India Nutraceutical Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD7377

November 2024

80

About the Report

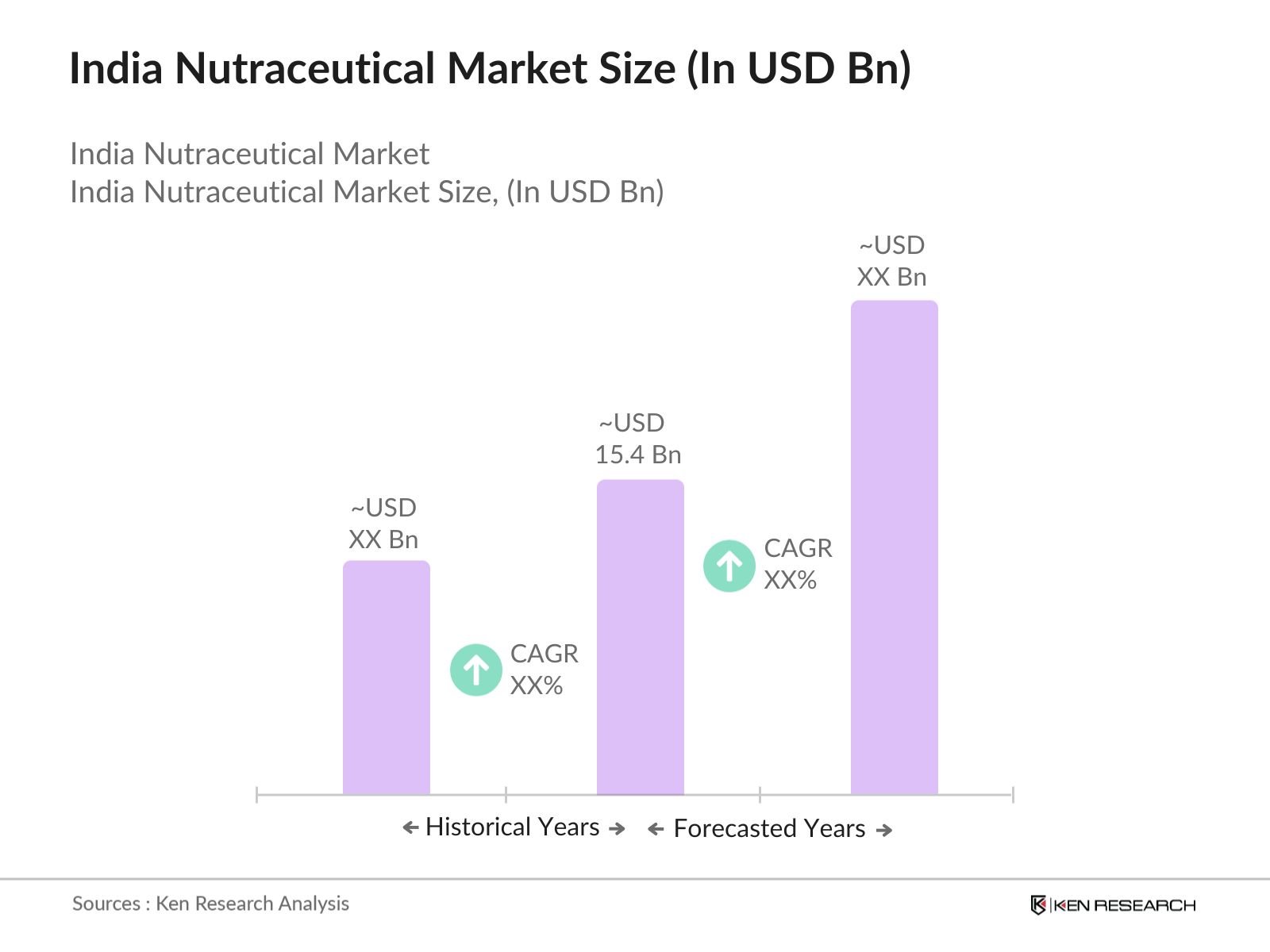

India Nutraceutical Market Overview

- The India nutraceutical market is valued at USD 15.4 billion, driven by the increasing awareness of preventive healthcare and a shift in consumer preferences towards dietary supplements and functional foods. The growth is majorly attributed to the rising disposable incomes, urbanization, and the heightened focus on maintaining health through fortified foods, dietary supplements, and herbal formulations. Additionally, the country's aging population is increasingly looking towards nutraceuticals to combat lifestyle-related health issues, further boosting market growth. These insights are backed by legitimate sources, including government-backed reports and leading research firms in the field.

- The market dominance in India is largely centered in metro cities like Mumbai, Delhi, and Bangalore, which lead in terms of consumption due to their higher purchasing power, access to premium healthcare products, and greater awareness of nutraceutical benefits. These cities have a well-developed retail infrastructure that supports the widespread distribution and sale of nutraceutical products, making them hubs for the industry. Their dominance is driven by consumers' inclination towards wellness products, especially in urban areas where lifestyle diseases like diabetes and heart disease are prevalent.

- FSSAIs stringent guidelines on labeling and ingredient safety play a crucial role in shaping the nutraceutical market. Over 5,000 product certifications were granted in 2023, highlighting regulatory compliance efforts. These regulations ensure product safety and transparency, essential for consumer trust in the nutraceutical sector.

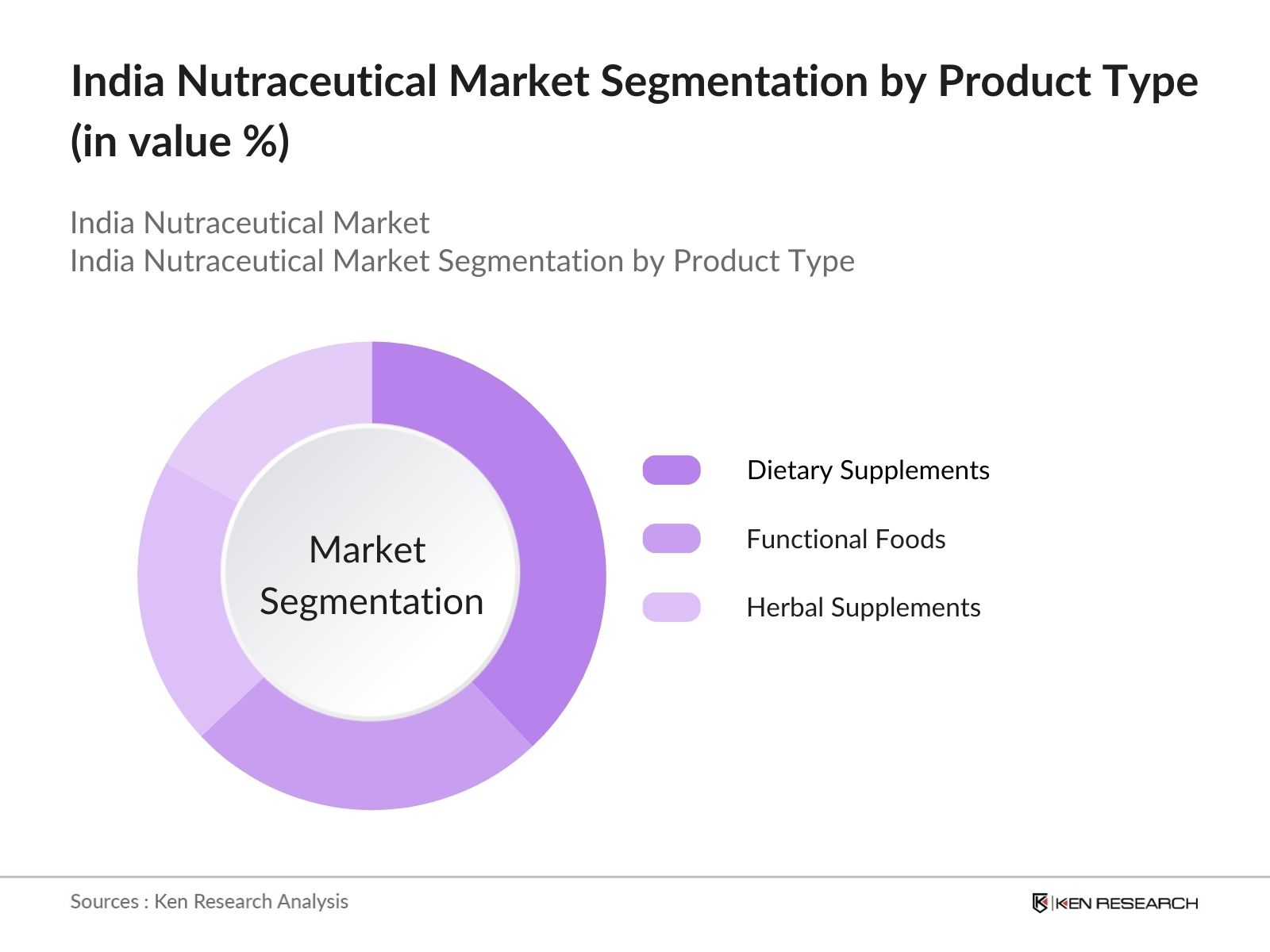

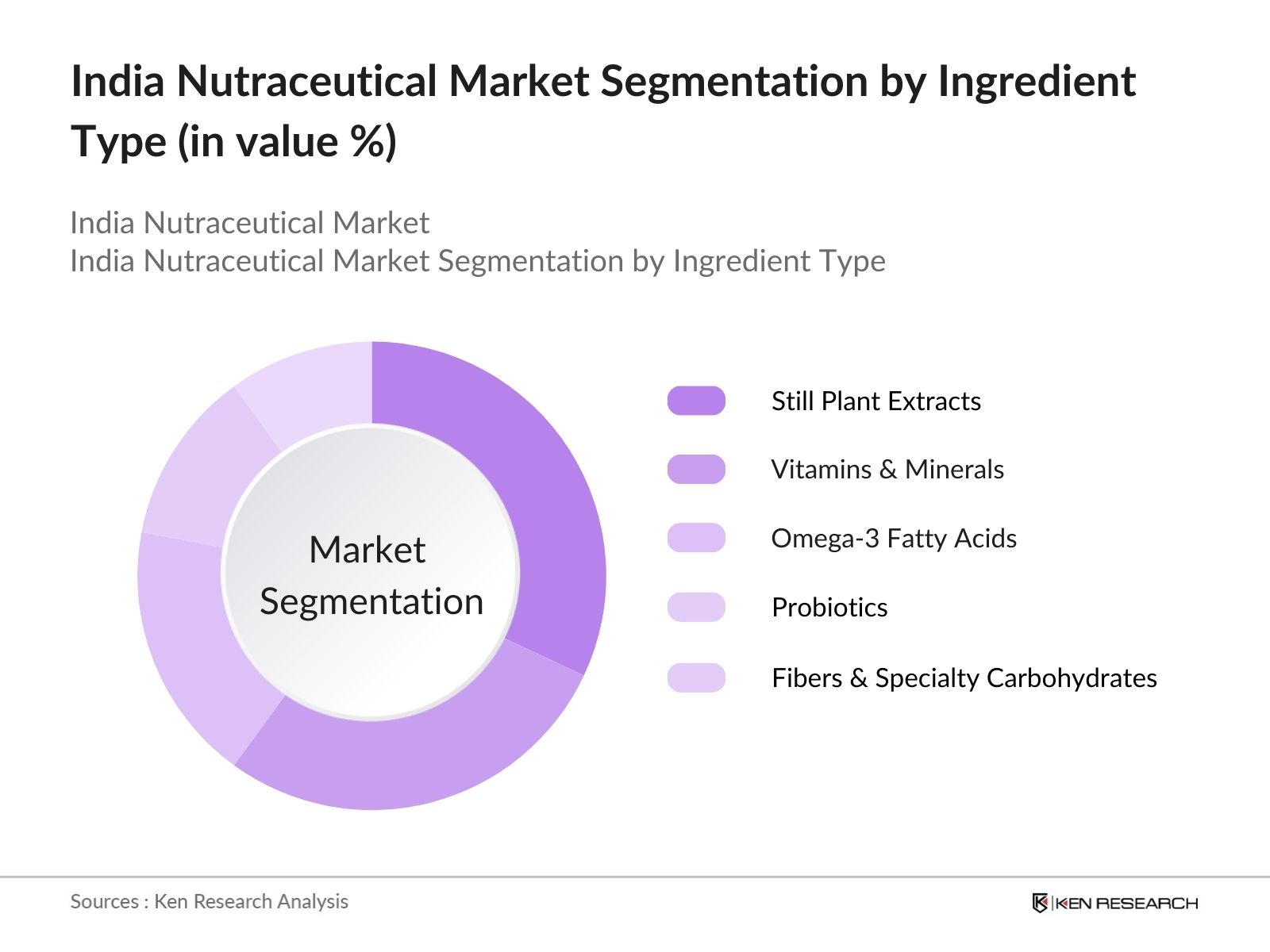

India Nutraceutical Market Segmentation

The India nutraceutical market is segmented by product type and by ingredient type.

- By Product Type: The market is segmented by product type into dietary supplements, functional foods, functional beverages, and herbal supplements. In 2023, dietary supplements have a dominant market share due to their widespread use among the health-conscious population. Vitamins and minerals lead this segment as they are essential for maintaining overall health, especially among the growing geriatric population. The rising awareness of immunity boosters, particularly post-pandemic, has also accelerated the demand for these products. Additionally, athletes and fitness enthusiasts increasingly consume protein supplements, contributing to the markets expansion.

- By Ingredient Type: The market is further segmented by ingredient type, including probiotics, vitamins & minerals, omega-3 fatty acids, fibers & specialty carbohydrates, and plant extracts. Among these, plant extracts dominate the market share due to the cultural and historical use of herbal remedies in India. The growing trend towards natural and organic health products has led to a significant increase in demand for ingredients like turmeric (curcumin), Ashwagandha, and green tea extracts, known for their medicinal properties. The Ayurvedic and herbal heritage of India positions these ingredients as preferred choices for consumers looking for safer, plant-based alternatives.

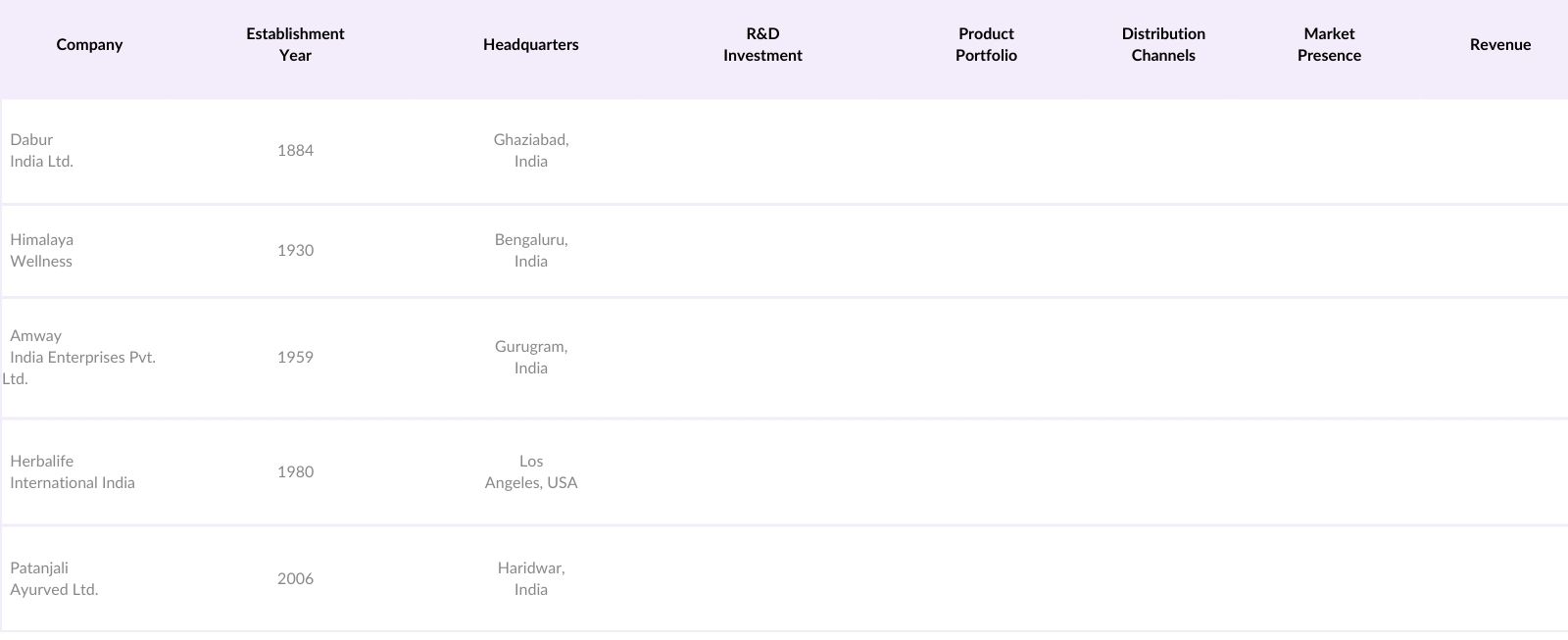

India Nutraceutical Market Competitive Landscape

The India nutraceutical market is dominated by key players who have established strong distribution networks and invest heavily in R&D. Major players include both multinational corporations and local players who compete based on product innovation and pricing. The market is characterized by its competitive nature, with key players leveraging their strong branding and customer loyalty. The nutraceutical market in India is characterized by the presence of both international brands such as Herbalife and local companies like Patanjali. These players have strong brand loyalty, extensive distribution networks, and have invested in consumer education to grow their market share.

India Nutraceutical Market Analysis

Growth Drivers

- Growing Consumer Awareness: Consumer awareness in India around functional foods and dietary supplements has surged, especially in urban centers where health-related spending increased by over 11% in 2023. An estimated 20 million people regularly consumed fortified foods, with a focus on vitamins, minerals, and protein supplements. Rising internet penetration (over 730 million active users) has also contributed to the accessibility of nutritional information. This accessibility correlates with a 25% increase in dietary supplement consumption across major cities like Delhi, Mumbai, and Bangalore, underscoring the demand for health-centric nutrition products.

- Rising Demand for Preventive Healthcare: Preventive healthcare spending in India has become a significant aspect of consumer behavior, with 15% of households shifting from treatment-focused spending to preventive health measures in 2023. Self-care and wellness practices are on the rise, evident from the steady growth in demand for nutraceutical products aimed at immunity and general wellness. Disposable income for the middle class increased by an average of $500 from 2022 to 2024, facilitating spending on wellness. Public health data supports this, showing a 12% reduction in hospital admissions due to preventive measures.

- Expanding Middle-Class Population: Indias middle-class population, estimated at over 350 million in 2024, has shown increased interest in health products, thanks to higher disposable incomes. Health expenditure for the middle class saw a significant boost, with an average of $150 dedicated annually to wellness and preventive products, as reported by the Ministry of Statistics and Programmed Implementation (MOSPI). The steady economic growth, with GDP per capita estimated at $2,400 in 2024, drives the trend of health-related spending across income brackets.

Market Challenges

- Regulatory Compliance Issues: Stringent Food Safety and Standards Authority of India (FSSAI) regulations present challenges for nutraceutical businesses. Nearly 15% of new products introduced in 2023 faced compliance issues due to unclear guidelines on ingredient use and labeling. FSSAI has set stringent standards for product safety, with penalties ranging from $2,000 for non-compliance. This regulatory environment requires ongoing investment in quality checks, impacting the pace at which companies can innovate and launch new products.

- High R&D Costs: High research and development (R&D) costs hinder nutraceutical companies from swiftly introducing innovative products. In 2023, R&D expenses accounted for over 20% of operational costs for major nutraceutical companies, primarily due to the high expense of sourcing premium ingredients and adhering to quality standards. The Ministry of Commerce and Industry reports that R&D costs in this sector are double compared to general FMCG products, owing to the unique requirements in formulation and bioavailability studies.

India Nutraceutical Market Future Outlook

Over the next five years, the India nutraceutical market is expected to witness significant growth, driven by an increasing focus on preventive healthcare, growing consumer preference for herbal and natural products, and government initiatives promoting wellness. The rise of e-commerce platforms has also played a vital role in expanding the reach of nutraceuticals, making them more accessible to a wider audience. Additionally, technological advancements in product formulations and packaging, along with the introduction of personalized nutrition solutions, will further fuel market expansion. The growing popularity of fitness and wellness trends, coupled with the rising incidence of lifestyle diseases, will propel demand for dietary supplements and functional foods.

Market Opportunities

- E-commerce and Digital Platforms: Indias e-commerce sector, valued at $150 billion in 2024, offers a vast distribution network for nutraceutical products. Approximately 55% of nutraceutical purchases were made online in major cities, reflecting the shift to digital platforms. Government initiatives like Digital India have improved internet access, which drives online sales for health supplements and wellness products, providing a lucrative channel for nutraceutical companies.

- Technological Advancements: With the rise of AI-driven health applications, consumers in India increasingly seek personalized nutrition solutions. Recent advancements allow nutraceutical companies to utilize AI for custom recommendations, catering to Indias tech-savvy population. The National Institution for Transforming India (NITI Aayog) reported that over 25 million consumers used health applications by 2023, boosting the demand for tailored health solutions. This trend reflects Indias rapid digital transformation and its impact on nutraceutical product adoption.

Scope of the Report

|

Dietary Supplements Functional Foods Functional Beverages Herbal Supplements |

|

|

By Ingredient Type |

Probiotics Vitamins & Minerals Omega-3 Fatty Acids Fibers & Carbohydrates Plant Extracts |

|

By Application |

Sports Nutrition Weight Management Digestive Health Heart Health Immunity Boosters |

|

By Distribution Channel |

Online Retail Offline Retail Specialty Stores D2C Platforms |

|

By Region |

North East West South |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of AYUSH)

Pharmaceutical Companies

Dietary Supplement Manufacturers

Functional Food & Beverage Manufacturers

Health and Wellness Retailers

E-commerce Platforms

Herbal and Ayurvedic Product Producers

Companies

Players Mention in the Report:

Dabur India Ltd.

Himalaya Wellness

Amway India Enterprises Pvt. Ltd.

Herbalife International India Pvt. Ltd.

Patanjali Ayurved Ltd.

Nestl India Ltd.

Abbott Nutrition

GNC Holdings, Inc.

Sun Pharmaceuticals Industries Ltd.

Cipla Health Ltd.

Zydus Wellness Ltd.

Procter & Gamble (P&G) Health

Sanofi India

GlaxoSmithKline Consumer Healthcare Ltd.

Danone India

Table of Contents

1. India Nutraceutical Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Driven by health-conscious consumer base, increasing demand for functional foods, rising geriatric population)

1.4. Market Segmentation Overview

2. India Nutraceutical Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Nutraceutical Market Analysis

3.1. Growth Drivers

3.1.1. Growing Consumer Awareness (Functional foods, dietary supplements, fortification trends)

3.1.2. Rising Demand for Preventive Healthcare (Shift towards self-care and wellness trends)

3.1.3. Expanding Middle-Class Population (Increased disposable income, spending on health products)

3.1.4. Increasing Geriatric Population (Nutritional deficiencies, demand for personalized nutrition)

3.2. Market Challenges

3.2.1. Regulatory Compliance Issues (Stringent FSSAI regulations, product standardization)

3.2.2. High R&D Costs (Innovation in formulations, ingredient sourcing challenges)

3.2.3. Limited Consumer Education (Lack of awareness about nutraceutical benefits)

3.3. Opportunities

3.3.1. E-commerce and Digital Platforms (Widespread access to nutraceutical products online)

3.3.2. Technological Advancements (Development of personalized nutrition apps, AI integration in product recommendation)

3.3.3. Increased Focus on Plant-based Ingredients (Rise of vegan and organic trends)

3.4. Trends

3.4.1. Fortified Foods and Beverages (Fortified snacks, cereals, dairy)

3.4.2. Personalized Nutrition (AI-driven customized health plans)

3.4.3. Probiotic and Prebiotic Products (Growing demand for gut health products)

3.4.4. Expansion of Ayurvedic Nutraceuticals (Traditional ingredients like Ashwagandha, Tulsi gaining momentum)

3.5. Government Regulation

3.5.1. FSSAI Guidelines (Labelling, ingredients, safety regulations)

3.5.2. Subsidies for Nutraceutical Startups (Government support through schemes and incentives)

3.5.3. Import Tariff Adjustments (Impact on raw material sourcing and international trade)

3.5.4. Public Health Initiatives (Government programs promoting fortified foods)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Manufacturers, Distributors, Retailers)

3.8. Porters Five Forces Analysis (Market rivalry, threat of substitutes, supplier and buyer power)

3.9. Competition Ecosystem (Key players in the nutraceutical space, distribution channels)

4. India Nutraceutical Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Dietary Supplements (Vitamins, Minerals, Protein Supplements)

4.1.2. Functional Foods (Fortified Cereals, Dairy, Bakery Products)

4.1.3. Functional Beverages (Energy Drinks, Fortified Juices, Probiotic Beverages)

4.1.4. Herbal Supplements (Ayurvedic Formulations, Plant-based Products)

4.2. By Ingredient Type (In Value %)

4.2.1. Probiotics

4.2.2. Vitamins & Minerals

4.2.3. Omega-3 Fatty Acids

4.2.4. Fibers & Specialty Carbohydrates

4.2.5. Plant Extracts (Curcumin, Green Tea, Ginseng)

4.3. By Application (In Value %)

4.3.1. Sports Nutrition

4.3.2. Weight Management

4.3.3. Digestive Health

4.3.4. Heart Health

4.3.5. Immunity Boosters

4.4. By Distribution Channel (In Value %)

4.4.1. Online Retail

4.4.2. Offline Retail (Supermarkets, Pharmacies)

4.4.3. Specialty Stores

4.4.4. Direct-to-Consumer (D2C Platforms)

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Nutraceutical Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Dabur India Ltd.

5.1.2. Himalaya Wellness

5.1.3. Amway India Enterprises Pvt. Ltd.

5.1.4. Herbalife International India Pvt. Ltd.

5.1.5. Patanjali Ayurved Limited

5.1.6. Nestl India Ltd.

5.1.7. Abbott Nutrition

5.1.8. GNC Holdings, Inc.

5.1.9. Danone India

5.1.10. Sun Pharmaceuticals Industries Ltd.

5.1.11. Cipla Health Ltd.

5.1.12. Zydus Wellness Ltd.

5.1.13. Procter & Gamble (P&G) Health

5.1.14. Sanofi India

5.1.15. GlaxoSmithKline Consumer Healthcare Ltd.

5.2 Cross Comparison Parameters (Revenue, Employee Count, Product Portfolio, Market Presence, Strategic Initiatives, R&D Investment, Distribution Network, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New product launches, market expansions, partnerships)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Nutraceutical Market Regulatory Framework

6.1. Regulatory Bodies (FSSAI, AYUSH)

6.2. Compliance Requirements (Labeling, safety testing, advertising)

6.3. Certification Processes (GMP, ISO certifications, organic labeling)

7. India Nutraceutical Future Market Size (In USD Bn)

7.1. Key Factors Driving Future Market Growth

7.2. Future Market Projections Based on Current Trends

8. India Nutraceutical Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. Marketing Initiatives

8.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on identifying key variables that influence the India nutraceutical market, including consumer behavior, regulatory factors, and technological advancements. This is supported by desk research leveraging proprietary databases and secondary sources.

Step 2: Market Analysis and Construction

This step includes the assessment of historical data and current market penetration levels. The goal is to provide an accurate depiction of market dynamics, including key drivers and challenges.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through interviews with industry stakeholders. These interviews provide critical insights into the operational landscape and help refine the analysis.

Step 4: Research Synthesis and Final Output

In the final step, the data is synthesized to create an actionable market report, incorporating insights from both primary and secondary research to ensure comprehensive coverage of the India nutraceutical market.

Frequently Asked Questions

01. How big is the India Nutraceutical Market?

The India nutraceutical market is valued at USD 15.4 billion. This growth is driven by the rising demand for dietary supplements and functional foods, alongside increased consumer awareness regarding health and wellness.

02. What are the challenges in the India Nutraceutical Market?

The India nutraceutical market faces challenges such as regulatory hurdles from bodies like FSSAI, high R&D costs for product innovation, and limited consumer awareness about the long-term benefits of nutraceutical products.

03. Who are the major players in the India Nutraceutical Market?

Key players in India nutraceutical market include Dabur India Ltd., Patanjali Ayurved Ltd., Himalaya Wellness, Amway India Enterprises Pvt. Ltd., and Herbalife International India Pvt. Ltd. These companies dominate due to their strong brand presence, extensive distribution networks, and diversified product portfolios.

04. What are the growth drivers of the India Nutraceutical Market?

The India nutraceutical market is propelled by factors like increasing consumer awareness of preventive healthcare, the rise of e-commerce platforms, and government initiatives promoting wellness and nutritional health.

05. What are the opportunities in the India Nutraceutical Market?

India nutraceutical market Opportunities include the growth of personalized nutrition solutions, the rising popularity of plant-based and herbal supplements, and the expansion of nutraceutical products into rural markets through improved distribution networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.