India Pet Nutraceuticals Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD5113

November 2024

91

About the Report

India Pet Nutraceuticals Market Overview

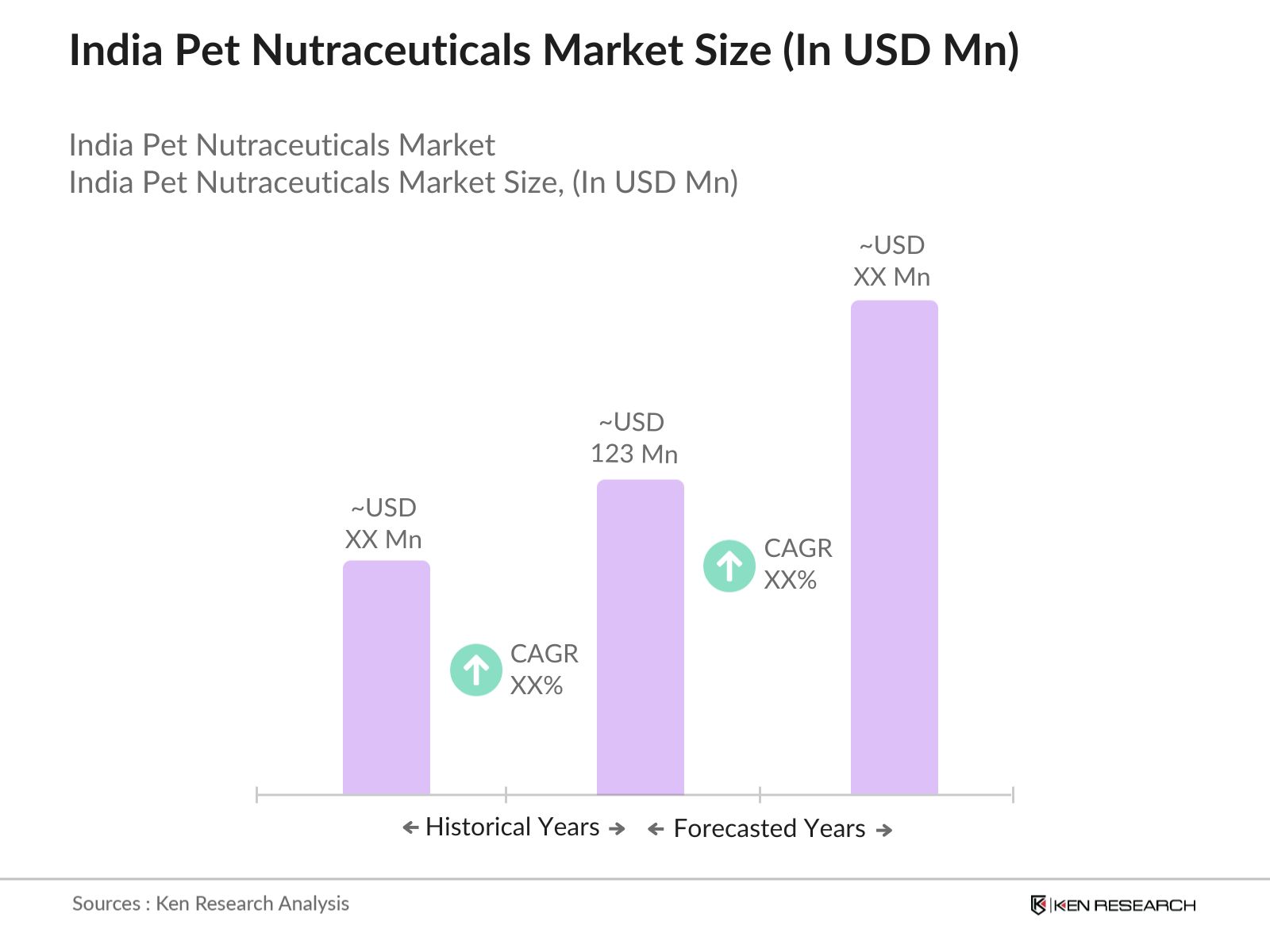

- The India Pet Nutraceuticals Market, based on a detailed five-year analysis, is valued at INR 123 million. The market's growth is primarily driven by an increasing trend of pet humanization, wherein pet owners treat their pets as part of the family, leading to higher demand for premium pet healthcare products. This shift in consumer behavior, combined with rising disposable incomes in urban regions, is further driving the adoption of high-quality nutraceuticals that cater to various health needs like joint health, immunity boosting, and digestion support. Increasing awareness about pet health has also significantly contributed to the market expansion.

- In India, metropolitan cities such as Mumbai, Delhi, and Bangalore dominate the pet nutraceuticals market. The dominance of these cities is attributed to the higher pet ownership rates, availability of advanced veterinary services, and a growing middle-class population willing to invest in premium pet care products. These cities also witness a proliferation of pet specialty stores and e-commerce platforms that offer a wide range of nutraceuticals, making the products easily accessible to pet owners.

- Manufacturers and sellers of pet nutraceuticals in India must obtain proper licensing and certifications to operate legally. The Central Drugs Standard Control Organization (CDSCO) oversees the certification of pet food and supplements, ensuring that products meet safety and quality standards before entering the market. Failure to comply with these regulations can lead to product recalls and legal consequences. The CDSCOs stringent approval process ensures that only high-quality nutraceutical products are available to Indian consumers, enhancing market reliability.

India Pet Nutraceuticals Market Segmentation

- By Product Type: The market is segmented by product type into Joint Health Supplements, Digestive Health Supplements, Skin & Coat Supplements, Multivitamins, and Omega-3 Supplements. Among these, Joint Health Supplements have a dominant market share, driven by the rise in conditions such as arthritis among aging pets. Pet owners are increasingly opting for joint supplements to enhance their pets' mobility and quality of life. Additionally, joint health supplements are widely recommended by veterinarians, which further boosts their market dominance.

- By Pet Type: The market is also segmented by pet type into Dogs, Cats, Birds, and Others (rabbits, fish, etc.). The Dog category holds the largest market share due to the widespread ownership of dogs in India. Dogs are considered loyal companions, and Indian pet owners are highly invested in ensuring their well-being through high-quality nutraceuticals. As dogs are prone to specific health issues such as joint problems and skin disorders, nutraceuticals catering to these needs have seen significant traction.

India Pet Nutraceuticals Market Competitive Landscape

The India Pet Nutraceuticals market is competitive, with both domestic and international players. The market is dominated by a few key companies that have extensive product portfolios and distribution networks. Leading players such as Mars Petcare and Himalaya Herbal Healthcare are well-established, while new entrants like Petvit and Vivaldis Health are gaining traction with innovative offerings. Companies in this space are increasingly focusing on expanding their e-commerce presence and engaging in direct-to-consumer marketing strategies to reach a broader customer base.

|

Company |

Established Year |

Headquarters |

Product Portfolio |

Revenue (INR Mn) |

No. of Employees |

Distribution Network |

Market Penetration |

Strategic Initiatives |

Market Presence |

|

Mars Petcare |

1911 |

McLean, Virginia, USA |

|||||||

|

Himalaya Herbal Healthcare |

1930 |

Bangalore, India |

|||||||

|

Petvit |

2017 |

Mumbai, India |

|||||||

|

Vivaldis Health & Foods |

2015 |

Pune, India |

|||||||

|

Natural Remedies |

1952 |

Bangalore, India |

India Pet Nutraceuticals Industry Analysis

Growth Drivers

- Increasing Pet Ownership: The rise in pet ownership in India is driven by rapid urbanization and the shift toward nuclear families. Urbanization in India grew from 31.2% in 2011 to over 34.5% in 2021, according to the World Bank. This trend, coupled with the preference for smaller family units, has increased demand for pets, especially in urban centers like Mumbai, Delhi, and Bangalore. This shift is expected to continue, supported by a growing middle class that can afford to care for pets and provide them with necessary nutrition and health supplements.

- Humanization of Pets: The humanization of pets in India is a growing trend, with more pet owners treating their pets like family members. This trend has driven demand for premium pet nutraceuticals that focus on health and wellness. Pet owners are opting for products rich in antioxidants, vitamins, and probiotics, contributing to the growth of premium brands in the market. India's middle class is expected to reach 500 million by 2025, further supporting this trend as households spend more on health-conscious and quality-driven products.

- Growing Focus on Pet Health and Wellness: As awareness of pet health increases, the focus on wellness has become a significant driver in the pet nutraceuticals market. The Indian governments focus on improving veterinary services and promoting health awareness through initiatives has further contributed to this trend. India currently has about 34,000 registered veterinarians, and the expansion of pet clinics and veterinary services in urban areas supports this market growth. The emphasis on preventive care has led to a surge in demand for supplements that boost immunity, digestion, and overall health.

Market Challenges

- High Product Costs: One of the primary challenges in the Indian pet nutraceuticals market is the high cost of premium products. Nutraceuticals, often imported or manufactured under strict quality regulations, tend to be more expensive, limiting their accessibility. According to Indias Ministry of Commerce, the import duty on pet food products can reach up to 30%, which inflates retail prices. The average pet owner in India spends around INR 1,500 to INR 2,000 per month on basic pet care, making it difficult for some to afford nutraceutical supplements.

- Regulatory Constraints: The Food Safety and Standards Authority of India (FSSAI) regulates pet food and supplements, requiring stringent approval processes for nutraceutical products. These regulatory constraints can delay product launches and lead to additional compliance costs for manufacturers. FSSAI guidelines mandate that all pet food products must meet safety and labeling standards, increasing the time to market. Additionally, the import of nutraceuticals faces challenges due to strict customs regulations, adding further complexity for international brands entering the Indian market.

India Pet Nutraceuticals Market Future Outlook

Over the next five years, the India Pet Nutraceuticals market is anticipated to experience steady growth due to the continued humanization of pets and increased awareness of pet health. This growth will be driven by technological advancements in nutraceutical product formulations, including the use of organic and natural ingredients. Additionally, the expansion of e-commerce platforms and growing penetration into Tier-II and Tier-III cities is expected to further boost market demand. The rising trend of preventive healthcare for pets will also encourage consumers to invest more in premium pet nutraceuticals.

Future Market Opportunities

- Expansion into Tier-II and Tier-III Cities: With over 65% of India's population living in Tier-II and Tier-III cities, there is substantial untapped potential for the pet nutraceutical market. As urbanization spreads to smaller cities, disposable income and awareness about pet healthcare are also rising. For example, cities like Surat, Lucknow, and Indore have shown a growing interest in premium pet products. According to the Ministry of Housing and Urban Affairs, these cities are witnessing infrastructure improvements that support better retail distribution, which presents an opportunity for nutraceutical companies to expand their presence.

- Innovation in Product Formulation: Innovative product formulations, such as organic and grain-free pet supplements, are gaining popularity as pet owners demand healthier options. Brands are increasingly focusing on customizing nutraceutical products to address specific health needs like joint health, digestion, and skin care. According to data from Indias Ministry of Agriculture, the organic farming sector grew to 2.9 million hectares in 2022, reflecting a growing preference for organic products. This trend aligns with the rising demand for organic and clean-label pet supplements in India.

Scope of the Report

|

Segment |

Sub-segments |

|---|---|

|

By Product Type |

Joint Health Supplements Digestive Health Supplements Skin & Coat Supplements Multivitamins Omega-3 Supplements |

|

By Pet Type |

Dogs Cats Birds Others (rabbits, fish) |

|

By Sales Channel |

Offline Channels (veterinary clinics, pet specialty stores) Online Channels (e-commerce platforms, direct-to-consumer) |

|

By Ingredient Type |

Natural Ingredients Synthetic Ingredients Functional Ingredients (probiotics, amino acids) |

|

By Region |

North South West East |

Products

Key Target Audience

Pet Retailers and Specialty Stores

Veterinary Clinics and Hospitals

E-commerce Platforms

Pet Supplement Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of Animal Husbandry)

Pet Owners and Pet Associations

Veterinary Pharmaceutical Companies

Companies

Major Players

Mars Petcare

Himalaya Herbal Healthcare

Petvit

Vivaldis Health & Foods Pvt Ltd

Natural Remedies Pvt. Ltd.

Pawsitively Pet Care

Drools Pet Food Pvt. Ltd.

Beaphar India

Innovacyn India

Dogsee Chew

VetriScience Laboratories

PetzLife

Farmina Pet Foods India

Wag & Love

Purina Petcare India

Table of Contents

1. India Pet Nutraceuticals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Pet Nutraceuticals Market Size (In INR Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Pet Nutraceuticals Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Pet Ownership (urbanization, nuclear families)

3.1.2. Rise in Disposable Income (household income growth)

3.1.3. Humanization of Pets (trend towards premium products)

3.1.4. Growing Focus on Pet Health and Wellness

3.2. Market Challenges

3.2.1. High Product Costs

3.2.2. Regulatory Constraints (FSSAI regulations, product approval process)

3.2.3. Limited Consumer Awareness (nutritional benefits, differentiation of products)

3.3. Opportunities

3.3.1. Expansion into Tier-II and Tier-III Cities

3.3.2. Innovation in Product Formulation (organic, grain-free, customized solutions)

3.3.3. Increasing Adoption of Online Retail Channels

3.4. Trends

3.4.1. Focus on Functional Ingredients (probiotics, omega-3, antioxidants)

3.4.2. Rise in Subscription-Based Services (monthly nutritional packages)

3.4.3. Increasing Preference for Natural and Organic Pet Supplements

3.5. Government Regulations

3.5.1. FSSAI Guidelines for Pet Food

3.5.2. Import Duties and Tariffs

3.5.3. Licensing and Certification Requirements (manufacturers and sellers)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Manufacturers, Distributors, Retailers)

3.8. Porters Five Forces

3.9. Competition Ecosystem (Domestic vs. International Players)

4. India Pet Nutraceuticals Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Joint Health Supplements

4.1.2. Digestive Health Supplements

4.1.3. Skin & Coat Supplements

4.1.4. Multivitamins

4.1.5. Omega-3 Supplements

4.2. By Pet Type (In Value %)

4.2.1. Dogs

4.2.2. Cats

4.2.3. Birds

4.2.4. Others (rabbits, fish)

4.3. By Sales Channel (In Value %)

4.3.1. Offline Channels (veterinary clinics, pet specialty stores)

4.3.2. Online Channels (e-commerce platforms, direct-to-consumer)

4.4. By Ingredient Type (In Value %)

4.4.1. Natural Ingredients

4.4.2. Synthetic Ingredients

4.4.3. Functional Ingredients (probiotics, amino acids)

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. India Pet Nutraceuticals Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Mars Petcare

5.1.2. Himalaya Herbal Healthcare

5.1.3. Petvit

5.1.4. Vivaldis Health & Foods Pvt Ltd

5.1.5. Pawsitively Pet Care

5.1.6. Natural Remedies Pvt. Ltd.

5.1.7. Drools Pet Food Pvt. Ltd.

5.1.8. Beaphar India

5.1.9. Innovacyn India

5.1.10. Dogsee Chew

5.1.11. VetriScience Laboratories

5.1.12. PetzLife

5.1.13. Farmina Pet Foods India

5.1.14. Wag & Love

5.1.15. Purina Petcare India

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Penetration, Product Portfolio, Distribution Network, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Pet Nutraceuticals Market Regulatory Framework

6.1. FSSAI Pet Food Standards

6.2. Compliance Requirements (labeling, packaging, and ingredient usage)

6.3. Certification Processes (organic certifications, import certifications)

7. India Pet Nutraceuticals Future Market Size (In INR Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (e-commerce, urbanization, pet wellness focus)

8. India Pet Nutraceuticals Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Pet Type (In Value %)

8.3. By Sales Channel (In Value %)

8.4. By Ingredient Type (In Value %)

8.5. By Region (In Value %)

9. India Pet Nutraceuticals Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process was to construct an ecosystem map covering all the major stakeholders in the India Pet Nutraceuticals market. This was achieved through desk research, involving both secondary sources such as industry reports and proprietary databases. The key variables, such as market size and growth drivers, were identified through this process.

Step 2: Market Analysis and Construction

The next step was to analyze historical market data for the nutraceuticals market. This involved calculating the market penetration, revenue growth rates, and geographic distribution of market players. Service quality statistics were also evaluated to ensure the reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, hypotheses on market dynamics were validated through consultations with industry experts, including senior executives from nutraceutical manufacturing companies and veterinary professionals. These consultations provided crucial insights that complemented the data collected through desk research.

Step 4: Research Synthesis and Final Output

In the final stage, the data was synthesized, and multiple cross-verification steps were conducted to ensure the accuracy of the findings. This included direct engagement with pet nutraceutical manufacturers, which helped provide a comprehensive analysis of market trends, product preferences, and customer behavior.

Frequently Asked Questions

01. How big is the India Pet Nutraceuticals Market?

The India Pet Nutraceuticals Market is valued at USD 123 million, driven by the growing trend of pet humanization and increasing awareness of pet health and wellness.

02. What are the challenges in the India Pet Nutraceuticals Market?

Challenges in India Pet Nutraceuticals Market include high product costs, limited awareness among pet owners about nutraceutical benefits, and regulatory constraints such as FSSAI approvals for pet supplements.

03. Who are the major players in the India Pet Nutraceuticals Market?

Key players in India Pet Nutraceuticals Market include Mars Petcare, Himalaya Herbal Healthcare, Petvit, and Vivaldis Health & Foods, all of whom have strong distribution networks and diverse product portfolios.

04. What are the growth drivers of the India Pet Nutraceuticals Market?

The India Pet Nutraceuticals Market is driven by increasing pet ownership, rising disposable incomes, and the growing humanization of pets. Innovations in product formulation and the increasing availability of nutraceuticals through online platforms also contribute to market growth.

05. How is the India Pet Nutraceuticals market segmented?

The India Pet Nutraceuticals market is segmented by product type (Joint Health Supplements, Digestive Health Supplements, Skin & Coat Supplements, etc.) and by pet type (Dogs, Cats, Birds, Others).

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.