India Portable Fire Extinguisher Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD8116

December 2024

96

About the Report

India Portable Fire Extinguisher Market Overview

- The India portable fire extinguisher market is valued at USD 700 million, driven by increasing industrial activities, urbanization, and stringent fire safety regulations. These factors have boosted the demand for fire extinguishers across residential, commercial, and industrial sectors. Government initiatives, such as mandatory fire safety equipment in buildings and vehicles, are key drivers of this market, leading to a robust growth trajectory.

- In terms of regional dominance, metropolitan cities like Mumbai, Delhi, and Bengaluru are the key players in the market. These cities dominate due to their high population density, extensive industrial activity, and increasing urban development, which necessitate strict adherence to fire safety regulations. Additionally, these urban centers house many commercial and residential complexes, further driving the demand for portable fire extinguishers.

- In 2024, the government made amendments to the National Building Code, mandating that all educational institutions, healthcare facilities, and public buildings have portable fire extinguishers on every floor. The new regulation will impact more than 100,000 buildings nationwide, driving demand for portable fire extinguishers.

India Portable Fire Extinguisher Market Segmentation

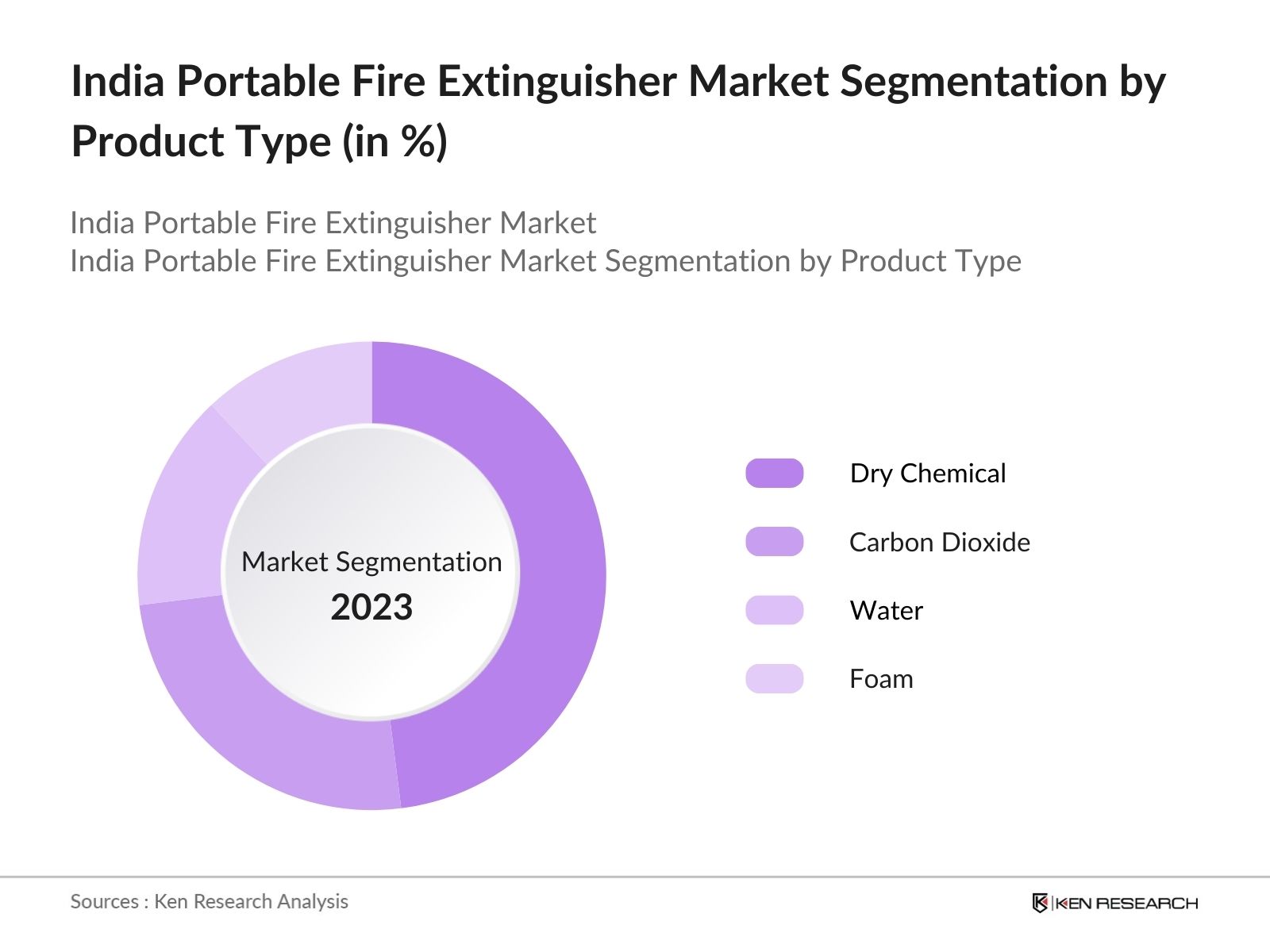

By Product Type: The market is segmented by product type into Dry Chemical, Carbon Dioxide, Water, and Foam extinguishers. Among these, dry chemical fire extinguishers dominate due to their versatility in fighting different classes of fires, including electrical and liquid-based fires. These extinguishers are widely used in industrial and commercial settings, contributing to their market dominance.

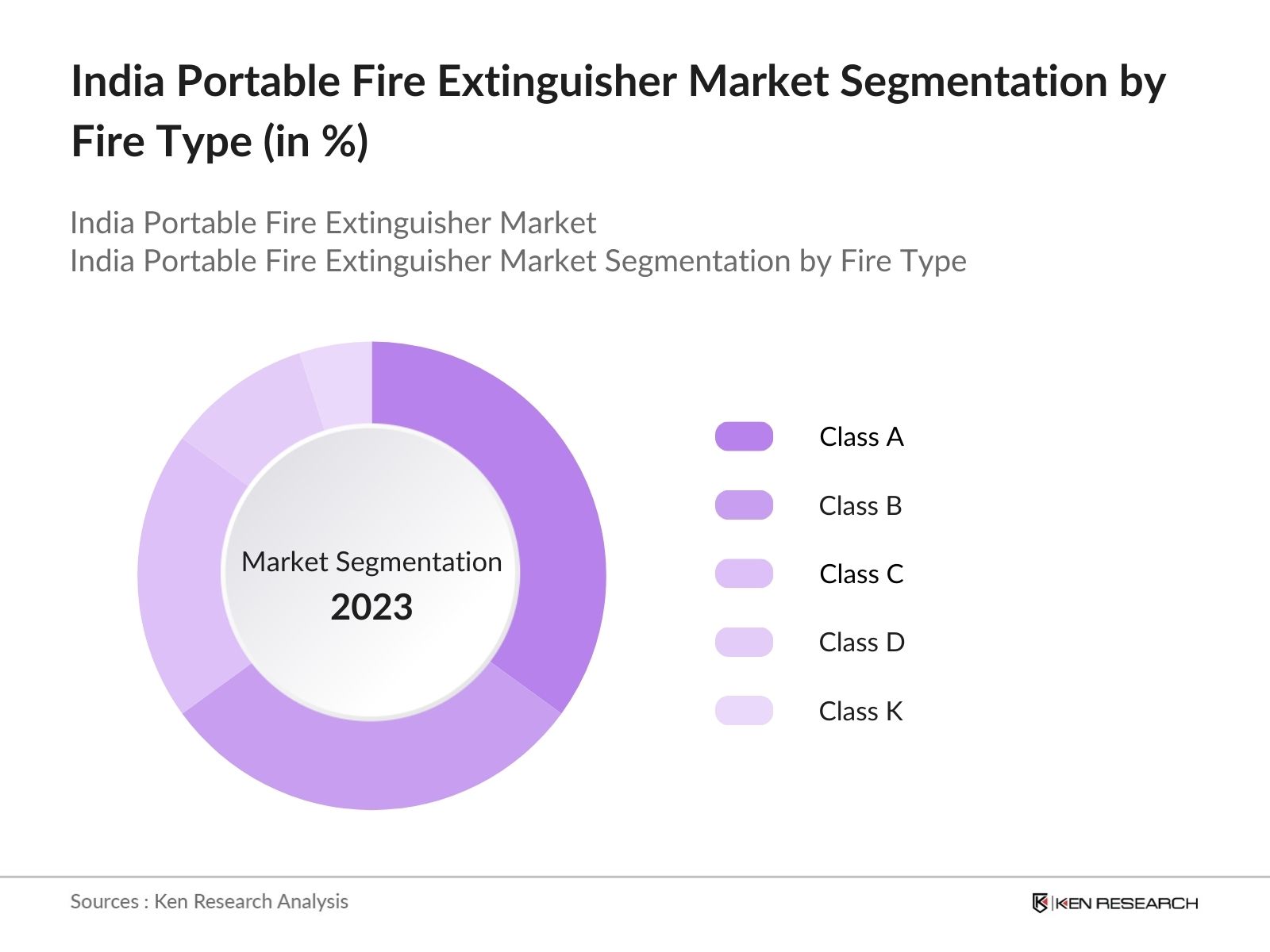

By Fire Type: The market is also segmented by fire type into Class A, Class B, Class C, Class D, and Class K. Class A extinguishers lead the segment, as they are effective in combating fires involving combustible materials like wood, paper, and fabric, which are common in both residential and commercial environments. The widespread use of these materials in everyday applications makes Class A extinguishers the most sought-after solution.

By Fire Type: The market is also segmented by fire type into Class A, Class B, Class C, Class D, and Class K. Class A extinguishers lead the segment, as they are effective in combating fires involving combustible materials like wood, paper, and fabric, which are common in both residential and commercial environments. The widespread use of these materials in everyday applications makes Class A extinguishers the most sought-after solution.

India Portable Fire Extinguisher Market Competitive Landscape

The market is characterized by the presence of several major players, both global and local. Key companies are heavily involved in strategic initiatives like product innovations, mergers, and partnerships to strengthen their market position.

|

Company |

Established |

Headquarters |

Product Range |

Revenue (USD Mn) |

Certifications |

Manufacturing Facilities |

Partnerships |

Global Reach |

Strategic Initiatives |

|

Ceasefire Industries Pvt. Ltd |

2002 |

New Delhi, India |

|||||||

|

Johnson Controls Intl |

1885 |

Cork, Ireland |

|||||||

|

Amerex Corporation |

1971 |

Alabama, USA |

|||||||

|

Minimax GmbH |

1902 |

Bad Oldesloe, Germany |

|||||||

|

Fike Corporation |

1945 |

Missouri, USA |

India Portable Fire Extinguisher Market Analysis

Market Growth Drivers

- Increased Awareness of Fire Safety Regulations in 2024 With India facing an increasing number of fire-related incidents in recent years, the Indian government has intensified its efforts to promote fire safety regulations. In 2024, the government expects to carry out approximately 12,000 awareness programs across urban and rural areas. This is likely to drive the demand for portable fire extinguishers, as the general population becomes more aware of the mandatory fire safety measures required in residential and commercial establishments.

- Growth in Construction Activities in 2024 India's construction sector is projected to witness rapid growth, driven by the governments focus on infrastructure development, including smart city projects and urban expansion. According to government data, over 1.5 million new residential and commercial buildings are expected to be completed by the end of 2024, all of which will be required by law to install fire safety equipment, including portable fire extinguishers, to comply with the National Building Code.

- Expansion of Manufacturing Sector in 2024 The Indian governments push for "Make in India" has led to growth in the countrys manufacturing sector. According to the Ministry of Commerce, the number of manufacturing units is expected to rise by 20,000 by the end of 2024. These units are legally mandated to install fire extinguishers, which is expected to boost the demand for portable fire extinguishers in industrial settings.

Market Challenges

- Stringent Regulatory Requirements In 2024, the Bureau of Indian Standards (BIS) introduced updated safety standards for fire extinguishers, which include stricter compliance and testing requirements. This has increased production costs for manufacturers, making it challenging for small and medium enterprises to remain competitive, especially in price-sensitive segments.

- Lack of Skilled Personnel for Maintenance and Inspection Portable fire extinguishers require regular maintenance and inspection to ensure they remain functional. A 2024 government report estimates that India has a shortage of over 25,000 certified fire safety professionals, which poses a challenge to maintaining fire safety equipment, especially in smaller towns and rural areas.

India Portable Fire Extinguisher Market Future Outlook

Over the next five years, the India portable fire extinguisher market is expected to witness growth. This expansion will be driven by rising fire safety awareness, the government's increasing regulatory push, and the growing use of fire safety systems in vehicles and commercial buildings.

Future Market Opportunities

- Government Support for Domestic Manufacturing: The Indian government is expected to continue supporting domestic manufacturing through subsidies and tax benefits. By 2029, local manufacturers will likely supply 80% of the markets demand, reducing dependency on imports and making high-quality portable fire extinguishers more affordable.

- Rise in Demand from the Healthcare and Education Sectors: Over the next five years, fire safety standards in healthcare and educational institutions are projected to tighten, driving demand for portable fire extinguishers. By 2029, an estimated 30,000 additional schools and hospitals will be equipped with extinguishers due to government mandates, ensuring a safer environment for students and patients.

Scope of the Report

|

Agent Type |

Dry Chemical Carbon Dioxide Foam Water |

|

Fire Type |

Class A Class B Class C Class D |

|

Application |

Residential Commercial Industrial |

|

Distribution Channel |

Online Retail Specialty Stores Department Stores |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Fire Safety Equipment Manufacturers

Industrial Facility Operators

Government & Regulatory Bodies (Bureau of Indian Standards, National Fire Protection Association)

Insurance Companies

Investor and Venture Capitalist Firms

Automotive Manufacturers

Private Equity Firms

Banks and Financial Institution

Companies

Players Mentioned in the Report:

Ceasefire Industries Pvt. Ltd.

Johnson Controls International PLC

Amerex Corporation

Minimax GmbH

Fike Corporation

FlameStop Australia Pty Ltd

Kidde Fire Systems

First Alert Inc.

Britannia Fire= Ltd.

Buckeye Fire Equipment

Table of Contents

India Portable Fire Extinguisher Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

India Portable Fire Extinguisher Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

India Portable Fire Extinguisher Market Analysis

3.1 Growth Drivers [Government Fire Safety Regulations, Increasing Construction Projects, Industrial Expansion, Public Safety Awareness]

3.2 Market Challenges [High Product Costs, Low Awareness in Rural Areas, Lack of Maintenance Infrastructure, Price Sensitivity]

3.3 Opportunities [Technological Advancements, Expansion in Tier 2 and 3 Cities, Demand for Eco-friendly Solutions, Smart Fire Extinguishers]

3.4 Market Trends [Smart Extinguishers, IoT Integration, Eco-friendly Agents, Increased Commercial Demand]

3.5 SWOT Analysis

India Portable Fire Extinguisher Market Segmentation

4.1 By Agent Type (In Value %)

4.1.1 Dry Chemical Extinguishers

4.1.2 Carbon Dioxide Extinguishers

4.1.3 Foam-based Extinguishers

4.1.4 Water Extinguishers

4.2 By Fire Type (In Value %)

4.2.1 Class A (Solid Combustibles)

4.2.2 Class B (Flammable Liquids)

4.2.3 Class C (Electrical Equipment)

4.2.4 Class D (Combustible Metals)

4.3 By Application (In Value %)

4.3.1 Residential

4.3.2 Commercial

4.3.3 Industrial

4.4 By Distribution Channel (In Value %)

4.4.1 Online Retail

4.4.2 Specialty Stores

4.4.3 Department Stores

4.5. By Region (In Value %)

4.5.1 North

4.5.2. South

4.5.3. West

4.5.4. East

India Portable Fire Extinguisher Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Amerex Corporation

5.1.2 Britannia Fire Ltd.

5.1.3 Ceasefire Industries Pvt. Ltd.

5.1.4 Minimax GmbH & Co. KG

5.1.5 Kidde Fire Systems

5.1.6 FlameStop Australia Pty Ltd

5.1.7 First Alert, Inc.

5.1.8 HATSUTA Seisakusho Co. Ltd.

5.1.9 Johnson Controls International PLC

5.1.10 Koetter Fire Protection LLC

5.1.11 Fike Corporation

5.1.12 Balafire

5.1.13 SHM Shipcare

5.1.14 Vimal Fire Controls Pvt. Ltd.

5.1.15 Feuerschutz Jockel Gmbh & Co. Kg

5.2 Cross Comparison Parameters [No. of Employees, Headquarters, Inception Year, Revenue, Product Range, Certifications, Distribution Network, Strategic Alliances]

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity Investments

India Portable Fire Extinguisher Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

India Portable Fire Extinguisher Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

India Portable Fire Extinguisher Market Segmentation

8.1 By Agent Type (In Value %)

8.2 By Fire Type (In Value %)

8.3 By Application (In Value %)

8.4 By Distribution Channel (In Value %)

8.5. By Region (In Value %)

India Portable Fire Extinguisher Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Marketing Initiatives

9.3 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved identifying and defining key variables influencing the market. Extensive desk research, supported by both secondary and proprietary databases, was conducted to gather industry-level data.

Step 2: Market Analysis and Construction

Historical market data was compiled and analyzed, focusing on factors like market penetration, growth trends, and service provider-to-consumer ratios.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through telephone interviews with industry experts, providing insights into operational and financial parameters directly from market practitioners.

Step 4: Research Synthesis and Final Output

The final step involved engagement with fire extinguisher manufacturers to acquire in-depth data on product performance, sales, and consumer preferences, complementing the bottom-up analysis for a comprehensive report.

Frequently Asked Questions

01. How big is the India Portable Fire Extinguisher Market?

The India portable fire extinguisher market is valued at USD 700 million, driven by increasing urbanization and stringent fire safety regulations.

02. What are the challenges in the India Portable Fire Extinguisher Market?

Key challenges in the India portable fire extinguisher market include high raw material costs, limited awareness in rural areas, and price sensitivity, which affects market penetration in cost-conscious segments.

03. Who are the major players in the India Portable Fire Extinguisher Market?

Major players in the India portable fire extinguisher market include Ceasefire Industries, Johnson Controls, Amerex Corporation, Minimax GmbH, and Fike Corporation, all known for their extensive product portfolios and innovative fire safety solutions.

04. What are the growth drivers of the India Portable Fire Extinguisher Market?

The India portable fire extinguisher market is propelled by factors like rising fire safety awareness, government regulations, and the expansion of industrial activities that require stringent fire safety measures.

05. What are the recent trends in the India Portable Fire Extinguisher Market?

Recent trends in the India portable fire extinguisher market include the introduction of smart extinguishers with IoT capabilities, environmentally friendly agents, and increased adoption of fire safety solutions in vehicles and commercial spaces.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.