India Plastic Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD5474

December 2024

80

About the Report

India Plastic Market Overview

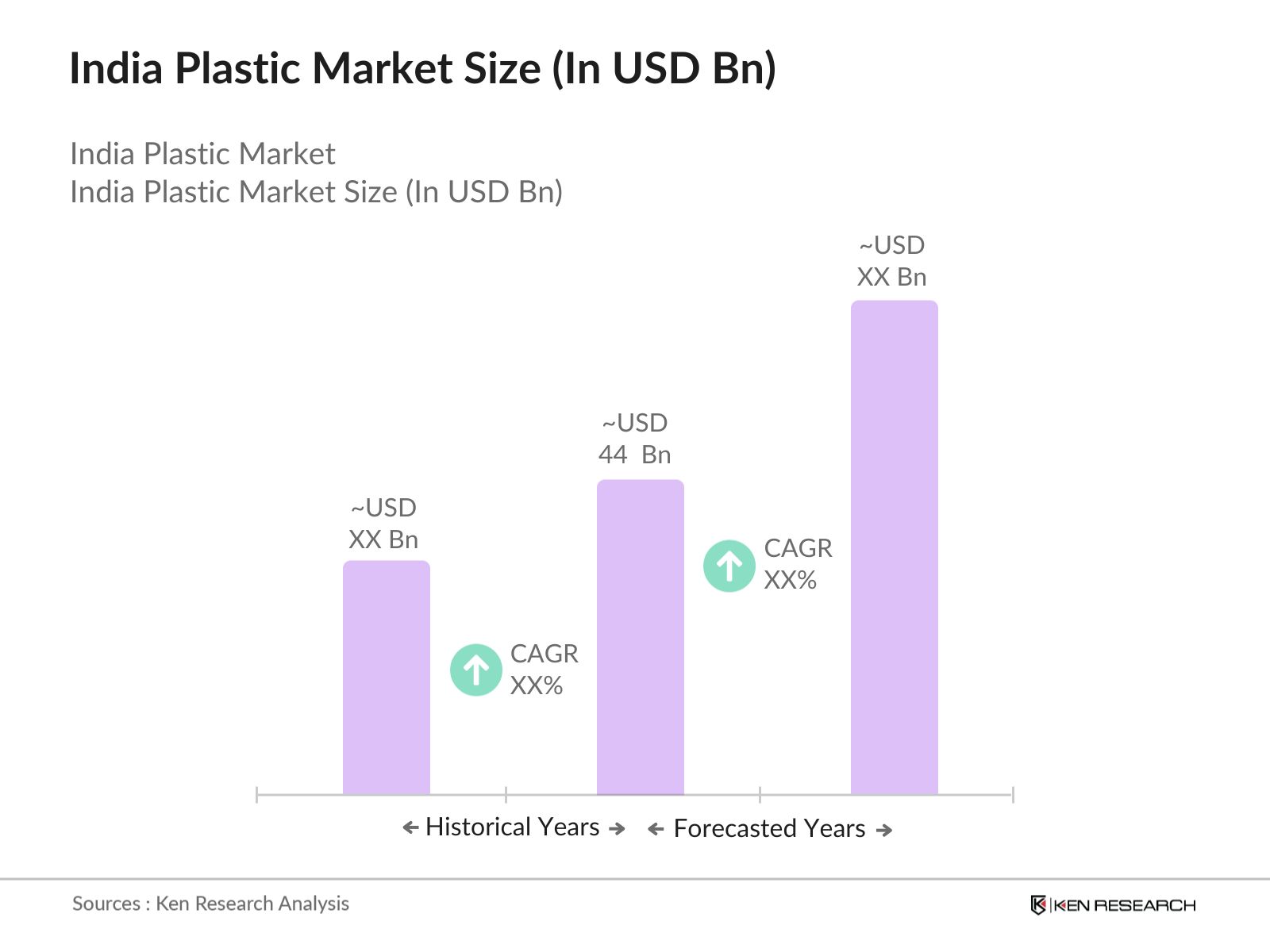

- The India Plastic Market is valued at USD 44 billion, driven by increasing industrialization, rapid urbanization, and the growing demand for packaging, automotive, and construction materials. The rise of the e-commerce sector has further propelled the demand for plastics, particularly in packaging applications. Key factors such as advancements in polymer technology, government initiatives supporting infrastructure development, and a burgeoning middle class contribute to the market's steady growth. Innovations in recycling technologies and sustainability initiatives are also fostering market expansion.

- Major demand centers for plastics in India include cities like Mumbai, Delhi, Bangalore, Chennai, and Hyderabad. Mumbai leads due to its strong industrial base and thriving packaging sector, while Delhi benefits from its robust manufacturing and automotive industries. Bangalores technology and electronics sectors contribute to its position, while Chennai and Hyderabad are key hubs for automotive and pharmaceutical industries, driving demand for high-performance plastics.

- The Indian government has implemented the Plastic Waste Management Rules to address the escalating plastic waste issue. The 2022 amendment introduced Extended Producer Responsibility (EPR), mandating producers, importers, and brand owners to manage the end-of-life disposal of plastic products. This policy aims to enhance recycling rates and reduce environmental pollution. The Central Pollution Control Board (CPCB) oversees compliance, ensuring that stakeholders adhere to these regulations.

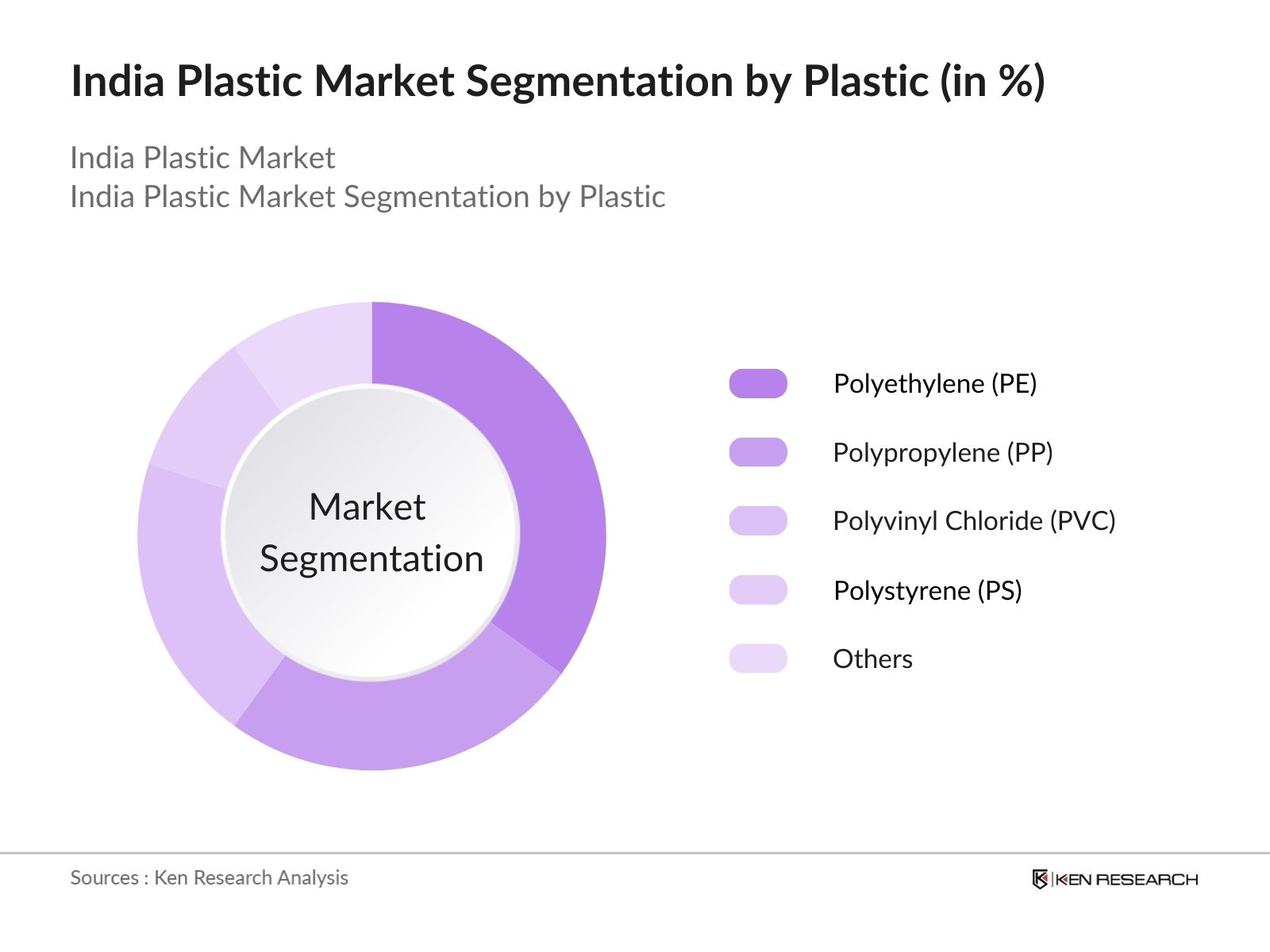

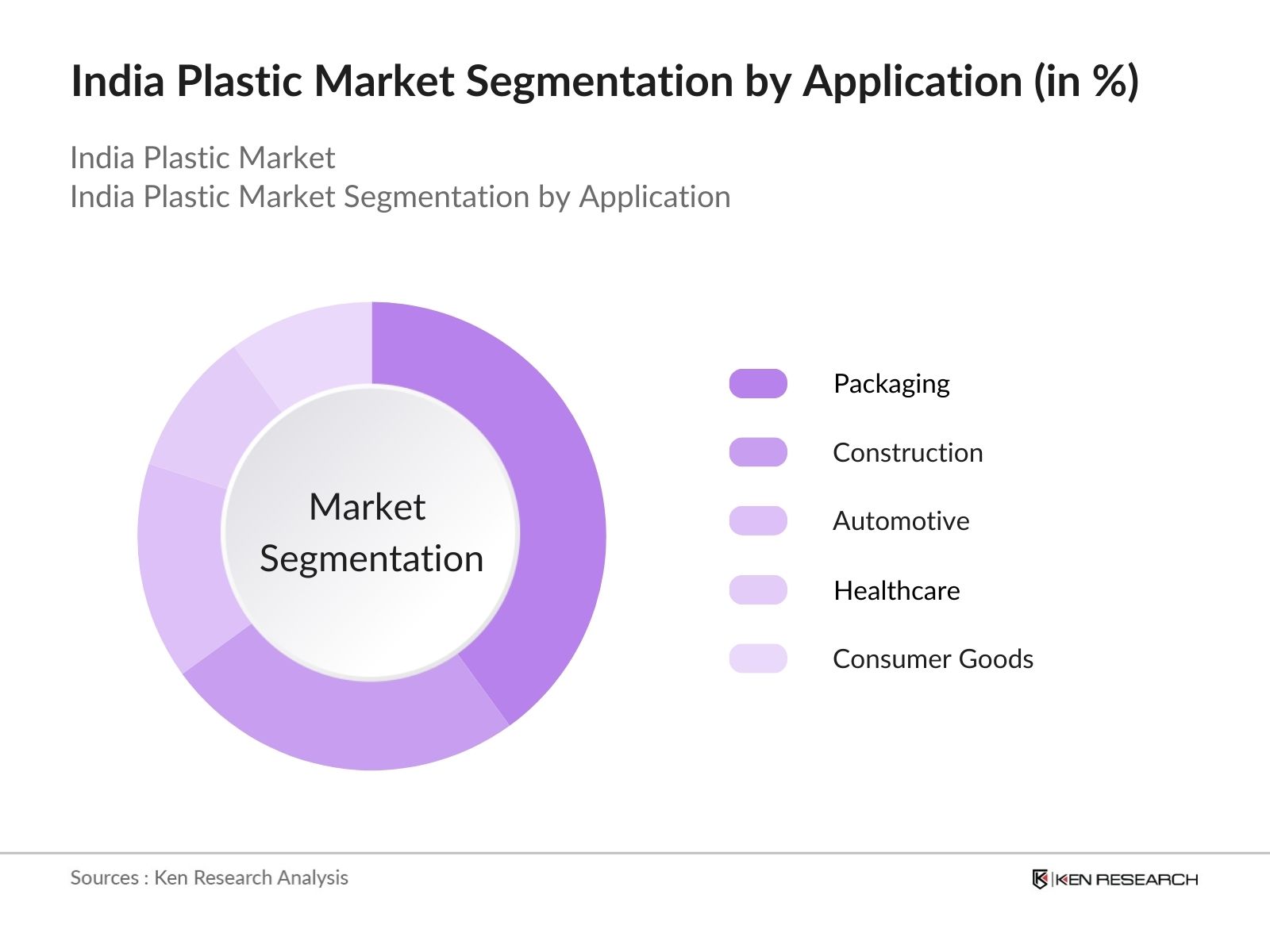

India Plastic Market Segmentation

- By Type of Plastic: The Market is segmented by type into Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), and Others. Polyethylene (PE) dominates the market, holding a 35% share in 2023. This dominance is due to its widespread applications in flexible packaging, consumer goods, and industrial uses. The material's lightweight properties, durability, and cost-effectiveness make it a preferred choice for manufacturers across diverse industries. Its versatility in producing films, bags, and bottles enhances its utility, ensuring consistent demand.

- By Application: The market is segmented by application into Packaging, Construction, Automotive, Healthcare, and Consumer Goods. Packaging leads the market with a 40% share in 2023, driven by India's booming e-commerce and food and beverage industries. The segment benefits from plastics' lightweight, cost-effective, and protective qualities, making it indispensable for preserving product quality during transportation. Innovations in biodegradable and recyclable plastics are also enhancing its appeal amid increasing environmental awareness.

India Plastic Market Competitive Landscape

The India Plastic Market is characterized by a mix of domestic and international players who leverage advanced technologies, extensive distribution networks, and sustainable practices to maintain their positions. Reliance Industries Limited and Hindustan Plastics dominate the domestic market, while global leaders like BASF and Dow Inc. also hold substantial market shares. Strategic investments in R&D and the development of recyclable plastics are key strategies employed by major players to address the growing demand for eco-friendly solutions.

India Plastic Market Analysis

Growth Drivers

- Expansion of Packaging Industry: The rapid growth of the e-commerce sector and the increasing demand for flexible and sustainable packaging solutions are major drivers of the India Plastic Market. The packaging industry relies heavily on plastics for lightweight and durable materials that ensure product safety during transit. With rising consumer demand, the sector continues to drive the overall growth of the plastic industry. This escalation has amplified the need for plastic packaging solutions, as businesses seek cost-effective and durable materials to meet consumer demands.

- Increasing Industrialization: India's industrial sector has been a significant contributor to the nation's GDP, with manufacturing accounting for around 17% of the GDP in 2023. The Index of Industrial Production (IIP) registered a growth of 6.5% in the fiscal year 2022-2023, indicating robust industrial activity. This surge in industrialization has led to heightened demand for plastic products across various sectors, including automotive, electronics, and consumer goods, thereby propelling the growth of the plastic market.

- Government Initiatives on Recycling: The Indian government has implemented several initiatives to promote plastic recycling and waste management. The Plastic Waste Management (Amendment) Rules, 2022, mandate the recycling of plastic packaging and encourage the use of recycled plastic content in products. Additionally, the Swachh Bharat Mission has intensified efforts to manage plastic waste, leading to the establishment of over 4,000 waste processing plants across the country.

Challenges

- Environmental Concerns: Increasing awareness about plastic pollution and its environmental impact poses a significant challenge to the industry. Governments and consumers are pushing for alternatives, leading to increased pressure on manufacturers to innovate and develop sustainable plastics. Plastic waste has been found to account for a major share of non-biodegradable pollutants in the country, affecting biodiversity, public health, and overall environmental sustainability. Governments, under pressure from global environmental commitments, have introduced strict regulations like the ban on single-use plastics and incentives for adopting biodegradable alternatives.

- Fluctuating Raw Material Prices: The volatility in crude oil prices directly affects the cost of plastic production, making it challenging for manufacturers to maintain stable profit margins. Such fluctuations also impact product pricing, influencing consumer purchasing behavior. This volatility has directly impacted the cost of raw materials for plastic production, making it difficult for manufacturers to forecast and stabilize their production budgets. Additionally, increased raw material costs often lead to higher product prices, affecting consumer affordability and demand.

India Plastic Market Future Outlook

The India Plastic Market is poised for substantial growth, driven by rising demand across industries and increasing adoption of eco-friendly materials. Government initiatives promoting recycling and sustainable practices will accelerate the transition to biodegradable and reusable plastics. Technological advancements, including automation and smart manufacturing, will enhance production efficiency and product customization, enabling manufacturers to meet evolving consumer demands. With robust infrastructure development and the expansion of key industries, the market is well-positioned for long-term growth.

Future Market Opportunities

- Development of Biodegradable Plastics: With increasing environmental concerns, the demand for biodegradable plastics is rising. Indian manufacturers are focusing on developing alternatives to traditional plastics that can be decomposed naturally, aligning with global sustainability goals. In 2023, several companies introduced polylactic acid (PLA)-based products derived from agricultural feedstocks, offering a viable eco-friendly alternative to petroleum-based plastics.

- Technological Innovations in Recycling: Advancements in plastic recycling technologies are creating opportunities for manufacturers to reuse materials efficiently. Enhanced recycling methods not only reduce production costs but also contribute to environmental conservation efforts, positioning companies favorably in the market. In 2023, advanced mechanical and chemical recycling technologies were adopted, enabling the processing of over 1.5 million metric tons of plastic waste annually in India.

Scope of the Report

|

By Type of Plastic |

Polyethylene (PE) |

|

By Application |

Packaging |

|

By End-User |

Food & Beverages |

|

By Region |

North |

|

By Product Form |

Granules |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Ministry of Chemicals and Fertilizers, Central Pollution Control Board)

Large-Scale Manufacturers

Automotive Industry Leaders

Construction Companies

Packaging Industry Stakeholders

Healthcare Product Manufacturers

Companies

Players Mentioned in the Report

Reliance Industries Limited

Hindustan Plastics

BASF

Dow Inc.

SABIC

Supreme Industries

Sintex Plastics Technology Ltd.

Cosmo Films Ltd.

Borosil Ltd.

Jubilant Life Sciences

Vardhman Plastic Ltd.

DIC India

Alpek India

Asahi India Glass Ltd.

Finolex Industries

Table of Contents

India Plastic Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

India Plastic Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Plastic Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Industrialization

3.1.2. Rise in Packaging Demand

3.1.3. Government Initiatives on Recycling

3.1.4. Urbanization and Lifestyle Changes

3.2. Market Challenges

3.2.1. Environmental Concerns

3.2.2. Fluctuating Raw Material Prices

3.2.3. Regulatory Compliance

3.3. Opportunities

3.3.1. Technological Innovations

3.3.2. Expansion in Emerging Markets

3.3.3. Growth in Automotive Sector

3.4. Trends

3.4.1. Adoption of Biodegradable Plastics

3.4.2. Shift Towards Lightweight Materials

3.4.3. Increased Focus on Sustainable Packaging

3.5. Government Regulation

3.5.1. Plastic Waste Management Rules

3.5.2. Ban on Single-Use Plastics

3.5.3. Incentives for Recycling Initiatives

3.5.4. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

India Plastic Market Segmentation

4.1. By Type of Plastic (In Value %)

4.1.1. Polyethylene (PE)

4.1.2. Polypropylene (PP)

4.1.3. Polyvinyl Chloride (PVC)

4.1.4. Polystyrene (PS)

4.1.5. Others

4.2. By Application (In Value %)

4.2.1. Packaging

4.2.2. Construction

4.2.3. Automotive

4.2.4. Healthcare

4.2.5. Consumer Goods

4.3. By End-Use Industry (In Value %)

4.3.1. Food & Beverages

4.3.2. Pharmaceuticals

4.3.3. Electronics

4.3.4. Agriculture

4.3.5. Others

4.4. By Geography (In Value %)

4.4.1. North

4.4.2. South

4.4.3. East

4.4.4. West

4.5. By Product Form (In Value %)

4.5.1. Granules

4.5.2. Films

4.5.3. Sheets

4.5.4. Others

India Plastic Market Competitive Analysis

5.1. Detailed Profiles of Major Companies 5.1.1. Reliance Industries Limited

5.1.2. Hindustan Plastics

5.1.3. Supreme Industries

5.1.4. Sintex Plastics Technology Ltd.

5.1.5. Cosmo Films Ltd.

5.1.6. Borosil Ltd.

5.1.7. Jubilant Life Sciences

5.1.8. Vardhman Plastic Ltd.

5.1.9. DIC India

5.1.10. Aftab Enterprises

5.1.11. Alpek India

5.1.12. Asahi India Glass Ltd.

5.1.13. Saurer India Pvt. Ltd.

5.1.14. Finolex Industries

5.1.15. JBF Industries Ltd.

5.2. Cross Comparison Parameters (Production Capacity, Revenue, Market Share, Geographic Presence, Product Range, R&D Investments, Sustainability Initiatives, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

India Plastic Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

India Plastic Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

India Plastic Market Future Segmentation

8.1. By Type of Plastic (In Value %)

8.2. By Application (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Geography (In Value %)

8.5. By Product Form (In Value %)

India Plastic Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Plastic Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Plastic Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple plastic manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Plastic Market.

Frequently Asked Questions

01. How big is the India Plastic Market?

The India Plastic Market was valued at USD 44 billion, driven by rapid industrialization, expanding packaging needs, and increasing consumer demand for plastic products across various sectors.

02. What are the challenges in the India Plastic Market?

Challenges in the India Plastic Market include environmental concerns regarding plastic waste, fluctuating raw material prices, and stringent regulatory compliance requirements, which impact production costs and market dynamics.

03. Who are the major players in the India Plastic Market?

Key players in the India Plastic Market include Reliance Industries Limited, Hindustan Plastics, BASF, Dow Inc., and SABIC. These companies dominate due to their extensive production capacities, strong distribution networks, and significant investments in R&D.

04. What are the growth drivers of the India Plastic Market?

The India Plastic Market is propelled by factors such as increasing industrialization, rising demand in the packaging sector, government initiatives promoting infrastructure development, and advancements in plastic manufacturing technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.