India Polyacrylic Acid Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD4732

November 2024

98

About the Report

India Polyacrylic Acid Market Overview

- The India Polyacrylic Acid market, valued at USD 280 million, is driven by increasing demand in the water treatment, agricultural, and consumer goods industries. The growing importance of wastewater treatment plants across industrial sectors, coupled with the need for water conservation, is a contributor to this markets size. Industrial expansion, rising environmental concerns, and government policies focusing on water management and pollution control are further propelling the market growth.

- Key cities such as Mumbai, Chennai, and Ahmedabad dominate the India Polyacrylic Acid market due to their concentration of industrial units and large-scale manufacturing capabilities. These cities are home to many water-intensive industries, including textiles, chemicals, and pharmaceuticals, driving high demand for polyacrylic acid in wastewater treatment applications. Additionally, their established infrastructure supports the use of polyacrylic acid across various end-user industries.

- Indias environmental protection laws, particularly the Environmental Protection Act of 1986, impose stringent regulations on chemical manufacturers, including polyacrylic acid producers. In 2024, the government continues to tighten regulations, requiring companies to reduce their environmental impact, especially in terms of waste management. Compliance with these laws is critical for companies operating in the polyacrylic acid market, as non-compliance can result in penalties, which totaled INR 15 billion in 2023.

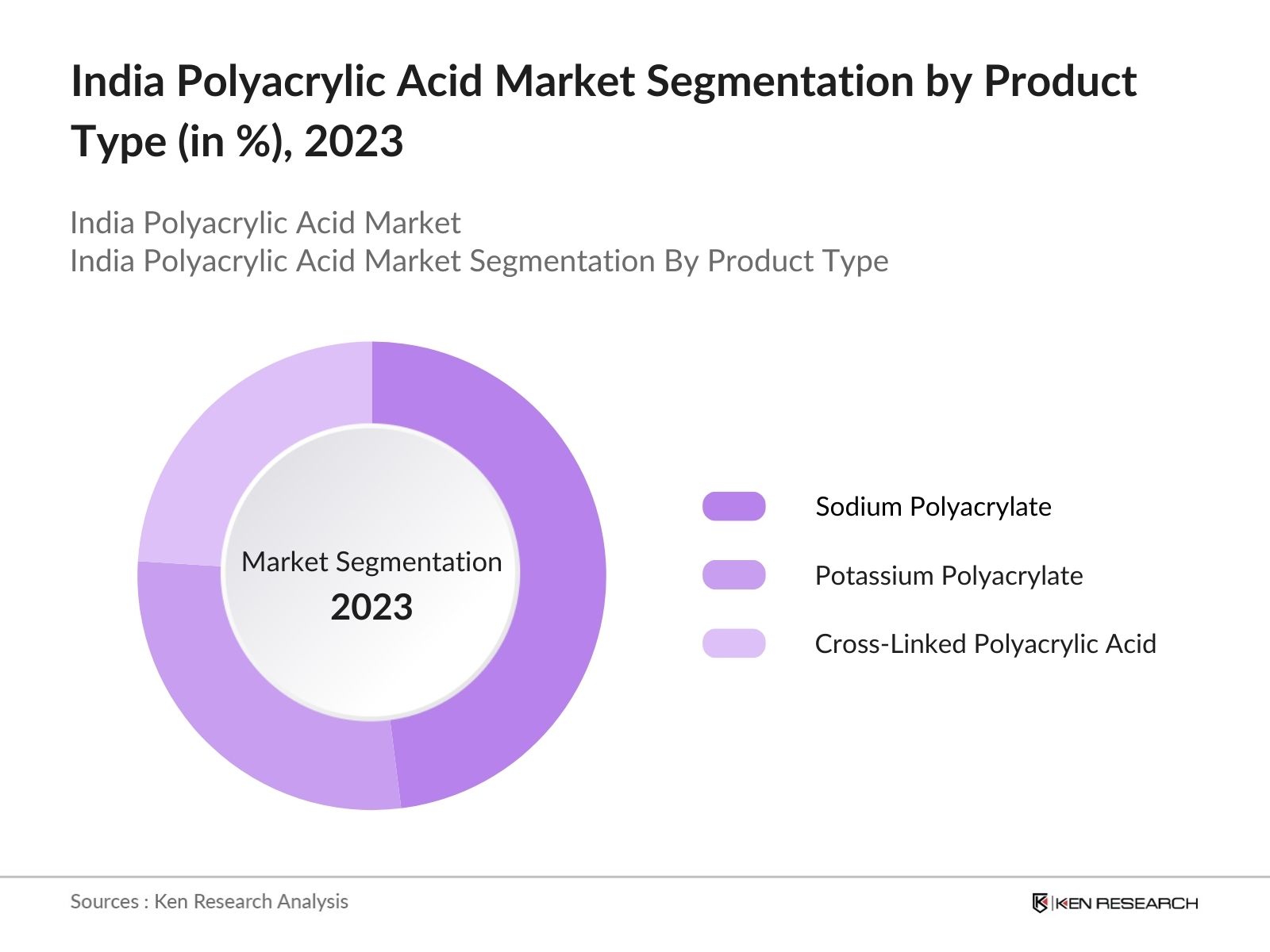

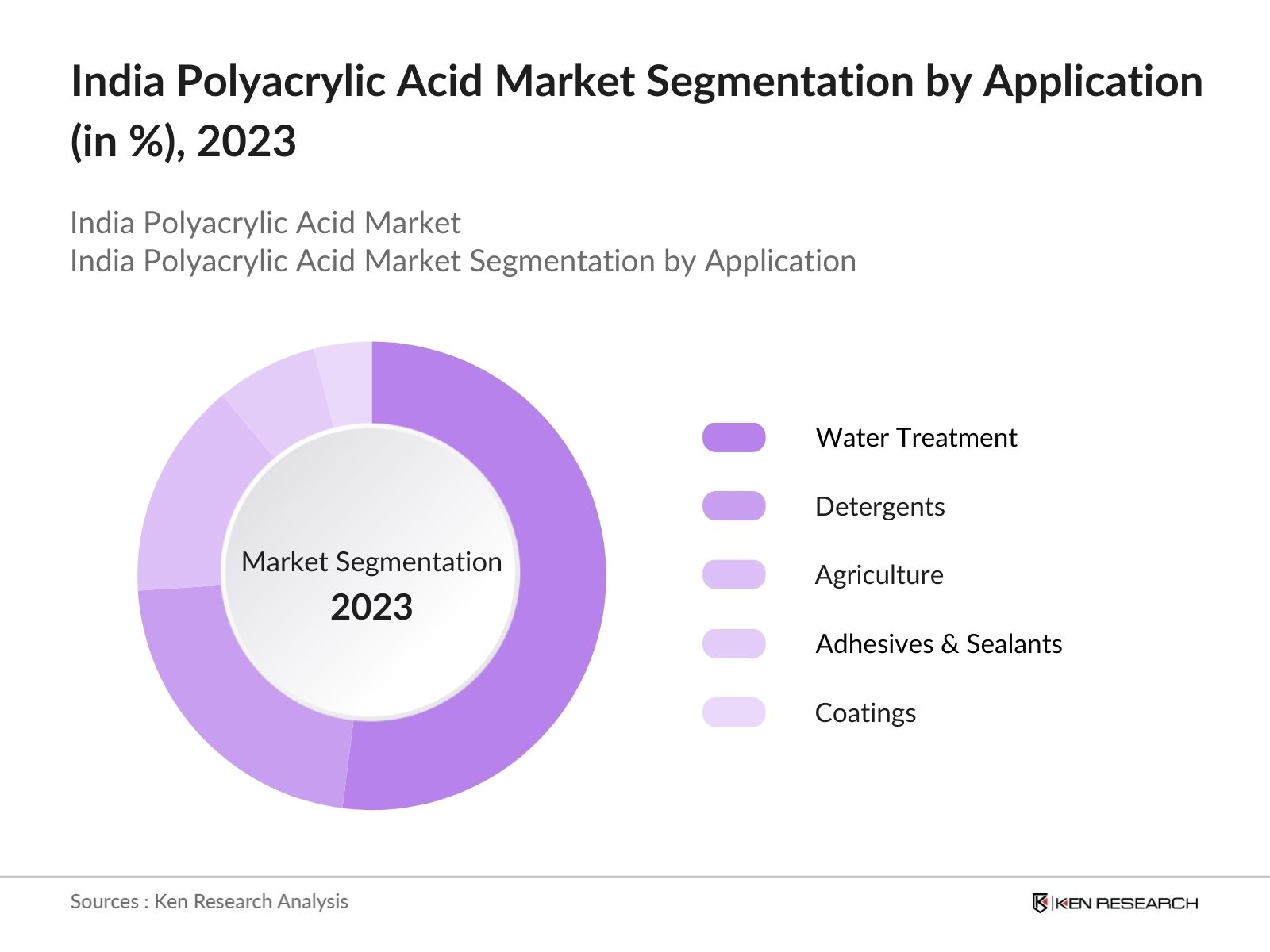

India Polyacrylic Acid Market Segmentation

By Product Type: The market is segmented by product type into sodium polyacrylate, potassium polyacrylate, and cross-linked polyacrylic acid. Among these, sodium polyacrylate holds the dominant market share due to its widespread use in water treatment applications. Sodium polyacrylates high water-absorbing capacity makes it a preferred choice in the wastewater treatment industry, where it is used for controlling industrial effluents. Its ability to absorb hundreds of times its own weight in water also makes it suitable for use in hygiene products and detergents, contributing to its share in the market.

By Application: The market is also segmented by application into water treatment, detergents, agriculture, adhesives & sealants, and coatings. Water treatment remains the leading application segment, driven by the growing demand for efficient wastewater management in industries such as chemicals, textiles, and manufacturing. Increasing regulations to reduce water pollution and the establishment of wastewater treatment plants further reinforce the dominance of this segment. The rising need for clean water in urban areas, coupled with the industrial requirement to treat water before disposal, continues to drive growth in this application area.

By Application: The market is also segmented by application into water treatment, detergents, agriculture, adhesives & sealants, and coatings. Water treatment remains the leading application segment, driven by the growing demand for efficient wastewater management in industries such as chemicals, textiles, and manufacturing. Increasing regulations to reduce water pollution and the establishment of wastewater treatment plants further reinforce the dominance of this segment. The rising need for clean water in urban areas, coupled with the industrial requirement to treat water before disposal, continues to drive growth in this application area.

India Polyacrylic Acid Market Competitive Landscape

India Polyacrylic Acid Market Competitive Landscape

The India Polyacrylic Acid market is dominated by a mix of domestic and international players. These companies leverage their extensive distribution networks, strong product portfolios, and technological advancements to maintain their competitive positions. The market is characterized by ongoing collaborations between industry leaders, product innovations, and a focus on sustainable solutions. Major players are adopting eco-friendly manufacturing processes to comply with stringent environmental regulations. Additionally, these companies are focusing on expanding their production capacities and strengthening their market presence through strategic mergers and acquisitions.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Mn) |

Product Portfolio |

R&D Expenditure |

Market Penetration |

Sustainability Initiatives |

Geographic Presence |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

||||||

|

Dow Chemical Company |

1897 |

Midland, USA |

||||||

|

Nippon Shokubai Co. Ltd. |

1941 |

Osaka, Japan |

||||||

|

Arkema Group |

2006 |

Colombes, France |

||||||

|

Shandong Taihe Water Treatment |

1998 |

Shandong, China |

India Polyacrylic Acid Industry Analysis

Growth Drivers

- Expanding Water Treatment Industry: The Indian polyacrylic acid market is seeing growth due to the expanding water treatment industry. In 2024, Indias water treatment sector is projected to treat 42 billion cubic meters of wastewater, driven by increased government investments in clean water initiatives like the Jal Jeevan Mission. Polyacrylic acid is widely used in industrial water treatment processes as a scale inhibitor. With India's urban population reaching approximately 510 million, the demand for clean water is surging. This expansion supports the need for polyacrylic acid, particularly in regions with industrial hubs.

- Growth in Personal Care & Hygiene Products: The growth of the personal care and hygiene sector is driving demand for polyacrylic acid, used in lotions and creams as a thickening agent. In 2024, India's personal care market is valued at over INR 1.4 trillion, with a substantial focus on hygiene products. The countrys population of 1.4 billion is also showing increased consumer spending on skincare and hygiene, boosting the use of polyacrylic acid in these formulations. Government programs promoting sanitation, such as Swachh Bharat, further amplify this trend, making polyacrylic acid crucial to meeting industrial needs.

- Government Initiatives in Industrial Water Treatment: Indias National Mission for Clean Ganga (NMCG) allocates over INR 30 billion to modernize water treatment facilities, particularly in the industrial sector, where polyacrylic acid plays a key role. The government is pushing stricter compliance for industrial water discharge, boosting the market demand for polyacrylic acid-based solutions to prevent scaling and fouling in treatment plants. In 2024, as Indias industrial output reaches $3.7 trillion, the need for efficient water management is becoming more urgent, directly benefiting polyacrylic acid consumption.

Market Challenges

- Price Fluctuation of Raw Materials: One of the key challenges for the polyacrylic acid market in India is the fluctuation in the prices of raw materials such as acrylic acid and propylene. With India importing around 60% of its acrylic acid in 2023, currency volatility and global supply chain disruptions affect the cost structure. In 2024, Indias dependency on imports continues, and any increase in crude oil prices directly impacts the availability and cost of propylene, posing a challenge to domestic manufacturers.

- Stringent Environmental Regulations: Indias Central Pollution Control Board (CPCB) enforces strict environmental guidelines that impact the production of chemicals, including polyacrylic acid. Companies must comply with these regulations, especially concerning hazardous chemical disposal. In 2024, the CPCB levied INR 10 billion in fines against industries violating environmental norms, making regulatory compliance a considerable challenge for manufacturers. These stringent norms not only increase operational costs but also create obstacles for local manufacturing, impacting the polyacrylic acid market.

India Polyacrylic Acid Market Future Outlook

The India Polyacrylic Acid market is expected to witness robust growth driven by an increasing focus on water treatment and the adoption of sustainable industrial practices. The rising concerns around water pollution and the necessity for efficient wastewater management in industries such as chemicals, textiles, and pharmaceuticals will continue to bolster demand for polyacrylic acid. Furthermore, as the agricultural sector increasingly turns to super absorbents to optimize water usage, the role of polyacrylic acid in enhancing crop yield will become more prominent.

Future Market Opportunities

- Increasing Demand for Superabsorbent Polymers in Diapers and Hygiene Products: The demand for superabsorbent polymers in India is surging due to the expanding hygiene products sector. In 2024, India's diaper market size is expected to cater to 27 million babies annually, driven by rising income levels and increased health awareness. Polyacrylic acid, used as a superabsorbent polymer, is critical in these applications. The governments push toward better sanitation and hygiene under initiatives like Swachh Bharat further propels this demand, opening opportunities for the polymer industry.

- Technological Advancements in Polymer Chemistry: Advances in polymer chemistry offer opportunities for Indias polyacrylic acid market, particularly in water treatment and superabsorbent applications. With the Indian government investing INR 100 billion in research and development in 2024, innovations in biodegradable polymers and sustainable chemical processes are on the rise. These advancements provide local manufacturers with opportunities to improve production processes and create more environmentally friendly products, helping them comply with strict environmental regulations while meeting market demand.

Scope of the Report

|

By Product Type |

Sodium polyacrylate Potassium polyacrylate Cross-linked polyacrylic acid |

|

By Application |

Water Treatment Chemicals Detergents & Cleaners Personal Care (Hygiene Products) Agriculture (Soil Conditioners) |

|

By End-User Industry |

Water Treatment Personal Care & Hygiene Agriculture Manufacturing & Textiles |

|

By Distribution Channel |

Direct Sales Distributors/Wholesalers Online Sales |

|

By Region |

North South East West |

Products

Key Target Audience

Polyacrylic Acid Manufacturers

Polyacrylic Acid Distributors and Suppliers

Water Treatment Companies

Agriculture Companies

Banks and Financial Institutes

Adhesive and Sealant Manufacturers

Government and Regulatory Bodies (Central Pollution Control Board)

Investor and Venture Capitalist Firms

Industrial Waste Management Companies

Companies

Major Players

BASF SE

Dow Chemical Company

Nippon Shokubai Co. Ltd.

Arkema Group

Evonik Industries

LG Chem

Kemira Oyj

Sumitomo Seika Chemicals Co., Ltd.

SNF Group

Shandong Taihe Water Treatment Technologies

Henan Qingshuiyuan Technology Co., Ltd.

Lubrizol Corporation

Ashland Global Holdings Inc.

Wanhua Chemical Group Co., Ltd.

Mitsubishi Chemical Corporation

Table of Contents

1. India Polyacrylic Acid Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Chemical Properties, Application Areas, Key End-User Industries)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Polyacrylic Acid Market Size (In USD Mn)

2.1. Historical Market Size (Volume & Value)

2.2. Year-On-Year Growth Analysis (Consumption, Import-Export Data, Domestic Production)

2.3. Key Market Developments and Milestones (Product Innovation, New Entrants, Industry Collaborations)

3. India Polyacrylic Acid Market Analysis

3.1. Growth Drivers

3.1.1. Expanding Water Treatment Industry

3.1.2. Growth in Personal Care & Hygiene Products

3.1.3. Rising Agriculture Demand (Superabsorbent Polymers)

3.1.4. Government Initiatives in Industrial Water Treatment

3.2. Market Challenges

3.2.1. Price Fluctuation of Raw Materials (Acrylic Acid, Propylene)

3.2.2. Stringent Environmental Regulations

3.2.3. Limited Local Manufacturing Capacities

3.3. Opportunities

3.3.1. Increasing Demand for Superabsorbent Polymers in Diapers and Hygiene Products

3.3.2. Technological Advancements in Polymer Chemistry

3.3.3. Expansion in Agricultural Soil Conditioners Market

3.4. Trends

3.4.1. Biodegradable Polyacrylic Acids

3.4.2. Rising Application in Green Infrastructure Projects

3.4.3. Shifts Towards Sustainable Water Treatment Solutions

3.5. Regulatory Framework

3.5.1. Indian Environmental Protection Laws

3.5.2. Certifications Required (BIS Standards, CPCB Guidelines)

3.5.3. Import-Export Compliance for Chemical Substances

3.6. SWOT Analysis (Market-Specific Insights)

3.7. Stakeholder Ecosystem (Producers, Distributors, End-Users)

3.8. Porters Five Forces Analysis (Bargaining Power, Supplier Impact, Threat of New Entrants)

3.9. Competitive Ecosystem

4. India Polyacrylic Acid Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Homopolymer Polyacrylic Acid

4.1.2. Copolymer Polyacrylic Acid

4.1.3. Polyacrylic Acid Derivatives

4.2. By Application (In Value %)

4.2.1. Water Treatment Chemicals

4.2.2. Detergents & Cleaners

4.2.3. Personal Care (Hygiene Products, Cosmetics)

4.2.4. Agriculture (Soil Conditioners, Fertilizer Additives)

4.3. By End-User Industry (In Value %)

4.3.1. Water Treatment

4.3.2. Personal Care & Hygiene

4.3.3. Agriculture

4.3.4. Manufacturing & Textiles

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Distributors/Wholesalers

4.4.3. Online Sales

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Polyacrylic Acid Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Arkema Group

5.1.3. Nippon Shokubai Co. Ltd

5.1.4. LG Chem Ltd.

5.1.5. Kemira Oyj

5.1.6. Dow Inc.

5.1.7. Mitsubishi Chemical Holdings Corporation

5.1.8. Ashland Global Holdings Inc.

5.1.9. Evonik Industries AG

5.1.10. Lubrizol Corporation

5.1.11. Sanyo Chemical Industries

5.1.12. Shandong Taihe Water Treatment Technologies Co., Ltd.

5.1.13. SNF Floerger Group

5.1.14. Zhejiang Satellite Petrochemical Co. Ltd.

5.1.15. Sumitomo Seika Chemicals Co. Ltd.

5.2. Cross Comparison Parameters (Manufacturing Capacity, R&D Investments, Key Product Portfolio, Global Presence, Market Share, Production Volume, Certifications, Innovation Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Expansions, Joint Ventures)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. India Polyacrylic Acid Market Regulatory Framework

6.1. Environmental Standards and Guidelines

6.2. Compliance Requirements for Manufacturers and Suppliers

6.3. Certification Processes for Water Treatment and Agriculture Applications

7. India Polyacrylic Acid Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Polyacrylic Acid Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India Polyacrylic Acid Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis (Key Consumer Segments, Purchase Behavior)

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involved mapping the entire polyacrylic acid ecosystem in India, including stakeholders such as manufacturers, suppliers, and end-users. Extensive secondary research was conducted using proprietary databases and government resources to identify critical variables influencing the market dynamics.

Step 2: Market Analysis and Construction

Historical data regarding the polyacrylic acid market was compiled to analyze trends in revenue, market penetration, and industry developments. This analysis helped to provide a clear picture of market growth over the past five years.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth and future opportunities were developed and validated through interviews with industry experts, including manufacturers and suppliers. These consultations helped in refining market estimates and confirming key growth drivers.

Step 4: Research Synthesis and Final Output

In the final phase, data from primary and secondary sources were synthesized to develop a comprehensive report on the India Polyacrylic Acid market. This approach ensured the accuracy and validity of the data, providing a clear and detailed market outlook.

Frequently Asked Questions

01. How big is the India Polyacrylic Acid market?

The India Polyacrylic Acid market is valued at USD 280 million, driven by increasing demand in water treatment and agriculture sectors.

02. What are the challenges in the India Polyacrylic Acid market?

Key challenges in the India Polyacrylic Acid market include the volatility of raw material prices and the stringent environmental regulations surrounding chemical manufacturing, which can impact production costs.

03. Who are the major players in the India Polyacrylic Acid market?

Major players in the India Polyacrylic Acid market include BASF SE, Dow Chemical Company, Nippon Shokubai Co. Ltd., Arkema Group, and Shandong Taihe Water Treatment Technologies.

04. What are the growth drivers of the India Polyacrylic Acid market?

Growth drivers in the India Polyacrylic Acid market include the increasing need for water treatment solutions, government regulations focusing on pollution control, and the rise of sustainable practices in agriculture and industry.

05. What opportunities exist in the India Polyacrylic Acid market?

In the India Polyacrylic Acid market, opportunities exist in the development of bio-based polyacrylic acid products and innovations aimed at increasing efficiency in water treatment and agricultural applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.