India Processed Fish and Seafood Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD9183

December 2024

98

About the Report

India Processed Fish and Seafood Market Overview

- The India Processed Fish and Seafood Market is valued at USD 20 billion as per a historical five-year analysis, driven primarily by the growing demand for convenient and high-quality food products, as well as rising health awareness regarding the benefits of seafood consumption. The market is further supported by government initiatives such as the Pradhan Mantri Matsya Sampada Yojana (PMMSY), which aims to enhance fish production and promote the sustainable development of the fishing sector.

- Certain regions within India, such as Kerala, Tamil Nadu, and Gujarat, are dominant in the processed seafood market. This dominance is attributed to their rich fishing heritage, established infrastructure, and the presence of large fish processing industries. Kerala, for example, is a major hub for seafood exports due to its vast coastline and seafood processing units.

- The governments flagship scheme aims to double the income of fish farmers and promote sustainable practices in the fisheries sector. By 2025, this initiative aims to add 70 lakh metric tons of fish to Indias production capacity, much of which will be processed for domestic and international markets. The scheme's financial outlay of INR 20,050 crore is directly benefiting the processed fish and seafood market by providing subsidies for fish processing plants and cold storage facilities.

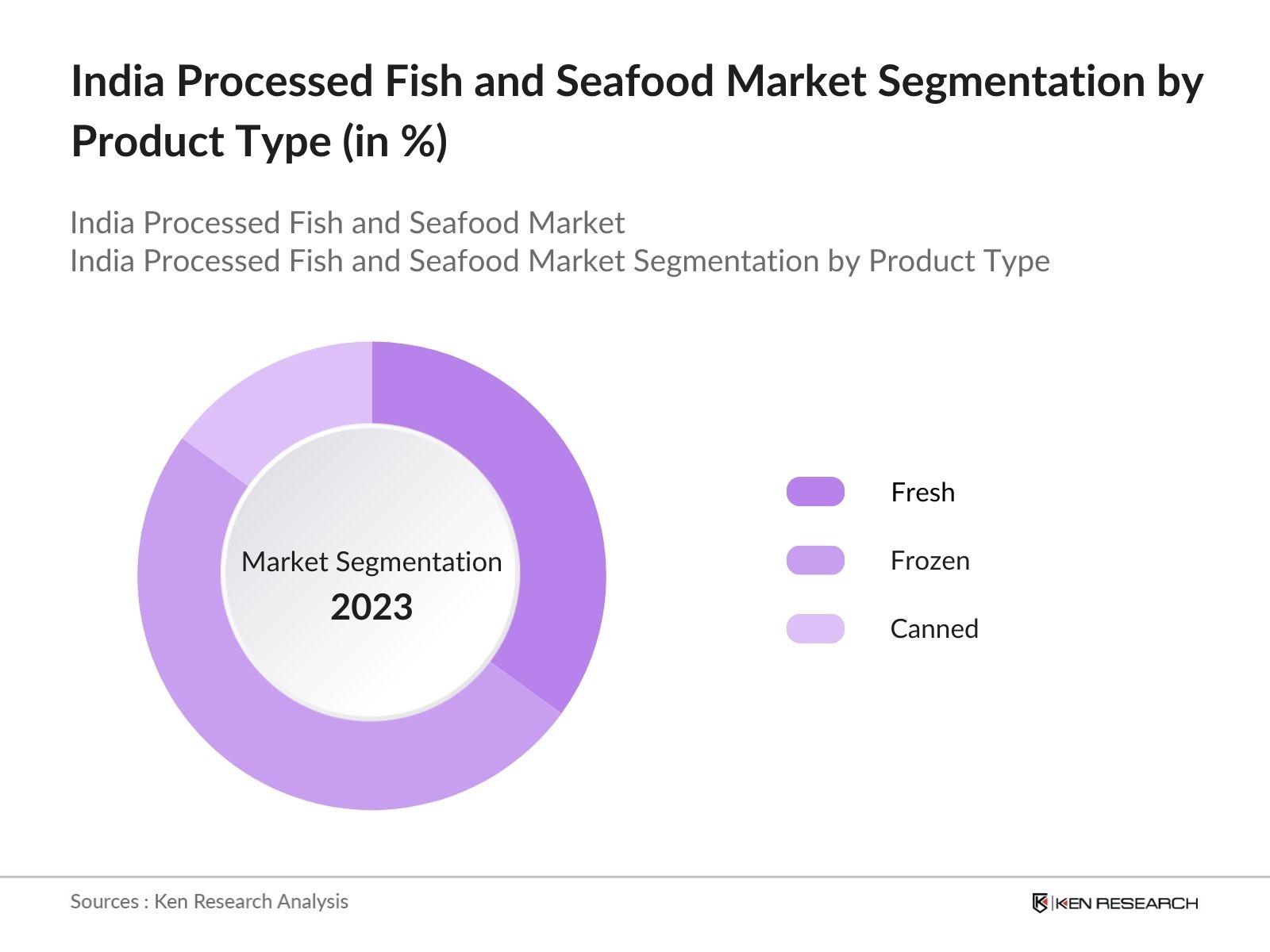

India Processed Fish and Seafood Market Segmentation

By Product Type: The market is segmented by product type into Fresh, Frozen, and Canned seafood. Recently, the Frozen segment has gained a dominant market share, largely due to the rise in cold chain logistics that ensure the quality and freshness of frozen seafood. Moreover, the convenience offered by frozen seafood for household consumption and its growing presence in supermarkets have contributed to its popularity among consumers.

By Seafood Type: The market is also segmented by seafood type, including Inland Fishes, Marine Fishes, Shrimps, and Scampi. Inland Fishes, particularly Indian Major Carps, hold a dominant share within this segment. This is due to the extensive inland fisheries infrastructure in states like West Bengal and Andhra Pradesh, where fish farming techniques have evolved, enabling higher production levels. Additionally, the affordable price point of inland fishes compared to marine varieties has fueled their demand.

India Processed Fish and Seafood Market Competitive Landscape

The market is marked by intense competition, with a mix of domestic players and exporters driving the market. Leading companies like Silver Sea Food, Abad Fisheries Private Limited, and Apex Frozen Foods Ltd have established significant market positions through modern processing techniques and compliance with international food safety standards.

|

Company |

Established |

Headquarters |

Market Focus |

Processing Technology |

Export Markets |

Sustainability Initiatives |

Product Diversification |

Cold Chain Infrastructure |

|

Silver Sea Food |

1980 |

Gujarat |

||||||

|

Abad Fisheries Private Limited |

1931 |

Kerala |

||||||

|

Apex Frozen Foods Ltd |

1993 |

Andhra Pradesh |

||||||

|

Munnujii Foods International |

2005 |

Maharashtra |

||||||

|

Marine Fresh Exports |

2000 |

Tamil Nadu |

India Processed Fish and Seafood Market Analysis

Market Growth Drivers

- Increasing Fish Consumption: The consumption of fish and seafood in India has been on the rise due to health consciousness and the inclusion of these products in daily diets. By 2024, the per capita consumption of seafood is expected to reach 7.4 kilograms annually. This increase in consumption has been driving the growth of the processed fish and seafood market, with households and restaurants seeking ready-to-cook and processed options.

- Rising Export Demand: India is one of the largest exporters of fish and seafood products globally, with export volumes reaching 1.43 million metric tons in 2023, valued at INR 60,000 crore. This rising demand from international markets, particularly from the EU, USA, and Japan, has led to an increase in processing activities domestically to meet the quality standards required for export.

- Government Support for Fishery Sector: The Government of India has been investing in the fishery sector through schemes like Pradhan Mantri Matsya Sampada Yojana (PMMSY), which allocated INR 20,050 crore for fisheries infrastructure between 2021 and 2025. These investments are aimed at improving cold chain infrastructure, processing facilities, and fishery development, which directly impacts the processed fish and seafood industry by enhancing supply chains and reducing post-harvest losses.

Market Challenges

- Supply Chain Inefficiencies: The Indian processed fish and seafood market faces challenges due to the lack of cold chain infrastructure and storage facilities. According to the National Fisheries Development Board (NFDB), nearly 30% of the fish harvested annually is lost due to inadequate cold storage facilities, which severely impacts the availability of processed seafood products.

- High Production Costs: The cost of processing seafood is high due to stringent hygiene and quality standards that need to be maintained. The investment in advanced freezing and packaging technology, coupled with the rising cost of raw materials, makes processing expensive. The average cost of seafood production increased by INR 2000 per metric ton in 2023, making it difficult for small and medium enterprises (SMEs) to compete in the market.

India Processed Fish and Seafood Market Future Outlook

Over the next five years, the India Processed Fish and Seafood Market is expected to show growth, driven by rising consumer demand for healthy and high-protein food options, as well as government incentives aimed at boosting production capacity in aquaculture.

Future Market Opportunities

- Increased Export Opportunities to New Markets: With growing demand from non-traditional markets like the Middle East, Southeast Asia, and Africa, Indias seafood export is expected to diversify. By 2028, these regions will account for an additional 500,000 metric tons of processed seafood exports, opening new avenues for Indian seafood processors.

- Adoption of Sustainable Fishing Practices: Over the next five years, there will be a shift toward sustainability, with Indian seafood companies adopting eco-friendly and sustainable fishing practices. The introduction of government-backed sustainability certifications will help Indian companies access premium international markets, potentially increasing revenues by INR 5,000 crore by 2028.

Scope of the Report

|

Product Type |

Fresh Frozen Canned |

|

Seafood Type |

Inland Fishes Marine Fishes Shrimps |

|

Distribution Channel |

Retail Institutional (HoReCa) |

|

Processing Technique |

Gutting Filleting Deboning |

|

Region |

North India West India South India East India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institution

Private Equity Firms

Government and Regulatory Bodies (FSSAI, Ministry of Fisheries)

Cold Chain Logistics Providers

Investor and Venture Capitalist Firms

Frozen Food Manufacturers

Companies

Players Mentioned in the Report:

Silver Sea Food

Abad Fisheries Private Limited

Apex Frozen Foods Ltd

Munnujii Foods International Pvt. Ltd

Marine Fresh Exports

Seasaga Group

Geo Seafood

Neptune Sea Exports

Pearl Marine Exports

Kirti Foods

Table of Contents

India Processed Fish and Seafood Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Market Growth Indicators

1.4 Market Segmentation Overview

India Processed Fish and Seafood Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

India Processed Fish and Seafood Market Analysis

3.1 Growth Drivers (Favorable government initiatives, health-conscious consumer shift)

3.2 Market Challenges (Overfishing, infrastructure gaps, climate change impact)

3.3 Opportunities (Aquaculture expansion, rising exports)

3.4 Trends (Technological innovation in seafood processing, increasing demand for frozen products)

3.5 Government Regulation (Pradhan Mantri Matsya Sampada Yojana, environmental sustainability regulations)

3.6 SWOT Analysis

3.7 Porters Five Forces

3.8 Competitive Landscape

India Processed Fish and Seafood Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Fresh

4.1.2 Frozen

4.1.3 Canned

4.2 By Seafood Type (In Value %)

4.2.1 Inland Fishes (Indian Major Carps, Pangasius, Tilapia)

4.2.2 Marine Fishes (Seabass, Mackerel)

4.2.3 Shrimps and Scampi

4.3 By Distribution Channel (In Value %)

4.3.1 Retail

4.3.2 HoReCa

4.4 By Processing Technique (In Value %)

4.4.1 Gutting

4.4.2 Filleting

4.4.3 Deboning

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 West India

4.5.3 South India

4.5.4 East India

India Processed Fish and Seafood Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Silver Sea Food

5.1.2 Abad Fisheries Private Limited

5.1.3 Seasaga Group

5.1.4 Kirti Foods

5.1.5 Geo Seafood

5.1.6 Apex Frozen Foods Ltd

5.1.7 Munnujii Foods International Pvt. Ltd

5.1.8 Oceans Secret

5.1.9 Prakash Foods

5.1.10 Golden Prize India

5.1.11 Neptune Sea Exports

5.1.12 Pearl Marine Exports

5.1.13 Seafood India Ltd.

5.1.14 Oceanic Foods Processing

5.1.15 Marine Fresh Exports

5.2 Cross Comparison Parameters (Number of employees, production capacity, revenue, export share, market share, geographic reach, sustainability initiatives, product portfolio)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

India Processed Fish and Seafood Market Regulatory Framework

6.1 Food Safety Standards (FSSAI Guidelines)

6.2 Export Regulations

6.3 Certification Processes

India Processed Fish and Seafood Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

India Processed Fish and Seafood Future Market Segmentation

8.1 By Product Type

8.2 By Seafood Type

8.3 By Distribution Channel

8.4 By Processing Technique

8.5 By Region

India Processed Fish and Seafood Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Segment Analysis

9.3 Marketing Initiatives

9.4 Opportunity White Spaces

Research Methodology

Step 1: Identification of Key Variables

The first step in analyzing the India Processed Fish and Seafood Market involved mapping the ecosystem, including processors, exporters, and retailers. Through extensive secondary research, including government reports and proprietary databases, key variables such as production capacity, consumption trends, and export dynamics were identified.

Step 2: Market Analysis and Construction

Historical data were compiled to analyze production and revenue trends across key seafood segments. Cold chain penetration, processing volumes, and product innovations were evaluated to generate revenue estimates for the market.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were developed and validated through consultations with industry experts, including major seafood processors and exporters. Their insights provided a detailed understanding of production challenges, regulatory impacts, and market opportunities.

Step 4: Research Synthesis and Final Output

The final output was generated through synthesis of expert inputs, government data, and market research reports. This phase also involved direct engagement with leading seafood processors to verify production data and export trends.

Frequently Asked Questions

How big is the India Processed Fish and Seafood Market?

The India Processed Fish and Seafood Market is valued at USD 20 billion driven by increasing demand for frozen and convenient seafood options, alongside rising health awareness among consumers.

What are the challenges in the India Processed Fish and Seafood Market?

Challenges in the India Processed Fish and Seafood Market include infrastructure gaps in cold storage and logistics, overfishing practices that threaten sustainability, and stringent regulatory frameworks governing seafood exports.

Who are the major players in the India Processed Fish and Seafood Market?

Major players in the India Processed Fish and Seafood Market include Silver Sea Food, Abad Fisheries Private Limited, Apex Frozen Foods Ltd, Munnujii Foods International Pvt. Ltd, and Marine Fresh Exports, all of whom leverage advanced processing technologies and cold chain logistics.

What are the growth drivers of the India Processed Fish and Seafood Market?

Growth drivers in the India Processed Fish and Seafood Market include government initiatives like the PMMSY, advancements in freezing technology, and rising exports to international markets like Europe and the Middle East.

What are the opportunities in the India Processed Fish and Seafood Market?

Opportunities in the India Processed Fish and Seafood Market lie in aquaculture expansion, increasing demand for premium seafood products, and the growing popularity of frozen seafood in both domestic and international markets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.