India Organic Personal Care Products Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD9061

November 2024

97

About the Report

India Organic Personal Care Products Market Overview

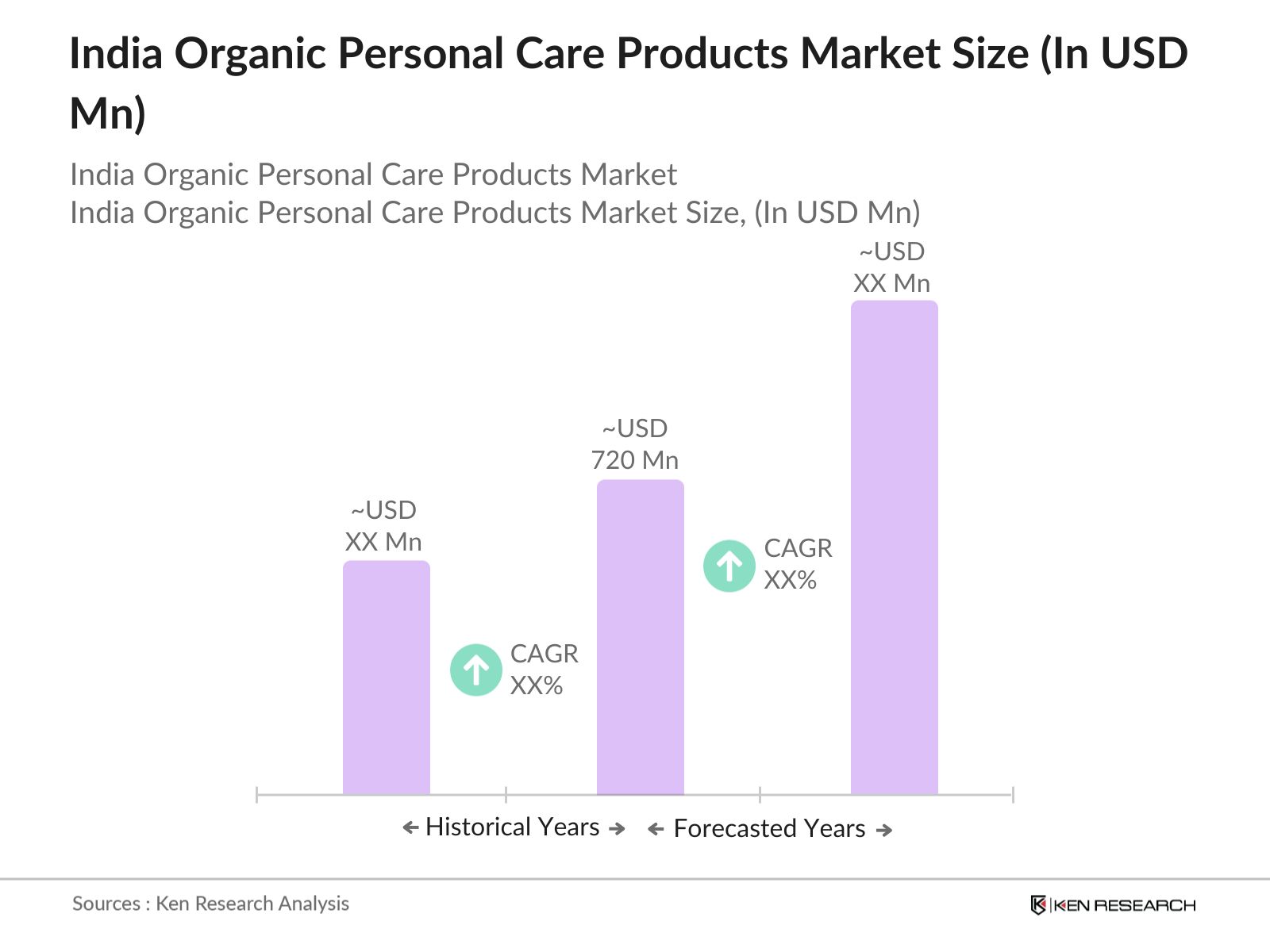

- The India Organic Personal Care Products market is valued at USD 720 million, based on a five-year historical analysis. This market is driven by increasing consumer awareness about the harmful effects of synthetic chemicals found in traditional personal care products. Moreover, growing demand for sustainable, cruelty-free, and organic alternatives has catalyzed market expansion. Government support in the form of organic certification programs further bolsters this sector, promoting growth across various segments, especially in skincare and haircare products.

- Cities like Delhi, Mumbai, and Bengaluru dominate the India Organic Personal Care Products market. These cities are key hubs for premium and luxury products due to their higher purchasing power, increasing urbanization, and heightened consumer awareness about organic products. The concentration of organic product retailers, including both offline and e-commerce platforms, adds to the dominance of these urban centers. Additionally, the educated population in these regions actively seeks eco-friendly and organic product options, contributing to the city's leadership in market share.

- In 2024, the Indian government has expanded its organic certification programs, offering subsidies and grants for companies obtaining organic labels under the National Programme for Organic Production (NPOP). Over 2,000 new companies have registered for certification in 2024, ensuring quality assurance for consumers and promoting market growth.

India Organic Personal Care Products Market Segmentation

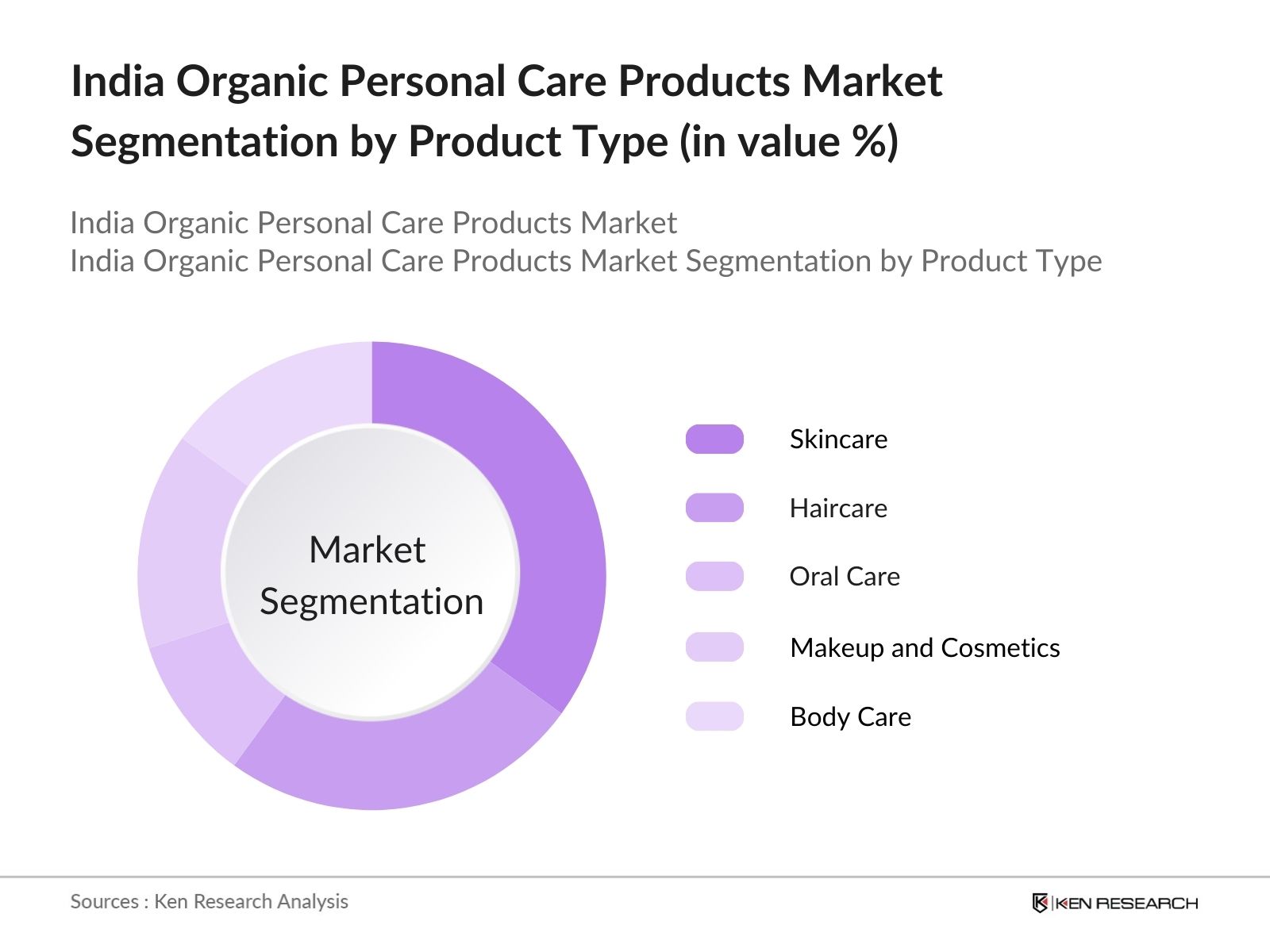

By Product Type: The India Organic Personal Care Products market is segmented by product type into skin care, hair care, oral care, makeup and color cosmetics, and body care. Skincare products, including moisturizers and cleansers, hold a dominant market share in the product type segmentation due to their widespread popularity among consumers who prioritize natural ingredients. Skincare brands such as Kama Ayurveda and Forest Essentials have cemented their reputation by offering chemical-free, organic alternatives that appeal to the growing health-conscious demographic in India. The increasing incidence of skin-related issues like acne, along with a growing preference for Ayurvedic-based formulations, contributes to the leadership of this segment.

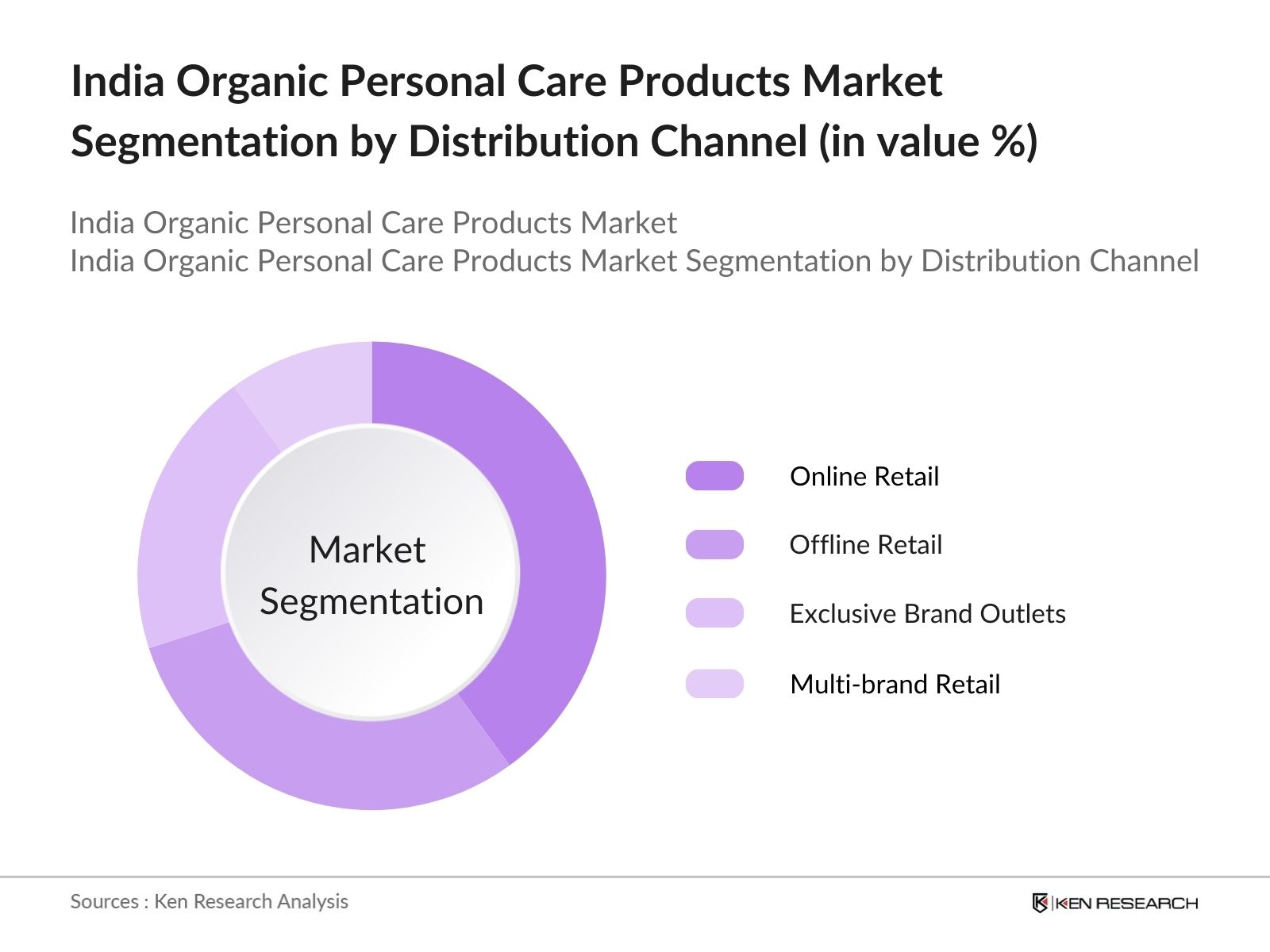

By Distribution Channel: The market is segmented by distribution channel into online retail, offline retail, exclusive brand outlets, and multi-brand retail. Online retail holds the largest market share under this segmentation due to the surge in e-commerce platforms such as Nykaa and Amazon, which provide consumers with easy access to organic personal care products. The shift towards digital shopping, especially during and post-pandemic, has pushed brands to expand their presence online. The convenience of home delivery, access to a wider range of products, and frequent promotional offers further amplify online retails dominance in the market.

India Organic Personal Care Products Market Competitive Landscape

The India Organic Personal Care Products market is moderately fragmented, with several key players leading the market through product innovations, sustainable practices, and strong online presence. The competition is intense, with brands vying for market share by expanding their portfolios to include a wider range of organic and eco-friendly offerings. In particular, brands such as Forest Essentials and Biotique have secured a strong foothold due to their premium pricing strategy and targeted marketing campaigns that appeal to environmentally conscious consumers. Additionally, international players such as The Body Shop have also established their presence, contributing to market competitiveness.

|

Company Name |

Establishment Year |

Headquarters |

Sustainability Initiatives |

Number of Outlets |

Online Presence |

Certifications |

Product Portfolio |

Revenue (INR) |

|

Forest Essentials |

2000 |

New Delhi |

- | - | - | - | - | - |

|

Kama Ayurveda |

2002 |

New Delhi |

- | - | - | - | - | - |

|

Biotique |

1992 |

Noida |

- | - | - | - | - | - |

|

Lotus Herbals |

1993 |

New Delhi |

- | - | - | - | - | - |

|

The Moms Co. |

2016 |

Gurugram |

- | - | - | - | - | - |

India Organic Personal Care Products Market Analysis

Growth Drivers

- Increasing Demand for Chemical-Free Products: Consumers in India are increasingly moving away from products containing synthetic chemicals, driven by health concerns and environmental awareness. In 2024, surveys show a growing demand for products labeled "organic" and "natural," with over 7 million households switching to organic personal care alternatives. This trend is further supported by Indias large urban population, which is expected to reach 600 million by 2025, pushing the demand for natural and eco-friendly products.

- Rising Consumer Awareness Regarding Ingredients: In 2024, there is a substantial rise in consumer awareness regarding the harmful effects of chemicals in personal care products. More than 8 million Indian consumers are making informed purchasing decisions based on product ingredients. Regulatory campaigns promoting organic standards have also educated consumers, leading to increased demand for products that are free from parabens, sulfates, and artificial dyes.

- Government Support for Organic Certification: The Indian government has significantly increased support for organic products in 2024, offering financial incentives for companies obtaining organic certification. The Ministry of Agriculture has allocated INR 200 crore to support organic farming and certification. This has driven over 500 companies to pursue organic certifications for personal care products, boosting consumer confidence and market growth.

Market Challenges

- High Product Pricing (Raw Material Cost, Processing)

Organic personal care products are priced 1.5 to 2 times higher than conventional products in 2024, due to the high cost of organic raw materials and processing. This has limited the accessibility of these products, especially for the middle-income population. Organic raw material imports have increased by 5% annually, contributing to the rise in production costs. - Limited Distribution Channels in Tier 2 and Tier 3 Cities

While organic personal care products are widely available in metropolitan areas, the penetration into Tier 2 and Tier 3 cities remains limited in 2024. Only 20% of total organic product sales occur in non-metro regions, largely due to the lack of well-established distribution networks. This limitation affects the overall market reach and growth potential.

India Organic Personal Care Products Market Future Outlook

The India Organic Personal Care Products market is expected to experience robust growth in the next five years, fueled by increasing consumer preference for natural and organic products. The growing middle class, coupled with rising disposable incomes, will continue to drive the demand for premium and eco-friendly alternatives. Furthermore, the expansion of e-commerce platforms and digital marketing strategies will play a pivotal role in attracting a wider consumer base, especially in Tier 2 and Tier 3 cities. The increasing emphasis on sustainability and ethical sourcing of ingredients will also encourage market growth, with brands investing heavily in certifications and eco-friendly packaging solutions.

Market Opportunities

- Expansion of E-commerce (Digital Platforms, Omni-channel Approach): In 2024, the organic personal care market is leveraging the rapid expansion of e-commerce platforms, with sales reaching over INR 3,000 crore annually through online channels. Digital platforms like Amazon and Flipkart have introduced dedicated organic product categories, while brands are adopting omni-channel strategies to reach wider audiences, both online and offline.

- Growing Demand for Premium Organic Products: The premium segment of organic personal care is gaining traction in 2024, with more than 2 million affluent consumers willing to spend over INR 1,000 per product. Premium brands are reporting a 15% year-on-year growth, driven by the demand for luxury organic products that offer unique formulations and packaging. This trend is most prominent in urban centers such as Mumbai, Delhi, and Bengaluru.

Scope of the Report

|

By Product Type |

Skin Care Hair Care Oral Care Makeup Body Care |

|

By Distribution Channel |

Online Retail Offline Retail Brand Outlets Multi-Brand Stores |

|

By Consumer Demographics |

Millennial Gen Z Baby Boomers Male Female |

|

By Ingredient Type |

Herbal/Plant-Based Essential Oils Natural Extracts Vegan Ingredients |

|

By Region |

North East South West |

Products

Key Target Audience

Organic Product Manufacturers

Organic Certification Bodies (COSMOS, NPOP)

Retailers and E-commerce Platforms

Investors and Venture Capitalist Firms

Distributors and Wholesalers

Government and Regulatory Bodies (FSSAI, Ministry of AYUSH)

Exporters and Importers of Organic Products

Skincare and Haircare Brands

Companies

Players Mentioned in the Report:

Forest Essentials

Kama Ayurveda

Biotique

Lotus Herbals

Juicy Chemistry

SoulTree

Khadi Natural

VLCC Natural Sciences

Organic Harvest

Just Herbs

Table of Contents

1. India Organic Personal Care Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Organic Personal Care Market Adoption Rate, CAGR, Consumer Awareness)

1.4. Market Segmentation Overview

2. India Organic Personal Care Products Market Size (In USD Mn)

2.1. Historical Market Size (Market Value, Organic Product Penetration)

2.2. Year-On-Year Growth Analysis (Growth Trends, Market Uptake)

2.3. Key Market Developments and Milestones (Innovations, Launches, Strategic Moves)

3. India Organic Personal Care Products Market Analysis

3.1. Growth Drivers

3.1.1 Increasing Demand for Chemical-Free Products

3.1.2 Rising Consumer Awareness Regarding Ingredients

3.1.3 Government Support for Organic Certification

3.1.4 Shifts in Lifestyle Towards Sustainable Products

3.2. Market Challenges

3.2.1 High Product Pricing (Raw Material Cost, Processing)

3.2.2 Limited Distribution Channels in Tier 2 and Tier 3 Cities

3.2.3 Regulatory Challenges (Compliance, Certifications)

3.3. Opportunities

3.3.1 Expansion of E-commerce (Digital Platforms, Omni-channel Approach)

3.3.2 Growing Demand for Premium Organic Products

3.3.3 Emerging Market for Mens Organic Personal Care

3.3.4 Sustainable Packaging Initiatives

3.4. Trends

3.4.1 Adoption of Eco-Friendly Packaging Solutions

3.4.2 Rise of Ayurveda-Based Organic Products

3.4.3 Integration of AI for Personalized Skincare Solutions

3.4.4 Natural Ingredients Sourcing and Fair Trade

3.5. Government Regulation

3.5.1 Organic Certification Standards (COSMOS, NPOP)

3.5.2 Import and Export Regulations for Organic Products

3.5.3 Tax Benefits for Organic Product Manufacturers

3.5.4 Environmental Laws and Impact on Personal Care Sector

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

4. India Organic Personal Care Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1 Skin Care (Moisturizers, Cleansers, Serums)

4.1.2 Hair Care (Shampoos, Conditioners, Oils)

4.1.3 Oral Care (Toothpaste, Mouthwash)

4.1.4 Makeup and Color Cosmetics (Foundation, Lip Care)

4.1.5 Body Care (Lotions, Bath Products)

4.2. By Distribution Channel (In Value %)

4.2.1 Online Retail (E-commerce, Brand Websites)

4.2.2 Offline Retail (Supermarkets, Specialty Stores)

4.2.3 Exclusive Brand Outlets

4.2.4 Multi-Brand Retailers

4.3. By Consumer Demographics (In Value %)

4.3.1 Millennial (25-40)

4.3.2 Gen Z (18-24)

4.3.3 Baby Boomers (40+)

4.3.4 Male vs. Female Consumers

4.4. By Ingredient Type (In Value %)

4.4.1 Herbal/Plant-Based Ingredients

4.4.2 Essential Oils

4.4.3 Natural Extracts (Aloe Vera, Shea Butter)

4.4.4 Vegan Ingredients

4.5. By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

5. India Organic Personal Care Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1 Forest Essentials

5.1.2 Kama Ayurveda

5.1.3 SoulTree

5.1.4 Biotique

5.1.5 Lotus Herbals

5.1.6 Juicy Chemistry

5.1.7 Organic Harvest

5.1.8 Khadi Natural

5.1.9 Just Herbs

5.1.10 VLCC Natural Sciences

5.1.11 The Moms Co.

5.1.12 Purearth

5.1.13 Plum Goodness

5.1.14 Arata

5.1.15 Nykaa Naturals

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Regional Presence, Number of Outlets, Online vs Offline Share, Pricing Strategy, Sustainability Initiatives, Certifications)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Product Launches and Innovations

6. India Organic Personal Care Products Market Regulatory Framework

6.1. Compliance with Organic Certification Standards (NPOP, USDA Organic)

6.2. Indian Consumer Protection Laws for Organic Claims

6.3. Labeling and Packaging Regulations

6.4. Environmental Regulations Impacting Organic Ingredients

7. India Organic Personal Care Products Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Emerging Consumer Preferences, Product Innovations, Sustainability Commitments)

8. India Organic Personal Care Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredient Type (In Value %)

8.4. By Consumer Demographics (In Value %)

8.5. By Region (In Value %)

9. India Organic Personal Care Products Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Insights

9.3. Product Diversification Strategies

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves creating a comprehensive overview of all the stakeholders in the India Organic Personal Care Products Market. This includes mapping out consumer trends, evaluating regulatory frameworks, and analyzing product certifications. Extensive desk research and proprietary databases are used to gather market insights.

Step 2: Market Analysis and Construction

Historical data is compiled to assess market penetration and evaluate the performance of various product segments. This phase also includes analyzing the growth of different distribution channels, consumer behavior shifts, and revenue trends across the organic personal care market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and then validated through consultations with industry experts from key brands and regulatory bodies. These consultations help refine the market projections and provide practical insights into the operational challenges and growth opportunities within the sector.

Step 4: Research Synthesis and Final Output

In the final phase, direct interaction with key market players helps verify the data collected through secondary research. This ensures that the report provides a well-rounded and accurate analysis of the market dynamics, product segments, and competitive landscape.

Frequently Asked Questions

01. How big is the India Organic Personal Care Products Market?

The India Organic Personal Care Products market is valued at USD 720 million, driven by increased consumer demand for natural and sustainable products across various segments, including skincare, haircare, and cosmetics.

02. What are the challenges in the India Organic Personal Care Products Market?

Challenges in the India Organic Personal Care Products market include high product pricing due to expensive natural ingredients, limited distribution in rural areas, and stringent regulatory requirements for certification and labeling.

03. Who are the major players in the India Organic Personal Care Products Market?

Key players in the India Organic Personal Care Products market include Forest Essentials, Biotique, Kama Ayurveda, Lotus Herbals, and The Moms Co. These brands dominate the market due to their strong product portfolios, certifications, and sustainability efforts.

04. What are the growth drivers of the India Organic Personal Care Products Market?

Growth drivers include rising consumer awareness about the harmful effects of synthetic chemicals, increasing demand for sustainable and eco-friendly products, and government initiatives promoting organic certifications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.