India Paper Market Outlook to 2030

Region:Asia

Author(s):Shubham

Product Code:KROD2438

October 2024

95

About the Report

India Paper Market Overview

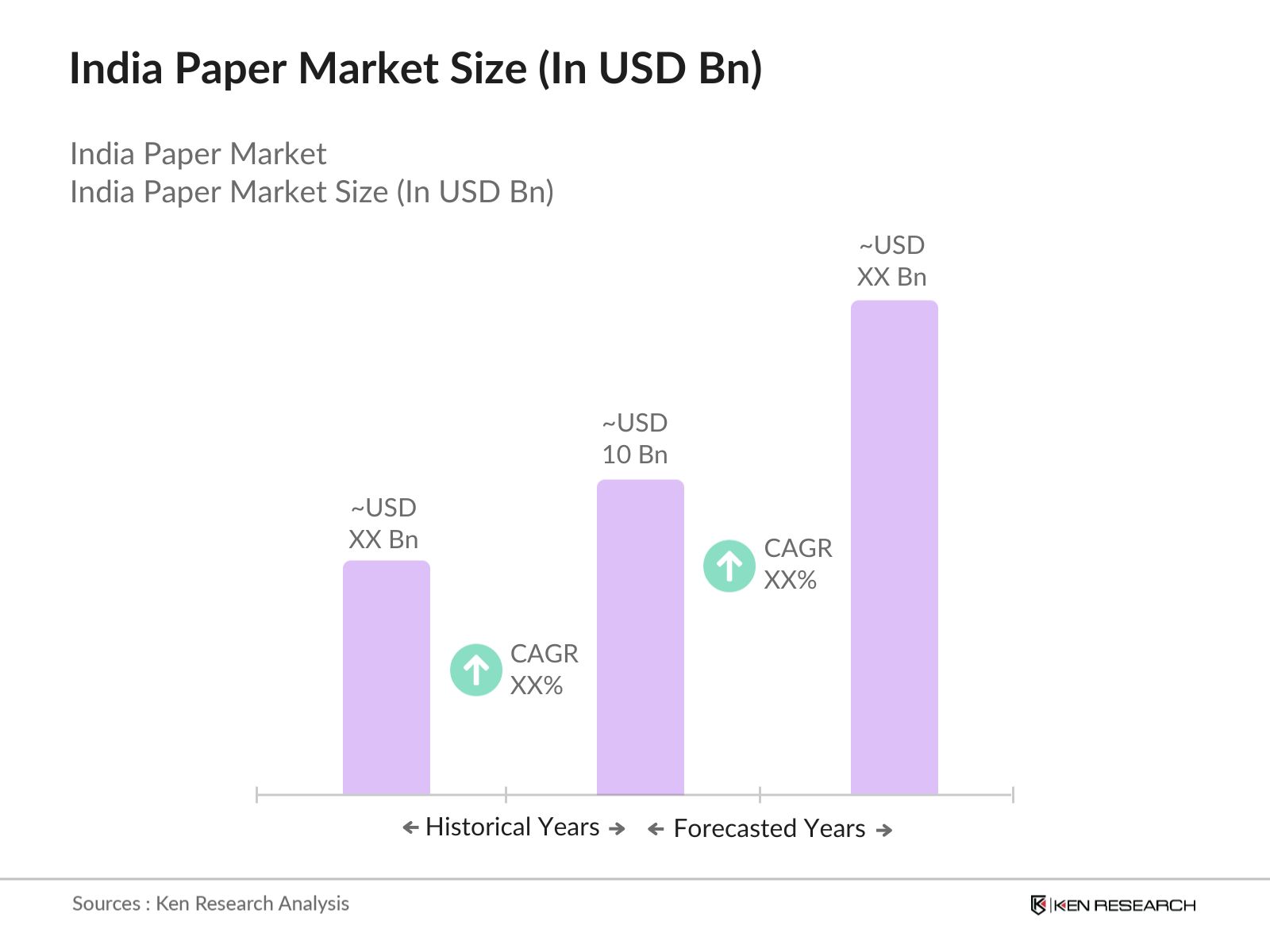

- The India Paper Market was valued at USD 10 billion, driven by increasing demand from the packaging, education, and publishing sectors. The paper industry in India is diverse, producing a wide variety of products including printing and writing paper, packaging paper, specialty paper, and newsprint. Rising literacy rates, growing e-commerce, and increased use of paper in sustainable packaging have bolstered demand across multiple segments.

- Major players in the Indian paper market include ITC Paperboards and Specialty Papers, Ballarpur Industries, JK Paper, and West Coast Paper Mills. These companies lead the market through extensive manufacturing capacities, innovative product offerings, and a strong distribution network.

- The demand for paper is particularly strong in packaging (for cartons, corrugated boxes, and paper bags), education (for books and notebooks), and hygiene products (tissues and sanitary napkins). Industrial hubs in states such as Maharashtra, Tamil Nadu, and Gujarat have seen notable growth in paper consumption due to advancements in packaging and an increased focus on eco-friendly alternatives.

- JK Paper has announced plans to invest USD 100 Mn by 2026 to expand its production capacities and enhance sustainability practices. This investment includes capital expenditures at its existing plants and aims to improve energy efficiency and reduce resource consumption, such as water and coal

India Paper Market Segmentation

The India Paper Market is segmented based on type, application, and region.

- By Paper Type: The market is segmented into printing and writing paper, packaging paper, newsprint, specialty paper. Packaging paper dominated the market, driven by the rise in e-commerce and sustainable packaging solutions. Printing and writing paper are also experiencing steady demand, particularly in the education sector. Key players such as ITC and West Coast Paper Mills lead this segment with their focus on innovation and capacity expansion.

- By Application: The market is categorized into education, packaging, printing and publishing. Packaging held the largest market share, driven by the surge in online retail and the shift towards eco-friendly packaging solutions. The education sector is another major contributor, with increased government spending on literacy programs and educational materials. Printing and publishing continue to see demand, albeit at a slower pace, due to digitalization trends.

- By Region: The market is divided into North, South, East, and West. In 2023, West India, particularly Maharashtra and Gujarat, led the market due to the presence of numerous packaging and paper manufacturing hubs. South India, known for its well-developed education and publishing sectors, also saw a substantial rise in demand for paper products.

India Paper Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

ITC Paperboards and Specialty Papers |

1925 |

Kolkata, India |

|

Ballarpur Industries Ltd |

1945 |

Gurgaon, India |

|

JK Paper Ltd |

1962 |

New Delhi, India |

|

West Coast Paper Mills |

1955 |

Bangalore, India |

|

Seshasayee Paper and Boards |

1960 |

Erode, Tamil Nadu |

- JK Paper Ltd: ITC Fibre Innovations Ltd, a subsidiary of ITC Paperboards and Specialty Papers, recycles nearly 100% of its solid waste, recycling 1.1 lakh tonnes of waste paper in the past year. This circular approach reduces waste and contributes to a positive environmental footprint, demonstrating ITC's commitment to sustainability across its operations.

- Ballarpur Industries: In March 2023, the National Company Law Tribunal (NCLT) in Mumbai approved the bid from Finquest Financial Solutions to acquire the company.This acquisition marks a pivotal moment for BILT, as it aims to stabilize its operations and potentially reinvigorate its market position.

India Paper Market Analysis

Growth Drivers:

- Rise in Demand for Sustainable Packaging Solutions: With the Indian governments stringent regulations on single-use plastics, demand for sustainable and biodegradable packaging has surged. In 2023, the Indian packaging industry recorded a substantial rise in the use of paper-based materials due to a ban on plastic bags and packaging materials. FMCG companies and e-commerce platforms have increasingly adopted paper-based packaging alternatives, contributing to the rising demand. This shift is further bolstered by increasing awareness about environmental sustainability, leading to more businesses opting for eco-friendly paper packaging solutions.

- Increased Demand from the Education Sector: The Indian governments continued focus on improving literacy rates through programs like Samagra Shiksha Abhiyan has driven up demand for printing and writing paper. In 2024, Department of Higher Education, allocated USD 5.8 billion to improve educational infrastructure, including the provision of textbooks and other learning materials. This investment is expected to boost the demand for paper products across schools and higher education institutions, especially as India continues to expand its educational outreach to rural areas.

- Surge in E-commerce and Food Delivery Industries: Indias e-commerce industry has experienced rapid growth, with gross merchandise value (GMV) reaching over USD 60 billion in 2023, marking a 22% increase from the previous year. This expansion has driven demand for corrugated boxes and paper-based packaging products. Additionally, the penetration of online food delivery in India increased from 8% to 12% between 2019 and 2023, this increase reflects a 2.8 times growth compared to overall food services during the same period. This has increased its use of sustainable paper packaging to comply with the ban on plastic packaging.

Challenges:

- Rising Raw Material Costs: The cost of raw materials such as wood pulp, recycled paper, and agricultural residues has been on the rise since 2022. In 2023, the cost of wood pulp increased substantially due to higher demand and supply chain disruptions. This surge in raw material prices has led to increased production costs for paper manufacturers, pressuring profit margins.

- Environmental Regulations and Compliance Costs: Stricter environmental regulations imposed by the Indian government in 2023 have required paper manufacturers to adopt cleaner production technologies, which come with higher operational costs. The Ministry of Environment, Forest, and Climate Change has set strict guidelines for emissions and waste disposal in the paper industry.

Government Initiatives

- National Green Paper Initiative (2023): Launched on October 13, 2023, the GCP is a market-based mechanism designed to incentivize voluntary environmental actions across various sectors. It focuses on activities like water conservation and afforestation, allowing individuals and organizations to earn tradable Green Credits for their environmental efforts.This program is expected to increase the use of recycled paper remarkably in the forecasted period, helping the industry reduce its carbon footprint.

- Plastic Waste Management Rules Amendment (2022): The Indian governments 2022 amendment to the Plastic Waste Management Rules banned the use of single-use plastics. This regulation has created a significant opportunity for the paper industry, as companies look for eco-friendly alternatives for packaging. The government has provided subsidies to businesses that shift from plastic to paper packaging, further incentivizing the adoption of paper products.

India Paper Market Future Outlook

The India Paper Market is expected to grow remarkably over the forecast period, driven by rising demand from the packaging and education sectors, a growing emphasis on sustainability, and technological advancements in paper production.

Future Market Trends:

- Sustainable Packaging Solutions: By 2028, eco-friendly and biodegradable packaging will play a pivotal role in the growth of the paper industry. The shift towards green packaging solutions, spurred by both consumer demand and regulatory changes, is expected to drive innovation in the paper sector.

- Rising Demand for Tissue Paper and Hygiene Products: Post-pandemic, the demand for tissue paper and hygiene products, such as sanitary napkins, has surged due to heightened awareness of hygiene and sanitation. Companies like West Coast Paper Mills are expanding their production capacity to meet this growing demand, a trend expected to continue into the coming years.

Scope of the Report

|

By Paper |

Packaging Paper Printing and Writing Paper Newsprint Specialty Paper |

|

By Application |

Education Packaging Printing and Publishing Others |

|

By Region |

North East South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report

Paper and Packaging Manufacturers

Printing and Publishing Houses

FMCG Companies

Food and Beverage Industry

E-commerce Platforms

Industrial Packaging Companies

Government and Regulatory Bodies (Ministry of Environment, Forest and Climate Change)

Banks and Financial Institutes

Investors and Venture Capital Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

ITC Paperboards and Specialty Papers

JK Paper Ltd

West Coast Paper Mills

Ballarpur Industries Ltd

Tamil Nadu Newsprint and Papers Ltd

Seshasayee Paper and Boards

Andhra Paper Ltd

Orient Paper and Industries Ltd

Century Pulp and Paper

Khanna Paper Mills Pvt. Ltd

N R Agarwal Industries Ltd

Emami Paper Mills Ltd

Ruchira Papers Ltd

Shree Krishna Paper Mills & Industries Ltd

Astron Paper and Board Mill Ltd

Table of Contents

1. India Paper Market Overview

1.1. Definition and Scope

1.2. Market Structure and Taxonomy

1.3. Market Growth Rate Analysis (Financial and Operational Metrics)

1.4. Key Market Developments and Milestones

2. India Paper Market Size (USD Million)

2.1. Historical Market Size (Value and Volume)

2.2. Year-on-Year Growth Analysis (Operational Parameters)

2.3. Contribution of Key Regions (North, South, East, West)

2.4. Industry Revenue Analysis (Top-to-Bottom Approach)

2.5. Breakdown of Market Value by Paper Type (Printing & Writing Paper, Packaging Paper, Newsprint, Specialty Paper, Others)

3. India Paper Market Dynamics

3.1. Growth Drivers

3.1.1. Rising Demand for Sustainable Packaging Solutions

3.1.2. Growth in Education Sector and Government Literacy Programs

3.1.3. Expansion of E-commerce and Food Delivery Industries

3.2. Market Challenges

3.2.1. Rising Raw Material Costs (Wood Pulp, Recycled Paper)

3.2.2. Environmental Regulations and Sustainability Pressures

3.2.3. Competition from Digital Media (Decreasing Demand for Newsprint)

3.3. Market Opportunities

3.3.1. Expansion of Recycling Technologies and Circular Economy Practices

3.3.2. Growing Demand for Hygiene Products (Tissue Paper, Sanitary Napkins)

3.3.3. Digital and Automation Adoption in Paper Production

4. India Paper Market Segmentation

4.1. By Paper Type (In Value %)

4.1.1. Printing & Writing Paper

4.1.2. Packaging Paper

4.1.3. Newsprint

4.1.4. Specialty Paper

4.2. By Application (In Value %)

4.2.1. Education

4.2.2. Packaging

4.2.3. Printing and publishing

4.3. By Region (In Value %)

4.3.1. North India

4.3.2. South India

4.3.3. East India

4.3.4. West India

5. India Paper Market Competitive Landscape

5.1. Competitive Market Share Analysis (Market Share %, Financial and Operational Metrics)

5.2. Strategic Initiatives and Partnerships (Investments, JVs, and Alliances)

5.3. Key Market Players Analysis

5.3.1. ITC Paperboards and Specialty Papers

5.3.2. JK Paper Ltd

5.3.3. West Coast Paper Mills

5.3.4. Ballarpur Industries Ltd

5.3.5. Tamil Nadu Newsprint and Papers Ltd

5.4. Cross-Comparison (Company Profiles Establishment Year, Headquarters, Revenue, No. of Employees)

5.4.1. Seshasayee Paper and Boards

5.4.2. Andhra Paper Ltd

5.4.3. Emami Paper Mills

5.4.4. Century Pulp and Paper

5.4.5. Khanna Paper Mills

6. India Paper Market Financial Analysis

6.1. Financial Performance of Key Players

6.1.1. Revenue Analysis by Key Companies

6.1.2. Operational Efficiency Metrics (Cost Efficiency, Production Output)

6.2. Investment and Venture Capital Analysis

6.2.1. Recent Investments and Fundings (Venture Capital, Government Grants)

6.2.2. Mergers and Acquisitions

6.3. Profitability and Revenue Forecasts

7. India Paper Market Regulatory Framework

7.1. Government Policies Supporting the Paper Industry

7.2. Compliance and Certification Requirements for Paper Production

7.3. Environmental Regulations and Sustainability Standards

7.4. Recycling Guidelines and Initiatives

7.5. Labor and Safety Regulations in the Paper Industry

8. Future Outlook for India Paper Market

8.1. Market Growth Projections

8.2. Key Trends Shaping Future Demand (Sustainable Packaging, Hygiene Products)

8.3. Expansion of Recycling Infrastructure

8.4. Automation and Digital Transformation in Paper Manufacturing

9. India Paper Market Future Segmentation, 2028

9.1. By Paper Type (In Value %)

9.2. By Application (In Value %)

9.3. By Region (In Value %)

10. Analyst Recommendations

10.1. TAM/SAM/SOM Analysis for India Paper Market

10.2. Key Strategic Recommendations for Paper Producers

10.3. Emerging Markets and White-Space Opportunities (Recycled Paper, Specialty Paper)

10.4. Sustainable Production and Circular Economy Strategies

11. Disclaimer

12. Contact Us

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry-level information.

Step 2 Market Building:

Collating statistics on the India paper market over the years, penetration of marketplaces, and service providers ratio to compute revenue generated for the India paper market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing:

Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research Output:

Our team will approach multiple essential paper companies and understand the nature of product segments and sales, consumer preference, and other parameters, which will support us to validate statistics derived through a bottom-to-top approach from paper companies.

Frequently Asked Questions

01. How big is India Paper Market?

The India Paper Market was valued at USD 10 billion, driven by increasing demand from the packaging, education, and hygiene sectors. The growth is supported by the rise of e-commerce, literacy rates, and a shift toward sustainable packaging solutions.

02. What are the challenges in India Paper Market?

Challenges include rising raw material costs, particularly wood pulp and recycled paper, and stringent environmental regulations. Additionally, the competition from digital media, which reduces the demand for printing and writing paper, poses a threat to market growth.

03. Who are the major players in the India Paper Market?

Key players in the India Paper Market include ITC Paperboards and Specialty Papers, JK Paper Ltd, West Coast Paper Mills, Ballarpur Industries, and Tamil Nadu Newsprint and Papers Ltd. These companies dominate due to their strong production capacities and sustainable practices.

04. What are the growth drivers of India Paper Market?

The market is driven by the increasing demand for sustainable packaging solutions, the growth of the education sector, and the expansion of the e-commerce and food delivery industries. Government policies promoting recycling and sustainable production also support market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.