India Plastic Additives Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD2609

December 2024

92

About the Report

India Plastic Additives Market Overview

- The India Plastic Additives Market is valued at USD 4 billion, driven by the rapid expansion of end-use industries like packaging, automotive, and construction. This market has seen a steady rise in demand for additives, particularly with the need for durability and extended plastic lifespan. The increase in government regulations on sustainable plastic production and management has also contributed to the growing demand for bio-based plastic additives.

- The dominant regions in the India Plastic Additives Market include Maharashtra, Gujarat, and Tamil Nadu. These regions dominate due to their well-established industrial hubs for plastic manufacturing and the presence of key players in packaging and automotive industries. These regions also benefit from better infrastructure, supply chain efficiency, and access to raw materials, making them key contributors to the growth of the plastic additives market in India.

- The Plastic Waste Management (Amendment) Rules, 2024 focus on reducing plastic pollution by introducing key measures like stricter guidelines for biodegradable plastics and expanding definitions for importers and manufacturers. These rules aim to improve recycling efficiency, reduce microplastics, and enforce Extended Producer Responsibility (EPR) for producers, importers, and brand owners. Certification from the Central Pollution Control Board (CPCB) is now mandatory for manufacturers of biodegradable plastics before marketing. These amendments reflect India's increased focus on sustainable plastic use and better waste management.

India Plastic Additives Market Segmentation

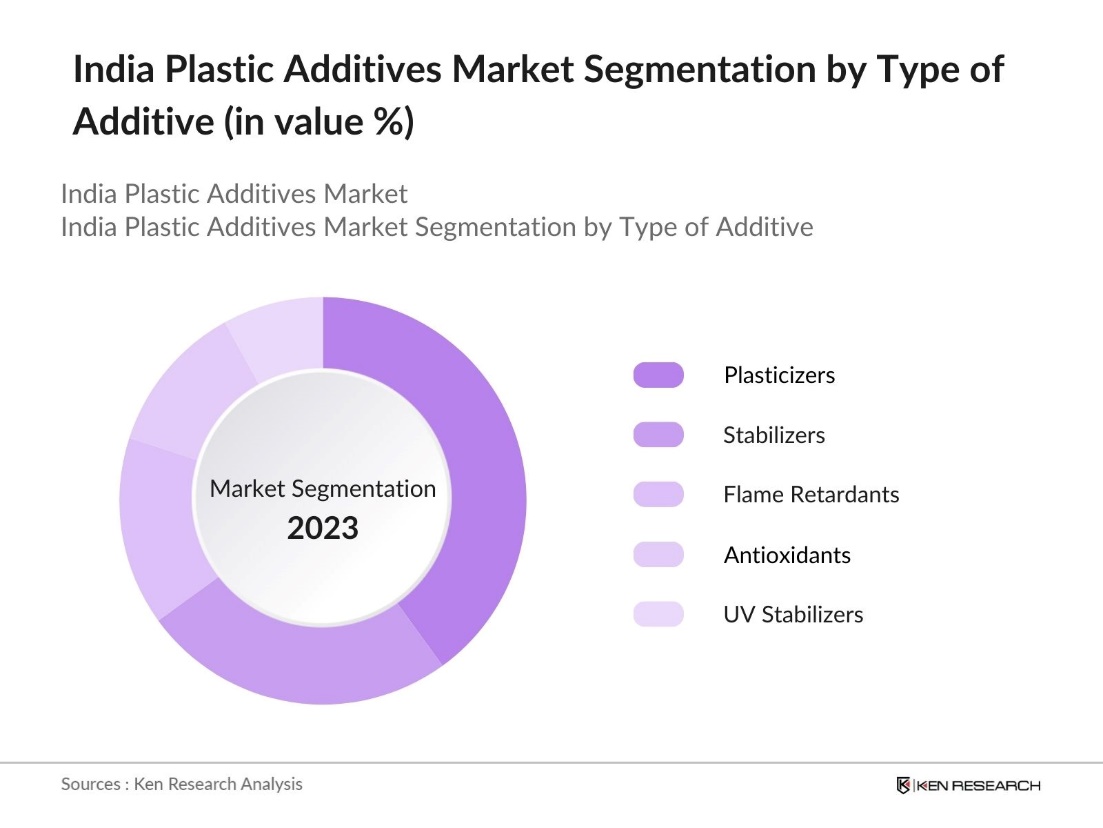

By Type of Additive: The India Plastic Additives market is segmented by type of additive into plasticizers, stabilizers, flame retardants, antioxidants, and UV stabilizers. Among these, plasticizers hold a dominant share due to their extensive use in flexible PVC applications. Plasticizers are essential in increasing the flexibility, durability, and longevity of plastic products, making them integral for products like cables, films, and sheets. The demand from the construction and automotive sectors further strengthens their dominance, especially in producing pipes and wiring materials that require enhanced flexibility.

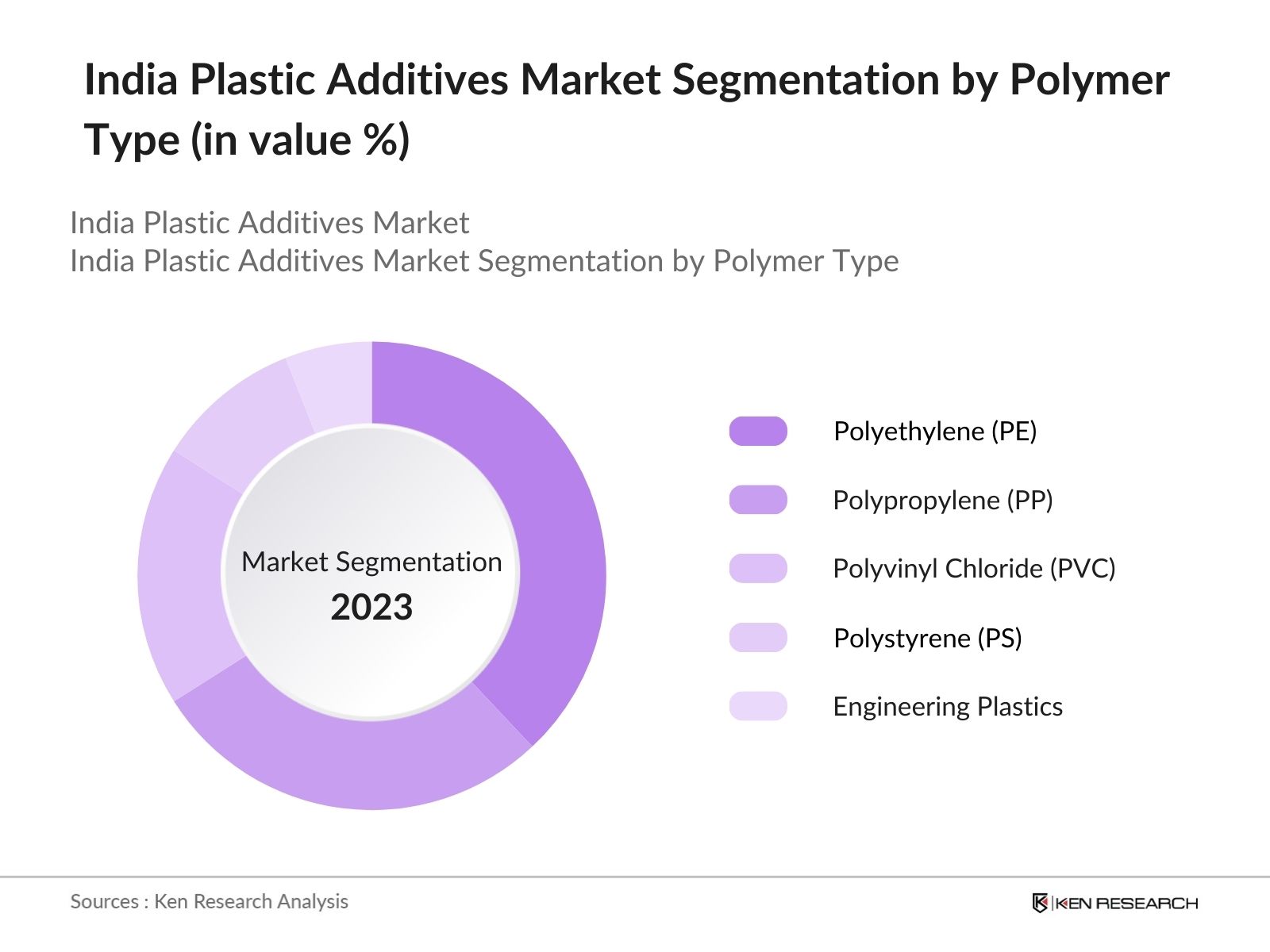

By Polymer Type: The market is segmented by polymer type into polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), and engineering plastics. Polyethylene holds the largest market share due to its widespread use in packaging materials, especially in the food and beverage industry. PE's lightweight and versatile properties, coupled with its cost-effectiveness, make it the preferred choice for flexible and rigid packaging solutions, including plastic bags, bottles, and containers, driving its demand in the plastic additives market.

India Plastic Additives Market Competitive Landscape

The India Plastic Additives market is characterized by a few key players who dominate the market, leveraging their extensive production capabilities, innovative product offerings, and strong distribution networks. The presence of global giants such as BASF SE and Clariant AG further strengthens the competitive environment. Companies are focusing on sustainability initiatives and investments in R&D to offer eco-friendly additive solutions to comply with rising environmental regulations.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

R&D Investment |

Product Portfolio |

Revenue (2023) |

Sustainability Initiatives |

Global Presence |

Market Strategy |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|||||||

|

Clariant AG |

1995 |

Muttenz, Switzerland |

|||||||

|

Evonik Industries AG |

2007 |

Essen, Germany |

|||||||

|

LANXESS |

2004 |

Cologne, Germany |

|||||||

|

Dow Chemical Company |

1897 |

Midland, Michigan |

India Plastic Additives Industry Analysis

Growth Drivers

- Growth in Automotive Manufacturing: India's automotive sector drives the demand for plastic additives, with a focus on lightweight materials to enhance vehicle performance. Government initiatives like "Make in India" boost manufacturing, promoting advanced plastics for fuel efficiency and lower emissions. In April 2024, total production across passenger vehicles, three-wheelers, two-wheelers, and quadricycles reached 23,58,041 units. Innovation and sustainability efforts are making plastic additives crucial for energy-efficient, eco-friendly vehicle designs.

- Rising Use in Construction Sector: The Indian construction sector's rapid expansion has spurred the demand for plastic additives, especially in PVC pipes, insulation materials, and flooring. The GDP from the construction sector in India was reported at approximately 4,200.90 billion INR (USD 50.6 billion) for the first quarter of 2024. The use of plastic additives in construction materials, particularly in urban infrastructure projects, is critical for enhancing material longevity and sustainability. Plastic additives are integral to the Smart Cities Mission, with an emphasis on improving the quality of construction materials.

- Increasing Demand from Packaging Industry: The packaging industry in India is experiencing significant growth, driven by the increasing need for durable, flexible, and heat-resistant materials. Plastic additives play a vital role in enhancing these qualities, making them essential for packaging applications. With the rise of e-commerce and the growing demand for food packaging, the use of plastic additives has become more prominent. These additives are particularly valuable in multilayer packaging, as they help extend the shelf life of products and improve overall packaging performance. The ongoing expansion of consumer goods packaging is expected to further fuel the demand for plastic additives in the industry.

Market Restraints

- Fluctuating Raw Material Prices: The production of plastic additives is closely tied to the availability and cost of raw materials, such as crude oil, which are prone to price fluctuations. These changes in raw material costs directly affect the profitability of manufacturers in the plastic additives market. Since plastic additives are derived from petrochemical feedstocks, price volatility can disrupt production schedules and lead to increased operational costs. The unpredictability of these prices presents a challenge for manufacturers, making it difficult to maintain stable production and manage expenses effectively.

- Stringent Environmental Regulations: India's environmental regulations around plastic production and waste management have become more stringent, impacting the plastic additives market. Rules such as the Plastic Waste Management amendment require the use of recycled content in plastic products, which increases the complexity and cost of production. Additionally, the Extended Producer Responsibility (EPR) guidelines impose further obligations on manufacturers to reclaim a portion of the plastic they produce, adding to compliance costs. These regulations are aimed at reducing the environmental impact of plastic waste, but they also present financial and operational challenges for the industry.

India Plastic Additives Market Future Outlook

Over the next five years, the India Plastic Additives market is poised for significant growth driven by rising demand from key industries like packaging, automotive, and construction. The shift towards bio-based and environmentally friendly plastic additives, in response to stricter environmental regulations, will also fuel market expansion. Additionally, the growing investment in R&D to create high-performance additives will enhance product quality and open new market opportunities.

Market Opportunities

- Technological Advancements in Additive Manufacturing: The plastic additives sector in India is experiencing significant technological advancements, especially in the realm of additive manufacturing, such as 3D printing. These advancements allow manufacturers to develop highly customized additives tailored to specific industries like automotive and healthcare. The ability to create specialized plastic additives promotes efficiency and sustainability in production processes. As the technology behind additive manufacturing continues to improve, its application is expected to grow in niche areas like high-performance polymers, further enhancing the capabilities of plastic products across various sectors.

- Increasing Preference for Bio-based Additives: The shift towards bio-based plastic additives is gaining momentum as manufacturers and industries focus on sustainability and reducing environmental impact. Bio-based additives, made from renewable resources, are increasingly favored in sectors such as packaging and automotive due to their eco-friendly nature. This growing preference aligns with global environmental goals and government incentives aimed at promoting sustainable plastic alternatives. As bio-based plastic additives become more widely accepted, they present new opportunities for manufacturers to innovate and offer sustainable solutions across various industries.

Scope of the Report

|

Type of Additive |

Plasticizers Stabilizers Flame Retardants Antioxidants UV Stabilizers |

|

Polymer Type |

Polyethylene Polypropylene Polyvinyl Chloride Polystyrene Engineering Plastics |

|

End-use Industry |

Packaging Automotive Building and Construction Electrical and Electronics Consumer Goods |

|

Functionality |

UV Protection Flexibility Improvement Anti-aging Heat Resistance |

|

Region |

North South West East |

Products

Key Target Audience

Plastic Manufacturers

Automotive Component Suppliers

Packaging Industry Players

Construction Materials Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Bureau of Indian Standards, Ministry of Environment, Forest and Climate Change)

Additives Distributors Companies

Companies

Players Mentioed in the Report

BASF SE

Clariant AG

LANXESS

Evonik Industries AG

Dow Chemical Company

Adeka Corporation

Solvay

Songwon Industrial Co. Ltd.

Kaneka Corporation

Baerlocher GmbH

AkzoNobel N.V.

Milliken & Company

Lubrizol Corporation

Mitsubishi Chemical Holdings Corporation

PolyOne Corporation

Table of Contents

1. India Plastic Additives Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Plastic Additives Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Plastic Additives Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand from Packaging Industry

3.1.2. Growth in Automotive Manufacturing

3.1.3. Rising Use in Construction Sector

3.1.4. Government Initiatives for Sustainable Plastic Use

3.2. Market Restraints

3.2.1. Fluctuating Raw Material Prices

3.2.2. Stringent Environmental Regulations

3.2.3. High Manufacturing Costs for Bio-based Additives

3.3. Opportunities

3.3.1. Technological Advancements in Additive Manufacturing

3.3.2. Increasing Preference for Bio-based Additives

3.3.3. Export Opportunities to Neighboring Markets

3.4. Trends

3.4.1. Shift Towards Eco-friendly and Sustainable Additives

3.4.2. Increased Investment in R&D for High-performance Additives

3.4.3. Rising Demand for Additives in Recycled Plastics

3.5. Government Regulation

3.5.1. Plastic Waste Management Rules

3.5.2. BIS Standards for Plastic Additives

3.5.3. Environmental Impact Assessments

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Plastic Additives Market Segmentation

4.1. By Type of Additive (In Value %)

4.1.1. Plasticizers

4.1.2. Stabilizers

4.1.3. Flame Retardants

4.1.4. Antioxidants

4.1.5. UV Stabilizers

4.2. By Polymer Type (In Value %)

4.2.1. Polyethylene (PE)

4.2.2. Polypropylene (PP)

4.2.3. Polyvinyl Chloride (PVC)

4.2.4. Polystyrene (PS)

4.2.5. Engineering Plastics

4.3. By End-use Industry (In Value %)

4.3.1. Packaging

4.3.2. Automotive

4.3.3. Building and Construction

4.3.4. Electrical and Electronics

4.3.5. Consumer Goods

4.4. By Functionality (In Value %)

4.4.1. UV Protection

4.4.2. Flexibility Improvement

4.4.3. Anti-aging

4.4.4. Heat Resistance

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. India Plastic Additives Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Clariant AG

5.1.3. LANXESS

5.1.4. Evonik Industries AG

5.1.5. Croda International Plc

5.1.6. Dow Chemical Company

5.1.7. Adeka Corporation

5.1.8. Solvay

5.1.9. Songwon Industrial Co. Ltd.

5.1.10. Kaneka Corporation

5.1.11. Baerlocher GmbH

5.1.12. AkzoNobel N.V.

5.1.13. Milliken & Company

5.1.14. Lubrizol Corporation

5.1.15. Mitsubishi Chemical Holdings Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, R&D Investment, Global Presence, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Plastic Additives Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Plastic Additives Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Plastic Additives Future Market Segmentation

8.1. By Additive Type (In Value %)

8.2. By Polymer Type (In Value %)

8.3. By End-use Industry (In Value %)

8.4. By Functionality (In Value %)

8.5. By Region (In Value %)

9. India Plastic Additives Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying major stakeholders within the India Plastic Additives market through desk research, industry reports, and secondary databases. The primary objective is to outline the critical factors influencing market dynamics, including environmental regulations, industry demand drivers, and technological innovations.

Step 2: Market Analysis and Construction

During this phase, historical market data is collected and analyzed to assess growth trends, industry penetration rates, and overall market performance. The analysis includes the relationship between additives and polymer production and a thorough evaluation of market drivers across different segments.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses developed are validated through interviews with industry experts and manufacturers. Consultations are carried out via CATIS to obtain operational and financial insights that directly correlate with market trends and projections.

Step 4: Research Synthesis and Final Output

The final stage synthesizes all data, leveraging bottom-up and top-down approaches. This includes comprehensive analysis on product segments, consumer preferences, and distribution networks. The final report is compiled after validating the research findings with real-time industry data.

Frequently Asked Questions

01. How big is the India Plastic Additives Market?

The India Plastic Additives Market is valued at USD 4 billion, driven by the increasing demand from industries such as packaging, automotive, and construction.

02. What are the challenges in the India Plastic Additives Market?

Challenges in the India Plastic Additives Market include stringent environmental regulations, fluctuating raw material prices, and the high costs associated with manufacturing bio-based additives.

03. Who are the major players in the India Plastic Additives Market?

Key players in the India Plastic Additives Market include BASF SE, Clariant AG, Evonik Industries AG, Dow Chemical Company, and LANXESS, all of which have a strong global presence and a focus on sustainable products.

04. What are the growth drivers of the India Plastic Additives Market?

The India Plastic Additives Market is propelled by increasing demand from the packaging and automotive industries, growing awareness of sustainable products, and government regulations supporting eco-friendly solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.