India Premium Carbonated Soft Drinks Market Outlook to 2030

Region:Asia

Author(s):Rebecca Mary Reji

Product Code:KROD11443

June 2025

90

About the Report

India Premium Carbonated Soft Drinks Market Overview

- India Premium Carbonated Soft Drinks Market is experiencing remarkable growth in recent years. This is reflected by the growth of the overall India Carbonated Soft Drinks Market, which reached a market size of USD 19.5 Bn, driven by rising disposable incomes, evolving consumer preferences toward premium beverages, increasing urbanization, and the growing popularity of flavored and functional drinks among young consumers.

- Key cities dominating the India Premium Carbonated Soft Drinks Market include Mumbai, Delhi, and Bangalore. These metropolitan hubs have a high concentration of affluent, health-conscious, and trend-driven consumers who actively seek premium beverage experiences. The cities are characterized by upscale retail outlets, boutique cafés, and luxury hospitality venues that prioritize premium offerings. The presence of specialty stores, modern trade channels, and exclusive brand activations further accelerates the adoption and growth of premium carbonated soft drinks in these urban markets.

- In recent years, the Indian government and regulatory bodies have actively encouraged beverage manufacturers in the premium carbonated soft drinks segment to reduce sugar content as part of broader public health initiatives. Although there is no official mandate specifying a maximum sugar limit of 10 grams per 100 ml, premium brands are increasingly shifting towards lower-sugar and zero-sugar formulations in response to heightened health awareness and government campaigns promoting healthier consumption habits.

India Premium Carbonated Soft Drinks Market Segmentation

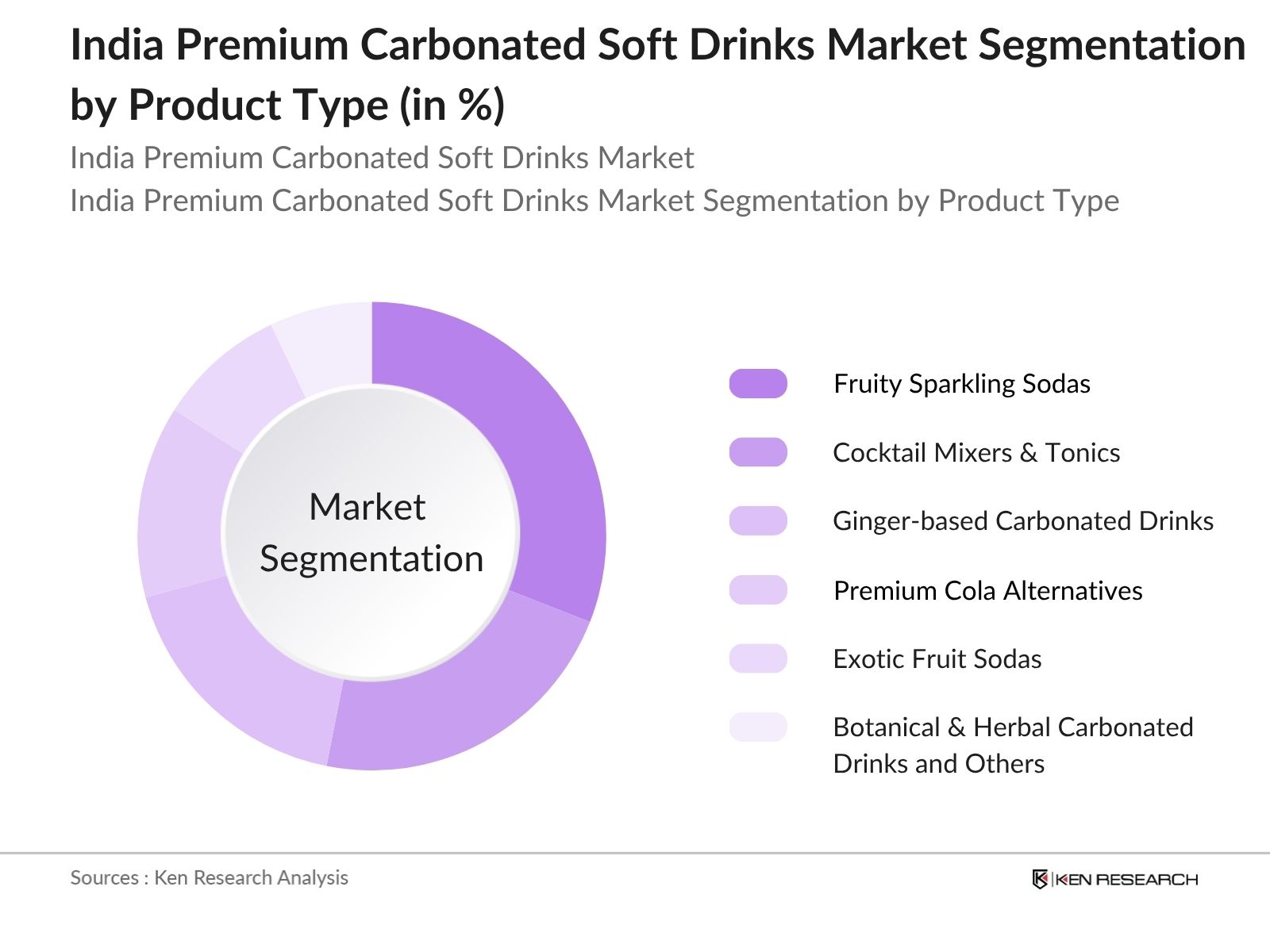

By Type: The market is segmented into Fruity Sparkling Sodas, Cocktail Mixers & Tonics, Ginger based Carbonated Drinks, Premium Cola Alternatives, Exotic Fruit Sodas, and Botanical & Herbal Carbonated Drinks. Among these, Fruity Sparkling Sodas dominate the premium segment due to their rising use in at-home mixology and upscale beverage experiences. These mixers are increasingly popular among urban millennials and Gen Z consumers seeking sophisticated, bar-style drinks at home. The shift toward experimentation, natural ingredients, and premiumization is reshaping consumer preferences across all categories.

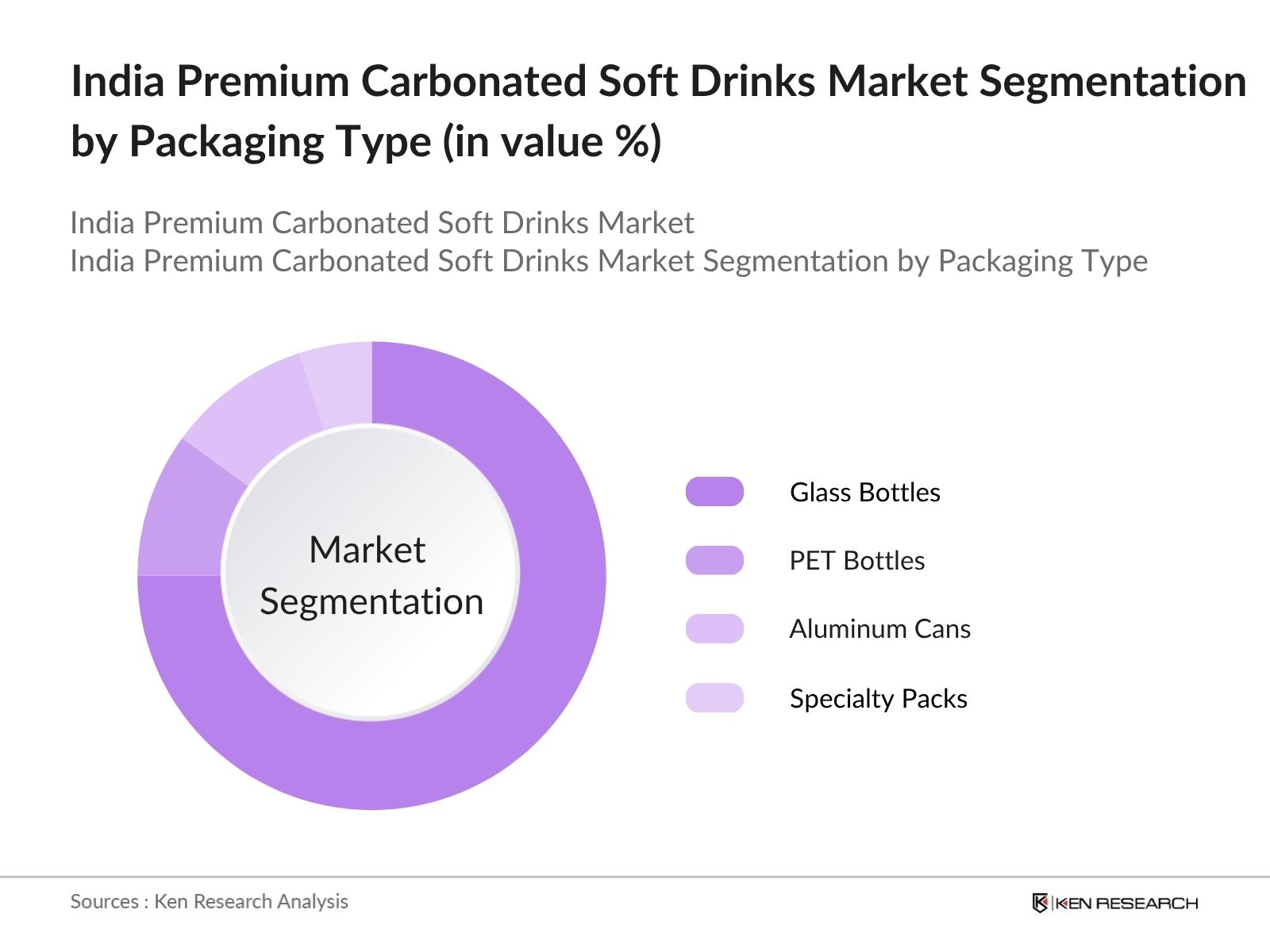

By Packaging Type: The market is categorized into Glass Bottles, PET Bottles, Aluminum Cans, and Specialty Packs. Glass bottles dominate the segment, driven by their premium appeal, reusability, and strong association with high-quality and craft beverages. They are especially favored in upscale dining, hospitality, and niche premium brands aiming to enhance customer perception. Aluminum cans follow closely, valued for their lightweight nature, portability, and superior recyclability—attributes that resonate well with younger, environmentally conscious consumers.

India Premium Carbonated Soft Drinks Market Competitive Landscape

The India Premium Carbonated Soft Drinks Market is characterized by intense competition among both local and international players. Major companies such as Coca-Cola, PepsiCo, and Parle Agro dominate the landscape, leveraging their extensive distribution networks and strong brand recognition. The market is also witnessing the entry of niche players focusing on health-oriented and innovative beverage options, which adds to the competitive dynamics.

India Premium Carbonated Soft Drinks Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness Among Consumers: The Indian market is witnessing a notable shift towards health-oriented products, with approximately 48% of consumers actively seeking beverages with lower sugar content. This trend is driven by rising awareness of health issues, resulting in an estimated 12% increase in demand for low-calorie carbonated drinks in 2023. The Food Safety and Standards Authority of India (FSSAI) continues to encourage manufacturers to innovate healthier options, further supporting this growth driver.

- Rising Disposable Incomes and Urbanization: With India's GDP growth projected at around 6.3% in 2024, disposable incomes are steadily increasing, especially in urban centers. The urban population is expected to surpass 560 million by 2025, fueling increased spending on premium products. This demographic shift is contributing to an approximate 14% year-on-year growth in the premium carbonated soft drinks segment, as consumers show greater willingness to pay for quality and brand prestige.

- Innovative Product Offerings and Flavor Varieties: The introduction of unique flavors and innovative product lines continues to drive market expansion. In 2023, over 28 new premium carbonated beverages were launched, catering to diverse consumer preferences. This innovation is backed by a 22% increase in R&D spending among leading brands, enabling them to capture niche markets and enhance consumer engagement through tailored offerings.

Market Challenges

- Intense competition characterizes the Indian premium carbonated soft drinks market: Major players like Coca-Cola and PepsiCo commanding a substantial portion of the market. This rivalry drives aggressive pricing strategies and extensive marketing campaigns, creating significant barriers for new entrants attempting to establish themselves. In recent years, promotional spending has notably increased, further heightening competition and putting pressure on profit margins across the industry.

- Regulatory compliance and health concerns present ongoing challenges for manufacturers: The Food Safety and Standards Authority of India (FSSAI) has implemented stringent regulations on sugar content and labeling, leading to increased compliance costs that disproportionately affect smaller companies. Meanwhile, rising consumer awareness about health and sugar intake is encouraging a gradual shift away from traditional carbonated beverages, posing potential risks to market stability and prompting manufacturers to innovate healthier alternatives.

India Premium Carbonated Soft Drinks Market Future Outlook

The outlook for the India premium carbonated soft drinks market remains optimistic, propelled by shifting consumer preferences and an increasing emphasis on health and wellness. As urbanization advances, brands are expected to focus on innovative marketing approaches and diversify their product portfolios to appeal to the expanding health-conscious segment. Sustainability will also become a key priority, with companies adopting environmentally friendly packaging and production methods to meet consumer expectations and comply with regulatory standards.

Market Opportunities

- Expansion of E-commerce and Online Sales Channels: The growth of e-commerce in India offers a substantial opportunity for premium carbonated soft drink brands. Online sales are anticipated to rise significantly, fueled by greater internet access and evolving purchasing behaviors. Brands can capitalize on this by broadening their reach and enhancing customer engagement through precise digital marketing tactics.

- Growing Demand for Natural and Organic Ingredients: Consumers are increasingly favoring beverages made with natural and organic ingredients, reflecting a broader health and wellness trend. This shift provides brands with the chance to introduce new product lines tailored to these preferences, potentially boosting market share and fostering stronger brand loyalty in a competitive environment.

Scope of the Report

| By Product Type |

Fruity Sparkling Sodas Cocktail Mixers & Tonics Ginger-based Carbonated Drinks Premium Cola Alternatives Exotic Fruit Sodas Botanical & Herbal Carbonated Drinks and Others |

| By Packaging Type |

Glass Bottles PET Bottles Aluminum Cans Specialty Packs |

| By Sweetener Type |

Sugar-Sweetened Low-Calorie/Zero Sugar Natural Sweeteners |

| By Distribution Channel |

Modern Trade Traditional Retail HoReCa Online Platforms |

| By Region |

North India South India East India West India |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Food Safety and Standards Authority of India, Ministry of Consumer Affairs)

Manufacturers and Producers

Distributors and Retailers

Marketing and Advertising Agencies

Packaging Suppliers

Industry Associations (e.g., All India Soft Drink Manufacturers' Association)

Financial Institutions

Companies

Players Mentioned in the Report:

Coca-Cola India

PepsiCo India

Parle Agro

Himalaya Soft Drinks

Red Bull India

Fizzy Fusion Beverages

Sparkle India Drinks

Carbonate Craze Pvt. Ltd.

Bubbly Bliss Beverages

Zestful Sips Pvt. Ltd.

Table of Contents

1. India Premium Carbonated Soft Drinks Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

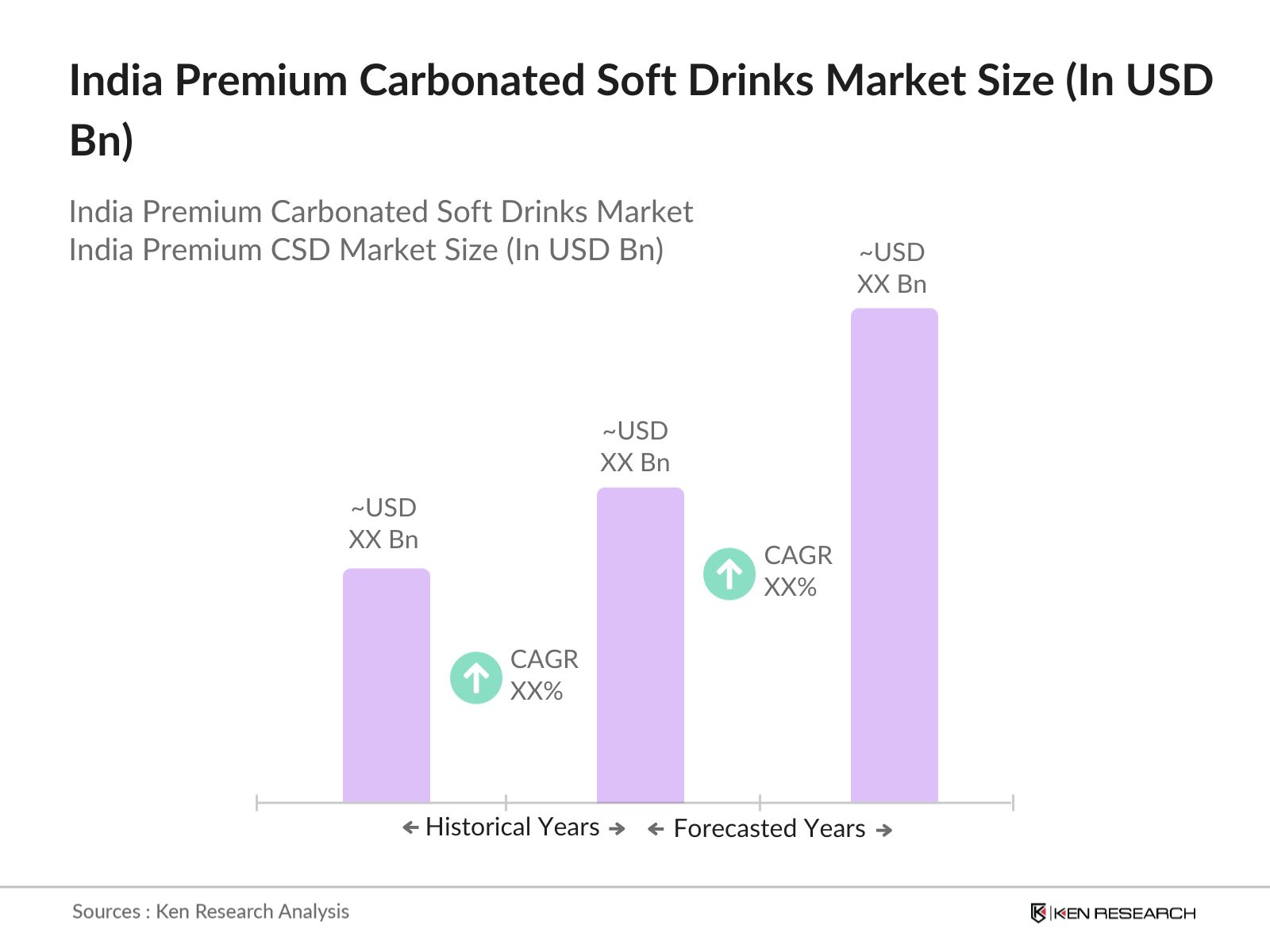

2. India Premium Carbonated Soft Drinks Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Premium Carbonated Soft Drinks Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Consciousness Among Consumers

3.1.2. Rising Disposable Incomes and Urbanization

3.1.3. Innovative Product Offerings and Flavor Varieties

3.2. Market Challenges

3.2.1. Intense Competition Among Established Brands

3.2.2. Regulatory Compliance and Health Concerns

3.2.3. Fluctuating Raw Material Prices

3.3. Opportunities

3.3.1. Expansion of E-commerce and Online Sales Channels

3.3.2. Growing Demand for Natural and Organic Ingredients

3.3.3. Potential for Product Diversification and Customization

3.4. Trends

3.4.1. Shift Towards Low-Calorie and Sugar-Free Options

3.4.2. Increasing Popularity of Craft and Artisan Beverages

3.4.3. Emphasis on Sustainable Packaging Solutions

3.5. Government Regulation

3.5.1. Food Safety and Standards Authority of India (FSSAI) Guidelines

3.5.2. Labeling and Advertising Regulations

3.5.3. Environmental Regulations on Packaging Waste

3.5.4. Taxation Policies Affecting Sugar-Sweetened Beverages

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. India Premium Carbonated Soft Drinks Market Segmentation

.1. By Product Type

4.1.1. Fruity Sparkling Sodas

4.1.2. Cocktail Mixers & Tonics

4.1.3. Ginger-based Carbonated Drinks

4.1.4. Premium Cola Alternatives

4.1.5. Exotic Fruit Sodas

4.1.6. Botanical & Herbal Carbonated Drinks and Others

4.2. By Packaging Type

4.2.1. Glass Bottles

4.2.2. PET Bottles

4.2.3. Aluminum Cans

4.2.4. Specialty Packs

4.3. By Sweetener Type

4.3.1. Sugar-Sweetened

4.3.2. Low-Calorie/Zero Sugar

4.3.3. Natural Sweeteners

4.4. By Distribution Channel

4.4.1. Modern Trade

4.4.2. Traditional Retail

4.4.3. HoReCa

4.4.4. Online Platforms

4.5. By Region

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Premium Carbonated Soft Drinks Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Coca-Cola India

5.1.2. PepsiCo India

5.1.3. Parle Agro

5.1.4. Himalaya Soft Drinks

5.1.5. Red Bull India

5.1.6. Fizzy Fusion Beverages

5.1.7. Sparkle India Drinks

5.1.8. Carbonate Craze Pvt. Ltd.

5.1.9. Bubbly Bliss Beverages

5.1.10. Zestful Sips Pvt. Ltd.

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Product Range

5.2.3. Pricing Strategies

5.2.4. Distribution Network

5.2.5. Brand Loyalty

5.2.6. Marketing Spend

5.2.7. Innovation Rate

5.2.8. Customer Satisfaction Ratings

6. India Premium Carbonated Soft Drinks Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Premium Carbonated Soft Drinks Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Premium Carbonated Soft Drinks Market Future Market Segmentation

8.1. By Product Type

8.1.1. Fruity Sparkling Sodas

8.1.2. Cocktail Mixers & Tonics

8.1.3. Ginger-based Carbonated Drinks

8.1.4. Premium Cola Alternatives

8.1.5. Exotic Fruit Sodas

8.1.6. Botanical & Herbal Carbonated Drinks and Others

8.2. By Packaging Type

8.2.1. Glass Bottles

8.2.2. PET Bottles

8.2.3. Aluminum Cans

8.2.4. Specialty Packs

8.3. By Sweetener Type

8.3.1. Sugar-Sweetened

8.3.2. Low-Calorie/Zero Sugar

8.3.3. Natural Sweeteners

8.4. By Distribution Channel

8.4.1. Modern Trade

8.4.2. Traditional Retail

8.4.3. HoReCa

8.4.4. Online Platforms

8.5. By Region

8.5.1. North India

8.5.2. South India

8.5.3. East India

8.5.4. West India

9. India Premium Carbonated Soft Drinks Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key stakeholders in the India Premium Carbonated Soft Drinks Market. This is achieved through extensive desk research, utilizing secondary data sources such as industry reports, market studies, and proprietary databases. The goal is to pinpoint and define the essential variables that drive market trends and consumer behavior.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical market data specific to the India Premium Carbonated Soft Drinks Market. This includes evaluating market size, growth rates, and competitive landscape. Additionally, we will assess consumer demographics and preferences to construct a detailed market profile that reflects current and future trends.

Step 3: Hypothesis Validation and Expert Consultation

We will formulate market hypotheses and validate them through structured interviews with industry experts and key stakeholders. These consultations will provide insights into market dynamics, challenges, and opportunities, allowing us to refine our hypotheses and ensure they are grounded in real-world experiences and data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and insights into a cohesive report. This includes engaging with manufacturers and distributors to gather firsthand information on product performance and consumer preferences. The synthesis will ensure that the final output is comprehensive, accurate, and reflective of the current state of the India Premium Carbonated Soft Drinks Market.

Frequently Asked Questions

01. How big is the India Premium Carbonated Soft Drinks Market?

The India Premium Carbonated Soft Drinks Market is valued at USD XX Bn, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the India Premium Carbonated Soft Drinks Market?

Key challenges in the India Premium Carbonated Soft Drinks Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the India Premium Carbonated Soft Drinks Market?

Major players in the India Premium Carbonated Soft Drinks Market include Coca-Cola India, PepsiCo India, Parle Agro, Himalaya Soft Drinks, Red Bull India, among others.

04. What are the growth drivers for the India Premium Carbonated Soft Drinks Market?

The primary growth drivers for the India Premium Carbonated Soft Drinks Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.