India Paraffin Wax Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD4055

December 2024

85

About the Report

India Paraffin Wax Market Overview

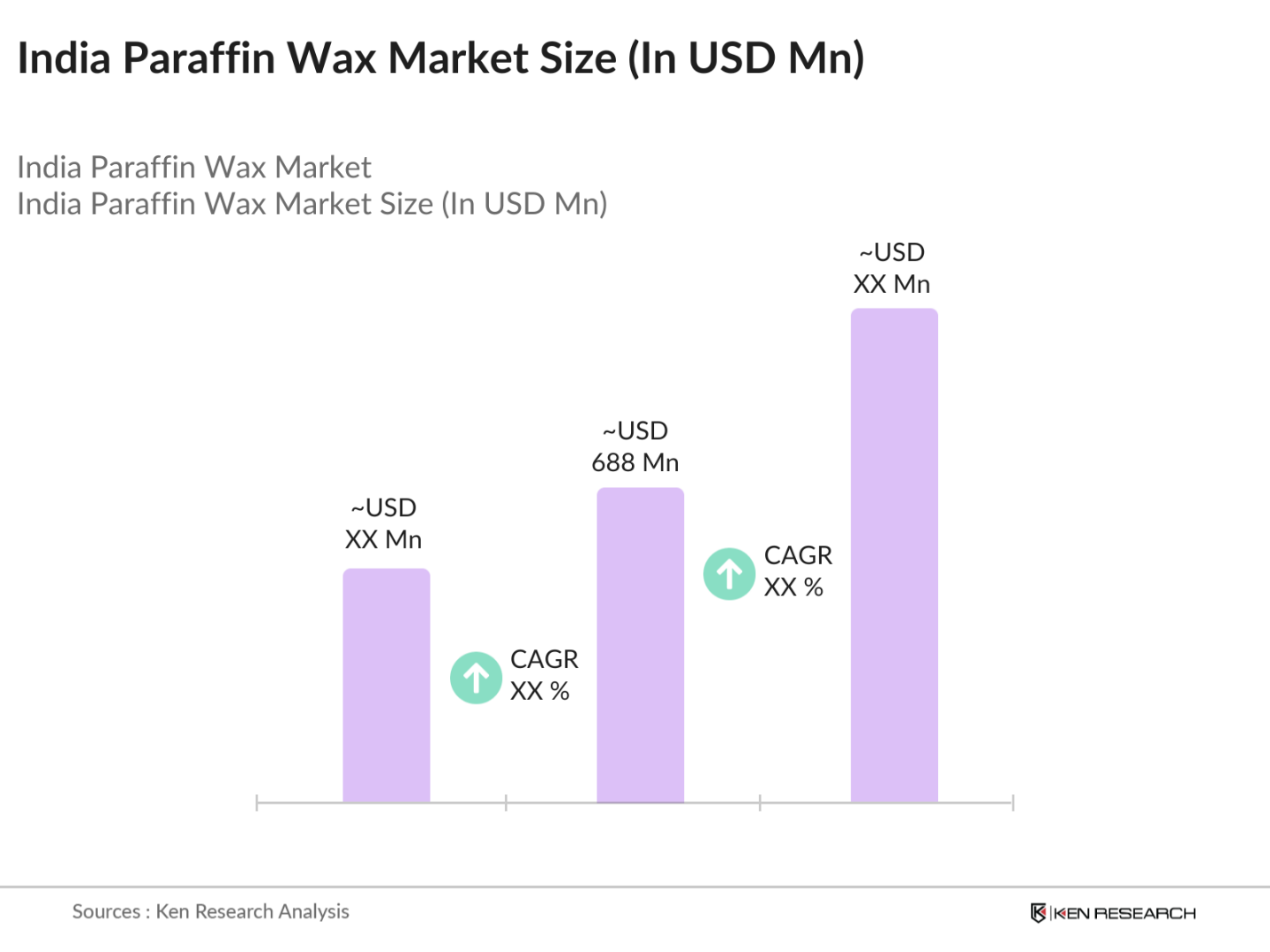

- The India Paraffin Wax Market is valued at USD 688 million, based on a comprehensive five-year historical analysis. This market is predominantly driven by the rapid expansion of the packaging industry, coupled with the rising demand for paraffin wax in personal care and candle manufacturing applications. The increasing adoption of paraffin wax in flexible packaging solutions, due to its moisture-resistant and sealing properties, is a key growth catalyst. Furthermore, the market is witnessing substantial traction in the cosmetics sector, where paraffin wax is used in skincare products and therapeutic treatments.

- Cities such as Mumbai, Delhi, and Gujarat dominate the India Paraffin Wax Market due to their well-established industrial zones and proximity to major refineries. Gujarat, in particular, has emerged as a key hub due to the presence of large-scale manufacturing facilities and easy access to raw materials. The dominance of these regions is attributed to their strategic locations, robust infrastructure, and ease of logistics which support the import-export trade of wax-based products.

- The Food Safety and Standards Authority of India (FSSAI) tightened regulations for paraffin wax use in food packaging in 2023, focusing on eliminating harmful contaminants. This led to a 15% decrease in the use of low-quality paraffin wax in the food industry, promoting safer packaging standards and compliance across manufacturers.

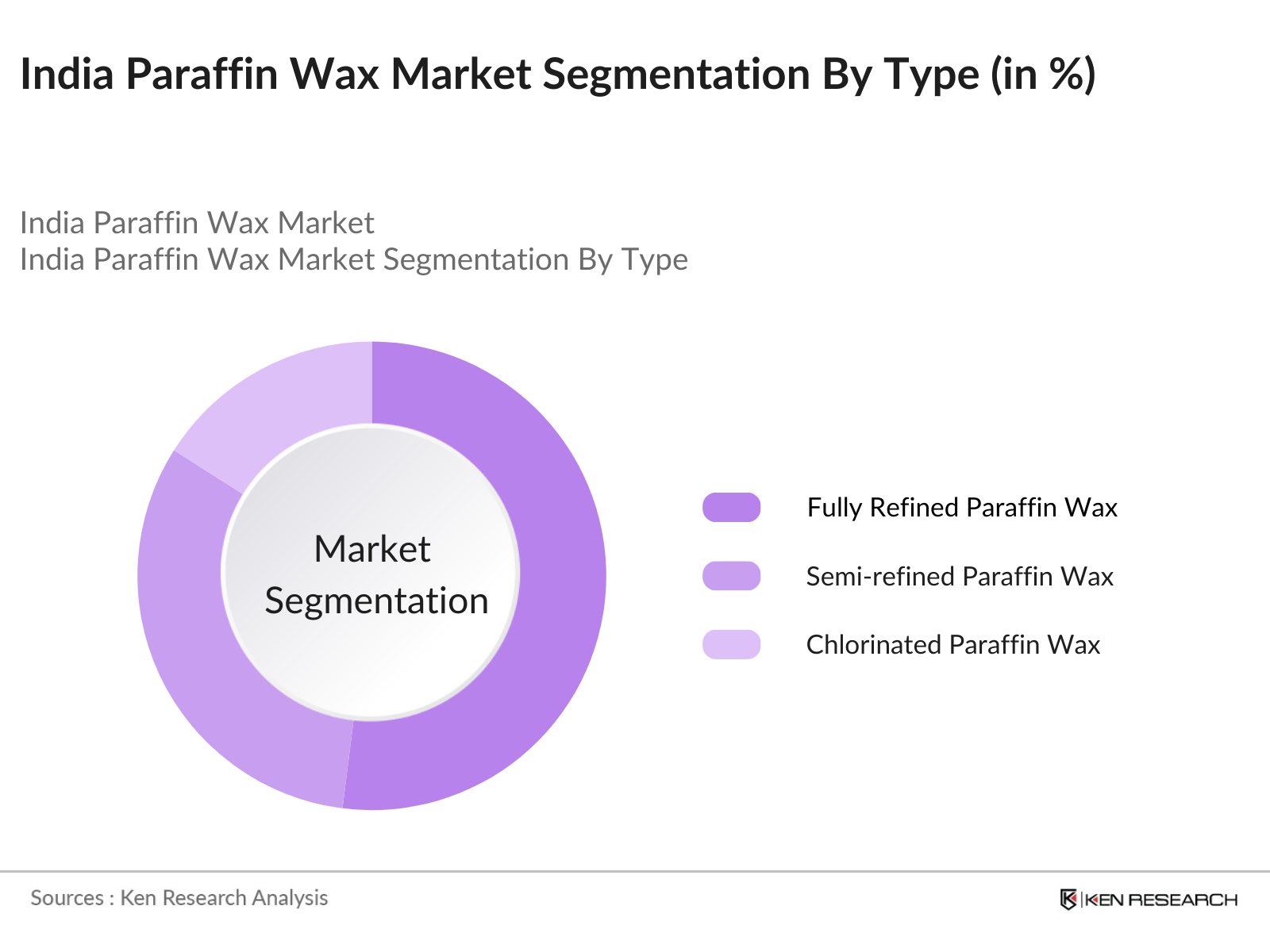

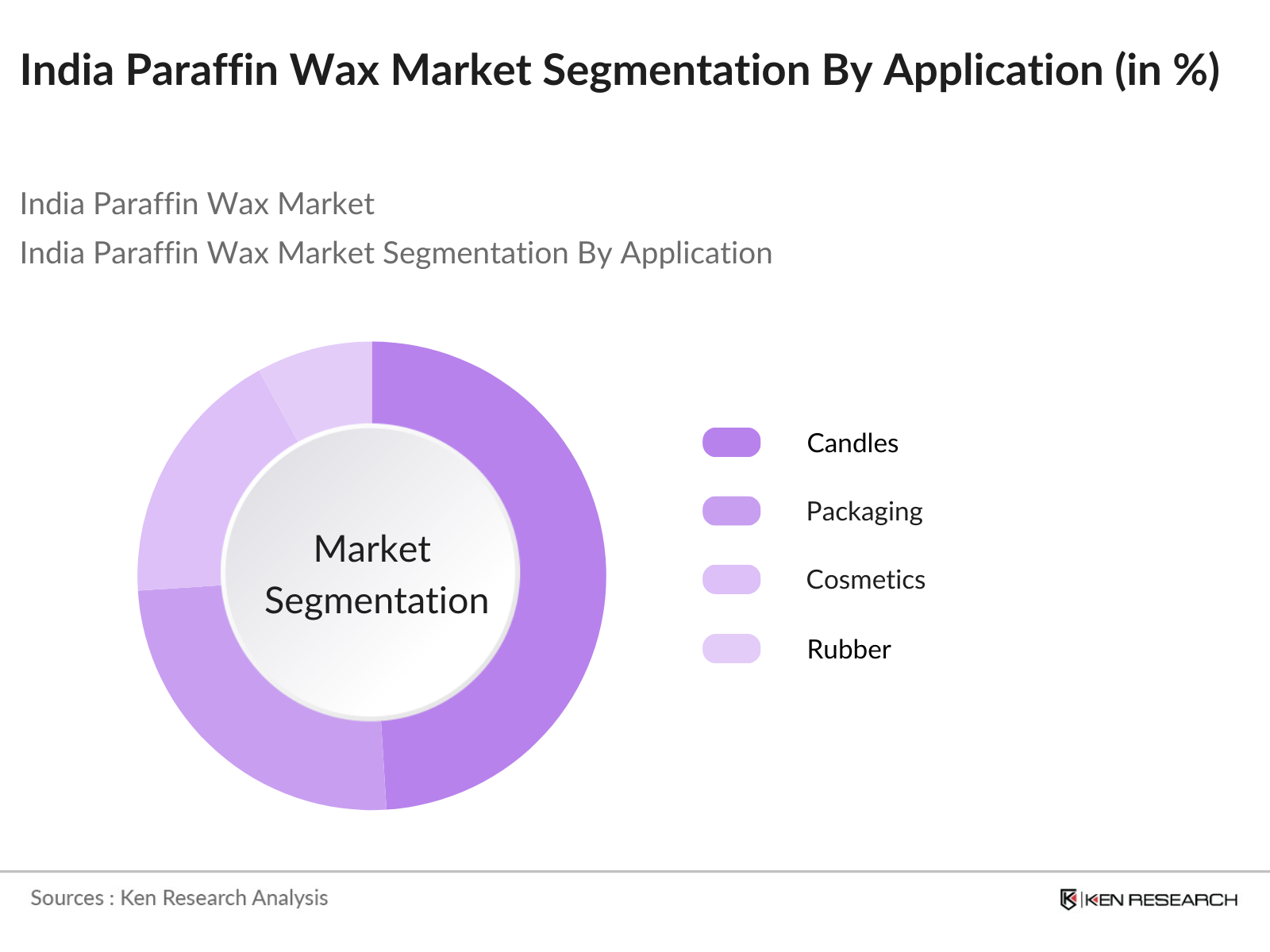

India Paraffin Wax Market Segmentation

By Type: The India Paraffin Wax market is segmented by type into fully refined paraffin wax, semi-refined paraffin wax, and chlorinated paraffin wax. Among these, fully refined paraffin wax has captured a dominant market share due to its high purity levels and suitability for applications such as cosmetics and pharmaceuticals. The refined structure of this type ensures that it meets the safety and quality standards required for direct human contact, which is a major consideration in these industries.

By Application: The India Paraffin Wax market is also segmented by application into food and beverage, candles, cosmetics, packaging, rubber, paper and board sizing, hotmelts, and others. Among these, the candle-making segment holds the highest market share. The demand for candles, particularly for decorative and religious purposes, has increased significantly, especially during festive seasons.

India Paraffin Wax Market Competitive Landscape

The India Paraffin Wax market is characterized by a mix of domestic and international players. These companies have established strong distribution networks and focus on maintaining product quality and consistency to sustain their market presence. Key strategies employed by market players include capacity expansions, mergers and acquisitions, and strategic collaborations.

India Paraffin Wax Industry Analysis

Growth Drivers

- Increased Demand for Packaging Solutions (Increased E-Commerce Penetration): India's e-commerce sector continues to grow significantly, supported by a strong logistics and digital payments ecosystem. In FY 2023-24, Indias e-commerce transactions exceeded 8 billion, spurred by increased internet penetration and growing preference for online shopping. This has led to a surge in demand for packaging materials, including paraffin wax, used in moisture-proof and tamper-evident packaging solutions.

- Expansion of the Candle Manufacturing Sector: The Indian candle manufacturing industry has witnessed a consistent rise in demand due to both domestic and export markets. India exported over 120 million units of candles to the United States and Europe in 2024, driven by a growing preference for aesthetic home decor and aromatherapy products.

- Rising Applications in Cosmetics and Personal Care (Growing Consumer Preference for Chemical-Free Products): With an increase in disposable incomes and a shift towards natural products, the demand for paraffin wax in cosmetics has seen robust growth. As of 2024, the Indian personal care industry, valued at $11.6 billion, is leaning towards chemical-free products, and paraffin wax serves as a base ingredient in several natural formulations.

Market Challenges

- Fluctuating Raw Material Prices: India imports a significant proportion of its paraffin wax requirements, making the industry vulnerable to global price fluctuations. In 2023, the import of paraffin wax amounted to 1.6 million tons, primarily from the Middle East and China. The fluctuating crude oil prices, which influence the cost of paraffin wax, have increased procurement challenges, leading to operational uncertainties for domestic manufacturers.

- Competition from Alternative Wax Types (Soy Wax, Palm Wax): Paraffin wax faces stiff competition from alternative wax types like soy and palm wax, which are considered more environmentally friendly. In 2023, Indias imports of palm wax products increased by 35%, reflecting a shift towards sustainable alternatives due to rising consumer awareness. The governments subsidy programs for soybean and palm production have further supported the growth of these alternatives, posing a challenge to the paraffin wax market.

India Paraffin Wax Market Future Outlook

Over the next few years, the India Paraffin Wax Market is anticipated to experience robust growth, driven by expanding applications in cosmetics, packaging, and specialized coatings. The increasing adoption of fully refined paraffin wax in pharmaceuticals and cosmetics due to its purity and safety attributes is expected to create new growth opportunities. Moreover, the development of bio-based paraffin wax and its potential acceptance in various end-use industries could alter market dynamics significantly.

Market Opportunities

- Growth of the Flexible Packaging Industry (Moisture and Odor Control Properties): The flexible packaging industry in India has grown exponentially, driven by food and beverage, pharmaceuticals, and e-commerce sectors. The paraffin wax industry benefits from its application in packaging due to its moisture and odor control properties. As of 2023, Indias flexible packaging sector consumed 500,000 tons of paraffin wax, a notable increase from the previous year, making it a key growth area for the industry.

- Technological Advancements in Production Processes (Bio-Based Paraffin Wax): The paraffin wax industry is increasingly focusing on sustainable alternatives and innovations in production technology. With advancements in bio-based paraffin wax production, domestic manufacturers have begun scaling operations. In 2024, the production of bio-based paraffin wax reached 60,000 tons, supported by government incentives for green technology and investments amounting to 2,500 crore for R&D initiatives.

Scope of the Report

|

By Product Type |

Fully Refined Paraffin Wax Semi-Refined Paraffin Wax Others (Microcrystalline Wax, Synthetic Wax) |

|

By Application |

Packaging Candle Manufacturing Cosmetics & Personal Care Industrial Applications Others (Medical, Electrical Insulation) |

|

By End-User |

FMCG and Consumer Goods Food & Beverage Automotive Pharmaceuticals |

|

By Technology |

Hydrocarbon Cracking Distillation and Refining |

|

Region |

Northern India Western India Southern India Eastern India |

Products

Key Target Audience

Cosmetics and Personal Care Companies

Food and Beverage Manufacturers

Candle Manufacturers

Rubber and Tire Manufacturing Companies

Pharmaceutical Companies

Packaging Companies

Government and Regulatory Bodies (Ministry of Petroleum and Natural Gas, Government of India)

Investments and Venture Capitalist Firms

Companies

Players Mentioned in the Report

BASF SE

Petroleum Product Mfg. Society

Unicorn Petroleum Industries Pvt. Ltd.

Eastern Petroleum Pvt. Ltd.

Goyel Chemical Corporation

Gandhar Oil Refinery India Ltd.

WaxOils Private Limited

Numaligarh Refinery Limited

Mitsui Chemicals India Pvt. Ltd.

Yakun Marketing Pvt. Ltd.

Table of Contents

1. India Paraffin Wax Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Absolute Growth, Incremental Opportunity)

1.4. Market Segmentation Overview

1.5. Value Chain Analysis (Upstream Raw Material Analysis, Production Processes, and Downstream Applications)

2. India Paraffin Wax Market Size (In USD Million)

2.1. Historical Market Size (Market Revenue, Volume)

2.2. Year-On-Year Growth Analysis (Revenue Growth, Production Volume)

2.3. Key Market Developments and Milestones

3. India Paraffin Wax Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand for Packaging Solutions (Increased E-Commerce Penetration)

3.1.2. Expansion of the Candle Manufacturing Sector

3.1.3. Rising Applications in Cosmetics and Personal Care (Growing Consumer Preference for Chemical-Free Products)

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Competition from Alternative Wax Types (Soy Wax, Palm Wax)

3.2.3. Environmental and Regulatory Compliance Costs

3.3. Opportunities

3.3.1. Growth of the Flexible Packaging Industry (Moisture and Odor Control Properties)

3.3.2. Technological Advancements in Production Processes (Bio-Based Paraffin Wax)

3.4. Trends

3.4.1. Increased Adoption of Sustainable Packaging Solutions

3.4.2. Growth in Use of Paraffin Wax for Hot Melt Adhesives

3.5. Government Regulation

3.5.1. Compliance with FSSAI Standards for Food-Grade Paraffin Wax

3.5.2. Environmental Protection Laws on Wax Disposal

3.6. SWOT Analysis

3.7. Stake Ecosystem Analysis (Suppliers, Manufacturers, Distributors, and End-Users)

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem Analysis

4. India Paraffin Wax Market Segmentation

4.1. By Product Type (In Value and Volume %)

4.1.1. Fully Refined Paraffin Wax

4.1.2. Semi-Refined Paraffin Wax

4.1.3. Others (Microcrystalline Wax, Synthetic Wax)

4.2. By Application (In Value and Volume %)

4.2.1. Packaging

4.2.2. Candle Manufacturing

4.2.3. Cosmetics & Personal Care

4.2.4. Industrial Applications

4.2.5. Others (Medical, Electrical Insulation)

4.3. By End-User Industry (In Value and Volume %)

4.3.1. FMCG and Consumer Goods

4.3.2. Food & Beverage

4.3.3. Automotive

4.3.4. Pharmaceuticals

4.4. By Technology (In Value and Volume %)

4.4.1. Hydrocarbon Cracking

4.4.2. Distillation and Refining

4.5. By Region (In Value and Volume %)

4.5.1. Northern India

4.5.2. Western India

4.5.3. Southern India

4.5.4. Eastern India

5. India Paraffin Wax Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Reliance Industries

5.1.2. Indian Oil Corporation Limited

5.1.3. Chennai Petroleum Corporation Limited

5.1.4. Bharat Petroleum Corporation Limited

5.1.5. Hindustan Petroleum Corporation Limited

5.1.6. Sasol Limited

5.1.7. Exxon Mobil Corporation

5.1.8. Shell International

5.1.9. Total SE

5.1.10. Honeywell International Inc.

5.1.11. Calumet Specialty Products Partners, L.P.

5.1.12. Nippon Seiro Co., Ltd.

5.1.13. Repsol S.A.

5.1.14. The International Group, Inc.

5.1.15. China Petrochemical Corporation (Sinopec)

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Product Portfolio, Market Presence, R&D Investment)

5.3. Market Share Analysis (Top Players, Regional Dominance)

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Paraffin Wax Market Regulatory Framework

6.1. Environmental Standards (Emission Regulations, Disposal Standards)

6.2. Compliance Requirements (FSSAI, BIS)

6.3. Certification Processes

7. India Paraffin Wax Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Paraffin Wax Market Segmentation

8.1. By Product Type (In Value and Volume %)

8.2. By Application (In Value and Volume %)

8.3. By End-User Industry (In Value and Volume %)

8.4. By Technology (In Value and Volume %)

8.5. By Region (In Value and Volume %)

9. India Paraffin Wax Market Analysts Recommendations

9.1. Total Addressable Market (TAM)/Serviceable Available Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Paraffin Wax Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the India Paraffin Wax Market is compiled and analyzed. This includes assessing market penetration, evaluating the ratio of product segments, and the resultant revenue generation. Further evaluation of service quality statistics ensures the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights, instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple paraffin wax manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction verifies and complements the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Paraffin Wax market.

Frequently Asked Questions

01. How big is the India Paraffin Wax Market?

The India Paraffin Wax Market is valued at USD 688 million, based on a comprehensive five-year historical analysis. This market is predominantly driven by the rapid expansion of the packaging industry, coupled with the rising demand for paraffin wax in personal care and candle manufacturing applications.

02. What are the challenges in the India Paraffin Wax Market?

Challenges include supply chain disruptions, fluctuating raw material prices, and stringent environmental regulations that impact the production and distribution of paraffin wax.

03. Who are the major players in the India Paraffin Wax Market?

Key players include BASF SE, Petroleum Product Mfg. Society, Unicorn Petroleum Industries Pvt. Ltd., Gandhar Oil Refinery India Ltd., and WaxOils Private Limited, among others.

04. What are the growth drivers of the India Paraffin Wax Market?

The growth is propelled by increasing demand for cosmetics, rising use in industrial applications, and innovation in bio-based wax alternatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.