India Pet Boarding Services Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD5093

December 2024

89

About the Report

India Pet Boarding Services Market Overview

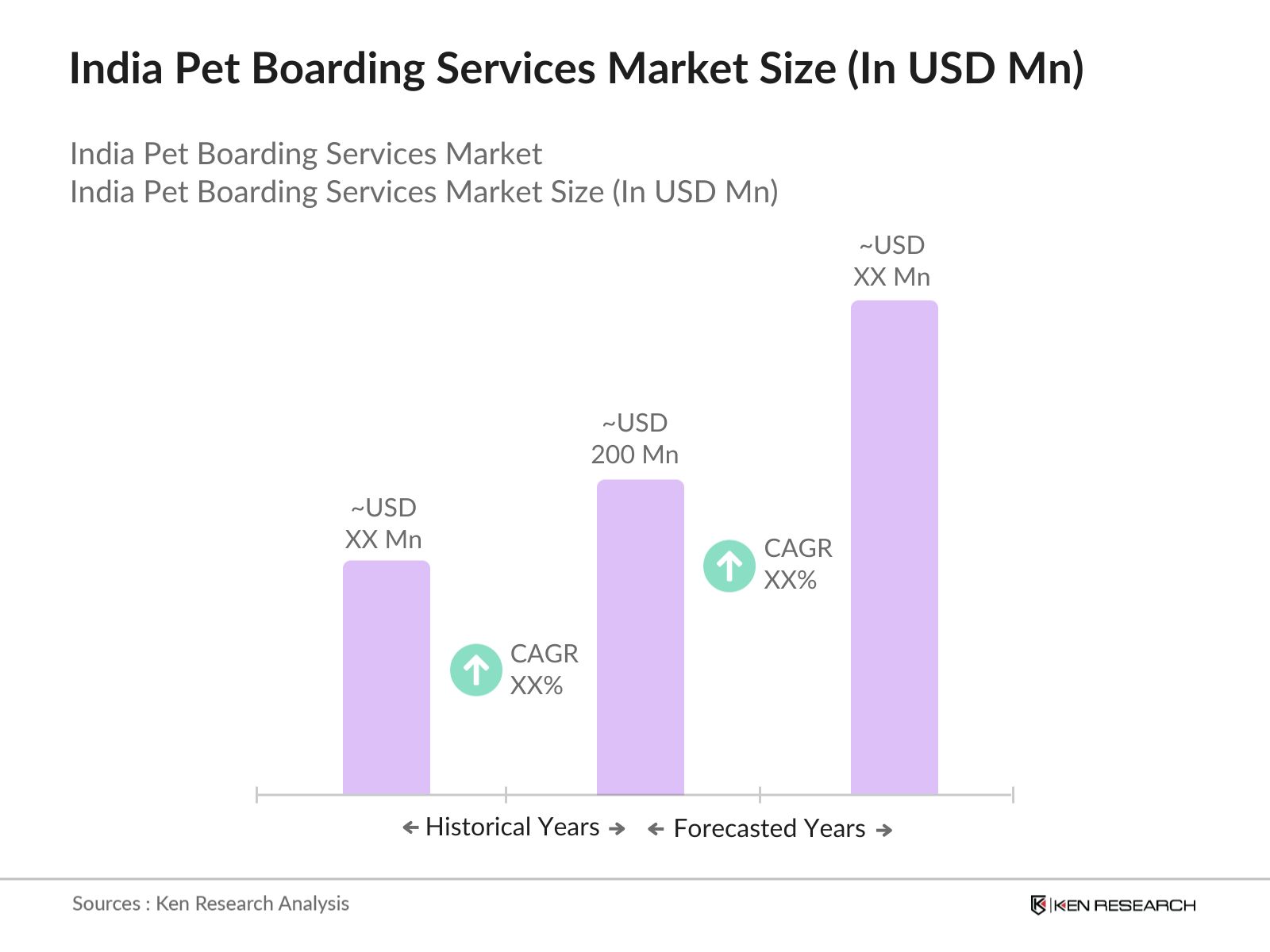

- The India pet boarding services market is valued at USD 200 million, primarily driven by increasing pet ownership, especially in urban areas, and rising disposable incomes. The market is experiencing steady growth as more pet owners seek professional care options due to their busy lifestyles. Key factors include the shift towards nuclear families, greater awareness of pet welfare, and the growing trend of pets as family members. These factors contribute to the rising demand for reliable, high-quality pet boarding facilities, cementing India's position as a rapidly growing market in this sector.

- Major demand centers for pet boarding services in India include metro cities such as Mumbai, Delhi, and Bengaluru. These cities lead due to their dense pet population, high concentration of upper-middle-class families, and better infrastructure to support pet services. The economic affluence in these urban areas and the availability of premium boarding options contribute to the dominance of these cities. Additionally, these areas house pet-friendly communities, making them ideal for expanding pet boarding facilities.

- Indian laws mandate that pet boarding facilities adhere to specific welfare standards, including adequate space, hygiene, and safety measures. Compliance with the Prevention of Cruelty to Animals Act is essential for obtaining operating licenses, ensuring that facilities meet basic pet welfare standards. These regulations help set a minimum quality bar, though compliance can be costly and complex, especially for small businesses.

India Pet Boarding Services Market Segmentation

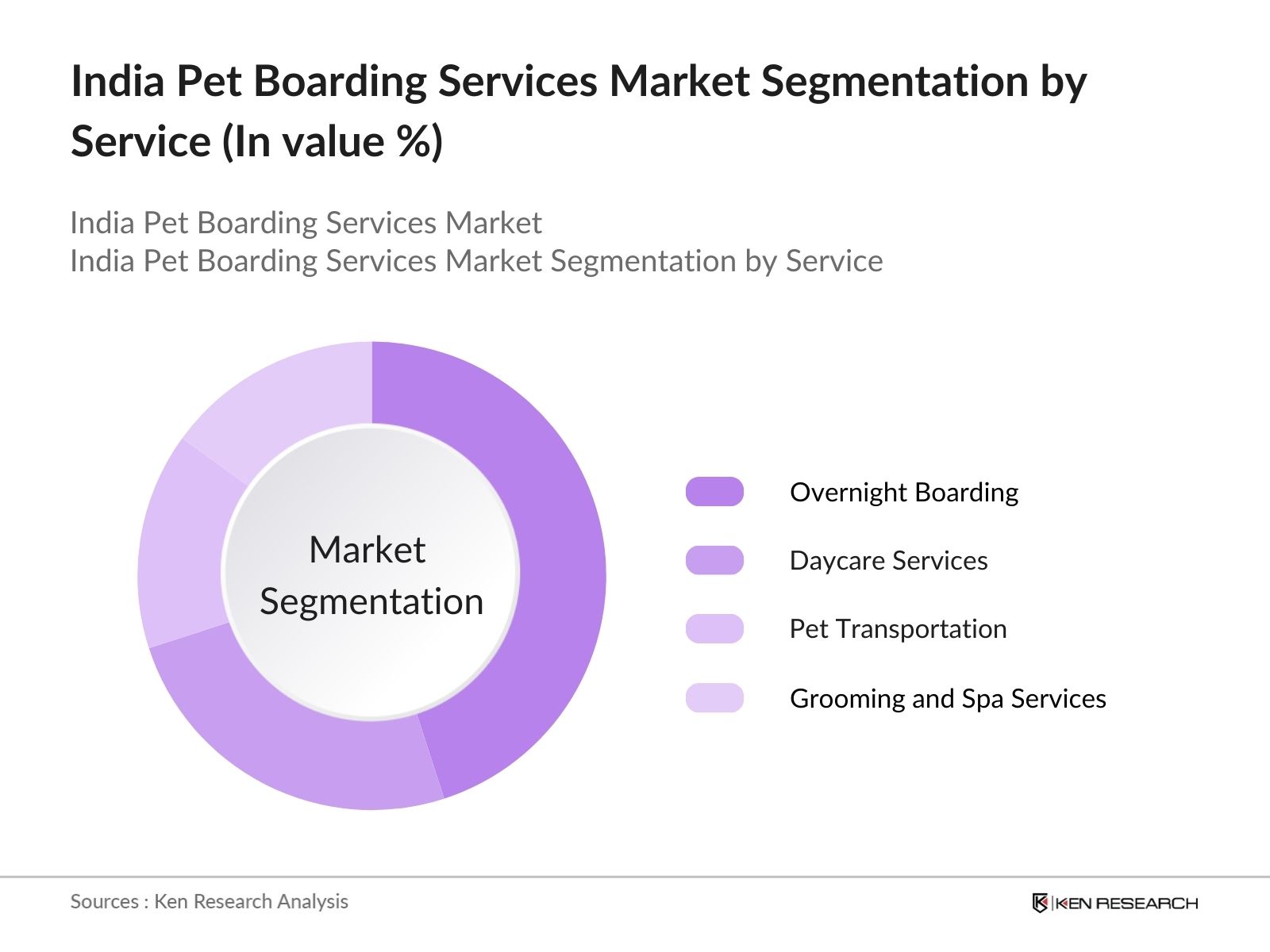

- By Service Type: The market is segmented by service type into Overnight Boarding, Daycare Services, Pet Transportation, and Grooming and Spa Services. Overnight boarding holds a dominant market share under the service type segmentation, as it caters to the needs of pet owners who travel for extended periods. These facilities provide safe, supervised accommodations, including pet-centric amenities like designated play areas, temperature-controlled rooms, and 24/7 monitoring. The demand for overnight boarding is driven by pet owners' desire for reliable care options that ensure pets' comfort and well-being while owners are away.

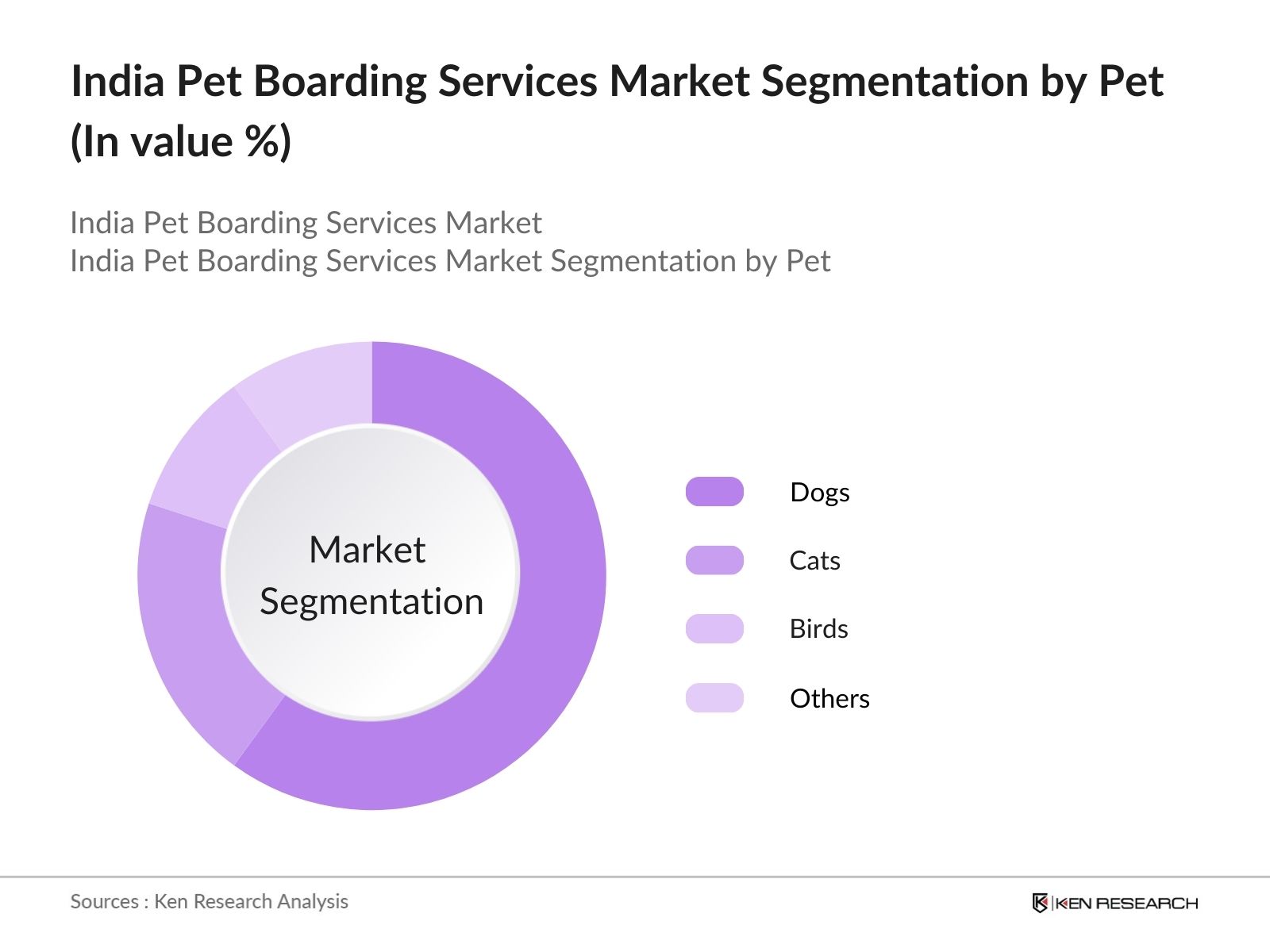

- By Pet Type: The market is segmented by pet type into Dogs, Cats, Birds, and Others. Dogs have a dominant share in the pet boarding services market in India under the segmentation by pet type, due to their popularity as family pets. The dedicated care requirements for dogs, such as frequent exercise, socialization, and grooming, drive demand for professional boarding services. Many facilities are tailored specifically for dogs, offering amenities like dog parks, grooming, and special dietary options, which make dog boarding services the most sought-after by pet owners.

India Pet Boarding Services Market Competitive Landscape

The India pet boarding services market is characterized by several established and emerging players who cater to the rising demand for pet care services. Companies leverage their service quality, digital booking capabilities, and customer engagement to establish a competitive edge.

India Pet Boarding Services Market Analysis

Growth Drivers

- Rising Pet Ownership: Pet ownership in India has seen substantial growth in recent years, largely driven by urban dwellers and changing family structures. As of 2024, around 32 million households in India now own pets, a significant increase from previous years, aligning with global trends in pet adoption. The rise in pet ownership is further supported by macroeconomic factors, including an increased emphasis on pet companionship as families shrink and urban populations grow, creating a robust demand for pet-related services like boarding.

- Urbanization and Lifestyle Changes: Indias urban population has grown to over 519 million in 2023, driving lifestyle changes that emphasize convenience and pet care services. As urban households are often smaller and busier, more pet owners seek boarding solutions, especially during work hours or travels. The demand for urban pet services is now concentrated in metro cities like Delhi, Mumbai, and Bengaluru, each with a significant percentage of urban pet owners. This urban trend bolsters the growth trajectory for pet boarding facilities, addressing lifestyle needs aligned with fast-paced city living.

- Increase in Disposable Income: With a per capita GDP of approximately USD 2,500 in 2024, India has experienced a rise in disposable income, allowing pet owners to spend more on premium care services. Higher earnings in middle-class and upper-middle-class households directly translate to increased spending on pet care, including boarding services. This financial growth provides pet owners with the flexibility to invest in boarding solutions, thus fueling market expansion, especially in economically progressive regions such as Maharashtra, Karnataka, and Tamil Nadu.

Challenges

- Operational and Infrastructure Costs: Operating pet boarding facilities in India entails substantial overhead expenses, which include maintenance, staffing, and ensuring compliance with animal welfare regulations. Key cost drivers involve utilities, specialized pet amenities, and maintaining high hygiene standards. These expenses challenge profitability, especially for small and medium-sized service providers, and create entry barriers for new businesses. The burden of managing these costs limits the expansion of pet boarding services and restricts their availability in less economically developed regions.

- Limited Skilled Workforce: India experiences a significant shortage of trained professionals in pet care, posing a challenge for the pet boarding sector. The lack of skilled workers affects the ability of service providers to uphold high standards of care, particularly in handling and managing pets with specific needs. This talent gap disproportionately impacts smaller businesses and those located in non-metro areas, where access to skilled professionals is even more limited. This constraint inhibits the scalability of the industry and restricts service quality across various regions.

India Pet Boarding Services Market Future Outlook

The India Pet Boarding Services market is expected to continue its upward trajectory, driven by rising pet ownership, urbanization, and disposable incomes. Increasingly, pet owners are opting for professional boarding services to meet their pets' specific care needs. The expansion of digital platforms for online booking and real-time pet monitoring is set to further propel market growth. Furthermore, growing demand from Tier 2 and Tier 3 cities offers significant opportunities for expansion, as pet care services gain popularity outside metro regions.

Future Market Opportunities

- Growth in Tier 2 and Tier 3 Cities: As pet ownership spreads beyond major metropolitan areas, there is a rising demand for pet boarding services in Tier 2 and Tier 3 cities like Jaipur, Chandigarh, and Coimbatore. These cities now represent substantial portion of Indias pet-owning households in 2024, as families in smaller urban centers seek quality pet care services. This geographic expansion provides a promising avenue for pet boarding businesses to tap into an underserved market and establish their presence in regions with a growing consumer base.

- Technological Advancements in Service Offerings: Technology integration in pet boarding, including app-based booking and real-time monitoring, has elevated service quality and customer convenience. As of 2024, majority of urban pet owners in India prefer digital solutions for service. This digital adoption, coupled with advancements in monitoring systems, presents an opportunity for boarding service providers to cater to tech-savvy customers who value convenience and transparency in pet care.

Scope of the Report

|

By Service Type |

Overnight Boarding |

|

By Pet Type |

Dogs |

|

By Service Channel |

Offline (Physical Centers) |

|

By Customer Type |

Individual Households |

|

By Region |

North |

Products

Key Target Audience

Pet Boarding Service Providers

Pet Care Product Manufacturers

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Animal Welfare Board of India, Municipal Licensing Bodies)

Animal Welfare Organizations

Online Pet Services Platforms

Luxury Pet Service Providers

Companies

Players Mentioned in the Report

Heads Up for Tails

PetBacker

Wagging Tails

Pawspace

Fur Ball Story

Flying Fur

PetSpot

Doggie Bazaar

Petmate India

BarkNBond

Petsville

Just Dogs

Petcart

Petzz

Petofy

Table of Contents

01 India Pet Boarding Services Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

02 India Pet Boarding Services Market Size (in INR Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

03 India Pet Boarding Services Market Analysis

3.1 Growth Drivers

3.1.1 Rising Pet Ownership

3.1.2 Urbanization and Lifestyle Changes

3.1.3 Increase in Disposable Income

3.1.4 Expanding Middle-Class Segment

3.2 Market Challenges

3.2.1 High Operational Costs

3.2.2 Limited Skilled Workforce

3.2.3 Regulatory Barriers

3.3 Opportunities

3.3.1 Growth in Tier 2 and Tier 3 Cities

3.3.2 Technological Advancements in Service Offerings

3.3.3 Partnerships with Veterinary Clinics

3.4 Trends

3.4.1 Rise in Premium Pet Care Services

3.4.2 Online Booking and App-Based Platforms

3.4.3 Demand for Pet-Specific Amenities

3.5 Government Regulation

3.5.1 Pet Welfare and Care Standards

3.5.2 Licensing Requirements for Pet Boarding Facilities

3.5.3 Zoning and Compliance Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

04 India Pet Boarding Services Market Segmentation

4.1 By Service Type (in Value %)

4.1.1 Overnight Boarding

4.1.2 Daycare Services

4.1.3 Pet Transportation

4.1.4 Grooming and Spa Services

4.2 By Pet Type (in Value %)

4.2.1 Dogs

4.2.2 Cats

4.2.3 Birds

4.2.4 Others

4.3 By Service Channel (in Value %)

4.3.1 Offline (Physical Centers)

4.3.2 Online (Mobile Apps and Websites)

4.4 By Customer Type (in Value %)

4.4.1 Individual Households

4.4.2 Corporate Clients (Expatriates, etc.)

4.5 By Region (in Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

05 India Pet Boarding Services Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Heads Up for Tails

5.1.2 PetSpot

5.1.3 PetBacker

5.1.4 Wagging Tails

5.1.5 Pawspace

5.1.6 Petzz

5.1.7 Fur Ball Story

5.1.8 Flying Fur

5.1.9 BarkNBond

5.1.10 Doggie Bazaar

5.1.11 Petmate India

5.1.12 Petsville

5.1.13 Petofy

5.1.14 Just Dogs

5.1.15 Petcart

5.2 Cross Comparison Parameters (No. of Employees, Revenue, Inception Year, Service Portfolio, Region of Operation, Online Booking Capabilities, Pricing Strategy, Customer Retention Rate)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Incentives

5.9 Partnership and Collaboration Strategies

06 India Pet Boarding Services Market Regulatory Framework

6.1 Animal Welfare Laws

6.2 Pet Boarding Licensing

6.3 Health and Sanitation Compliance

6.4 Insurance Regulations

07 India Pet Boarding Services Future Market Size (in INR Billion)

7.1 Market Growth Potential

7.2 Key Factors Driving Future Market Growth

08 India Pet Boarding Services Future Market Segmentation

8.1 By Service Type (in Value %)

8.2 By Pet Type (in Value %)

8.3 By Service Channel (in Value %)

8.4 By Customer Type (in Value %)

8.5 By Region (in Value %)

09 India Pet Boarding Services Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Strategies

9.4 Opportunity Mapping and White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive view of the India Pet Boarding Services Market by identifying key stakeholders such as boarding providers, pet product manufacturers, and regulatory bodies. Desk research is conducted to gather secondary data on market dynamics and influencing factors.

Step 2: Market Analysis and Data Collection

This step involves compiling historical data on Indias pet boarding market, assessing trends in service adoption, and analyzing geographical distribution. Data on revenue trends and service penetration is examined to establish an accurate baseline for further research.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses regarding market drivers and trends are formulated and validated through structured interviews with industry experts. These consultations provide insights into operational challenges and allow for direct verification of data obtained from secondary sources.

Step 4: Data Synthesis and Final Output

In this final stage, data from primary and secondary research sources is synthesized to create a cohesive report that includes detailed market segmentation, competitive landscape, and growth projections for the India Pet Boarding Services Market.

Frequently Asked Questions

01. How big is the India Pet Boarding Services Market?

The India Pet Boarding Services Market is valued at USD 200 million, with growth driven by increasing pet ownership, rising disposable incomes, and the trend of pets being considered family members.

02. What are the challenges in the India Pet Boarding Services Market?

Challenges in the India Pet Boarding Services Market include high operational costs, limited skilled workforce, and the need to maintain consistent service quality, particularly in non-metro regions.

03. Who are the major players in the India Pet Boarding Services Market?

Key players in the India Pet Boarding Services Market include Heads Up for Tails, PetBacker, Wagging Tails, Pawspace, and Fur Ball Story. These companies lead due to their comprehensive service offerings and strong customer retention.

04. What are the growth drivers of the India Pet Boarding Services Market?

The India Pet Boarding Services Market growth is propelled by urbanization, rising disposable incomes, and the humanization of pets, which has led to increased spending on professional pet care services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.