India Online Travel Market Outlook to 2030

Region:Asia

Author(s):Pranav Krishn

Product Code:KROD764

July 2024

100

About the Report

India Online Travel Market Overview

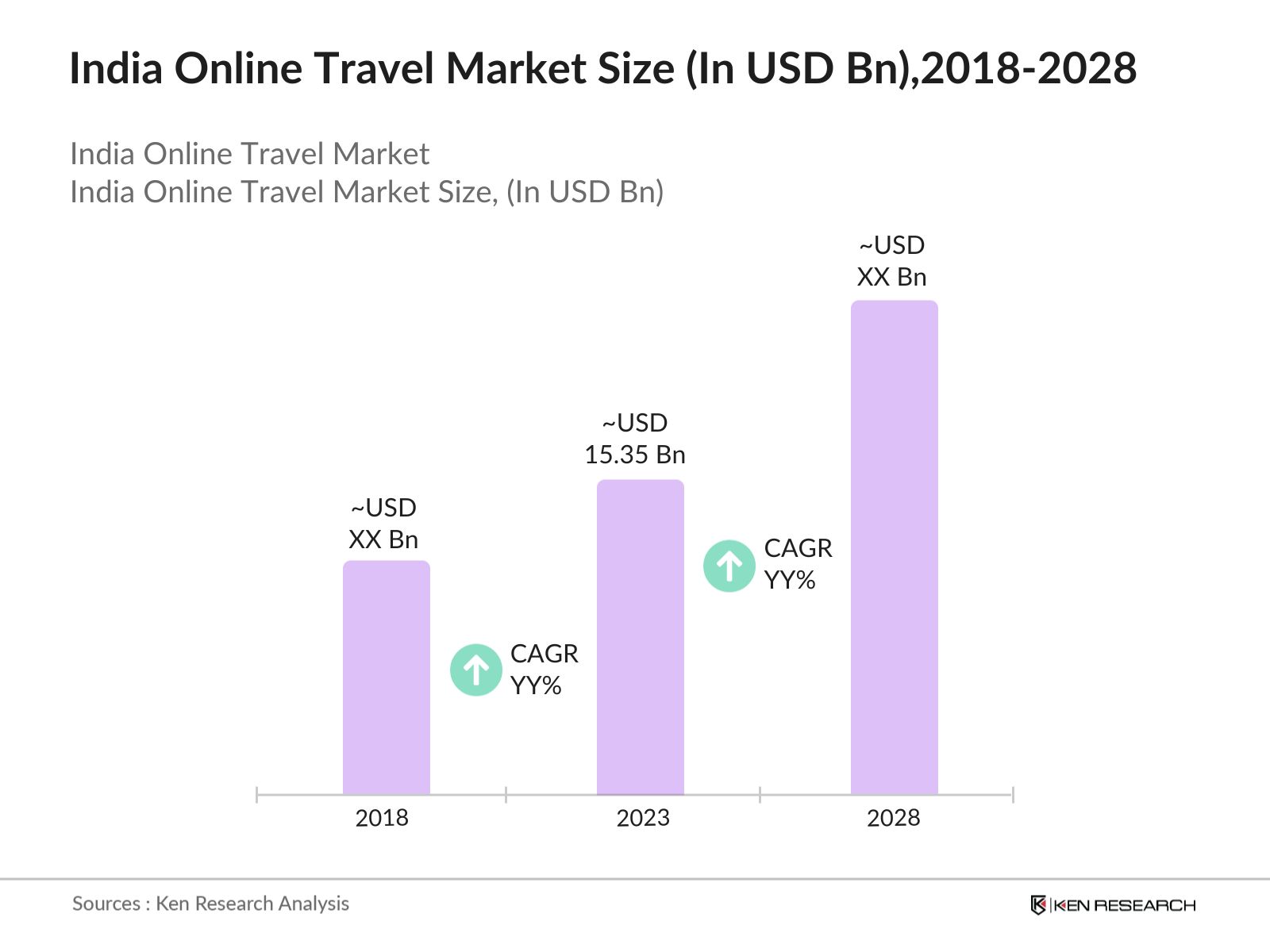

- In 2023, the India Online Travel Market was valued at USD 15.35 billion. This significant market size is attributed to factors such as enhanced internet connectivity, widespread adoption of smartphones, and increasing levels of disposable income among consumers. These elements have collectively fostered a conducive environment for the growth of online travel services across the country.

- The market is dominated by key players such as MakeMyTrip, Yatra, Cleartrip, Goibibo, and EaseMyTrip. These companies have established strong brand recognition and extensive networks of partnerships with hotels, airlines, and other service providers, making them significant players in the online travel sector.

- In recent news, MakeMyTrip announced a strategic partnership with Amazon Pay in 2023, aiming to enhance customer experience by integrating seamless payment solutions. This collaboration is expected to leverage Amazon's vast customer base and MakeMyTrip's extensive travel services, potentially increasing market reach and customer engagement.

India Online Travel Current Market Analysis

- The UDAN (Ude Desh ka Aam Nagrik) scheme, aimed at enhancing regional air connectivity, has led to the development of new airports and air routes. By December 2024, 766 routes have been sanctioned under the UDAN scheme facilitating easier access to remote destinations. This initiative has resulted in a notable increase in online flight bookings, as more travelers can now fly to previously inaccessible locations.

- The ease of comparing prices, booking tickets, and accessing travel information online has significantly reduced the reliance on traditional travel agents, reshaping consumer behavior towards a more digital-oriented approach.

- The northern and western regions of India dominate the online travel market due to higher urbanization rates, better internet infrastructure, and greater economic activity. Cities like Delhi, Mumbai, and Bangalore are major contributors to the market, with many technology-proficient consumers opting for online travel services.

India Online Travel Market Segmentations

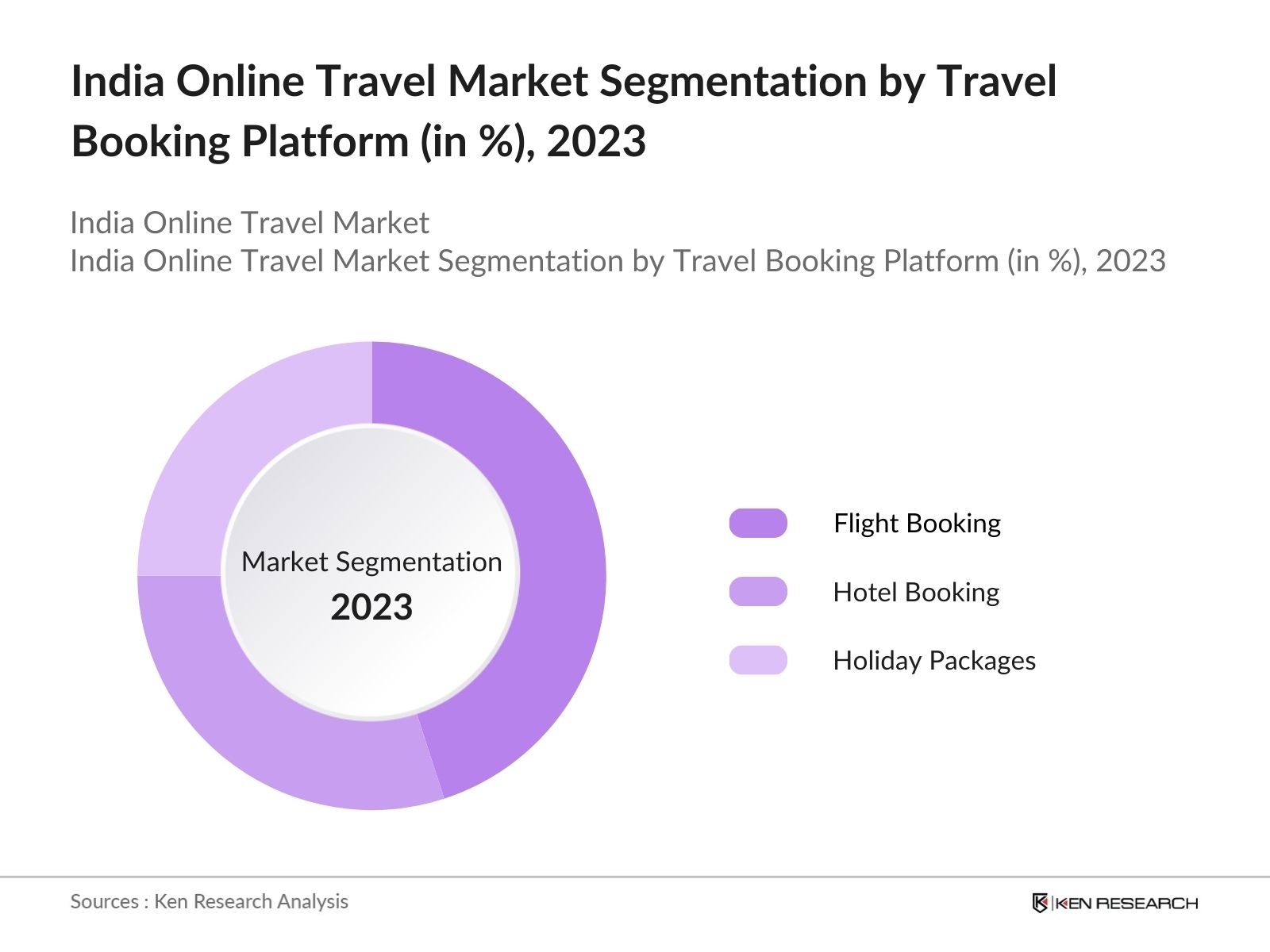

By Travel Booking Platform: In 2023, the India online travel market is segmented by travel booking platform type into flight booking, hotel booking, and holiday packages. Flight bookings dominate the market as air travel becomes more accessible and affordable. With increasing connectivity and lower airfares, this segment has become the preferred choice for long-distance travel.

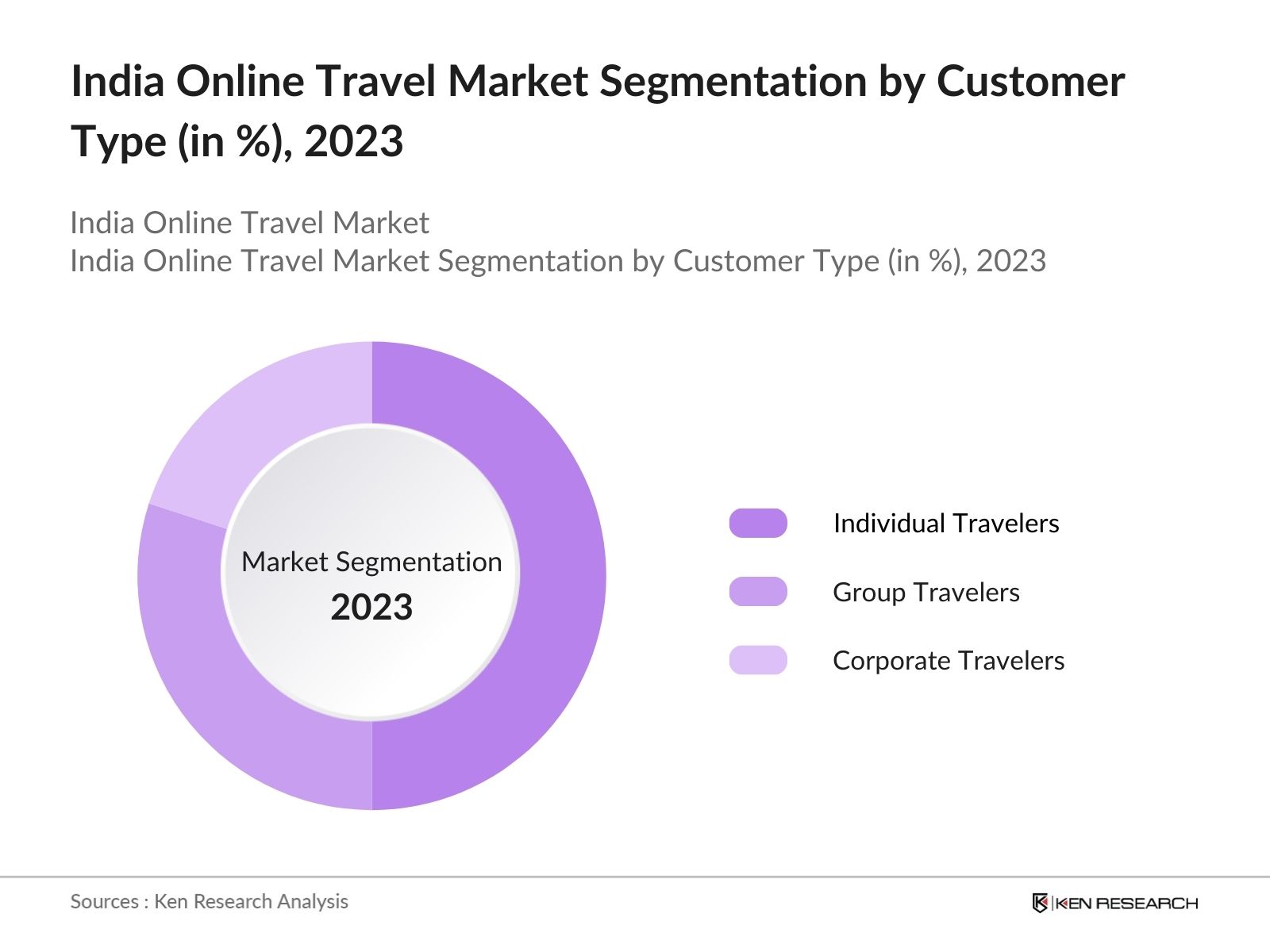

By Customer Type: In 2023, the India online travel market is segmented by customer type into individual, group and corporate travelers. The ease of planning and booking individual trips online, combined with the flexibility and control it offers, has made this the individual travelers segment dominant. Additionally, the rise of digital nomads and remote work has further fueled solo travel.

By Payment Method: In 2023, India online travel market is segmented by payment method into credit/ debit card, digital wallets, net banking and cash on delivery. Credit and debit cards dominate due to their Widely adopted due to convenience, security, and associated discounts, credit/debit cards streamline transactions on travel platforms.

India Online Travel Market Competitive Parameters

| Company | Establishment Year | Headquarters |

| MakeMyTrip | 2000 | Gurgaon |

| Yatra | 2006 | Gurgaon |

| Cleartrip | 2006 | Mumbai |

| Goibibo | 2007 | Gurgaon |

| EaseMyTrip | 2008 | Delhi |

- EaseMyTrip’s IPO: EaseMyTrip went public in 2021, raising USD 62 million capital for expansion and innovation. By 2024, the company had utilized these funds to enhance its technological infrastructure and expand its service offerings, resulting in a 30% increase in its user base.

- Cleartrip and Flipkart Partnership: Cleartrip's partnership with Flipkart in 2022 aimed to leverage Flipkart’s extensive customer base for travel bookings. This strategic alliance led to over 1.5 million new customers using Cleartrip’s platform by 2024, significantly boosting its market presence.

- Goibibo’s AI Chatbot Launch: Goibibo introduced an AI-based chatbot in 2023 to assist users with travel bookings and inquiries. This innovation has improved customer service efficiency, handling over 5 million queries in its first year and enhancing the overall user experience on the platform.

India Online Travel Industry Analysis

India Online Travel Market Growth Drivers

- Expansion of Online Payment Solutions: The adoption of online payment methods has seen a remarkable increase, with over 1.2 billion digital transactions recorded in the travel sector alone in 2024. This expansion has simplified the booking process, encouraging more consumers to use online travel services.

- Rise of Budget Airlines: The emergence of budget airlines has made air travel more affordable for a larger segment of the population. In 2024, budget airlines accounted for 70 million passengers, reflecting a significant rise in the number of travelers opting for low-cost carriers. This trend has boosted the online travel market as consumers increasingly turn to online platforms for booking affordable flights.

- Increase in Domestic Tourism: The surge in domestic tourism has significantly fueled the online travel market. In the first quarter of 2024, Indian airports registered a historic milestone with 97 million passengers. This growth reflects India's vigorous economic expansion and rising disposable incomes, stimulating heightened domestic travel demand among its populace.

India Online Travel Market Challenges

- Data Privacy and Security Concerns: With the rise in online transactions, the travel industry has faced numerous challenges related to data privacy and security. In 2024, there were over 5,000 reported cases of data breaches in the online travel sector, highlighting the need for robust security measures. These incidents have led to a loss of consumer trust and have posed significant challenges for online travel companies to maintain their reputation.

- Technological Infrastructure Issues: Despite advancements, there are still significant gaps in technological infrastructure, particularly in rural and semi-urban areas. In 2024, it was reported that 300 million potential consumers in these areas lacked reliable internet access, limiting their ability to use online travel services.

- Regulatory Hurdles: The travel industry in India faces various regulatory challenges, including stringent licensing requirements and compliance issues. In 2024, over 200 travel companies faced penalties for non-compliance with regulatory norms. These hurdles have increased the operational costs for online travel agencies and have hindered their ability to expand and innovate.

India Online Travel Market Government Initiatives

- E-Visa Scheme (2014): The introduction of the e-Visa scheme in 2014 has simplified the visa application process for international travelers. By 2024, over 10 million e-Visas were issued, facilitating easier travel to India and boosting the online travel market as more tourists opted for digital visa services.

- National Digital Communications Policy (2018): The National Digital Communications Policy, implemented in 2018, aims to provide universal broadband connectivity across India. By 2024, the policy had connected over 1 billion people to the internet, significantly expanding the potential customer base for online travel services.

- Swadesh Darshan Scheme (2014): The Swadesh Darshan Scheme, launched in 2014, focuses on developing theme-based tourist circuits. By 2024, 15 such circuits were operational, promoting domestic tourism and increasing the demand for online travel bookings as travelers sought to explore these curated destinations.

India Online Travel Market Future Outlook

The India Online Travel Market is expected to grow steadily by 2028, driven by increasing digital adoption and changing consumer preferences towards more convenient and personalized travel experiences.

Future Market Trends

-

- Personalized Travel Experiences: The demand for personalized travel experiences has been on the rise. In 2024, over 15 million travelers opted for customized travel packages tailored to their preferences and interests. This trend is driving online travel agencies to invest in AI and machine learning technologies to offer more personalized recommendations and services, enhancing customer satisfaction and loyalty.

- Sustainable Travel: Sustainable travel has gained significant traction, with an estimated 20 million eco-conscious travelers seeking environmentally friendly travel options in 2024. Online travel agencies are responding by offering eco-friendly accommodations, carbon offset options, and sustainable travel itineraries, catering to the growing demand for responsible tourism.

- Rise of Experiential Travel: Experiential travel, which focuses on immersive and authentic experiences, has become increasingly popular. In 2024, 86% of millennials prefer to travel for experiences and cultural immersion. Online travel agencies are capitalizing on this trend by offering a wide range of experiential travel packages that cater to diverse interests.

Scope of the Report

|

By Service Type |

Flight Booking Hotel Booking Holiday Packages Others (Train, Bus, etc.) |

|

Customer Type |

Individual Travelers Group Travelers Corporate Travelers |

|

By Payment Type |

Credit/Debit Card Digital Wallets Net Banking Cash on Delivery |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Online Travel Agencies (OTAs)

Airline Companies

Hotel and Accommodation Providers

Travel Technology Companies

Travel and Tour Operators

Payment Gateway Providers

Corporate Travel Managers

Hospitality Management Companies

Tourism Boards

Ministry of Tourism, Government of India

E-commerce Platforms

Banks and financial Institution

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

MakeMyTrip

Cleartrip

Yatra

Goibibo

Expedia

Ixigo

Travelocity India

OYO

Airbnb

EaseMyTrip

com

TripAdvisor

Thomas Cook India

SOTC

Cox & Kings

Table of Contents

1. India Online Travel Market Overview

1.1 India Online Travel Market Taxonomy

2. India Online Travel Market Size (in USD Bn), 2018-2023

3. India Online Travel Market Analysis

3.1 India Online Travel Market Growth Drivers

3.2 India Online Travel Market Challenges and Issues

3.3 India Online Travel Market Trends and Development

3.4 India Online Travel Market Government Regulation

3.5 India Online Travel Market SWOT Analysis

3.6 India Online Travel Market Stake Ecosystem

3.7 India Online Travel Market Competition Ecosystem

4. India Online Travel Market Segmentation, 2023

4.1 India Online Travel Market Segmentation by Service Type (in %), 2023

4.2 India Online Travel Market Segmentation by Customer Type (in %), 2023

4.3 India Online Travel Market Segmentation by Payment Method (in %), 2023

5. India Online Travel Market Competition Benchmarking

5.1 India Online Travel Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Online Travel Future Market Size (in USD Bn), 2023-2028

7. India Online Travel Future Market Segmentation, 2028

7.1 India Online Travel Market Segmentation by Service Type (in %), 2028

7.2 India Online Travel Market Segmentation by Customer Type (in %), 2028

7.3 India Online Travel Market Segmentation by Payment Method (in %), 2028

8. India Online Travel Market Analysts’ Recommendations

8.1 India Online Travel Market TAM/SAM/SOM Analysis

8.2 India Online Travel Market Customer Cohort Analysis

8.3 India Online Travel Market Marketing Initiatives

8.4 India Online Travel Market White Space Opportunity Analysis

Â

Disclaimer

Contact UsResearch Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2 Market Building:

Collating statistics on India Online Travel Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India online travel industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4 Research Output:

Our team will approach multiple online travel companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such online travel companies.

Frequently Asked Questions

01 How big is the India Online Travel Market?

The India Online Travel Market was valued at USD 15.35 billion in 2023, driven by increasing digital adoption and changing consumer preferences towards more convenient and personalized travel experiences.

02 Who are the major players of India Online Travel Market?

Some major players of the India Online Travel Market include MakeMyTrip, Cleartrip, Yatra, Goibibo, and EaseMyTrip. These companies have established strong brand recognition and extensive networks of partnerships with hotels, airlines, and other service providers, making them significant players in the online travel sector.

03 Factors driving the India Online Travel Market?

Factors driving the India Online Travel Market include increasing internet penetration, rising disposable incomes, and government initiatives promoting digital transactions. The emergence of budget airlines has made air travel more affordable for a larger segment of the population.

04 What are some challenges in India Online Travel Market?

Some challenges of the India Online Travel Market include intense competition, data security concerns, and regulatory changes. Despite advancements, there are still significant gaps in technological infrastructure, particularly in rural and semi-urban areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.