India Oil and Gas Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD7165

December 2024

94

About the Report

India Oil and Gas Market Overview

- The India Oil and Gas market is valued at USD 433.8 billion, based on a five-year historical analysis. This market is primarily driven by the country's growing energy demand across industrial, transportation, and residential sectors. As one of the fastest-growing economies, India's need for energy resources continues to expand, with investments made to enhance oil refining capacity and increase natural gas production to meet both domestic and industrial demands.

- Key cities such as Mumbai, New Delhi, and Jamnagar dominate the market. Jamnagar is home to one of the largest oil refineries in the world, operated by Reliance Industries, which gives it a central role in India's oil industry. Additionally, Mumbai serves as a key hub due to the presence of major oil companies, such as Oil and Natural Gas Corporation (ONGC), which operate offshore exploration activities. These cities have become central due to their infrastructural advancements and strategic positions along major transportation and energy corridors.

- The Hydrocarbon Exploration Licensing Policy (HELP) introduced in 2016 simplified the licensing regime for oil and gas exploration in India. By 2024, under this policy, over 105 exploration blocks covering 156,580 square kilometers have been awarded through Open Acreage Licensing Programme (OALP) bidding rounds. This policy is aimed at boosting exploration and production in unexplored and underexplored areas, providing operators the flexibility to explore both conventional and unconventional resources.

India Oil and Gas Market Segmentation

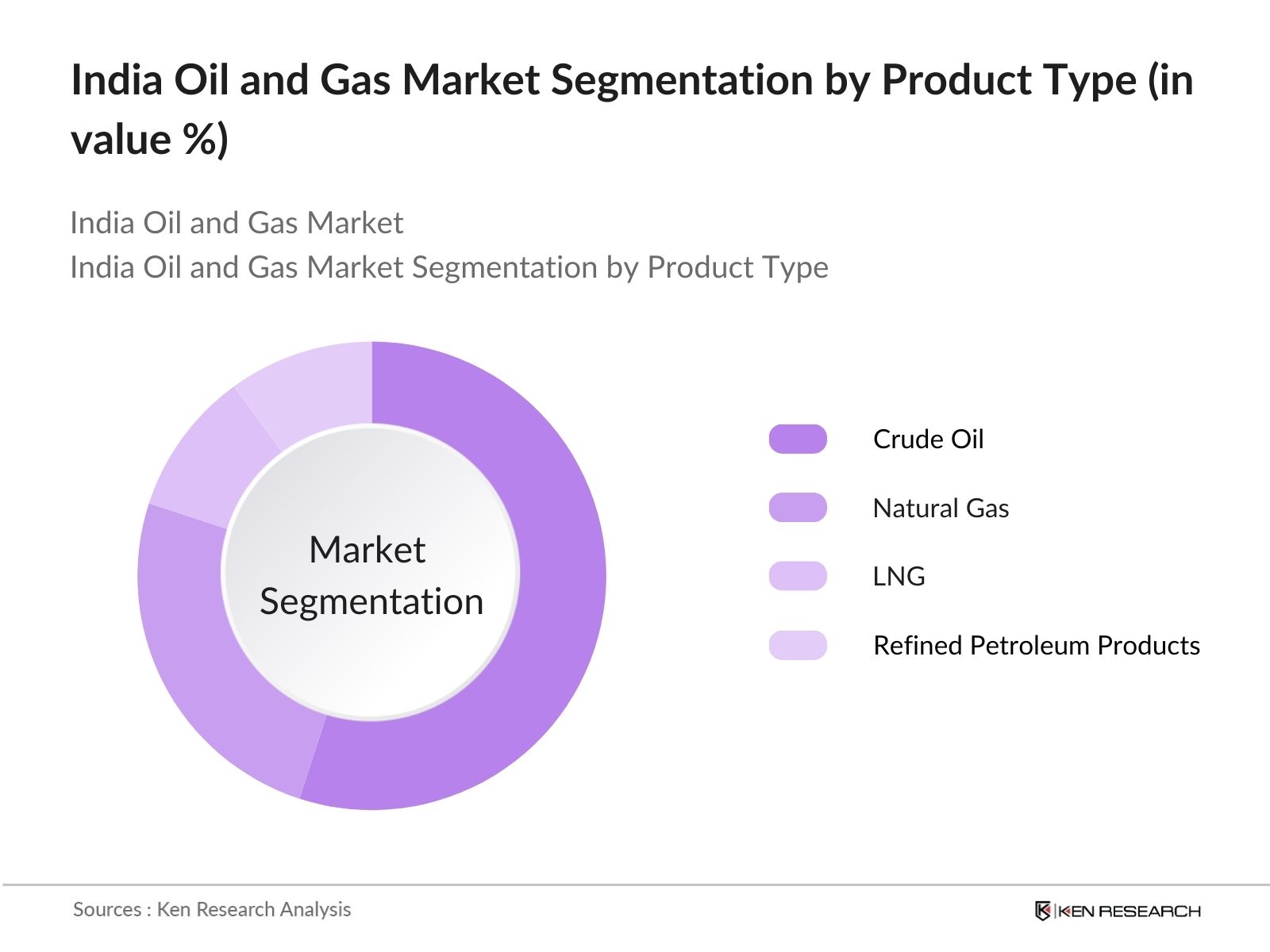

- By Product Type: Indias Oil and Gas market is segmented by product type into crude oil, natural gas, LNG, and refined petroleum products. Crude oil dominates the market primarily due to its essential role in refining processes that cater to transportation fuels, chemicals, and industrial usage. India's heavy reliance on crude imports, coupled with growing refining capacity, strengthens the dominance of this sub-segment. Furthermore, with expanding demand for transportation fuels, the refining and distribution of crude oil remain a critical part of the economy.

- By Application: The market is also segmented by application into industrial use, power generation, transportation, and residential/commercial usage. Transportation has a dominant market share in Indias oil and gas sector due to the high demand for diesel and petrol, which powers the majority of Indias vehicles. With the country's growing vehicle population and inadequate public transportation infrastructure in many regions, reliance on gasoline and diesel fuels remains high, thus bolstering this segment's lead.

India Oil and Gas Market Competitive Landscape

The India Oil and Gas market is dominated by both public and private sector entities. Major players include Indian Oil Corporation Limited (IOCL), Oil and Natural Gas Corporation (ONGC), and Reliance Industries, among others. Public sector companies such as ONGC and IOCL enjoy market presence due to government backing and operational scale, while private companies like Reliance lead in refining capacity.

|

Company Name |

Establishment Year |

Headquarters |

Refining Capacity (Barrels/Day) |

Natural Gas Infrastructure (Km) |

LNG Terminals (Count) |

Revenue (USD Bn) |

Exploration Licenses (Count) |

Sustainability Initiatives |

Production Volume (Million Tonnes) |

|

Indian Oil Corporation Ltd |

1959 |

New Delhi |

- |

- |

- |

- |

- |

- |

- |

|

Oil and Natural Gas Corp. |

1956 |

Dehradun |

- |

- |

- |

- |

- |

- |

- |

|

Reliance Industries Ltd |

1966 |

Mumbai |

- |

- |

- |

- |

- |

- |

- |

|

Bharat Petroleum Corp. Ltd |

1952 |

Mumbai |

- |

- |

- |

- |

- |

- |

- |

|

GAIL (India) Ltd |

1984 |

New Delhi |

- |

- |

- |

- |

- |

- |

- |

India Oil and Gas Market Analysis

India Oil and Gas Market Growth Drivers

- Energy Demand from Industrial Sector: India's industrial sector has witnessed a robust increase in energy demand, with oil and gas playing a critical role in fueling key industries such as manufacturing, power generation, and transportation. According to the World Bank, industrial consumption of energy reached around 360 million metric tonnes of oil equivalent (MTOE) in 2023, driven by large-scale infrastructure projects and increased manufacturing output. Additionally, the Indian economy is projected to grow steadily, with GDP expansion expected to sustain the need for energy, thereby strengthening the oil and gas sector. This trend positions the industry as a crucial enabler of India's industrial growth.

- Urbanization and Infrastructure Development: Indias urban population has been expanding rapidly, with more than 480 million people living in urban areas by 2024, according to the United Nations. This urbanization is coupled with aggressive infrastructure development, including highways, smart cities, and housing projects, driving demand for oil and gas for construction, transportation, and other utilities. The Indian government allocated INR 10 lakh crore ($125 billion) for capital expenditure in its 2024 Union Budget, targeting infrastructure growth, which directly impacts energy consumption in the oil and gas industry. The urbanization trend is anticipated to continue contributing to the sector's expansion.

- Increasing Domestic Refining Capacity: Indias domestic refining capacity is one of the largest in the world, with a total refining capacity of 250 million tonnes per annum (MTPA) as of 2024. Public and private refiners are expanding capacity to meet domestic and international demand for refined petroleum products. For instance, Indian Oil Corporation and other companies are involved in upgrading existing refineries to produce cleaner fuels, in line with the countrys commitment to achieving environmental targets. This growth in refining capacity bolsters Indias self-reliance in oil processing and enhances its role as a refining hub.

India Oil and Gas Market Challenges

- Exploration and Production (E&P) Regulatory Constraints: The Indian oil and gas industry faces regulatory challenges in exploration and production activities. The approval process for new oil fields and gas blocks, governed by policies such as the Hydrocarbon Exploration Licensing Policy (HELP), has been slow. India has only been able to develop around 70% of its sedimentary basins despite having a total sedimentary area of 3.14 million square kilometers as of 2024. This regulatory lag impacts timely exploration and development of resources, hindering the country's ability to enhance its domestic energy production.

- Environmental Concerns and Compliance: Environmental regulations concerning the oil and gas sector have become increasingly stringent in India, particularly after the country committed to achieving net-zero carbon emissions by 2070. According to India's Ministry of Environment, Forest and Climate Change (MoEFCC), the sector is responsible for emissions, necessitating the adoption of cleaner technologies and emission control measures. Compliance with these regulations adds to operational costs for companies, especially in exploration, refining, and transportation, creating financial and operational challenges for the sector.

India Oil and Gas Market Future Outlook

Over the next five years, Indias oil and gas market is projected to experience substantial growth driven by several factors, including government initiatives to reduce import dependency, development of domestic oil and gas fields, and the expansion of the liquefied natural gas (LNG) infrastructure. The shift towards cleaner energy sources, particularly natural gas, is expected to increase demand for LNG. Furthermore, ongoing advancements in exploration technology and increased foreign direct investment will continue to shape the industry.

India Oil and Gas Market Opportunities

- Foreign Direct Investments (FDI) in Oil and Gas Sector: The Indian oil and gas sector has seen a surge in Foreign Direct Investment (FDI), with the government allowing 100% FDI under the automatic route in many segments. In the financial year 2023, India attracted over $10 billion in FDI in petroleum refining and exploration activities, with global players investing in domestic oil companies. This influx of capital has spurred growth in both upstream and downstream activities, supporting expansion and modernization of infrastructure across the country.

- Renewable Energy Integration in Oil and Gas Operations: India's oil and gas companies are increasingly integrating renewable energy into their operations to reduce their carbon footprint. Public sector companies like ONGC and Indian Oil are investing in solar and wind energy to power their oil fields and refineries. As of 2023, Indian Oil had installed over 240 MW of renewable energy capacity across its operations, contributing to a more sustainable business model. This integration of renewables offers an opportunity for companies to improve operational efficiency while addressing environmental concerns.

Scope of the Report

|

Product Type |

Crude Oil Natural Gas LNG Refined Petroleum Products |

|

Application |

Power Generation Industrial Use Transportation Residential and Commercial Use |

|

Technology |

Offshore Exploration Onshore Exploration Refining Technology Gasification and LNG Technology |

|

Sector |

Upstream Midstream Downstream |

|

Region |

Northern Region Western Region Southern Region Eastern Region |

Products

Key Target Audience

Oil and Gas Exploration Companies

Refining and Processing Companies

Government and Regulatory Bodies (Ministry of Petroleum and Natural Gas, Directorate General of Hydrocarbons)

LNG Import and Export Companies

Transportation and Logistics Firms

Banks and Financial Institutions

Pipeline Infrastructure Companies

Investor and Venture Capitalist Firms

Equipment and Technology Providers

Companies

Players Mentioned in the Report

Indian Oil Corporation Limited (IOCL)

Oil and Natural Gas Corporation (ONGC)

Reliance Industries Limited

Bharat Petroleum Corporation Limited (BPCL)

Hindustan Petroleum Corporation Limited (HPCL)

GAIL (India) Limited

Essar Oil and Gas Exploration and Production Ltd.

Cairn Oil and Gas

Shell India

ExxonMobil India

Table of Contents

1. India Oil and Gas Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Industry Value Chain

1.4. Market Growth Rate

1.5. Market Segmentation Overview

2. India Oil and Gas Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

2.4. Domestic Production vs. Import Dependency

2.5. Capital Expenditure Analysis

3. India Oil and Gas Market Analysis

3.1. Growth Drivers

3.1.1. Energy Demand from Industrial Sector

3.1.2. Urbanization and Infrastructure Development

3.1.3. Government Policies and Subsidies

3.1.4. Increasing Domestic Refining Capacity

3.2. Market Challenges

3.2.1. Exploration and Production (E&P) Regulatory Constraints

3.2.2. Environmental Concerns and Compliance

3.2.3. Declining Domestic Reserves

3.2.4. Dependency on Imports

3.3. Opportunities

3.3.1. Foreign Direct Investments (FDI) in Oil and Gas Sector

3.3.2. Technological Innovations in Exploration and Production

3.3.3. Renewable Energy Integration in Oil and Gas Operations

3.3.4. Strategic Petroleum Reserves

3.4. Trends

3.4.1. Digitalization of Oil and Gas Operations

3.4.2. Development of LNG Infrastructure

3.4.3. Growth in Natural Gas Demand

3.4.4. Sustainable and Environmentally Friendly Operations

3.5. Government Regulations

3.5.1. Hydrocarbon Exploration Licensing Policy (HELP)

3.5.2. Natural Gas Marketing Reforms

3.5.3. Strategic Petroleum Reserves Policy

3.5.4. Indias National Policy on Biofuels

3.6. SWOT Analysis

3.7. Stake Ecosystem Analysis

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Oil and Gas Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Crude Oil

4.1.2. Natural Gas

4.1.3. LNG

4.1.4. Refined Petroleum Products

4.2. By Application (In Value %)

4.2.1. Power Generation

4.2.2. Industrial Use

4.2.3. Transportation

4.2.4. Residential and Commercial Use

4.3. By Technology (In Value %)

4.3.1. Offshore Exploration

4.3.2. Onshore Exploration

4.3.3. Refining Technology

4.3.4. Gasification and LNG Technology

4.4. By Sector (In Value %)

4.4.1. Upstream

4.4.2. Midstream

4.4.3. Downstream

4.5. By Region (In Value %)

4.5.1. Northern Region

4.5.2. Western Region

4.5.3. Southern Region

4.5.4. Eastern Region

5. India Oil and Gas Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Indian Oil Corporation Limited (IOCL)

5.1.2. Oil and Natural Gas Corporation (ONGC)

5.1.3. Reliance Industries Limited

5.1.4. Bharat Petroleum Corporation Limited (BPCL)

5.1.5. Hindustan Petroleum Corporation Limited (HPCL)

5.1.6. GAIL (India) Limited

5.1.7. Essar Oil and Gas Exploration and Production Ltd.

5.1.8. Cairn Oil and Gas

5.1.9. Shell India

5.1.10. ExxonMobil India

5.1.11. TotalEnergies India

5.1.12. Adani Gas

5.1.13. Petronet LNG Limited

5.1.14. Vedanta Limited

5.1.15. Schlumberger India

5.2. Cross Comparison Parameters (Revenue, Production Volume, Refining Capacity, Market Share, Operational Efficiency, Exploration Licenses, Technological Capabilities, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures and Strategic Partnerships

5.8. Government Contracts and Licensing

6. India Oil and Gas Market Regulatory Framework

6.1. Hydrocarbon Exploration Licensing Policy

6.2. Environmental Standards and Regulations

6.3. Taxation Policies for Oil and Gas Companies

6.4. Gas Pricing Reforms

6.5. Subsidies and Incentives

7. India Oil and Gas Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

7.3. Transition to Renewable Energy and Implications

8. India Oil and Gas Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Sector (In Value %)

8.5. By Region (In Value %)

9. India Oil and Gas Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segment Analysis

9.3. Strategic Market Positioning

9.4. Opportunities for Investment in Emerging Technologies

9.5. White Space Analysis for New Entrants

Research Methodology

Step 1: Identification of Key Variables

In this step, a comprehensive ecosystem map was created for the India Oil and Gas market. This map highlights the major stakeholders, including exploration companies, regulatory bodies, and logistics firms. Desk research was performed using proprietary databases and secondary sources to gather relevant market data.

Step 2: Market Analysis and Construction

Historical market data was analyzed, covering production capacity, domestic demand trends, and revenue generation. This analysis also involved examining pipeline infrastructure, refinery utilization rates, and import-export ratios to derive the core market structure.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through interviews with industry executives and operational experts across leading oil and gas companies. These interactions helped validate the data and provided additional insights into production trends and technological advances.

Step 4: Research Synthesis and Final Output

Lastly, the research findings were synthesized and cross-referenced with key market reports from top oil and gas organizations, including sectoral reports and government publications. This final synthesis ensured the accuracy and completeness of the report.

Frequently Asked Questions

01. How big is Indias Oil and Gas Market?

Indias oil and gas market is valued at USD 433.8 billion. It is primarily driven by the countrys industrial and transportation energy needs, along with investments in refining and LNG capacity.

02. What are the challenges in Indias Oil and Gas Market?

The key challenges in the Indias oil and gas market include the dependency on crude oil imports, environmental concerns surrounding oil exploration, and regulatory hurdles in the natural gas and LNG sectors. Additionally, domestic oil production has been in decline, further increasing the countrys reliance on imports.

03. Who are the major players in the India Oil and Gas Market?

The major players in the Indias oil and gas market include Indian Oil Corporation Limited (IOCL), Oil and Natural Gas Corporation (ONGC), Reliance Industries, Bharat Petroleum Corporation Limited (BPCL), and GAIL (India) Limited. These companies lead the market through refining, exploration, and infrastructure investments.

04. What are the growth drivers of Indias Oil and Gas Market?

The Indias oil and gas market is driven by rising energy demands, particularly in transportation and industry, government initiatives to enhance domestic production, and investments in LNG and refining capacity. Increased foreign direct investment and technology adoption are also factors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.