India Phosphoric Acid Market Outlook to 2030

Region:Asia

Author(s):Shivani

Product Code:KROD7496

October 2024

82

About the Report

India Phosphoric Acid Market Overview

- The India Phosphoric Acid market is valued at USD 2.60 billion, driven primarily by the robust agricultural sector and growing demand for chemical fertilizers. The countrys reliance on agriculture, which forms a significant portion of its GDP, has propelled the use of phosphoric acid in fertilizer production. Government subsidies and increasing food security initiatives further support the market growth. With phosphoric acid being a key ingredient in manufacturing phosphate fertilizers, the industry remains crucial in boosting crop yield and ensuring food supply stability.

- Cities like Paradeep and Mumbai dominate the phosphoric acid market due to their proximity to major fertilizer manufacturing plants and easy access to import ports. Paradeep, located in Odisha, hosts one of Indias largest fertilizer production hubs, making it a key player in the phosphoric acid market. Additionally, Mumbais strategic location along the western coast and its advanced port infrastructure make it a vital gateway for phosphoric acid imports, ensuring smooth distribution across the country.

- The Government of India has extended customs duty exemptions for key raw materials required in phosphoric acid production, including phosphate rock and sulfur. As part of its efforts to promote domestic production, these exemptions help reduce the overall cost of imports and improve the competitiveness of local manufacturers. The exemptions, originally introduced in 2022, have been instrumental in lowering production costs, enabling companies to invest in expanding their production capacity and modernizing their operations. This move aligns with Indias broader objective to reduce dependency on foreign raw materials.

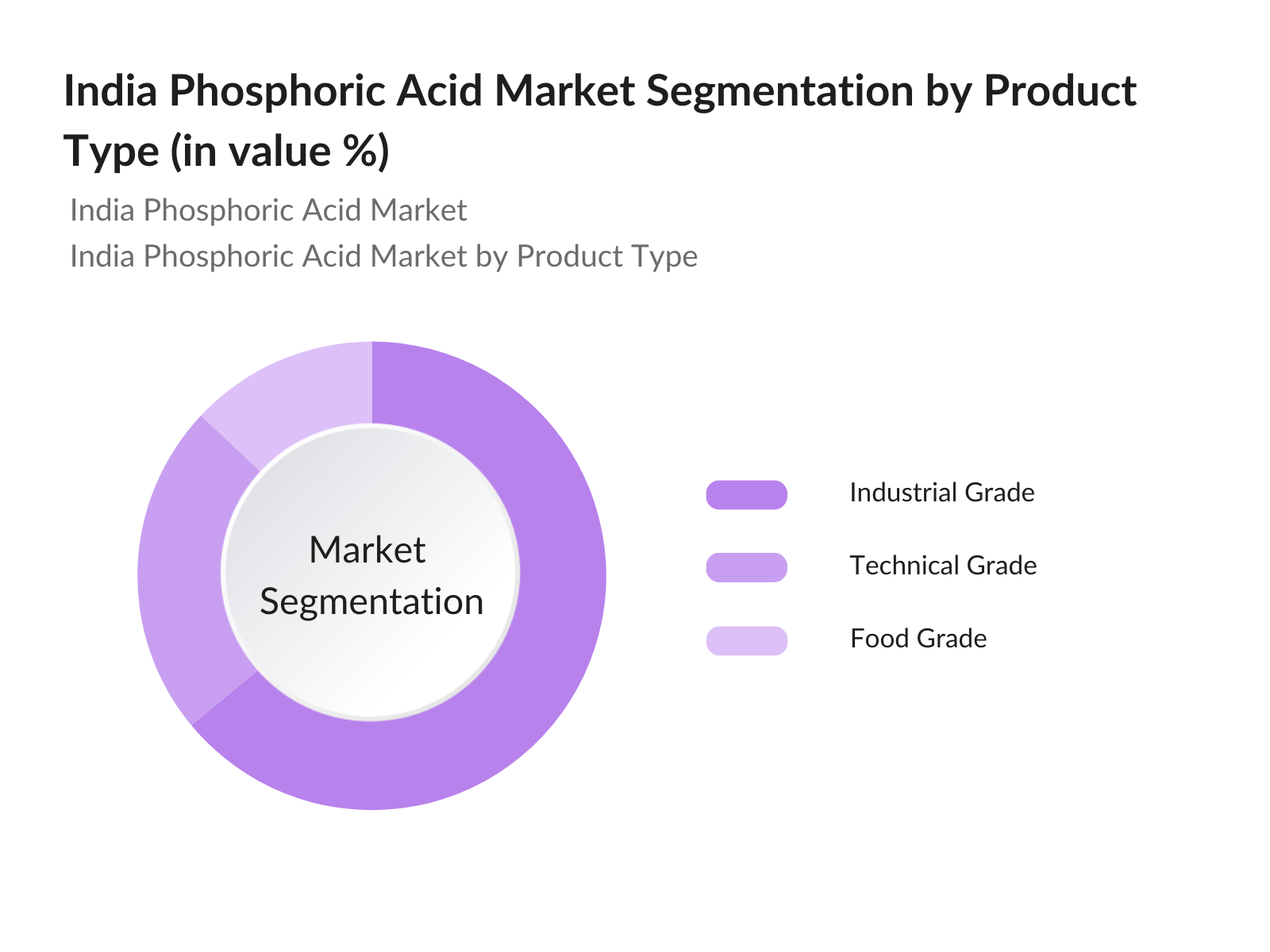

India Phosphoric Acid Market Segmentation

By Product Type: The India Phosphoric Acid market is segmented by product type into food grade, technical grade, and industrial grade phosphoric acid. The industrial grade phosphoric acid segment holds the dominant market share. This is attributed to its extensive usage in fertilizer manufacturing, which continues to be a major driver of demand. The need for enhanced agricultural output to meet the countrys growing food demand and the introduction of government subsidies have strengthened the segments position in the market. Additionally, industrial grade phosphoric acid is widely used in metal treatment and chemical production, further contributing to its dominance.

|

Product Type |

Market Share (2023) |

|---|---|

|

Industrial Grade |

64% |

|

Technical Grade |

23% |

|

Food Grade |

13% |

By Application: Indias Phosphoric Acid market is segmented by application into fertilizers, food & beverages, chemical manufacturing, and metal treatment. Fertilizer application accounts for the largest market share due to Indias dependence on agriculture. Fertilizers derived from phosphoric acid, such as diammonium phosphate (DAP), are crucial for ensuring high crop yields. The increasing demand for food security and the Indian government's consistent focus on subsidizing fertilizers have bolstered this segment. The widespread use of phosphoric acid in chemical manufacturing and food processing industries also provides significant growth opportunities in these sectors.

|

Application |

Market Share (2023) |

|---|---|

|

Fertilizers |

68% |

|

Chemical Manufacturing |

17% |

|

Food & Beverages |

9% |

|

Metal Treatment |

6% |

India Phosphoric Acid Market Competitive Landscape

The India Phosphoric Acid market is dominated by a few major players, with leading manufacturers like Coromandel International Limited and IFFCO leveraging their well-established distribution networks and strong market presence. These companies benefit from large-scale production capacities and proximity to key agricultural regions, allowing them to cater to the growing demand for fertilizers. Additionally, international players like Mosaic India also influence the market by offering competitive pricing and innovative product offerings. The competitive landscape highlights the consolidation of the market, with a few key players driving growth through technological advancements and strategic partnerships.

|

Company |

Establishment Year |

Headquarters |

Key Metrics |

|

Coromandel International Ltd. |

1961 |

Hyderabad, India |

|

|

IFFCO |

1967 |

New Delhi, India |

|

|

Gujarat State Fertilizers |

1962 |

Vadodara, India |

|

|

Mosaic India Private Limited |

2004 |

Mumbai, India |

|

|

Paradeep Phosphates Ltd. |

1981 |

Bhubaneswar, India |

India Phosphoric Acid Market Analysis

Market Growth Drivers

- Agricultural Demand (Fertilizer consumption, demand elasticity): Indias phosphoric acid market is driven by high agricultural demand, with fertilizers being a primary consumer of phosphoric acid. According to the World Bank, Indias agricultural sector experienced significant growth, with food grain production reaching 314 million tons in 2023. Phosphoric acid plays a vital role in supporting this demand, especially in agriculturally rich regions such as Uttar Pradesh and Punjab, where demand elasticity is high. The countrys large agricultural workforce ensures that the demand for phosphoric acid remains strong as crop yields continue to increase, driven by Indias growing need for food production.

- Increasing Demand for Food Security (Supply chain bottlenecks, production capacity): India faces growing concerns over food security due to its population exceeding 1.4 billion in 2023, requiring continuous growth in agricultural output. The Government of India has implemented measures to alleviate supply chain bottlenecks by investing $10 billion in improving agricultural infrastructure, according to the Ministry of Agriculture. This move directly impacts the phosphoric acid market as it supports the fertilizer industrys production capacity, essential to maintain food supply. With increasing global disruptions in the food supply chain, this is a vital driver of market growth, ensuring that domestic production meets food security demands.

- Industrial Applications (Chemical, Metal treatment): Phosphoric acid is integral to Indias chemical and metal treatment industries, particularly in manufacturing detergents, water treatment chemicals, and rust inhibitors. Indias chemical production value reached over $178 billion in 2023, representing a key sector for phosphoric acid use. The Bureau of Indian Standards estimates that the domestic metal treatment industry alone requires over 600,000 tons of phosphoric acid annually for treating steel and other metals. These industrial applications continue to grow as India pushes forward in its Make in India initiative, targeting self-sufficiency in industrial production.

Market Challenges

- Environmental Regulations (Emission norms, water usage): Phosphoric acid production in India faces stringent environmental regulations, particularly on emissions and water usage. The Central Pollution Control Board (CPCB) mandates that industries reduce phosphorus emissions to less than 0.5 mg/L, making compliance costly for many manufacturers. In addition, water usage limits in production processes pose a significant challenge, as water scarcity affects many Indian regions. Industries in Gujarat and Maharashtra face penalties if they exceed the government-set quotas for water usage, leading to increased operational costs for producers who rely on large volumes of water for phosphoric acid manufacturing.

- Import Dependence (Global supply chain disruptions): India relies heavily on imports of phosphate rock for phosphoric acid production, with a significant portion of its requirements coming from countries like Morocco and Jordan. Supply chain disruptions, driven by geopolitical tensions and logistics bottlenecks in 2023, have caused delays and increased shipping costs. These disruptions affect the stability of domestic production, impacting fertilizer availability and pricing. The continued dependence on imports makes India vulnerable to global market fluctuations, presenting a key challenge for the phosphoric acid market in maintaining consistent supply and stable pricing.

India Phosphoric Acid Market Future Outlook

Over the next few years, the India Phosphoric Acid market is expected to show steady growth driven by continued investments in agriculture, the development of new fertilizer formulations, and the government's support for food security. The growing focus on sustainable farming practices and eco-friendly fertilizers will create opportunities for manufacturers to explore green phosphoric acid production. In addition, advancements in industrial applications of phosphoric acid, particularly in metal treatment and the electronics industry, are likely to open up new avenues for market expansion.

Market Opportunities:

- Technological Innovations (Cost-efficient production): Technological advancements in production processes, such as the use of innovative energy-efficient machinery, have the potential to significantly reduce production costs for phosphoric acid. The National Institute of Industrial Engineering (NITIE) reports that technology adoption could notably lower operational costs, enhancing profitability for domestic producers. These innovations include automated systems that reduce labor requirements and energy-efficient machinery that lowers electricity consumption, providing a competitive edge in the global market. The governments initiatives to promote technology transfer through grants and tax incentives further make this an attractive opportunity for manufacturers.

- Expansion into Specialty Applications (Electronics, Pharma-grade): Phosphoric acid is witnessing growing demand in specialty applications such as the electronics and pharmaceutical industries. Indias pharmaceutical exports, valued at over $24 billion in 2023, present a significant opportunity for phosphoric acid producers to meet the rising demand for pharma-grade acid. Additionally, the electronics sector, which relies on phosphoric acid for semiconductor manufacturing, is rapidly expanding. Diversifying into these high-value applications offers considerable potential for market growth and profit maximization, allowing phosphoric acid producers to capitalize on the increasing demand from these specialized industries.

Scope of the Report

|

By Product Type |

Food Grade Technical Grade Industrial Grade |

|

By Application |

Fertilizers Food & Beverages Chemical Manufacturing Metal Treatment Others |

|

By Process Type |

Wet Process Thermal Process |

|

By End-User |

Agriculture Industrial Food Processing |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Phosphate Fertilizer Manufacturers

Agricultural Corporations and Farmers' Associations

Food and Beverage Manufacturers

Chemical Processing Industries

Metal Treatment Companies

Government and Regulatory Bodies (Fertilizer Regulatory Authority, Ministry of Chemicals and Fertilizers)

Investments and Venture Capitalist Firms

Raw Material Suppliers

Companies

Major Players

-

Coromandel International Limited

Indian Farmers Fertilizer Cooperative (IFFCO)

Gujarat State Fertilizers & Chemicals Ltd.

Paradeep Phosphates Limited

Tata Chemicals Limited

Chambal Fertilizers & Chemicals

Rashtriya Chemicals & Fertilizers Limited

Mosaic India Private Limited

Greenstar Fertilizers Limited

Zuari Agro Chemicals Ltd.

Hindalco Industries Limited

SNC Lavalin Engineering India Pvt Ltd.

J.R. Simplot Company

Foskor India Ltd.

Yara India Private Limited

Table of Contents

1. India Phosphoric Acid Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Industry Lifecycle Analysis

1.4. Market Segmentation Overview

1.5. Value Chain Analysis

2. India Phosphoric Acid Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Market Share by Key Manufacturers

2.3. Market Concentration Ratio

2.4. Value-Based CAGR Analysis

3. India Phosphoric Acid Market Drivers, Challenges, and Opportunities

3.1. Growth Drivers

3.1.1. Agricultural Demand (Fertilizer consumption, demand elasticity)

3.1.2. Increasing Demand for Food Security (Supply chain bottlenecks, production capacity)

3.1.3. Industrial Applications (Chemical, Metal treatment)

3.1.4. Government Subsidies (Import duty, tax incentives)

3.2. Market Challenges

3.2.1. Environmental Regulations (Emission norms, water usage)

3.2.2. Rising Input Costs (Raw material prices, labor costs)

3.2.3. Import Dependence (Global supply chain disruptions)

3.3. Opportunities

3.3.1. Green Phosphoric Acid Production (Sustainable methods)

3.3.2. Technological Innovations (Cost-efficient production)

3.3.3. Expansion into Specialty Applications (Electronics, Pharma-grade)

3.4. Market Trends

3.4.1. Increased Investment in Capacity Expansion

3.4.2. Shift towards Eco-friendly Fertilizers

3.4.3. Strategic Mergers & Acquisitions

3.5. Regulatory Environment

3.5.1. Government Policies (Fertilizer subsidy schemes, GST impact)

3.5.2. Environmental Compliance (Pollution control, hazardous material management)

3.5.3. Safety Standards in Phosphoric Acid Handling

4. India Phosphoric Acid Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Food Grade

4.1.2. Technical Grade

4.1.3. Industrial Grade

4.2. By Application (In Value %)

4.2.1. Fertilizers

4.2.2. Food & Beverages

4.2.3. Chemical Manufacturing

4.2.4. Metal Treatment

4.2.5. Others

4.3. By Process Type (In Value %)

4.3.1. Wet Process

4.3.2. Thermal Process

4.4. By Region (In Value %)

4.4.1. North India

4.4.2. South India

4.4.3. East India

4.4.4. West India

4.5. By End User (In Value %)

4.5.1. Agriculture

4.5.2. Industrial

4.5.3. Food Processing

5. India Phosphoric Acid Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Coromandel International Limited

5.1.2. IFFCO (Indian Farmers Fertilizer Cooperative)

5.1.3. Gujarat State Fertilizers & Chemicals Ltd.

5.1.4. Paradeep Phosphates Limited

5.1.5. Tata Chemicals Limited

5.1.6. Chambal Fertilizers & Chemicals

5.1.7. Rashtriya Chemicals & Fertilizers Limited

5.1.8. Mosaic India Private Limited

5.1.9. Greenstar Fertilizers Limited

5.1.10. Zuari Agro Chemicals Ltd.

5.1.11. Hindalco Industries Limited

5.1.12. SNC Lavalin Engineering India Pvt Ltd.

5.1.13. J.R. Simplot Company

5.1.14. Foskor India Ltd.

5.1.15. Yara India Private Limited

5.2. Cross Comparison Parameters (Production capacity, Manufacturing process, Domestic market share, R&D spending, Cost competitiveness, Geographical presence, Distribution network, Strategic partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives by Key Players

5.5. Mergers and Acquisitions

5.6. Joint Ventures and Collaborations

5.7. Investment Analysis

5.8. Government Grants

5.9. Private Equity and Venture Capital Investments

6. India Phosphoric Acid Market Regulatory Framework

6.1. Environmental Standards and Norms

6.2. Compliance Requirements (Handling and storage)

6.3. Certification Processes (ISO standards, Food safety compliance)

7. India Phosphoric Acid Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Demand-Supply gap, Agri-innovation)

8. India Phosphoric Acid Market Analysts' Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Market Penetration Strategies

8.3. Technological Roadmap for Sustainability

8.4. Customer Segmentation and Positioning Strategies

8.5. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves building a comprehensive map of stakeholders in the India Phosphoric Acid Market. By leveraging a combination of secondary research from proprietary databases and primary data sources, we identify and define critical market variables, such as production processes, distribution channels, and end-user demand.

Step 2: Market Analysis and Construction

In this phase, historical data on production volumes, consumption patterns, and revenue streams are analyzed to assess the overall market performance. We examine key drivers and challenges, including government policies, input costs, and export-import trends, to provide a robust market outlook.

Step 3: Hypothesis Validation and Expert Consultation

Our market hypotheses are validated through consultations with industry experts and stakeholders from leading companies. This process includes structured interviews and CATI surveys, ensuring the accuracy of insights and the reliability of market data.

Step 4: Research Synthesis and Final Output

Finally, we synthesize the collected data into a cohesive report, cross-verifying information with manufacturers and industry stakeholders. This ensures that the report presents an accurate and reliable analysis of the India Phosphoric Acid market.

Frequently Asked Questions

01. How big is the India Phosphoric Acid Market?

The India Phosphoric Acid market is valued at USD 2.60 billion, driven by the increasing demand for fertilizers and the growth of the agriculture sector.

02. What are the challenges in the India Phosphoric Acid Market?

The market faces challenges such as rising input costs for raw materials, dependency on imports, and stringent environmental regulations related to phosphoric acid production and waste management.

03. Who are the major players in the India Phosphoric Acid Market?

Key players include Coromandel International Limited, IFFCO, Gujarat State Fertilizers & Chemicals Ltd., Paradeep Phosphates Ltd., and Mosaic India Private Limited, all of which have extensive manufacturing capacities and strong market positions.

04. What are the growth drivers of the India Phosphoric Acid Market?

Growth drivers include increased agricultural demand, government subsidies for fertilizers, and expanding industrial applications of phosphoric acid in the chemical and metal treatment industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.