India Packaging Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11411

December 2024

84

About the Report

India Packaging Market Overview

- The India packaging market, valued at USD 75.97 billion units, is driven by several factors, primarily the rapid growth in e-commerce and the food & beverage sector. The shift towards convenience and online shopping has significantly boosted the demand for sustainable and efficient packaging solutions across the nation. Furthermore, innovations in packaging technology, including the adoption of biodegradable and eco-friendly materials, continue to fuel market growth.

- India's packaging industry is dominated by key urban centers like Mumbai and Delhi due to their status as industrial hubs with well-established infrastructure and access to raw materials. These cities also house some of the largest production facilities and are well connected to both national and international supply chains, making them key drivers of the packaging sector.

- The Extended Producer Responsibility (EPR) framework mandates that producers, importers, and brand owners take responsibility for managing the lifecycle of their packaging materials. In 2023, compliance with EPR guidelines has become crucial for companies, requiring them to ensure proper collection and recycling of their packaging waste. The governments enforcement of these guidelines has pushed companies to adopt circular economy practices, leading to a surge in the use of recycled materials in packaging.

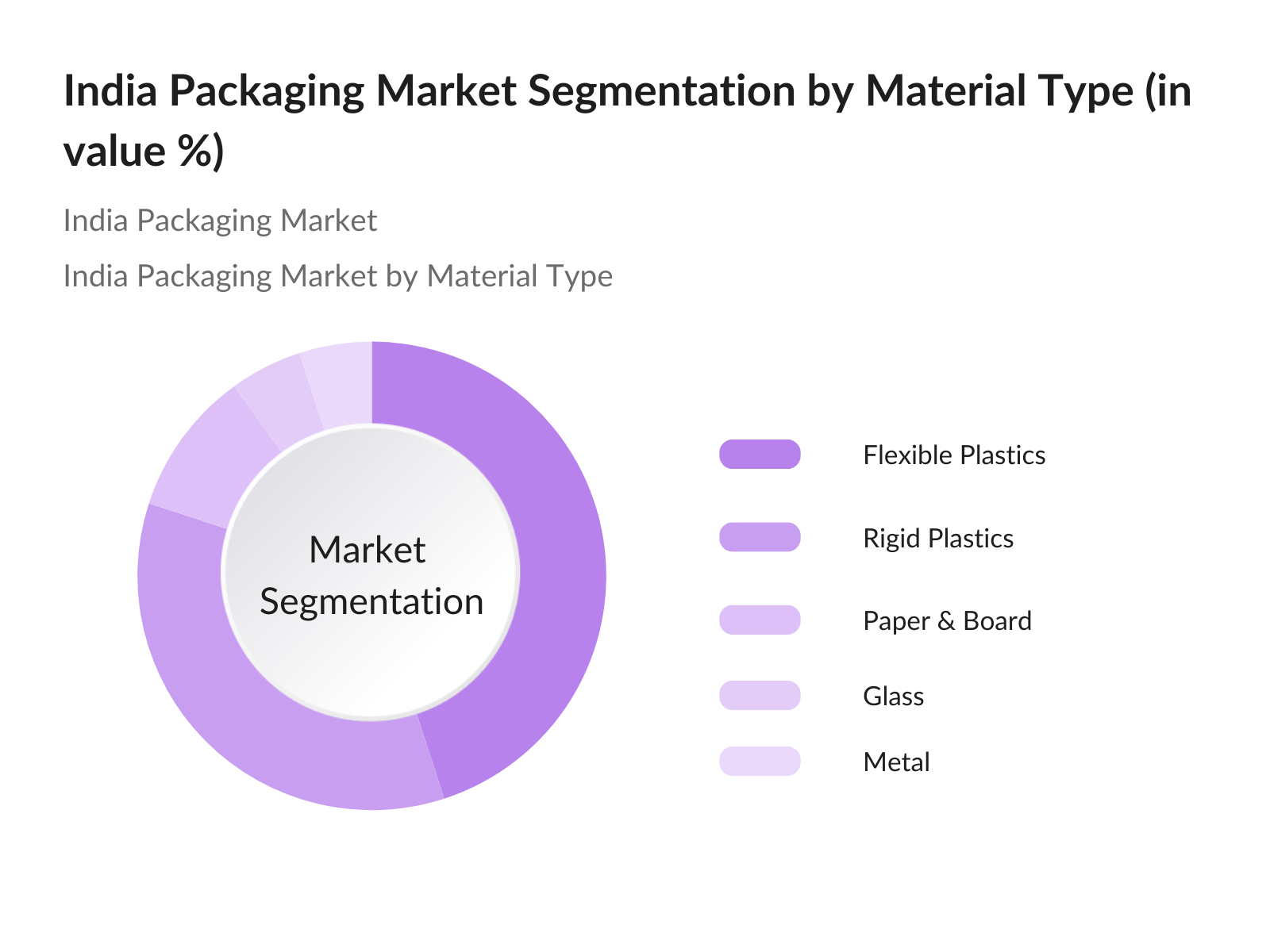

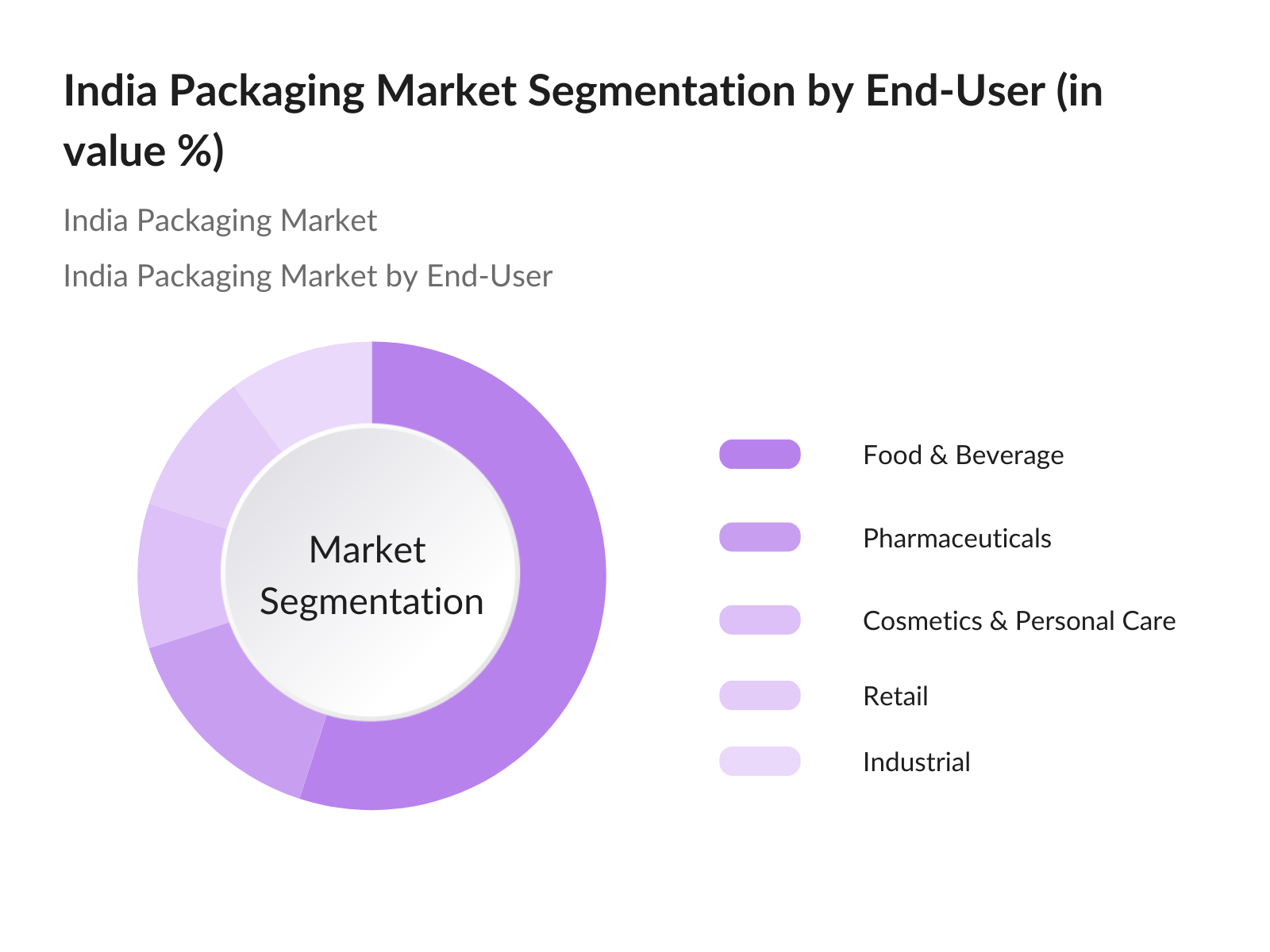

India Packaging Market Segmentation

By Material Type: India's packaging market is segmented by material type into plastic, paper, glass, and metal. Among these, plastic packagingboth rigid and flexibleholds the dominant market share. The flexibility, durability, and cost-effectiveness of plastic, coupled with its widespread use in food and beverage, personal care, and pharmaceuticals, make it a preferred choice for manufacturers.

By End-User: The end-user segment is divided into food and beverage, pharmaceuticals, cosmetics, retail, and industrial sectors. The food and beverage industry dominates the market due to the rising demand for packaged food, ready-to-eat meals, and beverages. The shift towards urbanization and increased disposable income have encouraged the adoption of packaged goods. The growth of retail and online food delivery services further amplifies this demand.

India Packaging Market Competitive Landscape

The India packaging market is highly competitive, with a mix of domestic and international players. Key players dominate the landscape through strategic acquisitions, innovation, and the adoption of advanced packaging solutions. The introduction of sustainable and eco-friendly packaging alternatives has also become a major trend, as companies compete to meet regulatory demands and consumer preferences.

|

Company |

Established |

Headquarters |

Product Range |

Sustainability Initiatives |

Market Share (%) |

Manufacturing Capacity |

Regional Presence |

|

Manjushree Technopack Ltd. |

1987 |

Bengaluru |

Rigid Plastics |

- |

- |

- |

- |

|

Uflex Limited |

1983 |

Noida |

Flexible Plastics |

- |

- |

- |

- |

|

Jindal Poly Films Ltd. |

1985 |

Delhi |

BOPP Films, PET |

- |

- |

- |

- |

|

Berry Global Inc. |

1967 |

United States |

Rigid & Flexible Plastics |

- |

- |

- |

- |

|

Amcor Plc |

1860 |

Australia |

Rigid & Flexible Plastics |

- |

- |

- |

- |

India Packaging Market Analysis

Market Growth Drivers

- Demand for Sustainable Packaging (Green Packaging): With rising environmental awareness, there is increasing demand for eco-friendly packaging solutions. In 2023, bioplastics and recycled paperboard materials are becoming more prevalent across industries. The Indian governments push for green alternatives, under its Plastic Waste Management Rules, has led to more companies adopting sustainable packaging, which is reducing the usage of plastic packaging. The food and beverage sector, one of the largest contributors to packaging demand in India, is increasingly adopting bioplastics and compostable materials, helping reduce reliance on traditional plastic and improving environmental sustainability.

- Rising Consumer Awareness on Product Safety: Consumer focus on packaging safety has escalated post-pandemic. In 2023, the Bureau of Indian Standards (BIS) reported an increase in demand for food-grade, tamper-evident packaging solutions to maintain product hygiene. Urban consumers are increasingly prioritizing packaging that guarantees product safety and extends shelf life. This has bolstered demand for advanced packaging technologies, such as aseptic and vacuum packaging, particularly in sectors like food, beverages, and pharmaceuticals, where maintaining hygiene and preventing contamination are critical to consumer trust.

- Expanding Food & Beverage Sector: Indias food and beverage industry, valued at INR 10 trillion in 2023, is a major contributor to packaging demand. The growth of the processed food sector has led to the adoption of diverse packaging formats, including flexible packaging, paperboard, and multi-layer plastics. Government initiatives like Make in India and the increase in processed food exports have further fueled the need for reliable, safe, and durable packaging solutions. This expansion in food production and distribution is driving significant demand for innovative packaging to ensure product safety and longevity.

Market Challenges:

- Government Environmental Regulations: Indias packaging industry is challenged by stringent environmental regulations aimed at curbing plastic pollution. The 2023 amendment to the Plastic Waste Management Rules, which restricts single-use plastics and mandates the use of biodegradable alternatives, has compelled packaging firms to invest in R&D for eco-friendly solutions. Companies failing to comply face fines and restrictions. The rules have created operational hurdles, particularly for industries heavily dependent on plastic packaging, such as the fast-moving consumer goods (FMCG) and pharmaceutical sectors.

- Recycling Infrastructure Limitations: Indias recycling infrastructure remains underdeveloped, posing a significant challenge to the packaging sector. In 2024, a substantial portion of the countrys plastic waste remains unmanaged, with a significant gap in recycling efforts, particularly in tier-2 and tier-3 cities where formal recycling systems are limited. This lack of an organized recycling framework hampers the country's efforts to promote circular economy practices in the packaging industry, slowing down the adoption of sustainable packaging solutions and increasing the environmental burden from waste.

India Packaging Market Future Outlook

Over the next five years, the India packaging market is expected to experience substantial growth driven by the expansion of e-commerce, increasing demand for sustainable packaging, and the growth of food and beverage packaging. The government's regulatory push for eco-friendly packaging, combined with advances in technology such as smart packaging, will play pivotal roles in the evolution of the sector. Key players will focus on innovations like biodegradable materials and the use of recycled plastics to align with the global sustainability movement.

Market Opportunities:

- Sustainable Innovations (Bioplastics, rPET Usage): Sustainable innovations such as bioplastics and recycled polyethylene terephthalate (rPET) are creating growth opportunities for the packaging industry. In 2024, Indias production of bioplastics reached 300,000 tonnes, with sectors like food and beverages and personal care increasingly adopting these materials. The governments initiatives, such as Swachh Bharat, are driving the demand for rPET, helping to reduce plastic waste. Companies are investing in technologies that allow them to incorporate recycled content into packaging materials, significantly reducing environmental impact and aligning with the global shift toward sustainable packaging solutions.

- Expansion in Rural and Tier-2 Markets: The growth of the FMCG sector in rural and tier-2 markets presents significant opportunities for packaging manufacturers. With a large portion of Indias population residing in rural areas, the demand for packaging solutions, such as sachets, pouches, and small-sized units, is rising in 2024. As rural consumers increasingly shift toward branded products, there is a growing need for cost-effective, durable packaging solutions that cater to these markets. This shift has driven innovations in packaging, including smaller and lightweight designs, tailored to meet the affordability and convenience requirements of rural consumers.

Scope of the Report

|

By Material Type |

Rigid Plastics Flexible Plastics Paper Glass, Metal |

|

By End-User |

Food & Beverage Pharmaceuticals Personal Car E-commerce Industrial |

|

By Technology |

Injection Molding Blow Molding Extrusion Thermoforming |

|

By Packaging Type |

Bottles & Jars, Trays Pouches Caps Cans |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Food and Beverage Manufacturers

Pharmaceutical Companies

Personal Care and Cosmetic Brands

E-commerce Platforms

Industrial Goods Manufacturers

Government and Regulatory Bodies (Ministry of Environment, Forest and Climate Change, Bureau of Indian Standards)

Investors and Venture Capitalist Firms

Packaging Material Suppliers

Companies

Players Mentipon in the Report

Manjushree Technopack Ltd.

Uflex Limited

Jindal Poly Films Ltd.

Berry Global Inc.

Amcor Plc

Cosmo Films Ltd.

Constantia Flexibles

ITC Limited (Packaging Division)

Packman Packaging Pvt. Ltd.

Huhtamaki Oyj

Tetra Pak India Pvt. Ltd.

Garware Hi-Tech Films Ltd.

Time Technoplast Ltd.

Mold-Tek Packaging Ltd.

Pearl Polymers Limited

Table of Contents

01. India Packaging Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

02. India Packaging Market Size (In USD Billion)

2.1 Historical Market Size (Plastic, Paper, Metal, Glass)

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

03. India Packaging Market Analysis

3.1 Growth Drivers

3.1.1 E-Commerce Boom

3.1.2 Demand for Sustainable Packaging (Green Packaging)

3.1.3 Rising Consumer Awareness on Product Safety

3.1.4 Expanding Food & Beverage Sector

3.2 Market Challenges

3.2.1 High Raw Material Costs (Plastic Resins, Paper)

3.2.2 Government Environmental Regulations

3.2.3 Recycling Infrastructure Limitations

3.3 Opportunities

3.3.1 Technological Advancements (Smart Packaging, IoT Integration)

3.3.2 Sustainable Innovations (Bioplastics, rPET Usage)

3.3.3 Expansion in Rural and Tier-2 Markets

3.4 Trends

3.4.1 Shift to Flexible Packaging

3.4.2 Rise in Refillable and Reusable Packaging

3.4.3 Adoption of Lightweight Materials

3.5 Regulatory Framework

3.5.1 Single-Use Plastic Ban Policies

3.5.2 Extended Producer Responsibility (EPR) Guidelines

3.5.3 BIS Certification for Safety Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

04. India Packaging Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 Rigid Plastics

4.1.2 Flexible Plastics

4.1.3 Paper & Board

4.1.4 Glass

4.1.5 Metal

4.2 By End-User (In Value %)

4.2.1 Food and Beverage

4.2.2 Pharmaceuticals and Healthcare

4.2.3 Personal Care and Cosmetics

4.2.4 Retail and E-commerce

4.2.5 Industrial and Chemical Packaging

4.3 By Technology (In Value %)

4.3.1 Injection Molding

4.3.2 Blow Molding

4.3.3 Extrusion

4.3.4 Thermoforming

4.3.5 Printing Technologies (Digital, Flexographic, Offset)

4.4 By Packaging Type (In Value %)

4.4.1 Bottles and Jars

4.4.2 Trays and Containers

4.4.3 Pouches and Sachets

4.4.4 Caps and Closures

4.4.5 Cans and Tins

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

4.5.5 Central India

05. India Packaging Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Manjushree Technopack Ltd.

5.1.2 Uflex Limited

5.1.3 Jindal Poly Films Ltd.

5.1.4 Cosmo Films Ltd.

5.1.5 Amcor Plc

5.1.6 Mold-Tek Packaging Ltd.

5.1.7 Berry Global Inc.

5.1.8 Time Technoplast Ltd.

5.1.9 ITC Limited (Packaging Division)

5.1.10 Tetra Pak India Pvt. Ltd.

5.1.11 Pearl Polymers Limited

5.1.12 Huhtamaki Oyj

5.1.13 Constantia Flexibles

5.1.14 Packman Packaging Pvt. Ltd.

5.1.15 Garware Hi-Tech Films Ltd.

5.2 Cross-Comparison Parameters (Revenue, Product Range, Regional Presence, Innovations, Sustainability Initiatives, Strategic Partnerships, Market Share, Manufacturing Capacity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Policies

5.8 Private Equity and Venture Capital Funding

06. India Packaging Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

07. India Packaging Market Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

08. India Packaging Market Future Segmentation

8.1 By Material Type (In Value %)

8.2 By End-User (In Value %)

8.3 By Technology (In Value %)

8.4 By Packaging Type (In Value %)

8.5 By Region (In Value %)

09. India Packaging Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Strategies

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial stage involved identifying and mapping all relevant stakeholders in the India packaging industry. This was based on secondary research from reliable industry reports and proprietary databases to establish key influencing factors for the market.

Step 2: Market Analysis and Construction

At this phase, historical market data was gathered, focusing on packaging material demand and production across different end-use industries. The analysis included a detailed assessment of revenue generated and the role of evolving customer preferences.

Step 3: Hypothesis Validation and Expert Consultation

Interviews were conducted with industry experts through telephonic consultations. These discussions provided deeper insights into operational challenges, financial aspects, and trends shaping the packaging industry in India, aiding the hypothesis validation process.

Step 4: Research Synthesis and Final Output

The final step involved verifying and synthesizing data collected from manufacturers, packaging experts, and analysts. This ensured a well-rounded and accurate representation of the market dynamics for the India packaging sector.

Frequently Asked Questions

01. How big is the India Packaging Market?

The India packaging market, valued at USD 75.97 billion units, is driven by the surge in e-commerce and packaged food demand, along with innovations in sustainable packaging materials.

02. What are the challenges in the India Packaging Market?

Challenges include rising raw material costs, especially for plastic resins, and stricter environmental regulations that are pushing companies to innovate and adopt sustainable solutions.

03. Who are the major players in the India Packaging Market?

Major players include Manjushree Technopack Ltd., Uflex Limited, Jindal Poly Films Ltd., and Berry Global Inc., which dominate due to their extensive production capacity and innovative packaging solutions.

04. What are the growth drivers of the India Packaging Market?

The market is driven by increasing demand for packaged food and beverages, expansion of e-commerce, and consumer preferences for eco-friendly packaging.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.