India Nutraceuticals Market Outlook to 2029

Region:Asia

Author(s):Shashank, Rhythm

Product Code:KR1492

April 2025

80-100

About the Report

India Nutraceuticals Market Overview

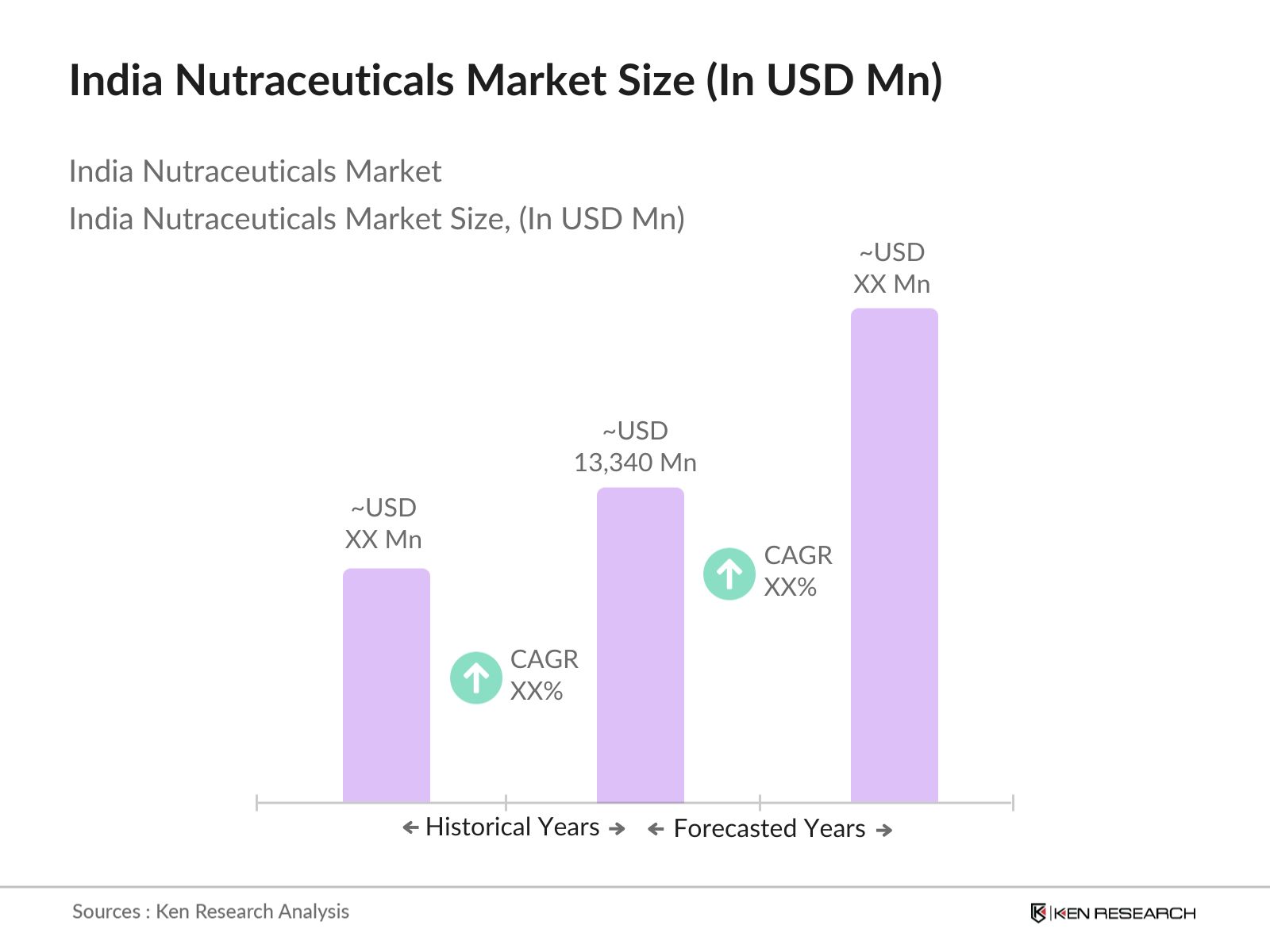

- The India Nutraceuticals market is valued at USD 13,340 million, based on a five-year historical analysis. The market has steadily grown due to increasing consumer awareness about lifestyle diseases, a shift toward preventive healthcare, and higher disposable incomes. Functional foods and dietary supplements, especially those fortified with vitamins, omega-3, and probiotics, are witnessing increased demand.

- Urban hubs such as Delhi, Mumbai, and Bengaluru serve as the primary consumption zones in the India Nutraceuticals Market. These cities are characterized by health-conscious populations, higher disposable incomes, and well-developed retail and e-commerce infrastructure. The concentration of modern pharmacies, wellness centers, and digital health platforms in these regions further drives nutraceutical accessibility and consumer engagement across diverse health segments.

- As of 2024, the Food Safety and Standards Authority of India (FSSAI) has mandated fortification norms for six staple food categories, including milk, oil, and salt, through its +F symbol scheme. Over 150,000 food products have now been registered under this initiative. Additionally, FSSAI conducts continuous nationwide surveillance of nutraceuticals under its Nutraceuticals Compliance Monitoring Programme. These measures aim to enhance consumer safety and promote transparency in ingredient sourcing and health claims.

India Nutraceuticals Market Segmentation

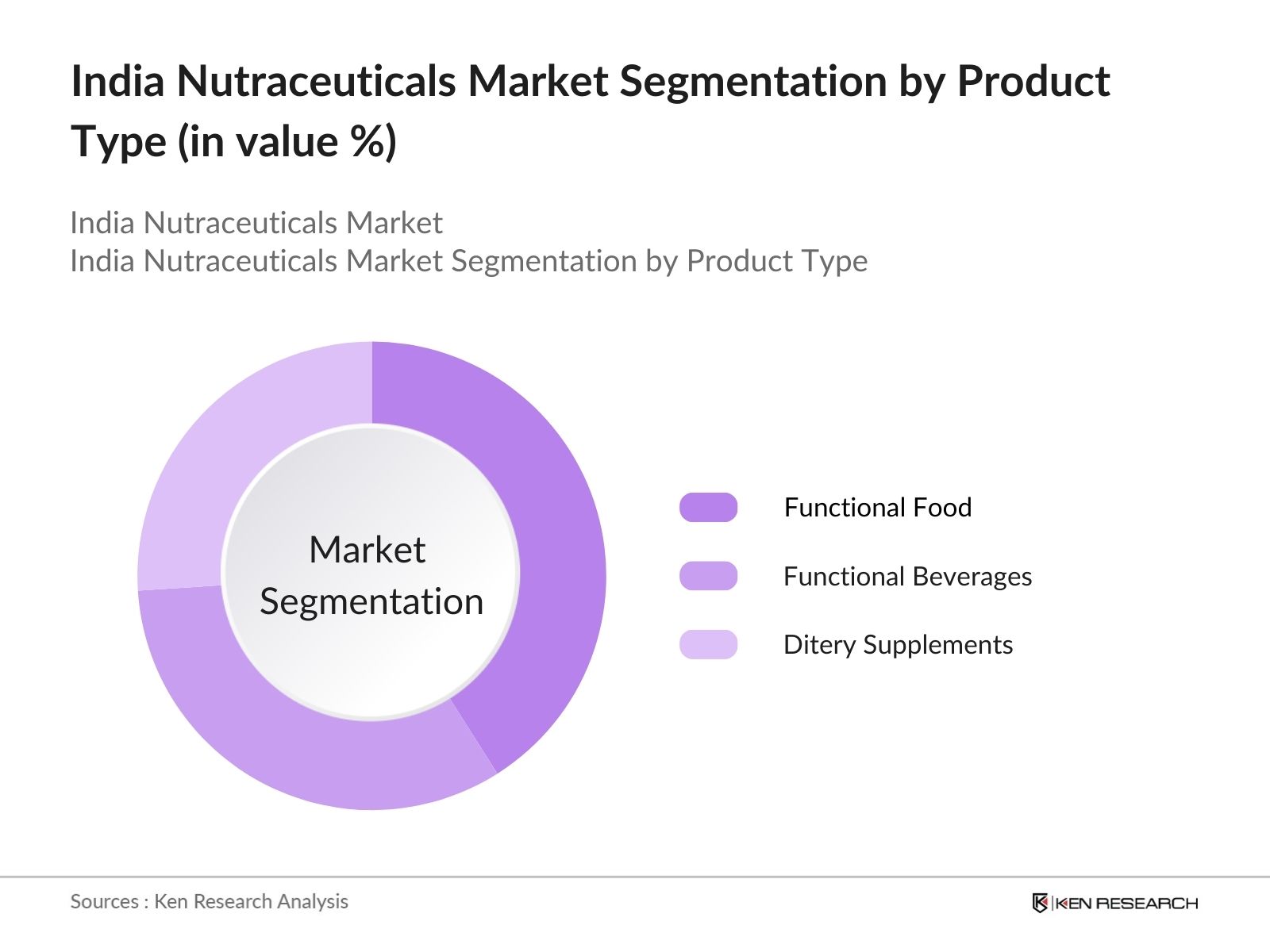

By Product Type: India Nutraceuticals Market is segmented by product type into functional food, functional beverages, and dietary supplements. Functional food leads due to rising demand for health-boosting foods like fortified cereals and probiotics. Their convenience suits urban lifestyles, while government-backed food fortification and the growing preference for on-the-go nutrition have further accelerated adoption, making functional food the most preferred segment among consumers.

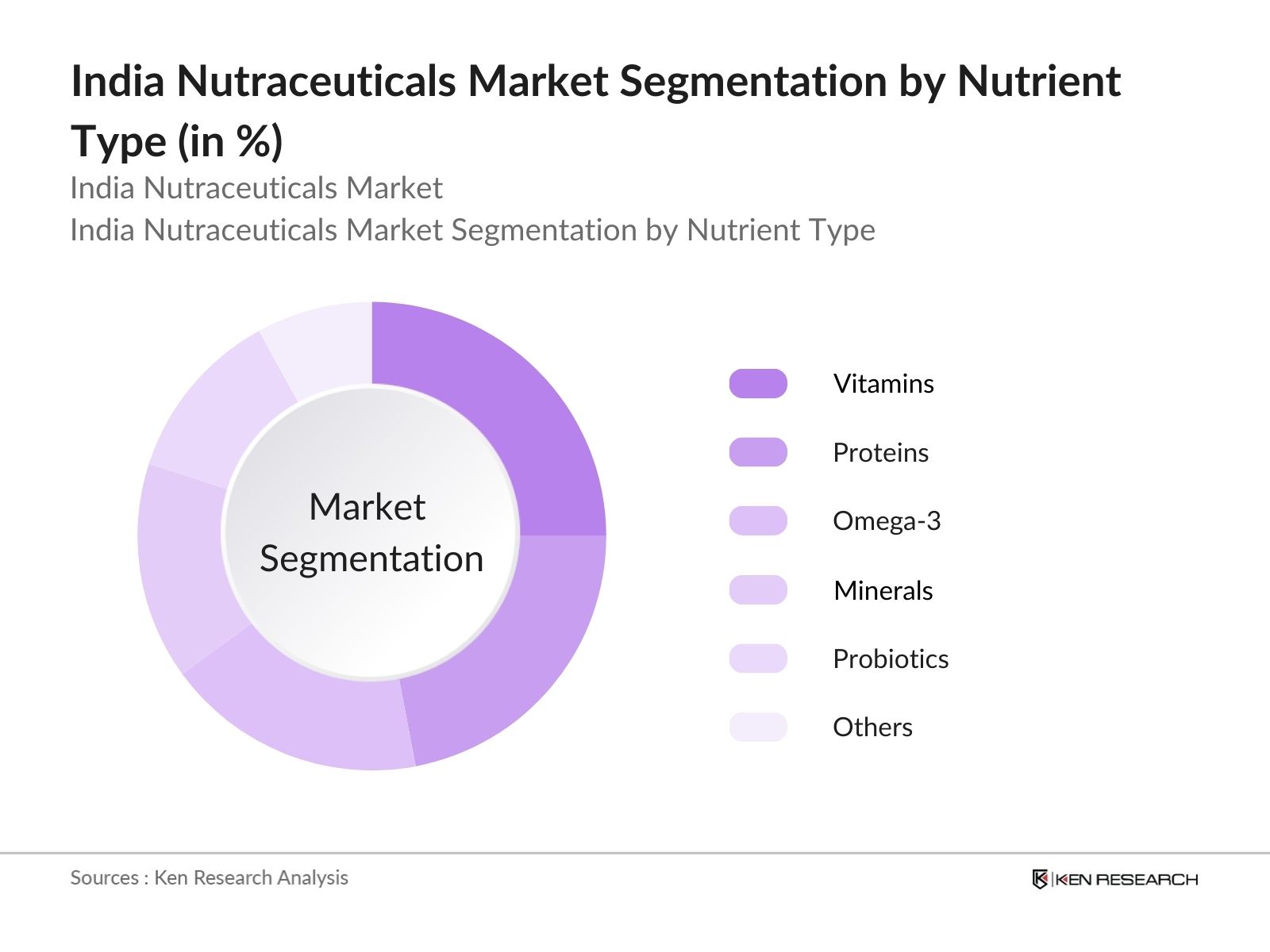

By Nutrient Type: India Nutraceuticals Market is segmented by nutrient type into vitamins, proteins, omega-3, minerals, probiotics, and others. Vitamins dominate due to their critical role in immunity and daily health, with widespread use of Vitamin C, D, and multivitamins. Easy availability in tablets, gummies, and effervescent forms enhances accessibility across age groups, supported by rising doctor recommendations.

India Nutraceuticals Market Competitive Landscape

India Nutraceuticals Market Competitive Landscape

The India Nutraceuticals market is dominated by a few major players including Amway, Herbalife Nutrition, Abbott, Himalaya Wellness Company, and Dabur. This consolidation highlights the significant influence of these key companies, which have established robust brand trust, diverse product portfolios, and widespread distribution channels across urban and semi-urban regions.

India Nutraceuticals Market Analysis

Growth Drivers

- Rising Urban Health Consciousness and Supplement Uptake: Urbanization in India has resulted in 498 million people living in urban areas in 2024, according to the World Bank. This demographic shift has been crucial in accelerating the uptake of dietary supplements and functional foods. With more than 330 million smartphone users and widespread internet connectivity, awareness about gut health, immune support, and personalized nutrition has increased. Coupled with changing dietary preferences and digital health tracking, this has positively influenced the demand for nutraceuticals among working professionals and millennials in metro cities.

- Infant Health and Women Wellness Supplements Demand: India recorded over 24 million live births in 2023, as per UNICEF and MoHFW statistics. This high birth rate, paired with a steadily improving female labor force participation rate (up to 37.0% in 2024 as per World Bank), has spurred demand for maternal nutrition and postnatal dietary support. The rise of fortified nutraceutical products targeting hormonal balance, PCOD/PCOS, and menopause support also coincides with Indias growing women-centric wellness sector. These dynamics are intensifying the growth of targeted nutraceutical formulations for female and infant health.

- Immunity-Driven Formulations and Preventive Care: A significant shift in consumer focus toward immunity-boosting and preventive care supplements has emerged post-pandemic. India's Ministry of AYUSH reported over 260 million citizens engaged with immunity-strengthening products in 2024 through AYUSH-licensed retail and digital platforms. Herbal immunity boosters and vitamin-based formulations are being increasingly adopted for respiratory, digestive, and metabolic health. This consumer trend, supported by government-endorsed wellness days and awareness drives, is deepening long-term demand across preventive healthcare categories.

Market Challenges

- Lack of Standardization and Regulatory Non-Compliance: In 2023, FSSAI reported over 7,200 samples of supplements failing compliance checks due to inconsistent ingredient labeling and exaggerated health claims. This lack of standardization restricts consumer confidence and hampers market penetration, especially for Ayurvedic and herbal formulations.

- Limited Penetration in Semi-Urban and Rural Markets: Despite growing urban demand, nutraceutical availability and awareness remain low in non-metro areas. Over 65% of India's population resides in rural regions (World Bank, 2024), where lack of regulatory outreach and supply-chain gaps limit consumption growth.

India Nutraceuticals Market Future Outlook

Over the next five years, the India Nutraceuticals market is expected to show significant growth driven by continuous government support, improvements in product innovation, and an increase in health awareness across age groups. The rising prevalence of non-communicable diseases, growing inclination towards self-health monitoring, and adoption of preventive healthcare are expected to remain strong market drivers. Advancements in e-commerce infrastructure, rising penetration of smartphones, and increased collaboration between pharma and food-tech companies will further expand the consumer base for nutraceuticals. Additionally, policy focus on nutritional security, food fortification, and local manufacturing incentives will act as strong tailwinds.

Market Opportunities

- Digital Health Integration and Personalized Nutrition Expansion: With 1.2 billion Aadhaar-linked health IDs already activated under ABDM in 2024, the foundation for hyper-personalized nutrition is well established. In the coming years, nutraceutical brands are expected to scale AI-powered supplement diagnostics, enabling real-time, biomarker-driven recommendations via telehealth platforms. As e-pharmacies continue integrating with national health databases, this convergence will empower pharmacies and brands to deliver precision-driven preventive care tailored to individual dietary gaps and lifestyle conditions.

- Surge in Women-Centric and Maternal Health Supplementation: India's 24 million live births and a 37% female workforce participation rate in 2024 (MoHFW, World Bank) are setting the stage for long-term demand in maternal nutrition and hormonal wellness products. Moving forward, companies are likely to expand R&D in lifecycle-based nutraceuticals, targeting stages like postnatal recovery, menstrual health, and menopause. This demand trajectory will be reinforced by dual-income families prioritizing preventive and functional nutrition for both mothers and infants.

Scope of the Report

|

By Product Type |

Functional Food |

|

By Nutrient Type |

Vitamins, Proteins |

|

By Form Type |

Capsule |

|

By Application Type |

General Health |

|

By Source Type |

Plant-Based |

Products

Key Target Audience

Dietary Supplement Manufacturers

Functional Food Producers

Online Health & Wellness Retailers

E-commerce Enablers for Health Products

Pharmaceuticals Firms (with OTC verticals)

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of AYUSH)

FMCG Players entering Health Nutrition

Companies

Players Mentioned in the Report

Amway

Herbalife Nutrition

Abbott

Himalaya Wellness Company

Dabur

Table of Contents

1. Indonesia Nutraceuticals Market Overview

1.1. Definition and Market Scope (Nutraceutical Classifications, FSSAI/ASEAN Guidelines, Market Inclusion Criteria)

1.2. Taxonomy of Indonesia Nutraceuticals Sector (By Nutrient, Product, Application, Form, Source)

1.3. Consumer Behavior Analysis (Purchase Frequency, Urban vs. Rural Penetration, Preferred Channels)

1.4. Macro Indicators (Healthcare Expenditure, Urbanization Rate, Geriatric Population, Women Workforce)

2. Indonesia Nutraceuticals Market Size (In USD Mn)

2.1. Historical Performance Analysis (2018–2023 Market Value and Volume)

2.2. Year-on-Year Growth Trends (Segment-Wise Acceleration, OTC Uptake, Supplement Usage)

2.3. Urban vs. Rural Nutraceutical Consumption

2.4. Household Health Product Spending Metrics

3. Indonesia Nutraceuticals Market Analysis

3.1. Growth Drivers (Chronic Disease Rates, Female Labor Force Data, Urban Health Trends)

3.2. Restraints (Regulatory Non-Compliance, Supply Chain Fragmentation, Low Penetration in Rural Indonesia)

3.3. Opportunities (Digital Health Integrations, Personalized Nutrition, OTC Wellness Rise)

3.4. Trends (Protein-Driven Innovations, Gut Health, Functional Ingredients, Gummy Format Rise)

3.5. Government Regulations (FSSAI Alignment, Fortification Programs, Herbal Ingredient Guidelines)

3.6. Value Chain Analysis (From Raw Material Sourcing to End Distribution)

3.7. Stakeholder Ecosystem (Supplement Manufacturers, Herbal Extract Producers, Pharmacies, Labs)

3.8. Porter’s Five Forces Model

3.9. Competitive Landscape Mapping

4. Indonesia Nutraceuticals Market Segmentation

4.1. By Product Type (Functional Food, Functional Beverages, Dietary Supplements)

4.2. By Nutrient Type (Vitamins, Proteins, Omega-3, Minerals, Probiotics, Others)

4.3. By Form Type (Tablet, Capsule, Powder, Liquid, Soft Gel, Others)

4.4. By Application Type (General Health, Sports Nutrition, Bone & Joint Health, Weight Management, Others)

4.5. By Source Type (Plant-Based, Animal-Based, Synthetic)

5. Indonesia Nutraceuticals Competitive Landscape

5.1. Company Profiles (5 Key Players)

5.1.1. Amway

5.1.2. Herbalife Nutrition

5.1.3. Abbott

5.1.4. Himalaya Wellness Company

5.1.5. Dabur

5.2. Cross Comparison Parameters (SKUs, R&D Spend, Herbal % Share, Digital Sales, Urban Reach, Source Focus, Regional Base, Form Innovation)

5.3. Market Share by Product Category and Brand Cluster

5.4. Recent M&A and Strategic Alliances

5.5. Distribution Channel Partnerships (Modern Trade, Online Health Platforms, Clinic Tie-ups)

5.6. Licensing and Certification Landscape

6. Indonesia Nutraceuticals Regulatory Framework

6.1. FSSAI-Equivalence Compliance in Indonesia (BPOM Guidelines)

6.2. National Fortification Programs

6.3. AYUSH-Type Herbal Safety Approvals

6.4. Labeling, Claims, and Advertisement Monitoring

7. Indonesia Nutraceuticals Future Market Size (In USD Mn)

7.1. Nutrient-Wise Value Projections

7.2. Supplement vs. Functional Food Uptake Shift

7.3. E-Pharmacy and Direct-to-Consumer Demand Outlook

8. Indonesia Nutraceuticals Future Market Segmentation

8.1. By Nutrient Type (Forecasted Value)

8.2. By Form Type (Forecasted Format Shift)

8.3. By Application Type (Emerging Demand Drivers)

8.4. By Product Type (Functionality Expansion)

8.5. By Region (Urbanization-Driven Split)

9. Analyst Strategic Insights and Recommendations

9.1. TAM/SAM/SOM Opportunity Matrix for Multinationals

9.2. White Space Mapping: PCOS, Senior Wellness, Immune Support

9.3. Entry Barriers for Herbal Brands and License Models

9.4. Localization Strategies for Mass Nutraceutical Players

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Nutraceuticals Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Nutraceuticals Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of consumption pattern changes is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple nutraceutical manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Nutraceuticals Market.

Frequently Asked Questions

01. How big is India Nutraceuticals Market?

The India Nutraceuticals Market, valued at USD 13,340 million, is driven by rising awareness around preventive healthcare, increased disposable income, and the growing demand for functional food and supplements.

02. What are the challenges in India Nutraceuticals Market?

India Nutraceuticals Market Face Challenges including lack of standardization across product categories, regulatory bottlenecks, pricing inconsistencies, and consumer skepticism due to counterfeit or unverified claims in the market.

03. Who are the major players in the India Nutraceuticals Market?

Key players in the India Nutraceuticals Market include Amway, Abbott, Herbalife Nutrition, Dabur, and Himalaya Wellness Company. These firms dominate due to strong distribution networks, diverse product lines, and robust consumer trust.

04. What are the growth drivers of India Nutraceuticals Market?

India Nutraceuticals Market Growth is driven by rising incidence of chronic diseases, increasing consumer awareness of preventive healthcare, and rapid expansion of e-commerce platforms offering health and wellness products.

05. Which city dominates the India Nutraceuticals Market?

Cities like Delhi, Mumbai, and Bengaluru dominate India Nutraceuticals Market due to their advanced healthcare infrastructure, strong demand for wellness products, and widespread retail and digital availability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.