India Packaged Food Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD10626

December 2024

91

About the Report

India Packages Food Market Overview

- The India Packaged Food market is valued at USD 76 billion, driven by rapid urbanization, evolving consumer preferences, and an increasing demand for convenience-oriented food products. This market has witnessed robust growth, underpinned by the expansion of modern retail outlets, government investments in food processing, and rising disposable incomes. The sectors diversification, from traditional foods to ready-to-eat meals and snacks, has further accelerated growth.

- Major cities, such as Delhi, Mumbai, and Bengaluru, dominate the market due to their dense urban populations, higher income levels, and a well-established retail infrastructure. These cities lead in the consumption of packaged foods, largely because of the busy lifestyles of urban dwellers, which spur demand for ready-to-eat and processed foods. Moreover, these urban centers also act as innovation hubs, driving new product launches.

- The National Food Processing Policy, launched in 2023, aims to increase food processing levels from 10% to 20% by 2027, contributing to the growth of the packaged food sector. By 2024, the government has already approved investments worth INR 8,000 crore under this policy for setting up new processing units and upgrading existing facilities, which will help packaged food manufacturers scale operations and introduce more products into the market.

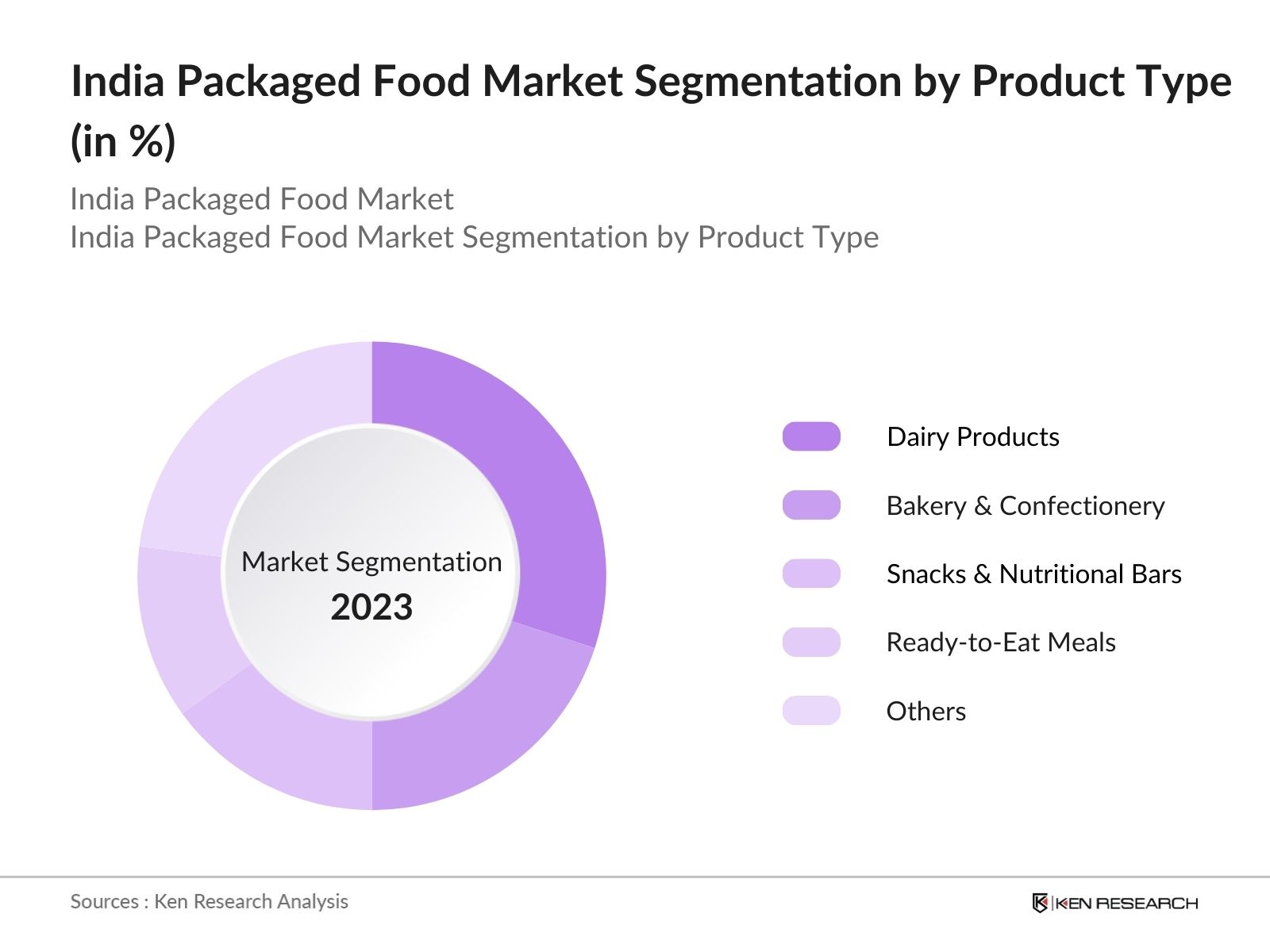

India Packaged Food Market Segmentation

By Product Type: The market is segmented by product type into dairy products, bakery and confectionery, snacks and nutritional bars, ready-to-eat meals, beverages, and processed meats. Among these, dairy products hold a dominant market share, fueled by the strong presence of established brands and high demand for products such as milk, yogurt, and cheese. The Indian diet traditionally emphasizes dairy, making it a staple product.

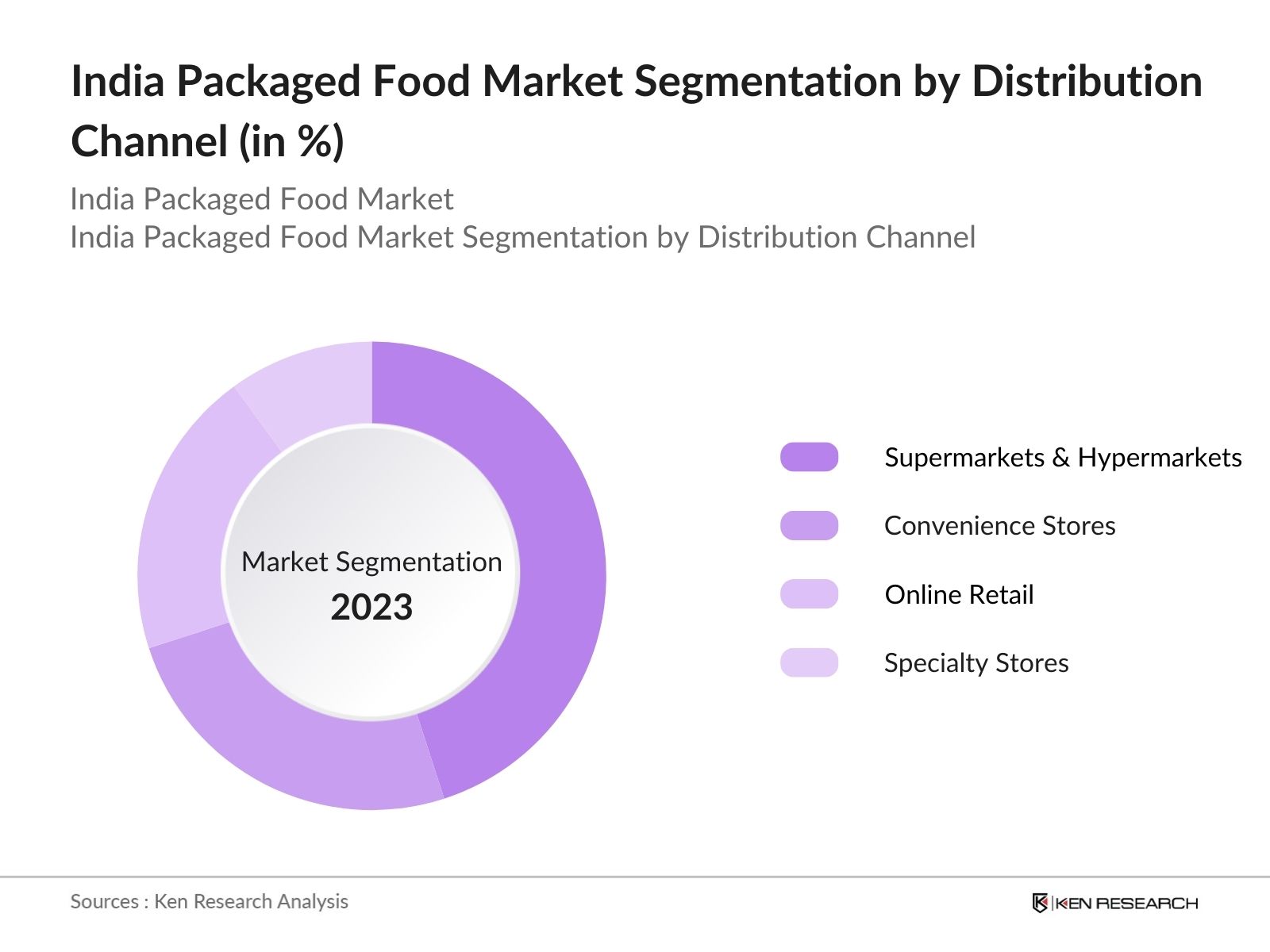

By Distribution Channel: The market is also segmented by distribution channels into supermarkets & hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets and hypermarkets account for the largest market share, owing to their widespread reach, ability to offer discounts, and the availability of a variety of packaged food options under one roof. These outlets have become increasingly popular as they cater to the needs of urban consumers who seek both variety and convenience.

India Packages Food Market Competitive Landscape

The market is highly competitive, with several key players dominating the landscape. These companies leverage strong brand recognition, extensive distribution networks, and continuous product innovation to maintain their market positions.

|

Company Name |

Established |

Headquarters |

Key Product Portfolio |

Revenue (USD Bn) |

Market Share (%) |

Distribution Reach |

Sustainability Initiatives |

Recent Developments |

|

Nestle India Ltd |

1961 |

Gurgaon, Haryana |

||||||

|

Britannia Industries Ltd |

1892 |

Kolkata, West Bengal |

||||||

|

ITC Limited |

1910 |

Kolkata, West Bengal |

||||||

|

Hindustan Foods Ltd |

1984 |

Mumbai, Maharashtra |

||||||

|

Parle Products Pvt Ltd |

1929 |

Mumbai, Maharashtra |

India Packages Food Market Analysis

Market Growth Drivers

- Increasing Health-Consciousness Among Consumers: In 2024, over 250 million Indian consumers are shifting towards healthier packaged food options, driven by rising concerns over lifestyle diseases such as diabetes and obesity. This trend is particularly evident in the demand for low-sugar, low-fat, and organic products, which are gaining traction in urban and rural markets alike. The Indian packaged food sector is seeing an influx of new product launches tailored to these preferences.

- Expanding E-commerce Penetration in Rural and Tier-2, Tier-3 Cities: The growth of e-commerce platforms has given packaged food brands unprecedented access to a broader consumer base across India. In 2024, it is estimated that over 120 million rural households are engaging with e-commerce platforms, helping packaged food products reach previously untapped markets.

- Favorable Government Policies Promoting Food Processing: The Government of India's Pradhan Mantri Kisan Sampada Yojana (PMKSY), with an investment outlay of INR 6,000 crore, is a key growth driver for the packaged food industry. By 2024, it is expected that the food processing capacity will increase by 200% under this scheme.

Market Challenges

- Stringent Food Safety Regulations: With the Food Safety and Standards Authority of India (FSSAI) introducing more stringent labeling and food safety standards in 2024, packaged food companies face challenges in compliance. Over 200 companies have been fined or issued notices for failing to meet new packaging standards regarding nutritional content, ingredient lists, and safety certifications.

- High Competition from Unorganized Sector: Despite the growth of organized packaged food brands, the unorganized sector continues to dominate, with local brands holding over 40% of the market share in 2024. Small and regional players, operating with lower overheads and reduced marketing costs, often offer products at significantly lower prices compared to larger companies.

India Packages Food Market Future Outlook

Over the next five years, the India Packaged Food industry is expected to experience sustained growth, driven by increasing demand for convenience foods, expanding urbanization, and the rise of e-commerce.

Future Market Opportunities

- Expansion of Private Label Packaged Foods: The next five years will see a rise in the sale of private-label packaged food products, especially through large e-commerce platforms like Amazon and Flipkart. By 2029, private label sales in the packaged food market are expected to reach INR 50,000 crore, driven by competitive pricing and growing consumer trust in retailer-owned brands.

- Growth in Plant-Based Packaged Foods: The plant-based food movement is projected to gain substantial traction in India over the next five years, with an estimated 20 million Indian consumers incorporating plant-based packaged food products into their diets by 2029.

Scope of the Report

|

By Product Type |

Dairy Products Bakery Snacks RTE |

|

By Distribution |

Supermarkets Hypermarkets Online |

|

By Region |

North India South India West India East India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Food Processing Companies

Banks and Financial Institution

Private Equity firms

Government and Regulatory Bodies (FSSAI, Ministry of Food Processing Industries)

Investors and Venture Capitalist Firms

Logistics and Cold Chain Operators

Companies

Players Mentioned in the Report:

ADF Foods Ltd

Nestle India Ltd

Hatsun Agro Products

Britannia Industries Ltd

DFM Foods Ltd

Hindustan Foods Ltd

MTR Foods

Unilever

ITC Limited

Parle Products Pvt Ltd

Table of Contents

India Packaged Food Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Key Growth Metrics: Revenue Growth, Market Expansion)

1.4 Market Segmentation Overview (Core Market Segments: By Product Type, By Distribution Channel, By Region)

India Packaged Food Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

India Packaged Food Market Analysis

3.1 Growth Drivers

3.1.1 Growing Urbanization and Modernization

3.1.2 Expansion of Retail Sector (Contribution to Increased Consumer Access)

3.1.3 Rise in Consumer Preference for Convenience Foods

3.1.4 Government Initiatives to Boost Food Processing Infrastructure

3.2 Market Challenges

3.2.1 Health Concerns Related to Processed Foods (Public Health Impact)

3.2.2 Fluctuating Raw Material Prices (Impact on Profit Margins)

3.2.3 Regulatory Compliance and Food Safety Standards

3.2.4 Cold Chain Infrastructure Deficiency

3.3 Opportunities

3.3.1 Rising Demand for Healthy and Organic Packaged Foods

3.3.2 E-commerce Expansion in Food Retail

3.3.3 Investment in Technological Advancements (Smart Packaging, Automation)

3.4 Trends

3.4.1 Plant-Based and Vegan Foods (Growing Segment)

3.4.2 Increasing Penetration of Private Labels

3.4.3 Sustainability Trends (Eco-friendly Packaging, Reduced Food Waste)

3.5 Government Regulations

3.5.1 FSSAI Compliance for Packaged Foods

3.5.2 Initiatives Supporting Food Safety and Public Health

3.5.3 Promotion of Make in India for Packaged Foods

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.8.1 Bargaining Power of Suppliers

3.8.2 Bargaining Power of Buyers

3.8.3 Threat of New Entrants

3.8.4 Threat of Substitutes

3.8.5 Intensity of Rivalry

3.9 Competitive Landscape

India Packaged Food Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Dairy Products

4.1.2 Bakery and Confectionery

4.1.3 Snacks and Nutritional Bars

4.1.4 Ready-to-Eat Meals

4.1.5 Beverages

4.1.6 Processed Meats

4.1.7 Rice, Pasta, & Noodles

4.1.8 Ice Creams & Frozen Novelties

4.1.9 Others (Organic Foods, Plant-based Foods)

4.2 By Distribution Channel (In Value %)

4.2.1 Supermarkets & Hypermarkets

4.2.2 Convenience Stores

4.2.3 Online Retail

4.2.4 Others (Specialty Stores)

4.3 By Region (In Value %)

4.3.1 North India

4.3.2 South India

4.3.3 East India

4.3.4 West India

India Packaged Food Market Competitive Analysis

5.1 Profiles of Key Companies

5.1.1 ADF Foods Ltd

5.1.2 Nestle India Ltd

5.1.3 Hatsun Agro Products

5.1.4 Britannia Industries Ltd

5.1.5 DFM Foods Ltd

5.1.6 Hindustan Foods Ltd

5.1.7 MTR Foods

5.1.8 Unilever

5.1.9 ITC Limited

5.1.10 Parle

5.1.11 Zydus Wellness Ltd

5.1.12 Gold Coin Health Foods Ltd

5.1.13 Herman Milkfoods Ltd

5.1.14 Pepsico Inc

5.1.15 General Mills Inc

5.2 Cross Comparison Parameters

(Key Parameters: Revenue, Market Presence, Product Portfolio, Distribution Network, Innovation Index, Sustainability Initiatives, Employee Count, Mergers & Acquisitions)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment and Expansion Analysis

India Packaged Food Market Regulatory Framework

6.1 Key Regulatory Authorities

6.2 FSSAI Standards for Packaged Food

6.3 Environmental Regulations on Packaging Materials

6.4 Compliance and Certifications

India Packaged Food Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Growth Drivers for Future Market Expansion

India Packaged Food Future Market Segmentation

8.1 By Product Type

8.2 By Distribution Channel

8.3 By Region

India Packaged Food Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Innovation and White Space Opportunity Analysis

9.3 Strategic Market Positioning

9.4 Consumer Demographic Insights and Marketing Initiatives

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This stage involves identifying all key stakeholders within the India Packaged Food market, including manufacturers, distributors, and retailers. Extensive desk research was conducted, utilizing both secondary and proprietary databases to understand the market structure and key influencing factors.

Step 2: Market Analysis and Construction

Historical market data was compiled to analyze market trends and revenue generation across various segments. This phase also included a review of service quality metrics and an evaluation of supply chain infrastructure.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed in the previous stages were validated through interviews with key industry experts and stakeholders. These consultations provided insights into operational efficiencies, market challenges, and growth opportunities, contributing to more accurate market estimations.

Step 4: Research Synthesis and Final Output

The final research output was synthesized by triangulating data from interviews and market databases. The data was further verified through consultations with top manufacturers and distributors to ensure the validity of the findings.

Frequently Asked Questions

01. How big is the India Packaged Food market?

The India Packaged Food market was valued at USD 76 billion, driven by rapid urbanization, evolving consumer preferences, and the rise of modern retail formats.

02. What are the challenges in the India Packaged Food market?

Challenges in the India Packaged Food market include health concerns related to processed foods, fluctuating raw material prices, and the need for robust cold chain infrastructure to maintain product quality.

03. Who are the major players in the India Packaged Food market?

Key players in the India Packaged Food market include Nestle India Ltd, Britannia Industries Ltd, ITC Limited, Hindustan Foods Ltd, and Parle Products Pvt Ltd.

04. What are the growth drivers of the India Packaged Food market?

Growth drivers in the India Packaged Food market include the expansion of urban areas, increasing demand for convenience foods, and government support for the food processing sector.

05. How is the e-commerce segment performing in the India Packaged Food market?

The e-commerce segment is growing rapidly, with online retail expected to account for a significant share of sales in the coming years, thanks to increasing internet penetration and consumer preference for convenience.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.