India Phase Transfer Catalyst Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD647

August 2024

100

About the Report

India Phase Transfer Catalyst Market Overview

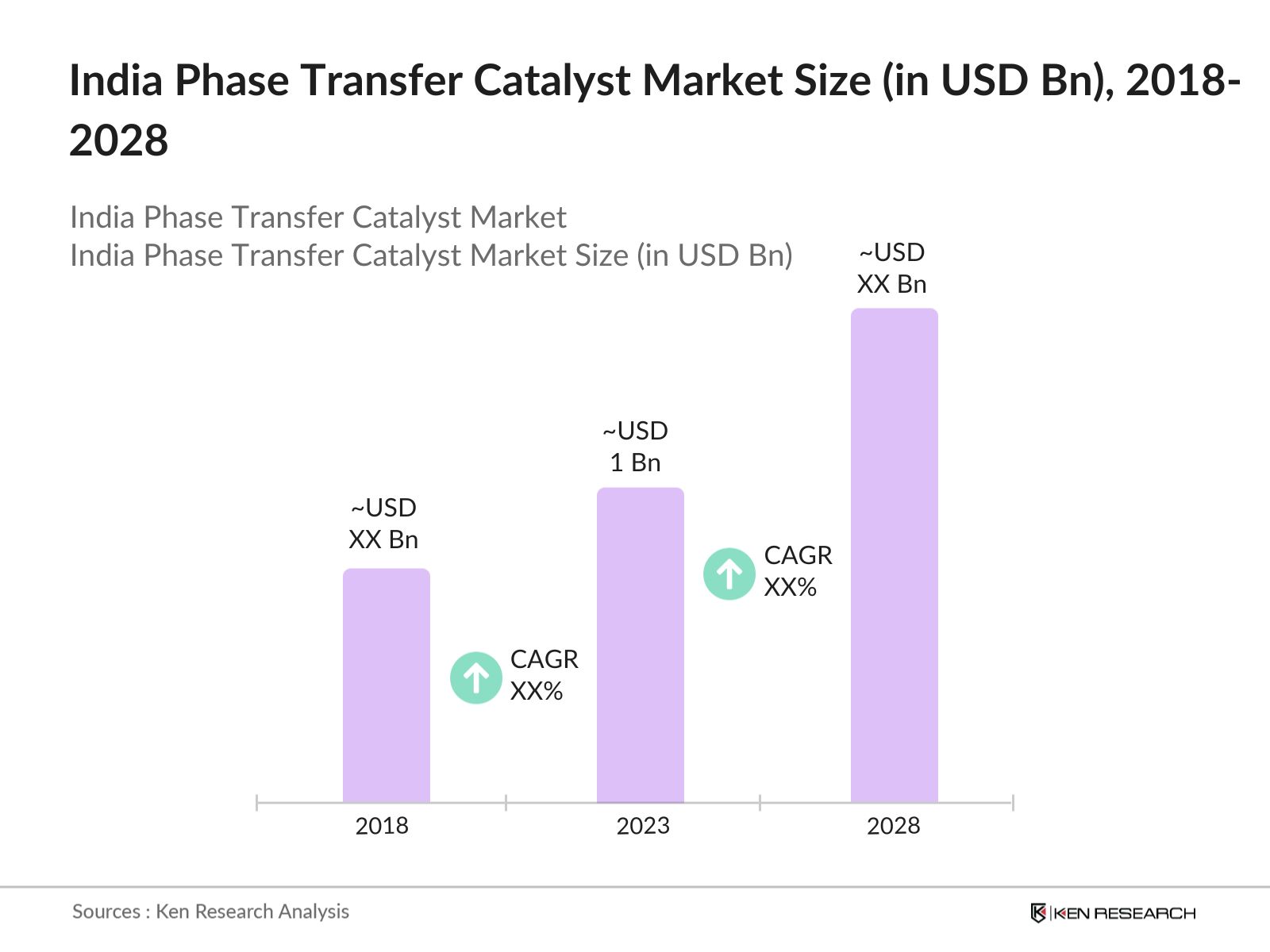

- The India phase transfer catalyst market has experienced notable growth, this is reflected by global phase transfer catalyst market reaching a valuation of USD 1 Bn in 2023. This growth is fueled by expanding chemical industry, increased demand for fine chemicals, and advancements in pharmaceutical and agrochemical sectors.

- The market is dominated by several key players, including Evonik Industries AG, Clariant International Ltd, Albemarle Corporation, Solvay S.A and BASF SE. These companies play a crucial role in shaping market trends through their extensive product portfolios and significant investments in R&D.

- Technological advancements in catalysis are a major driver for the phase transfer catalyst (PTC) market. In 2024, innovations in PTC technologies are anticipated to result in the creation of more efficient catalysts, with major investment in research and development across the chemical and pharmaceutical sectors. These advancements will focus on improving catalyst efficiency and selectivity, leading to enhanced reaction rates and higher product yields.

- Gujarat is dominating the market due to its well-established chemical and pharmaceutical industries, driven by the presence of major chemical manufacturing hubs and favorable state policies promoting industrial growth.

India Phase Transfer Catalyst Market Segmentation

The India phase transfer catalyst market can be segmented based on several factors:

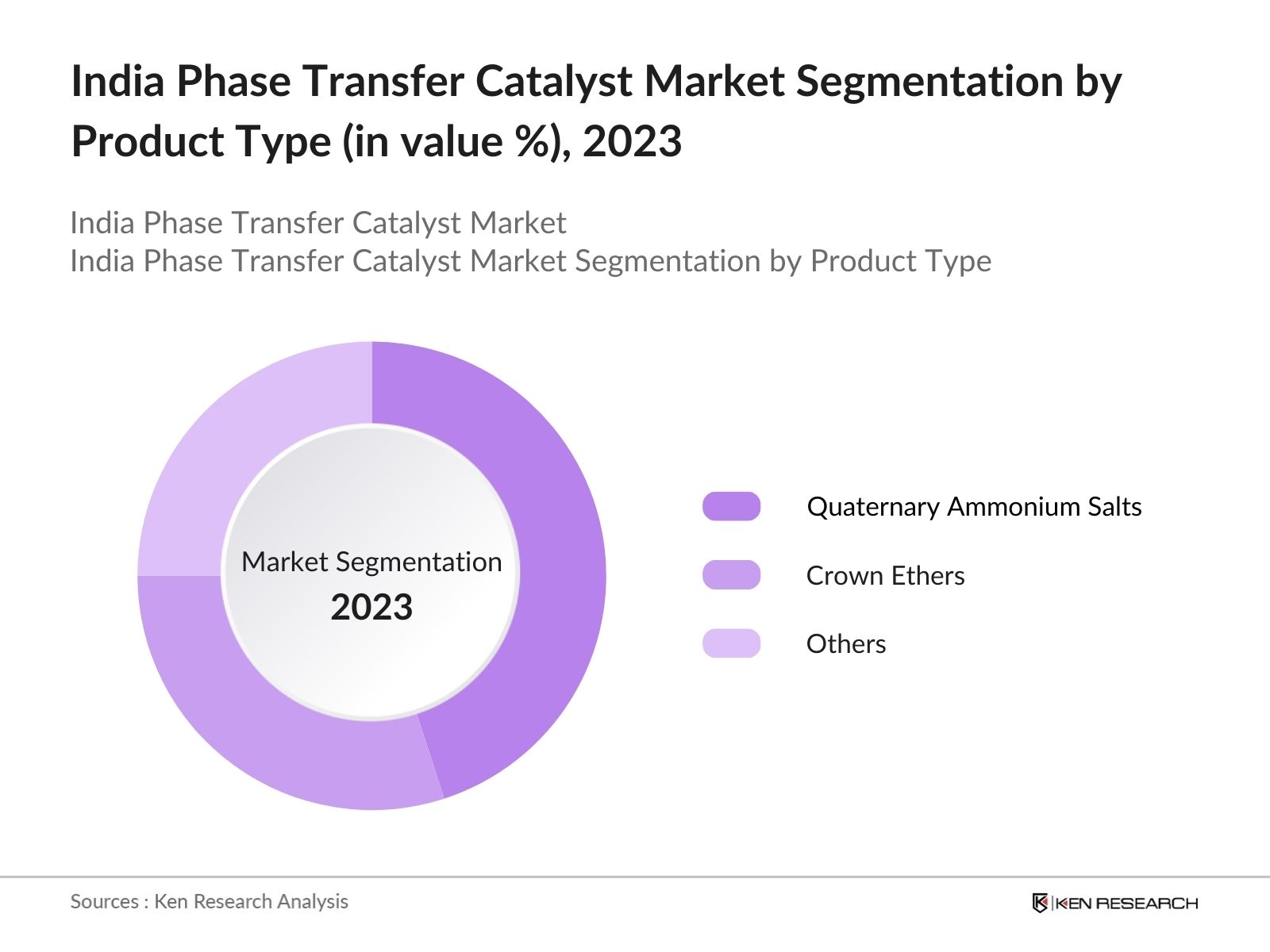

By Product Type: India phase transfer catalyst market segmentation by product type is divided into quaternary ammonium salts, crown ethers and others. In 2023, Quaternary ammonium salts emerged as the dominant product type in market. Their leadership is due to their efficiency in enhancing chemical reactions across phases, particularly in organic synthesis. Widely used in pharmaceuticals, agrochemicals, and polymers, their cost-effectiveness and versatility have solidified their market position.

By Application: India phase transfer catalyst market segmentation by application is divided into chemical synthesis, pharmaceuticals, agrochemicals and others. In 2023, the market was driven by the chemical synthesis segment. This dominance stems from PTCs' crucial role in improving reaction efficiency and yields in various industries such as pharmaceuticals, agrochemicals, and specialty chemicals.

By Region: India phase transfer catalyst market segmentation by region is divided into north, south, east and west. In 2023, the Northern region led the market. This dominance is due to its strong industrial base, rapid growth in pharmaceuticals and chemicals, and a well-established manufacturing and R&D infrastructure. The region’s extensive supply chain network also contributes to its leading position in the market.

India Phase Transfer Catalyst Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Evonik Industries AG |

2007 |

Essen, Germany |

|

Clariant International Ltd. |

1995 |

Muttenz, Switzerland |

|

Albemarle Corporation |

1887 |

Charlotte, USA |

|

Solvay S.A. |

1863 |

Brussels, Belgium |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

- Clariant Expands Strategic Partnership with KBR: On July 30, 2024, Clariant, a specialty chemicals company dedicated to sustainability, revealed an expansion of its strategic collaboration with KBR in ammonia production. Recognizing ammonia's critical role in food production and its future potential as a clean energy source, the partnership will not only maintain its involvement in traditional ammonia projects but will also intensify efforts on low-carbon and carbon-free “green ammonia” applications.

- Solvay S.A. Strategic Partnership: In 2020, Solvay S.A. has recently entered a strategic partnership with Anthea, a leading Indian chemical manufacturer, to co-develop new technologies in the field of specialty chemicals. This collaboration involves the establishment of a joint venture named CATÃ SYNTH Specialty Chemicals, which focuses on the production of catechol derivatives. The aim is to enhance the supply chain for essential products used in the flavor, fragrance, agrochemical, and pharmaceutical industries.

India Phase Transfer Catalyst Industry Analysis

India Phase Transfer Catalyst Market Growth Drivers:

- Increased Chemical Manufacturing: The expansion of chemical manufacturing in India is a key growth driver for the phase transfer catalyst (PTC) market, driven by the rise in production capacities and the introduction of new chemical processes. This growth in the chemical sector directly impacts the demand for PTCs, which are essential in various synthesis processes.

- Expansion of the Pharmaceutical Sector: The Indian pharmaceutical sector is a major driver of PTC demand. In 2024, the sector is expected to show robust growth owing to increased drug production and advancements in pharmaceutical technologies. This growth is driven by both domestic needs and export opportunities. For instance, the Indian pharmaceutical exports are forecasted to reach USD 24 Bn in 2024.

- Rising Agrochemical Production: The agrochemical industry in India is experiencing significant growth, with production expected to rise in coming years. This increase is driven by the need for advanced agrochemical products to enhance crop yields and protect crops from pests and diseases. PTCs are integral in the synthesis of various agrochemical products, which supports their rising demand. The growth in agrochemical production is supported by favorable weather conditions and increased investment in agricultural technology.

India Phase Transfer Catalyst Market Challenges:

- Regulatory Compliance and Safety Standards: Compliance with stringent regulatory and safety standards is a significant challenge for the PTC market. In 2024, new regulations are expected to be introduced that will impose stricter requirements on the production and handling of PTCs, including enhanced safety protocols and environmental regulations. Companies will need to invest in compliance measures and adjust their operations to meet these standards, which could lead to increased operational costs and potential delays in product development and market entry.

- Supply Chain Disruptions: The PTC market is also facing challenges related to supply chain disruptions. In 2024, disruptions in the supply of key raw materials and logistical challenges are expected to affect the availability and pricing of PTCs. For instance, the supply of certain critical raw materials used in PTC production is projected to experience delays, impacting the timely delivery of products to end-users. Companies may need to develop alternative supply chain strategies and build stronger relationships with suppliers to mitigate these issues.

India Phase Transfer Catalyst Market Government Initiatives:

- Mission on Advanced and High-Impact Research (MAHIR): In 2023, ministry of Power and Ministry of New and Renewable Energy have jointly launched the "Mission on Advanced and High-Impact Research (MAHIR)" to quickly identify emerging technologies in the power sector, including phase transfer catalysts, and develop them indigenously for deployment within and outside India. The mission aims to serve as a catalyst for national priorities such as achieving Net Zero emissions and promoting initiatives like Make in India and Startup India.

- Startup India Initiative: The Government of India launched the Startup India initiative in 2016 to build a strong ecosystem for nurturing innovation and encouraging investments. As of June 30, 2024, the Department for Promotion of Industry and Internal Trade (DPIIT) has recognized 1,40,803 entities as startups under this initiative. The recognized startups have reported creating over 15.5 lakh direct jobs.

India Phase Transfer Catalyst Future Market Outlook

The India phase transfer catalyst market is expected to show significant growth driven by ongoing advancements in chemical processes, increasing investments in R&D, and expanding applications in various industrial sectors, including pharmaceuticals, agrochemicals, and electronics.

Future Market Trends

-

- Emergence of Green Catalysts: Over the next five years, the PTC market is expected to see a significant shift towards green and sustainable catalysts. By 2028, it is projected that green phase transfer catalysts, which minimize environmental impact and reduce hazardous by-products. This shift is driven by increasing regulatory pressures and growing demand for eco-friendly solutions in chemical processes. Government policies and industry initiatives will support the development and adoption of these green technologies.

- Growth in Specialized Applications: The demand for PTCs in specialized applications, such as electronics and renewable energy, is expected to increase significantly by 2028, driven by advancements in electronic materials and the increasing complexity of electronic devices. This trend will lead to the development of new catalyst formulations tailored to specific industrial needs.

Scope of the Report

|

By Product Type |

Quaternary Ammonium Salts Crown Ethers Others |

|

By Application |

Chemical Synthesis Pharmaceuticals Agrochemicals Others |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Chemical Manufacturers

Pharmaceutical Companies

Agrochemical Producers

End User Industry (Oil & Gas, Fine Chemicals and Plastic and Polymer)

Banks and Financial Institutions

Investors and VCs

Government and Regulatory Bodies (CDSCO and DCPC)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Evonik Industries AG

Clariant International Ltd.

Albemarle Corporation

Solvay S.A.

BASF SE

Honeywell International Inc.

Johnson Matthey Plc

Huntsman Corporation

Dow Chemical Company

SABIC

INEOS Group Holdings S.A.

Arkema S.A.

Chemtura Corporation

Momentive Performance Materials Inc.

Gujarat Alkalies and Chemicals Ltd.

Table of Contents

1. India Phase Transfer Catalyst Market Overview

1.1 India Phase Transfer Catalyst Market Taxonomy

2. India Phase Transfer Catalyst Market Size (in USD Bn), 2018-2023

3. India Phase Transfer Catalyst Market Analysis

3.1 India Phase Transfer Catalyst Market Growth Drivers

3.2 India Phase Transfer Catalyst Market Challenges and Issues

3.3 India Phase Transfer Catalyst Market Trends and Development

3.4 India Phase Transfer Catalyst Market Government Regulation

3.5 India Phase Transfer Catalyst Market SWOT Analysis

3.6 India Phase Transfer Catalyst Market Stake Ecosystem

3.7 India Phase Transfer Catalyst Market Competition Ecosystem

4. India Phase Transfer Catalyst Market Segmentation, 2023

4.1 India Phase Transfer Catalyst Market Segmentation by Product Type (in value %), 2023

4.2 India Phase Transfer Catalyst Market Segmentation by Application (in value %), 2023

4.3 India Phase Transfer Catalyst Market Segmentation by Region (in value %), 2023

5. India Phase Transfer Catalyst Market Competition Benchmarking

5.1 India Phase Transfer Catalyst Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Phase Transfer Catalyst Future Market Size (in USD Bn), 2023-2028

7. India Phase Transfer Catalyst Future Market Segmentation, 2028

7.1 India Phase Transfer Catalyst Market Segmentation by Product Type (in value %), 2028

7.2 India Phase Transfer Catalyst Market Segmentation by Application (in value %), 2028

7.3 India Phase Transfer Catalyst Market Segmentation by Region (in value %), 2028

8. India Phase Transfer Catalyst Market Analysts’ Recommendations

8.1 India Phase Transfer Catalyst Market TAM/SAM/SOM Analysis

8.2 India Phase Transfer Catalyst Market Customer Cohort Analysis

8.3 India Phase Transfer Catalyst Market Marketing Initiatives

8.4 India Phase Transfer Catalyst Market White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on India phase transfer catalyst market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India phase transfer catalyst market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple phase transfer catalyst manufacturers and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from phase transfer catalyst manufacturers.

Frequently Asked Questions

01 How big is India Phase Transfer Catalyst Market?

The India phase transfer catalyst market has experienced notable growth, this is reflected by global phase transfer catalyst market reaching a valuation of USD 1 Bn in 2023. This growth is fueled by expanding chemical industry, increased demand for fine chemicals, and advancements in pharmaceutical and agrochemical sectors.

02 What are the challenges in India Phase Transfer Catalyst Market?

Key challenges in India phase transfer catalyst market are high costs of advanced catalysts, stringent regulatory compliance and safety standards, supply chain disruptions, and market saturation in mature segments. These factors impact profitability and operational efficiency for market players.

03 Who are the major players in India Phase Transfer Catalyst Market?

Major players in India phase transfer catalyst market include Clariant International Ltd., Evonik Industries AG, Albemarle Corporation, and Solvay S.A. These companies lead the market due to their strong R&D capabilities, extensive product portfolios, and strategic partnerships.

04 What are the growth drivers of the India Phase Transfer Catalyst Market?

Growth drivers in India phase transfer catalyst market are increased chemical manufacturing, expansion of the pharmaceutical sector, rising agrochemical production, and technological advancements in catalysis. These factors collectively support the increasing demand for phase transfer catalysts in various industrial applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.