India Nutritional Supplements Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD4364

October 2024

100

About the Report

India Nutritional Supplements Market Overview

- The India nutritional supplements market is valued at USD 35.25 billion, supported by growing consumer awareness regarding health and wellness. The demand for supplements has increased as more consumers seek to manage chronic diseases, support immunity, and achieve fitness goals. Key drivers include the expanding fitness industry, a rise in lifestyle-related diseases, and growing disposable incomes. The market is also benefiting from technological advancements in product development, particularly in personalized and plant-based formulations. Additionally, government initiatives encouraging health awareness and nutrition have positively impacted market growth.

- In terms of geographic dominance, metropolitan areas like Mumbai, Delhi, and Bengaluru have emerged as the primary hubs for nutritional supplement consumption. This is attributed to higher disposable incomes, urban lifestyles, and greater access to healthcare information. These cities are also centers for fitness and wellness trends, contributing to the increased demand for sports nutrition products and general health supplements. The concentration of gyms, fitness centers, and health-conscious consumers in these urban areas further boosts their dominant position in the market.

- The introduction of the Goods and Services Tax (GST) has had a significant impact on the pricing of nutritional supplements in India. With a GST rate of 18% applied to most supplements, there has been a noticeable increase in end-consumer prices, particularly for imported products. According to the Central Board of Indirect Taxes and Customs, GST revenue from the health and wellness sector grew to INR 12 billion in 2023. However, this taxation has also prompted domestic manufacturers to explore cost-efficient, locally sourced ingredients to remain competitive.

India Nutritional Supplements Market Segmentation

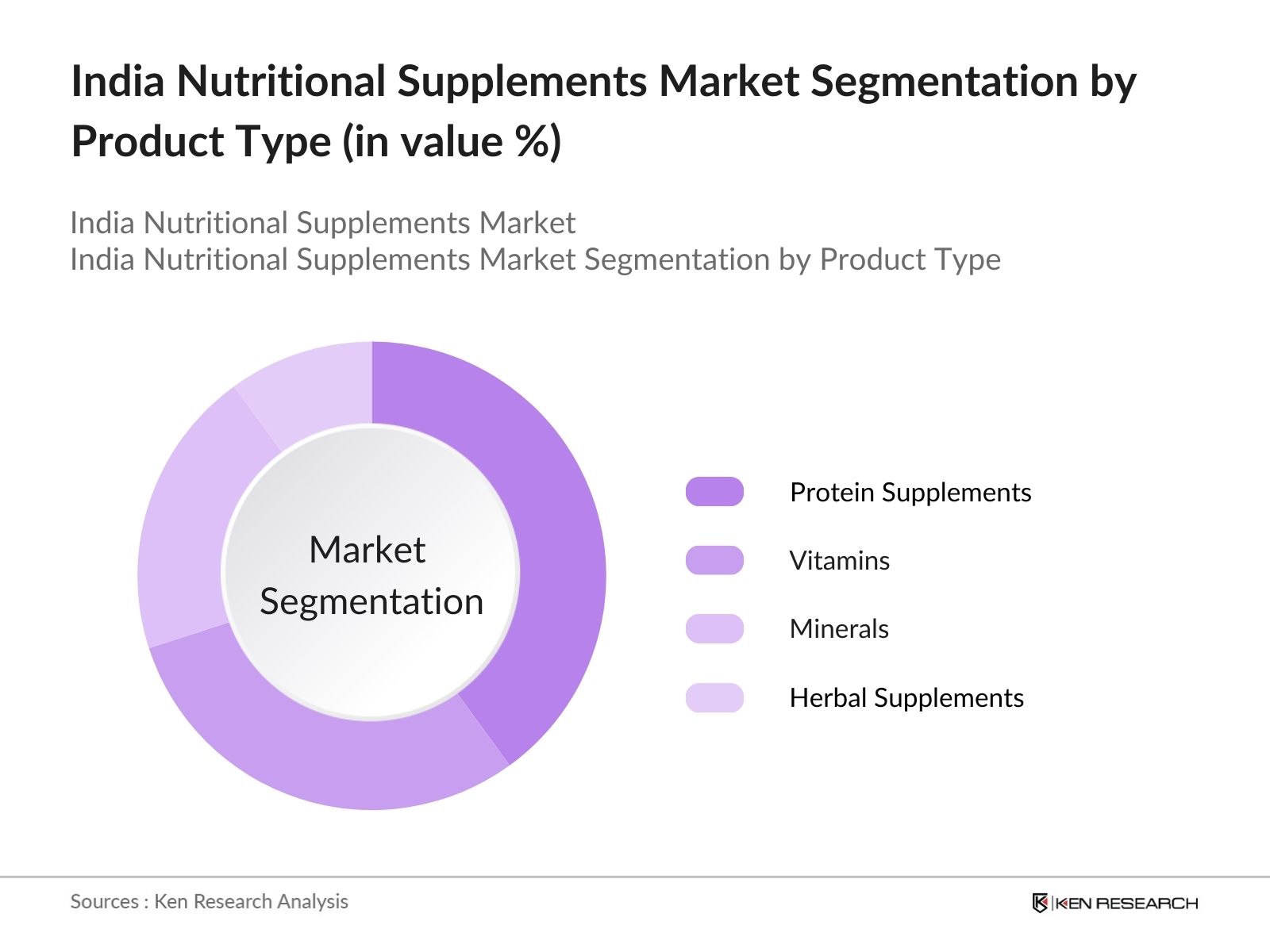

- By Product Type: Indias nutritional supplements market is segmented by product type into vitamins, minerals, protein supplements, herbal supplements, and omega-3 supplements. In 2023, protein supplements dominate the market, driven by the rising number of fitness enthusiasts and gym-goers who are actively seeking protein-rich diets. The demand is also supported by an increase in the vegan population and health-conscious individuals looking to supplement their diets with plant-based or alternative protein sources. Brands like MuscleBlaze and Optimum Nutrition have significantly boosted their product lines to cater to these demands, particularly in the metro cities where fitness culture is prevalent.

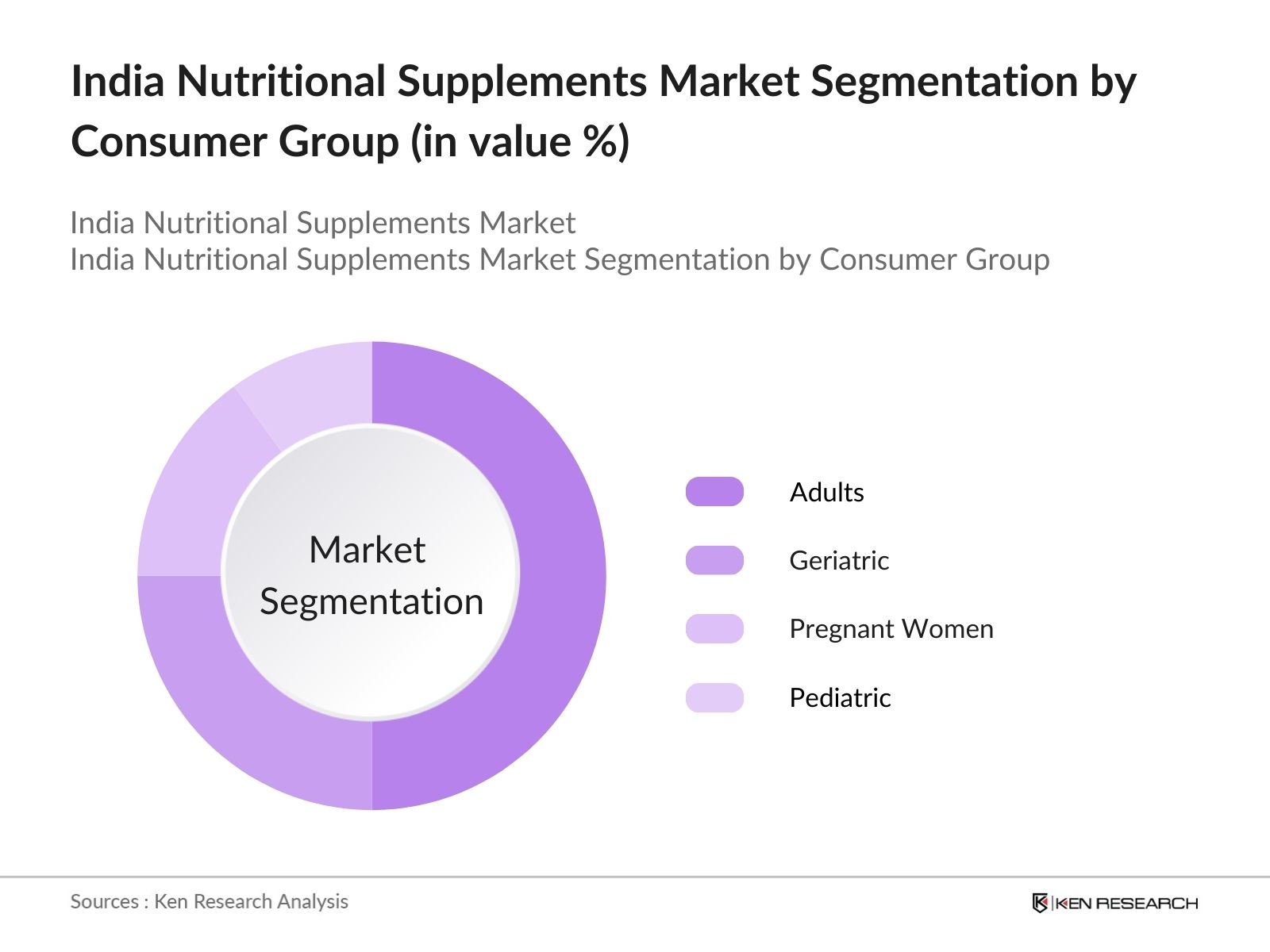

- By Consumer Group: By consumer group, the India nutritional supplements market is segmented into pediatric, adults, geriatric, pregnant women, and sports enthusiasts. Among these, the adult segment holds the largest market share in 2023, primarily due to the rising prevalence of lifestyle diseases such as diabetes, obesity, and cardiovascular issues. Adults are increasingly turning to supplements for preventative healthcare and to meet their nutritional gaps. Furthermore, the availability of a wide variety of products tailored to different age groups and specific health needs has led to significant adoption among this consumer segment.

India Nutritional Supplements Market Competitive Landscape

The India nutritional supplements market is dominated by both global and local players, creating a competitive yet dynamic environment. Key players such as Herbalife Nutrition, Amway India, and Abbott Nutrition are expanding their presence, fueled by growing consumer demand for high-quality and clinically-tested products. Local brands like Himalaya and MuscleBlaze have a stronghold due to their cost-effectiveness and tailored solutions for Indian consumers. The rise in direct-to-consumer sales through e-commerce platforms has also enabled smaller players to capture niche markets.

Major Players Table

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

Revenue |

R&D Spending |

Market Reach |

Distribution Channels |

Sustainability Initiatives |

|

Herbalife Nutrition |

1980 |

Los Angeles, USA |

||||||

|

Amway India Enterprises |

1959 |

Gurugram, India |

||||||

|

Abbott Nutrition |

1888 |

Chicago, USA |

||||||

|

Himalaya Wellness Company |

1930 |

Bengaluru, India |

||||||

|

MuscleBlaze |

2012 |

Gurgaon, India |

India Nutritional Supplements Industry Analysis

Market Growth Drivers

- Increasing Health Awareness: In India, consumer health awareness has been significantly growing, driven by rising healthcare penetration. As per the latest data from the Ministry of Health and Family Welfare, healthcare expenditure reached INR 5.95 trillion in 2023, reflecting increased public awareness towards preventive healthcare and nutrition. The Consumer Health Awareness Index shows a marked improvement from 61 in 2021 to 69 in 2023, signifying an upward trend in knowledge regarding health and wellness. Additionally, urban centers have seen increased uptake of vitamins and minerals, with 10 million households purchasing supplements regularly.

- Growing Sports Nutrition Demand: India has witnessed a steady rise in demand for sports nutrition products, driven by an increase in fitness awareness and sports participation. According to the Sports Authority of India, the athlete penetration rate rose to 15.3 athletes per 1,000 people in 2023, up from 12.5 in 2020. Moreover, sports nutrition consumption per capita stood at 1.8 kg in 2023, marking an increased focus on protein supplements, energy boosters, and recovery formulas. Sports nutrition brands are increasingly targeting the urban youth demographic, with over 500,000 fitness enthusiasts using specialized supplements.

- Rise in Geriatric Population: Indias geriatric population, aged 60 and above, reached 140 million in 2023 according to the Ministry of Statistics and Programme Implementation (MoSPI). This demographic shift has led to a surge in demand for supplements targeting age-related issues such as bone health and immunity. Supplement usage in the elderly population increased by 25%, with common choices being calcium and multivitamin supplements, owing to a higher prevalence of chronic diseases. Geriatric-specific nutrition brands have grown in availability, serving an estimated 30 million older adults.

Market Restraints

- Regulatory Compliance Hurdles: The regulatory landscape in India remains a significant challenge for nutritional supplement manufacturers. The Food Safety and Standards Authority of India (FSSAI) has set stringent guidelines, with an average compliance timeline of 18-24 months for product approvals. Indias Regulatory Compliance Index for nutritional products stands at 58 in 2023, indicating substantial delays in market entry due to regulatory bottlenecks. These issues make it difficult for new players to meet safety and labeling standards, especially those related to ingredient certifications.

- High Costs of Nutritional Ingredients: The high cost of nutritional ingredients is another significant challenge for the Indian supplement market. Prices of essential ingredients like whey protein and vitamins have increased due to import dependency. As of 2023, India imports 85% of its whey protein needs, contributing to high ingredient costs. The Nutritional Ingredient Price Index showed a 10% rise in the price of key ingredients between 2022 and 2023. The government has also imposed tariffs on several imported health ingredients, making domestically manufactured supplements more expensive.

India Nutritional Supplements Market Future Outlook

The India nutritional supplements market is poised for significant growth over the next five years. Increasing health awareness, rising consumer spending on healthcare, and the proliferation of e-commerce platforms will drive market expansion. Additionally, the market will witness a shift towards personalized nutrition, where supplements are customized based on individual health data. The growing popularity of herbal and plant-based supplements due to a rising preference for natural products is expected to further fuel market growth.

Market Opportunities

- Innovations in Product Formulations: Innovations in supplement formulations present significant opportunities for growth in Indias nutritional supplement market. The National Innovation Index of India highlights increased research and development in nutraceuticals, particularly in plant-based and immunity-boosting products. In 2023, over 120 new formulations were launched, including personalized vitamins, chewable supplements, and herbal blends designed to cater to specific health needs. This product innovation is driven by consumer demand for convenience and better absorption rates, opening new avenues for niche categories such as gut health and mental wellness supplements.

- E-commerce Growth: E-commerce has become a crucial growth channel for nutritional supplements in India. According to the Ministry of Electronics and Information Technology, the online sales growth rate for health and wellness products reached INR 150 billion in 2023, driven by the increasing adoption of digital payment platforms. E-commerce penetration in the nutritional supplement market grew to 18% in 2023, with platforms like Amazon, Flipkart, and niche health websites seeing a rise in monthly sales of supplements. This shift provides brands with direct access to consumers, especially in tier 2 and tier 3 cities.

Scope of the Report

|

By Product Type |

Vitamins, Minerals Protein Supplements Herbal Supplements Omega-3 Supplements |

|

By Consumer Group |

Pediatric Adults Geriatric Pregnant Women Sports Enthusiasts |

|

By Distribution Channel |

Pharmacies/Drug Stores Online Channels Supermarkets/Hypermarkets Specialty Stores |

|

By Formulation Type |

Capsules Tablets Powders Gummies Liquids |

|

By Region |

North India South India West India East India |

Products

Key Target Audience

Nutritional Supplement Manufacturers

Retailers and Distributors

Fitness and Wellness Centers

Pharmacies and Drug Stores

Healthcare Practitioners

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of Health)

E-commerce Platforms

Companies

Players Mentioned in the Report:

Herbalife Nutrition

Amway India Enterprises Pvt Ltd.

Abbott Nutrition

Glanbia Performance Nutrition

Himalaya Wellness Company

Sun Pharmaceuticals

Pfizer India

Dabur India Ltd.

Zydus Wellness Ltd.

Nestl Health Science

Nature's Bounty

GNC India

MuscleBlaze

Patanjali Ayurved Ltd.

Procter & Gamble Health Ltd.

Table of Contents

1. India Nutritional Supplements Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Nutritional Supplements Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Nutritional Supplements Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Awareness (Consumer Health Awareness Index, Healthcare Penetration)

3.1.2. Growing Sports Nutrition Demand (Sports Nutrition Consumption per Capita, Athlete Penetration Rate)

3.1.3. Rise in Geriatric Population (Aging Population Metrics, Supplement Usage in Elderly)

3.1.4. Government Initiatives for Health Promotion (Healthcare Expenditure, Government Nutrition Policies)

3.2. Market Challenges

3.2.1. Regulatory Compliance Hurdles (Compliance Index, Regulatory Approval Timeline)

3.2.2. High Costs of Nutritional Ingredients (Ingredient Price Index, Import Dependency)

3.2.3. Consumer Skepticism on Efficacy (Consumer Confidence Index, Supplement Rejection Rate)

3.3. Opportunities

3.3.1. Innovations in Product Formulations (Innovation Index, New Product Launches)

3.3.2. E-commerce Growth (Online Sales Growth, E-commerce Penetration)

3.3.3. Expansion in Rural Markets (Rural Penetration Rate, Distribution Channel Expansion)

3.4. Trends

3.4.1. Rise of Plant-based Supplements (Plant-based Supplement Growth, Consumer Preference Shift)

3.4.2. Personalization in Supplementation (Custom Product Requests, AI Integration in Nutrition)

3.4.3. Mergers and Acquisitions (M&A Volume, Strategic Alliances)

3.5. Government Regulation

3.5.1. FSSAI Guidelines on Nutritional Supplements (Regulatory Amendments, Compliance Requirements)

3.5.2. GST Impacts on Supplement Costs (Taxation Impact, GST Revenue Contribution)

3.5.3. Public Health Policies Supporting Nutritional Supplements (Public Health Initiative Participation, Government Campaigns)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Nutritional Supplements Market Segmentation

4.1. By Product Type (In Value %) 4.1.1. Vitamins

4.1.2. Minerals

4.1.3. Protein Supplements

4.1.4. Herbal Supplements

4.1.5. Omega-3 Supplements

4.2. By Consumer Group (In Value %) 4.2.1. Pediatric

4.2.2. Adults

4.2.3. Geriatric

4.2.4. Pregnant Women

4.2.5. Sports Enthusiasts

4.3. By Distribution Channel (In Value %) 4.3.1. Pharmacies/Drug Stores

4.3.2. Online Channels

4.3.3. Supermarkets/Hypermarkets

4.3.4. Specialty Stores

4.4. By Formulation Type (In Value %) 4.4.1. Capsules

4.4.2. Tablets

4.4.3. Powders

4.4.4. Gummies

4.4.5. Liquids

4.5. By Region (In Value %) 4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India Nutritional Supplements Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Herbalife Nutrition

5.1.2. Amway India Enterprises Pvt Ltd.

5.1.3. Abbott Nutrition

5.1.4. Glanbia Performance Nutrition

5.1.5. Himalaya Wellness Company

5.1.6. Sun Pharmaceuticals

5.1.7. Pfizer India

5.1.8. Dabur India Ltd.

5.1.9. Zydus Wellness Ltd.

5.1.10. Nestl Health Science

5.1.11. Nature's Bounty

5.1.12. GNC India

5.1.13. MuscleBlaze

5.1.14. Patanjali Ayurved Ltd.

5.1.15. Procter & Gamble Health Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, R&D Spending, Product Range, Geographic Reach, Distribution Network Strength)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Nutritional Supplements Market Regulatory Framework

6.1. FSSAI Compliance and Standards

6.2. FDA Approval Process for Supplements

6.3. Nutritional Labeling Standards

7. India Nutritional Supplements Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Nutritional Supplements Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Consumer Group (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Formulation Type (In Value %)

8.5. By Region (In Value %)

9. India Nutritional Supplements Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involves mapping the India Nutritional Supplements Market, focusing on major stakeholders such as manufacturers, distributors, and end-users. This step includes comprehensive secondary research, utilizing a mix of proprietary and publicly available databases to gather relevant market data and trends.

Step 2: Market Analysis and Construction

In this stage, historical data on market revenue, product categories, and consumer demographics are analyzed. The ratio of nutritional supplement purchases across various distribution channels is also evaluated. This aids in constructing accurate market forecasts and understanding demand patterns.

Step 3: Hypothesis Validation and Expert Consultation

To verify market hypotheses, in-depth interviews with industry experts and key opinion leaders are conducted. These consultations provide insights into consumer preferences, purchasing behaviors, and the impact of regulatory frameworks on market growth.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data, followed by cross-validation with industry practitioners. This ensures that the research outputs are accurate and align with real-world market conditions, particularly focusing on the competitive landscape and future trends in the nutritional supplements sector.

Frequently Asked Questions

1. How big is the India Nutritional Supplements Market?

The India Nutritional Supplements Market is valued at USD 35.25 billion, supported by growing demand for preventive healthcare products and a rising fitness culture in urban areas.

2. What are the challenges in the India Nutritional Supplements Market?

Challenges include regulatory compliance, high competition among local and international players, and fluctuating raw material prices that can affect profit margins.

3. Who are the major players in the India Nutritional Supplements Market?

Major players include Herbalife Nutrition, Amway India, Abbott Nutrition, Himalaya Wellness Company, and MuscleBlaze, each leveraging strong brand loyalty and distribution networks.

4. What are the growth drivers of the India Nutritional Supplements Market?

The market is driven by rising health consciousness, increased disposable incomes, and the growing trend of personalized nutrition solutions, especially in urban areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.