India Night & Underwear Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD9023

December 2024

95

About the Report

India Night & Underwear Market Overview

- The India Night & Underwear Market is valued at USD 1 billion, based on extensive historical analysis. This market is primarily driven by increasing demand for comfortable, sustainable clothing and the rapid shift towards e-commerce platforms. The rise of online shopping, especially for intimate wear, has fueled the demand, with consumers gravitating toward convenience, privacy, and a wide array of options.

- The market is dominated by metropolitan cities like Mumbai, Delhi, and Bengaluru. These cities, with their diverse population and higher disposable incomes, foster a thriving demand for premium nightwear and underwear. Additionally, the presence of fashion-conscious consumers and a robust retail network enables brands to push innovative designs and sustainable products in these regions.

- The government's Make in India initiative has encouraged domestic manufacturing of textiles and garments, including nightwear and underwear. In 2024, the Indian textile sector has received investments worth INR 2,000 crore under this initiative, promoting local production and reducing reliance on imports, which has positively impacted the innerwear market.

India Night & Underwear Market Segmentation

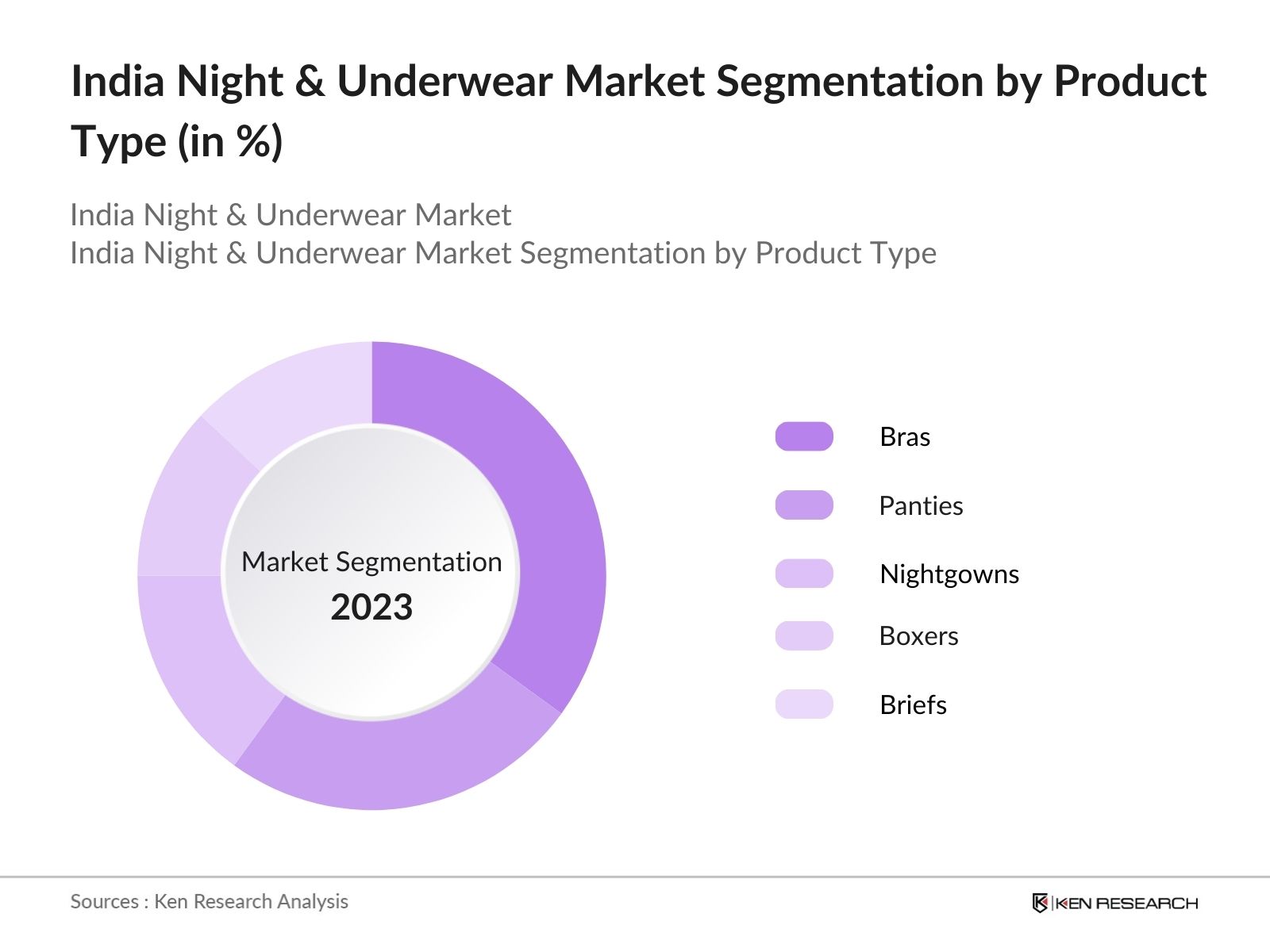

By Product Type: The market is segmented by product type into Bras, Panties, Nightgowns, Boxers, and Briefs. Bras continue to dominate the segment, as they are a staple of womens intimate wear and see frequent purchases due to hygiene and comfort concerns. The preference for more supportive, well-fitting bras and the increasing trend of sports bras as athleisure wear contribute to this dominance. Brands offering varied styles like push-up, t-shirt bras, and seamless bras are highly popular due to their comfort and functional diversity.

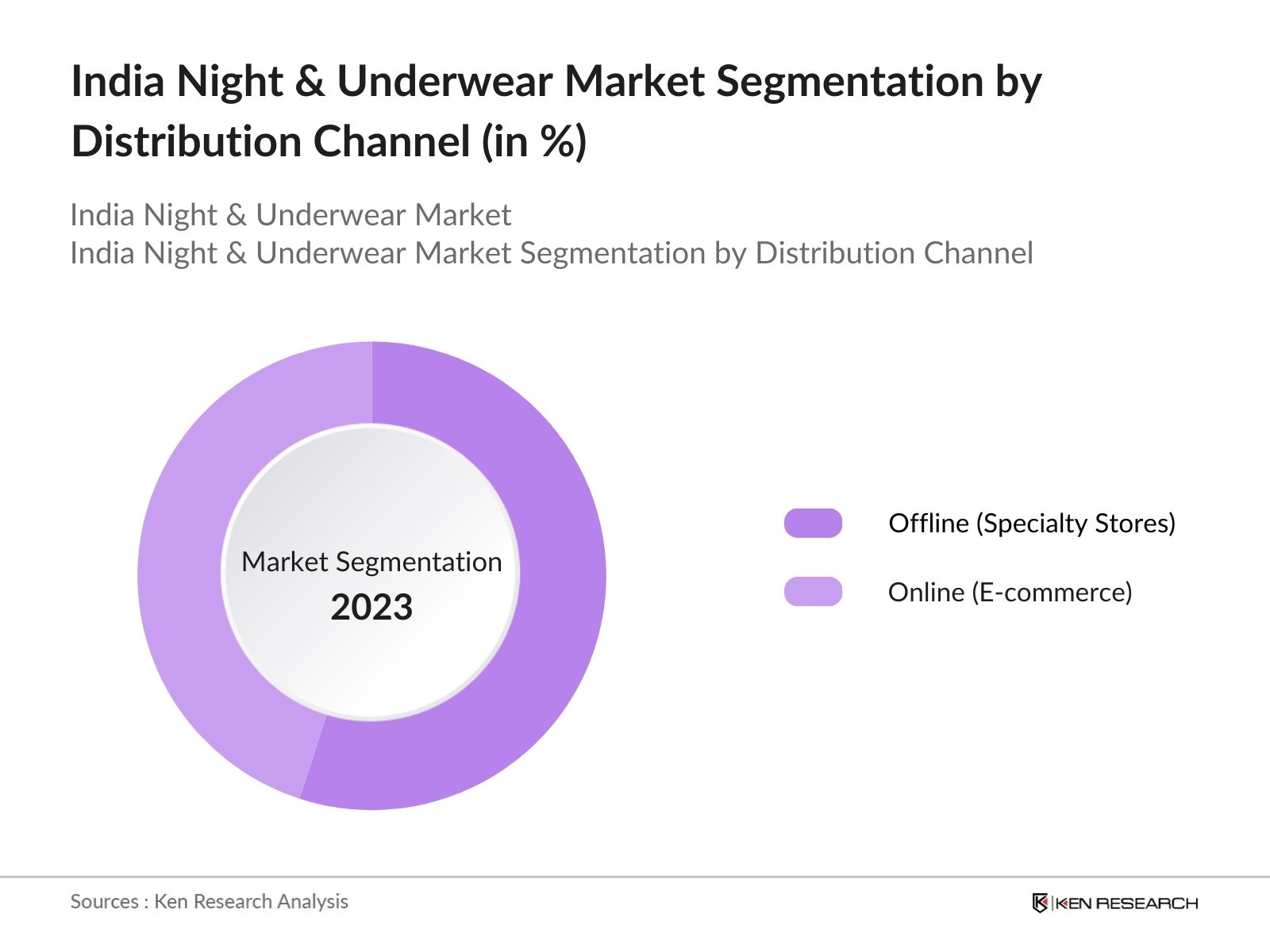

By Distribution Channel: The market is also segmented by distribution channel into Offline (Specialty Stores, Supermarkets) and Online (E-commerce Platforms, Brand Websites). E-commerce platforms have witnessed the most rapid growth in this segment, driven by convenience, easy return policies, and an increased variety of brands. Consumers prefer online shopping for intimate wear due to privacy concerns and the ability to access global brands. Additionally, the heavy discounts offered online have made this channel more attractive.

India Night & Underwear Market Competitive Landscape

The market is dominated by both international and local players. This competitive landscape highlights the influence of major brands, which have established themselves through years of brand loyalty, marketing, and distribution channels.

|

Company |

Established Year |

Headquarters |

Revenue (USD bn) |

Product Range |

Online Reach |

Sustainability Initiatives |

Brand Collaborations |

Market Penetration |

|

Jockey India |

1994 |

Bengaluru, India |

||||||

|

Lux Industries |

1957 |

Kolkata, India |

||||||

|

Clovia |

2013 |

Noida, India |

||||||

|

Van Heusen |

1881 |

New York, USA |

||||||

|

Zivame |

2011 |

Bengaluru, India |

India Night & Underwear Market Analysis

Market Growth Drivers

- Increase in Female Workforce Participation: The rise in the number of women entering the workforce in India has significantly contributed to the demand for nightwear and underwear, as women are seeking more comfortable and functional clothing options. According to the Ministry of Labour and Employment, the female labor force participation in 2024 is expected to reach 120 million, a notable increase from previous years, driving the demand for premium and mid-range lingerie products.

- Shift in Consumer Preferences Towards Comfort and Style: There has been a noticeable shift in consumer preferences towards comfort and stylish nightwear and underwear, especially among the younger population. In 2024, an estimated 700 million consumers in India fall within the age group of 15-40 years, fueling demand for fashion-forward innerwear that blends comfort with aesthetics. This trend is leading to the rapid expansion of the organized retail sector.

- Growing E-commerce Penetration: With over 500 million internet users in India in 2024, online platforms are becoming a popular purchasing medium for nightwear and underwear. The ease of access to a wide range of products, coupled with the rising trend of online shopping, has led to a surge in sales for this category. Companies like Zivame and Clovia have reported over a 20% increase in online sales for innerwear in the last two years, indicating robust market growth.

Market Challenges

- Limited Penetration in Rural Areas: Despite India's vast rural population of over 800 million people, penetration of organized and branded nightwear and underwear remains limited in rural regions. Due to lower purchasing power and lack of awareness, rural consumers often opt for cheaper, unbranded products. In 2024, the rural organized market accounts for only about 20% of total nightwear and underwear sales.

- Stiff Competition from International Brands: International brands such as Calvin Klein and Victorias Secret have entered the Indian market aggressively, providing stiff competition to domestic players. In 2024, these global brands have expanded their presence in metropolitan areas, capturing a significant share of the premium segment, which has led to increased pressure on domestic brands to innovate and differentiate themselves.

India Night & Underwear Market Future Outlook

Over the next five years, the India Night & Underwear industry is expected to show strong growth, driven by rising consumer awareness of premium, sustainable intimate wear and the proliferation of e-commerce platforms.

Future Market Opportunities

- Growth of Athleisure-inspired Innerwear: The athleisure trend will continue to influence the underwear market over the next five years. By 2029, an additional 15 million units of athleisure-inspired innerwear, which combines style, functionality, and comfort, are expected to be sold. This trend will be driven by a more health-conscious population that values both comfort and performance in their clothing.

- Expansion of Offline Stores in Tier II and Tier III Cities: By 2029, leading brands are expected to expand their retail presence in Tier II and Tier III cities to tap into the growing demand for branded innerwear. With an estimated 300 million consumers residing in these areas as of 2024, brands are likely to open over 1,000 new stores in the next five years, providing greater access to organized retail options.

Scope of the Report

|

Product Type |

Bras Panties Nightgowns Boxers Briefs |

|

Distribution Channel |

Offline (Specialty Stores, Supermarkets) Online (E-commerce Platforms, Brand Websites) |

|

Material |

Cotton Silk Polyester Cellulosic |

|

End User |

Women Men Kids |

|

Price Segment |

Premium Mid-range Economy |

|

Region |

North |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

C-Suite Executives

Product Developers and Marketers

Banks and Financial Institution

Private Equity Firms

E-commerce Platforms

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Textiles, Indian Textile Association)

Textile Manufacturers

Companies

Players Mentioned in the Report:

Jockey India

Lux Industries

Clovia

Van Heusen

Zivame

Amante

Rupa & Co. Ltd

Dixcy Scott

Hanes

Dollar Industries

Table of Contents

India Night & Underwear Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

India Night & Underwear Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Night & Underwear Market Analysis

3.1. Growth Drivers

3.1.1. E-commerce Expansion

3.1.2. Changing Consumer Preferences

3.1.3. Increased Brand Awareness

3.1.4. Sustainable Apparel Trends

3.2. Market Challenges

3.2.1. Price Sensitivity

3.2.2. Supply Chain Disruptions

3.2.3. Competition from Unorganized Sector

3.3. Opportunities

3.3.1. Rising Demand for Comfort Wear

3.3.2. Untapped Rural Markets

3.3.3. Celebrity Endorsements and Influencer Marketing

3.4. Trends

3.4.1. Shift Toward Eco-Friendly Fabrics

3.4.2. Rise in Loungewear Adoption

3.4.3. Customization in Underwear and Nightwear

3.5. Government Regulations

3.5.1. Import Tariff Structures

3.5.2. Compliance with Textile Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

India Night & Underwear Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Bras

4.1.2. Panties

4.1.3. Nightgowns

4.1.4. Boxers and Briefs

4.2. By Distribution Channel (In Value %)

4.2.1. Offline (Specialty Stores, Supermarkets)

4.2.2. Online (E-commerce Platforms, Brand Websites)

4.3. By Material (In Value %)

4.3.1. Cotton

4.3.2. Silk

4.3.3. Polyester

4.3.4. Cellulosic

4.4. By End User (In Value %)

4.4.1. Women

4.4.2. Men

4.4.3. Kids

4.5. By Price Segment (In Value %)

4.5.1. Premium

4.5.2. Mid-range

4.5.3. Economy

4.6. By Region (In Value %)

4.6.1. North

4.6.2. East

4.6.3. West

4.6.4. South

India Night & Underwear Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Jockey India

5.1.2. Lux Industries

5.1.3. Rupa & Co. Ltd

5.1.4. Amante

5.1.5. Clovia

5.1.6. Van Heusen

5.1.7. Enamor

5.1.8. Zivame

5.1.9. Dixcy Scott

5.1.10. Hanes

5.1.11. Dollar Industries

5.1.12. Calvin Klein India

5.1.13. VIP Clothing

5.1.14. Biba

5.1.15. DaMensch

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Distribution Reach, Sustainability Initiatives, Market Penetration, Innovations, Consumer Loyalty Programs, Expansion Strategies)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

India Night & Underwear Market Regulatory Framework

6.1. Textile Industry Standards

6.2. Import and Export Regulations

6.3. Certifications Required

India Night & Underwear Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

India Night & Underwear Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Material (In Value %)

8.4. By End User (In Value %)

8.5. By Price Segment (In Value %)

8.6. By Region (In Value %)

India Night & Underwear Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involves building an ecosystem map of key stakeholders in the India Night & Underwear Market. Extensive desk research is conducted using both proprietary and secondary databases to gather industry-level data. The main goal is to identify key variables such as product types, distribution channels, and consumer demographics that drive market dynamics.

Step 2: Market Analysis and Construction

Historical data on the market is compiled to assess its penetration levels and market size. This includes a detailed evaluation of sales channels, revenue generation, and pricing structures. Data accuracy is ensured through robust methodologies including trend analysis and comparison with industry benchmarks.

Step 3: Hypothesis Validation and Expert Consultation

The market hypothesis is then validated through expert interviews, using CATIS (Computer-Assisted Telephone Interviews). Industry veterans from leading companies are consulted to gain insights into consumer behavior and operational metrics, helping refine the hypothesis further.

Step 4: Research Synthesis and Final Output

The final phase of the research involves direct engagement with multiple manufacturers and retailers. This interaction helps to verify sales performance data and consumer preferences, ensuring that the final output is comprehensive, accurate, and reliable.

Frequently Asked Questions

01. How big is the India Night & Underwear Market?

The India Night & Underwear Market is valued at USD 1 billion, with contributions from online sales and increasing consumer preference for sustainable clothing options.

02. What are the challenges in the India Night & Underwear Market?

Challenges in the India Night & Underwear Market include high price sensitivity among consumers, competition from unorganized retailers, and rising raw material costs which affect the profitability of premium brands.

03. Who are the major players in the India Night & Underwear Market?

Key players in the India Night & Underwear Market include Jockey India, Lux Industries, Clovia, Van Heusen, and Zivame. These brands dominate due to their extensive distribution networks, innovative product offerings, and strong brand presence.

04. What are the growth drivers of the India Night & Underwear Market?

The growth drivers in the India Night & Underwear Market include rising e-commerce penetration, a shift towards comfort-first clothing, and the increasing adoption of body-positive and inclusive fashion. Additionally, the growing demand for eco-friendly fabrics is boosting market expansion.

05. What are the future trends in the India Night & Underwear Market?

Future trends in the India Night & Underwear Market include a focus on sustainability, with brands offering eco-friendly materials. There will also be an expansion in size inclusivity and maternity wear, targeting niche markets within the segment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.