2024, ensure consumer protection while enhancing operational transparency for neobanks.

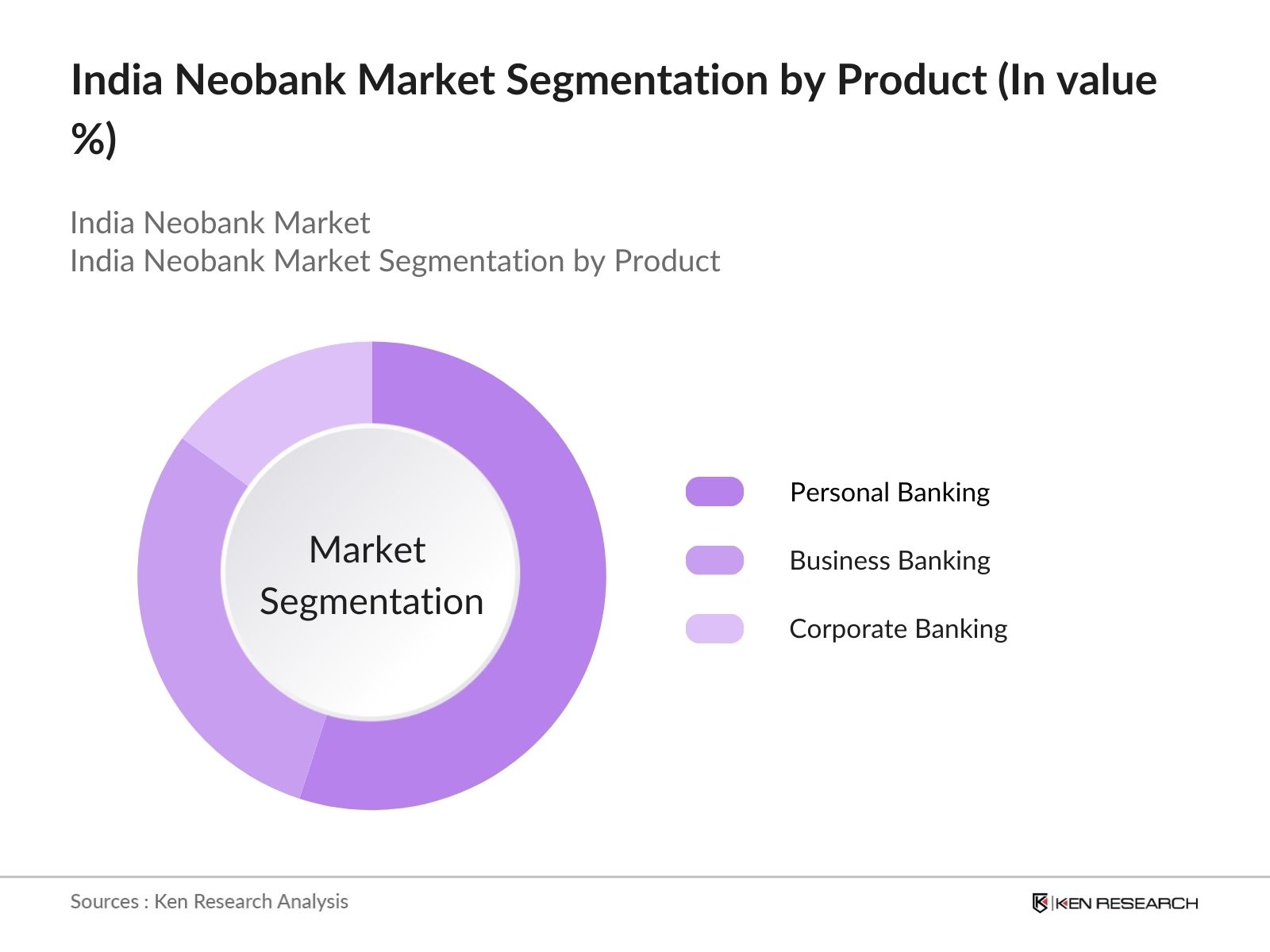

India Neobank Market Segmentation

- By Product Type: The market is segmented by product type into Personal Banking, Business Banking, and Corporate Banking. Personal Banking has recently taken a dominant market share in India under this segmentation, primarily due to the growing demand for seamless digital banking experiences among individual consumers. With a large population increasingly reliant on mobile devices, neobanks focusing on personal banking offer user-friendly apps that facilitate instant transactions, easy account management, and personalized financial services. This segment's growth is further supported by a rising trend of millennials and Gen Z consumers seeking accessible and cost-effective banking solutions.

- By Service Type: The market is segmented by service type into Payment Processing, Lending Services, and Wealth Management. Payment Processing holds the largest market share, primarily due to the increasing volume of digital transactions across various sectors in India. With e-commerce booming and consumers moving towards cashless payments, neobanks that excel in providing reliable payment solutions are seeing significant growth. They offer features such as real-time payment notifications, integrated payment gateways, and cost-effective transaction fees, which cater to both individual users and businesses, thereby solidifying their position in the market.

India Neobank Market Competitive Landscape

The India neobank market is competitive, with numerous players ranging from established financial institutions to innovative fintech startups. Leading companies such as Paytm Payments Bank, Niyo Solutions, and RazorpayX dominate the landscape by leveraging advanced technologies and robust business models. These players are focusing on enhancing customer experience through personalization and innovative offerings. Additionally, emerging neobanks are carving a niche by catering to specific demographics, such as gig workers and small businesses, thus intensifying the competition in the market.

India Neobank Market Analysis

Growth Drivers

- Rising Digital Adoption: Indias digital transformation has grown sharply in recent years, creating a conducive environment for neobanks. As per World Bank data, India's internet user base reached over 900 million in 2024, facilitated by high-speed mobile internet availability and affordable data plans. This shift has made digital banking services accessible to a larger demographic. In addition, the Unified Payments Interface (UPI) platform saw approximately 10 billion monthly transactions in early 2024, reflecting widespread adoption of digital financial services. These metrics underscore the role of digital transformation in supporting neobank adoption.

- Rising Smartphone Penetration: Smartphone penetration in India is a pivotal factor behind the growth of digital financial services. According to the Telecom Regulatory Authority of India (TRAI), smartphone users in India surpassed 930 million in 2023, enabling greater access to digital banking services, especially for rural populations. Increased smartphone availability has allowed neobanks to reach previously unbanked sections of the population, supporting growth in financial inclusion. This access is anticipated to drive further growth in digital financial interactions.

- Increased Financial Inclusion: Financial inclusion initiatives by the Indian government have significantly expanded banking services across India. According to the Ministry of Finance, over 500 million bank accounts were opened under the Pradhan Mantri Jan Dhan Yojana (PMJDY) by 2024, introducing a new segment of potential users to digital banking. This extensive user base offers neobanks a unique opportunity to bring digitally-enabled banking solutions to underserved communities, helping drive financial inclusion through advanced digital platforms.

Market Challenges

- Regulatory Constraints: The Indian neobank industry faces challenges due to stringent regulatory measures set by the Reserve Bank of India (RBI). For instance, the RBIs digital-only banking policies limit neobanks from providing certain traditional banking services. As of 2024, these restrictions are particularly pronounced in areas like customer fund safety and KYC norms, which often require stringent compliance. Such regulatory constraints can hamper operational flexibility and expansion efforts of neobanks, challenging their growth trajectory.

- Trust and Security Concerns: Trust and security remain significant barriers to the mass adoption of neobanks in India. With reported cyber fraud incidents rising to 200,000 cases in 2023 as per the Ministry of Home Affairs, Indian consumers are cautious about fully adopting digital banking. These concerns, especially prevalent among older demographics, can limit the widespread acceptance of digital-only banks. Implementing robust cybersecurity measures and building trust through data security policies are crucial for overcoming these challenges

India Neobank Market Future Outlook

The India Neobank market is expected to witness continued growth, in the forecasted period. This growth will be driven by the ongoing shift towards digital banking, advancements in fintech, and increasing consumer demand for efficient and user-friendly banking solutions. The rise of AI and machine learning in financial services will further enhance the customer experience, driving innovation in service delivery.

Future Market Opportunities

- Partnership with Traditional Banks: Partnerships between neobanks and traditional banks are essential in improving service reach. Collaborations with banks like the State Bank of India (SBI) allow neobanks to offer traditional banking services while focusing on digital advancements. According to the Ministry of Finance, these partnerships resulted in more than 10 million joint accounts by 2023, providing customers with access to a broader range of services and enhancing market reach for neobanks. Such alliances enable neobanks to leverage traditional infrastructure while expanding digital capabilities, enhancing overall service quality.

- Expansion of Customer Segments: Neobanks are increasingly targeting diverse customer segments, including MSMEs and millennials. MSMEs, numbering 63 million as per the Ministry of Micro, Small and Medium Enterprises, often lack streamlined banking services, presenting a significant growth opportunity. Additionally, with a young demographic that values digital convenience, neobanks can tap into the substantial millennial market segment, which comprises nearly 440 million individuals in India. By addressing the unique needs of these segments, neobanks can drive broader adoption of digital banking services across various user groups.

Scope of the Report

|

By Product Type |

Personal Banking Business Banking Corporate Banking |

|

By Service Type |

Payment Processing Lending Services Wealth Management |

|

By Customer Type |

Individual Customers SMEs Corporates |

|

By Technology Adoption |

Mobile-Only Banking Web-Based Services API Integration |

|

By Region |

North South East West |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Reserve Bank of India, SEBI)

Digital Payment Solution Providers

Technology and Software Companies

E-commerce and Retail Companies

Mobile Network Operators

Fintech Solution Providers

Companies

Players Mentioned in the Report

Paytm Payments Bank

RazorpayX

Niyo Solutions

Open Financial Technologies

Fi Money

Jupiter Money

Freo

Fampay

ICICI iMobile

Digibank by DBS

InstantPay

Zeta

Mahindra Finance Digi

YONO (SBI)

Kotak 811

Table of Contents

01 India Neobank Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

02 India Neobank Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

03 India Neobank Market Analysis

3.1 Growth Drivers

3.1.1 Digital Transformation

3.1.2 Rising Smartphone Penetration

3.1.3 Increased Financial Inclusion

3.1.4 Government Initiatives

3.2 Market Challenges

3.2.1 Regulatory Constraints

3.2.2 Trust and Security Concerns

3.2.3 Operational Scalability Issues

3.3 Opportunities

3.3.1 Partnership with Traditional Banks

3.3.2 Expansion of Customer Segments

3.3.3 Cross-border Payment Integration

3.4 Trends

3.4.1 Use of AI and ML in Service Delivery

3.4.2 Integration with Fintech Ecosystems

3.4.3 Increased Focus on Customer Experience

3.5 Government Regulation

3.5.1 RBI Digital Banking Guidelines

3.5.2 Data Privacy Standards

3.5.3 Open Banking Policies

3.5.4 Customer Protection Policies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

04 India Neobank Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Personal Banking

4.1.2 Business Banking

4.1.3 Corporate Banking

4.2 By Service Type (In Value %)

4.2.1 Payment Processing

4.2.2 Lending Services

4.2.3 Wealth Management

4.3 By Customer Type (In Value %)

4.3.1 Individual Customers

4.3.2 Small and Medium Enterprises (SMEs)

4.3.3 Corporates

4.4 By Technology Adoption (In Value %)

4.4.1 Mobile-Only Banking

4.4.2 Web-Based Services

4.4.3 API Integration

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

05 India Neobank Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Paytm Payments Bank

5.1.2 RazorpayX

5.1.3 Niyo Solutions

5.1.4 Open Financial Technologies

5.1.5 YONO (SBI)

5.1.6 Kotak 811

5.1.7 Jupiter Money

5.1.8 Freo

5.1.9 Fi Money

5.1.10 ICICI iMobile

5.1.11 Digibank by DBS

5.1.12 InstantPay

5.1.13 Zeta

5.1.14 Fampay

5.1.15 Mahindra Finance Digi

5.2 Cross Comparison Parameters (No. of Customers, Headquarters, Revenue, No. of Services Offered, Digital Platform Type, Customer Acquisition Rate, Monthly Active Users, Service Integration)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

06 India Neobank Market Regulatory Framework

6.1 RBI Licensing Requirements

6.2 Compliance with Data Protection Laws

6.3 Certification and Licensing Standards

07 India Neobank Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08 India Neobank Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Service Type (In Value %)

8.3 By Customer Type (In Value %)

8.4 By Technology Adoption (In Value %)

8.5 By Region (In Value %)

09 India Neobank Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation Insights

9.3 Marketing and Branding Strategies

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves constructing an ecosystem map of all primary stakeholders within the India Neobank market. Desk research and industry databases are employed to define and catalog essential market-driving variables, such as digital adoption rates and regulatory impacts.

Step 2: Market Analysis and Construction

Historical data on market penetration and service adoption are compiled and analyzed to determine revenue projections. This includes comparing neobanking penetration against traditional banking services and evaluating growth in payment gateway usage.

Step 3: Hypothesis Validation and Expert Consultation

Industry-specific hypotheses are developed and validated through interviews with senior professionals across neobank firms, providing operational insights on consumer behavior and technological challenges.

Step 4: Research Synthesis and Final Output

In the final phase, direct consultations with neobank executives allow for validation of trends and segment-specific findings, ensuring a thorough analysis of the India Neobank market with an emphasis on accuracy and reliability.

Frequently Asked Questions

01 How big is the India Neobank Market?

The India Neobank market, valued at USD 9.30 billion, is growing rapidly due to increasing mobile usage, digital adoption, and supportive regulations.

02 What are the challenges in the India Neobank Market?

Key challenges in the India Neobank market include regulatory constraints, high competition, and security concerns, all of which can impact consumer trust and market adoption.

03 Who are the major players in the India Neobank Market?

Prominent players in the India Neobank market include Paytm Payments Bank, Niyo Solutions, and RazorpayX, leveraging advanced technology and user-friendly platforms to capture significant market share.

04 What are the growth drivers of the India Neobank Market?

Growth drivers in the India Neobank market include smartphone penetration, government support for financial inclusion, and consumer demand for digital banking convenience.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.