India Phone Case Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD5820

December 2024

91

About the Report

India Phone Case Market Overview

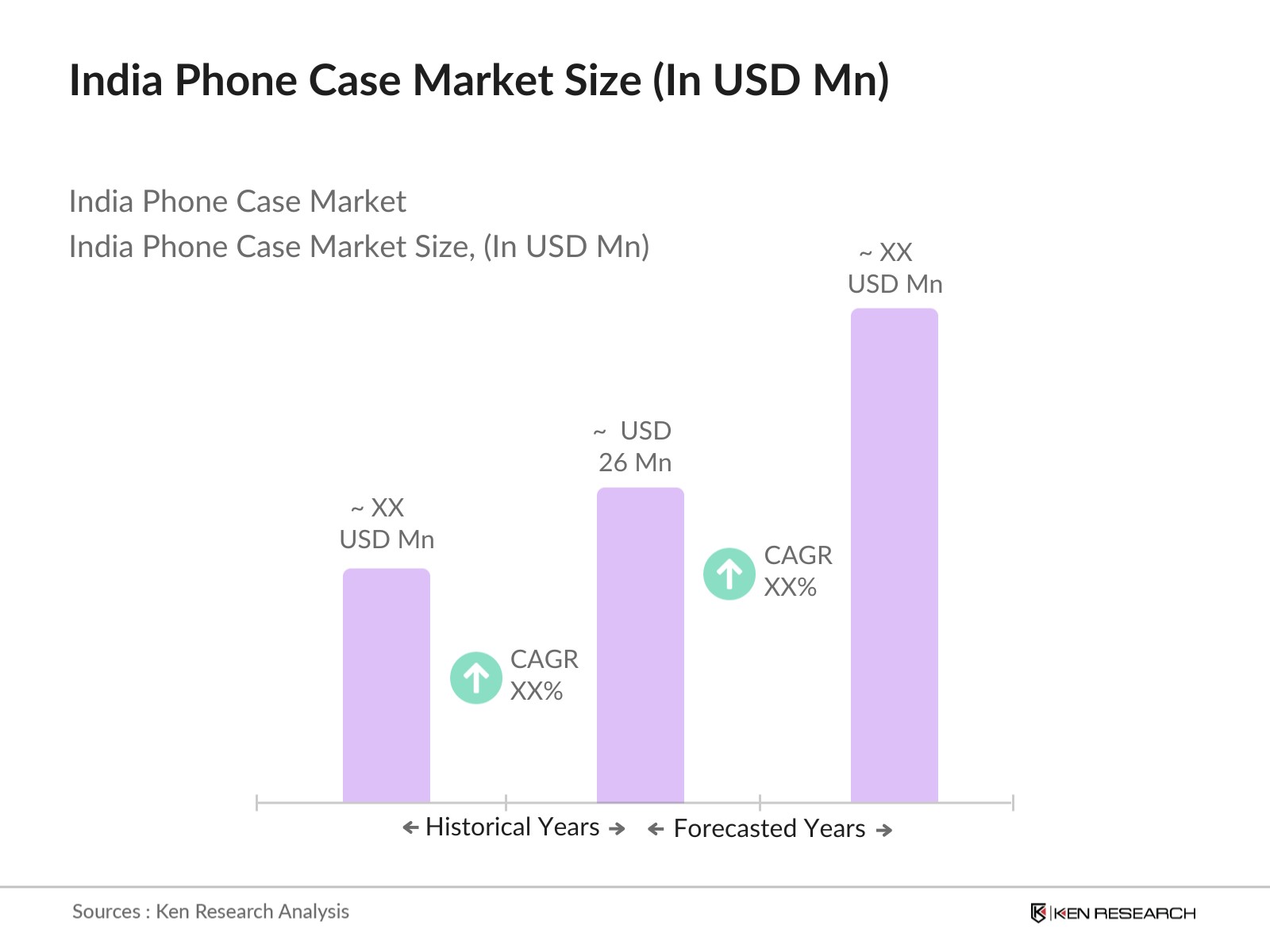

- The India phone case market is valued at USD 26 Million, based on a five-year historical analysis. This market is primarily driven by the rapid growth in smartphone adoption, the rising demand for protective accessories, and the increasing trend of personalization and customization. With the proliferation of e-commerce platforms, consumers have easy access to a wide variety of phone cases, further boosting market growth. Premium and designer cases, along with durable, protective models, are gaining popularity among consumers as they seek to enhance the aesthetics and protection of their devices.

- The Indian market is dominated by major cities like Mumbai, Delhi, and Bengaluru, which account for a significant portion of phone case demand. These urban centers are characterized by high disposable incomes, a growing preference for branded products, and a tech-savvy population that frequently upgrades their smartphones. These factors make these cities the top contributors to the phone case market in India.

- Indias phone case market is influenced by import duties on mobile accessories, which range from 10% to 20% according to the Central Board of Indirect Taxes and Customs. These duties impact price structuring for imported cases and encourage domestic manufacturing. Brands manufacturing locally benefit from reduced tariffs, promoting the Make in India initiative and supporting local economic growth.

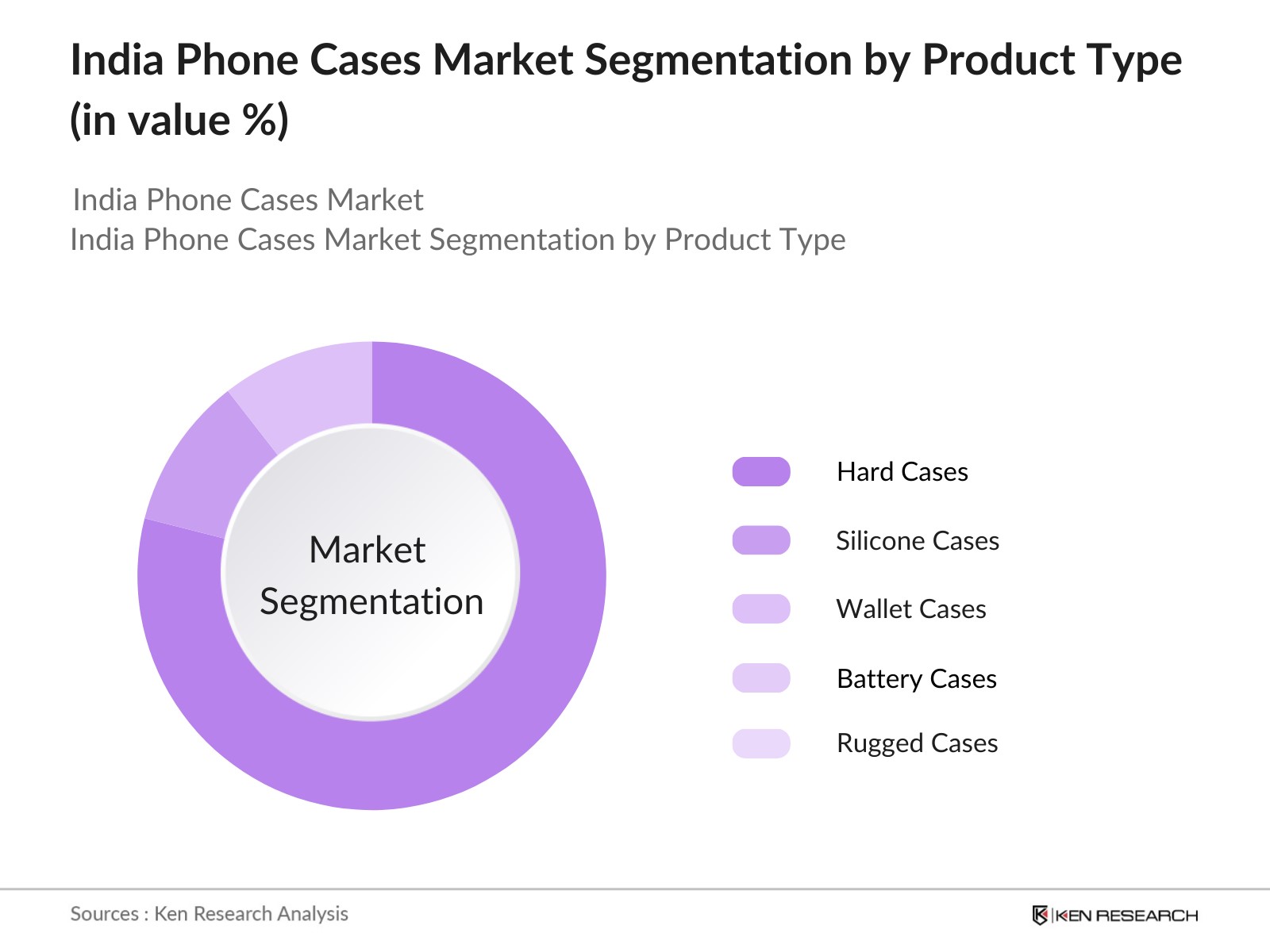

India Phone Case Market Segmentation

- By Product Type: The India phone case market is segmented by product type into hard cases, silicone cases, wallet cases, battery cases, and rugged cases. Among these, hard cases dominate the market share due to their combination of durability and style. These cases offer robust protection against drops and scratches, making them popular among consumers looking to safeguard their smartphones. Additionally, hard cases are often available in sleek and fashionable designs, which appeal to a wide demographic. Their durability, coupled with the availability of a variety of designs, positions hard cases as the leading product type in the market.

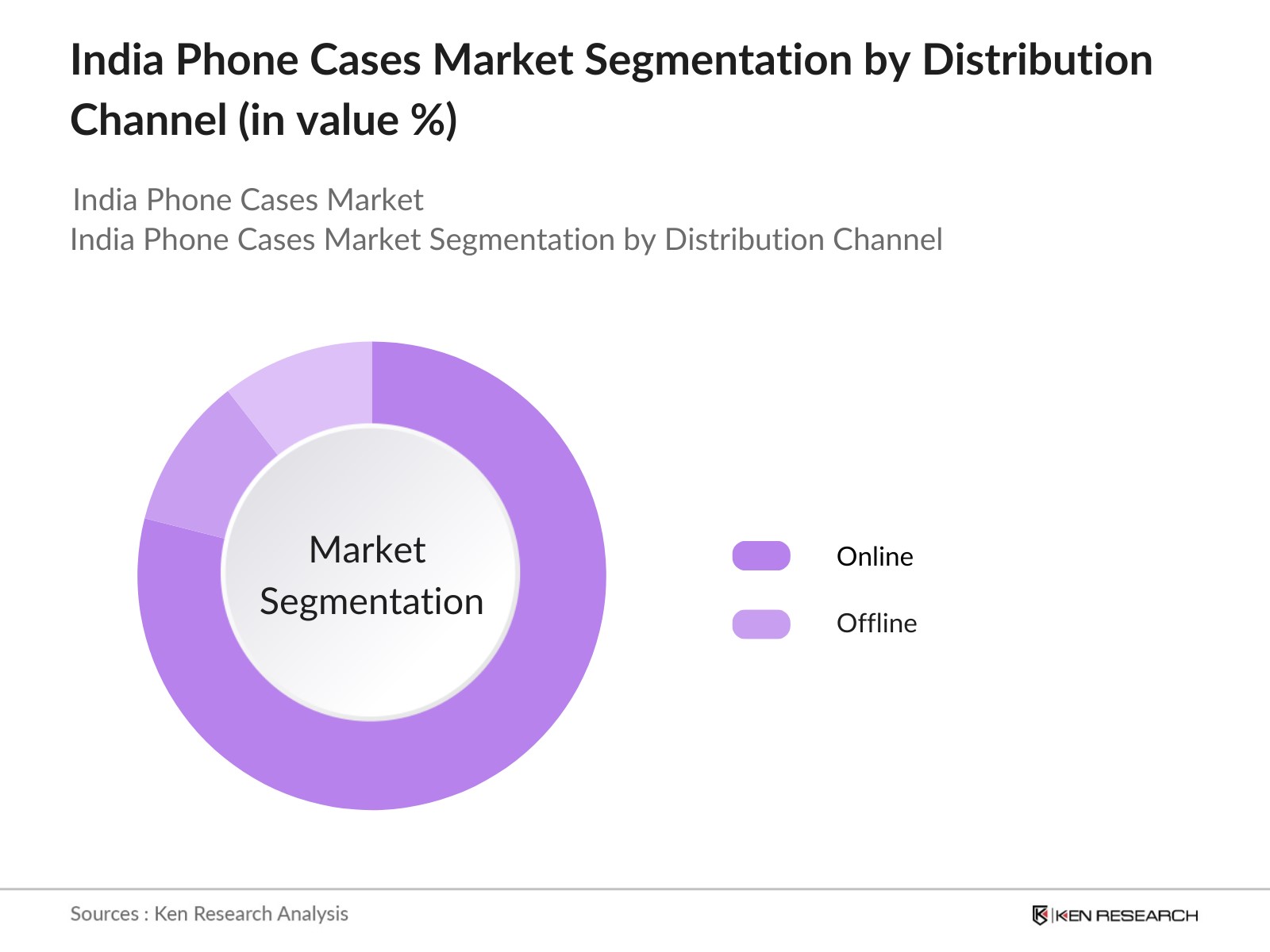

- By Distribution Channel: Indias phone case market is segmented by distribution channel into online and offline segments. The online segment holds the dominant market share, driven by the convenience of e-commerce platforms like Amazon, Flipkart, and specialized accessory stores. Consumers increasingly prefer online shopping due to the ability to compare prices, read reviews, and access a wider range of products, including customizable and premium options. The expansion of mobile internet services and rising smartphone penetration in India have further fueled the growth of the online distribution channel.

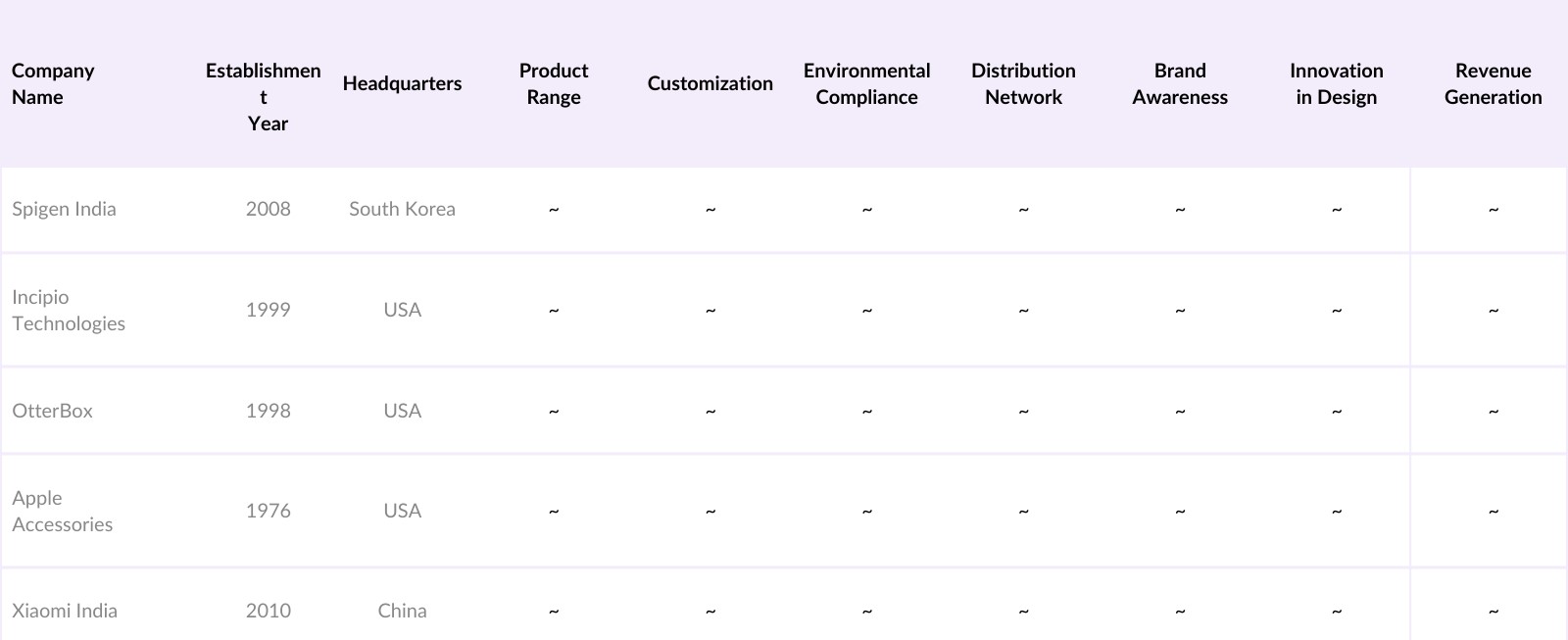

India Phone Case Market Competitive Landscape

The India phone case market is dominated by a mix of domestic and international players who offer a variety of products targeting different customer segments. The competitive landscape features a blend of established brands and smaller players, each catering to diverse consumer preferences.

The India phone case market is competitive, with key players like Spigen, Incipio, and OtterBox offering a wide variety of products. These brands have established themselves through strong online distribution networks and effective branding. Premium phone cases, such as those by OtterBox and Apple, command high prices due to their focus on design and durability. On the other hand, local and regional players cater to the budget-conscious segment, offering affordable and stylish options, especially through online platforms.

India Phone Case Market Analysis

Growth Drivers

- Smartphone Adoption Rate Indias smartphone user base has rapidly expanded, reaching 700 million users in 2024, influenced by increasing affordability and government initiatives to bridge the digital divide (Ministry of Electronics and Information Technology, India). With over 1.1 billion mobile connections reported by Telecom Regulatory Authority of India, the market for accessories like phone cases sees direct growth due to the broadening smartphone user demographic, especially in rural areas. Furthermore, urban penetration drives higher consumer demand for premium accessories to complement smartphone investments, emphasizing the role of phone cases in maintaining device longevity.

- E-commerce Expansion: E-commerce sales in India are expected to reach over 100 million transactions per month in 2024, with smartphone accessories ranking among the top-purchased items, as per the India Post's Digital India report. Increased internet penetration (hovering at around 50% in rural and 75% in urban areas) and government-backed infrastructure enhancements enable wider accessibility to e-commerce platforms, facilitating the distribution of phone cases to Tier II and III cities. This expansion catalyzes growth for both established and new phone case brands by lowering operational costs and expanding market reach.

- Customization Demand: A rising trend in personalized phone accessories has elevated the demand for customizable cases, with over 40% of phone case purchases now featuring bespoke designs according to the India Cellular and Electronics Association. Consumers seek distinctive styles that reflect personal tastes, and the youth demographic, particularly in metropolitan cities, drives this demand. Supported by over 80 million millennial buyers in 2024, customization is pivotal in maintaining competitive differentiation in the market, and brands are leveraging this trend to strengthen customer loyalty.

Market Challenges

- Competition from Unorganized Sector: Indias phone case market faces high competition from the unorganized sector, which accounts for over 60% of phone case sales as per data from the Ministry of Commerce and Industry. Local manufacturers offer low-cost alternatives, impacting branded manufacturers ability to maintain market share. This competition often targets consumers in rural and semi-urban areas who prioritize affordability, presenting a significant hurdle for established brands attempting to penetrate these regions. Source

- Price Sensitivity: Indias price-sensitive consumer base, especially within rural and semi-urban areas, limits the market potential for premium phone case options. According to the Reserve Bank of India, the per capita income disparity between rural and urban areas contributes to this sensitivity, with rural incomes averaging at one-third of urban counterparts. Consequently, brands often struggle to set competitive prices for durable, high-quality cases, as consumers may opt for less expensive alternatives from local suppliers.

India Phone Case Market Future Outlook

Over the next five years, the India phone case market is expected to experience sustained growth driven by increasing smartphone penetration, rising disposable incomes, and an expanding e-commerce sector. As smartphones become more integral to daily life, consumers are investing more in protective and aesthetically pleasing phone cases. Additionally, growing environmental consciousness is likely to lead to a rise in demand for sustainable and eco-friendly phone cases, creating new opportunities for manufacturers to cater to this niche segment. The market is also poised to witness an increase in demand for premium and customizable phone cases as consumers seek to personalize their devices.

Market Opportunities

- Sustainable Material Use: The shift towards sustainable materials in phone case manufacturing is gaining traction, with Indias Ministry of Environment reporting over 20 million metric tons of plastic waste annually, sparking consumer awareness around eco-friendly alternatives. Phone case manufacturers using biodegradable materials, such as bamboo or recycled plastic, are capitalizing on this trend, especially within environmentally-conscious urban markets. This opportunity aligns with Indias commitment to reduce plastic usage and supports brand differentiation in an increasingly sustainability-driven marketplace.

- Premium and Luxury Segment Growth: The rising demand for luxury and premium phone cases is evident as Indias high-income demographic grows, particularly in metropolitan regions. According to data from the Ministry of Finance, the segment of high-income households in urban India has expanded by 5% year-over-year, fueling demand for high-end accessories that complement premium smartphones. Manufacturers catering to this demographic are focusing on materials like leather and metallic finishes, with premium branding strategies to attract affluent consumers.

Scope of the Report

|

By Product Type |

Hard Cases Silicone Cases Wallet Cases Battery Cases Rugged Cases |

|

By Price Range |

Budget Segment Mid-Range Segment Premium Segment |

|

By Material Type |

Plastic Leather Silicone/Rubber Metal Hybrid Materials |

|

By Distribution Channel |

Online Offline (Retail Stores, Hypermarkets, Brand Exclusive Stores) |

|

By Region |

North India South India West India East India |

Products

Key Target Audience

Smartphone Manufacturers

Phone Accessories Retailers

E-commerce Platforms

Distributors and Suppliers of Phone Cases

Corporate Branding Firms

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (BIS Certification, Environmental Standards)

Logistics and Supply Chain Companies

Companies

Players mentioned in the report

Spigen India

Incipio Technologies

OtterBox

Apple Accessories

Xiaomi India

Belkin International

Caseology

Capdase

Urban Armor Gear (UAG)

Ringke India

Nillkin

Rhinoshield

Stuffcool

Puro

Case-Mate

Table of Contents

1. India Phone Case Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Phone Case Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Phone Case Market Analysis

3.1 Growth Drivers (Smartphone Adoption Rate, E-commerce Expansion, Customization Demand, Consumer Spending on Accessories)

3.2 Market Challenges (Competition from Unorganized Sector, Price Sensitivity, Counterfeit Products)

3.3 Opportunities (Sustainable Material Use, Premium and Luxury Segment Growth, Corporate Branding Opportunities)

3.4 Trends (Wireless Charging Compatibility, Rugged Case Designs, Personalization, Eco-Friendly Cases)

3.5 Government Regulation (Import Duties, Environmental Policies, BIS Certification, E-Waste Management Regulations)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. India Phone Case Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Hard Cases

4.1.2 Silicone Cases

4.1.3 Wallet Cases

4.1.4 Battery Cases

4.1.5 Rugged Cases

4.2 By Price Range (In Value %)

4.2.1 Budget Segment

4.2.2 Mid-Range Segment

4.2.3 Premium Segment

4.3 By Material Type (In Value %)

4.3.1 Plastic

4.3.2 Leather

4.3.3 Silicone/Rubber

4.3.4 Metal

4.3.5 Hybrid Materials

4.4 By Distribution Channel (In Value %)

4.4.1 Online

4.4.2 Offline (Retail Stores, Hypermarkets, Brand Exclusive Stores)

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 West India

4.5.4 East India

5. India Phone Case Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Spigen India

5.1.2 Incipio Technologies

5.1.3 OtterBox

5.1.4 Apple Inc. (Phone Accessories Division)

5.1.5 Samsung Electronics Co. (Accessories Division)

5.1.6 Xiaomi India

5.1.7 Belkin International

5.1.8 Caseology

5.1.9 Capdase

5.1.10 Urban Armor Gear (UAG)

5.1.11 Ringke India

5.1.12 Nillkin

5.1.13 Rhinoshield

5.1.14 Stuffcool

5.1.15 Puro

5.2 Cross Comparison Parameters (Product Range, Material Quality, Price Range, Innovation in Design, Customization, Environmental Compliance, Distribution Network, Brand Awareness)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Phone Case Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. India Phone Case Market Future Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Phone Case Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Price Range (In Value %)

8.3 By Material Type (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. India Phone Case Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this stage, we constructed an ecosystem map that included all major stakeholders within the India phone case market. Using extensive desk research, we gathered comprehensive industry-level information from secondary sources, including government databases, and proprietary reports. The primary objective was to identify the critical variables that influence the market dynamics, such as consumer trends, environmental policies, and technological innovations.

Step 2: Market Analysis and Construction

We compiled and analyzed historical data on the India phone case market. This involved assessing the market's penetration, the ratio of online to offline sales, and the overall revenue generation from different product types. A thorough evaluation of the supply chain and quality standards was conducted to ensure the reliability of our revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

We developed market hypotheses regarding consumer behavior and product demand, which were then validated through expert consultations. These consultations were conducted with representatives from leading companies in the phone accessories industry, providing valuable insights into operational challenges and market trends.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with phone case manufacturers to gather detailed insights into product segments, sales performance, and customer preferences. This step verified and complemented our bottom-up approach, ensuring the accuracy of the data and analysis in the India phone case market report.

Frequently Asked Questions

01. How big is the India Phone Case Market?

The India phone case market is valued at USD 26 Million, driven by the widespread adoption of smartphones, increased consumer spending on accessories, and the growing preference for phone protection and customization.

02. What are the challenges in the India Phone Case Market?

The market faces challenges such as high competition from unorganized sectors, the influx of counterfeit products, and price sensitivity among consumers, which can impact the profitability of premium phone case brands.

03. Who are the major players in the India Phone Case Market?

Key players in the market include Spigen India, Incipio Technologies, OtterBox, Apple Accessories, and Xiaomi India. These brands dominate due to their strong distribution networks, high-quality products, and significant online presence.

04. What are the growth drivers of the India Phone Case Market?

The market is driven by factors such as the increasing penetration of smartphones, the rise of e-commerce, and consumer demand for customizable and durable phone accessories. The growing environmental awareness is also boosting the demand for sustainable phone case options.

05. What are the trends in the India Phone Case Market?

Key trends include the rising demand for eco-friendly phone cases, the integration of wireless charging compatibility, and the growing preference for rugged and protective designs among consumers. Additionally, the trend of phone case personalization is gaining momentum among younger demographics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.