India Polypropylene Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD9103

December 2024

96

About the Report

India Polypropylene Market Overview

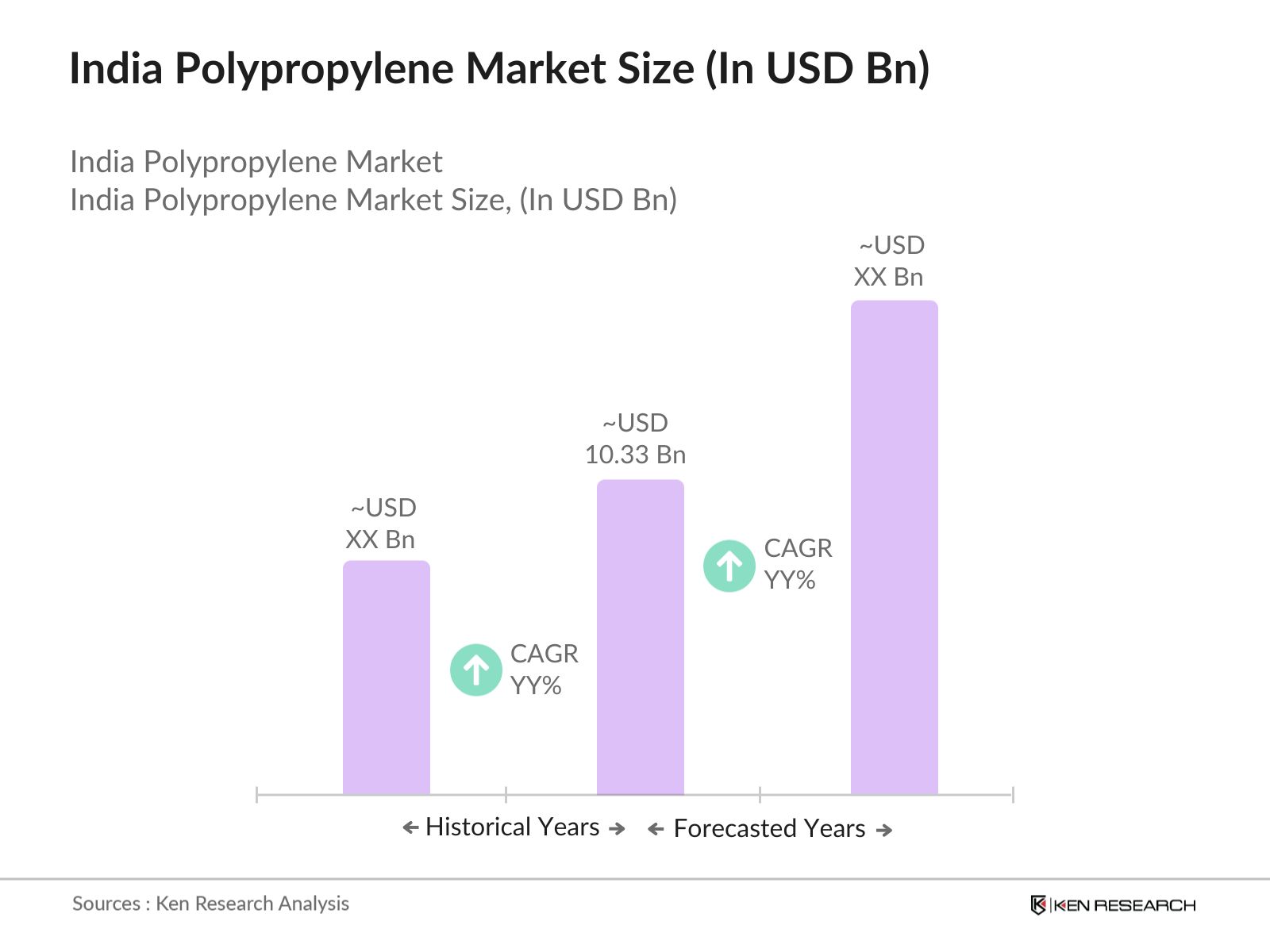

- The India Polypropylene market is valued at USD 10.33 billion, based on a detailed five-year historical analysis. The market is predominantly driven by the increasing demand for polypropylene across industries like packaging, automotive, and construction. The versatility of polypropylene in manufacturing plastic components, coupled with its cost-effectiveness and durability, positions it as a key material in various industries.

- The dominant players in the market are concentrated in cities like Mumbai and Jamnagar, driven by the presence of large petrochemical plants and refineries. Reliance Industries, headquartered in Mumbai, has a significant influence on the market, with its massive production capacity. Additionally, Gujarats strong presence in petrochemical production makes it a leader in polypropylene manufacturing.

- The Indian governments Make in India initiative is focused on boosting domestic manufacturing, including the petrochemical and polymer sectors. In 2024, the government allocated INR 20 billion for setting up new petrochemical plants, with polypropylene being a significant focus. This will lead to increased production capacities and reduced reliance on imports.

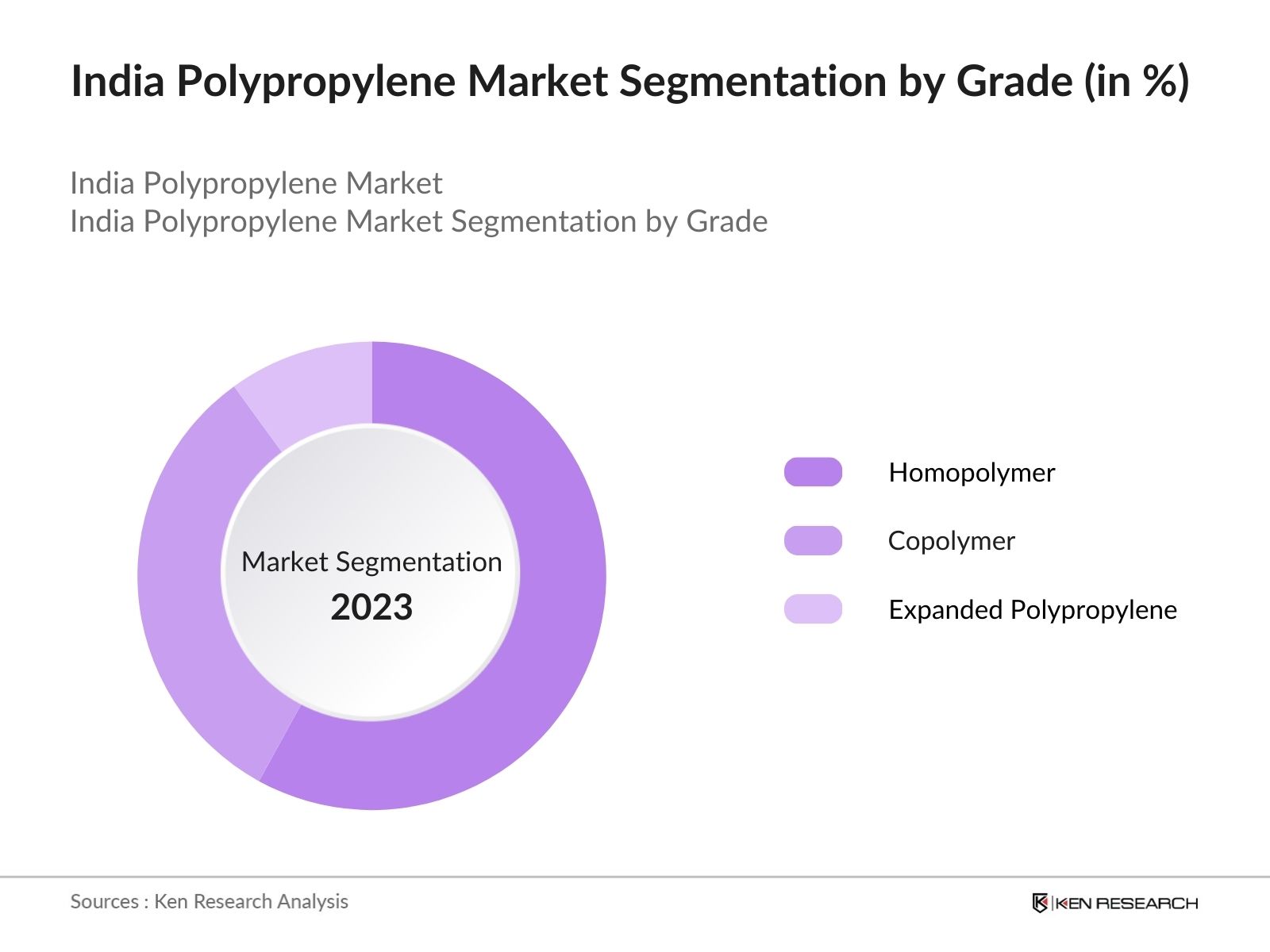

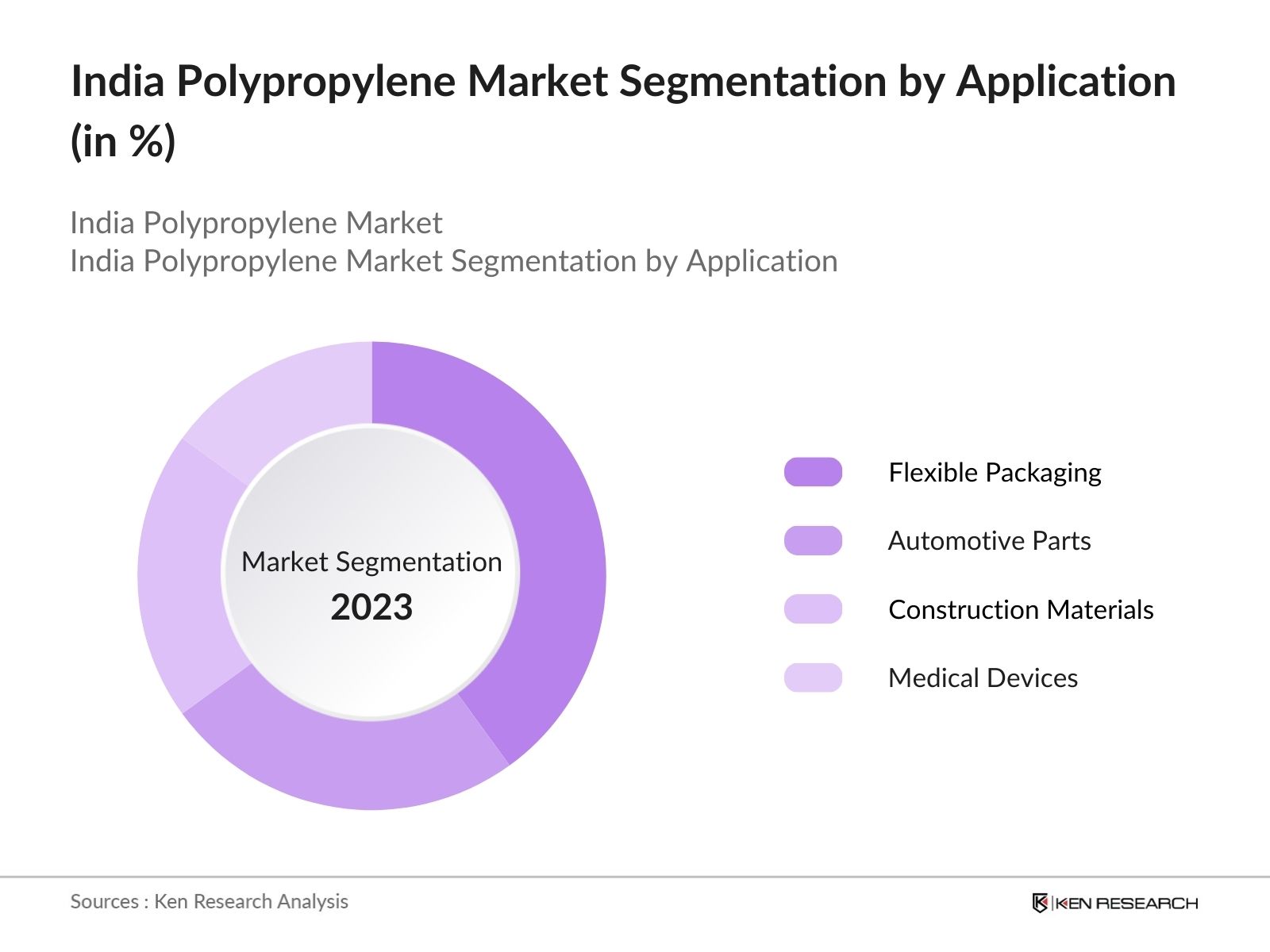

India Polypropylene Market Segmentation

By Grade: The market is segmented by grade into homopolymer, copolymer, and expanded polypropylene. Homopolymer polypropylene holds a dominant market share due to its stiffness and strong mechanical properties, making it ideal for applications in packaging and textiles. The automotive industry also favors homopolymer due to its cost efficiency and adaptability in producing automotive components such as bumpers and interior trims.

By Application The market is also segmented by application into flexible packaging, automotive parts, construction materials, and medical devices. Flexible packaging holds the largest market share, driven by the growing demand in the food and beverage industry, thanks to polypropylene's excellent barrier properties against moisture. The shift towards sustainable packaging and the need for lightweight yet durable materials for consumer goods are reinforcing the dominance of flexible packaging.

India Polypropylene Market Competitive Landscape

The market is dominated by a few major players, each with production capacities and strong domestic and international reach. Reliance Industries Limited continues to be the leading player, benefiting from its vertically integrated operations and vast market footprint.

|

Company Name |

Establishment Year |

Headquarters |

Annual Production (KTPA) |

Core Products |

R&D Capabilities |

Sustainability Initiatives |

Partnerships |

Major Clients |

|

Reliance Industries Limited |

1973 |

Mumbai |

||||||

|

Indian Oil Corporation Limited |

1959 |

New Delhi |

||||||

|

ONGC Petro Additions Limited |

2006 |

Gujarat |

||||||

|

Haldia Petrochemicals Limited |

1994 |

Kolkata |

||||||

|

Mangalore Refinery & Petrochemicals |

1988 |

Karnataka |

India Polypropylene Market Analysis

Market Growth Drivers

- Rising Demand from Packaging Industry: The Indian packaging industry is witnessing growth, driven by the increasing demand for lightweight, durable, and cost-effective materials. Polypropylene (PP), being versatile, is widely used in flexible and rigid packaging solutions. The Indian packaging market, driven by sectors like food and pharmaceuticals, accounted for a market consumption of over 18 million metric tons of polymers in 2024, with polypropylene playing a crucial role.

- Increased Agricultural Application: Polypropylene is increasingly used in the Indian agriculture sector for various applications like woven sacks for grain storage, baler twine, and greenhouses. India, being the second-largest producer of agricultural products, needs efficient storage solutions. The Government of India, through initiatives like the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), aims to provide better irrigation facilities.

- Growth in Automotive Sector: Polypropylene is widely used in the Indian automotive industry for parts such as bumpers, dashboards, and fuel tanks due to its light weight and resistance to corrosion. The Indian automotive market produced over 4 million passenger cars in 2024, with each vehicle using around 60-70 kg of polypropylene. This rising production, along with increasing demand for electric vehicles (EVs), will continue to push the demand for polypropylene in this sector.

Market Challenges

- Fluctuations in Crude Oil Prices: Polypropylene is derived from petrochemical feedstocks, making its prices highly sensitive to fluctuations in crude oil prices. In 2024, India imported more than 210 million metric tons of crude oil, and any price volatility affects the production costs of polypropylene, which can hinder profitability for manufacturers.

- Environmental Regulations and Sustainability Concerns: Indias push for reducing plastic waste has led to the enforcement of stringent regulations regarding plastic use. The ban on single-use plastics by 2022 has affected the demand for certain polypropylene products, particularly in packaging. With over 3 million tons of plastic waste generated in India annually, manufacturers are under increasing pressure to find eco-friendly alternatives or improve recyclability of polypropylene.

India Polypropylene Market Future Outlook

Over the next five years, the India Polypropylene industry is expected to see substantial growth. This will be fueled by rising investments in petrochemical capacities, increased demand from the automotive and construction industries, and greater emphasis on sustainability.

Future Market Opportunities

- Expansion of Recycling Infrastructure: India is expected to expand its polypropylene recycling infrastructure over the next five years. The government plans to invest over INR 50 billion in waste management and recycling projects by 2029, which will help the market meet growing demand for recyclable and sustainable PP products.

- Increased Use in Healthcare Applications: The demand for polypropylene in the healthcare sector will rise as Indias healthcare infrastructure expands. By 2029, more than 500,000 tons of polypropylene are projected to be consumed annually in medical devices, syringes, and personal protective equipment (PPE) as the country continues to build healthcare resilience post-pandemic.

Scope of the Report

|

By Grade |

Homopolymer Copolymer Expanded Polypropylene |

|

By Application |

Flexible Packaging Rigid Packaging Automotive Textiles |

|

By End-Use Industry |

Packaging Automotive Construction Medical Devices Electronics |

|

By Region |

North India West India South India East India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Polypropylene Manufacturers

Polypropylene Distributors and Suppliers

Government and Regulatory Bodies (Indian Ministry of Chemicals and Fertilizers)

Automotive Parts Manufacturers

Packaging Solutions Providers

Construction Material Producers

Medical Device Manufacturers

Investor and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Reliance Industries Limited

Indian Oil Corporation Limited

ONGC Petro Additions Limited

HPCL-Mittal Energy Limited

Haldia Petrochemicals Limited

Mangalore Refinery and Petrochemicals Limited

Brahmaputra Cracker and Polymers Limited

Exxon Mobil Corporation

LyondellBasell Industries

Sinopec

Table of Contents

India Polypropylene Market Overview

Definition and Scope

Market Taxonomy (Industry Segmentation and Categorization)

Market Growth Rate (CAGR-based growth insights)

Polypropylene Value Chain Analysis (Manufacturing to End Use)

India Polypropylene Market Size (In USD Bn)

Historical Market Size (Volume Analysis)

Year-On-Year Growth Analysis (Market Development Trends)

Key Market Milestones (Significant Growth Drivers in India)

India Polypropylene Market Dynamics

Growth Drivers

Packaging Demand Growth (Food & Beverage Industry)

Automotive Sector Expansion (Polymer-based Parts)

Government Support for Polymer Processing (Tax Relief, SME Initiatives)

Increased Use in Construction (Pipes, Insulation, and Liners)

Market Challenges

Substitutes Availability (PLA, Bioplastics)

Fluctuating Crude Oil Prices (Impact on Production Costs)

Environmental Concerns (Regulatory Push for Sustainable Materials)

Limited Skilled Workforce in Specialized Applications

Opportunities

Rising Demand in Flexible Packaging

Technological Advancements in Injection Molding

Growth in Medical Device Manufacturing (Disposable Products)

Domestic Production Capacity Expansion

Trends

Adoption of Sustainable Practices (Recycling Initiatives)

Shift towards High-performance Polypropylene Grades

Rising Automotive Lightweighting Strategies

India Polypropylene Market Regulatory Framework

Government Regulations (Environmental Standards, BIS Certifications)

Trade Policies (Import-Export Regulations, Tariff Measures)

Industry Compliance (Safety and Environmental Certifications)

India Polypropylene Market Segmentation

By Grade (Market Share Breakdown)

Homopolymer

Copolymer

Expanded Polypropylene

By Application

Flexible Packaging

Rigid Packaging

Automotive Parts

Textiles

By End-Use Industry

Packaging (Food & Beverage, Pharmaceuticals)

Automotive (Parts, Trims, Bumpers)

Construction (Pipes, Insulation Materials)

Medical Devices (Disposable Products)

Electrical and Electronics

By Region

North India

West India

South India

East India

India Polypropylene Market Competitive Landscape

Detailed Profiles of Major Competitors

Reliance Industries Limited

Indian Oil Corporation Limited

ONGC Petro Additions Limited

HPCL-Mittal Energy Limited

Haldia Petrochemicals Limited

Mangalore Refinery and Petrochemicals Limited

Brahmaputra Cracker and Polymers Limited

Exxon Mobil Corporation

LyondellBasell Industries

Milliken Chemical

Sinopec

SABIC

BASF SE

DuPont de Nemours

Kingfa Science & Technology

Cross-Comparison Parameters (No. of Employees, Revenue, Product Range, Regional Presence, R&D Capabilities, Market Share, Sustainability Initiatives, Key Partnerships)

Strategic Initiatives (Partnerships, Mergers & Acquisitions, R&D)

Market Share Analysis (Competitive Positioning and Market Share by Revenue)

India Polypropylene Market Future Outlook

Future Market Size Projections (In USD Bn)

Key Factors Driving Future Growth (Domestic Capacity Expansion, Increased Usage in Emerging Sectors)

Forecasted Market Segmentation (Applications, End-Use Industries)

India Polypropylene Market Segmentation

8.1 By Grade

8.2 By Application

8.3 By End-Use Industry

8.4 By Region

India Polypropylene Market Analyst Recommendations

TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market)

Market Entry Strategies (Partnerships, Local Manufacturing Opportunities)

Customer Cohort Analysis (Key Buying Segments)

White Space Opportunity (Untapped Market Potential)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research began with constructing a comprehensive ecosystem map, focusing on key stakeholders in the India Polypropylene market. This involved extensive desk research and the use of proprietary databases to identify the key factors influencing market growth.

Step 2: Market Analysis and Construction

In this step, historical data on market size, production, and demand was analyzed. Various indicators such as crude oil prices, production capacity, and regional trends were evaluated to assess the market structure and its growth trajectory.

Step 3: Hypothesis Validation and Expert Consultation

We consulted industry experts through structured interviews to validate the hypotheses developed during our analysis. This provided crucial insights into real-world market dynamics, including pricing trends and customer preferences.

Step 4: Research Synthesis and Final Output

In the final phase, multiple sources were cross-referenced, and the data collected was synthesized into actionable insights. The accuracy of the market forecast was ensured through expert validation and triangulation with industry-level data.

Frequently Asked Questions

01. How big is the India Polypropylene Market?

The India Polypropylene market is valued at USD 10.33 billion, driven by increased demand in packaging, automotive, and construction sectors, which has seen significant growth in recent years.

02. What are the challenges in the India Polypropylene Market?

Challenges in the India Polypropylene market include fluctuating crude oil prices affecting production costs, the emergence of substitutes like bioplastics, and environmental regulations pushing for more sustainable alternatives.

03. Who are the major players in the India Polypropylene Market?

Key players in the India Polypropylene market include Reliance Industries, Indian Oil Corporation, ONGC Petro Additions, Haldia Petrochemicals, and Mangalore Refinery & Petrochemicals Limited.

04. What are the growth drivers of the India Polypropylene Market?

Growth in the India Polypropylene market is driven by rising demand for polypropylene in packaging and automotive applications, as well as government support for domestic petrochemical production.

05. What are the opportunities in the India Polypropylene Market?

Opportunities in the India Polypropylene market lie in the expansion of production capacities, increasing applications in medical devices, and the growing demand for lightweight automotive components.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.