India Physical Therapy Equipment Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD6357

December 2024

90

About the Report

India Physical Therapy Equipment Market Overview

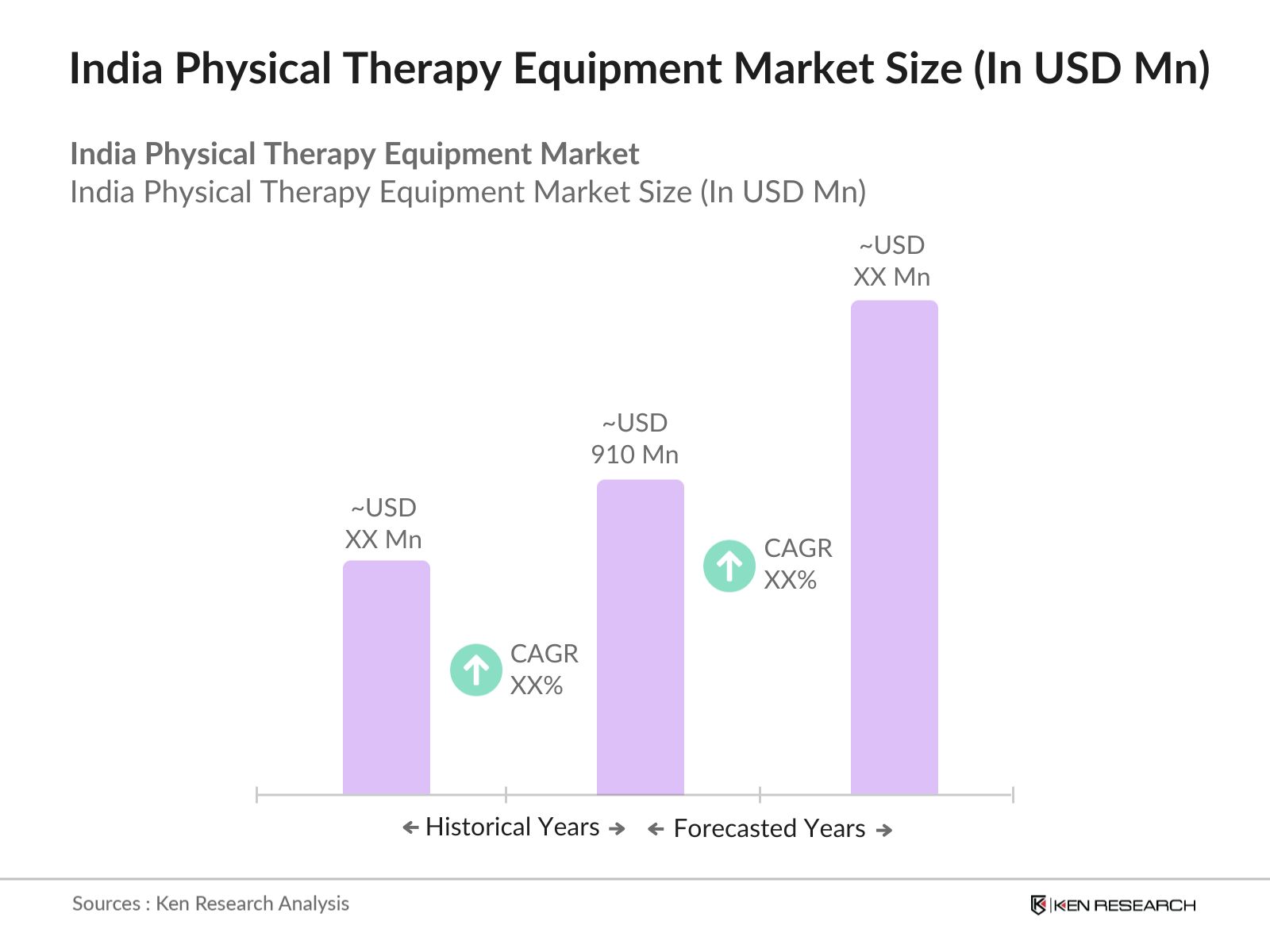

- The India Physical Therapy Equipment Market, valued at USD 910 million, is driven by a surge in demand for rehabilitation services, technological advancements in therapy devices, and an increasing awareness of physical health among the population. Government initiatives promoting healthcare infrastructure, along with rising disposable incomes, have bolstered market growth. The focus on effective rehabilitation for chronic illnesses and post-surgery recovery is a critical factor supporting the market's expansion.

- Key cities such as Mumbai, Delhi, and Bengaluru are pivotal to the growth of the physical therapy equipment market. These urban centers have a high concentration of healthcare facilities, advanced medical technology adoption, and a growing elderly population, which drives the need for physical therapy solutions. Additionally, the presence of well-established hospitals and clinics that offer specialized rehabilitation services significantly contributes to the market's prominence in these regions.

- Indias Medical Device Rules mandate that all physical therapy equipment meets quality and safety standards, with strict monitoring enforced by the Central Drugs Standard Control Organization. A 2023 report from the Ministry of Health and Family Welfare indicated that over 800 inspections were conducted to ensure compliance, underscoring the regulatory emphasis on ensuring only approved and safe devices are available in the market.

India Physical Therapy Equipment Market Segmentation

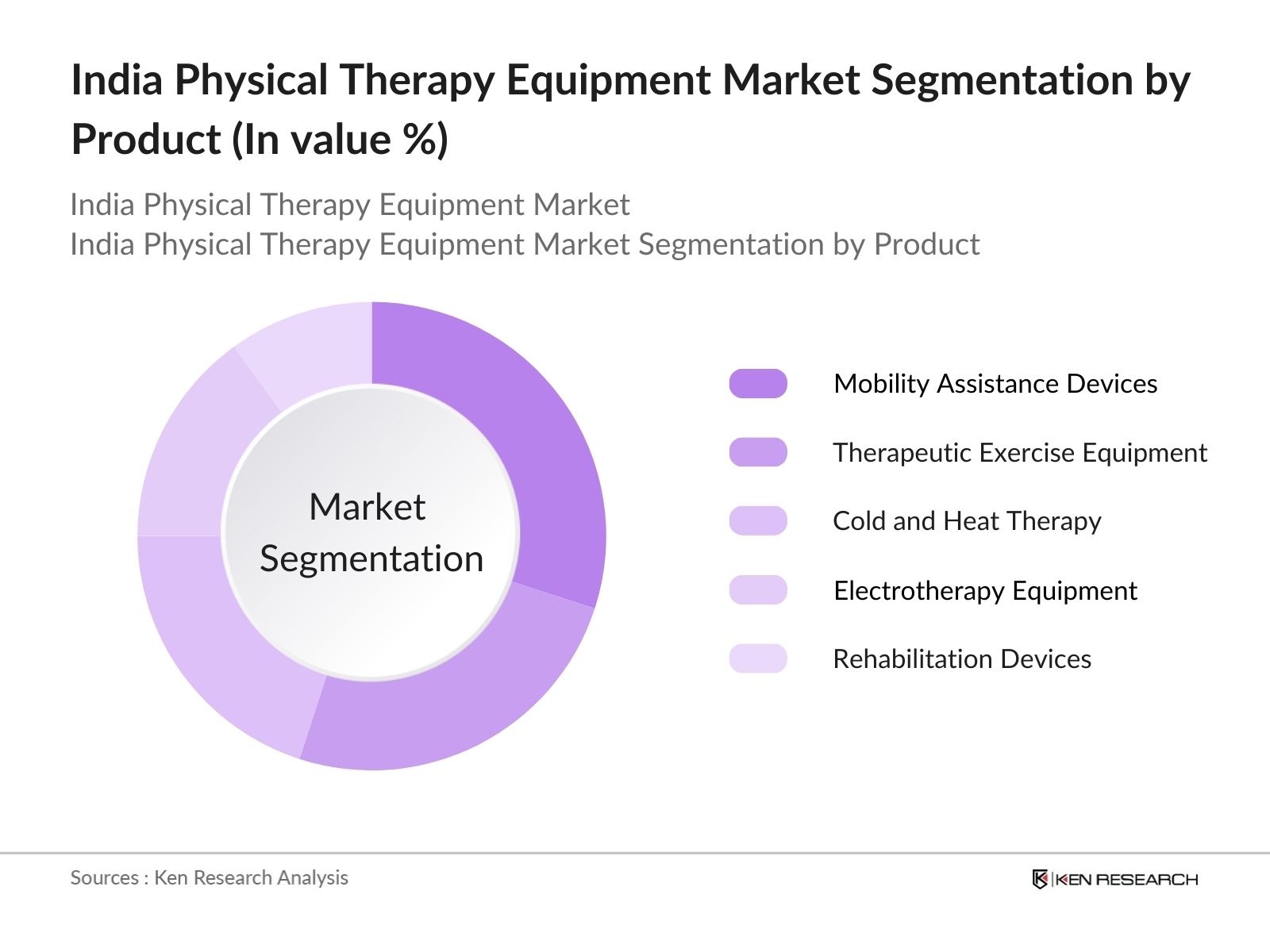

- By Product Type: The market is segmented by product type into mobility assistance devices, therapeutic exercise equipment, cold and heat therapy equipment, electrotherapy equipment, and rehabilitation devices. Mobility assistance devices have recently taken a dominant market share due to the rising elderly population and an increasing number of surgeries that require post-operative care. The demand for mobility aids such as walkers and wheelchairs is steadily increasing as more patients seek independence in their recovery process, making this segment crucial in the physical therapy landscape.

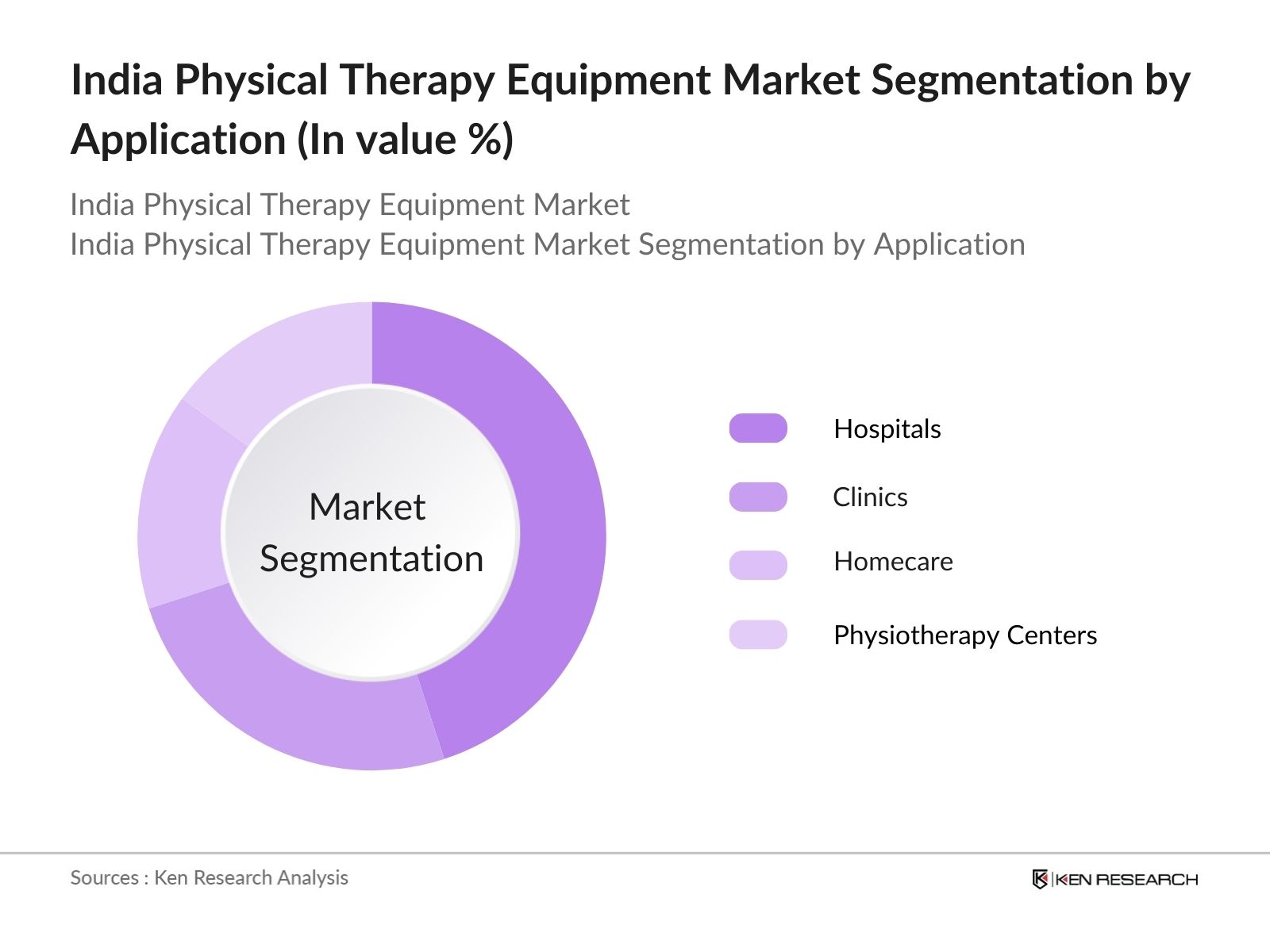

- By Application: The market is segmented by application into hospitals, clinics, homecare, and physiotherapy centers. The hospital segment holds the largest share, driven by the high volume of surgical procedures and the need for comprehensive rehabilitation services. Hospitals are increasingly investing in advanced physical therapy equipment to enhance patient recovery times and improve the overall quality of care. The expansion of specialized rehabilitation units within hospitals significantly boosts the demand for these therapeutic devices.

India Physical Therapy Equipment Market Competitive Landscape

The India physical therapy equipment market is highly competitive, characterized by a mix of both domestic and international players vying for market share. Leading companies such as Bharat Medical Systems, Omron Healthcare, and RMS India dominate the market through a combination of innovative product offerings and strong distribution channels. Local manufacturers also play a crucial role, particularly in price-sensitive segments, creating a diverse competitive landscape that fosters innovation and product development.

India Physical Therapy Equipment Market Industry Analysis

Growth Drivers

- Increasing Geriatric Population: India's elderly population has been steadily increasing, with 140 million individuals aged 60 and above in 2023. By 2024, an estimated 20% of Indias total healthcare burden is expected to be linked to the aging populations health needs, which is driving demand for physical therapy equipment to manage chronic pain, mobility issues, and recovery from age-related conditions. The National Statistical Office reports an annual increase of approximately 4 million elderly individuals, reinforcing the sustained demand for physical rehabilitation services and associated equipment.

- Increase in Post-Surgical Rehabilitation Needs: India has witnessed a significant rise in surgical procedures, with 5.6 million orthopaedic surgeries recorded in 2022, primarily driven by lifestyle diseases and accidental injuries. Post-surgical rehabilitation equipment is in greater demand due to the uptick in joint replacements, ligament repairs, and fracture recoveries. This trend is amplified by data from the Ministry of Health and Family Welfare, indicating an annual 8% increase in elective surgeries, thereby creating a steady requirement for effective physical therapy tools to assist recovery.

- Technological Advancements in Equipment: In 2023, Indias physical therapy sector saw significant adoption of technology-enhanced devices, with one third of clinics implementing equipment that includes real-time monitoring, AI-assisted mobility, and sensor-based tools to track rehabilitation progress. A recent National Health Mission report highlighted that over hundreds of facilities incorporated such technology, especially in urban centers where tech-enabled recovery tools streamline care. This integration aids in improving treatment accuracy, shortening recovery times, and promoting personalized rehabilitation strategies.

Market Challenges

- High Cost of Equipment: The premium pricing of advanced physical therapy equipment restricts accessibility for smaller healthcare facilities and individual home users, particularly in resource-limited rural areas. This lack of access not only hinders patient care but also limits effective rehabilitation, as smaller institutions struggle to afford high-quality devices needed for comprehensive treatments. Consequently, there is a pressing need for more affordable, scalable equipment options that can cater to underserved market segments, ensuring wider coverage and improved rehabilitation outcomes across India.

- Limited Skilled Workforce: The Indian physical therapy sector faces a critical shortage of trained professionals skilled in the effective use of advanced therapy equipment. Although educational programs are expanding, the rate of training remains insufficient to meet the growing demand for qualified physical therapists. This skills gap limits the sector's ability to offer comprehensive, high-quality rehabilitation services and impacts patient outcomes, creating a pressing need for targeted efforts in workforce development to meet the demands of modern healthcare standards.

India Physical Therapy Equipment Market Future Outlook

The India Physical Therapy Equipment Market is expected to continue its upward trajectory, projected to reach INR 6 billion by 2028. This growth is driven by an increased focus on rehabilitation services, government initiatives promoting healthcare accessibility, and technological advancements in therapy devices. The introduction of smart rehabilitation solutions and an expanding elderly population will further stimulate market demand.

Future Market Opportunities

- Expansion into Rural and Semi-Urban Areas: Rural regions in India represent an underserved market, with only a small portion of these areas currently accessing basic rehabilitation services, according to the Rural Health Statistics Report 2024. With government initiatives promoting health center establishments in tier-2 and tier-3 cities, rural healthcare centers saw a notable increase in rehabilitation services, creating a substantial growth opportunity for physical therapy equipment providers to expand their market presence.

- Growth in Tele-rehabilitation: Indias telemedicine industry has expanded by 4 times in the past three years, driven by increased mobile internet access and government support under the Digital India initiative. A study by the Ministry of Electronics and Information Technology shows that millions of individuals utilized tele-rehabilitation services in 2023, primarily for post-operative and chronic care, indicating strong potential for remote physical therapy equipment integration, especially in underserved areas.

Scope of the Report

|

By Product Type |

Mobility Assistance Devices |

|

By Application |

Hospitals |

|

By Distribution Channel |

Direct Sales |

|

By Technology |

Manual Therapy |

|

By Region |

North |

Products

Key Target Audience

Hospitals and Healthcare Facilities

Rehabilitation Centers

Homecare Equipment Suppliers

Orthopedic and Geriatric Clinics

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Central Drugs Standard Control Organization)

Telemedicine and Remote Healthcare Providers

Companies

Players Mentioned in the Report

Bharat Medical Systems

Omron Healthcare India

RMS India Pvt. Ltd.

Tenko Medical System

Enraf-Nonius India

BTL India

Indian MedTech Pvt. Ltd.

Modi Medical Devices

Equinox Medical Technologies

Advanced Physiotherapy Equipments

Kinesio Medical Equipment

PT Physio Equipment

Elpro Technologies

Lure Medical Systems

Bionix India

Table of Contents

01 India Physical Therapy Equipment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Dynamics

1.4 Market Segmentation Overview

02 India Physical Therapy Equipment Market Size (in INR Million)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Milestones and Developments

03 India Physical Therapy Equipment Market Analysis

3.1 Growth Drivers

3.1.1 Rising Aging Population

3.1.2 Increase in Post-Surgical Rehabilitation Needs

3.1.3 Technological Advancements in Equipment

3.1.4 Government Initiatives Supporting Healthcare Facilities

3.2 Market Challenges

3.2.1 High Equipment Costs

3.2.2 Limited Availability of Skilled Therapists

3.2.3 Regulatory Constraints

3.3 Opportunities

3.3.1 Expansion into Rural and Semi-Urban Areas

3.3.2 Growth in Tele-rehabilitation

3.3.3 Rising Adoption of Portable Devices

3.4 Trends

3.4.1 Demand for Wearable Devices

3.4.2 Integration with IoT and AI Technologies

3.4.3 Adoption of Robot-Assisted Therapy

3.5 Regulatory Overview

3.5.1 Medical Device Regulatory Compliance

3.5.2 Government Subsidies and Support Programs

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Ecosystem

04 India Physical Therapy Equipment Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Mobility Assistance Devices

4.1.2 Therapeutic Exercise Equipment

4.1.3 Cold and Heat Therapy

4.1.4 Electrotherapy Equipment

4.1.5 Rehabilitation Equipment

4.2 By Application (in Value %)

4.2.1 Hospitals

4.2.2 Clinics

4.2.3 Homecare

4.2.4 Physiotherapy Centers

4.3 By Distribution Channel (in Value %)

4.3.1 Direct Sales

4.3.2 Online Retail

4.3.3 Distributors and Dealers

4.4 By Technology (in Value %)

4.4.1 Manual Therapy

4.4.2 Digital Therapy Devices

4.4.3 Robotic Rehabilitation

4.5 By Region (in Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

05 India Physical Therapy Equipment Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Bharat Medical Systems

5.1.2 BTL India

5.1.3 Indian MedTech Pvt. Ltd.

5.1.4 Modi Medical Devices

5.1.5 Omron Healthcare India

5.1.6 RMS India Pvt. Ltd.

5.1.7 Tenko Medical System

5.1.8 Equinox Medical Technologies

5.1.9 Advanced Physiotherapy Equipments

5.1.10 Enraf-Nonius India

5.1.11 Kinesio Medical Equipment

5.1.12 PT Physio Equipment

5.1.13 Elpro Technologies

5.1.14 Lure Medical Systems

5.1.15 Bionix India

5.2 Cross-Comparison Parameters

(No. of Employees, Headquarters Location, Inception Year, Revenue, Regional Focus, Product Portfolio, R&D Spending, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

5.7 Government Grants

5.8 Private Equity and Venture Capital Funding

06 India Physical Therapy Equipment Market Regulatory Framework

6.1 Medical Device Standards

6.2 Compliance Requirements

6.3 Certification and Approval Processes

07 India Physical Therapy Equipment Future Market Size (in INR Million)

7.1 Future Market Size Projections

7.2 Key Growth Drivers for the Future

08 India Physical Therapy Equipment Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By Application (in Value %)

8.3 By Distribution Channel (in Value %)

8.4 By Technology (in Value %)

8.5 By Region (in Value %)

09 India Physical Therapy Equipment Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segment Analysis

9.3 Marketing Strategy Recommendations

9.4 White Space Opportunity Identification

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves mapping major stakeholders within the India Physical Therapy Equipment Market. Using secondary research and proprietary data sources, we identify key variables affecting market growth and dynamics.

Step 2: Market Analysis and Construction

We compile historical data and evaluate market penetration and utilization rates across various physical therapy equipment categories. Market dynamics, like hospital adoption rates and product use trends, are also analyzed to ensure comprehensive coverage.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market drivers and competitive positioning are validated through interviews with key stakeholders, including manufacturers, distributors, and healthcare providers. Insights from these experts enrich the data, adding granularity to our analysis.

Step 4: Research Synthesis and Final Output

In the final stage, data from interviews and market assessments are synthesized. This validated data forms the basis for the report, providing a clear and accurate view of the market for potential investors and business leaders.

Frequently Asked Questions

01 How big is the India Physical Therapy Equipment Market?

The India physical therapy equipment market is valued at USD 910 million, driven by an aging population and the need for rehabilitation services.

02 What are the key growth drivers in the India Physical Therapy Equipment Market?

Key drivers in the India physical therapy equipment market include an increase in post-operative rehabilitation needs, advancements in therapeutic technology, and government healthcare support.

03 Which cities dominate the India Physical Therapy Equipment Market?

Major cities such as Mumbai, Delhi, and Bengaluru lead the India physical therapy equipment market due to advanced healthcare infrastructure and high patient demand for physical therapy services.

04 Who are the main players in the India Physical Therapy Equipment Market?

Key players in the India physical therapy equipment market include Bharat Medical Systems, Omron Healthcare India, and RMS India, offering diverse product ranges across rehabilitation and therapy equipment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.