India Physiotherapy Equipment Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD5696

December 2024

92

About the Report

India Physiotherapy Equipment Market Overview

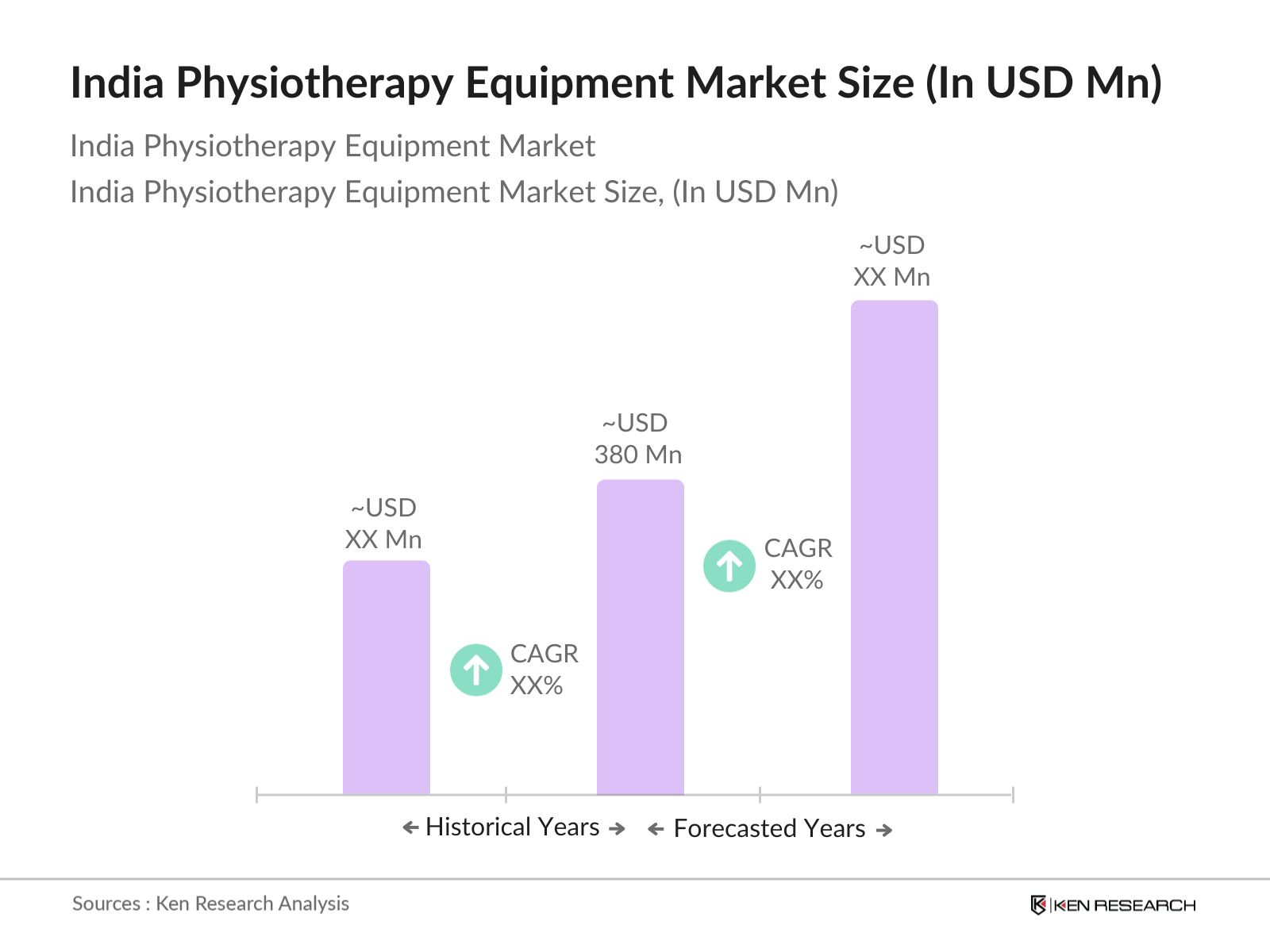

- The India physiotherapy equipment market, based on a five-year historical analysis, is valued at USD 380 million. This market is primarily driven by the increasing prevalence of musculoskeletal disorders and a rising geriatric population, which leads to an elevated demand for physiotherapy treatments. The market also benefits from the growing awareness of the importance of physical rehabilitation in injury recovery and chronic disease management. Furthermore, the advancement of technology, such as electrotherapy and robotic rehabilitation, has been a major driver of market growth in recent years.

- Major urban centers such as Mumbai, Delhi, and Bangalore dominate the physiotherapy equipment market in India. These cities have a higher concentration of advanced healthcare facilities and specialized rehabilitation centers, which demand cutting-edge physiotherapy equipment. The presence of top-tier hospitals and medical institutions, coupled with better access to skilled physiotherapists and modern treatment technologies, allows these cities to lead the market. Additionally, these cities also benefit from high patient volumes, which further boosts the market for physiotherapy equipment.

- The Indian Medical Device Regulations (IMDR) introduced stringent safety and efficacy standards for physiotherapy equipment in 2022. The Central Drugs Standard Control Organization (CDSCO) is responsible for implementing these regulations, which mandate that all physiotherapy devices undergo clinical trials and quality checks before entering the market. These regulations have improved the quality of equipment available, ensuring that physiotherapy devices in India meet global standards, thus boosting consumer confidence.

India Physiotherapy Equipment Market Segmentation

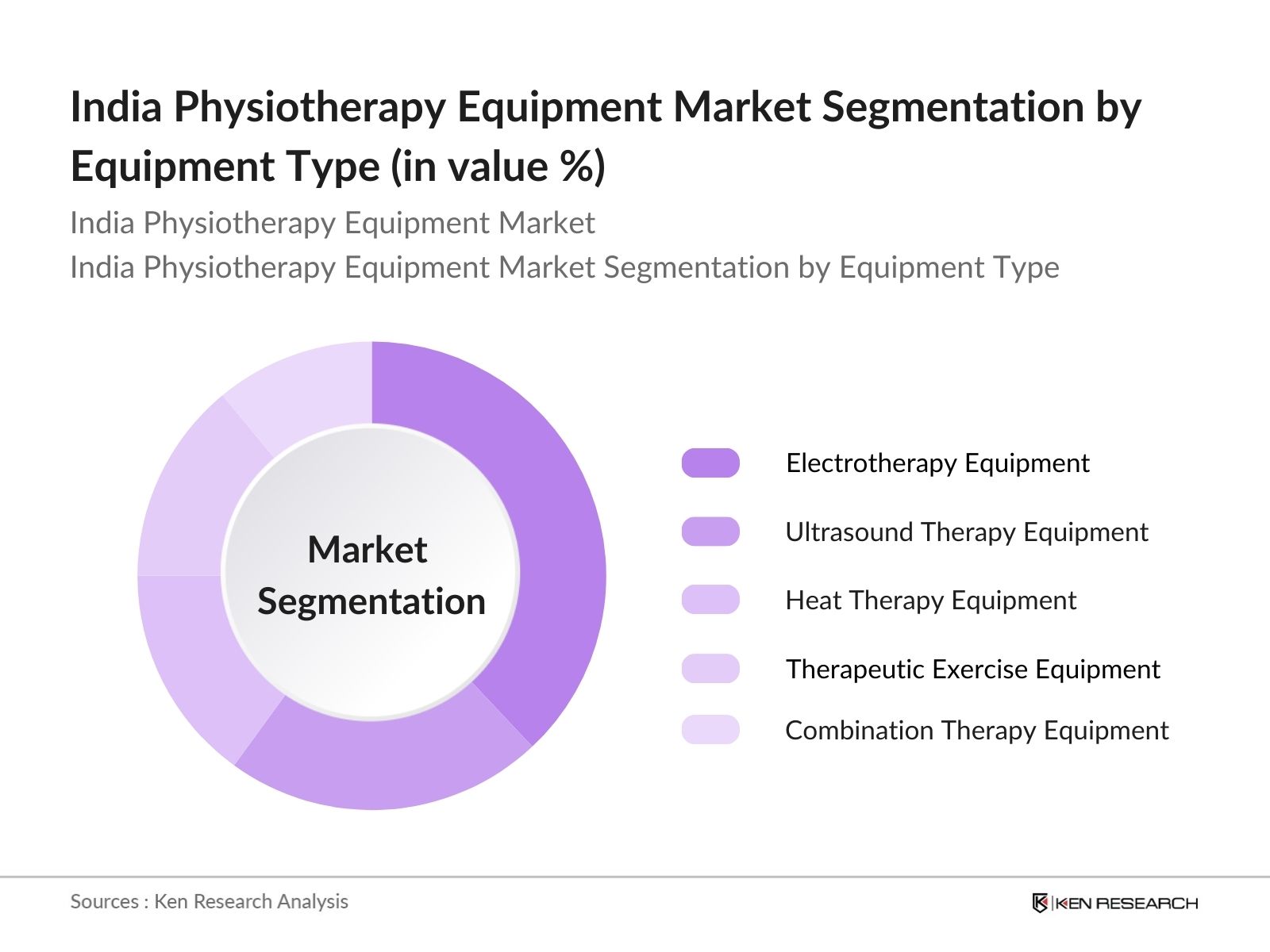

- By Equipment Type: The India physiotherapy equipment market is segmented by equipment type into electrotherapy equipment, ultrasound therapy equipment, heat therapy equipment, therapeutic exercise equipment, and combination therapy equipment. Recently, electrotherapy equipment has dominated the market due to its extensive use in pain management and rehabilitation. Electrotherapy, which includes modalities such as transcutaneous electrical nerve stimulation (TENS) and interferential therapy (IFT), is widely adopted in both clinical and home settings. Its non-invasive nature, combined with its effectiveness in promoting tissue repair and reducing inflammation, makes it a popular choice in physiotherapy practices.

- By Application: The market is further segmented by application into orthopaedic applications, neurological applications, cardiopulmonary applications, paediatric applications, and geriatric applications. Orthopaedic applications dominate the segment due to the high incidence of conditions such as arthritis, fractures, and sports injuries. With an increasing geriatric population in India prone to osteoporosis and degenerative joint disorders, physiotherapy plays a crucial role in pain management, mobility improvement, and recovery. Additionally, orthopaedic rehabilitation techniques, such as joint mobilization and strength training, are essential for post-surgery recovery, further driving demand in this segment.

India Physiotherapy Equipment Market Competitive Landscape

The India physiotherapy equipment market is characterized by a competitive landscape dominated by both domestic and international players. Leading companies focus on developing innovative products, such as advanced electrotherapy devices and robotic rehabilitation tools, to cater to the increasing demand. In particular, multinational companies such as DJO Global and BTL Industries leverage their global expertise, while domestic companies like Bharat Medical Systems focus on cost-effective solutions tailored to the local market. This blend of global and local players ensures a healthy competitive environment in the market.

|

Company Name |

Established Year |

Headquarters |

Revenue (INR) |

R&D Expenditure |

Product Portfolio |

Market Share |

No. of Employees |

Geographical Presence |

|

DJO Global |

1978 |

Texas, USA |

- |

- |

- |

- |

- |

- |

|

BTL Industries |

1993 |

Prague, Czech Republic |

- |

- |

- |

- |

- |

- |

|

EMS Physio Ltd. |

1924 |

Oxfordshire, UK |

- |

- |

- |

- |

- |

- |

|

Bharat Medical Systems |

1987 |

Chennai, India |

- |

- |

- |

- |

- |

- |

|

Zimmer Biomet Holdings Inc. |

1927 |

Indiana, USA |

- |

- |

- |

- |

- |

- |

India Physiotherapy Equipment Market Analysis

India Physiotherapy Equipment Market Growth Drivers

- Rising Prevalence of Musculoskeletal Disorders: In India, musculoskeletal disorders (MSDs) are becoming increasingly common, particularly among the working-age population and the elderly. According to the World Health Organization, over 40 million people in India suffer from MSDs, including arthritis and back pain, which lead to a growing demand for physiotherapy services. Indias Ministry of Health highlights that these disorders account for a substantial portion of non-communicable diseases (NCDs) impacting labor productivity. This rising prevalence emphasizes the need for physiotherapy equipment in clinics and home care settings, thus driving the market demand.

- Increasing Geriatric Population: India's population aged 60 and above has surpassed 142 million in 2023, as reported by the United Nations Department of Economic and Social Affairs. This growing elderly demographic is more susceptible to conditions like osteoarthritis, fractures, and joint stiffness, which require frequent physiotherapy interventions. The National Program for Health Care of the Elderly (NPHCE) also aims to improve access to rehabilitative care for older adults, further stimulating the demand for physiotherapy equipment in hospitals and home healthcare environments.

- Expanding Home Healthcare Services: Indias home healthcare market is seeing robust growth, driven by increased demand for in-home physiotherapy services. By 2023, around 8 million patients received home-based care, according to the Ministry of Health and Family Welfare. This trend is fueled by convenience, technological advancements, and a rise in chronic diseases requiring long-term rehabilitation. Physiotherapy equipment, such as portable ultrasound and electrical stimulation devices, is essential for home care services, and this shift is boosting the overall physiotherapy equipment market.

India Physiotherapy Equipment Market Challenges

- High Equipment Costs: One of the main challenges in the Indian physiotherapy equipment market is the high cost of advanced devices such as robotic rehabilitation machines and virtual reality (VR)-based therapy tools. According to the Indian Medical Device Manufacturers Association, the cost of importing these devices can exceed INR 2 million per unit, making them unaffordable for smaller clinics and rural hospitals. The lack of local production of such advanced equipment further exacerbates this issue, restricting market penetration and adoption in lower-income regions.

- Lack of Skilled Physiotherapists: India faces a shortage of skilled physiotherapists, with only 200,000 registered professionals serving a population of over 1.4 billion, according to the Indian Association of Physiotherapists. This results in a gap in the availability of proper rehabilitation services, particularly in rural and semi-urban areas. While metropolitan cities have better access to skilled professionals, rural regions still rely on outdated physiotherapy methods and equipment, limiting the market growth potential in these areas.

India Physiotherapy Equipment Market Future Outlook

Over the next five years, the India physiotherapy equipment market is expected to witness growth driven by an aging population, increasing awareness of the benefits of physiotherapy, and the rising demand for advanced rehabilitation technologies. Key factors such as the expansion of healthcare infrastructure, growth in home-based rehabilitation services, and technological advancements in physiotherapy devices, including the use of AI and robotics, will play a critical role in shaping the future of the market. The rising incidence of chronic conditions, such as arthritis and cardiovascular diseases, will also support market growth.

India Physiotherapy Equipment Market Opportunities

- Increasing Government Support for Healthcare Infrastructure: Government initiatives, such as the National Health Mission and Ayushman Bharat, have allocated over INR 5.6 trillion for healthcare infrastructure improvement by 2025. This includes provisions for purchasing rehabilitation equipment for public hospitals, which will boost the demand for physiotherapy devices in underserved areas. The governments focus on increasing the number of physiotherapy centers and integrating rehabilitation services into primary healthcare is creating new growth opportunities for the physiotherapy equipment market.

- Growth of Tele-physiotherapy Platforms: Tele-physiotherapy services are gaining momentum in India, driven by improved internet penetration and the increasing use of smartphones, especially in rural and remote regions. According to the Telecom Regulatory Authority of India, more than 800 million Indians have access to high-speed internet, enabling remote physiotherapy consultations and monitoring. This digital transformation is expanding the reach of physiotherapy services, with platforms like Portea and Nightingale seeing a 40% rise in patient consultations. The growing telemedicine ecosystem presents ample opportunities for companies offering portable physiotherapy equipment.

Scope of the Report

|

By Equipment Type |

Electrotherapy Equipment Ultrasound Therapy Heat Therapy Therapeutic Exercise Equipment Combination Therapy Equipment |

|

By Application |

Orthopaedic Neurological Cardiopulmonary Paediatric Geriatric |

|

By End User |

Hospitals Physiotherapy Clinics Home Healthcare Rehabilitation Centers |

|

By Technology |

Manual Therapy Electrical Stimulation Ultrasound & Heat Exercise Therapy |

|

By Region |

North India South India East India West India |

Products

Key Target Audience

Hospitals and Rehabilitation Centers

Physiotherapy Equipment Manufacturers

Banks and Financial Institutions

Home Healthcare Service Providers

Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare, Indian Medical Association)

Investor and Venture Capitalist Firms

Medical Device Distributors

Large Multinational Corporations

Insurance Companies

Companies

Players Mentioned in the Report

DJO Global

BTL Industries

EMS Physio Ltd.

Zimmer Biomet Holdings Inc.

Bharat Medical Systems

Enraf-Nonius

Proxomed Medizintechnik GmbH

ITO Co., Ltd.

Dynatronics Corporation

Algeo Ltd.

Table of Contents

1. India Physiotherapy Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Physiotherapy Equipment Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Physiotherapy Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Musculoskeletal Disorders

3.1.2. Increasing Geriatric Population

3.1.3. Expanding Home Healthcare Services

3.1.4. Growing Awareness of Physiotherapy Benefits

3.2. Market Challenges

3.2.1. High Equipment Costs

3.2.2. Lack of Skilled Physiotherapists

3.2.3. Limited Access to Advanced Technologies in Rural Areas

3.3. Opportunities

3.3.1. Technological Advancements in Equipment (e.g., Robotics, VR-based Therapy)

3.3.2. Increasing Government Support for Healthcare Infrastructure

3.3.3. Growth of Tele-physiotherapy Platforms

3.4. Trends

3.4.1. Adoption of Wearable Physiotherapy Devices

3.4.2. Integration with Smart Healthcare Systems

3.4.3. Rising Demand for Home-Based Rehabilitation Services

3.5. Government Regulations

3.5.1. Indian Medical Device Regulations (IMDR)

3.5.2. Public-Private Partnerships for Healthcare Expansion

3.5.3. National Health Policy Initiatives Supporting Rehabilitation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Physiotherapy Equipment Market Segmentation

4.1. By Equipment Type (In Value %)

4.1.1. Electrotherapy Equipment

4.1.2. Ultrasound Therapy Equipment

4.1.3. Heat Therapy Equipment

4.1.4. Therapeutic Exercise Equipment

4.1.5. Combination Therapy Equipment

4.2. By Application (In Value %)

4.2.1. Orthopedic Applications

4.2.2. Neurological Applications

4.2.3. Cardiopulmonary Applications

4.2.4. Pediatric Applications

4.2.5. Geriatric Applications

4.3. By End User (In Value %)

4.3.1. Hospitals

4.3.2. Physiotherapy Clinics

4.3.3. Home Healthcare

4.3.4. Rehabilitation Centers

4.4. By Technology (In Value %)

4.4.1. Manual Therapy

4.4.2. Electrical Stimulation Therapy

4.4.3. Ultrasound & Heat Therapy

4.4.4. Exercise Therapy

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Physiotherapy Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. DJO Global

5.1.2. BTL Industries

5.1.3. EMS Physio Ltd.

5.1.4. Zimmer Biomet Holdings Inc.

5.1.5. Enraf-Nonius

5.1.6. HMS Medical Systems

5.1.7. Proxomed Medizintechnik GmbH

5.1.8. ITO Co., Ltd.

5.1.9. Dynatronics Corporation

5.1.10. Bharat Medical Systems

5.1.11. Algeo Ltd.

5.1.12. Trimed Medical Equipment

5.1.13. India Medico Instruments

5.1.14. Whitehall Manufacturing

5.1.15. Chattanooga Group

5.2. Cross Comparison Parameters (Revenue, Number of Employees, Product Portfolio, Market Share, R&D Expenditure)

5.3. Market Share Analysis (Based on Product Type, Application, and Region)

5.4. Strategic Initiatives (Partnerships, Mergers & Acquisitions, Product Launches)

5.5. Investment Analysis (Key Investments in Innovation and Expansion)

5.6. Technological Innovations (Robotics, AI, and Advanced Physiotherapy Equipment)

6. India Physiotherapy Equipment Market Regulatory Framework

6.1. Certification Requirements

6.2. Compliance to Indian Medical Devices Rules

6.3. Guidelines for Import/Export of Physiotherapy Equipment

7. India Physiotherapy Equipment Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Physiotherapy Equipment Future Market Segmentation

8.1. By Equipment Type (In Value %)

8.2. By Application (In Value %)

8.3. By End User (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. India Physiotherapy Equipment Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Penetration Strategies

9.3. Customer Cohort Analysis

9.4. White Space Opportunities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India physiotherapy equipment market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India physiotherapy equipment market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple physiotherapy equipment manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India physiotherapy equipment market.

Frequently Asked Questions

01. How big is the India Physiotherapy Equipment Market?

The India physiotherapy equipment market is valued at USD 380 million, driven by factors such as the rising prevalence of musculoskeletal disorders and the growing geriatric population.

02. What are the challenges in the India Physiotherapy Equipment Market?

Challenges in the India physiotherapy equipment market include high equipment costs, limited access to advanced rehabilitation technologies in rural areas, and a lack of skilled physiotherapists.

03. Who are the major players in the India Physiotherapy Equipment Market?

Major players in the India physiotherapy equipment market include DJO Global, BTL Industries, EMS Physio Ltd., Zimmer Biomet Holdings Inc., and Bharat Medical Systems.

04. What are the growth drivers of the India Physiotherapy Equipment Market?

The India physiotherapy equipment market is driven by increasing awareness of physical rehabilitation, advancements in rehabilitation technologies, and a growing focus on home-based physiotherapy services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.