India Nutraceuticals Market Outlook 2030

Region:Asia

Author(s):Harsh Saxena

Product Code:KR1550

December 2024

99

About the Report

India Nutraceuticals Market Overview

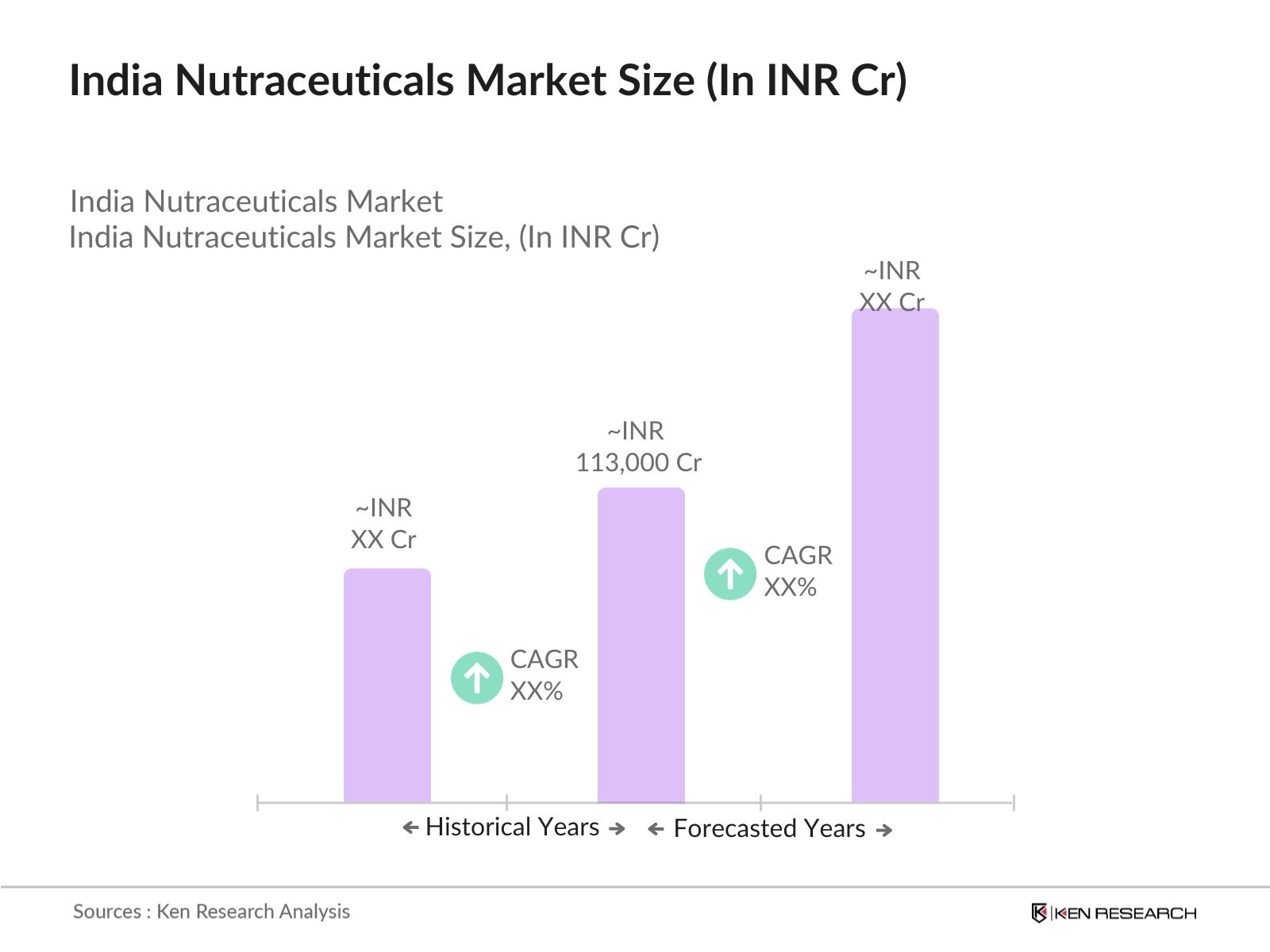

- The India nutraceuticals market is valued at INR 113,000 Crores, driven by increasing health awareness and rising disposable income among the population. Consumers are showing a growing preference for preventive healthcare solutions, and nutraceuticals are emerging as a popular choice. With government backing, particularly through the Food Safety and Standards Authority of India (FSSAI), the market has expanded significantly.

- The dominant regions in India's nutraceuticals market include major urban hubs like Mumbai, Delhi, and Bangalore, where economic activity and health-conscious consumer bases are strong. These cities boast advanced retail infrastructure and a growing reliance on e-commerce, making them key markets for nutraceutical products. Additionally, the presence of corporate headquarters for major nutraceutical companies in these regions drives concentrated marketing efforts, further solidifying their leadership in the market.

- The AYUSH Ministry has established clear standards for the production and sale of herbal supplements to promote traditional Indian medicine systems. The ministry's guidelines, revised in 2023, set strict criteria for the quality and authenticity of herbal ingredients used in nutraceutical products. According to data from the Ministry of AYUSH, more than 800 companies have registered under these guidelines, with over 300 new products certified for sale under the AYUSH-approved label. This regulatory framework ensures the credibility of herbal supplements in both domestic and international markets.

India Nutraceuticals Market Segmentation

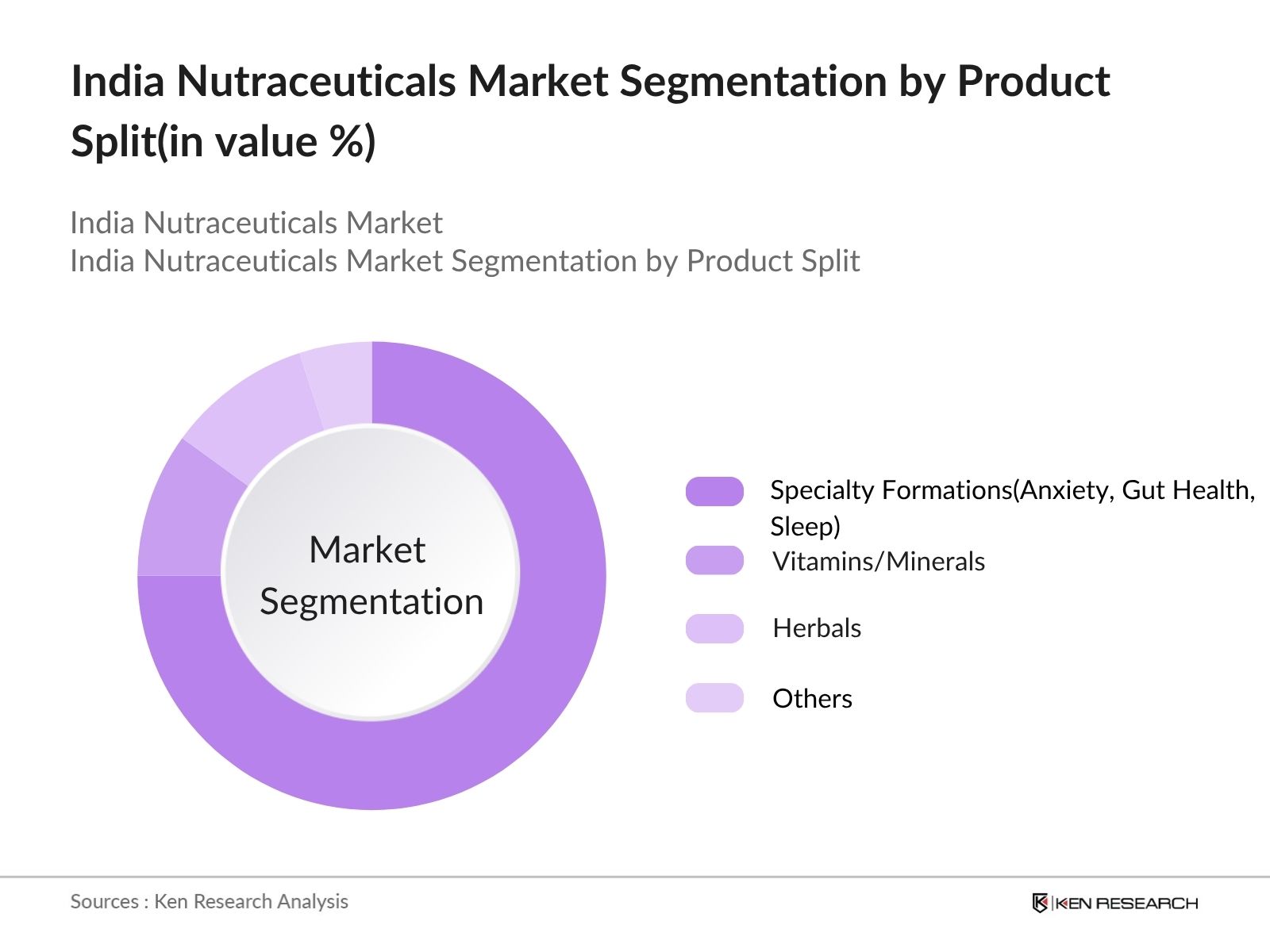

By Product Split: The India nutraceuticals market is segmented into Specialty Formulations, Herbals, Vitamins/Minerals, and Others. Specialty formulations—covering gut health, sleep, and anxiety—lead the market, driven by rising lifestyle stress and preventive health trends. Herbals are gaining strong traction due to increased consumer preference for Ayurveda and plant-based products. Vitamins and minerals also contribute significantly, as awareness around immunity and nutritional balance continues to grow. The market’s expansion is underpinned by a holistic wellness shift, with all segments reflecting strong growth across urban and semi-urban areas.

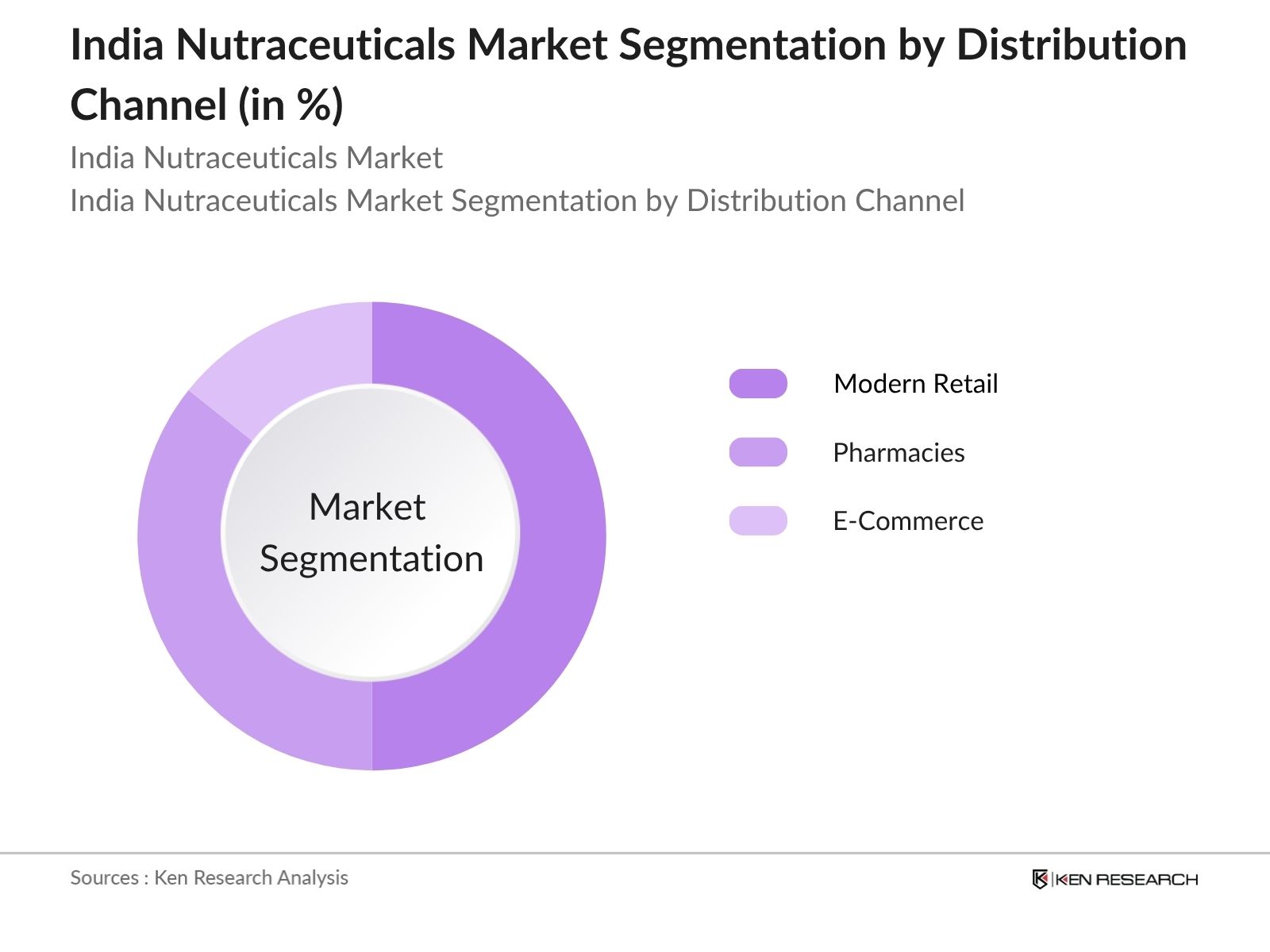

By Distribution Channel: The India nutraceuticals market is segmented into Modern Retail, Pharmacies, and E-Commerce. Modern retail dominates the landscape due to its wide reach, standardized quality, and growing presence in Tier I and Tier II cities. Pharmacies continue to serve as a trusted source for health supplements, especially among older consumers. However, E-commerce is the fastest-growing channel, driven by rising digital adoption and strategic partnerships with pharmacy chains. Online platforms like Tata 1mg, Netmeds, and Apollo 24/7 are making doorstep delivery, personalization, and competitive pricing more accessible to health-conscious consumers across India.

India Nutraceuticals Market Competitive Landscape

The India nutraceuticals market is dominated by both multinational and local players. Companies like Dabur and Patanjali Ayurved dominate the herbal and Ayurvedic segments, while global brands like GNC and Amway are strong in vitamins and dietary supplements. The competition is high, with players investing heavily in R&D, marketing, and distribution networks to stay ahead. The introduction of innovative products and strategic partnerships with e-commerce platforms have further intensified competition in the market.

|

Company |

Established |

Headquarters |

R&D Investment |

Distribution Network |

Product Range |

Revenue (USD Bn) |

Geographical Reach |

Partnerships |

|

Patanjali Ayurved Ltd. |

2006 |

Haridwar, India |

||||||

| Zydus (Cadila Healthcare) | 1952 | Gujarat, India | ||||||

| Abbott | 1888 | Chicago, Illinois, USA | ||||||

| Dr. Reddy's Laboratories Ltd. | 1984 | Hyderabad, India | ||||||

| Cipla Ltd. | 1935 | Mumbai, India |

India Nutraceuticals Market Analysis

Market Growth Drivers

- Growing Shift Toward Preventive Wellness: India’s nutraceutical market is witnessing strong momentum driven by rising demand for immunity boosters, gut health, weight management, and lifestyle-related disease prevention. Consumers are increasingly opting for herbal and plant-based products such as ashwagandha and probiotics, while formats like gummies, dissolvables, and functional beverages are gaining popularity. Post-COVID wellness culture, combined with digital access to health education, is reinforcing preventive consumption habits across urban and middle-class segments.

- Supportive Regulatory Framework Enhancements: The Food Safety and Standards Authority of India (FSSAI) is tightening labeling, safety, and health claims regulations for nutraceuticals, while ongoing discussions around disease-risk oversight may expand CDSCO’s role in future. These reforms aim to improve quality standards, ensure product transparency, and build consumer trust. With India’s regulatory environment evolving to match global benchmarks, manufacturers are innovating more confidently within a clearly defined compliance ecosystem.

- Urbanization and Rise of Health-Conscious Consumers: Rapid urbanization is reshaping nutraceutical demand by boosting purchasing power and shifting consumption toward personalized nutrition and functional foods. Urban consumers, especially women and aging populations, are seeking tailored solutions for chronic disease prevention, mood, sleep, and metabolism support. Retail pharmacies, e-commerce, and D2C brands are capitalizing on this shift, offering convenient access and reinforcing long-term growth across metro and semi-urban markets.

Market Challenges

- Regulatory Ambiguity and Compliance Burden (FSSAI, Standardization): India’s nutraceutical sector faces increasing compliance challenges due to regulatory ambiguity around FSSAI standards and overlap with AYUSH and drug classifications. Ambiguous definitions—especially for ingredients with therapeutic claims like curcumin or lycopene—complicate approval, labeling, and marketing. Over 15% of sampled health supplements failed compliance checks, highlighting the rising burden on manufacturers. SMEs, in particular, struggle to meet these evolving standards, delaying product launches and inflating costs.

- Consumer Skepticism and Prevalence of Counterfeit Products: Despite growing demand, low consumer trust in product efficacy and safety remains a key barrier to adoption. The rise of unregulated players selling supplements without proper FSSAI registration or scientific backing has worsened the issue. A 2023 survey found that 18% of products contained undeclared ingredients or failed label claims. This erodes brand credibility and hampers repeat purchases, forcing legitimate manufacturers to invest more in third-party testing and transparent labeling to regain confidence.

India Nutraceuticals Market Future Outlook

Over the next five years, the India nutraceuticals market is expected to show robust growth due to increasing consumer awareness, government initiatives, and advancements in product innovation. The shift towards preventive healthcare, combined with the increasing penetration of e-commerce, is likely to drive significant demand for nutraceuticals. Additionally, growing disposable income levels will make premium nutraceutical products more accessible to a broader audience, further boosting market growth.

Market Opportunities:

- Ayurveda-Driven Personalization Creating Hybrid Innovation Models: Ayurvedic principles are being adapted into modern nutraceutical formats—such as gummies, sprays, and effervescent tablets—to support personalization. Brands like TAE and Kapiva are blending traditional wisdom with tech-driven delivery systems to meet individual wellness needs across immunity, digestion, and energy. This hybridization caters to urban consumers seeking clean-label, convenient formats tailored to specific health outcomes.

- D2C Ecosystem Boosting Probiotic and Gut-Focused Offerings: Post-COVID awareness has accelerated demand for gut health solutions, with platforms like OZiva and Plix expanding probiotic SKUs through transparent, science-backed D2C models. These brands are capitalizing on increased digital engagement, offering subscription services and influencer-led communication to drive adoption. Probiotic-based formats—especially gummies and sachets—are now among the fastest-growing categories in India’s evolving preventive health market.

Scope of the Report

|

By Product Split |

Specialty Formations(Anxiety, Gut Health, Sleep) Vitamins/Minerals Herbals Others |

|

By Distribution Channel |

Modern Retail Pharmacies E-Commerce |

Products

Key Target Audience

Nutraceutical Manufacturers

Retail Chains and Pharmacies

E-commerce Platforms

Ingredient Suppliers

Government and Regulatory Bodies (FSSAI, Ministry of AYUSH)

Investments and Venture Capitalist Firms

Health and Wellness Centers

Hospitals and Medical Practitioners

Companies

Players Mentioned in the Report

Patanjali

Zydus (Cadila Healthcare)

Abbott

Dr. Reddy’s

Cipla

Sun Pharma

Alniche Life Sciences (alniche)

Nutrabay

ZeroHarm Sciences

Nutra Grace

Table of Contents

1. Executive Summary

2. Value Chain Analysis of Nutraceutical Landscape

3. Market Analysis

3.1. India Nutraceutical Market Size, FY’20 – FY’25 – FY’30F

3.1.1. By Type of Product Split, FY’25 – FY’30F

3.1.2. By Type of Distribution Channel, FY’25 – FY’30F

3.2. Average Realization, Margin Profiles

3.3. Consumer Health Trends & Urbanization Impact

-

Emerging Consumer Health & Wellness Trends

-

Impact of Urbanization on Nutraceutical Demand

4. India Contract Manufacturing (CDMO) Market Size & Private Label Solutions Scenario, FY’19 – FY’25 – FY’30F

4.1. India CDMO Market Size, Private Label Solutions Scenario & Growth

4.2. India as Top Global CDMO Destination

5. Export Market Dynamics

5.1. Export Market Sizing for Nutraceuticals from India with Focus on Russia, Africa, Philippines & LATAM, CY’25E

5.2. Regulatory Pathways & Registration Timelines

5.3. Export Matrix: Nutraceuticals

5.4. Margin Outlook: Nutraceuticals vs Contract Manufacturing

5.5. Trade Agreements & Forex Considerations

6. Innovation & Technology Adoption

6.1. In-house R&D Capabilities: Analytical & Product Development Labs

6.2. Tech-Transfer Framework: Pilot to Scale

6.3. Manufacturing Technologies: High-Shear Granulation, Capsule Filling, Coating

6.4. Digital Analytics for Process Optimization

7. Trends and Developments

7.1. Trends and Developments for the Nutraceutical Sector

8. Threats & Challenges to the Industry

9. Regulatory Landscape

9.1. Global Norms Governing Nutraceuticals

9.2. Domestic Compliance for Nutraceuticals

9.3. Global Entry Support by Key Government Initiatives

9.4. Export Enablement

9.5. Compliance Ecosystem and Regulatory Expertise

10. Government Initiatives

10.1. Policy & Incentives

10.2. Healthcare Missions

10.3. R&D & Infrastructure

10.4. Export Promotion

11. Competition Landscape

11.1. Major Players in the Industry

11.2. Positioning of SPL Biotech Ltd. in the Nutraceuticals Market

11.3. Cross-Comparison of Peers in India Nutraceuticals Export Market

12. Way Forward

13. Research Methodology

13.1. Market Definitions

13.2. Abbreviations

13.3. Market Sizing and Modeling

-

Consolidated Research Approach

14. Limitations

15. Conclusion

16. Disclaimer

17. Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research process begins with constructing a comprehensive ecosystem map of stakeholders within the India Nutraceuticals Market. Extensive desk research is conducted using both proprietary and public databases to gather accurate industry-level information. Critical variables influencing the market, such as consumer behavior, regulatory impacts, and market dynamics, are identified.

Step 2: Market Analysis and Construction

Historical data for the India nutraceuticals market is compiled, covering factors such as product penetration, consumer preferences, and regional market variations. The gathered data is analyzed to estimate market revenues and growth rates. Particular attention is paid to ensuring data reliability and accuracy, using multiple data points.

Step 3: Hypothesis Validation and Expert Consultation

The formulated market hypotheses are validated through direct interviews with industry experts. This is done using CATI (Computer Assisted Telephone Interviews), engaging key stakeholders such as nutraceutical manufacturers, distributors, and industry analysts. These consultations provide deep insights into operational and financial aspects of the market.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing all research findings into a cohesive report. In addition to numerical insights, qualitative inputs from nutraceutical manufacturers and industry experts are used to refine the market analysis. This ensures a well-rounded and accurate depiction of the India nutraceuticals market.

Frequently Asked Questions

01. How big is the India Nutraceuticals Market?

The India nutraceuticals market is valued at INR 113,000 Crores. The market is driven by increasing consumer demand for preventive healthcare solutions, such as dietary supplements and functional foods, amid growing health awareness.

02. What are the challenges in the India Nutraceuticals Market?

Key challenges include stringent regulatory compliance under FSSAI, limited consumer trust in the efficacy of nutraceutical ingredients, and a fragmented supply chain, which affects the timely distribution of products.

03. Who are the major players in the India Nutraceuticals Market?

The major players include Dabur India Ltd., Patanjali Ayurved Ltd., Himalaya Drug Company, GNC Holdings Inc., and Amway India Enterprises. These companies are leaders due to their extensive product range and strong distribution networks.

04. What are the growth drivers of the India Nutraceuticals Market?

Growth is driven by increasing health awareness, favorable government initiatives, and rising disposable incomes. The expanding e-commerce platforms are also boosting nutraceutical sales, allowing for wider market penetration.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.