India Precious Metals Derivatives Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD7886

October 2024

90

About the Report

India Precious Metals Derivatives Market Overview

- The India Precious Metals Derivatives market is valued at USD 326 billion, supported by increasing investor interest in safe-haven assets. Driven by a volatile macroeconomic environment, including inflationary pressures and currency fluctuations, precious metals such as gold and silver continue to attract significant trading activity. Institutional and retail investors alike are using derivatives to hedge against market risks, pushing volumes higher on platforms like the Multi Commodity Exchange (MCX). The surge in global commodity prices also contributes to the growing demand for precious metals derivatives, making it a highly dynamic market.

- Cities like Mumbai and Ahmedabad dominate the precious metals derivatives market in India due to their established financial infrastructure, proximity to commodity exchanges (MCX, NCDEX), and concentration of financial institutions that participate in derivatives trading. These cities have historically been financial hubs, which makes them attractive for brokers, institutional investors, and retail traders looking to leverage derivative products for hedging, speculative, and arbitrage opportunities. Additionally, Mumbai is home to MCX, the leading commodity exchange in India, further solidifying its dominance in this sector.

- Taxation on derivatives trading remains a significant consideration for market participants. In 2023, the Indian government continued to impose a 0.01% commodities transaction tax (CTT) on non-agricultural commodity derivatives, including precious metals This tax has been a point of contention, as traders argue that it increases transaction costs and hampers market participation. However, the government maintains that the tax helps regulate speculative trading.

India Precious Metals DerivativesMarket Segmentation

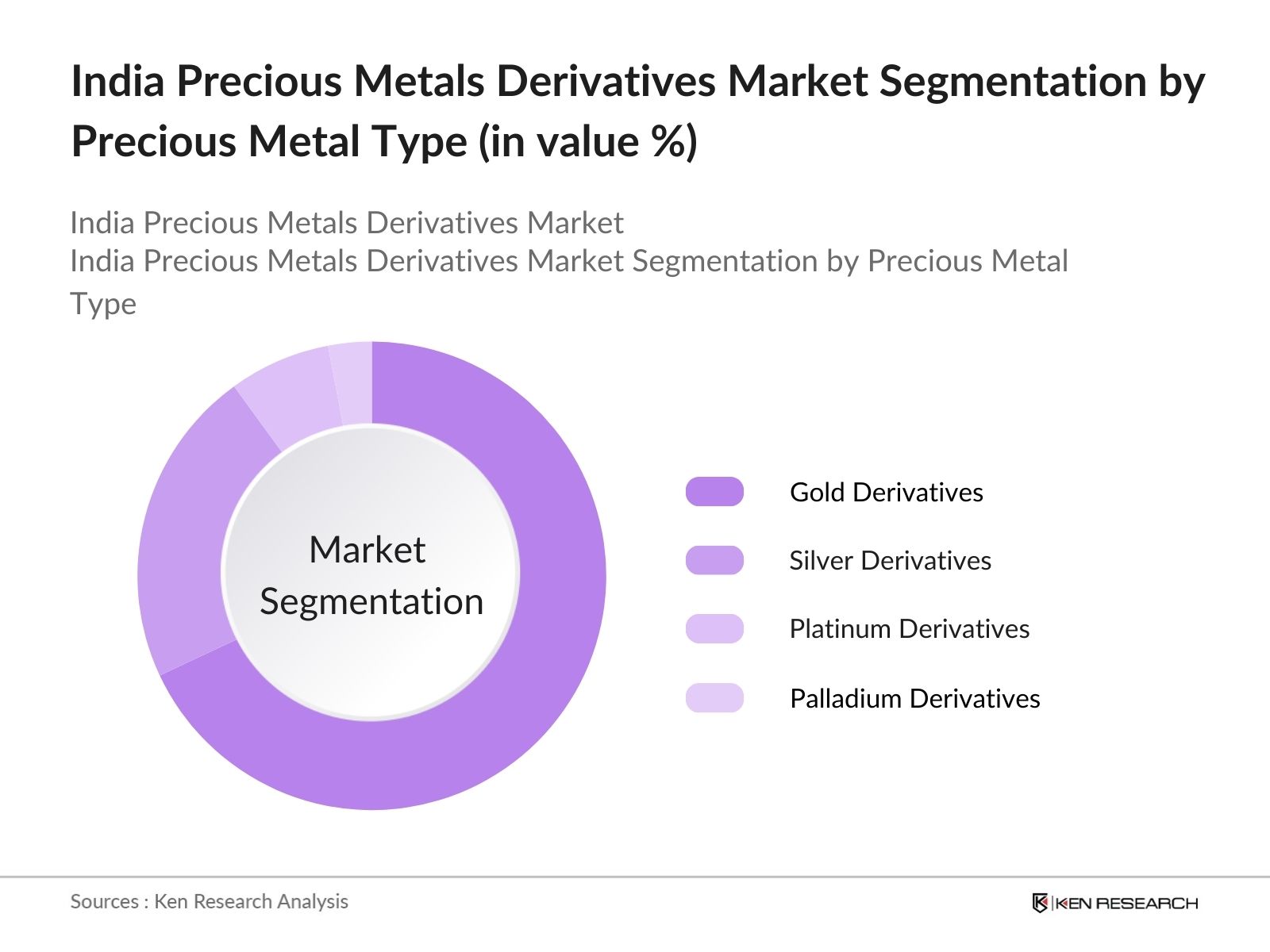

- By Precious Metal Type: India Precious Metals Derivatives market is segmented by metal type into gold derivatives, silver derivatives, platinum derivatives, and palladium derivatives. Gold derivatives dominate this segment due to golds historical significance as a safe-haven asset in times of economic uncertainty. Indian investors view gold as a stable store of value, which translates to higher volumes of gold futures and options contracts. Gold is also a culturally significant asset in India, further driving its dominance. Moreover, the liquidity and trading volumes for gold derivatives on exchanges like MCX remain substantially higher than other metals.

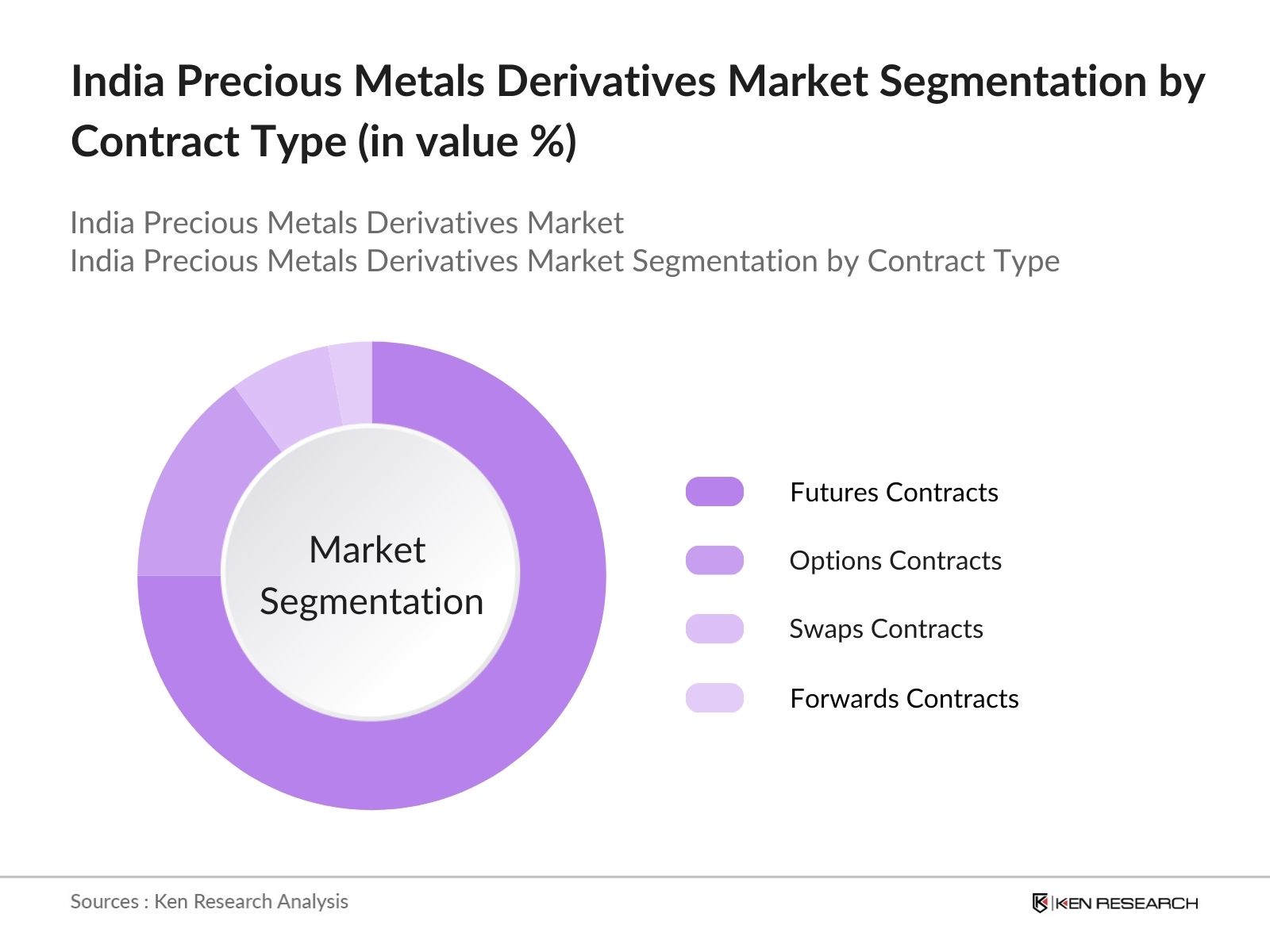

- By Contract Type: India Precious Metals Derivatives market is segmented by contract type into futures contracts, options contracts, swaps, and forwards. Futures contracts hold a dominant share in this segment due to their popularity among retail and institutional investors for speculative and hedging purposes. Futures provide investors with high liquidity and the ability to leverage positions with relatively low margins. Furthermore, futures contracts are highly standardized, which contributes to their widespread use in Indian commodity markets, especially for metals like gold and silver.

India Precious Metals Derivatives Market Competitive Landscape

The India Precious Metals Derivatives market is highly competitive, with key players focusing on providing diverse derivative products, improving trading platforms, and expanding retail participation. The market is dominated by exchanges like MCX and NCDEX, which account for the bulk of trading volumes. Global and domestic brokerage firms play a crucial role in connecting retail and institutional investors to the market, offering research, advisory, and trading solutions. Technological advancements, such as the rise of algorithmic trading and mobile trading platforms, are intensifying competition in this space.

|

Company |

Established Year |

Headquarters |

Market Capitalization |

Trading Volume (2023) |

Derivatives Offering |

Technology Adoption |

Customer Base |

Revenue Growth |

Regulatory Compliance |

|

MCX |

2003 |

Mumbai |

|||||||

|

NCDEX |

2003 |

Mumbai |

|||||||

|

HDFC Securities |

2000 |

Mumbai |

|||||||

|

Zerodha |

2010 |

Bangalore |

|||||||

|

Angel Broking |

1987 |

Mumbai |

India Precious Metals Derivatives Industry Analysis

Marlet Growth Drivers

- Macroeconomic Influence (Inflation, Currency Volatility): India's precious metals derivatives market is heavily influenced by macroeconomic factors such as inflation and currency volatility. In 2023, the Indian rupee showed significant fluctuation against major currencies like the US dollar, with the average value hovering around 82-84 INR/USD. Inflationary pressures in India, as measured by the Consumer Price Index, rose to 5.9% in early 2024, impacting investor behavior in hedging against currency devaluation through precious metals derivatives. This environment has driven demand for gold and silver futures, as these assets are considered safe havens in periods of economic uncertainty.

- Rising Investment Demand for Precious Metals: With the ongoing global economic uncertainties, investment demand for precious metals in India surged in 2023. Gold imports amounted to 650 metric tons, a sharp increase compared to 2022. As a result, derivative contracts linked to precious metals saw heightened activity. The Bombay Stock Exchange (BSE) reported an increase in gold derivative volumes by 10% in 2023. Precious metals derivatives have become more attractive as a hedge against inflation and currency volatility, especially for institutional investors managing portfolio risks.

- Global Commodity Market Trends: Global commodity market trends, especially fluctuations in gold and silver prices, are key drivers for Indias precious metals derivatives market. Gold prices, which reached $1,950 per ounce in mid-2024, were driven by geopolitical tensions and rising interest rates globally, making Indias derivatives market a critical platform for hedging and speculation. Additionally, the correlation between global oil prices and precious metals has seen corporates utilize precious metal derivatives to balance their exposure.

Market Restraints

- Regulatory Barriers: Despite significant growth, regulatory barriers continue to pose challenges for India's precious metals derivatives market. The Securities and Exchange Board of India (SEBI) maintains stringent oversight of derivative products, limiting certain speculative activities. In 2023, SEBI introduced new margin requirements, which raised compliance costs for small and medium-sized traders. Additionally, regulations related to foreign direct investment (FDI) in commodities derivatives have slowed market participation from global investors.

- Market Liquidity Constraints: Liquidity constraints remain a critical challenge in Indias precious metals derivatives market, particularly for smaller contracts. In 2024, daily trading volumes in silver futures, for example, fell below 10,000 contracts on some trading days. This limited liquidity hinders price discovery and reduces market efficiency, particularly for institutional players seeking to execute large trades without significant market impact.

India Precious Metals Derivatives Market Future Outlook

Over the next five years, the India Precious Metals Derivatives market is expected to see significant growth, driven by increasing participation from retail investors, the introduction of new derivative products, and technological innovations in trading platforms. As global economic uncertainties continue, precious metals are anticipated to remain a key asset class for hedging and speculation. Additionally, regulatory reforms by SEBI and growing financial literacy are expected to bring more retail investors into the derivatives market. This period will likely see an expansion of the market into Tier 2 and Tier 3 cities, further enhancing the markets growth prospects.

Market Opportunities

- Launch of New Derivative Products: The Indian market is set to benefit from the launch of new derivative products, especially around precious metals. In 2024, the Multi Commodity Exchange (MCX) introduced a platinum futures contract, adding diversity to the market offerings. With growing demand for precious metals as investment and hedging tools, these new products offer opportunities for both institutional and retail investors to engage with more specific contracts tailored to their needs.

- Integration with Global Derivatives Markets: India's integration with global derivatives markets is creating substantial opportunities. Cross-listing of Indian derivative products on platforms like the London Metal Exchange (LME) is under discussion as of 2024. Such integration is expected to deepen liquidity and enhance price discovery for Indian derivatives. The Reserve Bank of India (RBI) has also been working towards liberalizing capital account convertibility, further facilitating global participation in Indias precious metals derivatives market.

Scope of the Report

|

By Precious Metal Type |

- Gold Derivatives |

|

By Contract Type |

- Futures Contracts |

|

By Investor Type |

- Institutional Investors |

|

By Exchange |

- MCX |

|

By Region |

- Northern India |

Products

Key Target Audience

Institutional Investors

Retail Investors

Commodity Brokers

Derivative Product Innovators

Commodity Exchanges (MCX, NCDEX)

Government and Regulatory Bodies (SEBI, RBI)

Investment and Venture Capitalist Firms

Commercial Hedgers (Jewelry Manufacturers, Industrial Users)

Companies

Players Mentioned in the Report:

MCX

NCDEX

HDFC Securities

Zerodha

Angel Broking

Motilal Oswal

ICICI Securities

Kotak Securities

SMC Global Securities

Sharekhan

Religare Securities

Edelweiss Financial Services

IIFL Securities

Axis Securities

Geojit Financial Services

Table of Contents

1. India Precious Metals Derivatives Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Precious Metals Derivatives Market Size (In INR Bn/USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Precious Metals Derivatives Market Analysis

3.1. Growth Drivers

3.1.1. Macroeconomic Influence (Inflation, Currency Volatility)

3.1.2. Rising Investment Demand for Precious Metals

3.1.3. Global Commodity Market Trends

3.1.4. Increasing Hedging Activities by Corporates

3.2. Market Challenges

3.2.1. Regulatory Barriers

3.2.2. Market Liquidity Constraints

3.2.3. High Transaction Costs

3.2.4. Geopolitical Instabilities Affecting Metal Prices

3.3. Opportunities

3.3.1. Launch of New Derivative Products

3.3.2. Integration with Global Derivatives Markets

3.3.3. Development of Sustainable Investment Products

3.3.4. Expansion of Retail Investor Base

3.4. Trends

3.4.1. Digitalization of Trading Platforms

3.4.2. Use of Algorithmic Trading in Derivatives

3.4.3. Growing Interest in ESG-Compliant Investment

3.4.4. Increase in Hedging by Jewelry and Electronics Sectors

3.5. Government Regulation

3.5.1. SEBI Guidelines on Commodity Derivatives

3.5.2. Tax Implications on Derivatives Trading

3.5.3. Cross-Border Regulations (Capital Account Convertibility)

3.5.4. Integration with Global Commodities Regulation (Dodd-Frank Act, EMIR)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Exchanges, Brokers, Clearinghouses, Regulators)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Precious Metals Derivatives Market Segmentation

4.1. By Precious Metal Type (In Value %)

4.1.1. Gold Derivatives

4.1.2. Silver Derivatives

4.1.3. Platinum Derivatives

4.1.4. Palladium Derivatives

4.2. By Contract Type (In Value %)

4.2.1. Futures Contracts

4.2.2. Options Contracts

4.2.3. Swaps Contracts

4.2.4. Forwards Contracts

4.3. By Investor Type (In Value %)

4.3.1. Institutional Investors

4.3.2. Retail Investors

4.3.3. Commercial Hedgers (Jewelry, Manufacturing)

4.3.4. Speculators

4.4. By Exchange (In Value %)

4.4.1. Multi Commodity Exchange (MCX)

4.4.2. National Commodity & Derivatives Exchange (NCDEX)

4.4.3. National Stock Exchange (NSE)

4.4.4. Bombay Stock Exchange (BSE)

4.5. By Region (In Value %)

4.5.1. Northern India

4.5.2. Southern India

4.5.3. Western India

4.5.4. Eastern India

5. India Precious Metals Derivatives Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. MCX

5.1.2. NCDEX

5.1.3. NSE

5.1.4. BSE

5.1.5. HDFC Securities

5.1.6. Motilal Oswal

5.1.7. ICICI Securities

5.1.8. Zerodha

5.1.9. Angel Broking

5.1.10. Edelweiss Financial Services

5.1.11. Kotak Securities

5.1.12. Religare Securities

5.1.13. SMC Global Securities

5.1.14. IIFL Securities

5.1.15. Sharekhan

5.2. Cross Comparison Parameters (Trading Volume, Market Share, Derivatives Offering, Market Capitalization, Trading Platform, Fee Structure, Customer Base, Presence in Precious Metals)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Collaborations, Partnerships)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Precious Metals Derivatives Market Regulatory Framework

6.1. Regulatory Bodies and Oversight (SEBI, RBI, FMC)

6.2. Compliance Requirements for Brokers and Exchanges

6.3. Certification Processes for Precious Metals Derivatives

7. India Precious Metals Derivatives Future Market Size (In INR Bn/USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Precious Metals Derivatives Future Market Segmentation

8.1. By Precious Metal Type (In Value %)

8.2. By Contract Type (In Value %)

8.3. By Investor Type (In Value %)

8.4. By Exchange (In Value %)

8.5. By Region (In Value %)

9. India Precious Metals Derivatives Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Investor Sentiment Analysis

9.3. Marketing Strategies for Brokers and Exchanges

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the key stakeholders of the India Precious Metals Derivatives market, which includes exchanges, brokers, retail and institutional investors, and regulators. Primary and secondary data sources such as MCX annual reports, SEBI publications, and proprietary research databases are utilized to gather critical variables affecting the market.

Step 2: Market Analysis and Construction

In this phase, historical data is analyzed to assess trading volumes, open interest in derivatives contracts, and the impact of macroeconomic variables like currency fluctuations and commodity prices on trading behavior. The data collected is then used to estimate the market's size and structure accurately.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are developed and validated through consultations with market practitioners, including traders, brokers, and exchange representatives. These expert interviews provide real-time insights into trading behaviors, regulatory impacts, and market trends, which are vital for accurate market forecasts.

Step 4: Research Synthesis and Final Output

Finally, the data and insights gathered are synthesized into a comprehensive report, complete with market forecasts, growth drivers, challenges, and competitive landscape analysis. The final report provides a holistic view of the India Precious Metals Derivatives market, serving as a valuable resource for stakeholders.

Frequently Asked Questions

01. How big is the India Precious Metals Derivatives Market?

The India Precious Metals Derivatives market was valued at USD 326 billion, driven by increased investor interest in safe-haven assets like gold and silver, and rising trading volumes on exchanges like MCX.

02. What are the key challenges in the India Precious Metals Derivatives Market?

The market faces challenges such as regulatory barriers, liquidity constraints, and geopolitical risks affecting metal prices. High transaction costs also pose a barrier to wider adoption, especially among retail investors.

03. Who are the major players in the India Precious Metals Derivatives Market?

Major players in the market include MCX, NCDEX, HDFC Securities, Zerodha, and Angel Broking, with MCX accounting for the majority of trading volumes due to its wide range of derivative offerings and liquidity.

04. What drives the growth of the India Precious Metals Derivatives Market?

The growth of the market is driven by factors such as economic uncertainty, rising global commodity prices, and increased participation from both institutional and retail investors. The launch of new derivative products and technological advancements are also key growth drivers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.