India Power Market Outlook to 2030

Region:Asia

Author(s):Shambhavi Awasthi

Product Code:KROD966

July 2024

100

About the Report

India Power Market Overview

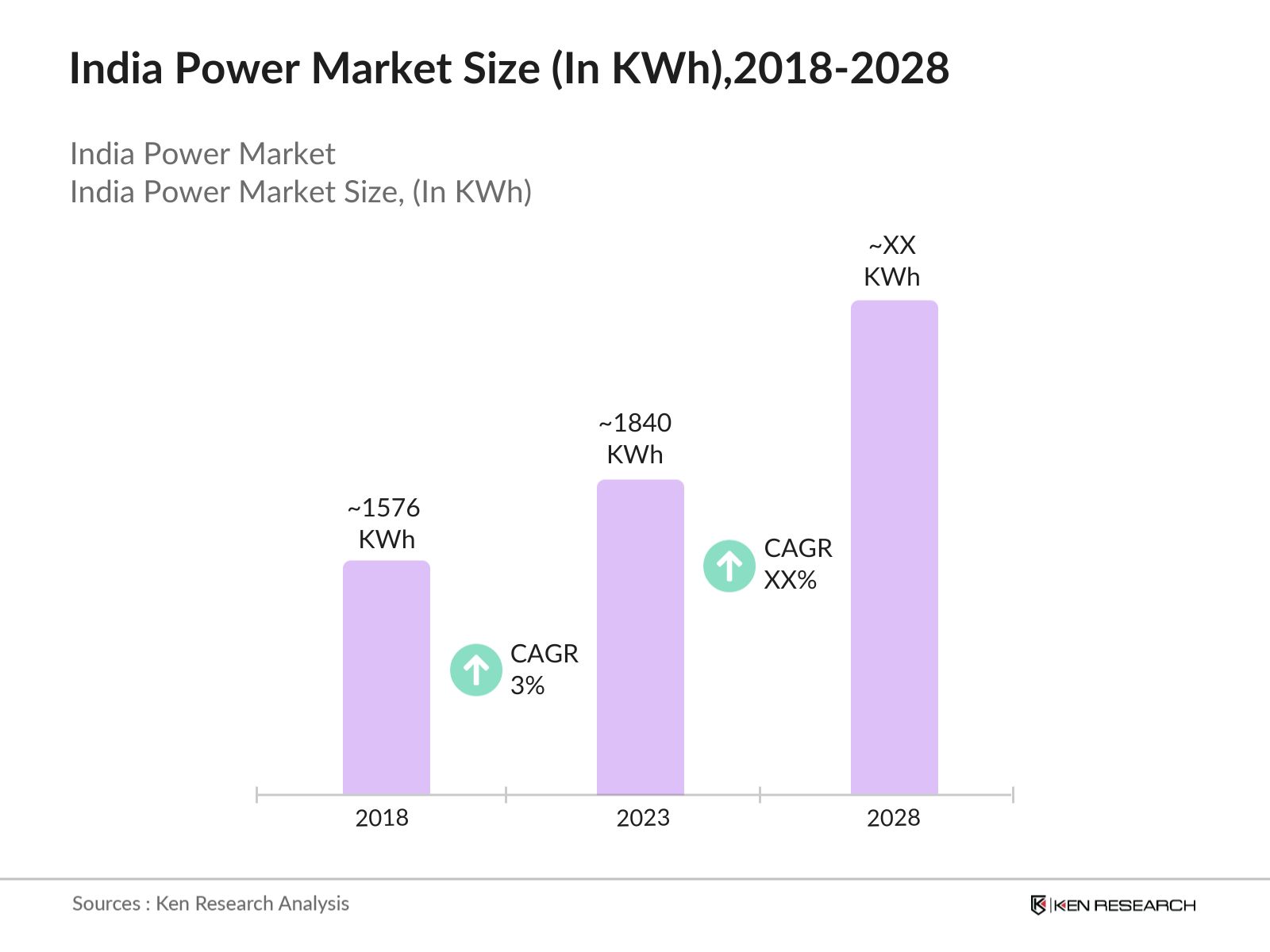

- The India power market was volumed 1840 KWh in 2023 which was 1576 KWh in 2018. The market size is driven by several factors including Expansion of Renewable Energy Capacity, Initiatives such as the Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya) and the Ujjwal Bharat Scheme are enhancing electricity access and promoting efficient power usage.

- Key players in the Indian power market include NTPC Limited, Tata Power Company Limited, Adani Power Limited, and Reliance Power Limited. NTPC Limited stands as the largest power company in India with a substantial share in the generation of electricity, followed by Tata Power with its diverse portfolio in thermal, hydro, solar, and wind energy.

- In 2023, NTPC Renewable Energy Limited (NTPC REL) secured a bid for an 80 MW floating solar project at the Omkareshwar Reservoir in Madhya Pradesh. This project will increase NTPC's total floating solar capacity to 342 MW.

- In 2023, Maharashtra emerged as the dominant state in the India power market. The state’s dominance is attributed to its extensive industrial base, high population density, and robust economic activities, which collectively drive significant electricity demand. The presence of major industries, large urban centers, and ongoing infrastructure development contribute to Maharashtra’s leading position in the power sector.

India Power Market Segmentation

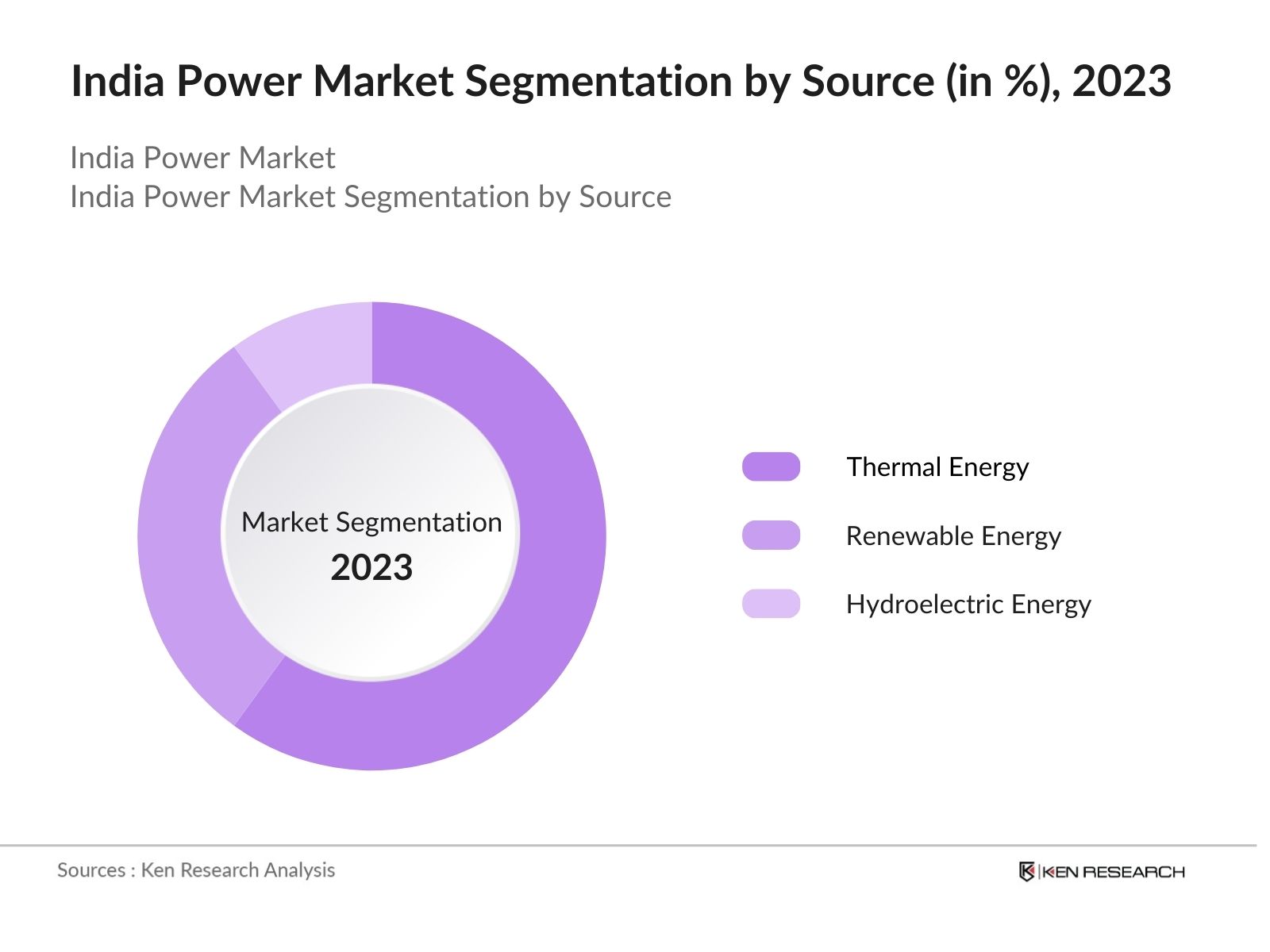

By Source: The India power market can be segmented by the source of energy into thermal power, renewable energy, and hydroelectric power. Thermal Power dominated this market segment in 2023. This dominance is due to the abundant availability of coal in India, making it a cost-effective source of energy. Despite the push towards renewable energy, coal remains a crucial part of India's energy mix due to its reliability and established infrastructure.

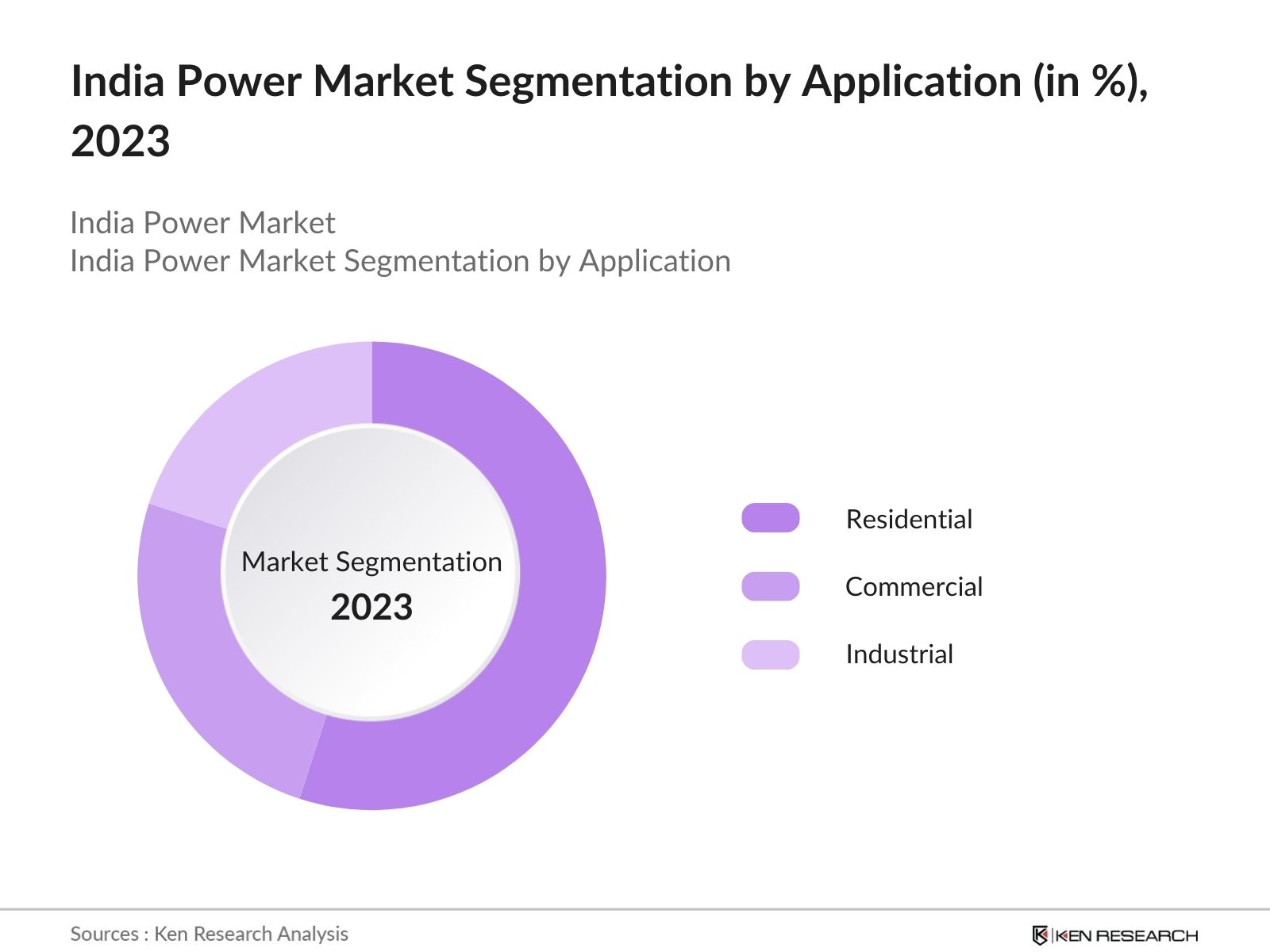

By Application: The India Power market is segmented by application into residential, commercial, and industrial sectors. The residential segment held the largest share in the India Power Market in 2023. The increasing urban population and rising disposable incomes have led to higher electricity consumption in urban areas. Additionally, the proliferation of electronic appliances and air conditioning units in urban households has significantly contributed to this growth.

By Region: The regional segmentation of the India power market includes North, South, East, and West regions. The North region, including states like Uttar Pradesh and Haryana, dominated the market in 2023. This dominance is attributed to the region's high population density and significant industrial activity, leading to increased electricity demand. North region has a well-established grid infrastructure and substantial investments in renewable energy projects, further supporting its leading position in the market.

India Power Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

NTPC Limited |

1975 |

New Delhi, India |

|

Tata Power Company Limited |

1911 |

Mumbai, India |

|

Adani Power Limited |

1996 |

Ahmedabad, India |

|

Power Grid Corporation of India |

1989 |

Gurugram, India |

|

Reliance Power Limited |

1995 |

Navi Mumbai, India |

- Adani Power's Acquisition: In 2023, Adani Power Limited acquired Essar Power's 1,200 MW Mahan Project, enhancing its operational capacity and market presence. This acquisition is part of Adani Power's strategy to expand its power generation portfolio and cater to the rising demand for electricity in India.

- Tata Power's Virtual Power Plant (VPP): Tata Power launched India's first Virtual Power Plant in 2023, integrating distributed energy resources for a more resilient and efficient electricity grid. The VPP leverages advanced technologies to optimize power generation, distribution, and consumption, highlighting Tata Power's innovative approach to grid management.

- Reliance Power's Renewable Energy Investments: In 2024, Reliance Power announced an investment of INR 5,000 crore in new solar and wind projects, aiming to add 4,000 MW of renewable capacity to its portfolio. This investment aligns with the company's goal of transitioning to cleaner energy sources and reducing its carbon footprint.

India Power Market Analysis

India Power Market Growth Drivers

- Increasing Power Consumption: Increasing Power Consumption: India's electricity demand is projected to grow by 8% in 2024 to reach 1,700 TWh, driven by the expansion of industrial activities, rapid urbanization, and the addition of new residential and commercial projects. This surge in demand is also influenced by technological advancements, increasing adoption of electric vehicles, and government initiatives aimed at improving energy access and efficiency.

- Government Push for Renewable Energy: Till February 2023, India had a total installed renewable energy capacity of 169 GW, with solar power contributing about 64.38 GW and wind power around 51.79 GW. This expansion is supported by initiatives such as the National Solar Mission and various state-level policies incentivizing renewable energy projects.

- Power Machinery Infrastructure Development: Significant investments are being made in upgrading and expanding the power grid infrastructure across India. In 2019, the government allocated INR 25,000 crore for the modernization of the power grid under the "Integrated Power Development Scheme" (IPDS).

India Power Market Challenges

- High Transmission and Distribution (T&D) Losses: The average cost of supply has risen, and the gap between the average cost of supply and average revenue realized has widened, indicating that while losses have decreased, financial pressures persist. The reduction in AT&C losses to 15.4% reflects progress, but the total energy losses still pose a significant challenge to the sector's sustainability and efficiency.

- Financial Health of Power Distribution Companies (DISCOMs): The financial health of state-owned power distribution companies (DISCOMs) remains a critical challenge. The cumulative debt of DISCOMs (Distribution Companies) in India for 2023 is indeed significant. According to a government report, the total debt of DISCOMs rose to approximately INR 70,000 crore due to increased power demand and associated costs, primarily for funding capital expenditures, working capital, and operational losses.

India Power Market Government Initiatives

- National Green Hydrogen Mission: Launched in 2023, the National Green Hydrogen Mission aims to produce 5 million metric tonnes of green hydrogen annually by 2030. This initiative is expected to significantly contribute to reducing carbon emissions, enhancing energy security, and promoting the use of renewable energy sources like solar and wind power

- Pradhan Mantri Kisan Urja Suraksha evam Utthan Mahabhiyan (PM-KUSUM): The PM-KUSUM scheme, with an allocation of INR 34,000 crore in 2024, aims to support the installation of solar pumps and grid-connected solar power plants in rural areas. This initiative targets installation of 20 lakh standalone solar powered agriculture pumps by 2026, thereby promoting the use of renewable energy in agriculture and rural sectors.

India Power Future Market Outlook

In the next five years, India Power Market will continue to increase its energy capacity. This expansion will be driven by ongoing investments in solar and wind projects, supported by government policies and incentives.

Future Market Trends

- Development of Energy Storage Systems: The development of advanced energy storage systems, such as battery storage, will play a crucial role in stabilizing the power grid and integrating renewable energy sources. By 2028, India aims to install 50 GWh of energy storage capacity, supported by initiatives like the National Energy Storage Mission.

- Expansion of Smart Grid Infrastructure: The expansion of smart grid infrastructure will be a key trend, with the government planning to invest INR 1 lakh crore in smart grid projects by 2028. The deployment of smart meters, automation technologies, and advanced data analytics will improve grid efficiency, reduce losses, and provide better demand management.

- Growth of Distributed Generation: Distributed generation, including rooftop solar and microgrids, will see significant growth over the next five years. The government aims to achieve 40 GW of rooftop solar capacity by 2028, supported by subsidies and net metering policies.

Scope of the Report

Scope of the Report:

|

By Source |

Thermal Power Renewable Energy Hydroelectric Power |

|

By Application |

Residential Commercial Industrial |

|

By Region |

North South West East |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Power Generation Companies

Power Distribution Companies (DISCOMs)

Government and Regulatory Bodies (Ministry of Power, CEA, CERC, BEE etc.)

Renewable Energy Companies

Industrial and Commercial Consumers

Manufacturers of Power Equipment

Banks and Financial Institutions

Time-Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

NTPC Limited

Tata Power Company Limited

Adani Power Limited

Reliance Power Limited

Power Grid Corporation of India

NHPC Limited

Damodar Valley Corporation

JSW Energy Limited

SJVN Limited

Torrent Power

CESC Limited

NLC India Limited

GMR Energy Limited

Lanco Infratech Limited

BHEL (Bharat Heavy Electricals Limited)

Table of Contents

1. India Power Market Overview

1.1 India Power Market Taxonomy

2. India Power Market Size (in Kwh), 2018-2023

3. India Power Market Analysis

3.1 India Power Market Growth Drivers

3.2 India Power Market Challenges and Issues

3.3 India Power Market Trends and Development

3.4 India Power Market Government Regulation

3.5 India Power Market SWOT Analysis

3.6 India Power Market Stake Ecosystem

3.7 India Power Market Competition Ecosystem

4. India Power Market Segmentation, 2023

4.1 India Power Market Segmentation by Source (in value %), 2023

4.2 India Power Market Segmentation by Application (in value %), 2023

4.3 India Power Market Segmentation by Region (in value %), 2023

5. India Power Market Competition Benchmarking

5.1 India Power Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Power Future Market Size (in Kwh), 2023-2028

7. India Power Future Market Segmentation, 2028

7.1 India Power Market Segmentation by Source (in value %), 2028

7.2 India Power Market Segmentation by Application (in value %), 2028

7.3 India Power Market Segmentation by Region (in value %), 2028

8. India Power Market Analysts’ Recommendations

8.1 India Power Market TAM/SAM/SOM Analysis

8.2 India Power Market Customer Cohort Analysis

8.3 India Power Market Marketing Initiatives

8.4 India Power Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 01 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 02 Market Building:

Collating statistics on India Power Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Power Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 03 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 04 Research output:

Our team will approach multiple Power companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Power companies.

Frequently Asked Questions

01 How big is the India Power Market?

The India power market was volumed at 1840 Kwh 2023, driven by increasing urbanization, industrialization, and government initiatives to expand electricity access and promote renewable energy sources.

02 What are the challenges in the India Power Market?

Challenges in the India power market include high transmission and distribution (T&D) losses and financial instability of power distribution companies (DISCOMs).

03 Who are the major players in the India Power Market?

Key players in the India power market include NTPC Limited, Tata Power Company Limited, Adani Power Limited, and Reliance Power Limited. These companies lead the market due to their substantial power generation capacities, diverse energy portfolios, and significant investments in renewable energy projects.

04 What are the growth drivers of the India Power Market?

The India power market is propelled by increasing power consumption, significant government initiatives like the National Green Hydrogen Mission and PM-KUSUM scheme, substantial investments in infrastructure development.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.