India Orthopedic Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD2700

December 2024

90

About the Report

India Orthopedic Market Overview

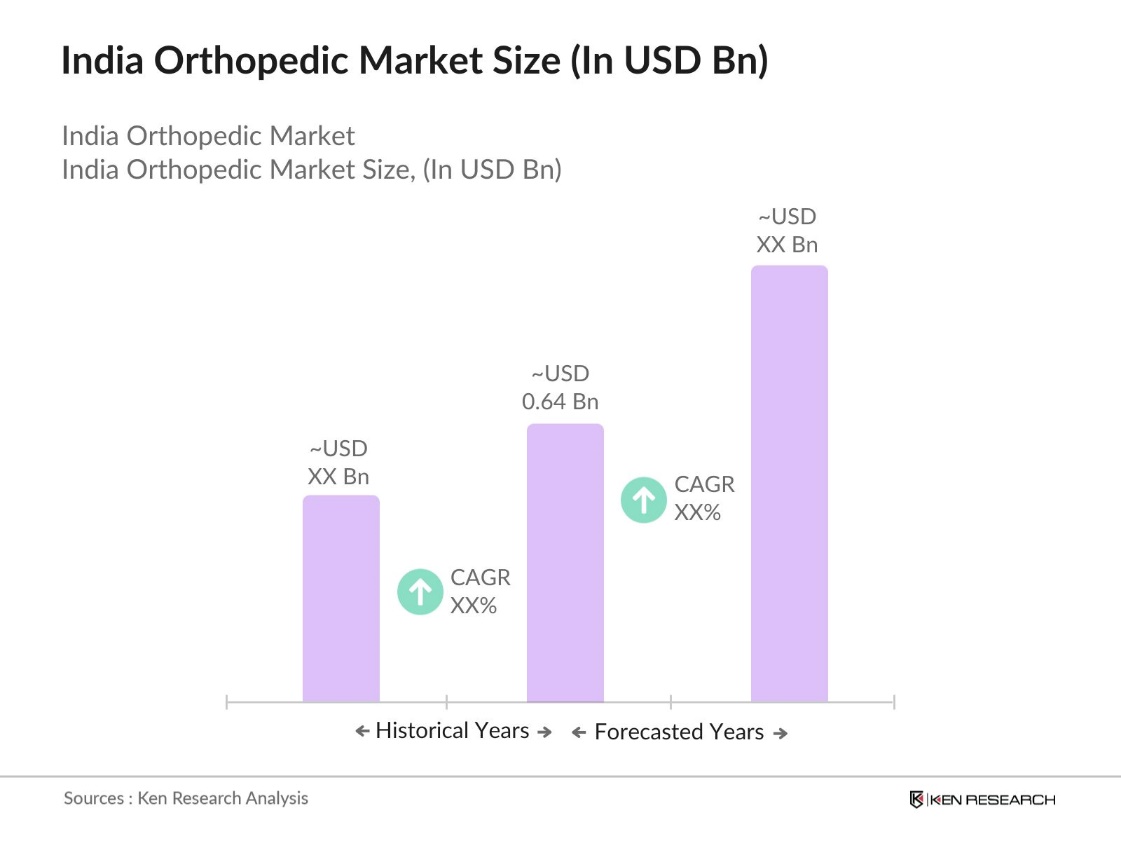

- The India Orthopedic Market is valued at USD 0.64 billion, based on a detailed five-year historical analysis. The market is primarily driven by the rising aging population, which significantly contributes to the increasing demand for joint replacement procedures, trauma care, and spine surgeries. Additionally, the growing prevalence of osteoporosis and arthritis, along with an increase in road accidents and sports injuries, further fuels the need for orthopedic devices in the country. This demand is supported by healthcare infrastructure development, including new hospitals and rehabilitation centers, ensuring market growth.

- Dominant cities in the Indian orthopedic market include Delhi, Mumbai, and Bengaluru. These cities are home to major healthcare hubs, advanced medical facilities, and high patient inflows for orthopedic treatments. Their dominance is attributed to the availability of state-of-the-art technologies, top-tier orthopedic surgeons, and the capacity to offer specialized surgeries such as joint replacements and spinal fusions. These urban centers also benefit from the medical tourism industry, which attracts a significant number of international patients seeking orthopedic treatments in India.

- The Government Initiative for medical device registration in India involves the Central Drugs Standard Control Organization (CDSCO), which administers regulations under the Drugs and Cosmetics Act and the Medical Devices Rules, 2017. As of October 1, 2023, all Class A, B, C, and D medical devices must have Import Licenses for market entry. The government also introduced streamlined classification and registration processes to ensure safety, with mandatory compliance to quality systems like ISO 13485.

India Orthopedic Market Segmentation

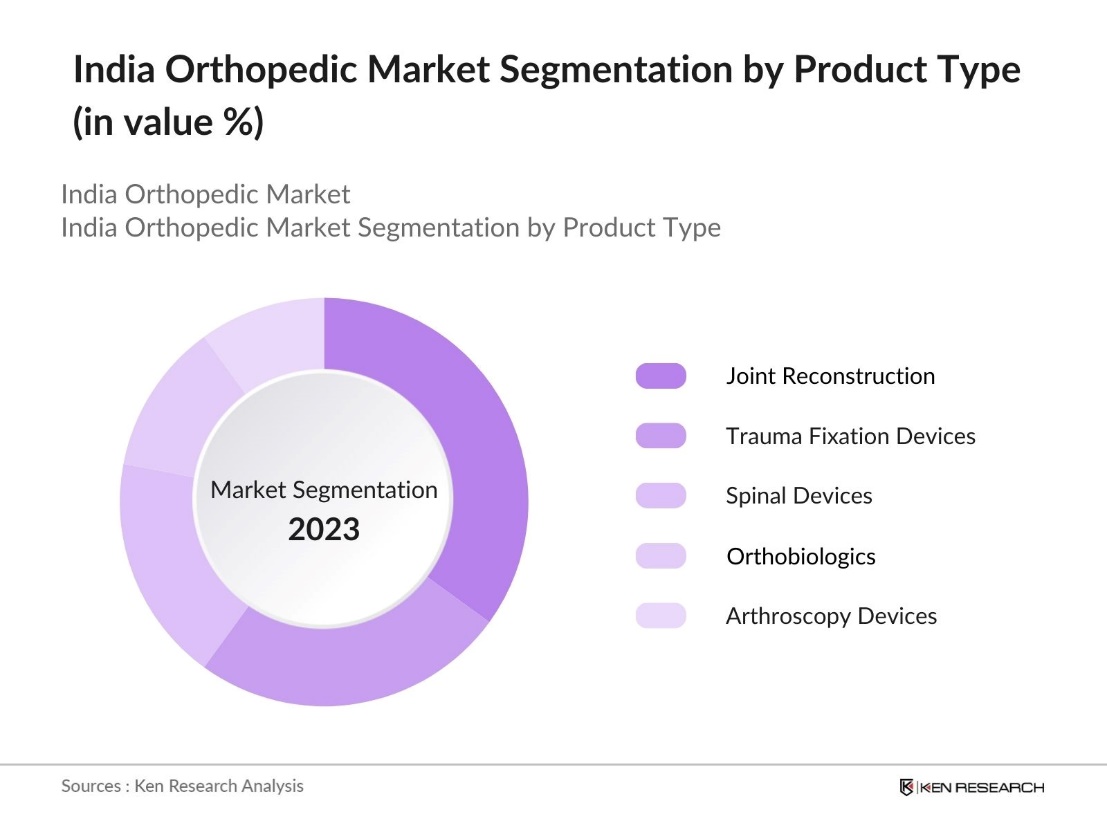

By Product Type: The India Orthopedic Market is segmented by product type into joint reconstruction devices, trauma fixation devices, spinal devices, orthobiologics, and arthroscopy devices. Among these, joint reconstruction devices dominate the market due to the high prevalence of knee and hip replacement surgeries. The aging population, particularly in urban areas, drives the demand for these devices as degenerative joint diseases become more common. Additionally, advancements in implant materials and techniques, such as minimally invasive surgeries, have increased patient satisfaction and recovery outcomes, further strengthening the dominance of this segment.

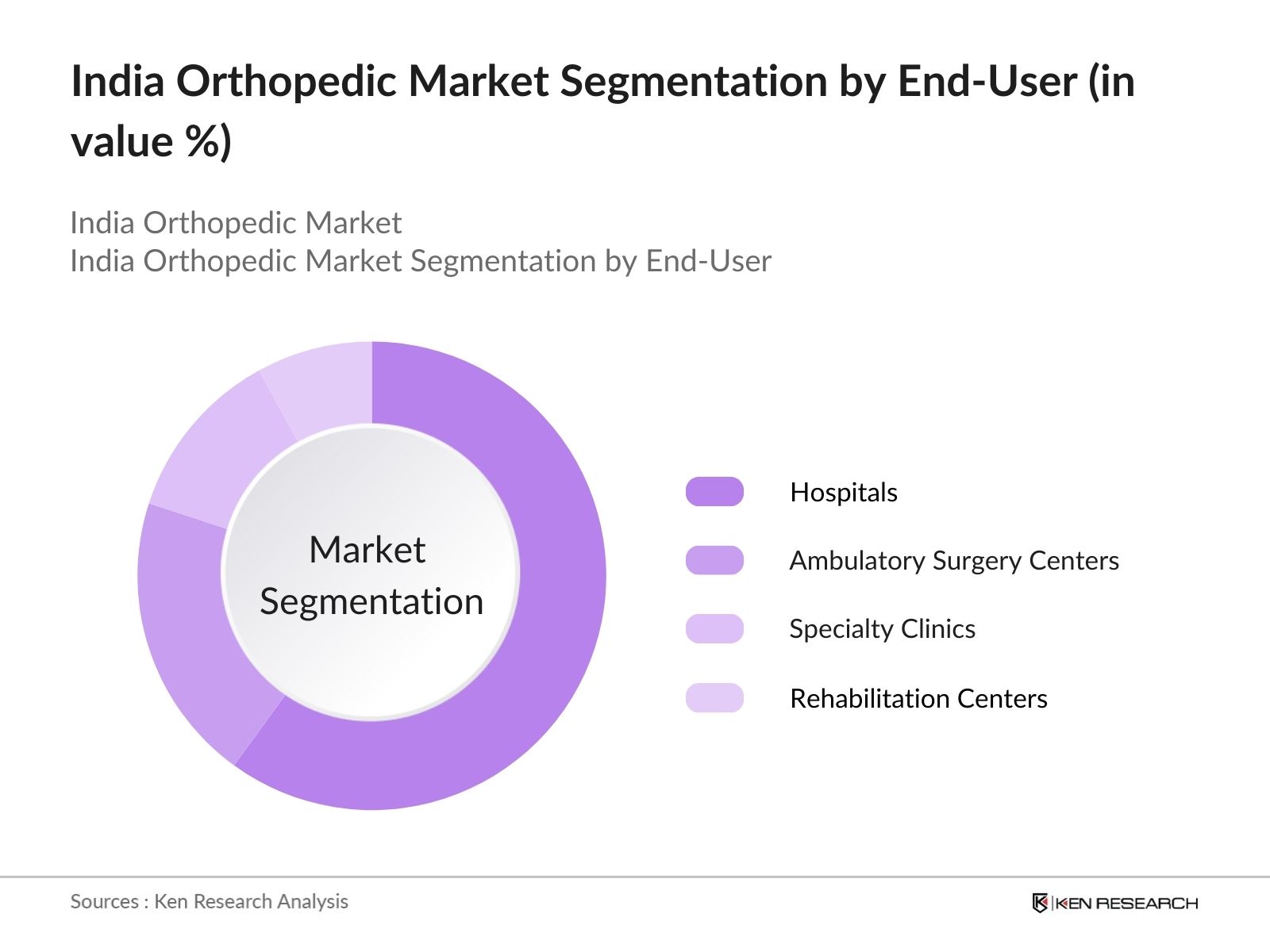

By End-User: The India Orthopedic Market is segmented by end-user into hospitals, ambulatory surgery centers (ASCs), specialty clinics, and rehabilitation centers. Hospitals hold the dominant market share in this segment due to their advanced infrastructure, the availability of expert surgeons, and the capacity to perform complex surgeries. Furthermore, hospitals are well-equipped with cutting-edge technologies, such as robotic surgery and 3D-printed implants, which makes them the preferred choice for orthopedic treatments, especially for procedures requiring multidisciplinary teams.

India Orthopedic Market Competitive Landscape

The market is characterized by the presence of both global and domestic players. Leading companies focus on product innovation, technological advancements, and collaborations to gain a competitive edge. Companies like Johnson & Johnson and Stryker have a significant foothold, attributed to their extensive portfolios and strong distribution networks.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

Revenue (INR Bn) |

Innovation Index |

Market Presence |

R&D Investment |

No. of Employees |

|

Johnson & Johnson Pvt. Ltd. |

1886 |

New Jersey, USA |

||||||

|

Stryker India Pvt. Ltd. |

1941 |

Michigan, USA |

||||||

|

Zimmer Biomet Holdings, Inc. |

1927 |

Indiana, USA |

||||||

|

Smith & Nephew Plc |

1856 |

London, UK |

||||||

|

Medtronic India Pvt. Ltd. |

1949 |

Minnesota, USA |

India Orthopedic Industry Analysis

Growth Drivers

- Aging Population: India's aging population, estimated at 153 million in 2024 and projected to reach 347 million by 2050, is driving a surge in demand for orthopedic treatments. Age-related conditions like joint degeneration, fractures, osteoporosis, and arthritis are becoming increasingly prevalent, necessitating more medical care. This demographic shift underscores the growing need for orthopedic devices and treatments, emphasizing the importance of addressing healthcare requirements in an aging society.

- Rise in Trauma Cases: Road accidents continue to be a leading cause of trauma cases in India, alongside a high prevalence of sports-related injuries, particularly among young adults, with rates ranging from 46.5% to 73.4% across various sports. These trauma incidents drive significant demand for orthopedic implants, fracture management systems, and surgical solutions, as the high number of cases requiring immediate medical intervention plays a key role in fueling the growth of the orthopedic market in the country.

- Increasing Incidence of Osteoporosis and Arthritis: Osteoporosis and arthritis are becoming increasingly common in India due to various factors, including changing lifestyles and aging demographics. These conditions lead to a higher demand for orthopedic treatments, such as surgeries and devices, as more people require medical intervention to manage bone-related health issues. The rise in these disorders underscores the growing need for improved healthcare solutions and infrastructure to meet the demand for orthopedic care. This trend is expected to continue driving growth in the orthopedic market as the population ages and lifestyle-related health concerns increase.

Market Restraints

- High Cost of Orthopedic Devices: The high cost of advanced orthopedic devices poses a significant challenge in India. With a substantial portion of these devices being imported, prices for essential treatments like orthopedic implants often remain beyond the reach of middle- and low-income families. The combined expense of devices and surgical procedures limits access to necessary orthopedic care, making it difficult for a large segment of the population to afford treatments like joint replacements.

- Reimbursement Issues: Reimbursement for orthopedic treatments continues to be a major hurdle, despite government healthcare initiatives. Many health schemes provide limited coverage for costly procedures like hip and knee replacements, leaving patients to pay a substantial portion of the cost themselves. This out-of-pocket expenditure creates financial strain for patients and hinders broader access to orthopedic care, thereby slowing market growth.

India Orthopedic Market Future Outlook

Over the next five years, the India Orthopedic Market is expected to witness steady growth driven by factors such as technological advancements in robotic-assisted surgeries, increasing medical tourism, and a growing focus on minimally invasive procedures. The expansion of healthcare infrastructure in tier-2 and tier-3 cities is also likely to boost the demand for orthopedic devices. Moreover, the development of cost-effective solutions for joint replacement surgeries, along with the governments initiatives to improve healthcare access and affordability, will further accelerate market growth.

Market Opportunities

- Advancements in 3D Printing and Robotics: India is seeing increased adoption of 3D printing technology and robotics in orthopedic surgeries, which allow for the creation of highly customized and precise implants. These technological advancements offer significant growth potential for the market, enhancing recovery times and improving the success rates of complex procedures. The integration of these technologies is driving demand for more advanced orthopedic solutions, creating a positive impact on the market.

- Rise in Medical Tourism: India has become a popular destination for medical tourism, especially for orthopedic procedures. The country's lower surgical costs, compared to Western nations, attract numerous foreign patients seeking treatments such as joint replacements and spinal surgeries. This influx of medical tourists is boosting demand for orthopedic services and contributing to the growth of the industry.

Scope of the Report

|

By Product Type |

Joint Reconstruction Devices Trauma Fixation Devices Spinal Devices Orthobiologics Arthroscopy Devices |

|

By End-User |

Hospitals Ambulatory Surgery Centers (ASCs) Specialty Clinics Rehabilitation Centers |

|

By Surgical Approach |

Open Surgery Minimally Invasive Surgery Robotic-Assisted Surgery |

|

By Technology |

3D Printing, Robotics Augmented Reality (AR) AI-Based Diagnostics |

|

By Region |

North South East West |

Products

Key Target Audience

Medical Device Manufacturers

Healthcare Providers (Hospitals, Clinics)

Orthopedic Surgeons and Medical Professionals

Medical Tourism Facilitators

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (CDSCO, NPPA)

Companies

Players Mnetioned in the Report

Johnson & Johnson Pvt. Ltd.

Stryker India Pvt. Ltd.

Zimmer Biomet Holdings, Inc.

Smith & Nephew Plc

Medtronic India Pvt. Ltd.

B. Braun Medical India Pvt. Ltd.

Depuy Synthes India Pvt. Ltd.

DJO Global, Inc.

Arthrex, Inc.

Conmed Corporation

Integra LifeSciences Holdings Corporation

Wright Medical Group N.V.

Aesculap Implant Systems

NuVasive, Inc.

Globus Medical India Pvt. Ltd.

Table of Contents

1. India Orthopedic Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Orthopedic Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Orthopedic Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population

3.1.2. Increasing Incidence of Osteoporosis and Arthritis

3.1.3. Rise in Trauma Cases (Road Accidents, Sports Injuries)

3.1.4. Healthcare Infrastructure Development

3.2. Market Restraints

3.2.1. High Cost of Orthopedic Devices

3.2.2. Reimbursement Issues

3.2.3. Regulatory Hurdles

3.3. Opportunities

3.3.1. Advancements in 3D Printing and Robotics

3.3.2. Rise in Medical Tourism

3.3.3. Increasing Penetration of Telemedicine

3.4. Trends

3.4.1. Growth in Minimally Invasive Surgeries

3.4.2. Shift Toward Personalized Implants

3.4.3. Digital Orthopedic Solutions

3.5. Government Regulation

3.5.1. Regulatory Approvals (CDSCO, MDR)

3.5.2. National Health Mission Initiatives

3.5.3. Price Control on Medical Devices (NPPA)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Orthopedic Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Joint Reconstruction Devices (Hip, Knee, Shoulder)

4.1.2. Trauma Fixation Devices

4.1.3. Spinal Devices

4.1.4. Orthobiologics

4.1.5. Arthroscopy Devices

4.2. By End-User (In Value %)

4.2.1. Hospitals

4.2.2. Ambulatory Surgery Centers (ASCs)

4.2.3. Specialty Clinics

4.2.4. Rehabilitation Centers

4.3. By Surgical Approach (In Value %)

4.3.1. Open Surgery

4.3.2. Minimally Invasive Surgery

4.3.3. Robotic-Assisted Surgery

4.4. By Technology (In Value %)

4.4.1. 3D Printing

4.4.2. Robotics

4.4.3. Augmented Reality (AR) for Surgery

4.4.4. AI-Based Diagnostics

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Orthopedic Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Johnson & Johnson Pvt. Ltd.

5.1.2. Stryker India Pvt. Ltd.

5.1.3. Zimmer Biomet Holdings, Inc.

5.1.4. Smith & Nephew Plc.

5.1.5. Medtronic India Pvt. Ltd.

5.1.6. B. Braun Medical India Pvt. Ltd.

5.1.7. Depuy Synthes India Pvt. Ltd.

5.1.8. DJO Global, Inc.

5.1.9. Arthrex, Inc.

5.1.10. Conmed Corporation

5.1.11. Integra LifeSciences Holdings Corporation

5.1.12. Wright Medical Group N.V.

5.1.13. Aesculap Implant Systems

5.1.14. NuVasive, Inc.

5.1.15. Globus Medical India Pvt. Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Market Share %, Product Portfolio, Innovation Index, Revenue, Geographical Presence, Manufacturing Capacity, Research & Development Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Orthopedic Market Regulatory Framework

6.1. Regulatory Standards (CDSCO, CE, FDA)

6.2. Compliance Requirements (MDR, Medical Devices Rules)

6.3. Certification Processes

7. India Orthopedic Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Orthopedic Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. Marketing Initiatives

8.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This step focuses on compiling historical data on market growth and penetration of orthopedic devices across India. The evaluation includes assessing patient demographics, device adoption rates, and procedural trends to ensure accuracy in revenue estimates.

Step 2: Market Analysis and Construction

This step focuses on compiling historical data on market growth and penetration of orthopedic devices across India. The evaluation includes assessing patient demographics, device adoption rates, and procedural trends to ensure accuracy in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with orthopedic surgeons, medical device manufacturers, and healthcare providers validate market hypotheses. These expert insights contribute to the refinement of data, ensuring it reflects actual market conditions.

Step 4: Research Synthesis and Final Output

Direct engagement with orthopedic device companies enables detailed insights into product segments, sales performance, and consumer preferences. This step confirms the validity of the data and ensures comprehensive market analysis.

Frequently Asked Questions

01 How big is the India Orthopedic Market?

The India Orthopedic Market is valued at USD 0.64 billion, driven by the aging population, increased prevalence of joint diseases, and advances in medical technologies.

02 What are the challenges in the India Orthopedic Market?

Challenges in the India Orthopedic Market include high costs of advanced devices, limited healthcare access in rural areas, and stringent regulatory requirements that delay the introduction of new products.

03 Who are the major players in the India Orthopedic Market?

Key players in the India Orthopedic Market include Johnson & Johnson Pvt. Ltd., Stryker India Pvt. Ltd., Zimmer Biomet Holdings, and Smith & Nephew Plc. These companies dominate due to their strong distribution networks and focus on innovation.

04 What are the growth drivers of the India Orthopedic Market?

The India Orthopedic Market is driven by factors such as the aging population, the rise in trauma cases, increased demand for minimally invasive surgeries, and advancements in technologies like 3D printing and robotic surgeries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.