India Plant-Based Meats Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD6405

December 2024

95

About the Report

India Plant-Based Meats Market Overview

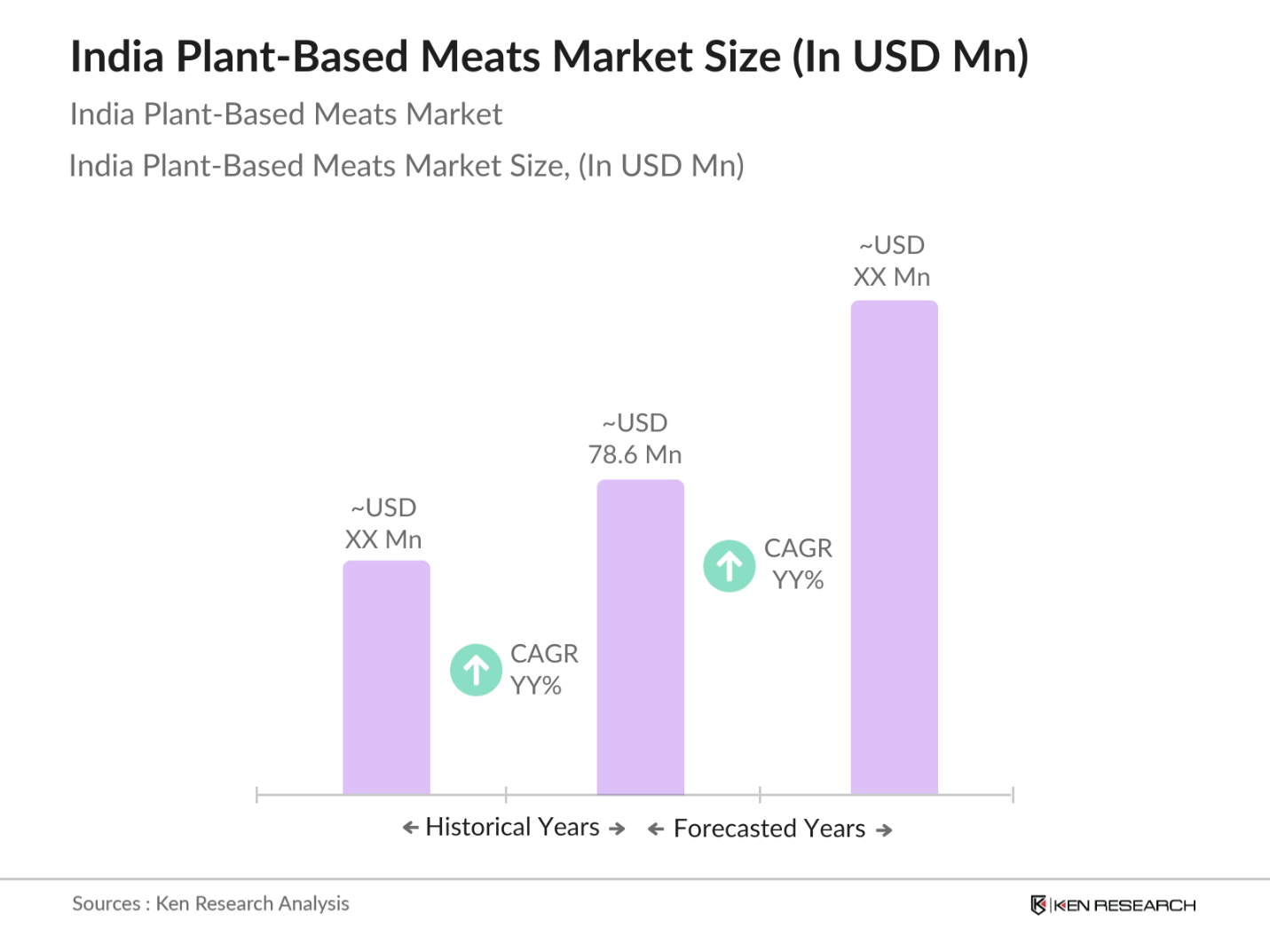

- The India plant-based meats market is valued at approximately USD 78.6 million, driven by growing consumer awareness of sustainability and health benefits. The increasing shift towards veganism, vegetarianism, and flexitarian diets has contributed significantly to this growth. The rise in urbanization and lifestyle changes, alongside a surge in demand for environmentally friendly and cruelty-free products, further boosts the market's expansion. The government's push towards sustainability and reducing greenhouse emissions also plays a critical role in market development.

- Cities like Mumbai, Delhi, and Bengaluru are the leading regions dominating the plant-based meats market in India. This dominance can be attributed to higher consumer awareness, access to a wider range of products, and the presence of premium retail outlets. These cities also host a large number of young, urban professionals and health-conscious consumers, which drives the demand for plant-based alternatives. Moreover, the expansion of e-commerce platforms has significantly contributed to the penetration of plant-based products in these regions.

- As plant-based meat products become more prevalent in the market, the government has introduced labeling norms to prevent consumer confusion. The FSSAI, in 2023, mandated that plant-based meat products be clearly labeled as plant-based to differentiate them from animal-based meats. This labeling is designed to enhance transparency and help consumers make informed decisions. Failure to comply with these regulations could lead to fines and the removal of non-compliant products from the market.

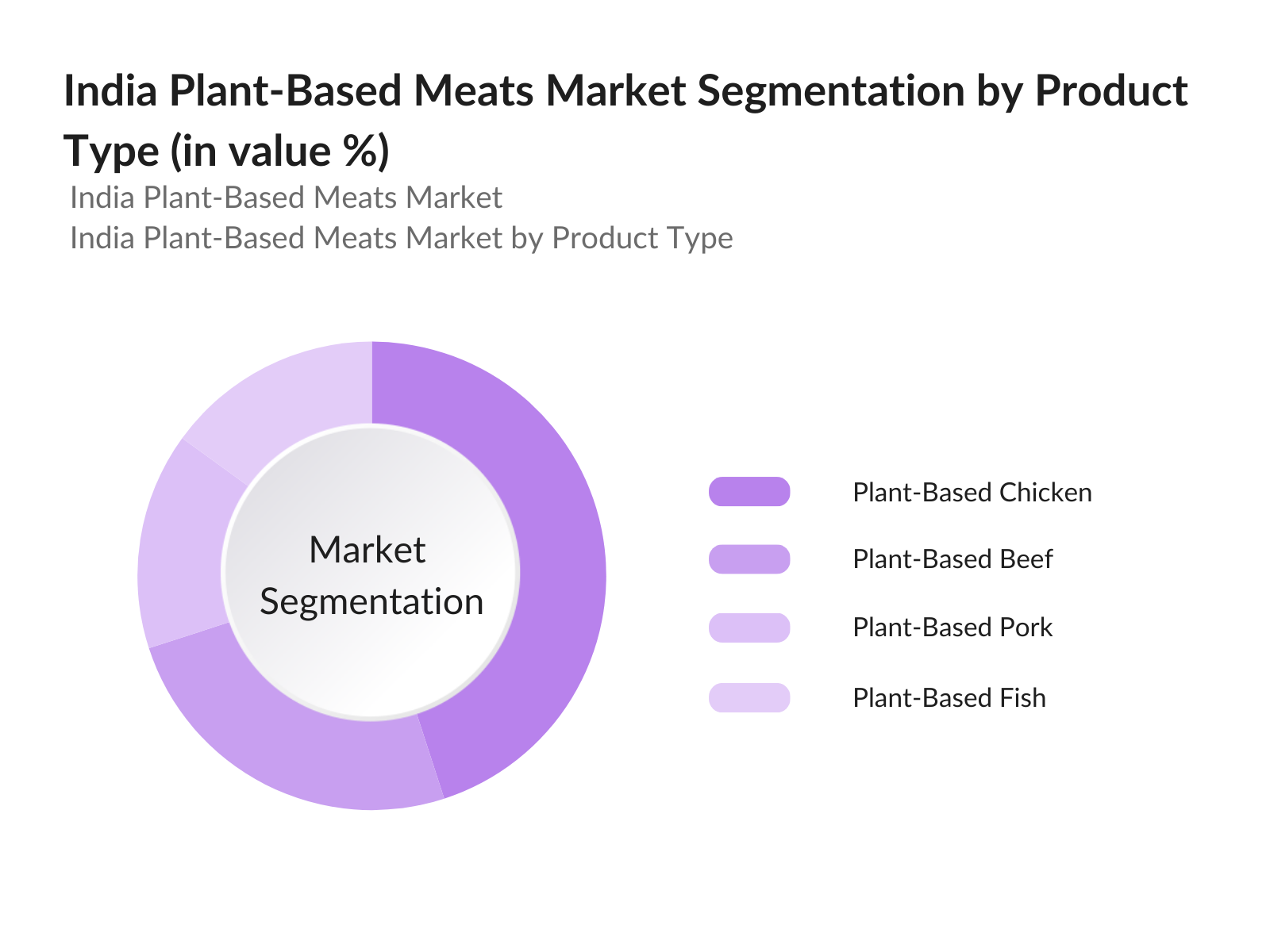

India Plant-Based Meats Market Segmentation

By Product Type: The Indias plant-based meats market is segmented by product type into plant-based chicken, plant-based beef, plant-based pork, and plant-based fish. Recently, plant-based chicken holds the dominant market share under the product type segmentation, largely due to its popularity and familiarity among Indian consumers. The chicken alternative is a key choice in the countrys foodservice and retail sectors, offering versatility in culinary applications and easy adoption in a traditionally meat-heavy culture.

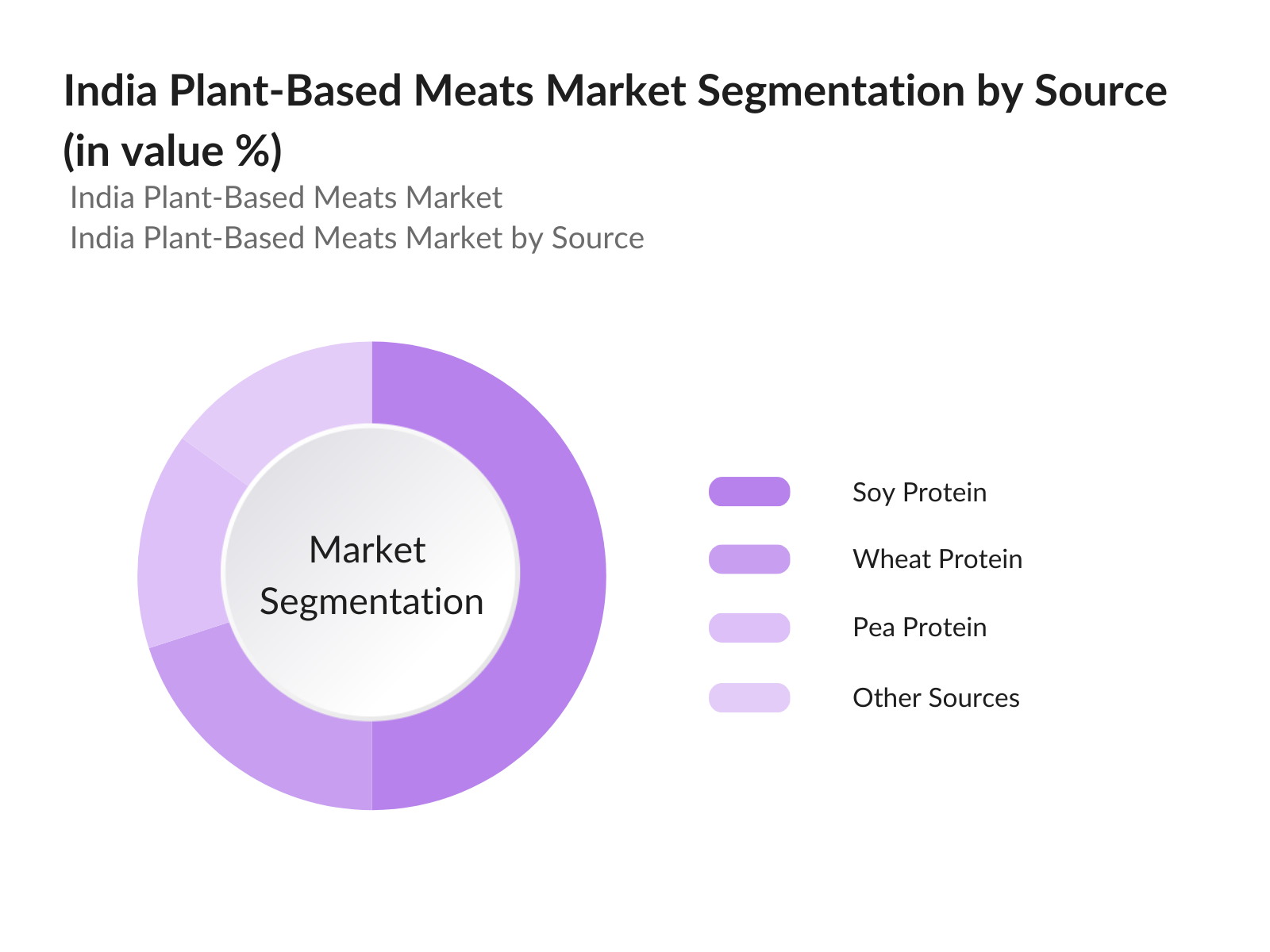

By Source: The Indias plant-based meats market is segmented by source into soy protein, wheat protein, pea protein, and other sources. Soy protein dominates the market share within this segment, primarily due to its wide availability, cost-effectiveness, and strong protein content. Moreover, soy proteins established usage in the food industry as a meat substitute adds to its growing presence in plant-based meat products across India.

India Plant-Based Meats Market Competitive Landscape

The India plant-based meats market is witnessing consolidation, with both local and international players competing for market share. The competitive landscape is driven by product innovation, partnerships with foodservice chains, and increasing investment in research and development. Key companies in the market are offering a wide range of plant-based products, targeting various consumer demographics, especially younger and health-conscious populations.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

Geographic Reach |

Sustainability Initiatives |

R&D Investments |

Revenue (USD Million) |

Key Partnerships |

|

Beyond Meat |

2009 |

California, USA |

||||||

|

Impossible Foods |

2011 |

California, USA |

||||||

|

Greenest Foods |

2018 |

Delhi, India |

||||||

|

GoodDot |

2016 |

Udaipur, India |

||||||

|

Vezlay Foods |

2010 |

Delhi, India |

India Plant-Based Meats Market Analysis

Market Growth Drivers

- Rising Health Consciousness: The increasing awareness of the negative health impacts associated with excessive meat consumption, such as heart disease and diabetes, is driving consumers toward plant-based alternatives. As per a 2023 report from the Indian Ministry of Health, lifestyle diseases are expected to rise significantly in India, with cardiovascular diseases predicted to affect over 50 million people by 2025. This health crisis is pushing consumers to consider healthier dietary choices like plant-based meats, which offer lower cholesterol levels and improved nutritional content compared to animal-based meat. This shift is a key driver of market growth.

- Growth of Vegan Population: The vegan population in India has grown significantly, supported by various advocacy groups and health campaigns. Data from the Food and Agriculture Organization (FAO) revealed that India saw a 12% increase in vegan adoption between 2022 and 2024. Additionally, the Indian Vegan Association estimates that nearly 8 million individuals in the country identify as vegan, further supporting the rise of plant-based meat consumption. This increase is particularly evident in urban centers, where younger, more health-conscious demographics are actively seeking out vegan options.

- Technological Advancements in Food Processing: Technological advancements in food processing are accelerating the growth of the plant-based meat industry. New innovations in texturizing soy, pea proteins, and other plant-based ingredients are making meat analogs more realistic and appealing to consumers. According to a 2023 report by the Indian Council of Agricultural Research (ICAR), the introduction of high-moisture extrusion technology has improved the quality of plant-based meats, making them more comparable to animal-based products in texture and flavor. This increased realism is driving wider consumer acceptance.

Market Challenges

- High Production Costs: The production of plant-based meats remains costly, particularly due to the high price of raw materials such as soy and pea proteins, which are mostly imported. As per data from the Ministry of Commerce & Industry (2023), India imported over $2 billion worth of plant-based protein raw materials, leading to higher final product costs. These elevated costs challenge manufacturers to price their products competitively against traditional meats, which still hold a larger share of the market.

- Supply Chain Issues: The plant-based meat industry faces significant supply chain bottlenecks, particularly in the transportation and storage of raw materials and finished products. Data from the Indian Ministry of Railways highlights ongoing inefficiencies in cold storage and logistics infrastructure, which are critical for preserving the quality of plant-based meats. These challenges are exacerbated by the lack of advanced cold chain systems, which limits the market's ability to distribute products efficiently, especially in regions with less developed logistics networks. These barriers hinder the industry's growth and the broader adoption of plant-based meat products across India.

India Plant-Based Meats Market Future Outlook

Over the next five years, the India plant-based meats market is expected to show significant growth, driven by increasing consumer demand for healthier food options and heightened awareness of environmental issues. The push for sustainability, coupled with growing government initiatives aimed at reducing the carbon footprint, is expected to propel market growth further. Additionally, advancements in food technology, especially in enhancing the texture and taste of plant-based meat products, are likely to attract a broader range of consumers.

Market Opportunities:

- Introduction of Meat Analogs: Meat analogs, which closely mimic the taste and texture of real meat, are gaining popularity in India. According to the Food Safety and Standards Authority of India (FSSAI), the demand for meat analogs increased by 25% in urban centers during 2023, with products like plant-based sausages and burgers now regularly stocked in major supermarkets. This trend is further supported by advancements in plant protein technologies that are improving the sensory attributes of these analogs, making them more appealing to meat-eating consumers.

- Enhanced Nutritional Value: Consumers are increasingly seeking plant-based meat products that offer not only great taste but also enhanced nutritional benefits. A 2024 report from the National Institute of Nutrition noted that many new plant-based meat products launched in India are fortified with essential nutrients like iron, vitamin B12, and omega-3 fatty acids. This reflects the growing demand for functional foods that provide added health benefits. As more consumers prioritize nutrition in their food choices, this trend continues to drive the growth of the plant-based meat market in India.

Scope of the Report

|

By Product Type |

Plant-Based Chicken Plant-Based Beef Plant-Based Pork Plant-Based Fish |

|

By Source |

Soy Protein Wheat Protein Pea Protein Other Sources |

|

By Distribution Channel |

Retail Foodservice E-Commerce |

|

By Application |

Snacks Ready-to-Eat Meals Bakery & Confectionery |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Food Manufacturers

Retail Chains

Quick-Service Restaurants

Health-Conscious Consumers

Plant-Based Product Startups

Government and Regulatory Bodies (FSSAI, Ministry of Food Processing Industries)

Investment and Venture Capitalist Firms

E-commerce Platforms

Companies

Players Mention in the Report

Beyond Meat

Impossible Foods

Greenest Foods

GoodDot

Vezlay Foods

Blue Tribe

Wakao Foods

Imagine Meats

Unilever (The Vegetarian Butcher)

Nestl (Garden Gourmet)

Tata Consumer Products

ITC (MasterChef Creations)

Veggie Champ

The Good Food Institute

Ahimsa Foods

Table of Contents

01. India Plant-Based Meats Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. India Plant-Based Meats Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. India Plant-Based Meats Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness

3.1.2. Growth of Vegan Population

3.1.3. Environmental Concerns

3.1.4. Technological Advancements in Food Processing

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Limited Consumer Awareness

3.2.3. Supply Chain Issues

3.3. Opportunities

3.3.1. Expansion into Tier 2 & 3 Cities

3.3.2. Government Initiatives for Sustainability

3.3.3. New Product Developments

3.4. Trends

3.4.1. Introduction of Meat Analogs

3.4.2. Collaboration with Retail and E-commerce Platforms

3.4.3. Enhanced Nutritional Value

3.5. Government Regulation

3.5.1. Food Safety Regulations

3.5.2. Plant-Based Meat Labeling Norms

3.5.3. Tax and Subsidy Policies

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

04. India Plant-Based Meats Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Plant-Based Chicken

4.1.2. Plant-Based Beef

4.1.3. Plant-Based Pork

4.1.4. Plant-Based Fish

4.2. By Source (In Value %)

4.2.1. Soy Protein

4.2.2. Wheat Protein

4.2.3. Pea Protein

4.2.4. Other Sources

4.3. By Distribution Channel (In Value %)

4.3.1. Retail

4.3.2. Foodservice

4.3.3. E-Commerce

4.4. By Application (In Value %)

4.4.1. Snacks

4.4.2. Ready-to-Eat Meals

4.4.3. Bakery & Confectionery

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

05. India Plant-Based Meats Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Beyond Meat

5.1.2. Impossible Foods

5.1.3. Greenest Foods

5.1.4. GoodDot

5.1.5. Vezlay Foods

5.1.6. Blue Tribe

5.1.7. Wakao Foods

5.1.8. Imagine Meats

5.1.9. Unilever (The Vegetarian Butcher)

5.1.10. Nestl (Garden Gourmet)

5.1.11. Tata Consumer Products

5.1.12. ITC (MasterChef Creations)

5.1.13. Veggie Champ

5.1.14. The Good Food Institute

5.1.15. Ahimsa Foods

5.2. Cross Comparison Parameters

(No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Geographic Presence, Sustainability Initiatives, Innovation Capabilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. India Plant-Based Meats Market Regulatory Framework

6.1. Food Safety Standards

6.2. Certification and Labeling Requirements

6.3. Compliance to Sustainability Guidelines

07. India Plant-Based Meats Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. India Plant-Based Meats Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Source (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

09. India Plant-Based Meats Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves creating a comprehensive ecosystem map, including all major stakeholders within the India Plant-Based Meats Market. Through extensive desk research and analysis of secondary and proprietary databases, critical variables influencing market trends, such as consumer demand, production costs, and distribution networks, are identified.

Step 2: Market Analysis and Construction

This step involves compiling and analyzing historical data related to the India plant-based meats market. The analysis includes assessing market penetration, evaluating the role of key players, and measuring revenue generation. Additionally, insights into service quality and consumer preferences are evaluated.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market assumptions are validated through consultations with industry experts, such as product developers and retail managers, using structured interviews. These insights are crucial in refining the research hypotheses and enhancing the accuracy of the data.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing data gathered from primary and secondary sources. Direct engagement with manufacturers, distributors, and retailers ensures the data's accuracy and reliability, providing a comprehensive view of the India plant-based meats market.

Frequently Asked Questions

01. How big is the India Plant-Based Meats Market?

The India plant-based meats market is valued at USD 78.6 million, driven by increasing consumer awareness and the rising adoption of vegan and flexitarian diets.

02. What are the key challenges in the India Plant-Based Meats Market?

Challenges in the market include high production costs, limited consumer awareness, and supply chain issues, especially concerning the sourcing of high-quality plant-based ingredients.

03. Who are the major players in the India Plant-Based Meats Market?

Key players in the market include Beyond Meat, Impossible Foods, Greenest Foods, GoodDot, and Vezlay Foods. These companies dominate through innovative product offerings and strong distribution networks.

04. What are the key growth drivers of the India Plant-Based Meats Market?

The market is primarily driven by growing health consciousness, environmental concerns, and the increasing availability of plant-based alternatives across retail and e-commerce channels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.