India Pharmaceutical Packaging Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD922

July 2024

100

About the Report

India Pharmaceutical Packaging Market Overview

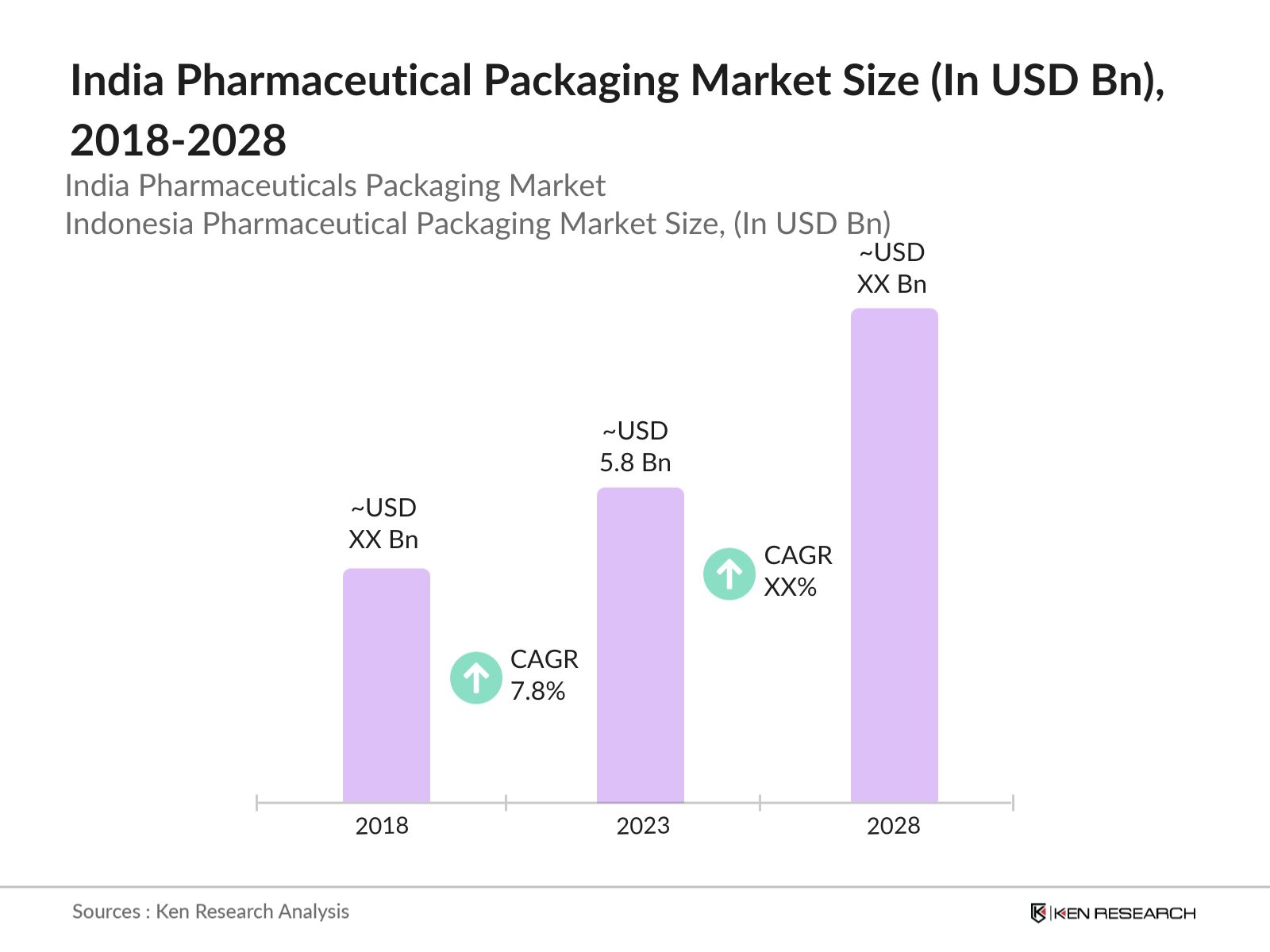

- The India pharmaceutical packaging market was valued at USD 5.8 billion in 2023, which is expected to grow at a CAGR of 7.8% for the period of 2023-2028. Factors contributing to this growth include the expansion of the pharmaceutical industry, increased healthcare spending, and regulatory requirements for safe packaging.

- Key players in the market include Amcor Limited, Gerresheimer AG, West Pharmaceutical Services, Inc., Uflex Ltd, and Piramal Glass. These companies focus on product innovation, strategic partnerships, and mergers & acquisitions to strengthen their market position.

- In 2023, Amcor announced it had agreed to acquire Phoenix Flexibles, extending Amcor's capacity in the high-growth Indian market. Amcor already has four flexible packaging plants in India and is investing to double its local footprint in the pharmaceutical and medical packaging categories.

India Pharmaceutical Packaging Current Market Analysis

- The market is highly competitive with several key players investing in innovative packaging solutions. The demand for eco-friendly and sustainable packaging materials is also rising, driven by environmental concerns and regulatory pressures so there are innovations among prefilled syringes and single-dose containers, which enhance patient compliance and safety.

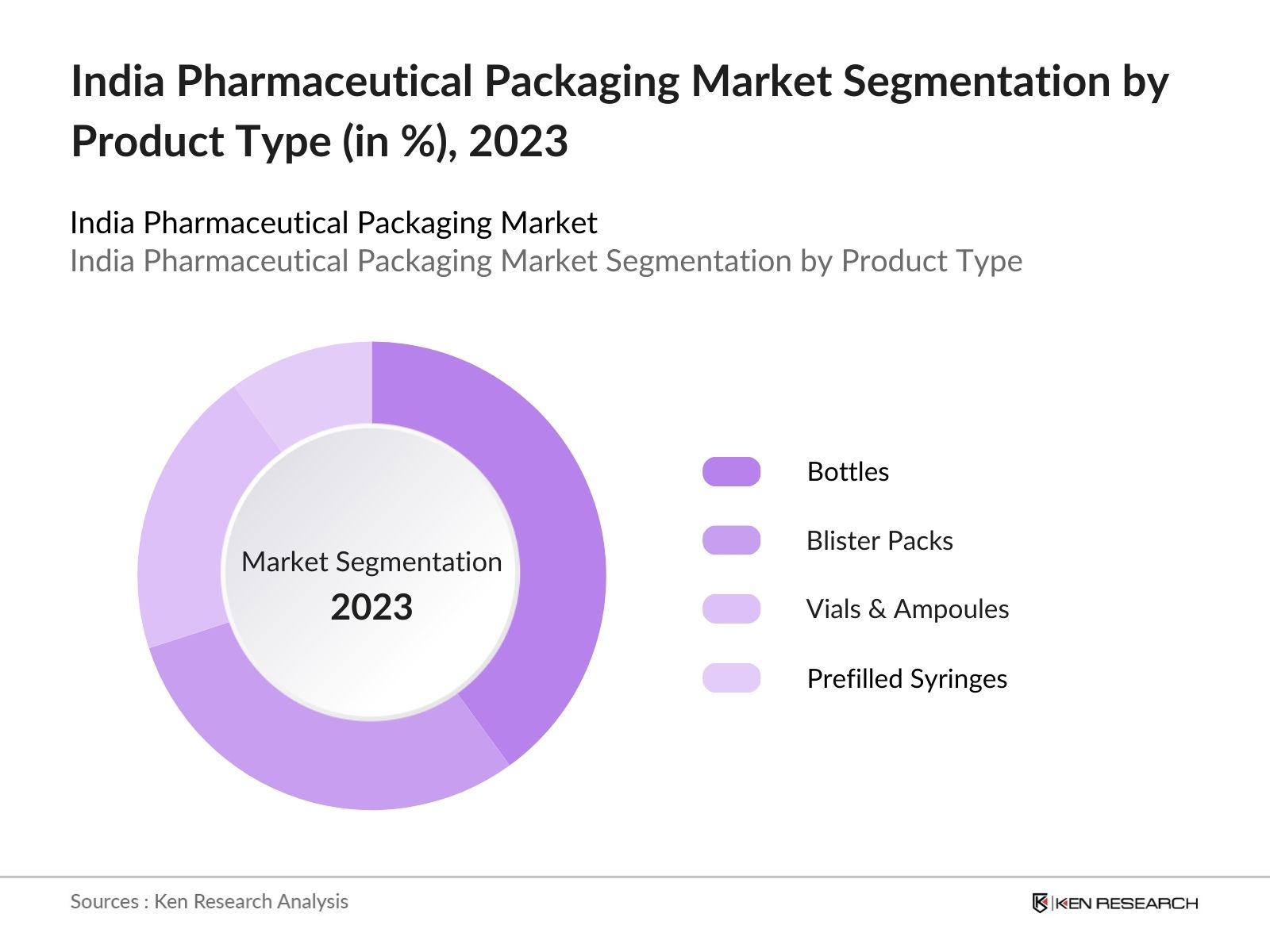

- Blister packs are among the bestselling products in the pharmaceutical packaging market due to their ability to protect drugs from moisture, contamination, and tampering. The plastic bottles segment is the largest in the market, driven by their versatility, cost-effectiveness, and widespread use for packaging a variety of liquid and solid medications.

- The Western region of India, particularly Maharashtra and Gujarat, dominates the pharmaceutical packaging market. Maharashtra alone accounted for approximately 35% of the market share in 2023, driven by its industrial base and access to ports for export.

India Pharmaceutical Packaging Market Segmentations

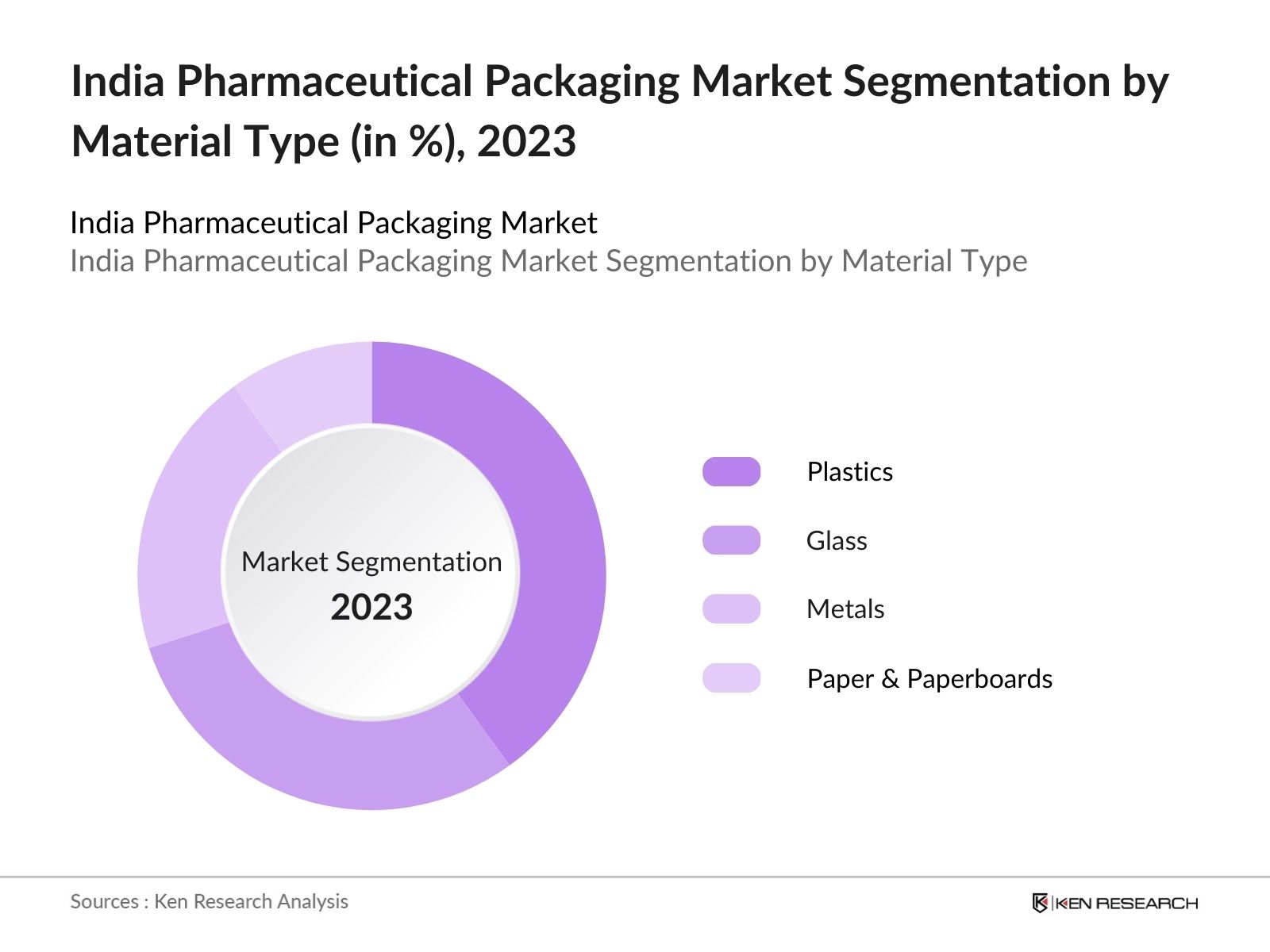

By Material Type: In 2023, the India pharmaceutical market segmentation by material type is divided into Plastic, Glass, Metal and Papers & Paperboard Plastic. Plastic is the dominant material due to its cost-effectiveness, lightweight, and versatility. It is widely used for manufacturing bottles, blister packs, and containers, making it a preferred choice for pharmaceutical packaging.

By Product Type: In 2023, the India pharmaceutical market segmentation by product type is divided into Oral drugs, Topical drugs, Injectables & Others. Oral drugs are the dominant product type due to their extensive use in packaging liquid medications, syrups, and other oral dosage forms. They provide excellent protection and are easy to handle and transport.

By Region: In 2023, the India pharmaceutical market segmentation by region is divided into Western, Eastern, Northern, and Southern India. The Western region, led by states like Maharashtra and Gujarat, dominates the India pharmaceutical packaging market due to its robust industrial infrastructure, proximity to major pharmaceutical manufacturing hubs, well-established logistics networks, and favorable government policies supporting industrial growth and innovation.

India Pharmaceutical Packaging Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Amcor Limited |

1860 |

Zurich, Switzerland |

|

Uflex Ltd. |

1985 |

Noida, India |

|

Essel Propack Limited |

1982 |

Mumbai, India |

|

Piramal Glass |

1984 |

Mumbai, India |

|

SGD Pharma |

1896 |

Puteaux, France |

- Launch of FlexGreen by Uflex: Uflex Ltd. introduced FlexGreen, an eco-friendly packaging solution designed to reduce environmental impact and enhance sustainability in pharmaceutical packaging, in 2023. Uflex's consolidated revenue grew from Rs. 7,432 crores in FY2020 to Rs. 13,237 crores in FY2022 because of these developments.

- Essel Propack's Antimicrobial Tubes: In 2022, Essel Propack Limited launched a new range of antimicrobial tubes aimed at enhancing the safety and shelf-life of pharmaceutical creams and ointments. These tubes are designed to prevent microbial contamination, ensuring the integrity of the packaged products.

- Piramal Glass's Expansion in Gujarat: Piramal Glass announced the expansion of its manufacturing facility in Gujarat in 2022, aiming to increase production capacity and meet the growing demand for glass packaging solutions. This expansion involves the installation of new production lines and the adoption of advanced technologies to enhance operational efficiency.

India Pharmaceuticals Packaging Industry Analysis

India Pharmaceuticals Packaging Market Growth Drivers

- Rising Demand for Pharmaceuticals: According to the World Health Organization (WHO), India has one of the highest burdens of chronic diseases, with 72 million cases of diabetes and 54 million cases of cardiovascular diseases in 2023. This growing demand for pharmaceuticals necessitates advanced and secure packaging solutions to ensure drug safety and efficacy.

- Technological Advancements in Packaging: Smart packaging, incorporating features like QR codes and RFID tags, enhances patient compliance and ensures the authenticity of pharmaceutical products. The adoption of smart packaging in the pharmaceutical industry is expected to grow by 15% annually, driven by the need for better drug monitoring and patient engagement.

- Expansion of the Generic Drugs Market: The Indian Pharmaceutical Alliance (IPA) reported that the generics market grew by 10% in 2023. This expansion necessitates efficient and cost-effective packaging solutions to meet the growing demand. The rise in generic drug production also supports the need for diverse and adaptable packaging solutions.

India Pharmaceuticals Packaging Market Challenges

- Stringent Regulatory Compliance: The pharmaceutical packaging industry faces stringent regulatory requirements to ensure drug safety and efficacy. Compliance with regulations such as CDSCO increases the complexity and cost of packaging operations. According to the FICCI, regulatory compliance costs account for approximately 20% of the total packaging costs for pharmaceutical companies in India.

- Environmental Concerns and Sustainability: The Central Pollution Control Board reported that India generates approximately 3.3 million metric tons of plastic waste annually, this has led to increased pressure on packaging companies to develop eco-friendly and recyclable packaging solutions, which require substantial investment in R&D and can be cost-prohibitive for smaller players.

- High Cost of Advanced Packaging Solutions: The adoption of advanced packaging technologies, such as smart packaging and tamper-evident solutions, involves high initial investment and operational costs. According to a report by the Indian Institute of Packaging (IIP), the cost of implementing smart packaging solutions can be 30-40% higher than traditional packaging methods.

India Pharmaceuticals Packaging Market Government Initiatives

- Production Linked Incentive (PLI) Scheme: According to the Ministry of Commerce and Industry, the PLI Scheme has attracted investments worth USD 3 billion in the pharmaceutical sector, significantly impacting the packaging industry by driving demand for high-quality and innovative packaging solutions.

- Ayushman Bharat: Launched in 2018, Ayushman Bharat is a national health protection scheme aimed at providing healthcare coverage to over 500 million citizens. According to the NHA, Ayushman Bharat has led to a 20% increase in the demand for essential medicines, directly impacting the pharmaceutical packaging market.

- Make in India: The Make in India initiative, launched in 2014, aims to promote domestic manufacturing and position India as a global manufacturing hub. The initiative has positively impacted the pharmaceutical packaging industry by encouraging investments in local manufacturing facilities and reducing dependency on imports.

India Pharmaceuticals Packaging Market Future Outlook

India Pharmaceutical Market is projected to grow substantially by 2028. Factors contributing to this growth include the expansion of the pharmaceutical industry, increased healthcare spending, and regulatory requirements for safe packaging.

Future Market Trends

- Adoption of Tamper-Evident Packaging: The adoption of tamper-evident packaging is anticipated to see substantial growth by 2028, driven by the need to ensure drug safety and prevent counterfeiting. According to the Indian Pharmaceutical Association (IPA), the implementation of tamper-evident solutions has increased by 25% in the last two years, reflecting the industry's commitment to ensuring the integrity and safety of pharmaceutical products.

- Increased Use of Smart Packaging: The demand for smart packaging technologies, such as QR codes, RFID tags, and temperature-sensitive indicators, is projected to rise sharply. The the adoption of smart packaging in the pharmaceutical industry is projected to grow exponentially in the coming years.

- Personalized Packaging Solutions: The rise of personalized medicine is expected to further drive the demand for customized packaging solutions tailored to individual patient needs. Personalized packaging ensures precise dosage, reduces the risk of medication errors, and enhances patient adherence to prescribed treatments.

Scope of the Report

|

By Material Type |

Plastic Glass Metal Papers & Paperboard |

|

By Product Type |

Oral drugs Topical drugs Injectables & Others |

|

By Region |

North South West East |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing this Report:

Pharmaceutical Companies

Packaging Manufacturers

Pharmaceutical Contract Manufacturing Organizations (CMOs)

Regulatory Authorities

Medical Device Manufacturers

Government Health Agencies

Pharmaceutical Distributors and Wholesalers

Pharmaceutical Exporters

Financial Institutions and Banks

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Amcor Limited

Gerresheimer AG

West Pharmaceutical Services, Inc.

Uflex Ltd

Piramal Glass

Schott AG

Berry Global Inc.

Nipro Corporation

SGD Pharma

Catalent Inc.

CCL Industries Inc.

Clondalkin Group Holdings B.V.

Constantia Flexibles

Drug Plastics & Glass Co., Inc.

AptarGroup, Inc.

Sonoco Products Company

Weener Plastics Group BV

Huhtamaki OYJ

Rexam PLC

Wipak Group

Table of Contents

1. India Pharmaceuticals Packaging Market Overview

1.1 India Pharmaceuticals Packaging Market Taxonomy

2. India Pharmaceuticals Packaging Market Size (in USD Bn), 2018-2023

3. India Pharmaceuticals Packaging Market Analysis

3.1 India Pharmaceuticals Packaging Market Growth Drivers

3.2 India Pharmaceuticals Packaging Market Challenges and Issues

3.3 India Pharmaceuticals Packaging Market Trends and Development

3.4 India Pharmaceuticals Packaging Market Government Regulation

3.5 India Pharmaceuticals Packaging Market SWOT Analysis

3.6 India Pharmaceuticals Packaging Market Stake Ecosystem

3.7 India Pharmaceuticals Packaging Market Competition Ecosystem

4. India Pharmaceuticals Packaging Market Segmentation, 2023

4.1 India Pharmaceuticals Packaging Market Segmentation by Material Type (in %), 2023

4.2 India Pharmaceuticals Packaging Market Segmentation by Product Type (in %), 2023

4.3 India Pharmaceuticals Packaging Market Segmentation by Region (in %), 2023

5. India Pharmaceuticals Packaging Market Competition Benchmarking

5.1 India Pharmaceuticals Packaging Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Pharmaceuticals Packaging Market Future Market Size (in USD Bn), 2023-2028

7. India Pharmaceuticals Packaging Market Future Market Segmentation, 2028

7.1 India Pharmaceuticals Packaging Market Segmentation by Material Type (in %), 2028

7.2 India Pharmaceuticals Packaging Market Segmentation by Product Type (in %), 2028

7.3 India Pharmaceuticals Packaging Market Segmentation by Region (in %), 2028

8. India Pharmaceuticals Packaging Market Analysts’ Recommendations

8.1 India Pharmaceuticals Packaging Market TAM/SAM/SOM Analysis

8.2 India Pharmaceuticals Packaging Market Customer Cohort Analysis

8.3 India Pharmaceuticals Packaging Market Marketing Initiatives

8.4 India Pharmaceuticals Packaging Market White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2 Market Building:

Collating statistics on India Pharmaceuticals Packaging Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Pharmaceuticals Packaging Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research output:

Our team will approach multiple pharmaceutical packaging companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from pharmaceuticals packaging companies.

Frequently Asked Questions

01 How big is the India pharmaceutical packaging market?

The India pharmaceutical packaging market was valued at USD 5.8 billion in 2023, which is expected to grow at a CAGR of 7.8% for the period of 2023-2028. Factors contributing to this growth include the expansion of the pharmaceutical industry, increased healthcare spending, and regulatory requirements for safe packaging.

02 What are the growth drivers for the India pharmaceutical packaging market?

Major growth drivers of the India pharmaceutical packaging market include increasing pharmaceutical production, advancements in packaging technology, rising healthcare expenditure, and stringent regulatory requirements. Smart packaging, incorporating features like QR codes and RFID tags, enhances patient compliance and ensures the authenticity of pharmaceutical products.

03 What are the challenges faced by the India pharmaceutical packaging market?

Key challenges faced by the India pharmaceutical packaging market include the high cost of advanced packaging, regulatory compliance, environmental concerns, supply chain disruptions, counterfeiting issues, and technological integration.

04 What are the trends in the India pharmaceutical packaging market?

Major trends in the India pharmaceutical packaging market include the shift towards eco-friendly packaging, the adoption of smart packaging solutions, customization and personalization, growth of prefilled syringes, enhanced barrier properties, and a focus on patient safety.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.