India Passenger Car Air Conditioners Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD9538

December 2024

99

About the Report

India Passenger Car Air Conditioners Market Overview

- The India Passenger Car Air Conditioners Market is valued at USD 1.2 billion, driven by the growing automotive sector and increasing consumer demand for enhanced comfort and safety. This growth is underpinned by technological advancements in HVAC systems and a steady rise in disposable incomes, encouraging more consumers to opt for vehicles equipped with air conditioning systems. The introduction of eco-friendly refrigerants and innovations in automatic climate control technology further fuels market growth.

- Key automotive hubs like Pune, Chennai, and Gurgaon dominate the market due to their established automotive manufacturing infrastructure and proximity to supplier ecosystems. Chennai, known as the "Detroit of India," contributes significantly due to its dense concentration of passenger vehicle manufacturers, skilled labor, and efficient logistics. Pune and Gurgaon complement this dominance with robust R&D centers and strong supplier networks.

- The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) India Scheme, with a budget allocation of 10,000 crore, aims to promote the adoption of electric vehicles, indirectly boosting the demand for specialized HVAC systems suitable for such vehicles.

India Passenger Car Air Conditioners Market Segmentation

By Vehicle Type: India's passenger car air conditioner market is segmented into hatchbacks, sedans, MUVs, and CUVs. Hatchbacks hold a dominant market share of 45% due to their affordability and suitability for urban driving. The growing middle-class population opts for hatchbacks as their first vehicle, ensuring sustained demand for air conditioning systems in this segment.

By Technology: The market is segmented by technology into manual/semi-automatic and automatic systems. Manual/semi-automatic air conditioning systems lead the market with a 55% share, attributed to their lower cost and prevalence in entry-level vehicles. However, rising consumer preference for convenience and premium features is driving significant growth in the automatic air conditioner segment.

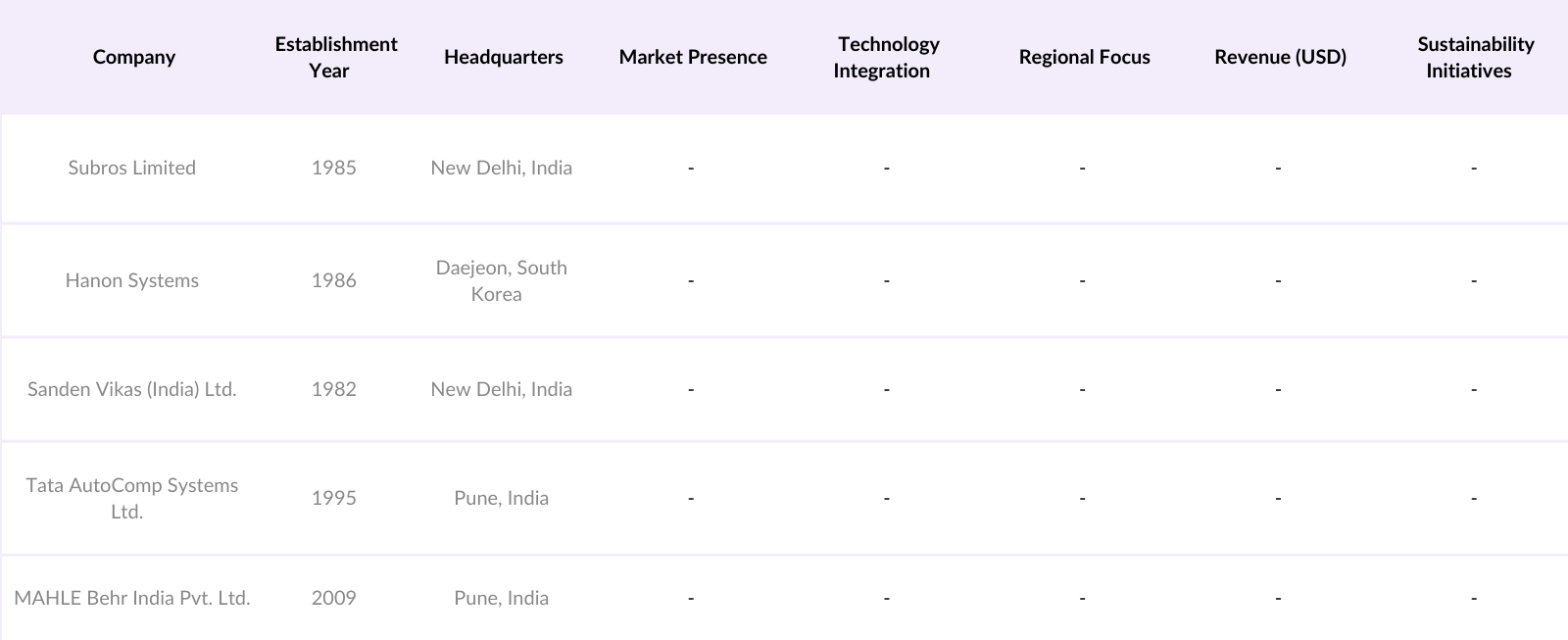

India Passenger Car Air Conditioners Market Competitive Landscape

The India Passenger Car Air Conditioners Market is dominated by a mix of local and international players, leveraging their expertise in technology and distribution.

India Passenger Car Air Conditioners Market Analysis

Growth Drivers

- Rising Vehicle Production and Sales: In the fiscal year 2022-2023, India's passenger vehicle production reached approximately 3.9 million units, reflecting a significant increase from the previous year's 3.1 million units. This surge in production is driven by heightened consumer demand and favorable economic conditions, directly boosting the market for passenger car air conditioners.

- Increasing Consumer Demand for Thermal Comfort: With average summer temperatures in India often exceeding 40C, there is a growing consumer preference for vehicles equipped with efficient air conditioning systems to ensure comfort during travel. This trend has led to a higher penetration rate of air-conditioned vehicles in the market.

- Technological Advancements in HVAC Systems: The automotive industry is witnessing the integration of advanced HVAC technologies, such as automatic climate control and multi-zone temperature settings, enhancing passenger comfort and driving the demand for sophisticated air conditioning systems in passenger cars.

Market Challenges

- High Installation and Maintenance Costs: The initial cost of installing advanced air conditioning systems in vehicles can be substantial, and ongoing maintenance expenses may deter some consumers, particularly in the budget-sensitive segments of the market.

- Fluctuating Raw Material Prices: The automotive HVAC industry is susceptible to volatility in the prices of raw materials such as aluminum and copper, which are essential for manufacturing components like condensers and compressors. Such fluctuations can impact production costs and profit margins.

India Passenger Car Air Conditioners Market Future Outlook

Over the next five years, the India Passenger Car Air Conditioners Market is expected to witness robust growth, driven by increasing vehicle production, adoption of advanced HVAC technologies, and rising demand for electric and hybrid vehicles. Innovations in energy-efficient systems and stringent environmental regulations are likely to reshape the market dynamics, fostering sustainable growth.

Market Opportunities

- Adoption of Eco-Friendly Refrigerants: The transition to low global warming potential refrigerants, such as hydrofluoroolefins (HFOs), presents an opportunity for manufacturers to develop environmentally sustainable air conditioning systems, aligning with global environmental goals and regulatory requirements.

- Expansion of Aftermarket Services: The growing number of vehicles on the road increases the demand for aftermarket services, including the installation, repair, and maintenance of air conditioning systems, providing a lucrative opportunity for service providers in the HVAC market.

Scope of the Report

|

By Vehicle Type |

Hatchback Multi-Utility Vehicle (MUV) Sedan Compact Utility Vehicle (CUV) |

|

By Technology |

Automatic Manual/Semi-Automatic |

|

By Compressor Type |

Variable Displacement Fixed Displacement |

|

By Component |

Compressor Condenser Evaporator Expansion Valve Receiver/Drier |

|

By Region |

North East West South |

Products

Key Target Audience

Passenger Vehicle Manufacturers

Tier-1 Automotive Component Suppliers

Electric Vehicle OEMs

Automotive Dealerships and Retailers

Investors and Venture Capitalist Firms

Automotive Research and Development Centers

Logistics and Supply Chain Companies

Government and Regulatory Bodies (Ministry of Heavy Industries, Ministry of Environment, Forest and Climate Change)

Companies

Players Mentioned in the Report:

Subros Limited

Hanon Systems

Sanden Vikas (India) Ltd.

Tata AutoComp Systems Ltd.

MAHLE Behr India Pvt. Ltd.

Valeo

Keihin Corporation

Mitsubishi Heavy Industries India Pvt. Ltd.

Visteon Corporation

Panasonic Corporation

Table of Contents

1. India Passenger Car Air Conditioners Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Passenger Car Air Conditioners Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Passenger Car Air Conditioners Market Analysis

3.1. Growth Drivers

3.1.1. Rising Vehicle Production and Sales

3.1.2. Increasing Consumer Demand for Thermal Comfort

3.1.3. Technological Advancements in HVAC Systems

3.1.4. Government Initiatives Promoting Automotive Sector Growth

3.2. Market Challenges

3.2.1. High Installation and Maintenance Costs

3.2.2. Fluctuating Raw Material Prices

3.2.3. Environmental Concerns Related to Refrigerants

3.3. Market Opportunities

3.3.1. Adoption of Eco-Friendly Refrigerants

3.3.2. Expansion of Aftermarket Services

3.3.3. Integration with Electric and Hybrid Vehicles

3.4. Market Trends

3.4.1. Shift Towards Automatic Climate Control Systems

3.4.2. Miniaturization and Weight Reduction of Components

3.4.3. Use of Advanced Materials for Enhanced Efficiency

3.5. Government Regulations

3.5.1. Emission Norms and Standards

3.5.2. Policies on Refrigerant Usage

3.5.3. Incentives for Electric Vehicles

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter's Five Forces Analysis

3.9. Competitive Landscape

4. India Passenger Car Air Conditioners Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Hatchback

4.1.2. Multi-Utility Vehicle (MUV)

4.1.3. Sedan

4.1.4. Compact Utility Vehicle (CUV)

4.2. By Technology (In Value %)

4.2.1. Automatic

4.2.2. Manual/Semi-Automatic

4.3. By Compressor Type (In Value %)

4.3.1. Variable Displacement

4.3.2. Fixed Displacement

4.4. By Component (In Value %)

4.4.1. Compressor

4.4.2. Condenser

4.4.3. Evaporator

4.4.4. Expansion Valve

4.4.5. Receiver/Drier

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. East India

4.5.3. West India

4.5.4. South India

5. India Passenger Car Air Conditioners Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Subros Limited

5.1.2. Hanon Automotive Systems India Private Limited

5.1.3. MAHLE Behr India Pvt. Ltd.

5.1.4. Sanden Vikas (India) Ltd.

5.1.5. DENSO Thermal Systems Pune Private Limited

5.1.6. TATA AutoComp Systems Limited

5.1.7. Mitsubishi Heavy Industries India Pvt. Ltd.

5.1.8. Samvardhana Motherson Group (SMG)

5.1.9. Aptiv PLC

5.1.10. Valeo Service

5.1.11. Keihin Corporation

5.1.12. Johnson Electric Holdings Limited

5.1.13. Sensata Technologies

5.1.14. Calsonic Kansei Corporation

5.1.15. Visteon Corporation

5.2. Cross Comparison Parameters

5.2.1 Revenue

5.2.2 Market Share

5.2.3 Product Portfolio

5.2.4 R&D Investment

5.2.5 Regional Presence

5.2.6 Strategic Initiatives

5.2.7 Employee Strength

5.2.8 Year of Establishment

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Passenger Car Air Conditioners Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Passenger Car Air Conditioners Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Passenger Car Air Conditioners Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Compressor Type (In Value %)

8.4. By Component (In Value %)

8.5. By Region (In Value %)

9. India Passenger Car Air Conditioners Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research began with mapping the entire automotive air conditioning ecosystem in India, utilizing secondary research sources like industry reports and proprietary databases. Key variables such as vehicle type, technology adoption, and regional demand patterns were identified.

Step 2: Market Analysis and Construction

Historical data on market size, segment performance, and technological advancements were analyzed to construct a reliable market framework. This phase also involved studying the relationship between automotive production trends and air conditioner adoption rates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through interviews with industry experts from automotive OEMs and HVAC component manufacturers. This step ensured accuracy in understanding technological and consumer trends.

Step 4: Research Synthesis and Final Output

Primary data from manufacturers and distributors was synthesized with secondary research findings to create a comprehensive and validated market report, ensuring actionable insights for stakeholders.

Frequently Asked Questions

01. How big is the India Passenger Car Air Conditioners Market?

The India Passenger Car Air Conditioners Market is valued at USD 1.2 billion, driven by increasing vehicle production and technological advancements in HVAC systems.

02. What are the key challenges in the market?

The key challenges in the India Passenger Car Air Conditioners Market include high costs of advanced HVAC systems, environmental concerns about refrigerants, and fluctuating raw material prices, which impact production costs and affordability.

03. Who are the major players in the India Passenger Car Air Conditioners Market?

Major players in the India Passenger Car Air Conditioners Market include Subros Limited, Hanon Systems, Sanden Vikas (India) Ltd., Tata AutoComp Systems Ltd., and MAHLE Behr India Pvt. Ltd., known for their strong technological expertise and extensive supplier networks.

04. What are the growth drivers for the market?

Growth of India Passenger Car Air Conditioners Market is driven by increasing consumer demand for comfort features, advancements in air conditioning technology, and government initiatives supporting automotive sector development.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.